Rajeev Kumar is a senior managing director of research at Georgeson Inc. This post is based on the executive summary of a Georgeson report; the full report is available here.

The stage for the 2015 proxy season was set early by the actions of the New York City Comptroller’s Office in sponsoring 75 shareholder proposals, with proxy access playing out as the dominant governance issue. The total number of shareholder proposals, as a result, reversed its decline and registered its highest total in the past five years. Support for say-on-pay proposals remained high, support for director elections continued to increase and the issues of board composition and succession planning remained in the spotlight. There were continued calls for engagement between issuers and shareholders, emphasizing increased participation by directors and a focus on long-term value creation and related issues. Proxy fight activism continued to raise interesting issues and discussions about how best to deal with activists.

Shareholder Proposals by Number: Significant Increase in 2015

Reversing a three-year decline, the number of shareholder proposals increased during the 2015 proxy season, hitting its highest level in five years. A total of 462 corporate governance shareholder proposals were submitted in 2015, an increase of 5.5 percent from 2014. The increase is significantly more pronounced when looking at the number of proposals in 2015 that were voted on by shareholders: 333 of the 462 submitted shareholder proposals (with the rest withdrawn or omitted), representing an increase of almost 34 percent over the 249 proposals that went to a vote in 2014. The percentage of submitted proposals that made it to a vote jumped from 57 percent in 2014 to 72 percent in 2015, another five-year high. Board-related proposals—more specifically, proxy access proposals—were the primary reason behind this increase. The S&P 1500 had 72 proxy access proposals come to a vote in the first half of 2015, compared with 13 in 2014.

Individual shareholders again accounted for a large portion of 2015’s shareholder proposals and submitted nearly half of the proposals that went to a vote. However, as a percentage their share declined from 2014. This was attributable to public pension funds nearly doubling the number of proposals they submitted in 2015, as New York City pension funds took the lead in sponsoring the proxy access proposals.

