Thomas C. Mosk is Assistant Professor of Finance at the Center of Excellence SAFE of the Goethe University Frankfurt. This post is based on an article forthcoming in the Review of Financial Studies by Professor Mosk; Reint Gropp, Professor of Economics at the Halle Institute for Economic Research; Steven Ongena, Professor of Banking at the University of Zurich; and Carlo Wix, Ph.D. candidate in Finance at Goethe University Frankfurt.

Basel III, which will become fully effective in 2019, significantly increases capital requirements for banks. However, at this point, the economic implications of such higher capital requirements are still unclear. Banks can increase their regulatory capital ratios by either increasing their levels of regulatory capital (the numerator of the capital ratio) or by decreasing their levels of risk-weighted assets (the denominator of the capital ratio). While raising capital is generally considered “good deleveraging” by regulators, shrinking assets has potentially adverse effects if many banks simultaneously engage in cutting lending. In Banks Response to Higher Capital Requirements: Evidence from a Quasi-Natural Experiment, we study the impact of the 2011 European Banking Authority (EBA) capital exercise—which required a subset of European banks to increase their regulatory capital ratios—on banks’ balance sheets and the transmission of this regulatory intervention to the real economy.

We find that capital exercise banks increased their capital ratios by reducing their risk-weighted assets and not by raising their levels of equity. Banks reduced lending to corporate and retail customers, resulting in lower asset, investment, and sales growth for firms obtaining a larger share of their bank credit from capital exercise banks.

The 2011 EBA Capital Exercise

The empirical identification of the effect of higher capital requirements on banks’ behavior faces a number of challenges. Since capital requirements mostly change for all banks in a given economic area at the same time, there is generally no control group of unaffected banks. Therefore, it can mostly not be ascertained whether banks change their lending because capital requirements increase or because of other economic factors affecting the demand for credit.

