Annette Nazareth is a partner in the Financial Institutions Group at Davis Polk & Wardwell LLP, and a former commissioner at the U.S. Securities and Exchange Commission. The following post is based on a Davis Polk client memorandum. The complete publication, including appendices, is available here.

Just one day in advance of the December 21, 2013 expiration of the CFTC’s exemptive order delaying the applicability of some CFTC swap regulations for non-U.S. swap dealers and foreign branches of U.S. swap dealers, the CFTC approved a series of comparability determinations. These comparability determinations will allow CFTC-registered non-U.S. swap dealers and foreign branches of U.S. swap dealers to comply with local requirements rather than the corresponding CFTC rules in cases where substituted compliance is available under the CFTC’s cross-border guidance. [1] The CFTC made comparability determinations for some swap dealer entity-level requirements for Australia, Canada, the European Union (the “EU”), Hong Kong, Japan and Switzerland and for a limited number of transaction-level requirements for the EU and Japan.

Contemporaneously with the comparability determinations, the CFTC published two no-action letters (here and here) providing temporary relief for certain non-U.S. swap dealers in some of the above-listed jurisdictions (generally not including Hong Kong) for compliance with swap data reporting rules under Parts 45 and 46 and certain internal business conduct rules under Part 23 of the CFTC’s regulations, including risk exposure reporting, restrictions on counterparty clearing relationships and clearing member risk management. While the CFTC deferred the decision to make comparability determinations for swap data reporting requirements, the reporting no-action relief will allow non-U.S. swap dealers that do not have a U.S. ultimate parent to delay CFTC-mandated reporting for transactions with non-U.S. persons until (i) March 3, 2014 for transactions with guaranteed and conduit affiliates [2] and (ii) the earlier of 30 days after a substituted compliance determination and December 1, 2014 for transactions with non-U.S. persons that are not guaranteed or conduit affiliates.

Where the CFTC did not provide for comparability or timing relief, swap dealers will need to comply with the relevant requirements immediately, to the extent required in the CFTC’s cross-border guidance.

Comparability Determinations

The CFTC issued separate comparability determinations for entity-level level requirements for Australia, Canada, the EU, Hong Kong, Japan and Switzerland and for transaction-level requirements in the EU and Japan. These determinations are summarized briefly below. The charts included as Appendix A and Appendix B to this memorandum list entity- and transaction-level requirements and summarize the comparability determinations and timing relief.

Entity-Level Requirements

The CFTC made determinations that local law in each of the six jurisdictions listed above is comparable to the following entity-level requirements:

- position limit monitoring;

- diligent supervision;

- business continuity and disaster recovery;

- research and clearing conflicts; and

- subject to conditions described in Appendix A, chief compliance officer, risk management program, availability of information for disclosure and swap data recordkeeping.

This will enable CFTC-registered non-U.S. swap dealers to comply with local law for these requirements in lieu of CFTC regulations.

The CFTC declined to take up requests for comparability determinations with respect to CFTC rules restricting counterparty clearing relationships, though, as noted above, the CFTC granted certain non-U.S. swap dealers temporary no-action relief from having to comply with those requirements until March 3, 2014.

The CFTC also declined to make comparability determinations for any jurisdiction for the CFTC requirement to provide compliance and risk reports to the CFTC. Thus, in addition to reserving its rights to conduct examinations and directly access required books and records of swap dealers, the CFTC is requiring all registered swap dealers to submit to the CFTC annual compliance and quarterly risk exposure reports. As the CFTC found the underlying compliance and risk management obligations comparable in each jurisdiction, swap dealers relying on substituted compliance will need to submit reports to the CFTC that address local law requirements.

Transaction-Level Requirements

The CFTC issued comparability determinations for non-U.S. swap dealers and foreign branches of U.S. swap dealers in the EU or Japan for a limited number of transaction-level requirements.

- For the EU: The CFTC found that EU trade confirmation, portfolio reconciliation and portfolio compression requirements are comparable to the analogous CFTC regulations, without condition or exception. The CFTC also found comparable local law to CFTC daily trading record requirements, except with respect to records of pre-trade execution information, including records of oral communications, and swap trading relationship documentation requirements, but only with respect to the confirmation and valuation provisions.

- For Japan: The CFTC found Japanese daily trading records and swap trading relationship documentation requirements comparable to CFTC requirements, except for CFTC requirements relating to disclosures and representations on the potential applicability of Dodd-Frank orderly liquidation authority provisions and certain counterparty clearing disclosures. The CFTC did not make a determination for Japanese rules with respect to trade confirmation, portfolio reconciliation and portfolio compression.

This will enable CFTC-registered swap dealers and foreign branches of U.S. swap dealers in these jurisdictions to comply with local law for these requirements where substituted compliance is available under the cross-border guidance, in lieu of complying with the relevant CFTC regulations.

