Chuck Callan is Senior Vice President of Regulatory Affairs at Broadridge Financial Solutions; Paul DeNicola is Principal of the Governance Insights Center, PricewaterhouseCoopers LLP; and Matt DiGuiseppe is Managing Director of the Governance Insights Center, PricewaterhouseCoopers LLP. This post is based on their Broadridge/PwC memorandum.

This post provides insights into key corporate governance and shareholder voting trends in the 2022 proxy season. We include data on the results of 4,125 public company annual meetings held between January 1 and June 30, 2021, along with five-year trends.

The 2022 proxy season is shaping up to be an especially active one, with environmental, social, and governance (ESG) matters. Given the SEC’s recent revisions to guidance regarding shareholder resolutions, it’s likely that many more proposals targeting climate change, diversity and inclusion, and other hot-button social issues will come to a vote. And, based on commentary from proxy advisory firms and large institutional investors, directors on boards of companies that are not taking proactive steps in these areas may face increased opposition.

From climate change to racial injustice, expectations that companies will take these matters seriously have never been higher. The 2022 proxy season will show just how focused investors are on making sure the companies they invest in are addressing them.

Against that backdrop, the key issues we’re watching include:

- A “race to the top” on climate change

- Evolving expectations around human capital

- The shifting landscape of shareholder activism

- Trends in retail and institutional shareholder voting

Looking Back on the 2021 Proxy Season

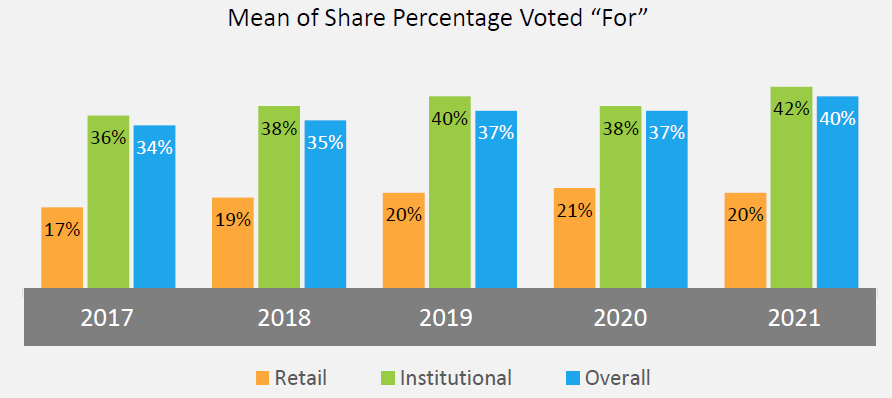

Support for shareholder proposals grew steadily over the past five years. In the 2021 proxy season, support overall rose to 40%, on average, up from 37% in 2020. There is significant divergence in the voting support by retail and institutional investors. As a group, retail shareholders were half as likely to favor shareholder proposals as were institutional investors. This is true not only for all 404 shareholder proposals that Broadridge tracked for the 2021 season but also for proposals on climate and corporate political spending. See the Appendix below for additional trends and insights.

What to Expect in the 2022 Proxy Season

Climate Change

Climate change is the top issue to watch in the 2022 proxy season. Many investors are no longer satisfied simply with greater disclosure of companies’ climate impacts and risks. They’re looking for concrete emissions targets. They want to see robust board oversight of climate risks. As a case in point, State Street Global Advisors said it will start voting against directors at some companies that don’t disclose (1) emission reduction targets or (2) how their boards are overseeing climate change-related risks, as required under the Task Force on Climate-related Financial Disclosures (TCFD) framework. [1]

Additionally, proxy advisory firms have toughened their policies on climate change. Institutional Shareholder Services (ISS) will recommend a vote against incumbent directors at the companies it finds to have inadequate climate change disclosures or that lack emissions reduction targets. [2]

New rules being developed by the SEC could radically change the future landscape for public companies when it comes to climate change-related disclosures. [3] Many shareholders are watching intently to see whether the companies they invest in are ready for a shift away from voluntary disclosures to mandatory ones. That will keep questions about climate risk oversight top of mind for many investors as they vote their proxies, even though any changes that could be coming from the SEC would not be expected to go into effect until a future season.

