Ramey Layne and Brenda Lenahan are partners at Vinson & Elkins LLP. This post is based on a Vinson and Elkins publication by Mr. Layne, Ms. Lenahan, Terry Bokosha, Mariam Boxwala, and Zach Swartz.

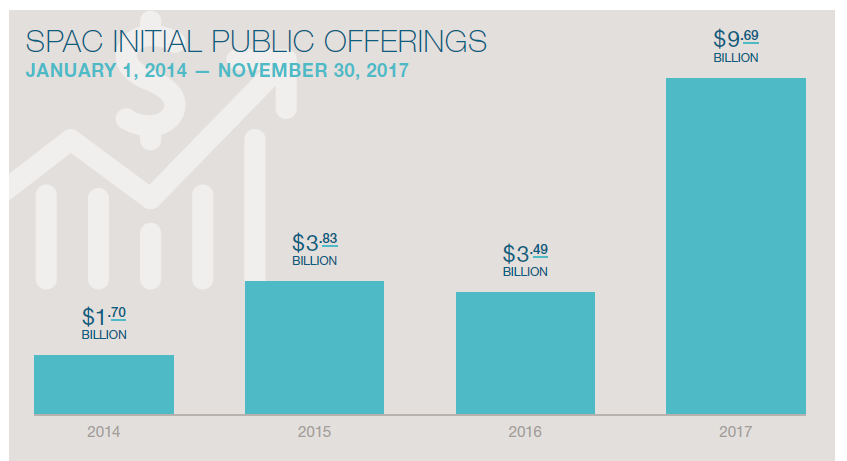

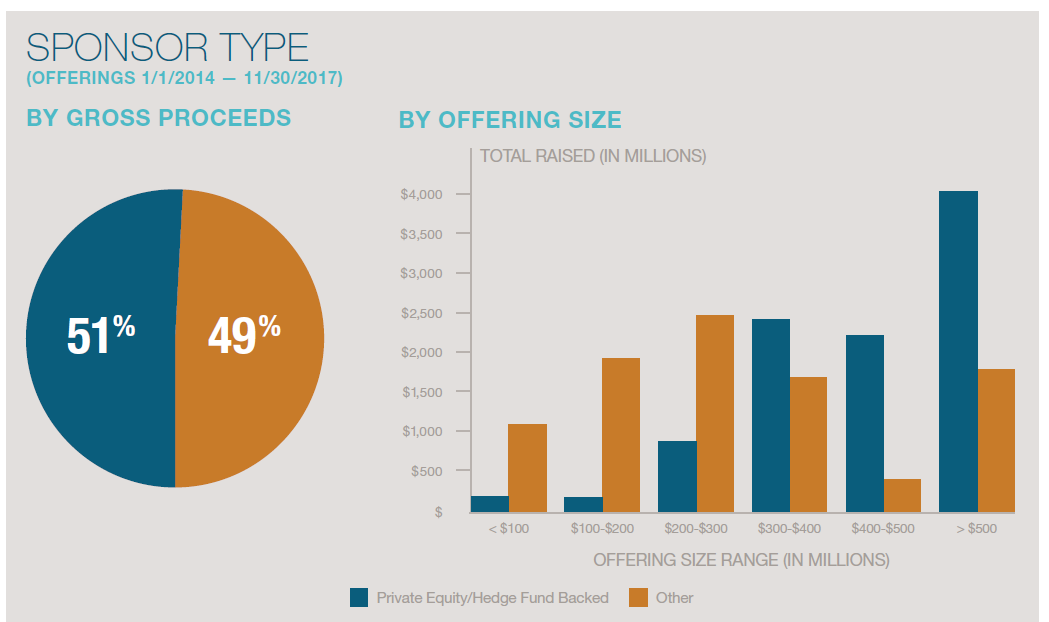

Special Purpose Acquisition Companies (“SPACs”) are companies formed to raise capital in an initial public offering (“IPO”) with the purpose of using the proceeds to acquire one or more unspecified businesses or assets to be identified after the IPO. From the beginning of 2014 through November 30, 2017, almost 80 SPAC IPOs have closed, raising approximately $19 billion in gross proceeds.

