Yafit Cohn is an associate at Simpson Thacher & Bartlett LLP. The following post is based on a Simpson Thacher publication authored by Ms. Cohn, Karen Hsu Kelley, and Avrohom J. Kess.

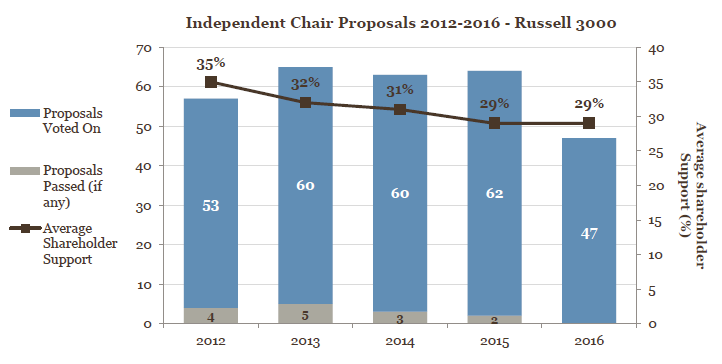

During the 2016 proxy season, 47 shareholder proposals calling for independent board chairs reached a vote at Russell 3000 companies, all of which failed. This development reflects a decline from last year’s proxy season during which 62 independent chair proposals reached a shareholder vote and two passed. Interestingly, the increased support of Institutional Shareholder Services, Inc. (“ISS”) for these proposals had little to no impact on the shareholder vote results. In addition to the fact that none of the proposals passed, average shareholder support for these proposals remained steady at 29 percent.

I. Positions of the Proxy Advisory Firms

A. Institutional Shareholder Services Inc. (“ISS”)

Prior to last year, ISS applied an objective six-factor test to determine its position with regard to independent chair proposals. Under that policy, ISS generally supported independent chair proposals unless the company counterbalanced the combined chairman/CEO structure through specified governance features. The current policy, instituted last year, takes a more holistic approach in determining its position with regard to independent chair proposals.

Under the current policy, ISS generally recommends voting for independent chair proposals, taking into consideration the following factors: (1) the scope of the proposal; (2) the company’s current board leadership structure; (3) the company’s governance structure and practices; (4) the company’s performance; and (5) any other relevant factors that may be applicable. [1] While ISS’s 2016 policy guidelines with respect to independent chair proposals were consistent with the prior year’s guidelines, ISS’s support for independent chair proposals substantially increased this year. [2]

B. Glass Lewis

Effective this year, Glass Lewis updated its proxy voting guidelines with regard to independent chair proposals. [3] The proxy advisory firm still takes the position that an independent chair is in the long-term best interests of shareholders and the company and will typically support shareholder proposals that seek to separate the roles of CEO and chair. Its revised guidelines, however, no longer state that Glass Lewis will not support proposals that contain “overly prescriptive” independence definitions. Similarly, Glass Lewis’s revised guidelines no longer indicate that Glass Lewis “may consider recommending against proposals where the company makes a compelling case for combining the two roles, has a clearly defined lead independent director role, has indicated that it intends to separate the two roles, and has strong performance and governance provisions.” [4] These changes suggest that Glass Lewis may now be more broadly supportive of independent chair proposals.

II. Positions of Large Institutional Shareholders

Major institutional shareholders tend to be interested in the governance structures of the companies in which they invest, but they vary in their positions on independent chair proposals. For example, Fidelity Management & Research Company generally votes against shareholder proposals calling for an independent chair unless it will further the interests of shareholders and promote effective oversight of management. [5]

Other investors, such as Blackrock, favor an independent chairperson but consider the designation of a lead independent director as an acceptable alternative to an independent chair, so long as certain enumerated criteria are met. [6] Accordingly, when evaluating potential responses to a shareholder proposal to separate the chair and CEO positions, it is important to understand the positions of the company’s largest shareholders.

III. Independent Chair Proposal Trends

A. Overall Trends

- Independent chair proposals remained second in popularity among corporate-governance-related proposals, even though the number of such proposals declined. From 2012 to 2014, independent chair proposals were the most popular among the corporate-governance-related shareholder proposals submitted to Russell 3000 companies. In both 2015 and 2016, independent chair proposals were second in prevalence, after proxy access proposals. Despite the continued popularity of independent chair proposals, fewer such proposals were submitted this year as compared to the last few years. Each year from 2013 through 2015, there were between 60 and 62 independent chair proposals submitted to a vote at Russell 3000 companies. This year, that number dropped to 47. This is the lowest number of independent chair proposals submitted to a vote at Russell 3000 companies since 2011, when only 27 proposals were submitted.

