Lyuba Goltser and Ellen Odoner are partners in the Public Company Advisory Group of Weil, Gotshal & Manges LLP. This post is based on a Weil publication by Ms. Goltser, Ms. Odoner, Megan Pendleton, and Niral Shah.

Over the last two proxy seasons, governance-oriented activists, pension funds and institutional investors led a charge to afford shareholders “proxy access”—the right to include their director nominees in a company’s proxy statement. Since January 1, 2015, 300 companies have adopted a proxy access bylaw following a shareholder proposal, negotiations with a proponent or proactively.

On November 10, 2016, in what appears to be the first use of a proxy access bylaw, GAMCO Investors, Inc. and its affiliated funds disclosed that they had nominated an individual for election to the board of directors of National Fuel Gas Company pursuant to the company’s recently adopted proxy access bylaw.

For the 2017 proxy season, a new front in the campaign for proxy access has opened, aimed at companies that have already adopted a proxy access bylaw. The proponents of proxy access have begun to submit so-called “fix-it” proposals seeking to amend specific features of adopted bylaws that they believe limit the ability of shareholders to use proxy access effectively. Opening the door to these “fix-it” proposals, the SEC Staff denied no-action relief to seven of the nine companies that sought exclusion on the ground that the proposal had been “substantially implemented” by the original bylaw. However, in granting relief to two companies, the Staff has provided some direction for companies seeking to exclude such proposals. In the relatively few instances to date where these proposals have gone to a shareholder vote, the results have been mixed. It is too early to draw a conclusion about how large institutional investors will react to fix-it proposals, particularly those seeking to amend bylaws that reflect the “3/3/20/20” consensus.

In this post, we discuss:

- First use of proxy access

- The SEC Staff’s no-action positions on “fix-it” proposals

- Institutional investor and proxy advisory firm policies

- Strategies for addressing proxy access in 2017

Pressure on companies that have not yet adopted proxy access is likely to continue into the 2017 proxy season, with over 50% of companies in the S&P 500 expected to have done so by the time the season ends. As the deadlines approach for shareholder proposals at calendar year reporting companies, boards should be preparing for the possibility of a proxy access proposal or, in some cases, a proposal to amend an existing bylaw. In addition, depending on the company’s year-end and access nomination window, boards should be aware of the potential for an existing proxy access bylaw to be used for one or more nominations. See our post here, and our prior Alerts on proxy access available here, here, and here.

First Use of Proxy Access Bylaw

On November 10, 2016, GAMCO Investors, Inc. and its affiliated funds filed a Schedule 14N disclosing their nomination of a proxy access candidate for election to the board of directors of National Fuel Gas Company pursuant to the company’s recently adopted proxy access bylaw. National Fuel has a nine-member classified board, and its access bylaw has a 3/3/20/20 formulation. GAMCO disclosed in its Schedule 14N aggregate beneficial ownership of 7.8% of National Fuel’s common stock, and based on its Schedule 13D filings, GAMCO has beneficially owned more than 3% for more than three years. In 2015, GAMCO submitted a shareholder proposal, which did not pass, requesting that the company engage an investment bank to effectuate a spin-off of the company’s utility segment.

I. Beyond the Consensus: Proposals to Amend Existing Proxy Access Bylaws

The overwhelming number of proxy access bylaws adopted to date have a 3/3/20/20 formulation: shareholders who have beneficially owned 3% or more of the company’s outstanding common stock continuously for at least three years (or group of no more than 20 shareholders meeting such requirements) may include in the company’s proxy statement a number of eligible director nominees equal to no more than 20% of the board. The 3/3/20/20 formulation received wide spread support from shareholders voting on the adoption of proxy access during the 2016 proxy season. However, proxy access proponents, including John Chevedden, James McRitchie and the New York City Comptroller, are now advocating that companies go beyond this formulation.