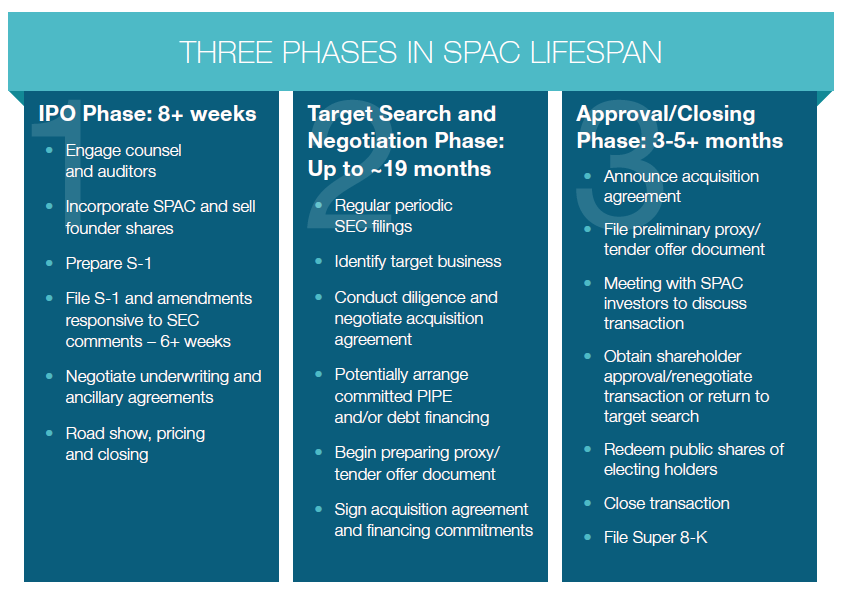

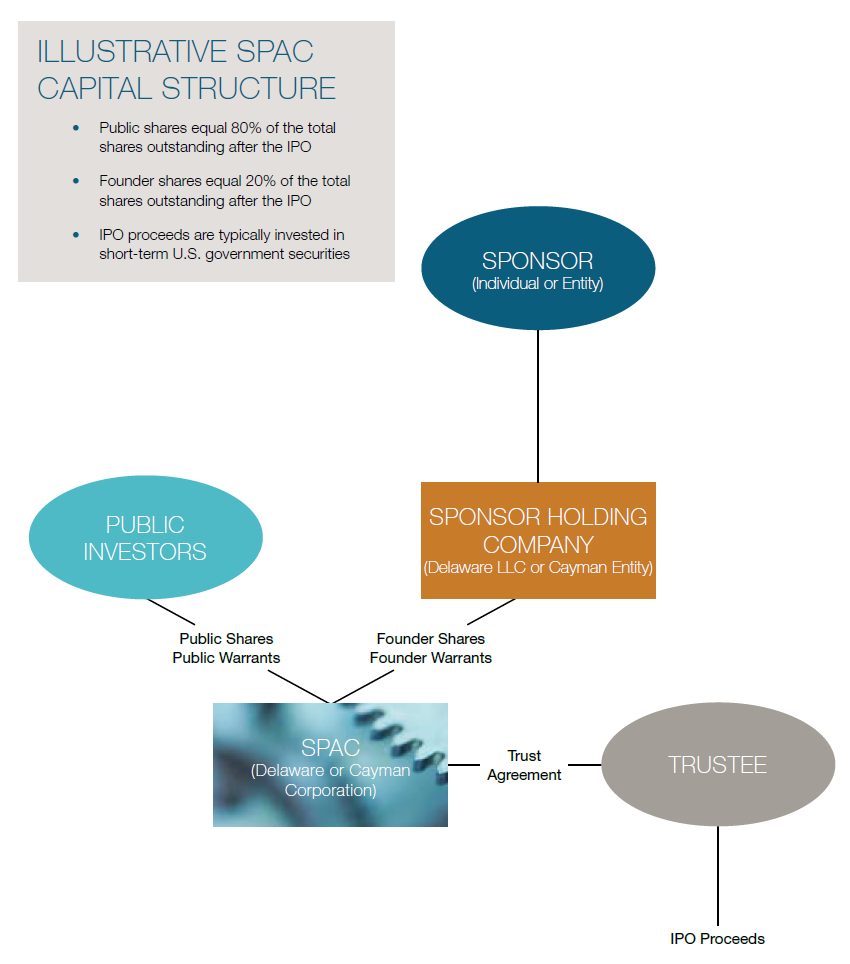

A SPAC will go through the typical IPO process of filing a registration statement with the U.S. Securities and Exchange Commission (“SEC”), clearing SEC comments, and undertaking a road show followed by a firm commitment underwriting. The IPO proceeds will be held in a trust account until released to fund the business combination or used to redeem shares sold in the IPO. Offering expenses, including the up-front portion of the underwriting discount, and a modest amount of working capital will be funded by the entity or management team that forms the SPAC (the “sponsor”). After the IPO, the SPAC will pursue an acquisition opportunity and negotiate a merger or purchase agreement to acquire a business or assets (referred to as the “business combination”). If the SPAC needs additional capital to pursue the business combination or pay its other expenses, the sponsor may loan additional funds to the SPAC. In advance of signing an acquisition agreement, the SPAC will often arrange committed debt or equity financing, such as a private investment in public equity (“PIPE”) commitment, to finance a portion of the purchase price for the business combination and thereafter publicly announce both the acquisition agreement and the committed financing. Following the announcement of signing, the SPAC will undertake a mandatory shareholder vote or tender offer process, in either case offering the public investors the right to return their public shares to the SPAC in exchange for an amount of cash roughly equal to the IPO price paid. If the business combination is approved by the shareholders (if required) and the financing and other conditions specified in the acquisition agreement are satisfied, the business combination will be consummated (referred to as the “De-SPAC transaction”), and the SPAC and the target business will combine into a publicly traded operating company.

Comparison to Operating Company IPO Process

As compared to operating company IPOs (referred to herein as “traditional IPOs”), SPAC IPOs can be considerably quicker. SPAC financial statements in the IPO registration statement are very short and can be prepared in a matter of weeks (compared to months for an operating business). There are no historical financial results to be disclosed or assets to be described, and business risk factors are minimal. In essence, the IPO registration statement is mostly boilerplate language plus director and officer biographies.