Governance-Related Shareholder Proposals: The Year of Proxy Access

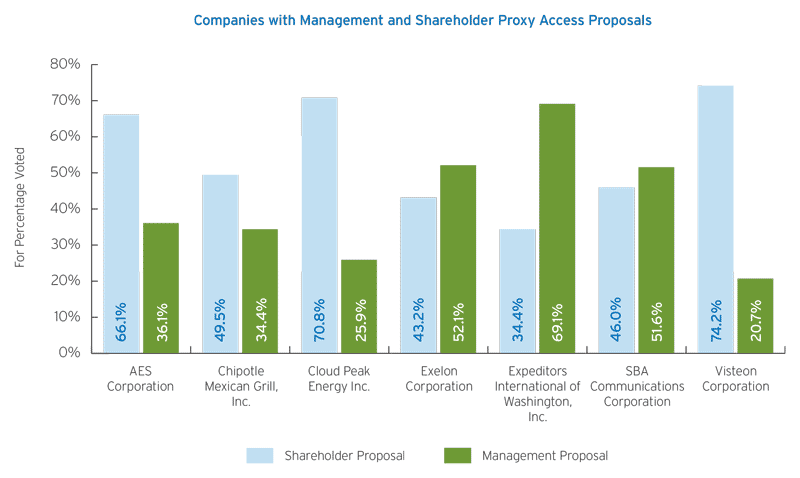

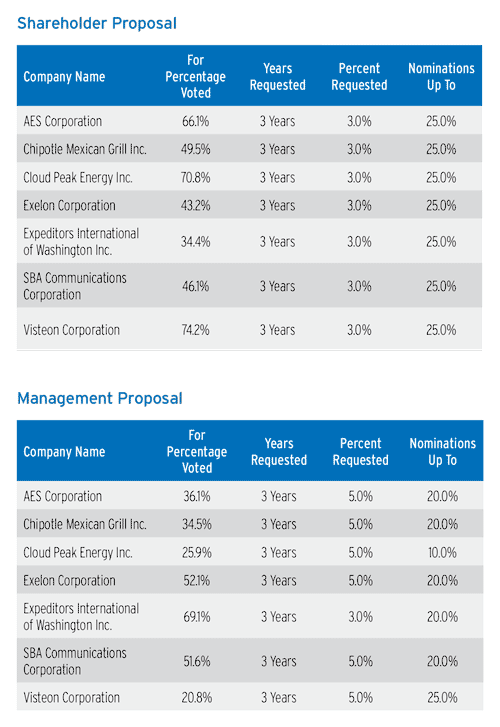

We noted in last year’s report that a consensus opinion has clearly started to form in favor of the Securities and Exchange Commission’s 2010 rule version of proxy access (that was later vacated), which called for holders to own three percent of the shares for three years, allowing nominations for up to 25 percent of the board. We suggested that the strong levels of support might result in more shareholder resolutions being submitted going forward. However, little did we expect the proxy access proposal to take center stage in 2015 the way that it did. Following the 2014 proxy season, the New York City Comptroller’s Office launched the “Boardroom Accountability Project,” submitting the three-percent/three-year version of the proxy access proposal to 75 companies and bringing the proxy access issue to the forefront. The 75 companies were targeted based on three priority issues of climate change (33), board diversity (24) and excessive CEO pay (25), with some companies appearing in more than one category. The next big turn of events occurred when the SEC unexpectedly reversed its earlier ruling that had provided “no-action” relief to Whole Foods to exclude the proxy access shareholder proposal based on the “conflicting proposal” rule. Not only did the SEC withdraw the no-action relief to Whole Foods, but it decided to review the whole issue of conflicting proposals, suspending its practice of providing such no-action relief to exclude shareholder proposals on the basis that they directly conflict with a management proposal involving the same subject matter. The SEC’s decision left many companies that were considering using such relief in a quandary as to how to proceed. As things played out, most of the companies ended up including the shareholder proposal expressing the board’s opposition but without including the company’s own counterproposal on proxy access. Some companies proactively adopted, proposed to adopt or proposed for shareholder vote a three-percent/three-year proxy access provision. As a result, they entered into a settlement with the proponent for the withdrawal of the shareholder proposal. Six companies adopted proxy access with the higher five-percent ownership threshold while six companies (Expeditors International of Washington’s counter-proposal was at three percent threshold) included such a counter-proposal on the ballot looking to defeat the shareholder proposal that advocated a lower three-percent ownership threshold.

To date, a total of 110 proxy access shareholder proposals were filed in 2015. Proposals at 88 companies went to a vote, with 18 omitted, withdrawn or merged-out (four are still pending). The average support level has been close to 54 percent of votes cast in favor, with 52 of the 88 proposals (59 percent) receiving majority support.

The vote results at the seven companies that included a competing proposal have been mixed. In three instances the shareholder proposal received majority support while the management proposal did not, and in three other instances the results were flipped—the management proposal received majority support while the shareholder proposal did not. In one final instance neither proposal garnered majority support.

Many of the shareholder-sponsored proposals in 2014 were not modelled after the SEC’s version and therefore did not receive Institutional Shareholder Services’ (ISS’s) support. Of the 17 proposals that went to a vote in 2014, nine proposals were of the three-percent/three-year variety that were opposed by the board but received ISS support. The average support was approximately 52 percent, with five of the nine proposals (55.5 percent) receiving a majority of votes cast in favor. It is interesting to note that when comparing the voting results of such proposals from 2015 with those of 2014, the outcome is not that different. In 2015, there were 84 such cases, and the average support level was 52.7 percent with over 58 percent receiving majority support. The likely reason that the expected higher level of support did not materialize is that there is still no consensus among institutional investors to support the three-percent/three-year proxy access proposal. Among the largest shareholders, a few favor an ownership threshold higher than the three percent, while a few others do not generally support proxy access.

For the 2016 proxy season, it will be interesting to see how companies that received shareholder proposals in 2015 respond to shareholder mandates, especially in cases where the proposal received meaningful but less than majority support. One thing is certain—we can expect to see another wave of shareholder proposals next year, and there will be continued focus and momentum on this issue. And the SEC will again be in the spotlight, as its guidance following its staff review of conflicting proposal Rule 14a-8(i)(9) will affect companies’ responses to the 2016 proposals.