Investors are engaged in a “race to the top” to see who can hold their portfolio companies to the highest standards

Last proxy season, the largest institutional investors opposed more directors because of inadequate climate risk oversight and they supported more shareholder proposals seeking to strengthen climate disclosures and policies. It’s likely that this trend will continue in 2022 as investors engage in a “race to the top” to see who can hold their portfolio companies to the highest standards.

Proponents of shareholder proposals may seek to take advantage of this trend. Last year, shareholders submitted 85 climate change-related proposals, up more than 40% from 2020. Support for the 24 climate proposals rose to 49% on average, versus about 41% a year earlier, and 11 of these proposals passed—a nearly threefold increase over 2020. [4] It’s likely that shareholder support will rise even further in 2022. What’s more, this proxy season’s climate proposals will better target companies’ climate risk oversight weaknesses based on institutional investors’ voting policies. With large institutional investors providing greater visibility into the rationale behind their proxy voting policies, proponents have a valuable playbook on how to win support for their causes.

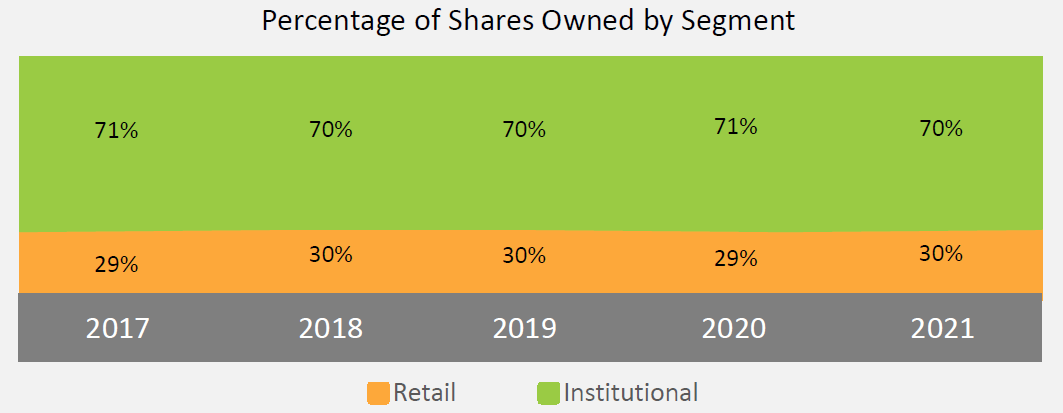

With institutional investors holding about 70% of the shares, climate change will certainly be one of the key issues to monitor this year. [5]

Human Capital

The COVID-19 pandemic has put workforce issues front and center for many investors. They want a better understanding of how companies are handling worker safety, return to office and other workplace policies, and hiring to fill deep workforce shortages. Many investors also expect companies to support racial justice by disclosing workforce diversity data and making their boards more diverse.

Human capital encompasses all of these matters and more, and it’s poised to be one of the most important topics to monitor for the upcoming proxy season.

For now, investors are largely focused on disclosure. Through engagement with company management teams, institutional investors such as New York City’s public sector pension funds have been able to significantly increase the number of firms disclosing their EEO-1 forms, the report of workforce diversity data provided to the US Equal Employment Opportunity Commission.

As a result, a majority of S&P 100 companies now share this information. [6] With State Street Global Advisors pledging to vote against compensation committee chairs at companies that do not disclose these forms, it’s likely more companies will decide to do so. That may keep the number of related shareholder proposals coming to a vote relatively low.

The SEC is considering whether to require public companies to increase their reporting on human capital issues. SEC Chair Gary Gensler has said the new disclosures could include metrics on turnover, training, compensation and benefits, and diversity, among others. [7]

And, just as investors’ approach to climate change has evolved from a focus on disclosure to a broader push for stronger governance and oversight, it’s likely that human capital management will follow a similar path. We expect demand for concrete plans and commitments to happen even faster than it did with climate change.

Shareholder Activism, Evolved

Historically, proxy contests have focused on board seats and improvements in a company’s near-term financial performance. In 2021, institutional investors showed that they’re increasingly open to supporting dissident board nominees based on a compelling, longer-range strategic vision. We expect a new chapter to open in shareholder activism that focuses on electing board members who look at the long-term impact of climate, as well as diversity and inclusion.

