Yafit Cohn is Counsel at Simpson Thacher & Bartlett LLP. This post is based on a Simpson Thacher co-publication with Rivel Research Group, authored by Ms. Cohn; Karen Hsu Kelley, partner at Simpson Thacher; David M. Bobker, Vice President, Corporate Governance & Board Evaluations at Rivel Research Group; and Brendan Sheehan, Managing Director, Corporate Governance at Rivel Research Group.

The corporate governance structure of any public company must enable the company to achieve the appropriate balance between the powers of the board of directors, which is typically composed primarily of independent directors, and those of the CEO. The Commission on Public Trust and Private Enterprise, convened in 2002 “to address the causes of declining public and investor trust in companies, their leaders and America’s capital markets,” concluded at the time that there are three equally valid approaches that issuers can take to strike such a balance:

- Separate the CEO and chairman roles, with the chairman being an independent director under stock exchange listing standards.

- Separate the CEO and chairman roles and, where the chairman is not an independent director (often the former CEO), establish a lead director position to be occupied by an independent director.

- Combine the CEO and chairman roles and establish a lead director position. [1]

In spite of this conclusion, in the years since the publication of the Commission’s findings, many have expressed the purported primacy of the first of these structures, and companies have faced increased pressure to require an independent chairman. Since 2012, for example, shareholder proposals requesting the installation of an independent chairman were either the most popular or second in popularity (after proxy access since the proxy access “private ordering” began in 2015) among governance-related proposals. Additionally, whether presented through a shareholder proposal or a management-sponsored proposal resulting from investor pressure, independent chairman proposals and the debate they have stirred at several large cap companies have made headlines in recent years. Moreover, the influential proxy advisory firm Institutional Shareholder Services, Inc. (“ISS”) has been supporting more independent chairman proposals than in years past. This year, for example, ISS recommended a vote in favor of 68% of independent chairman proposals for which they issued a recommendation. In contrast, ISS supported 63% of such proposals in 2015 and 48% in 2014.

Given the passage of time since the issuance of the Commission’s report and the increased prominence of the independent chairman issue over this period, we conducted an empirical analysis to determine whether the Commission’s conclusions remain valid today from an economic perspective. Specifically, we set out to investigate whether issuers that had a separate CEO/chairman structure outperformed those that had a combined CEO/chairman. As discussed in further detail below, we found that, while there may be legitimate reasons to separate the CEO and chairman positions at certain companies depending on their specific circumstances at any given point in time, from a financial performance perspective the current focus on separating the CEO and chairman positions across public companies appears to be misplaced. In other words, there appears to be little economic evidence to support separating the roles of the CEO and chairman.

Methodology

The objective of our analysis was to determine whether issuers’ CEO/chairman structure impacts company valuation. In order to minimize selection bias and time-based anomalies, we included in our analysis all companies in the S&P 500 over three specific time frames—15 years, 3 years and 17 months. Only companies that remained in the S&P 500 index throughout the period under examination were included in the analysis.

Because the purpose of our research was to ascertain the impact on investors, if any, of the CEO/chairman structure, it was determined that dividend adjusted share price was the most appropriate metric to use, as it reflects the total value returned to investors (in the form of stock price appreciation adjusted for cash dividend distributions) over a given period. Prices were adjusted, however, for events such as splits, stock dividends, spin-offs and rights issuances. These events are generally considered to be value neutral and, if not accounted for, could lead to distortions when comparing company valuations over a given time period.

To compare the relative performance over time of companies with different CEO/chairman structures, two custom indices were created for each time period examined: all companies that have a combined CEO/chairman and all of those that have separate CEO/chairman roles. Each company in each index was given equal weighting. Since the objective was to evaluate the relative performance of each pair of custom indices in each period, the value of each index was set to zero at the beginning of each period. The two groups were then compared on the basis of dividend adjusted share price over a 15-year time period, as well as over a 3-year time period.

In addition, we examined the dividend adjusted share price of companies that have made a change in their CEO/chairman structure since January 1, 2016, comparing the dividend adjusted index value of companies that have separated the CEO/chairman roles with the index value of those that have combined the roles in the 17 months since January 1, 2016.

It should be noted that, while there may be many factors that impact a company’s financial performance, no other financial or operational metrics were taken into account for the purposes of this study. Our report looks solely at CEO/chairman structure and dividend adjusted share price in an effort to test whether there is a correlation between a company’s leadership structure and its financial performance.