While proxy access dominated the governance-related proposals, the two other top proposals related to independent board chairs and shareholders’ right to act by written consent. The independent chair proposal largely mirrored the results of 2014 in terms of both volume and average shareholder support. In 2015, 58 proposals were voted on, and the average level of support was nearly 30 percent. The volume of proposals regarding shareholders’ right to act by written consent increased by 30 percent from last year, and the 39 percent average shareholder support for the 35 proposals in 2015 was roughly in line with last year’s average.

Director Election: Increasing Focus on Board Composition and Succession Planning

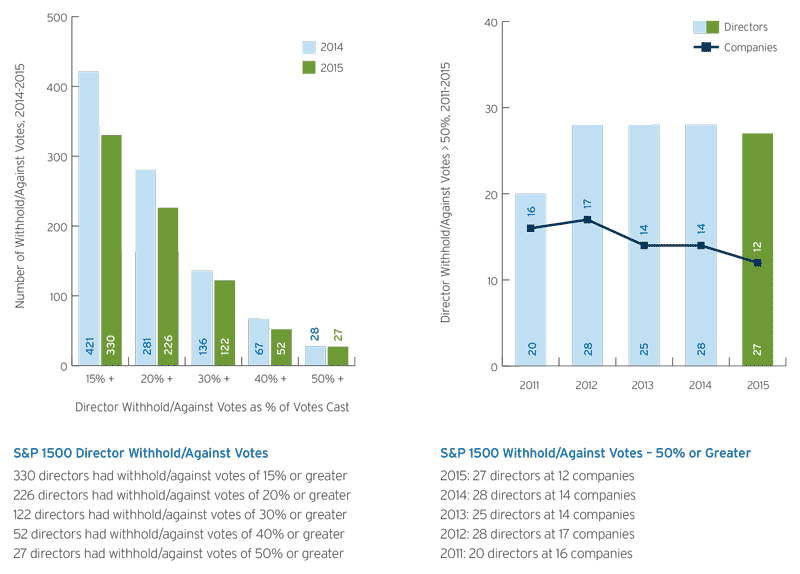

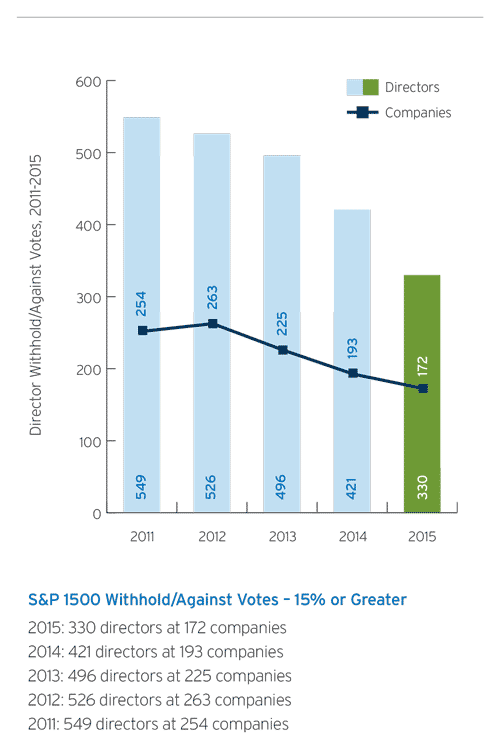

The trend of increased support for director elections that started in the 2011 proxy season, corresponding with the introduction of mandatory say on pay, continued in 2015. Among the S&P 1500 companies, the number of directors receiving 15 percent or greater opposition fell from 421 in 2014 to 330 in 2015. Indicative of the impressive showing, the number of directors receiving 15 percent or greater opposition has now fallen by more than 50 percent since 2010, according to Georgeson data.

The number of directors who faced majority opposition to their election was consistent with last year: 27 directors failed to get majority support in 2015 compared with 28 directors in 2014. The 27 directors were nominees to 12 companies, with 16 of them (over 59 percent) representing just three companies. In a repeat from last year, nine directors at Healthcare Services Group Inc. received majority withhold votes for reasons of a) non-responsiveness to 2014 majority-supported shareholder proposals, and b) failure to address the issues underlying the majority opposition to its 2014 director nominees. CtW Investment Group was conspicuously absent this year after having led the charge of “vote no” campaigns against the reelection of directors in all but one case in 2014. No such campaign surfaced during the 2015 proxy season.