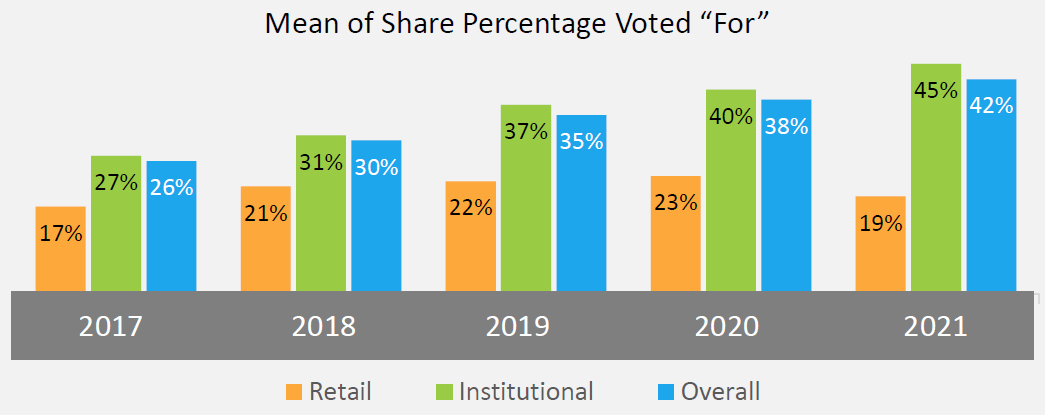

Proxy contests may make headlines, but there are implications for shareholder proposals as well. Institutional investors cast 40% of their voted shares in favor of environmental and social proposals in 2021, the highest level in at least five years, according to Broadridge. That figure is likely to rise this proxy season. With large institutional investors’ stewardship reports increasingly offering year-to-year comparisons of their voting activity, it’s clear that decisions about which proposals to support are based to some degree on what they supported in the past.

As they seek to capitalize on this growing momentum, proponents will likely work to better target their proposals to appeal to large institutional investors’ voting guidelines and public commitments on high-profile issues like climate change and diversity and inclusion. This could make such proposals easier for institutional investors to vote in favor of, creating a feedback loop that drives support even higher.

As discussed above, these factors, combined with revised SEC guidance that will make it more difficult for companies to exclude shareholder proposals that address “significant social policy” matters from their proxy statements, [8]mean the number of environmental and social proposals coming to a vote, as well as the number passing, may increase in 2022.

Appendix: 2021 Proxy Season: A Look Back

Recently, there has been much interest in the differences in voting support by retail and institutional investors. This review provides data on ESG voting by retail and institutional investors during the 2021 proxy season and trends in share ownership and voting over the past five years. The 2021 data covers the results of 4,125 public company annual meetings held between January 1 and June 30, 2021.

Data and Trends

Shareholder Proposals

Support for shareholder proposals rose to 40% overall, on average, in the 2021 proxy season for the 404 shareholder proposals identified by Broadridge, up from 37% in the prior proxy season. The data shows also that support for shareholder proposals has grown steadily over the past five years. [9] Retail shareholders as a group were half as likely to vote in favor of shareholder proposals as were institutional investors.