Findings

Companies that Have Consistently Had Either a Combined CEO/Chairman or Separate CEO and Chairman Roles Over the Past Fifteen Years

- There was no statistically significant difference in financial performance between companies that have consistently combined the CEO and chairman roles and those that have consistently separated them since 2002.

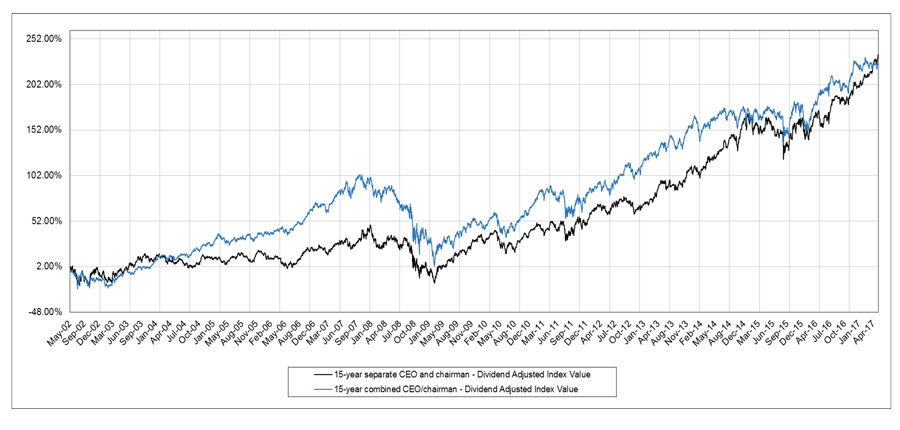

- As illustrated in the graph below, the 15-year dividend adjusted index change for the “combined” group was 223.68%, while that for the “separate” group was 234.56%. This is a 10.88% difference over 15 years, or a 0.72% difference per year, which is not statistically significant.

- For much of the past 15 years, the “combined” group outperformed the “separate” group. Indeed, the slight outperformance of the “separate” group is a recent occurrence; in April 2017, the “separate” group began to outperform the “combined” group for the first time in three years. At no point during the 15-year period studied, however, were the differences in performance between the two groups statistically significant.

Companies that Have Consistently Had Either a Combined CEO/Chairman or Separate CEO and Chairman Roles Over the Past Three Years

- There was no statistically significant difference in financial performance between companies that have consistently had a combined CEO/chairman and those that have consistently separated the roles over the past three years.

- From May of 2014 through May of 2017, the “separate” group saw a change in dividend adjusted index value of 41.48%, while the “combined” group saw an increase in dividend adjusted index value of 36.15%. From a statistical perspective, this 5.33% difference over three years is not significant.

- The dividend adjusted share price of the “separate” and “combined” groups have not diverged much over the past three years. When they have, they have always re-converged, rendering their respective rates of change in dividend adjusted index value identical at numerous points throughout the three-year period. While the respective rates of change in index value of the two groups have differed slightly in the last month of the three-year period studied, it seems, based on historical rates of change, that they will likely re-converge in the near term.

Companies that Have Made a Change to Their Leadership Structure—Either Separating or Combining the Roles of CEO and Chairman—in the Past 17 Months

- There was no statistically significant difference in financial performance between companies that have combined the CEO and chairman roles and those that have separated the roles since January 1, 2016.

- The dividend adjusted index value of those companies that have recently separated the roles of CEO and chairman has increased 15.14% in the 17 months since January 1, 2016, while the index value of those companies that have recently combined the roles has increased 15.32%. This difference is negligible and, from a statistical perspective, not significant.

Conclusion

As is evident by our research, separating the CEO and chairman roles is not correlated with a greater rate of change in dividend adjusted index value (i.e., outperformance). This appears to corroborate the view of the Commission on Public Trust and Private Enterprise that there is no single board leadership structure that is superior in achieving the appropriate balance between the board and CEO functions and providing the oversight that leads to corporate success. Based on our research, therefore, there does not appear to be any compelling economic reason for public companies to adopt any particular CEO/chairman structure. Instead, each company should continue to tailor its leadership structure to its own facts and circumstances at any given point in time.

Endnotes

1The Conference Board, Commission on Public Trust and Private Enterprise: Findings and Recommendations (2003) at 2, 19.(go back)

Print

Print