There were 15 shareholder proposals relating to board composition on the ballot in 2015 compared with nine in 2014. Four of these proposals were on the topic of board diversity and received 11.1 percent average shareholder support, down substantially from the average of 29.1 percent in 2014. The remaining proposals similarly had a low average level of voter support.

Board composition and succession planning continued to be in the spotlight in 2015. The issues about a board’s skill set and qualifications increasingly became targets of activism. The boards were faced with growing demands and challenges, with (among other issues) proxy fight activists frequently targeting long-tenured directors, the Thirty Percent Coalition and other groups continuing to push for greater board diversity, and cybersecurity and other IT risks affecting an increasing number of companies.

Shareholders, who now have increased expectations of boards, looked for greater direct engagement to understand how the directors think and interact as well as the skills they bring to the table. To help ensure the board has the necessary skills and expertise, a board succession plan and a regular process of board refreshment are viewed as increasingly necessary.

Shareholder Engagement: Calls for Increased Participation of Directors

In their effort to improve corporate governance, institutional investors continued to push for greater engagement with companies—especially for direct engagement with directors. Several major institutional investors wrote letters to companies (generally representing their largest holdings) supporting good corporate governance and highlighting the importance of shareholder engagement.

Instead of leaving the task of engagement to the chairman or a senior independent director, Vanguard’s letter proposed the creation of “shareholder liaison committees” to give shareholders greater access to board members. F. William McNabb III, Vanguard’s chief executive, indicated that meetings with directors would allow investors to express their opinions and allow discussion about important long-term issues. [1]

To date, we are aware of only one company, Tempur Sealy, that has agreed to create a shareholder liaison committee, following its proxy situation with H Partners. Many other companies have made directors available to speak with shareholders without such a committee.

BlackRock, Inc. CEO Larry Fink, in a letter to his firm’s largest portfolio companies, encouraged them to take a long-term approach to creating value. BlackRock views the use of its voice through engagement with the companies as an effective mechanism to help promote such focus. [2]

Roger W. Ferguson Jr., CEO of TIAA-CREF, similarly urged investors and companies to collaborate cooperatively, as this helps achieve outcomes that further the long-term interests of all shareholders. TIAA-CREF was also active in pushing for proxy access reform and wrote a letter to its top 100 portfolio companies asking them to voluntarily adopt proxy access by October, using the three-percent/three-year/25-percent model. [3]

SEC Chair Mary Jo White, in her remarks at the national conference of the Society of Corporate Secretaries and Governance Professionals, asked companies to be proactive in building meaningful communication and engagement with their shareholders. She urged more companies to embrace engagement so that more shareholders will be incentivized to choose direct engagement as their preferred first approach over the shareholder proposal process. [4]

The case for engagement between companies and their shareholders clearly gained further ground during the 2015 proxy season. There is an increasing realization of the mutual benefits of engagement, as it allows insight into both parties’ perspectives and promotes greater alignment.

Say on Pay: Shareholder Support Remains High

In its fifth year of mandatory votes, say on pay (SOP) proposals continued to receive high levels of shareholder support. Based on 2015 vote results for Russell 3000 companies with meetings through June 30, the average support level increased marginally from last year, and at nearly 92 percent, represents the best results for the proposal thus far. The results likely reflect the impact of ISS’s recommendations, since the percentage of ISS’s negative recommendations for SOP proposals declined to its lowest level this year: approximately 11 percent. The average vote in favor at companies that received ISS’s favorable recommendation remained at the 95 percent level—the same level as in 2014. In 2015, however, the level of support at companies that received ISS’s negative recommendation declined to a little less than 65 percent.

The main reason for low levels of support on SOP proposals continues to be a pay-for-performance disconnect, where the CEO’s pay level is misaligned with the company’s stock price performance. Special one-time grants made to CEOs (and other named executive officers) without adequate justification and/or lacking performance conditions were also one of the main pay concerns for shareholders.