As a result, the SEC comments are usually few and not particularly cumbersome. From the decision to proceed with a SPAC IPO, the entire IPO process can be completed in as little as eight weeks. On the other hand, the De-SPAC transaction involves many of the same requirements as would be applicable to an IPO of the target business, including audited financial statements and other disclosure items which may not otherwise be applicable if the target business were acquired by a public operating company. The over-allotment option in traditional IPOs (commonly referred to as a “green shoe” or just the “shoe”) typically extends for 30 days from pricing, while the option in SPAC IPOs typically extends for 45 days. Both, however, are 15% of the base offering size.

SPAC IPOs have an unusual structure for the underwriting discount. In a traditional IPO, the underwriters typically receive a discount of 5%-7% of the gross IPO proceeds, which they withhold from the proceeds that are delivered at closing. In a SPAC IPO, the typical discount structure is for 2% of the gross proceeds to be paid at the closing of the IPO, with another 3.5% deposited into the trust account and payable to the underwriters on closing of the De-SPAC transaction. If no De-SPAC transaction occurs, the deferred 3.5% discount is never paid to the underwriters and is used with the rest of the trust account balance to redeem the public shares.

In a traditional IPO, the sponsor and directors and officers sign a lock-up agreement for 180 days from the pricing of the IPO. For a SPAC IPO, the typical lock-up runs until one year from the closing of the De-SPAC transaction, subject to early termination if the common shares trade above a fixed price (usually $12.00 per share) for 20 out of 30 trading days starting 150 days after closing of the De-SPAC transaction.

Trust Account

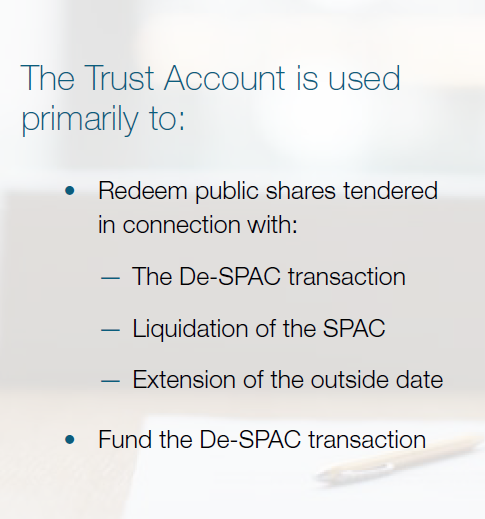

In connection with closing the IPO, the SPAC will fund a trust account with an amount typically equal to 100% [1] or more of the gross proceeds of the IPO, with approximately 98% of the amount funded by the public investors and 2% or more funded by the sponsor. The funds in the trust account are typically invested in short-term U.S. government securities [2] or held as cash and are released to fund (i) the business combination, (ii) redemption of common stock pursuant to a mandatory redemption offer (as described below in “De-SPAC Process—Redemption Offer”), (iii) payment of the deferred underwriting discount and (iv) if any amounts remain, to cover transaction expenses and working capital of the company post-De-SPAC transaction. The trust agreement typically permits withdrawals of interest earned on the funds held in the trust account to fund franchise and income taxes and occasionally permits withdrawal of a limited amount of interest (e.g., $750,000 per year) for working capital.

Private Equity Considerations

Private equity managers contemplating sponsoring a SPAC face unique considerations, including where the sponsor should reside in the fund structure and whether the fund documents permit the formation of a SPAC. A common question is whether the sponsor should be a portfolio company of one or more existing funds or a subsidiary of the investment manager. Fund agreements may limit the ability of the investment manager to form a SPAC outside of an existing fund. Alternatively, the types of assets the SPAC is designed to pursue may not be within the general investment mandate of an existing fund. In addition, the private equity manager will likely need to consider how to allocate investment opportunities between the SPAC and existing funds.

Private equity-backed SPACs often have independent management for the SPAC, such as a CEO or Chairman with pertinent publicly traded company and target industry experience. The private equity group and the management of the SPAC will often negotiate a private arrangement (usually contained in the organizational documents of the sponsor) dealing with, among other things, how much each of the parties will fund of the at risk capital, relative participation in forward purchase commitments (as described below), and vesting of equity (including incentive equity).

Capital Structure

Public Units

In a typical SPAC IPO, the public investors are sold units, each comprised of one share of common stock and a fraction [3] of a warrant to purchase a share of common stock in the future. The per unit purchase price is almost always $10.00. Following the IPO, the units become separable, such that the public can trade units, shares, or whole warrants, with each security separately listed on a securities exchange.

Public Shares

The common stock included in the units sold to the public is sometimes classified as “Class A” common stock, with the sponsor purchasing “Class B” or “Class F” common stock. For ease of reference, this primer refers to the shares and warrants included in the units sold to the public as the “public shares” and “public warrants,” and the shares and warrants sold to the sponsor as the “founder shares” and the “founder warrants.” The public shares and founder shares vote together as a single class and are usually identical except for certain anti-dilution adjustments described below.

Founder Shares

The sponsor will purchase founder shares prior to the SPAC filing or submitting a registration statement with the sec in connection with the SPAC’s IPO. The sponsor will pay a nominal amount (usually $25,000) for a number of founder shares that equals 25% of the number of shares being registered for offer to the public, inclusive of the traditional 15% green shoe. The holders of the founder shares will agree, to the extent the green shoe is not exercised in full, to forfeit a number of shares so that their number of founder shares continues to equal 25% of the number of public shares actually sold to the public. This results in the founder shares equaling 20% of the total shares outstanding after completion of the IPO, including any exercise or expiration of the green shoe. The 20% founder shares are often referred to as the “promote.”