The EU comparability determinations relating to trade confirmations, portfolio reconciliation, portfolio compression and swap trading relationship documentation requirements are identical in scope to the “essentially identical” determinations made by the CFTC staff in no-action letter 13-45 (available here). However, the set of transactions for which substituted compliance is available is not identical to the set of transactions for which relief under letter 13-45 is available. As a result, swap dealers will need to analyze their organizational structure and types of counterparties to determine what relief is available to specific transactions.

The CFTC declined to make comparability determinations in any jurisdiction for other key transaction-level requirements, including clearing and trade execution, and did not make determinations for transaction-level requirements for jurisdictions other than the EU and Japan.

Availability of Substituted Compliance

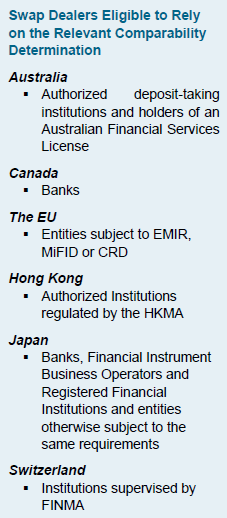

The CFTC’s recent comparability determinations are available to the non-U.S. swap dealers and foreign branches of U.S. swap dealers described in the sidebar for each jurisdiction. The determinations should be available to all currently registered non-U.S. swap dealers.

For requirements where the CFTC has made a comparability determination, substituted compliance is available for qualifying swap dealers, as provided by the CFTC’s cross-border guidance, as outlined below.

Entity-Level Requirements—General

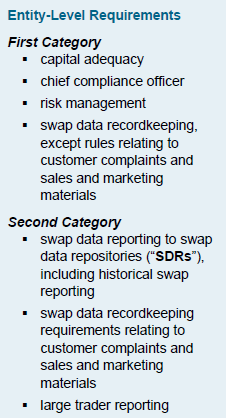

The CFTC’s cross-border guidance divides entity-level requirements into First Category and Second Category requirements, as described in the accompanying sidebar, and provides for the possibility of substituted compliance for entity-level requirements in some cases, as follows:

U.S. Swap Dealers (including their foreign branches): No substituted compliance is available.

Non-U.S. Swap Dealers (including those affiliated with U.S. persons): Substituted compliance is potentially available for First Category entity-level requirements, regardless of the U.S. person status of the counterparty to a swap. With respect to Second Category entity-level requirements:

- for SDR reporting, substituted compliance is potentially available only where the counterparty is a non-U.S. person and the CFTC has direct electronic access to the swap data stored at the foreign trade repository;

- for swap data recordkeeping requirements relating to customer complaints and sales and marketing materials, substituted compliance is potentially available only where the counterparty is a non-U.S. person; and

- for large trader reporting, substituted compliance is not available.

Transaction-Level Requirements—General

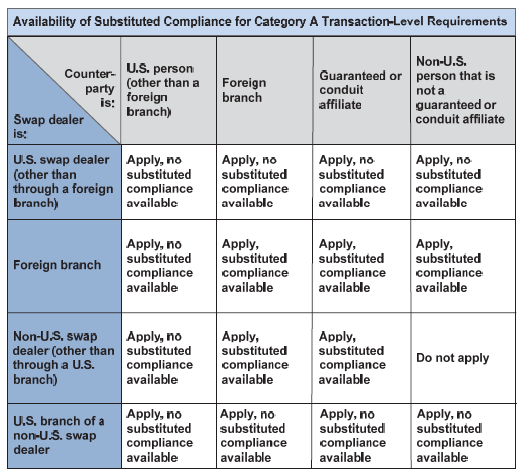

The CFTC’s cross-border guidance provides that substituted compliance is potentially available for transaction-level requirements other than external business conduct standards—so-called “Category A Transaction-Level Requirements”—based on the status of the counterparties, as summarized in the chart below.

Substituted compliance is not available for external business conduct standards—so-called “Category B Transaction-Level Requirements”—though such requirements do not apply to transactions between (i) non-U.S. swap dealers and non-U.S. persons, (ii) non-U.S. swap dealers and foreign branches of U.S. swap dealers, (iii) foreign branches of U.S. swap dealers and non-U.S. persons or (iv) foreign branches of U.S. swap dealers.

Other than by way of the December 20, 2013 comparability determinations described above, the CFTC has not yet made substituted compliance available for other entity-level or transaction-level requirements.

Next Steps for the CFTC

In the comparability determinations, the CFTC stated that it is in the process of negotiating supervisory arrangements with each applicable foreign regulator to establish a “roadmap” for how foreign regulators will cooperate, share information and consult with each other. These arrangements may include establishing expectations for ongoing communications between regulators, memorializing understandings related to CFTC on-site visits and addressing confidentiality issues related to non-public information.

Endnotes:

[1] The CFTC’s actions also extend to non-U.S. MSPs and foreign branches of U.S. MSPs.

(go back)

[2] This date is April 2, 2014 for purposes of Part 46 historical swap reporting.

(go back)

Print

Print