Daniel L. Luks is a Partner and Justin S. Einhorn is an Associate at Skadden, Arps, Slate, Meagher & Flom LLP. This post is based on their Skadden memorandum.

Key Points

- Aggregate global M&A deal value is up significantly in 2024 (even though deal volume is down), driven in large part by the announcement of megadeals in the U.S., and reflecting an appetite for dealmaking in the medium term.

- Notwithstanding continued relatively high interest rates, financial sponsors have pursued some very large transactions this year, sending the global value of sponsor deals soaring.

- Legislative changes could give a boost to M&A, particularly involving sponsors, by resolving uncertainty about Delaware law governing stockholder agreements.

Despite exogenous headwinds such as interest rates that remain high based on recent historical measures in spite of a recent cut, persistent inflation, geopolitical uncertainty and heightened regulatory scrutiny that continued to constrain M&A activity in 2024, total deal value is up year to date.

While overall deal value has not returned to 2021 levels, and the signals are somewhat mixed, there are grounds for cautious optimism for the midterm, including an increase in financial sponsor acquisitions this year.

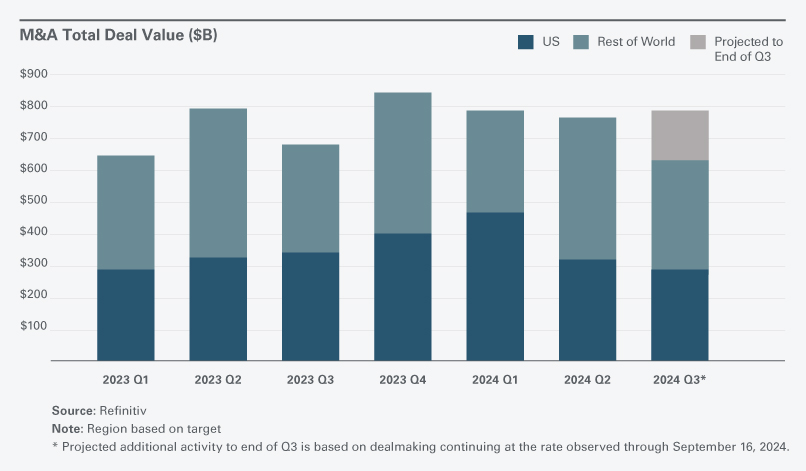

Total deal value is up year to date, driven by the U.S. market. Through mid-September 2024, aggregate global deal value rose 9% over the same period in 2023; and it was up almost 20% in the U.S., even though the number of deals announced globally over the same period was down 18%. [1]

M&A Total Deal Value ($B)

A bar chart shows the fluctuations in total M&A deal value each quarter from Q1 2023 to mid-September in Q3 2024. The bars are broken down into deals for U.S. targets (dark blue) and those in other countries (blue gray).

In the first three quarters of 2024, the value of all deals globally was less than that in Q4 of 2023, but global deal value has stayed at a relatively steady level each quarter in 2024, assuming that it continues through the end of Q3 at the rate observed through September 16, 2024. A gray-shaded portion of the Q3 2024 bar reflects an extrapolation of the full-quarter amount based on the rate observed through September 16.

The value of deals for U.S. targets surged in Q1 2024 before tapering off, but deals for targets elsewhere were up in Q2 and Q3 2024.

Source: Refinitiv

_____

The rise in aggregate value reflects a number of announced megadeals (i.e., those valued at $10 billion or more): Year to date, there have been 10 deals over $20 billion and another 12 deals over $10 billion.

The largest deal was Canadian retailer Couche-Tard’s $57.9 billion cross-border unsolicited offer for Japan’s Seven & i Holdings, the parent of 7-Eleven.

Sixteen of the 19 largest announced transactions globally involved U.S. buyers and targets, including:

- Mars’ $35.9 billion deal to acquire snack-maker Kellanova.

- Capital One’s $35.3 billion agreement to buy financial services company Discover Financial.

- Synopsys’ $35 billion agreement to buy engineering software developer Ansys.

The financial, technology and energy sectors accounted for many of the largest deals. Those deals pushed up U.S. deal value, even though there were 26% fewer deals over $10 million announced through mid-September 2024 than in the same time period in 2023.

Financial sponsors continue to pursue megadeals when they can. Through mid-September 2024, the value of financial sponsor deals globally had risen to $169 billion, up 66% compared to the first three complete quarters of 2023. It more than doubled in the U.S. over the same time period, rising 122% to $109 billion.