In many SPAC structures, the founder shares automatically convert into public shares [4] at the time of the de-SPAC transaction on a one-for-one basis. However, if additional public shares or equity-linked securities (defined as securities of the SPAC or its subsidiaries that are convertible into or exchangeable for equity of the SPAC) are issued in connection with the closing of the de-SPAC transaction (excluding shares and equity-linked securities issued to the seller of the target business), the exchange ratio upon which the founder shares convert to public shares will be adjusted to gross the founder shares up to 20% of the total founder shares and public shares and equity-linked securities outstanding.

Warrants

The units sold to the public typically include a fraction of a warrant to purchase a whole share, while the sponsor purchases whole warrants. Recently, the most common structure has been that the units sold in the IPO would include a half warrant, although one-third of a warrant is more common in larger IPOs. In all cases, only whole warrants are exercisable. The offerings of the founder warrants and the shares issuable upon exercise of the public warrants and founder warrants are not registered at the time of the IPO, but are typically subject to a registration rights agreement entered into at the time of the IPO that entitles the holders of these securities to certain demand and “piggyback” registration rights after the De-SPAC transaction.

The strike price for the warrants is $11.50 per whole warrant (15% above the $10.00 per share IPO price) with anti-dilution adjustments for splits, stock and cash dividends. The warrants become exercisable on the later of (i) 30 days after the De-SPAC transaction and (ii) the twelve-month anniversary of the SPAC IPO. The public warrants are designed to be cash settled—meaning the investors have to deliver $11.50 per warrant in cash in exchange for a share of stock. The founder warrants may be net settled (also referred to as a “cashless exercise”)—meaning the holder is not required to deliver cash but is issued a number of shares of stock with a fair market value equal to the difference between the trading price of the stock and the warrant strike price. In certain circumstances, such as the absence of an effective registration statement covering the common stock issuable upon exercise of the public warrants or at the option of management, the public warrants may also be net settled. If the public warrants are exercisable and the public shares trade above a fixed price (usually $18.00 per share) for a period of time, the public warrants will become redeemable by the company for nominal consideration, effectively forcing holders of the public warrants to exercise or lose the value of the warrants. The founder warrants are not redeemable. With the exception of the cashless exercise feature and the non-redeemability, the founder warrants and public warrants have identical terms.

The founder warrants and public warrants are identical except for the founder warrant cashless exercise and lack of redemption (forced exercise) provisions.

The purchase price paid by the sponsor for the founder warrants represents the “at risk capital” of the sponsor in the SPAC and is calculated as an amount equal to the upfront underwriting discount (typically 2% of the gross IPO proceeds) plus typically $2 million to cover offering expenses and post-IPO working capital. For that amount, the sponsor purchases founder warrants at a price of $1.50, $1.00 or $0.50 per warrant, depending on whether each unit sold in the IPO includes 1/3, 1/2 or 1 public warrant, respectively. [5] In addition to the founder warrants purchased at IPO, most SPACs contemplate that an additional $1.5 million of warrants can be issued to the sponsor at the De-SPAC transaction on conversion of any loans from the sponsor to the SPAC.

Both the sponsor and the public IPO investors receive warrants (although usually disproportionately to common shares), so the sponsor and the public IPO investors are aligned in terms of warrant structure and terms. The public warrants compensate the IPO investors for investing in a blind pool. The warrants essentially dilute any PIPE investors and any equity retained by the seller of the target business.

Forward Purchase

In a number of recent SPAC IPOs, affiliates of the sponsor or institutional investors have entered into a forward purchase agreement with the SPAC, committing to purchase equity (stock or units) in connection with the De-SPAC transaction to the extent the additional funds are necessary to complete the transaction. In cases where the forward purchase commitment comes from a private equity fund or other investor with a limited investment mandate, it may be appropriate to condition the obligation of the investor on the De-SPAC transaction satisfying the investment mandate of the investor. In a number of examples, the forward purchase commitment has been subject to approval by the forward purchaser or has been styled expressly as an option of the forward purchaser.

Governance & Domicile

SPACs are required to have a majority of independent board members under stock exchange listing requirements, subject to the same phase-in exceptions as are applicable to all newly public companies. Directors of the SPAC are selected by the sponsor at IPO, and thereafter additional directors, if necessary, are appointed by the SPAC board. In most instances, a SPAC will not hold a public election for directors until the De-SPAC transaction or thereafter, and some SPACs provide that only the founder shares vote in director elections until the De-SPAC transaction.

Most SPACs are formed as Delaware corporations, but several have been formed in foreign jurisdictions (most frequently the Cayman Islands, but occasionally the British Virgin Islands or the Marshall Islands). If the SPAC may reasonably pursue a target outside the United States, a foreign SPAC may allow for a more efficient post De-SPAC structure if foreign assets are acquired, or the SPAC may redomicile into the United States if domestic assets are purchased. The offshore structure will introduce other tax issues, such as passive foreign investment company issues. Corporate law of foreign jurisdictions, such as the Cayman Islands, is not as well developed as its Delaware analog, and Cayman Islands law notably does not expressly permit waiver of the corporate opportunity doctrine.

