Kilian Moote is a Managing Director and Amanda Buthe is a Director at Georgeson LLC.

Early results from the 2024 annual general meeting (AGM) season suggest that the major trends, of record-breaking shareholder proposal submissions, declining support for anti-ESG, environmental and social proposals, as well as strong support for say on pay and director elections; all of which emerged during the past few years, are continuing.

Current sustained levels of shareholder engagement in the proxy process also indicate that these trends will continue unless there are independent regulatory reform developments or legal challenges resulting in structural changes. These changes will likely inform how corporate governance and shareholder rights could develop over the next few years.

A review of the Russell 3000 companies that held their AGMs as of May 17, 2024, shows that these trends reinforce the impression that shareholder scrutiny continues to rise and that there is renewed interest in corporate governance.

To underline this impression (and, in keeping with the previous two AGM seasons), shareholder proposal submissions up until that date in May continue to rise. However, support for environmental and social proposals peaked in 2022 and dropped sharply in 2023, resulting in a slight decline in overall support for these types of proposals in 2024.

Separately, early indications suggest that support and passage rates for governance proposals so far in 2024 have rebounded from uncharacteristically weak support during the 2023 season: 36 have passed year-to-date (YTD), surpassing the 24 that passed in the full 2023 AGM season. Director elections and Say-on-Pay continued to receive strong support and, similar to the previous two years, experienced slightly increased shareholder support.

Meanwhile, support for anti-ESG proposals has consistently remained in the low single digits and has declined each year.

Another record-breaking year by the numbers

In 2024, shareholders filed a record-breaking 998 proposals as of May 17, 2024, surpassing the previous highs of 947 submissions during the 2023 AGM season and 941 during the 2022 season. So far this year, there has been an 18% increase in governance proposals and a 19% rise in anti-ESG proposals, which has driven the overall increase. Environmental and social proposal submissions declined.

Passage rate and average support for governance proposals rebounds in 2024

The volume of governance proposals increased in 2024 to 38% of all proposals filed as of May 17, 2024 (378 out of 998) compared to 34% (319 out of 947) in 2023. So far this season more governance proposals have passed than during the full season last year (36 YTD compared to 24 in 2023). Proposals that seek to change the existing company’s voting bylaw to one that is a simple majority (51% or more support) are largely driving this significant increase.

During the 2024 season, passage rates, or proposals receiving majority support according to the company’s voting standard, have continued to decline for environmental and social proposals, compared to figures in the 2023 early season report[1]. Specifically, only one environmental proposal has passed, and no social proposals have passed so far in 2024.

This year we identified 76 subtypes of proposals. Of the 998 proposals submitted, 45% fell within 12 of these. As in previous years, numerous distinct proponents (283 filers) filed or co-filed proposals, but nearly two-thirds (61%) of all proposals came from just 10 shareholders or affiliated shareholder groups.

Average support for environmental proposals remains low, and the passage rate declines.

This year the total volume of environmental proposals has slightly decreased compared to last year: 170 as of May 17, 2024, compared to 180 in 2023. While only one proposal has passed so far this year vs four in 2023, average support for environmental proposals remains similar to last season: 22% this season compared to 24% in 2023.

As with previous years, the top three topics (based on the number of submissions) are greenhouse gas (GHG) reduction (including Scope 3 and value/supply chain), plastic or sustainable packaging, and GHG reduction including Scope 1 and 2. GHG emissions-related proposals account for 52% (88 out of 170) of the total submissions so far in 2024.

GHG reduction proposals that encompass Scope 3 (i.e. reporting emissions from a company’s supply chain) receive lower support, with an average of 23% in 2024 so far, significantly below the 47% average support seen in 2022 for such proposals but close to the 25% support received in 2023.

GHG reduction proposals focusing only on Scope 1 and 2 emissions received higher average support than those that included Scope 3. Average support of the 11 voted-upon Scope 1 and 2 GHG reduction proposals was 35% YTD, compared to 21% for the five proposals voted on during the 2023 AGM season. However, the 35% figure for 2024 remains below the peak 44% average support observed in 2022 for six voted proposals.

A new and notable environmental topic in 2024 is biodiversity, which relates to a company’s impact on biological diversity and which typically refers to the environmental degradation resulting from mining practices or those leading to deforestation. To date we have seen 12 such proposals; a sharp increase given that no proposals were filed on this topic during the 2023 season. An increasing interest in biodiversity by investors is also reflected by the 2023 release of the Taskforce for Nature-related Financial Disclosures framework (TNFD), which provides companies and financial institutions with a risk management and disclosure framework to identify, assess, manage and disclose nature-related issues.

