The following post is based on a publication by members of the Tax Department of Latham & Watkins LLP, including partners Nicholas J. DeNovio, Joseph M. Kronsnoble, Jiyeon Lee-Lim, Elena Romanova, Laurence J. Stein and associate Patrick Allan Sharma.

Final bill retains key aspects of House and Senate proposals with some surprise last-minute modifications.

On December 15, 2017, a conference committee composed of members of the US House of Representatives and the US Senate approved a Conference Report (the Report) reconciling the tax reform bills passed by each chamber. Both the House and the Senate approved this final legislation on December 20, 2017.

The Report retains many of the features of the House and Senate bills, which Latham & Watkins analyzed in a previous Client Alert, while also clarifying and modifying a number of key provisions.

This post highlights several of the more significant changes in the Report compared with the House and Senate bills, as the changes apply to domestic and international businesses.

Key Points:

- The bill adopts, with some modifications, earlier US House and Senate tax reform legislation.

- The bill clarifies key issues, including corporate and deemed repatriation rates, limits on deductions for interest expenses and net operating losses, and taxation of income earned by pass-through businesses.

- The bill is expected to be signed into law before the end of the year or early next year, with most provisions effective on January 1, 2018.

Latham & Watkins intends to provide early in the new year a comprehensive analysis of the Report and its implications on structuring, financing, and executing domestic and cross-border transactions.

Corporate Rate

The Report cuts the corporate income tax rate to a flat 21%, rather than the 20% called for in the House and Senate bills. The 21% rate is effective January 1, 2018. The Report also eliminates the corporate alternative minimum tax (AMT), which the Senate bill had retained.

Pass-Through Entities

The Report generally follows the Senate bill’s favorable treatment of certain pass-through business income, though with certain changes.

Individuals (and now also trusts and estates per the Report) are generally allowed to deduct 20% of qualified business income (QBI) from certain pass-through entities. Note that this rate was reduced from 23% in the Senate bill to reflect the lowered top rate of 37%, so that the rate of tax on QBI would remain at 29.6%. QBI generally means income with respect to a taxpayer’s trade or business, but it continues to exclude various types of investment income, as well as reasonable compensation paid by an S corporation, any amount that is a guaranteed payment for services rendered to or on behalf of a partnership, and (to the extent provided in regulations) any amounts paid or incurred by a partnership to a partner who is acting other than in his or her capacity as a partner for services. As in the Senate bill, the provision sunsets on December 31, 2025.

The Senate bill had two different types of limitations on this new deduction, both of which were phased in above certain income levels. The Report continues these limitations, but it reduced the threshold amount above which both of these limitations phase in, and also made some additional modifications.

The first limitation in the Senate bill excluded income with respect to certain personal services businesses (including health, law, accounting, consulting, the performing arts, and financial services) from the definition of QBI. The Report continues this limitation, though it no longer treats engineering and architecture as excluded service businesses.

The second limitation in the Senate bill restricted the amount of the deduction to no more than 50% of the W-2 wages paid by the business. This was a potentially significant limitation, because if a business had no employees, then the owner of such business would have a zero limitation under this provision. The Report, however, modified this limitation by adding an alternative test so that the limitation is now the greater of (a) 50% of the W-2 wages paid by the business or (b) the sum of (i) 25% of the W-2 pages paid by the business and (ii) 2.5% of the unadjusted basis of certain depreciable tangible property held by the business at year-end and for which the depreciable period has not ended. Consequently, with this modification, owners of businesses with no employees but with invested capital can still be eligible for the 20% deduction.

Interest Deductibility

The Report generally follows the Senate bill’s provision that caps the deductibility of business net interest expense at 30% of adjusted taxable income, with two modifications. These two modifications reflect a compromise between the House and the Senate’s approaches. First, similar to the House bill, in computing the adjusted taxable income, the Report would add back depreciation, amortization, and depletion deductions, but unlike the House bill, would do so only for taxable years beginning before January 1, 2022. Second, the Report includes the House bill’s exception for all business interest incurred to finance motor vehicle inventory held for sale or lease (floor plan financing interest). In all other respects, the Report adopts the Senate bill’s provision, including allowing unlimited carryforward of the disallowed net business interest expense and distributing both excess business interest and excess taxable income to partners after the cap for the tax year is determined at the partnership level. This provision would replace the current “earnings stripping” interest limitation under Section 163(j)1, and would apply to taxable years beginning after December 31, 2017, with no grandfathering for any existing debt.