Historically, most SPACs have listed on the NASDAQ because the NYSE listing rules were considerably more restrictive than the NASDAQ rules. [6] The NYSE rules have recently changed, such that the NYSE and NASDAQ listing requirements are substantially similar, and pricing is comparable.

Typical IPO Agreements

There is a standard set of contracts and documents entered into in connection with the formation of the SPAC and the SPAC IPO. Some, like the certificate of incorporation and registration rights agreement, have analogs in traditional IPOs of operating companies, while others are unique to SPACs.

Charter

Every corporation has a certificate of incorporation or similar constituent document (for example, Cayman Islands corporations have a hybrid charter and bylaws document titled the “memorandum and articles of association”). SPAC charters provide for the establishment of the public shares and founder shares, including the anti-dilution adjustment to the conversion ratio for the founder shares. They also limit the ability of the SPAC to utilize funds in the trust account, (excepting certain specified uses), require the SPAC to offer to redeem the public shares, and set the minimum size for the target business in a De-SPAC transaction. SPAC charters for Delaware SPACs typically waive the corporate opportunity doctrine as applied to the SPAC’s officers and directors.

Securities Purchase Agreement

The sponsor and the SPAC enter into a securities purchase agreement providing for the issuance to the sponsor of the founder shares for $25,000. The number of founder shares is sized to be 25% of the amount of public shares initially registered on the registration statement, but will be increased or decreased through a stock split, dividend or forfeiture to size the founder shares to 25% of the number of public shares ultimately sold.

Warrant Agreement

The SPAC and the transfer agent will enter into a warrant agreement that specifies the terms of the warrants. The warrant agreement also contains an obligation for the SPAC to register the issuance of public shares upon exercise of the public warrants. The warrant agreement provides that the terms of the public warrants generally can be amended with the approval of holders of 50% of the public warrants.

Promissory Note

All organizational and offering expenses are paid by the SPAC from proceeds of the IPO and sale of the founder shares and founder warrants. These expenses include the (modest) legal fees and expenses, printing expenses, accounting fees, SEC/FINRA, NASDAQ/NYSE fees, travel and road show fees, D&O insurance premiums, and other miscellaneous fees. Prior to the closing of the IPO, the SPAC does not have sufficient cash to pay such fees, so the sponsor enters into a promissory note with the SPAC to loan funds to the SPAC until completion of the SPAC’s IPO. The promissory note covers any organizational or offering expenses until the SPAC can repay the loan from the proceeds of the IPO and sale of the founder warrants at the closing of the IPO.

Sponsor Constituent Documents

The sponsor is often a new limited liability company formed solely for the purpose of sponsoring the SPAC. The owners of the sponsor (e.g., a private equity fund and the independent management team of the SPAC) may document their relationship and relative participation in the SPAC, such as the relative amount of the founder warrant purchase price each will fund, and economic ownership of the founder warrants and founder shares in the constituent documents.

Letter Agreement

SPACs enter into a letter agreement with their officers, directors and sponsor. The letter agreement may include, among other things, a voting agreement obligating the officers, directors and sponsor to vote their founder shares and public shares, if any, in favor of the De-SPAC transaction and certain other matters, a lock-up agreement, an agreement from the sponsor to indemnify the SPAC for certain claims that may be made against the trust account, an obligation to forfeit founder shares to the extent the green shoe is not exercised in full, and an agreement not to sponsor other SPACs until the SPAC enters into a definitive agreement for a De-SPAC transaction. The letter agreement also documents the agreement of the officers, directors and sponsor to waive any redemption rights that they may have with respect to their founder shares and public shares, if any, in connection with the De-SPAC transaction, an amendment to the SPAC’s charter to extend the deadline to complete the De-SPAC transaction or the failure of the SPAC to complete the De-SPAC transaction in the prescribed timeframe (although the officers, directors and sponsor are entitled to redemption and liquidation rights with respect to any public shares that they hold if the SPAC fails to complete the De-SPAC transaction within the prescribed timeframe).

Registration Rights Agreement

The SPAC enters into a registration rights agreement with the sponsor and any other holders of founder shares and founder warrants (typically the SPAC’s independent directors), giving the sponsor and such other holders broad registration rights for the founder shares, founder warrants and other equity the sponsor and such other holders own in the SPAC.

Private Placement Warrants Purchase Agreement

The SPAC and the sponsor enter into an agreement pursuant to which the sponsor purchases the founder warrants. The purchase price is funded one business day prior to the closing of the IPO, and again one business day prior to the closing of any exercise of the green shoe.

Securities Assignment Agreement

Some sponsors compensate the independent directors of the SPAC through the sale of founder shares, at cost. For example, in several recent SPAC IPOs, the sponsor transferred between 30,000 and 40,000 founder shares to each of the SPAC’s independent directors. This provides compensation to the independent directors for their service, as independent directors are typically not otherwise paid for their service.

Administrative Services Agreement

The SPAC and the sponsor (or an affiliate of the sponsor) enter into an agreement pursuant to which the sponsor (or the affiliate of the sponsor) provides office space, utilities, secretarial support and administrative services to the SPAC in exchange for a monthly fee (typically $10,000 per month).