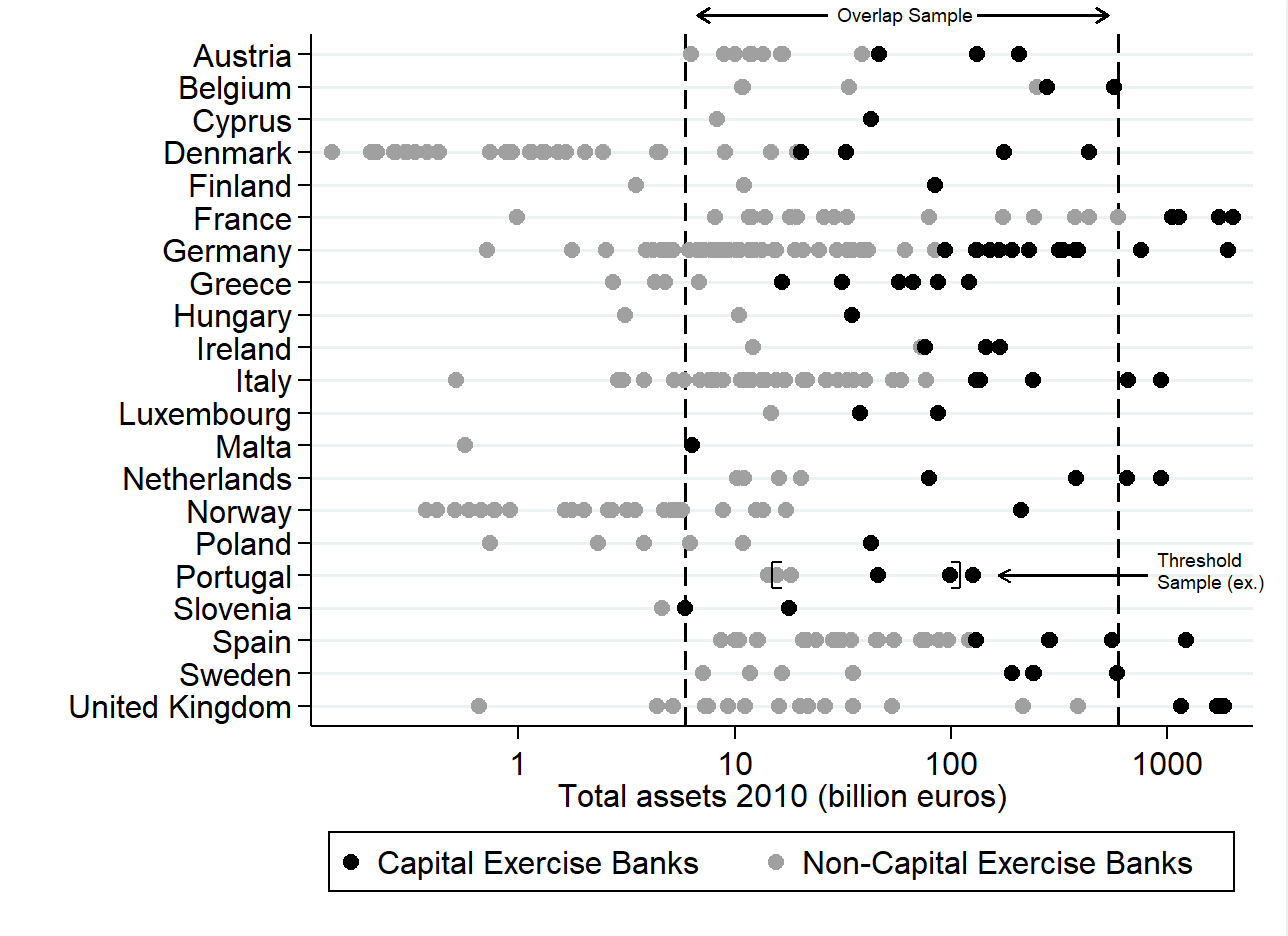

We address this challenge by exploiting the 2011 EBA capital exercise as a quasi-natural experiment. The capital exercise required a subset of European banks to reach and maintain a 9% core tier 1 capital ratio by the end of June 2012. The EBA used a country-specific selection rule and included the largest banks in each EU country to cover 50% of the country’s banking sector. Figure 1 shows that this country-specific selection threshold yielded a considerable overlap in size between banks selected and not selected into the capital exercise. Knowledge about the selection rule based on observable characteristics (total assets) in combination with an overlap in size allows us to compare banks subject to the capital exercise with a control group of similar banks not subject to the capital exercises and to study the effect of higher capital requirements on bank behavior.

Figure 1: Bank size distribution by country

How do banks respond to higher capital requirements?

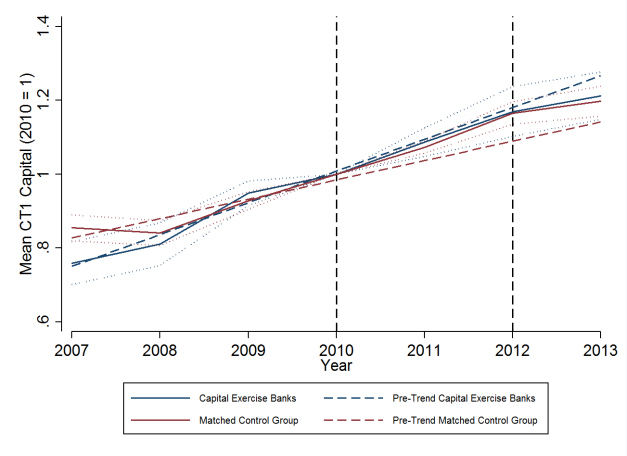

Our main findings are as follows. First, we document that capital exercise banks raised their core tier 1 capital ratios by 1.9 percentage points more compared to banks not subject to the higher capital requirements (the control group). Figure 2 shows that capital exercise banks achieved this by reducing their levels of risk-weighted assets, instead of raising new capital. The control group is crucial for uncovering this finding: Capital exercise banks increased their levels of core tier 1 capital by 19% over our sample period, but the control group raised their levels of core tier 1 capital by the same magnitude. We subsequently show that treated banks mainly reduced their exposures to corporate and retail borrowers.

Figure 2: Core tier 1 capital and risk-weighted assets over time

We then turn to the question why banks are reluctant to raise equity. Potential explanations include debt overhang and asymmetric information. Due to a debt overhang problem highly levered banks resist new equity issuances and may forgo positive NPV projects because the cash flows will accrue to debtholders. Consistent with debt overhang, we find that capital exercise banks with more subordinated debt are more likely to shrink assets and to retire subordinated debt.

Simply observing a reduction in outstanding customer loans on banks’ balance sheets is, however, not sufficient to conclude that the supply of credit by capital exercise banks contracted, since this might very well just reflect a reduction in credit demand by firms borrowing from these banks. To disentangle credit supply from credit demand, we use syndicated loan data and exploit the presence of multiple bank-firm relationships to control for credit demand. We show that capital exercise banks reduced their credit supply of syndicated loans by 17 percentage points relative to banks in the control group.

Ultimately, the degree to which a reduction in credit supply from capital exercise banks implies real effects at the firm level depends on the extent to which other banks, not subject to higher capital requirements, “pick up the slack.” We thus study, in a final step, whether the reduction in lending by capital exercise banks had real effects on firms. We find that firms with an initial high share of loans from capital exercise banks exhibited 4 percentage points lower asset growth, 6 percentage points lower investment growth, and 5 percentage points lower sales growth than firms less reliant on funding from capital exercise banks. This result is driven by unlisted firms which are less likely to substitute a reduction in credit supply with other sources of funding.

Lessons for policymakers

These results suggest that the 2011 EBA capital exercise had a detrimental impact on bank lending in Europe with adverse effects for the real economy, confirming concerns raised in advance about a policy-induced credit crunch. Our findings therefore have important policy implications for bank capital regulation: if regulators (such as the EBA in the 2011 capital exercise) impose an increase in capital requirements on short notice and focus on capital ratios as the policy target variable, then banks will choose to deleverage via shrinking assets rather than via raising new equity. Targeting the absolute amount of new capital that has to be raised instead of targeting the capital ratio could mitigate this problem, an approach which has been successfully applied in the U.S. SCAP stress test conducted in 2009.

The full paper is available for download here.

Print

Print