Financial Sponsor Deal Value ($B)

A bar chart shows the fluctuations in the value of M&A deals by financial sponsors each quarter from Q1 2023 to mid-September in Q3 2024. The bars are broken down into deals for U.S. targets (dark blue) and those in other countries (blue gray).

The value of sponsor M&A transactions soared in Q2 2024, to more than $85 billion, with 65% of that for U.S. targets. Q3 2024 saw sponsor deals at a lower rate but on par with that seen in Q3 2023 to Q1 2024.

A gray-shaded portion of the Q3 2024 bar reflects an extrapolation of the full-quarter amount based on the rate observed through September 16.

Source: Refinitiv

_____

Despite the constraint of higher financing costs, financial sponsors have struck some large deals this year:

- The $16.1 billion agreement by Blackstone and the Canada Pension Plan Investment Board to buy Australian data center operator AirTrunk Operating Pty.

- Stone Point Capital and Clayton, Dubilier & Rice’s $12.6 billion purchase of Truist Financial’s remaining stake in Truist Insurance.

Positive signs suggest a further upswing. The appetite of both corporates and sponsors for very large deals in 2024 is noteworthy, especially despite the fact that interest rates have remained relatively high most of the year, regulatory scrutiny of deals has remained intense and the upcoming U.S. election has generated marketplace uncertainty.

Many companies around the world also continue to explore and announce carve-outs, spin-offs and other divestitures (sometimes under pressure from activist investors) to maximize shareholder value. If the pressure for those types of transactions continues, it could be another source of deal flow.

We also expect companies in this environment to continue to pursue other types of M&A transactions that allow them to minimize risk and reduce capital outlay, such as joint ventures and minority investments.

Meanwhile, sponsors continue to have record levels of committed but uninvested capital, which could fuel more deals. If capital becomes less costly and bid-ask spreads ease, these factors could create opportunities for sponsors to exit investments that they have been holding, sometimes for longer-than-expected periods.

The recent reduction in interest rates, coupled with the greater availability of financing (both private capital and traditional bank financing) and cautious optimism about the near-term economic outlook, should help encourage deal activity to an even greater degree.

Uncertainty about Delaware law may be resolved. Another potentially positive factor is less frequently discussed but could help stabilize U.S. dealmaking.

Recent Delaware Court of Chancery decisions impacting certain M&A practices, including the use of stockholders’ agreements to address corporate governance matters, led to some initial uncertainty earlier this year. These decisions were particularly relevant for financial sponsors, given that over 30% of disclosed global financial sponsor M&A deal value in the first half of 2024 involved acquisitions of stakes of less than 100%. Those transactions typically involve mechanisms, such as entry into stockholders’ agreements, to address post-closing corporate governance matters.

To help remove this uncertainty, the Delaware General Corporation Law (DGCL) was amended, effective August 1, 2024, in direct response to the court decision regarding stockholders’ agreements. The 2024 DGCL amendments include new Section 122(18), which details the manner by which Delaware corporations may enter into agreements with current or prospective stockholders (or beneficial owners of their stock) and specifies the corporate governance matters that can be addressed by such stockholders’ agreements.

The new section is intended to provide market participants — including stockholders, corporations and their counsel — with a road map for implementing stockholders’ agreements and interpreting existing agreements, regardless of whether the matters covered by them are provided for in the corporation’s certificate of incorporation. (See our April 4, 2024, client alert “Proposed DGCL Amendments Would Expressly Authorize Stockholders’ Agreements and Align DGCL Provisions With Current M&A Practices.”)

Notwithstanding the guidance provided by Section 122(18), market participants must take into consideration that the adoption and implementation of stockholders’ agreements remain subject to the fiduciary duties directors and controlling stockholders owe to the corporation and its stockholders.

In Sum

Considering the rising M&A deal values, a heightened level of megadeals globally and a growing number of complex structured transactions (e.g., joint ventures, spin-offs, recapitalizations, restructurings and the like) — plus the Federal Reserve’s September 18, 2024, decision to cut rates a half point — transactions for the rest of 2024 and beyond in the medium term could contribute to a continuing rebound in deal activity.

1Data from London Stock Exchange Group-Refinitiv, based on announcement date for deals of $10 million or greater. Deal values include the target’s net debt. Year-to-date and Q3 figures are through September 16, 2024, except as noted in the charts where the full Q3 2024 has been projected based on figures through September 16, 2024. Excludes debt tender offers, equity carve-outs, exchange offers, loan modifications and open market repurchases..(go back)

Print

Print