* * *

In addition to the contracts and documents described above, the SPAC also adopts bylaws in connection with its formation, which are relatively standardized among Delaware SPACs and contain customary provisions for a publicly traded Delaware corporation. The SPAC also enters into an investment management trust agreement with a trustee, which governs the investment and release of the funds held in the trust account after the IPO. Finally, SPACs typically enter into agreements with their directors and officers to provide them with contractual indemnification in addition to the indemnification provided for in the charter.

To the extent that any of the SPAC’s contacts and documents do not terminate at the De-SPAC transaction by their terms, they are often amended in connection with the De-SPAC transaction. For example, the warrant agreement can be amended by a vote of the warrant holders, the registration rights agreement can be superseded by a stockholders agreement, charters and bylaws are often amended, etc.

The Acquisition Target

SPACs are required to either consummate a business combination or liquidate within a set period of time after their IPO. Stock exchange rules permit a period as long as three years, but most SPACs designate 24 months from the IPO closing as the period. [7]

No Target Identified at IPO

SPACs cannot identify acquisition targets prior to the closing of the IPO. If the SPAC had a specific target under consideration at the time of the IPO, detailed information regarding the target IPO registration statement, potentially including the target’s would be required to be included in the financial statements, thus delaying the IPO and rendering it similar in form and substance to a traditional IPO. The SEC often requires [8] disclosure in the IPO prospectus to the effect that the SPAC currently does not have any specific business combination under consideration and that the SPAC’s officers and directors have neither individually selected nor considered a target business for the business combination nor have they had any discussions regarding possible target businesses among themselves or with underwriters or other advisors.

If there is unsolicited interest from potential targets, the SPAC and its officers and directors should refuse to engage and should respond that they will not consider the potential target until after the IPO is completed.

If the SPAC is affiliated with a private equity group, the IPO prospectus will typically include disclosure indicating that members of the SPAC management team are employed by the private equity group, which is continuously made aware of potential business opportunities, one or more of which the SPAC may desire to pursue for a business combination. Additionally, the IPO prospectus will typically include a statement that the SPAC will not consider a business combination with any company that has already been identified to the private equity group as a suitable acquisition candidate.

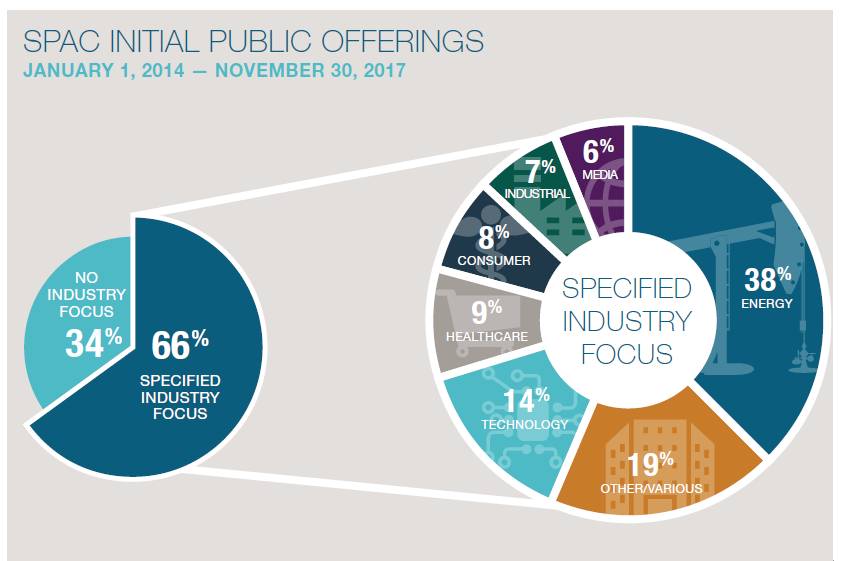

Target Industry

Most SPACs will specify an industry or geographic focus for their target business or assets. However, most will not be prohibited from pursuing businesses or assets in any industry sector or geography.

Target Size

Under stock exchange rules, the De-SPAC transaction must be with one or more target businesses or assets that together have an aggregate fair market value of at least 80% of the assets held in the trust account (excluding the deferred underwriting discount and taxes payable on the interest earned on the trust account) at the time of signing a definitive agreement for the De-SPAC transaction. As a practical matter, SPACs typically target business combination targets that are at least two to three times the size of the SPAC in order to mitigate the dilutive impact of the 20% founder shares.

There is no maximum size of transaction for the De-SPAC transaction. However, the transaction will need to be structured in a manner so that the SPAC does not become an investment company under the Investment Company Act of 1940. To this end, most SPAC IPO prospectuses contain disclosure that says that the SPAC “will only complete [a] business combination if the post-transaction company owns or acquires 50% or more of the outstanding voting securities of the target or otherwise acquires an interest in the target sufficient for it not to be required to register as an investment company under the Investment Company Act of 1940.” Occasionally, readers of SPAC IPO prospectuses interpret this as a maximum size for a target business of two times the size of the SPAC. This is inaccurate. The Investment Company Act restriction does not mean that the SPAC investors have to own 50% of the voting stock of the surviving company, as the Investment Company Act merely requires that the public company control its operating subsidiaries (or have another means for exclusion from the Investment Company Act), and is indifferent to how much of the public company the owners of the SPAC comprise.