In this post, we focus on 13 shareholder proposals seeking to amend (or fix) a company’s already-adopted proxy access bylaw. This number does not include (i) repeat proposals, such as those submitted by the NYC Comptroller in 2016, to adopt proxy access where the company failed to do so in response to the prior years’ proposal to adopt, and (ii) fix-it proposals that were submitted but subsequently withdrawn, perhaps as a result of negotiations with the proponent.

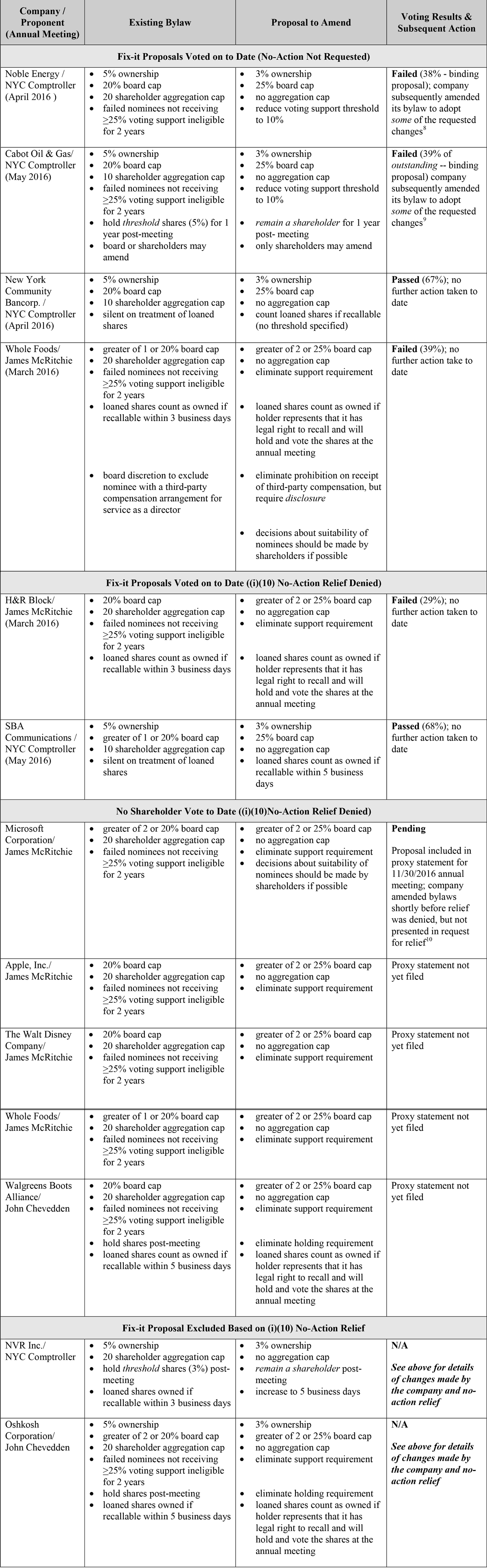

As highlighted in the table below, these 13 proposals primarily focus on amending bylaw features that their proponents believe make the implementation of proxy access excessively difficult and less effective than would have been the case under the SEC’s judicially invalidated federal proxy access rule, Rule 14a-11.

Key Features of Fix-it Proposals

- Aggregation Cap—Eliminate the cap on the number of shareholders permitted to aggregate holdings to reach the minimum beneficial ownership threshold (all 13 proposals)

- Board Cap—Raise the cap on the number of board seats available for proxy access nominees (12 proposals)

- To the greater of 2 or 25% of the board (8 proposals)

- To 25% of the board (4 proposals)

- Minimum Support Threshold for Future Nominations—Eliminate (or reduce) the restriction on re-nomination in future years of nominees who failed to receive voting support in excess of a specified minimum threshold (e.g., < 25% of votes cast for the election of the director) (10 proposals)

- Loaned Shares as “Owned”—Amend the provision on when loaned shares count as “owned” for the purposes of the minimum beneficial ownership threshold (7 proposals)

- Increase, from 3 business days to 5 business days, the number of days during which shares may be recallable (2 proposals)

- Provide that loaned shares count as “owned” so long as shareholder represents that it has the legal right to recall the shares and will hold and vote the shares at the meeting (5 proposals)

- Post-Meeting Shareholding—Eliminate the requirement for proponents to state their intent to hold shares beyond the annual meeting (4 proposals)

- Ownership Threshold—Reduce the beneficial ownership threshold from 5% to 3% (6 proposals)

Staff No-Action Position: Has the Staff Provided Direction to Exclude Fix-it Proposals?