The Report does not contain any provision to limit the deductibility of interest expense for domestic members of international groups, although the House and Senate bills had each included its own versions of such provision. However, a US corporation making deductible interest payments to certain related parties may be required to add back such payments in computing its “modified taxable income” for purposes of the base erosion minimum tax.

NOLs

Like the House and Senate bills, the Report generally repeals the ability to carry back net operating losses (NOLs), imposes a limit on the amount of taxable income that can be offset by NOLs, and permits NOLs to be carried forward indefinitely. The Report sets the offset limit at 80% of taxable income with respect to NOLs arising in tax years beginning after December 31, 2017.

Cost Recovery: Full Expensing

The Report follows the House bill in not requiring that the original use of property that would qualify for full expensing commence with the taxpayer. As Latham’s previous Client Alert noted, this could be an important consideration in M&A transactions.

International

The Report adopts the House and Senate bills’ imposition of a mandatory deemed repatriation on the accumulated foreign earnings of US-based multinationals at rates of 15.5% for post-1986 E&P to the extent of foreign cash and other liquid assets and 8% on all residual post-1986 E&P. The Report sets the date for determining post-1986 E&P as of November 2, 2017 or December 31, 2017, whichever is greater on aggregate.

While the Report generally follows the Senate bill, it makes several key changes:

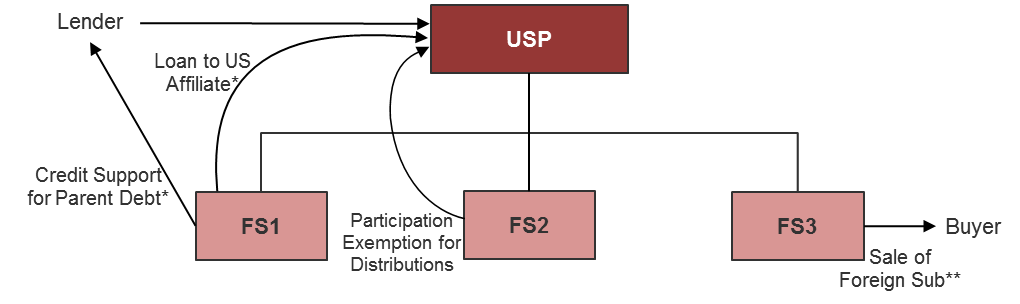

- In a surprise development, the Report does not repeal Section 956 (which applies when overseas earnings are invested in US property or provide credit support for US debt) as it applies to US corporate shareholders. As a result, overseas earnings that could be distributed without US tax under the participation exemption would actually be subject to US tax at the regular corporate rate if they become subject to Section 956. The last-minute change to retain Section 956 as it applies to corporate taxpayers may leave open a number of technical issues, particularly with the foreign tax credit, as the prior bills had assumed that the credit under Section 960 would apply only to the inclusion of current earnings under Subpart F and the new category of Global Intangible Low-Taxed Income (GILTI).

Territorial System for Future Foreign Earnings—A New Era

The Report replaces the worldwide tax system with a 100% exemption for dividends from foreign subsidiaries (in which USP owns at least a 10% stake).

But Section 956 is not repealed for US corporate shareholders. The Report eliminates the “lock-out effect” (earnings of US multinationals locked out of US due to tax on repatriation).

* Foreign subsidiary credit

** Participation Exemption to extent of support Section 1248 (dividend) characterization for US Parent debt, or loans to Same rule applies on sale of lower-tier US Affiliates, potentially taxed CFCs at 21% (less foreign tax credit)

- Because the Report sets the corporate tax rate at 21% (rather than 20% as proposed in the House and Senate bills), the tax on GILTI is 10.5%.

- The Report does not include a permanent extension of the CFC look-through rule of Section 954(c)(6). Presumably, Congress will deal with this in an “extenders” bill, to prevent expiration of Section 954(c)(6) after 2019.

- The Report removes the provision from the Senate bill that would have allowed the tax-free distribution of IP owned by foreign subsidiaries of US-parented groups.

Looking Ahead

Now that the bill has passed both houses, it will proceed to the President for his signature. Assuming (as expected) that the bill becomes law, many observers believe that the House and Senate will need to consider a range of technical corrections, given the likelihood of unanticipated errors or other problems with the legislation. How this process will play out remains uncertain, in part given the political divisions in Congress. The US Treasury and Internal Revenue Service may also need to adopt regulations to implement various provisions of the legislation, a potentially quite time-consuming process.

Print

Print