“We have not, nor has anyone on our behalf, taken any measure, directly or indirectly, to identify or locate any suitable acquisition candidate for us, nor have we engaged or retained any agent or other representative to identify or locate any such acquisition candidate.”

“We have not (nor have any of our agents or affiliates) been approached by any candidates (or representatives of any candidates) with respect to a possible acquisition transaction with us.”

Financial Statements

As described below, the De-SPAC transaction will require a proxy statement meeting the requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or tender offer materials containing substantially the same information. Depending on the timing of the transaction, the proxy statement or tender offer materials are required to include two or three years of audited [9] financial statements of the target business, plus unaudited interim financial statements. The audited financial statements of the target business in the proxy statement or tender offer materials may be audited under the American Institute of Certified Public Accountants (“AICPA”) rules, but the Super 8-K (discussed below) is required to have three years of audited financial statements of the target business audited in compliance with the Public Company Accounting Oversight Board (the “PCAOB”) rules. The PCAOB rules require that the auditor be registered with the PCAOB, meet qualification standards and be independent of the audited company and require a lower threshold for materiality. Most private companies either do not have audited financial statements or have financial statements audited under the AICPA rules. The necessary audit or reaudit of the target company’s financial statements is thus often a gating item for the De-SPAC transaction, and if the financial statements are not auditable, the target business is not suitable for a SPAC acquisition.

De-SPAC Process

Shareholder Approval

The De-SPAC process is similar to a public company merger, except that the buyer (the SPAC) is typically required to obtain shareholder approval, which must be obtained in accordance with SEC proxy rules, while the target business (usually a private company) does not require an SEC compliant proxy process.

Stock exchange rules do not always require a vote by the SPAC shareholders, but the structure of the De-SPAC transaction (e.g., if the SPAC does not survive a merger or is re-domiciling in a different jurisdiction) may require a vote, and if more than 20% of the voting stock of the SPAC is being issued in the De-SPAC transaction (to the seller of the target business, to PIPE investors or to a combination), the stock exchange rules will require a shareholder vote. This results in most De-SPAC transactions involving a public vote of the SPAC’s shareholders, which involves the filing of a proxy statement with the SEC, review and comment by the SEC, mailing of the proxy statement to the SPAC’s shareholders and holding a shareholder meeting. The proxy process can take three to five or more months to complete from the date a definitive agreement for the De-SPAC transaction is signed.

Founder Vote Requirements

The sponsor and any other holders of founder shares will typically commit at the time of the IPO to vote any founder shares held by them and any public shares purchased during or after the IPO in favor of the De-SPAC transaction. As a result, at least 20% of the SPAC’s outstanding shares will be committed to vote in favor of a transaction, requiring only 37.5% of the public shares to achieve a majority vote and approve the transaction.

Redemption Offer

In connection with the De-SPAC transaction, SPACs are required to offer the holders of public shares the right to redeem their public shares for a pro rata portion of the proceeds held in the trust account, which typically results in a redemption amount equal to approximately $10.00 per public share. Under stock exchange listing rules, if a shareholder vote is sought, only shareholders who vote against the De-SPAC transaction are required to be offered the ability to redeem their public shares, but SPAC charter documents typically require the offer to be made to all holders. The redemption offer does not apply to the public warrants—they remain outstanding regardless of whether the originally associated public share is redeemed or not, until they are exercised or otherwise cancelled or exchanged pursuant to their terms or a vote. In addition, if the SPAC hits the outside date for consummating the De-SPAC transaction or seeks to amend its charter documents to permit an extended period to consummate the De-SPAC transaction, it will be required to redeem the public shares (or offer to redeem, in the case of a charter amendment) for their pro rata portion of the amount held in the trust account. Effectively, if the De-SPAC transaction never occurs, the public shareholders get their money back and the public warrants, founder shares and founder warrants expire without value.

In the rare event that a SPAC shareholder vote is not required, the SPAC will be required under its charter documents to conduct a tender offer to redeem the public shares and to file tender offer materials containing substantially the same information as would be required in a proxy statement. Even if a shareholder vote is not legally required, the SPAC could elect to put the De-SPAC transaction to a shareholder vote for business reasons.

The sponsor and the SPAC’s officers and directors will waive redemption rights with respect to their founder shares (and any public shares they may purchase) in connection with the De-SPAC transaction or a charter amendment to permit an extended period to consummate the De-SPAC transaction, effectively agreeing to stay invested in the SPAC through the closing of the De-SPAC transaction or until liquidation.

Super 8-K Material Disclosure

- Description of Property

- Description of Business

- Risk Factors

- Financial Information, including:

- Three Years of Audited Financial Statements

- Selected Financial Data

- MD&A

- Quantitative and Qualitative Disclosures About Market Risk

- Director and Executive Officer Biographical Information

- Executive Compensation

- Security Ownership of 5% Owners, Directors and Executive Officers

- Transactions with Related Persons

- Material Pending Legal Proceedings

- Description of the Registrant’s Securities

Super 8-K

SEC rules require that SPACs file a special Form 8-K within four business days following completion of a De-SPAC transaction. This Form 8-K is known as a “Super 8-K” and must contain all the information that would be required in a Form 10 registration statement (the registration statement for companies that become public reporting companies other than through a registered IPO). Much of the information in the Super 8-K will already have been included in the SPAC’s proxy statement or tender offer materials for the De-SPAC transaction, but the Super 8-K may require additional financial statement information for the target business.

