The following post comes to us from Luigi L. De Ghenghi and Andrew S. Fei, attorneys in the Financial Institutions Group at Davis Polk & Wardwell LLP, and is based on a Davis Polk client memorandum; the full publication, including diagrams, tables, and flowcharts, is available here.

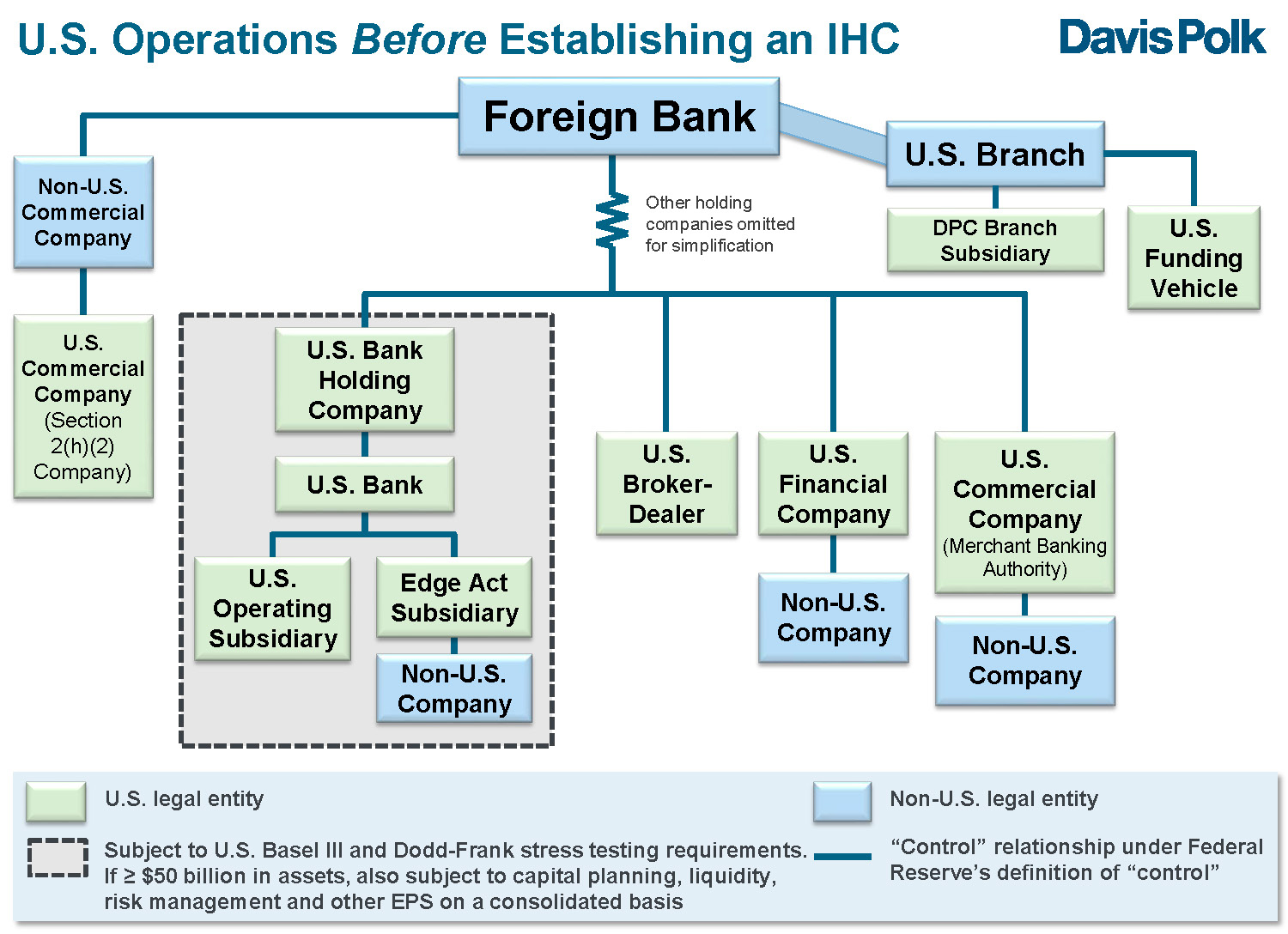

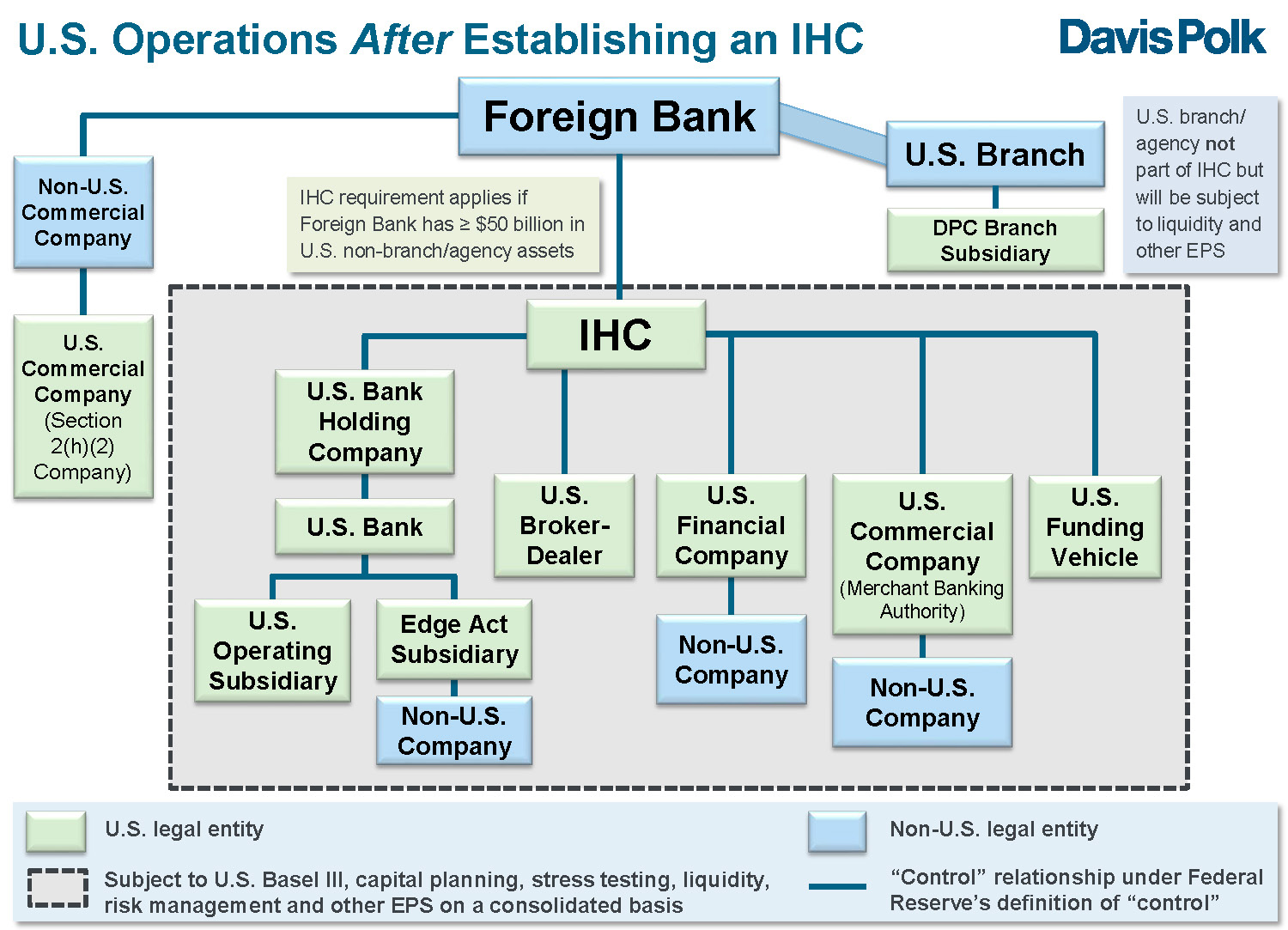

The Federal Reserve’s Dodd-Frank enhanced prudential standards (“EPS”) final rule requires a foreign banking organization with $50 billion or more in U.S. non-branch/agency assets (“Foreign Bank”) to place virtually all of its U.S. subsidiaries underneath a top-tier U.S. intermediate holding company (“IHC”). The IHC will be subject to U.S. Basel III, capital planning, Dodd-Frank stress testing, liquidity, risk management requirements and other U.S. EPS on a consolidated basis.

Establishing an IHC involves complex corporate structuring, regulatory, capital, liquidity, tax and corporate governance considerations and significant legal analysis. It is critical that the IHC be structured in an efficient and optimal manner from a business, operations, capital, funding, liquidity, tax, risk management and corporate governance perspective.

Visuals of a Foreign Bank’s U.S. Operations Before and After Establishing an IHC

Key IHC Structuring and Regulatory Considerations for Foreign Banks

Key IHC structuring and regulatory considerations for Foreign Banks include, among other things:

- Designate an existing entity as the IHC or establish a new IHC?

- Request permission from the Federal Reserve to establish multiple IHCs or use other alternative organizational structures?

- Should a U.S. subsidiary divest control of certain non-U.S. entities so that they will not be part of the IHC?

- Which ownership structures will be the most tax efficient?

- How will the IHC’s structure affect its ability to repatriate profits to the Foreign Bank parent?

- Which ownership structures will minimize the IHC’s investments in the capital of unconsolidated financial institutions, which are subject to a punitive capital deduction regime under U.S. Basel III and home country Basel III rules?

- How should the IHC hold certain subsidiaries so as to minimize the adverse impact of minority interest treatment under U.S. Basel III and home country Basel III rules?