- A majority of companies that faced independent chair proposals this proxy season faced an independent chair proposal last proxy season. Fifty-one percent of companies that received independent chair proposals this proxy season also received an independent chair proposal the prior year.

- Unlike in previous years, no independent chair proposals passed. During the 2012 through 2015 proxy seasons, between 3.2 and 8.3 percent of independent chair proposals submitted to a vote passed each year. This year, no independent chair proposals passed. [7]

- Average shareholder support remains relatively constant. From 2012 through 2015, independent chair proposals received average shareholder support of 29-35%. This year, like last year, independent chair proposals received average support of 29%.

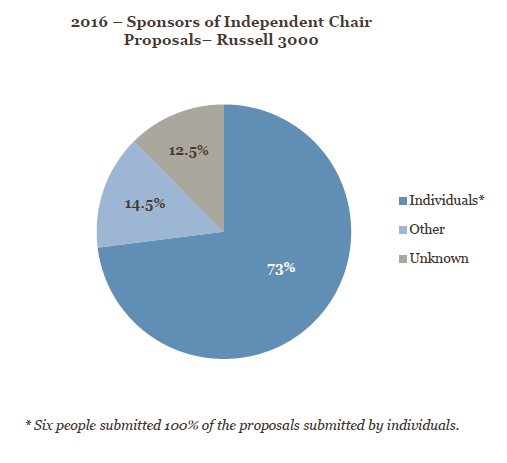

- The vast majority of proponents of independent chair proposals were individuals. Four investors (John Chevedden, Kenneth Steiner, William Steiner, and Gerald R. Armstrong) filed 32 of the 48 independent chair proposals (or 66.6%) at Russell 3000 companies this proxy season.

B. Impact of ISS Recommendations on Vote Results

This year, ISS support for independent chair proposals continued to increase. ISS supported 75% of these proposals in 2016, up from 63% and 48% in 2015 and 2014 respectively. [8] This increased support, however, did not have a meaningful impact on the voting results. Despite a 12% increase in favorable vote recommendations issued by ISS from 2015 to 2016, average shareholder support for independent chair proposals remained constant at 29%. Additionally, while the proposals supported by ISS in 2015 received average shareholder support of 34%, this year such proposals garnered, on average, 32% shareholder support. Conversely, proposals that received a negative vote recommendation from ISS in 2015 received average shareholder support of 19%, but this year, that number increased slightly to 21%.

IV. SEC No-Action Letters

This proxy season, a total of seven no-action requests were submitted to the Securities and Exchange Commission (“SEC”) with regard to independent chair proposals. Of these, only three requested no-action relief based on substantive grounds, one of which was granted.

Significantly fewer no-action requests pertaining to independent chair proposals were submitted to the SEC this proxy season as compared to last year. In 2015, companies submitted 26 requests to the SEC requesting no-action relief on substantive grounds with regard to independent chair proposals. Three of these requests were granted. This year’s decrease in the submission of requests may reflect a recognition of the difficulty in obtaining no-action relief with regard to independent chair proposals.

A review of the no-action responses issued by the SEC on substantive grounds this year reveals that one argument that was successful last proxy season, vagueness under Rule 14a-8(i)(3), was unsuccessful this year. The only successful argument this proxy season relied upon Rule 14a-8(i)(11)’s duplication rule—a rule only applicable in limited circumstances.

A. Duplication under Rule 14a-8(i)(11): The Goldman Sachs Group

The Goldman Sachs Group received two independent chair proposals within two days of each other. Under Rule 14a-8(i)(11), an issuer may exclude a proposal that substantially duplicates a previously submitted proposal. Though the language of the two proposals differed slightly, they were substantively similar; both asked the company’s board to separate the roles of CEO and chair. The SEC concurred with the company that the second proposal was excludable from the company’s proxy materials pursuant to Rule 14a-8(i)(11).