During the 2016 proxy season, more than 40 companies obtained no-action relief from the Staff to exclude a shareholder proposal to adopt proxy access on the ground that the company had, pursuant to the standards established in Rule 14a-8(i)(10), “substantially implemented” the shareholder proposal by having previously adopted a proxy access bylaw. In each case, the company’s access bylaw contained the minimum 3%, 3-year beneficial ownership requirements. In granting no-action relief to the company, the Staff expressed the view that the company’s adoption of a proxy access bylaw containing these thresholds achieved the “essential objective” of the shareholder proposal notwithstanding, in many cases, a number of differences between the proposal and the adopted bylaw.

However, the Staff has found the “substantially implemented” argument less persuasive when considering no-action requests to exclude proposals to amend an already adopted proxy access bylaws. The Staff has denied relief to seven companies, SBA Communications, H&R Block, Microsoft, Apple, Walgreens, Whole Foods and Disney, and granted relief to two, NVR Inc. and Oshkosh Corporation. In denying no-action relief, the Staff appeared to be distinguishing between a proposal to adopt proxy access and a proposal to amend an existing bylaw. However, this distinction now appears more nuanced in light of the relief granted to NVR and Oshkosh. After receipt of a fix-it proposal, each of NVR and Oshkosh amended its existing access bylaw to address half of the changes requested by the proponent, including lowering the required ownership threshold from 5% to 3%. The Staff ultimately granted no-action relief to each company under (i)(10), indicating that the company’s policies, practices and procedures compare favorably with the guidelines of the proposal, and therefore the company had substantially implemented the proposal.

| Proposal to Amend | Oshkosh Bylaw Amendment | NVR Bylaw Amendment |

|---|---|---|

| Reduce from 5% to 3% the ownership threshold | ✓ | ✓ |

| Eliminate 20 shareholder aggregation cap | ✗ | ✗ |

| Eliminate post-meeting holding requirement | ✓ | ✗ |

| Eliminate minimum support threshold for future nomination of candidate (e.g. support by 25% of votes cast) | ✓ | N/A |

| Increase the maximum number of proxy access nominees (20% to the greater of 2 or 25% of the board) | ✗ | N/A |

| Treatment of loaned shares as “owned” | ||

| Count loaned shares as “owned” so long as shareholder represents that it has the legal right to recall the shares and will hold and vote the shares at the meeting | ✗ | N/A |

| Increase from 3 business days to 5 business days the number of days within which loaned shares must be recallable to count as “owned” | N/A | ✓ |

The Staff’s NVR and Oshkosh no-action responses appear to provide some direction to companies seeking to exclude a multi-pronged proposal to amend a proxy access bylaw. While the reduction by NVR and Oshkosh of the ownership threshold from 5% to 3% likely weighed heavily in the Staff’s decision that the proposal was substantially implemented, the Staff may also be looking for companies to make some number and/or type of other changes to an existing proxy access bylaw in order to find that the essential objective of a fix-it proposal with multiple elements has been met. Moreover, the Staff has yet to address a fix-it proposal that is focused exclusively on one feature of a bylaw (e.g., a proposal solely to eliminate an aggregation cap).

Results of Shareholder Votes on “Fix-it” Proposals

Results have been mixed for the five proposals to amend access bylaws that have gone to a shareholder vote at an annual meeting: two received majority support and three failed but received significant support. Both proposals receiving majority support sought to amend, among other features, the 5% ownership threshold, a provision that has been largely disfavored by institutional investors, proxy access proponents, as well as the SEC Staff.

The table below presents the significant elements of each of the thirteen fix-it proposals, the voting result if a shareholder meeting has been held (based on votes cast except as otherwise indicated) and actions taken by the company subsequent to the proposal.