- Should the IHC issue U.S. Basel III-compliant capital instruments to third-party investors or receive funding from the Foreign Bank parent?

- Will the Foreign Bank be able to recognize U.S. capital and liquidity resources trapped in the IHC for purposes of calculating its own capital and liquidity ratios under home country standards?

- How should the IHC balance the different asset composition incentives created by risk-based capital, leverage capital and liquidity requirements under U.S. Basel III and home country Basel III rules?

- How will the U.S. liquidity buffer, U.S. Basel III liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) requirements affect the IHC’s and U.S. branch/agency’s funding models?

- What is the optimal risk management and corporate governance structure for the IHC and the Foreign Bank’s U.S. operations?

- How should the Foreign Bank reconcile U.S. and home country risk governance requirements and expectations?

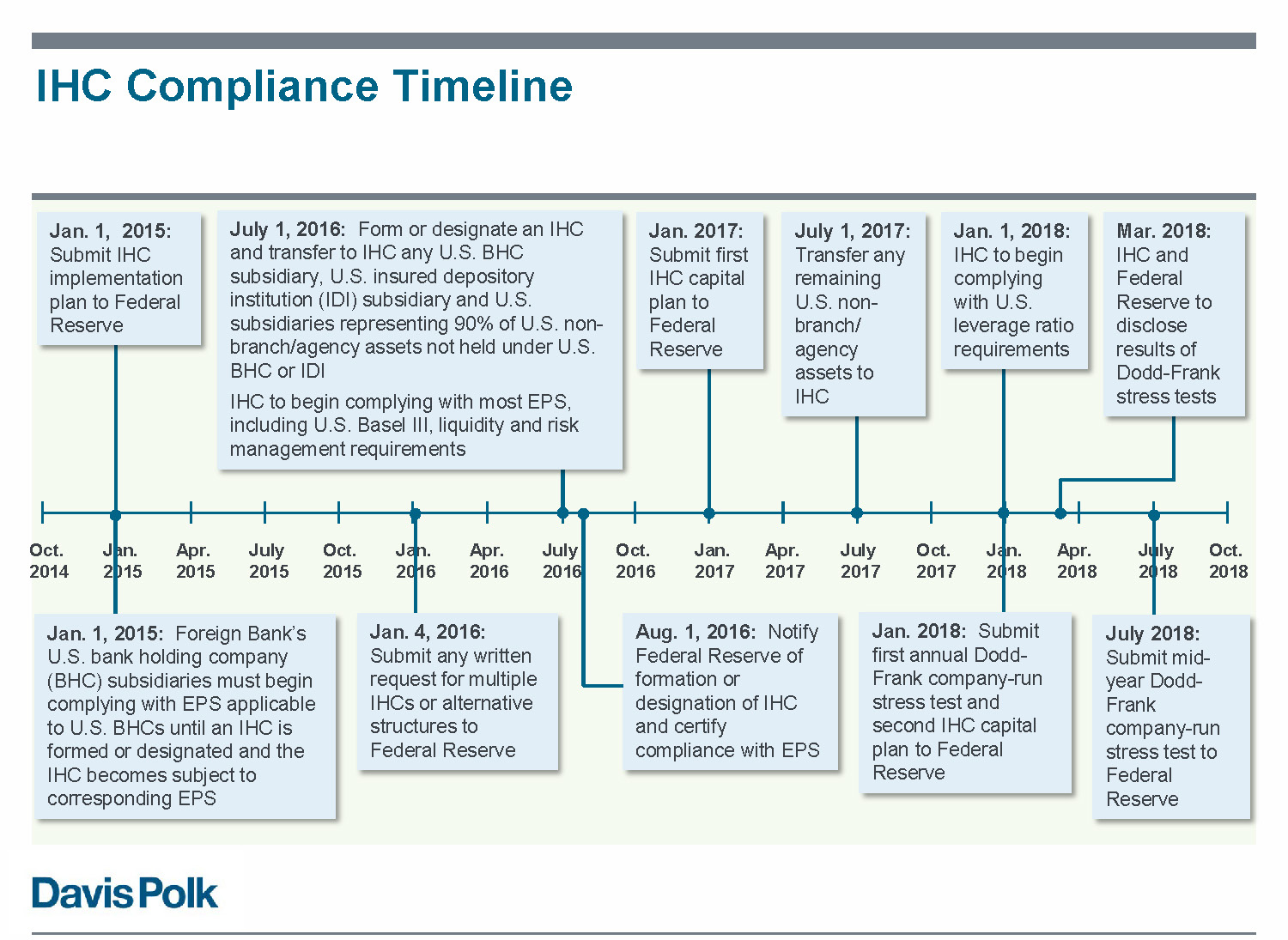

IHC Compliance Timeline

The full visual memorandum, which uses diagrams, charts, tables and flowcharts to explore key structuring and regulatory considerations for foreign banks that are required to establish an IHC, is available here.

Print

Print