BJ Firmacion and Torie Nilsen are consultants at Willis Towers Watson. This post is based on a Willis Towers Watson publication by Mr. Firmacion and Ms. Nilsen.

[In December 2017], Institutional Shareholder Services (ISS) released its complete FAQ compensation and equity plan documents along with detailed pay-for-performance mechanics for 2018.

While most of the changes were already disclosed by ISS in the 2018 proxy voting updates published in November (see “ISS 2018 policy changes reflect market feedback and draft policy expectations,” Executive Pay Matters, November 17, 2017), the FAQs further clarify these changes, particularly as they relate to the new pay-for-performance quantitative screen, as well as additional guidance on other elements of ISS policy. The FAQs also note how ISS will address the new CEO pay ratio disclosures in 2018.

Pay-for-Performance: New Financial Performance Assessment

The new Financial Performance Assessment (FPA), which was first introduced by ISS in 2017 as part of its qualitative proxy analysis, will be incorporated as the fourth test in the quantitative screen. It is a relative assessment that compares the percentile ranks of a company’s three-year CEO pay and financial performance relative to the ISS comparator group. Financial performance will be calculated as the weighted average of three to four of the following metrics, where the actual metrics and weightings will vary by industry:

- Three-year average return on invested capital (ROIC)

- Three-year average return on assets (ROA)

- Three-year average return on equity (ROE)

- Three-year EBITDA growth

- Three-year operating cash flow growth

Performance is measured using the 12 most recent trailing quarters (16 for growth metrics) as of ISS’ latest quarterly data download.

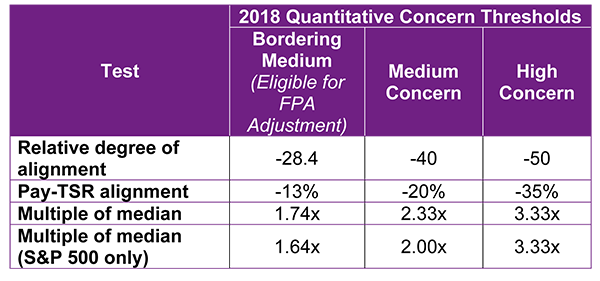

The FPA will serve as a secondary assessment after the first three initial tests (Relative Degree of Alignment (RDA), Multiple of Median (MoM) and Pay-Total Shareholder Return (TSR) Alignment) have been calculated. It will affect the overall quantitative concern level only if any of the three initial measures trigger either a medium concern (in which case a strong FPA result may reduce the concern level to low) or a low concern level that is bordering the medium threshold (in which case a poor FPA result may increase the concern level to medium). ISS has not disclosed specific thresholds for evaluating the strength of FPA performance but has disclosed that this will depend on a company’s industry, index membership and the initial quantitative screen.

The FPA will not affect the overall quantitative concern level in cases wherein the initial three measures exhibit a high concern level or a low concern level that is not bordering on a medium level of concern. Based on back-testing conducted by ISS, it is estimated that less than 5% of all companies subject to the quantitative pay-for-performance screen will have their overall concern level modified by the FPA result.

Pay-for-Performance: New Concern Level Thresholds

In connection with the new FPA test described above, ISS has disclosed a third threshold hurdle which will determine whether a low concern level will be eligible for FPA adjustment. In addition, ISS has introduced a distinct set of thresholds for the MoM test applicable only to S&P 500 companies.

Pay-for-Performance: TSR Calculation

In the RDA test, TSR will now be calculated using the daily average closing stock prices in the beginning and end months of the three-year measurement period, rather than being measured solely using the beginning- and end-day stock prices of the three 12-month periods as ISS has calculated it in the past. For companies with a December 31 fiscal year end, this will be the daily average closing stock price in December 2014 and the daily average closing stock price in December 2017.

Equity Plan Scorecard (EPSC)

ISS disclosed the following changes to the EPSC policy for 2018:

- EPSC passing score for S&P 500 will increase from 53 points to 55 points

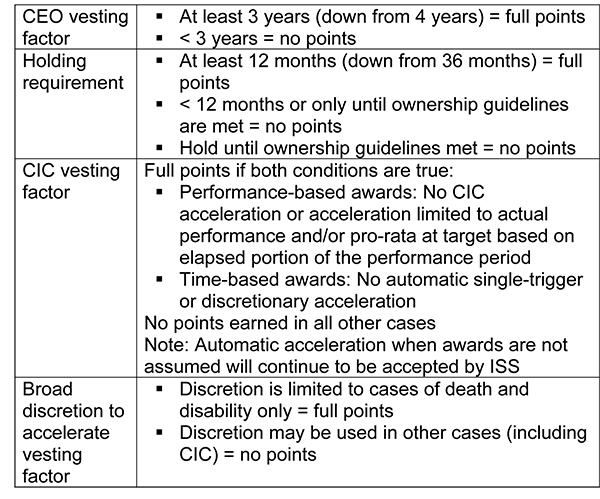

- EPSC factors related to vesting and holding requirements and broad discretion for vesting acceleration were simplified to provide for either full or no points scored (partial scoring will be eliminated). The minimum vesting and holding requirements were also reduced:

ISS has also changed its definition of a liberal change in control, a CIC trigger that ISS does not deem to constitute an actual change in control of the company. ISS now defines an acquisition of a low percentage of company stock to be a liberal CIC trigger when the acquisition comprises 15% of outstanding common stock or less (down from 20% in 2017). The addition of new directors not nominated by the incumbent board (i.e., in a proxy contest) would not be considered by ISS as liberal.

Other Updates: Problematic Pay Practices, Excessive Director Pay, Liberal Change In Control And CEO Pay Ratio

In 2018, ISS added two additional problematic pay practices that are likely to result in an adverse vote recommendation: multi-year guaranteed awards that are not at-risk due to rigorous performance conditions and a liberal change-in-control definition combined with any single-trigger CIC benefits (see the Equity Plan Scorecard segment for more information on liberal CIC provisions).

ISS may identify excessive pay by comparing non-employee director compensation (NED) pay to median levels of NEDs at companies in the same index and industry, and identifying patterns of extreme outliers (e.g., consecutive years of pay above the 95th percentile). In the future, this may lead ISS to scrutinize committee members responsible for setting consecutive years of excessive NED compensation.

Lastly, ISS will also begin to disclose a company’s median employee pay figure and the CEO pay ratio in its proxy research reports. This will not have any policy implication, nor will it impact vote recommendations in 2018.

Looking Ahead

In total, the 2018 compensation changes are robust but not unexpected. Some may require additional planning by companies, especially for those expecting scrutiny of their say-on-pay votes, either due to anticipated pay-for-performance alignment concerns or from a board (or committee) responsiveness perspective.

Policy updates are effective for shareholder meetings on or after February 1, 2018. Additional details and background can be found on the ISS Policy Gateway here.

Print

Print