Jonathan Bailey is Head of ESG Investing and Jake Walko is Vice President of ESG Investing at Neuberger Berman Group LLC. This post is based on a Neuberger Berman publication by Mr. Bailey and Mr. Walko.

Management teams at companies often say that they wished they had more clarity from their investors as to the types of sustainability data and disclosures that they would like to see. They believe that it is difficult to understand which, if any, of the many different surveys and questionnaires that they get from data providers, research companies, and non-profit organizations are actually used by investors in valuing a company and making a buy decision. That is why the Sustainability Accounting Standards Board’s (SASB) development of a market-based, investor-ready set of material sustainability disclosures is so important. Many of the world’s leading asset owners and asset managers were among the 2,800+ participants in SASB’s industry working groups that helped develop the standards, and many of those same investment firms have voiced their support for their implementation by companies.

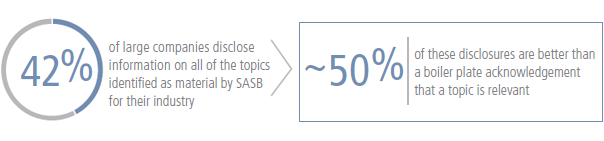

Yet despite the vocal support by investors, the state of disclosure by companies is still lacking—only 42% of large companies disclose information on all of the topics identified as material by SASB for their industry, and only about half of these disclosures are better than a boiler plate acknowledgement that a topic is relevant. [1] To encourage companies to elevate their disclosure levels, investors need to do more than be vocal—they need to start systematically embedding SASB in their processes and policies. In Neuberger Berman’s case, we decided that in addition to proactively and reactively talking to companies about why SASB standards are material and useful, we would integrate SASB into our Proxy Voting Guidelines. Our Proxy Voting Guidelines for the 2018 season include an expectation that directors be familiar with the SASB standard for their industry and be able to discuss how SASB’s topics and metrics relate to the risk assessment for their business.

We understand that stakeholders within companies often push-back on increasing sustainability disclosures because of perceived costs or risks. By incorporating SASB as a cost-effective solution into our Proxy Voting Guidelines, we can reach a wide set of these stakeholders—corporate secretaries, board members, CFOs and investor relations professionals—many of whom may not have historically engaged in discussions about sustainability reports or disclosures, or may not be aware of the sustainability frameworks that investors think are most relevant. We also know that the proxy voting advisory firms, and even the SEC, use guidelines published by asset managers and asset owners to help determine how investor perceptions of materiality are evolving.

Of course, proxy voting guidelines are intended not just to frame the discussion but also to drive voting behaviors, and so Neuberger Berman will be using the SASB industry research to help determine whether sustainability-focused shareholder proposals are material (see “Neuberger Berman Proxy Voting Policy—Guidelines”). In 2017, we used the SASB standards in our decision to support shareholder proposals requesting reports or action on climate change at 15 companies because we viewed climate change to be a material business issue for companies in the utilities and oil & gas sectors. We also used the framework in deciding to support shareholder proposals calling for gender pay equity reports at seven companies because we consider developing and rewarding a diverse talent pool to be a material business issue for companies in the financial services and technology sectors.

We believe SASB fills a critical gap in the current market infrastructure and as such serves as an important public good. It is therefore our view that it is incumbent on asset managers and asset owners to support SASB’s work by providing comment and input on the standards themselves, encouraging implementation of the standards among companies, integrating the standards into security selection and portfolio construction, and directly supporting SASB’s operations through the SASB Alliance. By working together we can raise the quality of sustainability disclosure, which help us identify the sustainable businesses that we believe will generate positive investment returns for our clients over the long run. This ultimately rewards sustainable businesses by reducing their cost of capital while building a more prosperous and resilient global economy.

Endnotes

1Sustainability Accounting Standards Board. State of Disclosure Report—2017—Excerpt, 2017.(go back)

Print

Print