The following post is based on a Davis Polk publication by Luigi L. De Ghenghi, Randall Guynn, Margaret E. Tahyar and Andrew S. Fei; the full publication, including visuals, tables and flowcharts, is available here.

In May 2014, the Federal Reserve issued a proposal that would implement the financial sector concentration limit set forth in Section 622 of the Dodd-Frank Act. The proposal reflects the Financial Stability Oversight Council’s January 2011 Study and Recommendations Regarding Concentration Limits on Large Financial Companies.

The concentration limit generally prohibits a financial company from merging or consolidating with, acquiring all or substantially all of the assets of, or otherwise acquiring control of another company if the “liabilities” of the resulting financial company, calculated using methodologies in the proposal, exceed 10% of aggregate financial sector liabilities.

Concentration Limit Is Approximately $1.8 Trillion: The Federal Reserve estimates aggregate financial sector liabilities to be approximately $18 trillion as of December 31, 2013. Accordingly, the 10% concentration limit would be approximately $1.8 trillion. The Federal Reserve noted that limitations in existing reporting requirements may result in underestimation of the aggregate financial sector liabilities calculated as of December 31, 2013.

Financial Institution M&A Transactions Subject to Close Regulatory Scrutiny Well Before Reaching Concentration Limit: In the current environment, large financial institution M&A transactions are subject to intense regulatory scrutiny for financial stability and other considerations well before they approach the statutory ceiling set by the Dodd-Frank concentration limit. Federal Reserve Governor Daniel K. Tarullo has stated that acquisitions by global systemically important banks (G-SIBs) are subject to presumptions against approval:

- “I would urge a strong, though not irrebuttable, presumption of denial for any acquisition by any firm that falls in the higher end of the list of global systemically important banks developed by the Basel Committee for purposes of assessing capital surcharges.”

- “Firms at the lower end of the Basel Committee [G-SIB] list, or that U.S. authorities may later designate as domestic systemically important banks under a parallel Basel Committee exercise, might have a slightly less robust, but still significant presumption against acquisitions.”

Financial companies subject to the concentration limit include:

- U.S. insured depository institution (IDI)

- Bank holding company (BHC)

- Savings and loan holding company (SLHC)

- Foreign banking organization (FBO)

- Any other company that controls an IDI, e.g., the parent company of an FDIC-insured industrial loan company, limited-purpose credit card bank or limited-purpose trust bank

- U.S. or foreign nonbank financial company designated as systemically important by the Financial Stability Oversight Council (Nonbank SIFI)

Financial institutions that are not affiliated with an IDI, such as stand-alone broker-dealers or insurance companies, are not subject to the concentration limit unless they are designated as Nonbank SIFIs.

New Reporting Obligations: The proposal would impose periodic reporting requirements on financial companies that do not otherwise report their financial information to the Federal Reserve or other U.S. banking agency.

Covered Acquisition is defined as a transaction in which a company merges or consolidates with, acquires all or substantially all of the assets of, or otherwise acquires control of another company, and the resulting company is a financial company. The concentration limit would not constrain internal or organic growth by a financial company. The proposal includes certain exclusions for ordinary business transactions as well as exclusions that require prior consent of the Federal Reserve.

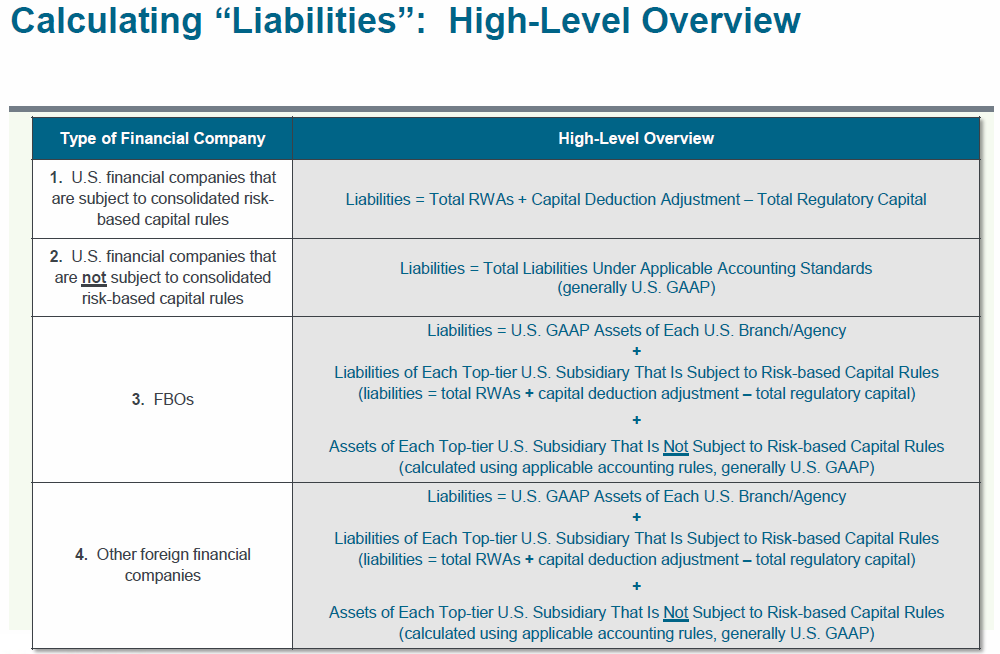

Calculating “Liabilities”: Following is a high-level overview of how “liabilities” would be calculated for different types of financial companies.