So far in 2024, proxy advisors’ vote recommendations on environmental proposals have shifted compared to the 2023 season. Specifically:

- ISS increased its support for environmental proposals, recommending ‘FOR’ in 66% of such proposals, compared to 56% for the full 2023 AGM season.

- Glass Lewis has slightly reduced its support, recommending only ‘FOR’ 27% of environmental proposals, compared to 30% in the 2023 AGM season.

New types of social shareholder proposals have emerged

As of May 17, 2024, 34% (338 of 998) of all proposals filed are social proposals, representing a slight decrease from the 37% (354 of 947) in the 2023 AGM season.

Notably, Artificial Intelligence (AI) has emerged as a new focus for proponents this year, with 15 proposals on the topic. No such proposals were filed in 2023.

Employee health and safety proposals have gained prominence, with 16 submissions this year across several different industries, including telecom services, transportation, real estate, manufacturing, restaurants, retail and technology. There were only a few proposals that mentioned or focused on employee health and safety in 2023.

Living wage language has also appeared more frequently in pay practice proposals during the 2024 season. Eight such proposals have been made so far in 2024, compared to only one in 2023.

Other human capital management proposals that consistently appear in 2024 from previous years include freedom of association and workplace harassment proposals.

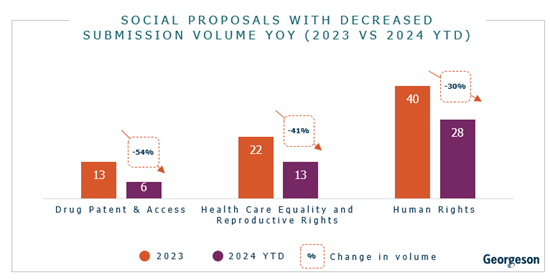

Several categories of proposals have decreased so far during 2024 (in volume) compared to 2023:

- Healthcare equality proposals, which include reproductive rights proposals, are down by 41%

- “Drug access” proposals, which typically relate to restrictions of access due to drug patents, have decreased by 54%

- Human rights proposals have declined by 30%

After a few years of what many investors have described as “more prescriptive proposals,” which encouraged specific courses of action, there has been a renewed focus on disclosure and reporting on outcomes. For example, diversity, equity and inclusion (DEI) proposals in 2024 focus more on general disclosure and are less prescriptive.

One of the most notable trends in DEI-related proposals is the sharp decline in support for both Civil Rights and Racial Equity audits. This decline is noteworthy because these proposals have maintained a similar format year after year, although only 13 have been voted in 2024 compared to 24 in 2023. Part of this almost halving of support can likely be attributed to the influence of proxy advisors: 46% (11 of 24) of the proposals received a positive recommendation from at least one advisor in 2023, compared to only 23% (3 of 13) in 2024. Additionally, ISS has not recommended ‘FOR’ any of these proposals in 2024, compared to recommendations for 21% (5 of 24) in 2023.

Seven governance proposal subtypes accounted (listed in the graphic below) for over 61% of all governance proposals submitted.

This season, the increased focus of the United Brotherhood of Carpenters and Joiners of America on board accountability has led to 40 proposals relating to enhanced director resignation policies. To date, none of these proposals have received majority support, averaging 16% support for the six that have been voted upon. Notably, 48% (19 of 40) submitted proposals were omitted, as the SEC has ruled in favor of issuers seeking no-action relief.

To date, 51 simple majority proposals have been submitted in 2024, more than double the 20 proposals received in 2023. The average support received from shareholders on such proposals so far this season has also been significant (74%), driven by the fact that most of the proposals are passing with well over majority support.

Of the 84 compensation-related proposals submitted so far in the 2024 season, 37 were related to executive severance payment policy and approach. Average support for the 24 severance proposals voted upon to date is 12%, a significant decline since 2022, when the average support for such proposals was 48%. This decline in average support correlates with proxy advisor recommendations, with 75% (17 of 24) of severance proposals receiving negative recommendations from both advisors so far in the 2024 season compared to 2022, when both advisors recommended ‘FOR’ more than 50% of severance proposals. For those proposals where at least one advisor recommended FOR the proposal in 2024, average support increased to 26%. When both recommended ‘FOR’ the proposal, average support rose to 35%.

