Zsombor Péli is a Research Manager, Rachit Gupta is the Head of Global Data & Research, and Yuxuan Zhao is a Data Analyst at Diligent Market Intelligence. This post is based on their Diligent memorandum.

Executive summary

Market cap growth

Our analysis of the 2021 IPO cohort revealed a strong positive correlation between longer CEO tenure and market cap growth, underscoring the importance of experienced leadership in driving performance.

“Say on pay” approval

At their latest AGM, the group of 2021 IPO companies we analyzed had the highest approval rate for “say on pay” proposals, with 93.93% of votes in favor, compared to lower figures for the Russell 3000 and S&P 500. However, proxy advisor recommendations were lower, around 65%, due to non-standard compensation arrangements for these newly public companies.

Financial performance

A sample of our selected group of companies demonstrated improving financial metrics post-IPO. Their average earnings per share (EPS) improved from -$1.96 in 2021 to -$0.33 in 2023, signalling a gradual move toward profitability. Additionally, these companies showed relatively stable earnings compared to broader market indices, although market cap growth was generally lower than the Russell 3000.

Return on capital

Elevated board independence, controlled company status, and higher realized CEO pay among the 2021 IPO companies in our study positively influenced the average return on capital over the last three years, highlighting the value of balanced governance structures in optimizing capital allocation.

Key facts about the cohort

Record IPO activity in 2021: The U.S. market witnessed a record-breaking year for IPOs in 2021, with 1,026 companies raising over $100 billion. This surge was driven by low interest rates, ample liquidity and growing retail investor participation. While nontraditional IPOs, mostly special purpose acquisition companies (SPACs) comprised almost 70% of the new listings, the rate of traditional IPOs also increased sharply. Subsequent years saw a decrease in listings due to the 2021 boom and tightening financial conditions. The analysis in this paper focuses on traditional IPOs to identify trends that may be more relevant in the future.

Sectoral focus: The Covid-19 pandemic spurred interest in Information Technology and Healthcare sectors, reflecting themes of digital transformation and tech-enabled healthcare solutions. These two sectors accounted for 47.2% of new listings in 2021.

Governance features: As of June 2024, having been public for three years, 2021 IPOed companies show distinct governance features when compared against the larger, more mature companies in S&P 500 & Russell 3000. Typically, the companies within the 2021 IPO cohort have a smaller board size but a high level of independence. CEOs on average have a tenure length of five years and hold a significant stake in the business (>1%). The majority of this cohort has classified boards with a significant minority of these companies having controlling shareholders. Board diversity standards are at par with larger, mature companies.

Why is this data important?

Boards and shareholders are faced with many choices — of governance structures, portfolio composition and investments — and engage regularly in good faith to debate the options open to them and how to achieve mutually beneficial outcomes.

The data in this analysis helps companies and investors identify structures and opportunities that can maximize shareholder value and allow executives to outperform.

Influence of governance on financial performance

Loose financial conditions created by ultra-low interest rates and high demand for newly IPOed companies allowed companies going public in 2021 to maintain governance structures that were founder- and executive-friendly, in contrast to previous years when institutional investors had demanded certain rights in return for underwriting IPOs.

Differences between S&P 500, Russell 3000, and IPO 2021 companies reflect the varying stages of corporate maturity and strategic priorities across different types of firms. S&P 500 companies exhibit governance characteristics that emphasize stability, experience and independence. Russell 3000 companies, which represent a diverse range of firm sizes and industries, show a balanced approach to governance. IPO 2021 companies, being newly public, exhibit governance characteristics typical of firms in their early stages of market presence. They have the smallest boards with lower board independence, as founders and early executives often retain significant influence.

The high percentage of controlled companies, classified boards, and multi-class stock structures indicates a strong emphasis on maintaining control and protecting against market volatility and activist demands. However, these firms also show a commitment to evolving their governance practices, as seen in their efforts to incorporate gender diversity and separate leadership roles.

High CEO ownership in IPO firms aligns leadership incentives with company performance, driving growth and innovation. As firms grow, the dilution of CEO ownership indicates a shift toward shared control and broader stakeholder engagement.

On average, companies without a classified board demonstrated a significant positive EPS growth, while those with a classified board suffered an average decline of negative 98.4%. Companies with a classified board also experienced a TSR decline while those without a classified board saw a positive average TSR.

Controlled companies, characterized by concentrated ownership, also showed a severe decline in EPS growth, in contrast to growth seen in non-controlled companies. However, controlled companies showed a significant positive impact on average return on capital, possibly as a result of quicker decision-making processes and a clear strategic direction.

Our analysis identified that a longer CEO tenure is positively associated with market cap growth. This may be due to stock price performance — and by extension, shareholder satisfaction — being the best protection for a CEO’s tenure. Alternatively, the value of experience, broader networks and deep understanding of the company’s business may facilitate smoother operations through financial cycles.

Other key findings

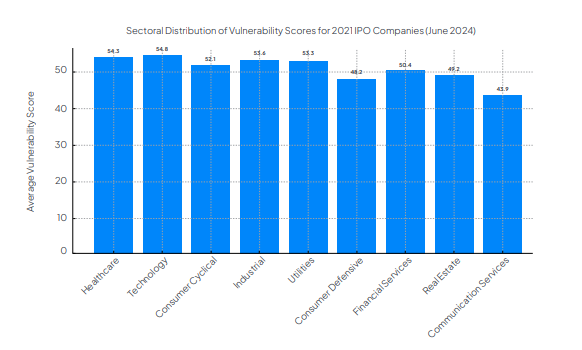

DMI has a partnership with ClarityAI which provides ESG scores — by assessing Scope 1, 2 and 3 greenhouse gas emissions data; a qualitative assessment of climate frameworks and targets and controversies against 39 business-relevant categories — benchmarked against wider market practice. Out of the 200 companies analyzed, 106 have available ESG scores.

5.5% |

of the companies within the IPO cohort were targeted by activist investors since listing — in line with the 5.1% rate of activism faced by all companies tracked by DMI’s activism data |

Print

Print