SPACs, as registrants with assets consisting solely of cash and cash equivalents, are “shell companies” under the Securities Act of 1933, as amended (the “Securities Act”), and forms and regulations thereunder. [10] SEC regulations prohibit or limit the use by shell companies (SPACs) and former shell companies (former SPACs) of a number of exemptions, safe harbors and forms that are available for other registrants. Some of these restrictions were adopted by the SEC in 2005 in response to the perceived use of certain shell companies as vehicles to commit fraud and abuse the SEC’s regulatory processes. The restrictions apply to SPACs and former SPACs for varying periods depending on the specific rule.

For example, a former SPAC is not eligible to register offerings of securities pursuant to employee benefit plans on Form S-8 until at least 60 days after it has filed a Super 8-K.

In addition, stockholders of former SPACs are required to hold their equity for a period of twelve months, measured from the date of the filing of the Super 8-K, before they can rely on Rule 144 under the Securities Act. Rule 144 provides a means by which persons who might otherwise be considered “statutory underwriters” (and therefore required to register their offer of equity under the Securities Act prior to their public sale) may sell their equity without registration, typically after a six-month holding period.

Further, SPACs and former SPACs (i) are not eligible to be well-known seasoned issuers until at least three years after the De-SPAC transaction, (ii) are limited in their ability to incorporate by reference information into long-form registration statements on Form S-1, and (iii) may not use the “Baby Shelf Rule” (which permits registrants with a public float of less than $75 million to use short-form registration statements on Form S-3 for primary offerings of their shares) for twelve months after the Super 8-K filing.

Endnotes

1NYSE and NASDAQ listing requirements would permit an amount less than 100% of the gross IPO proceeds to be funded into the trust account, but market practice is to fund 100% or more so that, when the SPAC liquidates or conducts redemption offers, the public shareholders should receive at least $10.00 for each public share purchased. (go back)

2Other investments raise Investment Company Act considerations for the SPAC during the period before it completes its De-SPAC transaction, as well as risk issues around whether the trust account will have sufficient cash to return $10.00 per public share to public shareholders on a redemption or liquidation.(go back)

3Occasionally, the unit includes a whole warrant to purchase a fraction of a share of common stock, rather than a fraction of a warrant. The difference is largely mechanical, impacting how the warrants trade and are exercised.(go back)

4Although the shares issued upon conversion of the founder shares are of the same class as the public shares, their resale would need to be registered under the Securities Act or eligible for an exemption from the registration requirements.(go back)

5As discussed above, some SPAC IPO units include a whole warrant to purchase a fraction of a share of common stock, rather than a fraction of a warrant. In those cases, the sponsor purchases founder warrants at a price of $1.50, $1.00 or $0.50 per warrant, depending on whether the public warrants are exercisable for 1/3, 1/2 or 1 share, respectively.(go back)

6For example, the NYSE listing rules required a shareholder vote and imposed a maximum 40% redemption requirement as a condition to consummate the De-SPAC transaction.(go back)

7Some SPACs have shorter periods to consummate the De-SPAC transaction, with examples as short as 12 months, or more frequently 18 or 21 months. Many contain features to automatically extend the period if a definitive agreement or letter of intent is signed by the end of the specified period or upon contribution of additional capital into the trust account by the sponsor.(go back)

8For example, “Please expand [your] disclosure, if accurate, to affirmatively confirm that no agent or representative of the registrant has taken any measure, direct or indirect, to locate a target business at any time, past or present. If any party, affiliated or unaffiliated with the registrant, has approached you with a possible candidate or candidates, then so disclose or advise the staff. Please note that, in particular, we are not seeking simply whether a potential business combination candidate has been “selected” but, rather, are looking more to the type, nature and results to date of any and all diligence, discussions, negotiations and/or other similar activities undertaken, whether directly by the registrant or an affiliate thereof, or by an unrelated third party, with respect to a business combination transaction involving the registrant. We may have further comment.” (go back)

9The target business financial statements must be audited for the most recent year “only to the extent practicable,” and earlier years need not be audited if they were not previously audited. (go back)

10SPACs are similar to “blank check companies,” which the SEC describes as “a development stage company that has no specific business plan or purpose or has indicated that its business plan is to engage in a merger or acquisition with an unidentified company or companies, or other entity or person[.]” The SEC sometimes describes SPACs as “blank check companies.” Blank check companies are development stage companies that have indicated that their business plan is to engage in a merger or acquisition with an unidentified company or companies and that are issuing “penny stock” under Rule 3a-51 of the Exchange Act. Blank check companies are subject to Rule 419 of the Securities Act. However, SPACs are not blank check companies within the scope of Rule 419 because SPACs have charter restrictions prohibiting them from being “penny stock” issuers (the term “penny stock” generally refers to a security issued by a very small company that trades at less than $5 per share). The major differences between SPAC and blank check companies/penny stock issuers are that SPAC equity may trade on an exchange prior to the SPAC’s business combination, brokers are not subject to heightened requirements on trades in SPAC securities, SPACs have a longer time period to complete their business combinations and SPACs are not prohibited under SEC rules from using interest earned on the trust account prior to the business combination. (go back)

Print

Print