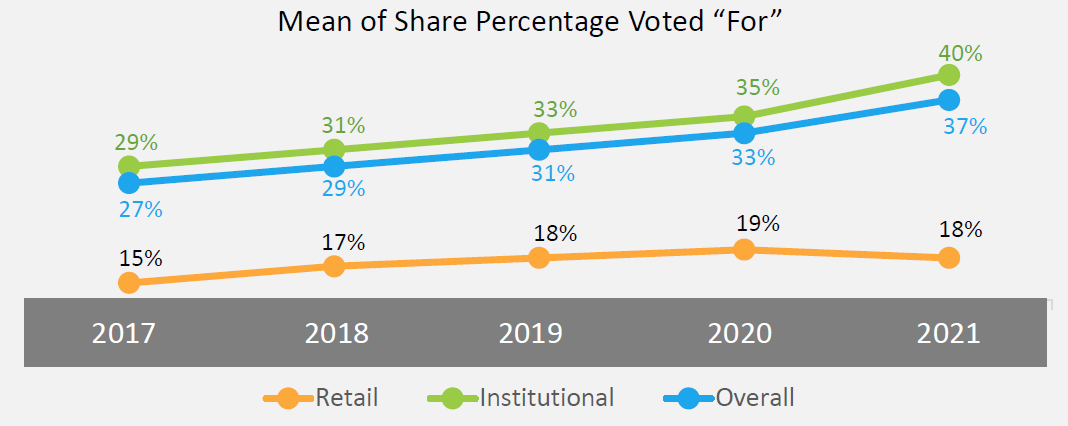

Environmental and Social Proposals

For 79 proposals identified as pertaining to environmental and/or social matters, support among all shareholders increased from 33% overall in 2020 to 37% in 2021. Voting by institutional investors drove the greater level of support, as 40% of their voted shares were cast in favor of these proposals in 2021, up from 35% in 2020. Their increased support was the highest recorded in the last five years. In fact, institutional investors were more than twice as likely as retail investors to support environmental and social proposals. Only 18% of votes by retail shareholders were cast in favor of environmental and social proposals. The gap between these two segments continues to widen.

Corporate Spending Proposals

Of 40 proposals pertaining to corporate political spending, support among all shareholders increased from 38% in 2020 to 42% in the 2021 proxy season. This, too, was driven by greater support from institutional investors which has been increasing over the last five years and which jumped in the past year. Only 19% of votes by retail shareholders were cast in favor of political spending proposals, and the gap between the two segments broadened significantly this past year, with 45% of institutional votes cast in favor.

Share Ownership

The proportion of shares held by the retail and institutional segments has remained relatively flat over the past five years. There was a slight uptick in retail ownership to 30% in 2021 from 29% in 2020, largely due to rounding.

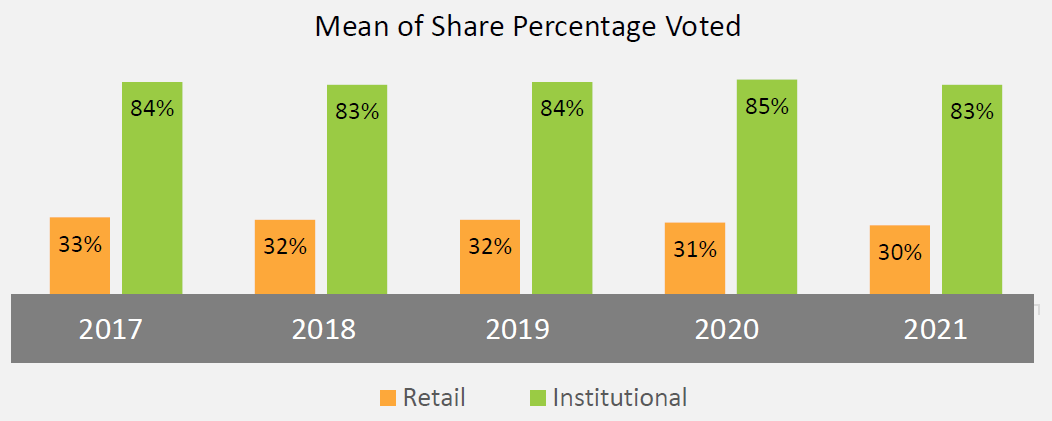

Shareholder Participation

There was a slight decline in the percentage of shares each segment voted. Institutional investor participation dropped this season from 85% of their owned shares in 2020 to 83% in 2021 (although it was in range with their participation over the last five years). Retail voting was down slightly to 30% of their owned shares, continuing a trend over the last five years.

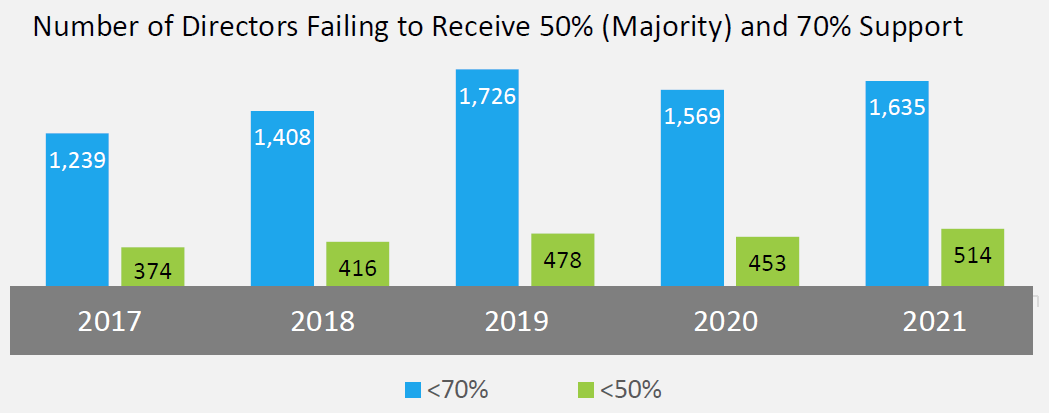

Director Elections

On average, shareholder support for directors was high at 94% overall. While more directors stood for election this season (23,009), more also failed to attain majority support (514) or to surpass the 70% support threshold monitored by some institutional investors and proxy advisors (1,635).