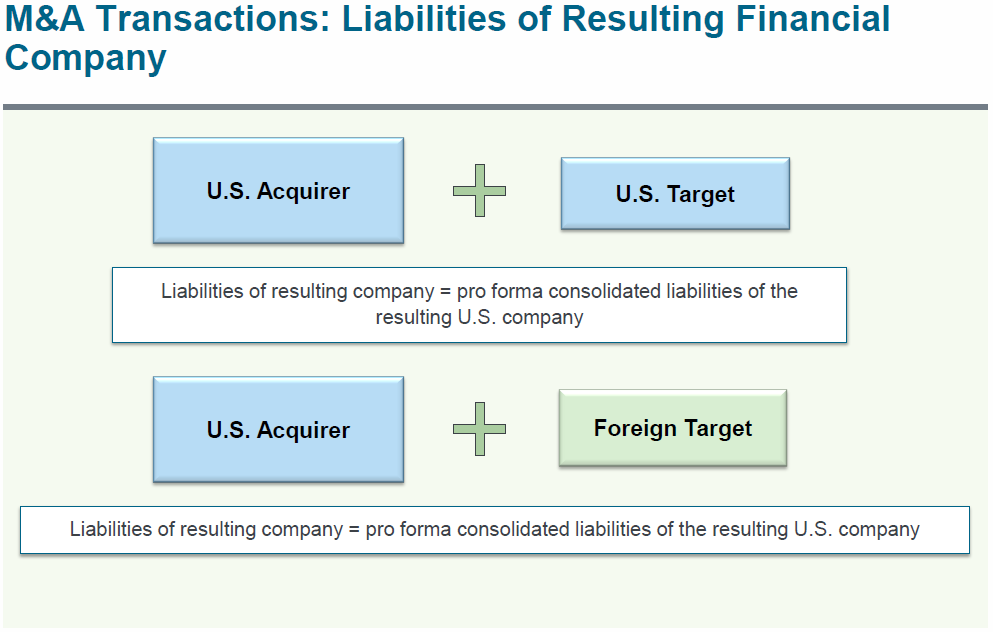

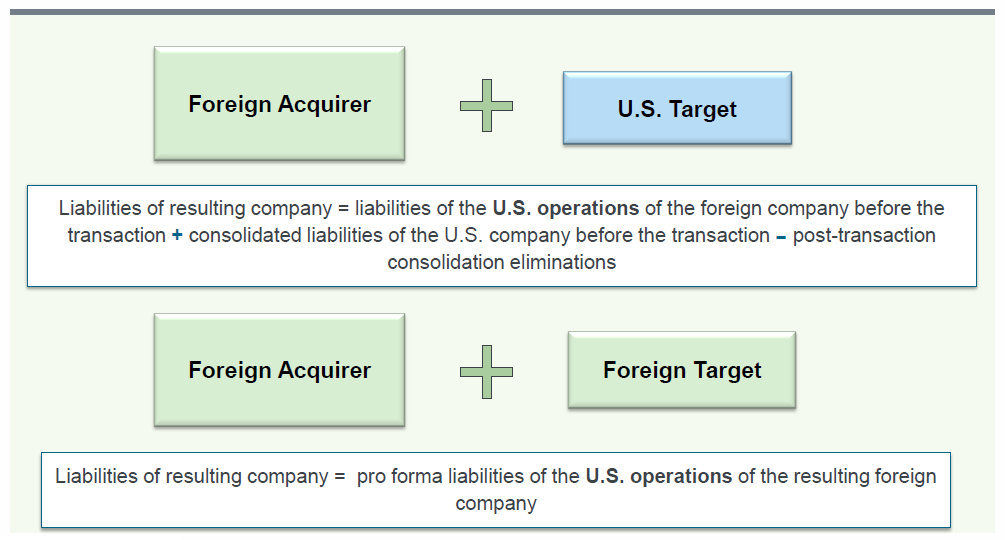

M&A Transactions: Calculating “Liabilities” of Resulting Financial Company

The full visual memorandum, which uses diagrams, formulas, tables and examples to illustrate key aspects of the Federal Reserve’s concentration limit proposal, is available here.

Print

Print