II. Know Your Shareholders

Companies still contemplating whether to adopt proxy access need to consider, and present to their boards of directors and/or governance committees, the range of potential features of a proxy access bylaw, some of which are attracting criticism from shareholders, investors and proxy advisory firms. The Council of Institutional Investors (CII), for example, has identified various proxy access features that it deems “troublesome.” ISS has identified provisions that it deems “problematic” or “especially problematic.”12 These and other features of proxy access bylaws are examined in greater detail in the Annex to this post. Companies should be familiar with the perspectives of different constituencies within their shareholder base, including, most importantly, their largest institutional shareholders, as part of their planning for shareholder engagement on proxy access and other major governance topics.

| Institution | Public Position |

|---|---|

| BlackRock (adopted proxy access on 5/25/16 after shareholder approval received) | Case-by-case review, but generally supportive. |

| State Street Global Advisers (adopted proxy access 10/15/15) | Case-by-case review, but generally supportive. |

| T. Rowe Price (adopted proxy access 12/10/15) | Case-by-case review, but generally supports proposals with a “balanced set of limitations and requirements for proxy access,” including the 3%/3-year threshold.15 Will generally vote against shareholder proposals to amend existing bylaws containing 3%/3. |

| The Vanguard Group | Generally supports proposals with 3% (lowered from 5% last year) /3-year threshold, for up to 20% of the board. |

| Fidelity Management & Research | Does not support proxy access. |

| CalPERS | Supports proxy access as a “strategic priority.” Supports shareholder proposals at the 3%/3-year threshold, for up to 25% of the board; will issue adverse votes in director elections where a proxy access proposal passed in prior years, but either was not implemented, or was implemented in a manner that limits the shareholders’ use of proxy access. |

| CalSTRS | Supports proxy access. |

| NYC Comptroller | Supports proxy access as a top priority. |

| TIAA | Supports proxy access upon satisfaction of reasonable conditions. |

| United Brotherhood Carpenters | Historically opposed proxy access, but in 2015 sent letters to 50 companies supporting access in limited circumstances where an incumbent director failed to receive majority support and the board does not accept the failed nominee’s resignation (a so-called “zombie” director). |

The proxy access bylaws that BlackRock, State Street and T. Rowe Price have adopted for themselves have the following features—which could signal what these institutions may find acceptable when voting on proposals to adopt or amend proxy access bylaws at other companies:

| Feature | BlackRock | State Street | T. Rowe |

|---|---|---|---|

| Ownership/Duration | 3%/3-years | 3%/3-years | 3%/3-years |

| Aggregation Cap | 20 | 20 | 20 |

| Cap on Number of Proxy Access Nominees | 25% | 20% | at least 2 or 20% |

| Restriction on Resubmission of Failed Nominees | Yes, for 2 years if < 25% support | Yes, for 2 years if < 25% support | Yes, for 2 years if < 25% support |

| Loaned Shares that Count for Ownership | Yes, if recallable on 5 business days’ notice | Yes, if recallable on 3 business days’ notice | Yes, if recallable on 5 business days’ notice |

| Post-Meeting Holding Requirements | None | None | None |

| Restrictions on Proxy Access if Proxy Contest | Yes | Yes | Yes |

ISS & Glass Lewis Positions

Both ISS and Glass Lewis generally support proxy access. ISS’s 2016 voting guidelines state that ISS will generally recommend in favor of management or shareholder proposals on proxy access that have the following features: (i) 3% beneficial ownership; (ii) a holding period no longer than three continuous years; (iii) minimal or no limits on the number of shareholders permitted to form a nominating group; and (iv) a cap on the number of proxy access nominee seats at no less than 25% of the board. The guidelines state that ISS will also review the reasonableness of any other restrictions on the right of proxy access.