Executive compensation became an issue of increasing focus in proxy fights in 2015. Dissidents at Qualcomm Inc., DuPont Co. and Perry Ellis criticized those companies on the use of performance metrics that inappropriately rewarded executives for lack of “true performance.” At Shutterfly Inc., where the company’s SOP proposal has received low shareholder support in the past two years, the CEO’s pay became the dissident shareholder’s main complaint. In addition to supporting two of the dissident’s three nominees, shareholders rejected the company’s SOP proposal with more than 78 percent opposition.

While average support levels for SOP proposals remain high, it is important for companies to pay attention to their specific situations. Companies should address any shareholder concerns from the previous year(s) or any misalignment that may have resulted from changes in compensation programs or as a result of poor performance.

Compensation-Related Shareholder Proposals: Focus on Change-in-Control, Clawback, and Equity Retention

There were a greater number of compensation-related shareholder proposals in the 2015 proxy season—an increase of 16 percent from last year—with voter support averaging 28 percent. Almost three-fourths of the 71 proposals related to one of the following three issues:

- Prohibiting acceleration of vesting of equity awards in the event of a change-in-control situation

- Recouping compensation of senior executives

- Requiring senior executives to retain a significant portion of their equity awards

After a breakout year in 2014, change-in-control proposals saw an uptick in volume with 26 proposals appearing in 2015 compared with 20 such proposals last year. Average support declined slightly from 35 percent in 2014 to 33 percent in 2015, with only one of the proposals receiving majority shareholder support this year (FirstMerit Corporation) versus four in 2014. While the recoupment policy proposals jumped in number, from three in 2014 to 14 in 2015, the equity retention proposals more than halved, from 26 in 2014 to 12 in 2015. The best-performing proposal was on the issue of shareholder ratification of future severance arrangements, with an average of 42 percent of votes cast in its favor and three of the seven proposals (Hologic, Staples and TCF Financial Corporation) receiving majority shareholder support.

Environmental and Social (E&S) Proposals: Fewer Political Activity Proposals See Increased Support

In 2015, shareholder proposals relating to political activity fell from their perch as the leading topic for shareholder proposals, replaced by proxy access. However, when considered by category, environmental and social topics continued to represent the largest proposal type. In 2015, there were 63 political activity proposals, a 25 percent reduction in volume from 84 in 2014. All the other prominent subcategories of E&S proposals saw an increase: climate change and greenhouse gas emissions (34 proposals in 2015 versus 28 proposals in 2014), labor and human rights (10 in 2015 versus eight in 2014), and sustainability reporting (19 in 2015 versus 13 in 2014).

As in prior years, political activity proposals generally requested more robust disclosure of company political spending, lobbying activities and board oversight policies. Political spending proposals averaged shareholder support of 24 percent compared with an average of 20 percent in 2014, while the support level for lobbying activity proposals remained unchanged at 22 percent. None of the political activity proposals this year managed to receive majority support, although four such proposals did in 2014.

The CPA-Zicklin Index, which ranks companies based on their political transparency and oversight practices, expanded its benchmarking from the top 300 to all of the S&P 500 companies (using the same 24 indicators as in 2013 and 2014). The Center for Political Accountability (www.politicalaccountability.net) again partnered with the Sustainable Investments Institute, a nonprofit that conducts impartial research on companies’ ESG practices, to collect the data and to score companies based on their political disclosure practices. The CPA’s index findings were released in early October and in the past companies with low scores have found themselves the targets of shareholder resolutions.

Contested Solicitations: To Capitulate or to Fight? That Is the Question

With activism continuing to perform better than other hedge fund strategies, activist investors hit another record for their assets under management, with more than $140 billion as money continued to pour in to activism in 2015. As activist investors put their increasing war chest to work, 2015 brought another year of a high volume of proxy fights involving more companies with larger market caps being targeted.

Of the 36 proxy fights Georgeson tracked where dissidents filed proxy materials, eight were settled or withdrawn. Of the 28 situations that went the distance and came to a vote, the contest results were even: management won in 12 cases, and the dissident gained representation in 12 cases (four situations are still pending as of the writing of this report). The company win rate of 50 percent represents an improvement over the 40 percent success rate we noted in last year’s report. However, the results of the proxy fights that went to a vote don’t tell the full story. In many situations, the activist campaigns settled before the dissidents filed proxy materials. According to FactSet data, 2015 saw a record number of settlements when all activist campaigns were included.