Say-on-Pay

Similar to the 2023 season, average support for say-on-pay (SOP) voting results for the 2024 proxy season YTD increased for Russell 3000 companies, with approximately 91.7% of votes cast in favor (excluding abstentions), compared to 90.3% support during the 2023 proxy season.

Director election support from shareholders of Russell 3000 companies remains strong, averaging 95.2% for the proxy year 2024 YTD, slightly higher than the average support of 94.4% for the full proxy year 2023. For the proxy season 2024 YTD, 13 director nominees at Russell 3000 companies failed to receive at least 50% shareholder support. However, only one of these 13 directors failed to get elected due to the existence of a majority vote standard at the company, with the rest elected serving on boards with a plurality vote standard.

2024 marked the second full season in which the University Proxy Card (“UPC”) rule was in effect. One unforeseen consequence of UPC, first noticed during the 2023 season, has been the extent to which companies have engaged, or settled, with shareholder activists. There were 68 settlements in 2023 the first year of UPC and 52 settlements in 2024 as of May 17.

Looking at the 183 settlements researched between 2022 and 2024, it is notable that activists rarely withdrew their demands. During those years, instances where settlement included an activist withdrawing its demands ranged from between two to six. These were usually in the form of a standstill or cooperation agreement.

Withdrawn or no-action relief

In the 2024 season, we have seen fewer proposals withdrawn (14%) than last year (23%). The SEC has granted more no-action relief this year, contributing to a higher percentage of omitted proposals YTD, 14% compared to 9% for the 2023 season. Notably, 17 of the no-action reliefs granted were related to novel director resignation policy proposals. Of the 42% (424 out of 998) of proposals voted on so far this season, more have received majority support (37 in 2024 YTD vs 33 in 2023). It’s worth noting however that all but one of these proposals are governance related.

Anti-ESG

Anti-ESG proposals have risen by 19% to date in 2024 (112 proposals) compared to 2023 (94 proposals), representing a near-96% increase from the 57 proposals seen in 2022.

Social proposals constitute the majority of anti-ESG proposals at 71% (80 out of 112) in 2024 so far, similar to previous seasons. Anti-ESG social proposal submissions have increased by 19% in 2024 compared to 2023, rising from 67 in 2023 to 80 so far in 2024.

Civil Rights Audits and DEI proposals account for 38% (42 out of 112) of anti-ESG proposals this season. Similar to the 2023 season, these are the most prevalent types of anti-ESG proposals. Such proposals typically focus on the perceived risks of ESG proposals related to racial and gender equality efforts.

Environmental anti-ESG proposals have more than doubled (15 YTD in 2024 vs. six in 2023), although they still represent only 13% (15 out of 112) of all anti-ESG proposals YTD in 2024. Most of these proposals center around financial risks associated with decarbonization efforts.

The increase in anti-ESG proposals reflects the wider debates about such issues in society. To illustrate this point, some companies this season received both pro-ESG and anti-ESG proposals on the same social topic.

The increasing polarity of ESG topics coincides with a greater emphasis by institutional asset managers and leading proxy advisors on customized options for their clients. While such tools create more options for asset owners to express a point of view, we have observed limited uptake, and little investing behavior change.

Notably, some shareholders have expanded their interests beyond shareholder proposals to corporate governance. In the 2024 season, this has included organized labor groups engaging in two director contests and leveraging the 14a-4 process to file multiple proposals with a single company. Similarly, since 2021, pro and anti-ESG proponents have increased their use of the exempt solicitation process, filing statements in ‘support of’ or ‘opposition to’ director or shareholder proposals.

The current sustained level of engagement in the proxy process underlines how unprecedented numbers of shareholder submissions, falling support for anti-ESG and environmental and social proposals, and strong support for say-on-pay and director elections will likely continue unless there is regulatory reform or current legal challenges are successful.

As we head into the ‘AGM offseason’, companies, shareholders and activists will be digesting these trends as well as looking to the 2024 Election, upcoming legal challenges to shareholder rights and the SEC’s climate rule, not to mention a Supreme Court Decision that could impact SEC authority to determine rules. Each of these events, independently and jointly, will likely inform how corporate governance and shareholder rights develop over the next few years.

Endnotes

1The 2023 early season report included proposals for a proxy year from July 1, 2022, through May 12, 2023.(go back)

Print

Print