Glass Lewis’ voting guidelines indicate that it generally supports proxy access as a means to ensure that significant, long-term shareholders have an ability to nominate candidates to the board; however, it considers each proposal on a case-by-case basis. Specifically, the guidelines state that Glass Lewis considers specified minimum ownership and holding period requirements, as well as company size, board independence and diversity, company performance, existence of anti-takeover protections, board responsiveness to shareholders, and opportunities for shareholder action (e.g., ability to act by written consent or right to call a special meeting).

ISS Position on Board Responsiveness to Majority Supported Shareholder Proposals

Companies that adopt proxy access following majority support of a shareholder access proposal at the prior year’s annual meeting should carefully evaluate any ways in which the company-adopted bylaw differs from the shareholder proposal. ISS’s FAQ provides guidance on when ISS is likely to recommend a vote against directors because ISS views the board’s implementation a majority-supported proxy access shareholder proposal insufficient and non-responsive to the proposal. Among other factors, ISS will evaluate whether the major points of the shareholder proposal were implemented by the company-adopted bylaw and whether the adopted bylaw contains other features that “unnecessarily restrict the use a proxy access right” and/or that ISS views as “especially” or “potentially” problematic.23 ISS has not provided guidance on how it will evaluate a proxy access bylaw adopted in other contexts (i.e., not in response to a majority-supported shareholder proposal), or how it will evaluate competing shareholder and management proposals

In 2016, ISS issued “against” or “withhold” recommendations in director elections at five companies that ISS viewed as not having been responsive to a majority-supported shareholder proxy access proposal voted on the prior year: CBL & Associate Properties, Inc., Cheniere Energy, Inc., Cloud Peak Energy Inc. (recommendation reversed after company amended its bylaw), Nabors Industries Ltd. and Netflix, Inc. ISS targeted (i) a lead director and a governance committee chair at one of these companies, (ii) the entire governance committee at two of these companies, and (iii) the entire board at two of these companies, that, in ISS’s view, had a history of non-responsiveness. In making its voting recommendations, ISS called out differences between the shareholder proposal and the company-adopted proxy access bylaw, stating that the company-adopted bylaw was “significantly more restrictive than the majority-supported shareholder proposal,” or, in the case of Netflix, that the company had not adopted a proxy access bylaw. It is important to note that many of the features that ISS identified as “problematic” in these cases are included in the proxy access bylaws adopted by a large number of companies to date. We address many of these features in the Annex to the complete publication.

ISS Quality Score

For 2017, ISS’s Quality Score (formerly QuickScore) will include four newly weighted questions about proxy access focusing on ownership threshold and duration, cap on board nominees and aggregation limits. See our prior Alert on ISS Quality Score available here.

III. Strategies for 2017: Weighing the Options

Companies that have not adopted proxy access should thoughtfully consider their approach in anticipation of the 2017 proxy season. Whether to adopt proxy access preemptively, by way of either a company-adopted bylaw or a management proposal at the next annual meeting, or to take a wait-and-see approach, depends upon whether the company previously received a proxy access proposal that was submitted to a shareholder vote and the results of that vote, as well as the company’s shareholder base, performance, governance profile and risk tolerance. A “do-nothing” approach is not an advisable alternative for any company, as it can leave the company on the defensive and unprepared.

In formulating the approach for their company, we recommend that boards and management consider the following:

Whatever the approach taken, we believe that constructive engagement on proxy access should be added to the discussion topics between a company and its shareholders. Moreover, investors and proxy advisory firms will look to a company’s disclosure on engagement to evaluate the consistency of any proxy access bylaw adopted or proposed by management with the feedback received through engagement.

What to Do Now: Prepare, Engage and Stay Informed

- Evaluate alternatives for addressing proxy access in light of on the company’s experience to date.

- Engage with shareholders—not only on proxy access, but on all key governance issues.

- Understand the positions of key shareholders on proxy access.

- Monitor proxy access developments, including the use of proxy access for nominations, SEC Staff positions on exclusion and the features and voting outcomes of fix-it proposals that are submitted for shareholder vote.

- For companies that have not yet received a proposal, prepare a draft bylaw to keep “on the shelf.”

The complete publication, including footnotes and Annex, is available here.

Print

Print