B. Vagueness under Rule 14a-8(i)(3): Comcast and Kohl’s

Both Comcast and Kohl’s received independent chair proposals, and both requested no-action relief from the SEC on the ground that the proposal was vague and indefinite under Rule 14a-8(i)(3). The companies each argued that the proposal rendered the proxy statement misleading because it failed to define “independent director.” The SEC staff denied both requests.

The decision of the SEC staff alleviated any lingering uncertainty that surfaced last year regarding the application of Rule 14a-8(i)(3). In 2015, the SEC initially granted no-action relief to Pfizer under Rule 14-8(i)(3) due to the proposal’s failure to adequately define “independent director.” However, after several other companies in similar situations requested no-action relief on the same ground as a result of identical language in the proposal, the SEC changed course, declining to grant them relief. The Staff’s denial of Comcast’s and Kohl’s no-action requests this year confirm that the Staff will not recognize failure to define (or adequately define) “independent director” as a basis for exclusion under Rule 14a-8(i)(3).

The SEC’s no-action responses to Comcast and Kohl’s do not appear to affect the viability of other potential arguments under Rule 14a-8(i)(3), such as one argument that proved successful last proxy season. Last proxy season, an independent chair proposal submitted to General Electric (“GE”) stated that the board could cure a violation of independence by “follow[ing] SEC Staff Legal Bulletin 14C.” In its request for no-action relief, GE argued that this sentence refers to an external standard that cannot reasonably be understood by shareholders reading the proposal and its supporting statement. Accordingly, GE, citing Staff Legal Bulletin No. 14B (Sept. 15, 2004), maintained that “neither the stockholders voting on the proposal, nor the company in implementing the proposal (if adopted), would be able to determine with any reasonable certainty exactly what actions or measures the proposal requires.” The SEC agreed with GE that the proposal was vague and indefinite and could be properly excluded from GE’s proxy statement pursuant to Rule 14a-8(i)(3). A company facing a similar proposal in the future would likely be able to exclude it for the same reason.

V. Takeaways

Independent chair proposals continue to be among the most prevalent governance-related proposals. Boards should therefore be prepared to receive independent chair proposals and should note that these proposals are seldom excludable under the substantive provisions of Rule 14a-8. Boards should keep in mind, however, that independent chair proposals rarely garner majority support; absent systemic governance or performance failures at the company, these proposals are unlikely to pass. Accordingly, boards should take a firm stance against an independent chair proposal if they believe combining the positions of chair and CEO is in the best interest of the company at the time the proposal is received. As is the case with all shareholder proposals, however, a board’s failure to implement a successful independent chair proposal puts the directors at risk of receiving an “against” recommendation from ISS.

Endnotes:

[1] Institutional Shareholder Services Inc., United States Summary Proxy Voting Guidelines: 2016 Benchmark Policy Recommendation (Feb. 23, 2016).

(go back)

[2] For a discussion of the impact of ISS’s recommendations on this year’s vote results, see Section III.B.

(go back)

[3] Glass Lewis, Proxy Paper Guidelines, 2016 Proxy Season: An Overview of the Glass Lewis Approach to Proxy Advice, United States.

(go back)

[4] Glass Lewis, Proxy Paper Guidelines, 2015 Proxy Season: An Overview of the Glass Lewis Approach to Proxy Advice, Shareholder Initiatives.

(go back)

[5] See Fidelity Investments, Fidelity Funds’ Proxy Voting Guidelines (Jan. 2016).

(go back)

[6] See Blackrock, Proxy Voting Guidelines for U.S. Securities (Feb. 2015).

(go back)

[7] See Appendix A for the list of companies at which an independent chair proposal passed between 2012 and 2016.

(go back)

[8] ISS’s shift in policy with regard to independent chair proposals in 2015 from an objective, six-factor test to a holistic approach likely contributed to its increased support in 2015 and 2016.

(go back)

Appendix A

Companies At Which Independent Chair Shareholder Proposals Have Passed

| 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|

| Key Corp. | Freeport-McMoRan Inc. | Healthcare Services Group, Inc. | Omnicom Group Inc. | [None] |

| Kindred Healthcare, Inc. | Healthcare Services Group, Inc. | Staples, Inc. | Vornado Realty Trust | |

| McKesson Corporation | Kohl’s Corporation | Vornado Realty Trust | ||

| Sempra Energy | Netflix, Inc. | |||

| Vornado Realty Trust |

Print

Print