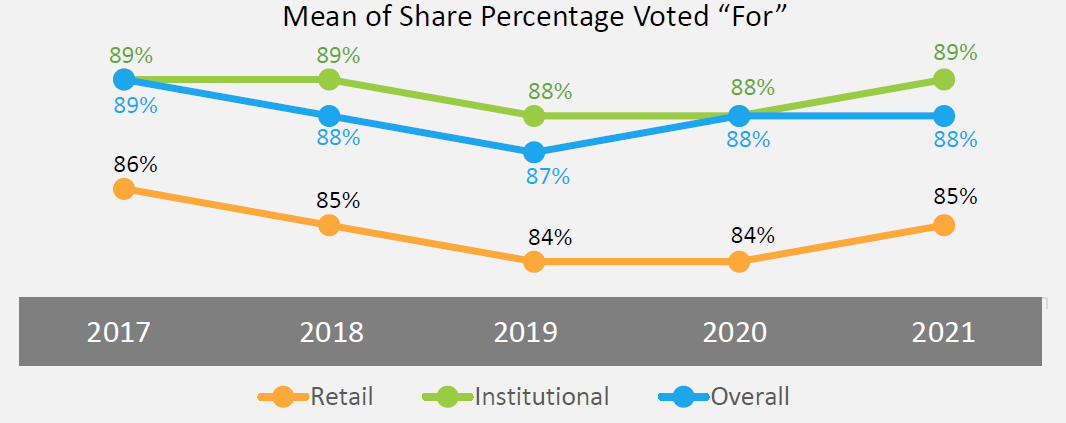

Say-on-Pay

Average support for say-on-pay proposals remained steady at 88% in 2021. The number of proposals that failed to receive majority support declined slightly to 105 in 2021 from 107 the prior year. A closer look at the data revealed low say-on-pay support correlates to low director support. Twenty-four percent (24%) of issuers who failed to achieve 50% favorability on say-on-pay also had at least one director who failed to achieve 50% support for re-election (25 out of 105). Also, 36% of issuers who failed to achieve 70% favorability on say-on-pay also had at least one director who failed to achieve 70% re-election support (90 out of 251).

Methodology

ProxyPulse is based in part on analysis of company Form 8-K filings from EDGAR and Broadridge’s processing of shares held in street name, which accounts for over 80% of all shares outstanding of US publicly-listed companies. Shareholder voting trends during the proxy season represent a snapshot in time and may not be predictive of full year results.

In this post we calculated voting outcomes by giving equal weight to each issuer. Our calculations for institutional and retail share ownership are taken in the aggregate. Our calculations on the outcomes of director elections take each director as a single data point.

The historical data used in the five-year trend charts excluded meetings of a few large volume, low value penny stocks.

Endnotes

1State Street Global Advisors, “CEO’s Letter on Our 2022 Proxy Voting Agenda,” January 12, 2022.(go back)

2Fenwick & West LLP, “Proxy Advisors Update Voting Guidelines for 2022 Focusing on Board Diversity, Climate and ESG Oversight,” December 9, 2021..(go back)

3Reuters, “U.S. SEC chair Gensler says new climate risk rules will require companies to detail, measure commitments to mitigating climate change,” December 7, 2021..(go back)

4Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates, Matters To Consider for the 2022 Annual Meeting and Reporting Season, December 2021.(go back)

5Based on Broadridge processing of shares held in street name.(go back)

6As You Sow, “S&P 500 Racial Justice and DEI Scorecard Separates Leaders From Laggards,” March 4, 2021..(go back)

7The Wall Street Journal, “SEC Weighs Requiring Companies to Give More Details on Workers,” August 20, 2021..(go back)

8See https://www.sec.gov/corpfin/announcement/announcement-14a-8-no-action-requests-20211213.(go back)

9The five-year trend data covers the proxy season, which is when the majority of public company meetings occur.(go back)

Print

Print