Jaewon Choi is Assistant Professor of Finance at the University of Illinois at Urbana-Champaign; Dirk Hackbarth is Professor of Finance at Boston University Questrom School of Business; and Josef Zechner is Professor of Finance at Vienna University of Economics and Business. This post is based on a recent article, forthcoming in the Journal of Financial Economics, by Professor Choi, Professor Hackbarth, and Professor Zechner.

The article Corporate Debt Maturity Profiles, forthcoming in the Journal of Financial Economics, studies a novel aspect of a firm’s capital structure, namely the dispersion of debt maturities. Extant literature offers little guidance on this aspect of capital structure, and lack of evidence is at variance with practitioners emphasizing that rollover risk affects debt maturity choice. Surveys of financial managers often suggest that avoiding so-called “maturity towers” (i.e. spreading debt maturity dates over time) is a key factor when firms choose debt maturities.

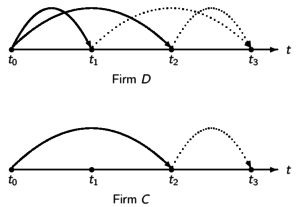

We build a framework to show that dispersion of debt maturities is an important dimension of a firm’s overall capital structure optimization. We consider a firm that can select one of the two debt maturity structures shown in the figure below. At time t0, the firm can choose a dispersed maturity profile with two small bond issues and staggered maturity dates, t1 and t2, which will be rolled over at each maturity date to the final time t3 (Firm D). Alternatively, the firm can choose a concentrated maturity profile with one large bond issue, which it will roll over once at time t2 to the final time t3 (Firm C). What are costs or benefits of these two different maturity structures?

We offer an answer based on trading off rollover risk and costs associated with a highly granular debt structure. On the one hand, Firm C has a transaction cost advantage, because of fixed cost components of issuing debt and secondary market illiquidity of bonds fragmented into many smaller issues. That is, concentrated maturity structures are optimal if this effect dominates. On the other hand, concentrated maturity profiles are risky if capital market conditions are more uncertain in that firms may potentially not be able to refinance expiring debt externally and hence need to forgo profitable investment opportunities or even inefficiently liquidate assets. Firm D has a rollover risk advantage due to smaller debt face values with maturities spread out over time. That is, dispersed maturity structures are optimal if firms expect, for example, increased rollover risk or valuable investment opportunities. In addition, the rollover risk concern will also motivate firms to avoid so-called “maturity towers” by issuing new debt with different maturities than the ones in their pre-existing maturity profile.

To take the model to the data, we use data from Standard & Poor’s Capital IQ for all sources of debt during the 2002–2012 period and group each firm’s debt maturities into the nearest integer years and compute fractions of amounts outstanding each year. We build two measures of debt maturity dispersion, which are new and useful: (1) inverse of a corporate maturity profile’s sum of squared fractions outstanding; and (2) average squared distance between a firm’s actual maturity profile and a perfectly dispersed maturity profile (i.e. standard deviation of fractions outstanding relative to equal fractions maturing each year up to the longest maturity).

Using these maturity dispersion measures, we analyze whether firms manage maturity profiles. We investigate two distinct yet related questions. Do firms adjust maturity dispersion after an exogenous shock to rollover risk? Do firms incorporate pre-existing maturity profiles into the maturity choice for newly issued debt?

First, we exploit the downgrade of General Motors (GM) and Ford Motor Company (Ford) in 2005 as a quasi-natural experiment. This downgrade created an exogenous and unexpected shock to firms’ beliefs about rollover risk, especially for firms not in the auto sector. Using this quasi-natural experiment, we employ difference-in-differences analyses by considering firms as treated if they had expiring bonds to roll over following the GM-Ford downgrade. Treated firms could change their maturity structures, either by retiring expiring bonds using internal liquidity or by rolling them over and issuing new bonds. When faced with higher risk of rollover, they should have increased the dispersion of their maturity profiles. In contrast, for the set of firms that did not need to roll over bonds, the shock to rollover risk is less likely to have an immediate effect on maturity dispersion, as this would require non-treated firms to actively repurchase and replace existing debt. In the empirical analysis, we use otherwise similar (matched) firms from this set as control group. Notably, we establish that treated firms significantly increased maturity dispersion in the aftermath of the downgrade, relative to the set of control firms. In addition, we do not find a similar response of treated firms in terms of higher cash holdings or higher credit lines. Moreover, a placebo test for a period prior to the downgrade episode reveals no significant differences in maturity dispersion. Thus, we establish that higher rollover risk (or beliefs about higher rollover risk) lead firms to increase debt maturity dispersion.

In addition, firms particularly vulnerable to higher rollover risk should exhibit a differential effect. Arguably, more highly levered firms should find rolling over expiring debt more burdensome than firms with lower indebtedness. We find indeed that, following the GM-Ford downgrade, treated firms with high market leverage or net debt ratios substantially increase debt maturity dispersion, while treated firms with little leverage do not change maturity dispersion much. In addition, the empirical results survive a battery of robustness checks. For example, we remove auto industry firms or employ maturity profiles known one year before the GM-Ford downgrade instead of using profiles known at the time of the downgrades to address a potential concern that firms could have anticipated the GM-Ford downgrades. We also examine a larger set of firms in Mergent’s Fixed Income Security Database during 2002–2012 period and also find that treated firms increase bond maturity dispersion after the GM-Ford downgrade.

Second, we study how maturity decisions for new debt issues affect maturity dispersion. That is, we analyze how pre-existing maturity profiles influence firms’ maturity choices when they issue new debt. Specifically, we investigate whether existing amounts in each maturity bucket predict the maturity of newly-issued debt. Indeed, we find that, the larger the fraction of debt outstanding in any given maturity bucket, the less likely it is that the firm issues new debt in this maturity bucket. For example, the fraction of debt issue amounts in the nine- or ten-year maturity bucket relative to total assets decrease by -20% for a one-percentage-point increase in the fraction of debt outstanding in that maturity bucket. In contrast, debt amounts in other maturity buckets do not tend to affect the fraction of issue amounts in the nine- or ten-year maturity bucket. The results hold across maturity buckets and are also economically significant.

In sum, we provide causal evidence supporting the view that firms manage maturity dispersion and document that maturity dispersion is of particular importance when they issue new debt.

The full article is available for download here.

Print

Print