Sarah Lindenberg Cohen and Tom Kohn are Consultants, and Rachel Chiu is a Principal at FW Cook. This post is based on their FW Cook report.

Introduction

The 53rd edition of the Top 250 Report explores executive long-term incentive practices at the 250 largest companies by market capitalization, with an emphasis on how prolonged 5-year market volatility and uncertainty has influenced and shaped plan design and structure.

Since 2020, overlapping shocks from the COVID-19 pandemic, geopolitical conflicts, trade tensions, policy shifts from a new administration, Federal Reserve rate hikes, and changing investor sentiment have fueled heightened volatility in US markets. In response, companies have reshaped and de-risked long-term incentive (“LTI”) designs while balancing program objectives such as the alignment of pay with performance and the retention of key employees during uncertain times.

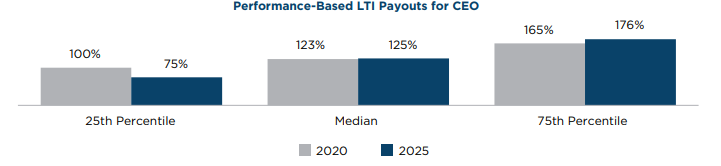

Heightened market volatility is reflected in the broader range of performance-based LTI award payouts observed in 2025 compared to 2020. While median payouts in 2020 and 2025 are nearly identical, the interquartile range has widened, with the spread between 25th percentile and 75th percentile payouts increasing from a 65-point spread in 2020 to a 100-point spread in 2025.

Key Findings

Impact of Volatility on Incentive Plan Design

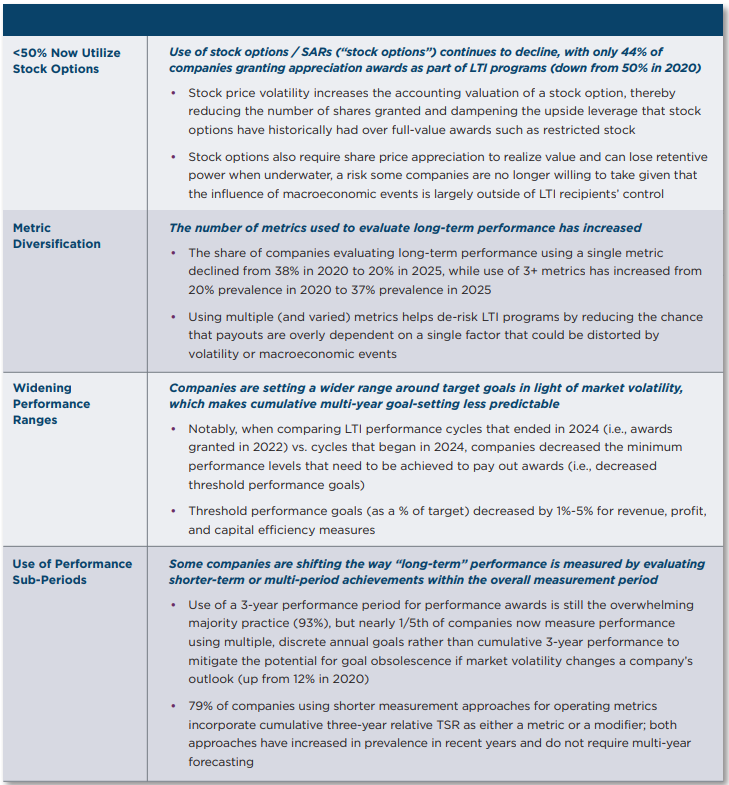

Relative to LTI design and practices from FW Cook’s 2020 Top 250 Report (generally reflecting plan design in effect in 2019, i.e., prior to the pandemic), current approaches have shifted to de-risking of programs, mitigating the challenges of multi-year financial goal setting, and providing downside protection, if needed, to ensure plans are durable during times of unprecedented disruption.

Evolving Use of Total Shareholder Return

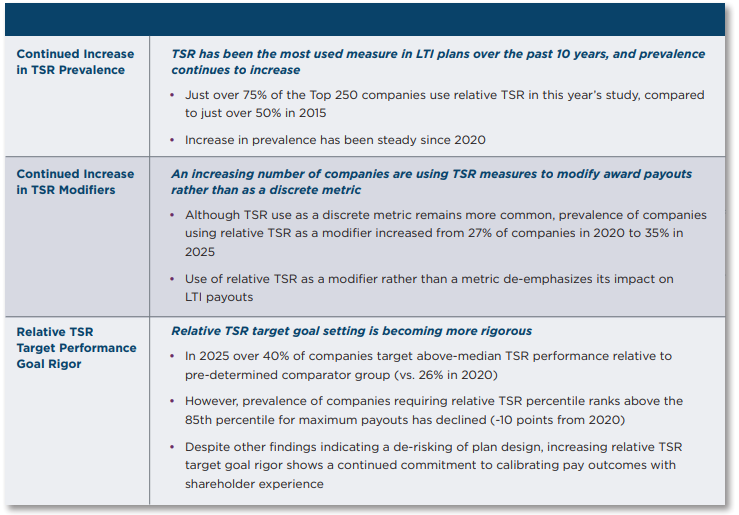

While the prevalence of relative total shareholder return (“TSR”) measures in long-term performance awards continues to increase, some companies are shifting how they incorporate TSR from a weighted metric to a performance modifier, which dampens its impact on pay outcomes. Using relative TSR as a modifier could be viewed as a palatable compromise for companies that are reluctant to tie executive pay to a relative metric they cannot fully control, while continuing to align with proxy advisor and investor preferences to incorporate relative TSR performance measures into pay programs.

Additionally, more companies than ever are requiring above-median relative TSR performance to achieve target payouts, which can be viewed as a response to proxy advisors and investors who favor more rigorous performance requirements.

These trends highlight the nuanced approach to LTI design that companies are taking to balance external expectations and accountability with the need to design compensation programs that align with each company’s compensation strategy.

Link to the full report can be found here.

Print

Print