While activist hedge funds generated superior returns for their investors, the debate continued as to whether activists who agitate for change actually improve company performance. While activism may be successful as an investment strategy, are the activists focused on short-term gains that may lead to negative consequences for the company and the broader economy in the long term? Larry Fink, chief executive of BlackRock Inc., the largest asset manager in the world, questioned the merits of such maneuvers as paying dividends and buying back stock, which are often carried out under pressure from activist investors. In his letter to the CEOs of S&P 500 companies, he indicated that the effects of the short-term phenomenon were troubling and that investors instead need to focus on long-term strategies and long-term outcomes. Fink’s letter likely surprised CEOs, as investors are generally seen to favor high dividends and bigger buybacks.

The issue of investing for the long term was also crucial to 2015’s highest-profile proxy fight that went to a vote, which also was the largest in U.S. history. Prominent activist investor Nelson Peltz, Chief Executive Officer and founding partner of the hedge fund Trian Partners, narrowly lost a bruising proxy battle against the $67 billion conglomerate E.I. du Pont de Nemours and Company (DuPont). In defeating Peltz, DuPont defended its investment in scientific research and raised the concern that Trian would slash research and development expenditures, an argument that resonated with some investors. DuPont’s victory has been viewed as significant because there is a concern that many companies capitulate to activists’ demands too readily. Even Marty Lipton, the most famous corporate defense attorney and one of the most outspoken critics of activism, suggested during the DuPont fight that in order to avoid the risks and potential harm from a public proxy contest, more companies should think about settling early rather than taking up a fight with activists. [5] The support that DuPont received from many of its significant shareholders indicates it is possible to win their endorsement if the company is pursuing a viable long-term strategy.

In addition to the DuPont proxy fight, there were a few other notable contested situations and developments. In a first, Third Point was successful in getting shareholder support for a special pay arrangement for its two activist directors on Dow Chemical Company’s board. The directors will be paid by Third Point for their service based on how Dow’s stock performs in the coming years. A dissident director pay arrangement that did not come to fruition occurred at General Motors Company. A group of investment funds represented by Harry Wilson, a former Obama administration Task Force on the Auto Industry member, pushed the company to buy back stock and give Wilson a seat on the board. Wilson had contractual agreements with the investment funds that provided him a percentage of any gain in the value of their GM holdings resulting from his efforts. General Motors eventually settled with Wilson and agreed to buy back stock without giving him a seat on the board. In another unusual occurrence, the hedge fund H Partners launched a vote-no campaign employing a dissident proxy card against three incumbent directors, including the CEO at Tempur Sealy International Inc. Typically, vote-no campaigns are waged using an “exempt solicitation” approach that does not employ a separate dissident card. Furthermore, in a rare vote-no outcome, Tempur Sealy entered into a settlement with H Partners whereby the three directors stepped down following significant opposition, ranging from nearly 80 percent to roughly 90 percent, to their election. In its continuing efforts to improve shareholder rights at lodging and hospitality REITs, labor union UNITE HERE targeted 15 companies in 2015 with proposals such as declassifying the board, giving shareholders a say in the use of antitakeover statutes and establishing the rights of shareholders to initiate bylaw amendments. While five of the targets agreed to implement the requested reforms, about half a dozen others agreed to include the proposals in their proxy materials. At the remaining four companies, UNITE HERE filed a separate proxy card under Rule 14a-4 with no dissident candidates but seeking shareholder support for its proposals. The dissident proposals fared extremely well, with most receiving majority voter support.

The complete publication is available here.

Endnotes:

[1] Vanguard CEO Shareholder Relations Letter

(go back)

[2] http://www.blackrock.com/corporate/en-at/literature/publication/long-term-value-letter-041415.pdf

(go back)

[3] http://www.thecorporatecounsel.net/member/FAQ/ShareholderAccess/03_15_TIAA-CREF.pdf

(go back)

[4] Building Meaningful Communication and Engagement with Shareholders.

(go back)

Print

Print