Yuliya Guseva is Associate Professor of Law at Rutgers Law School. This post is based on her recent article, recently published in the Boston College Law Review.

The question of finding an optimal approach to securities law liability and enforcement against foreign issuers in U.S. markets remains open. Seeking to find answers to this policy question, my recent article presents relevant empirical, doctrinal, economic, and institutional arguments. To my knowledge, this paper is the first empirical survey of the recent changes in SEC enforcement against foreign private issuers (“FPIs”). The article argues that although the Commission needs to react to the recent developments in class-action litigation against foreign corporations, a possible lemons problem, and the potential risk of underenforcement, it should not ramp up enforcement. Through traditional enforcement, the SEC would be pursuing an insurmountable task of designing a national “Pigouvian tax” on fraud committed by international corporations operating in multiple jurisdictions. The article suggests a logical alternative that I dub a soft preventive approach. The SEC may send an explicit signal to the market that it is designing more efficient, low-cost monitoring policies by building better cooperation with foreign firms and utilizing its recently improved capacity to analyze “big data” to identify anomalies in foreign issuer reporting.

The article begins with a set of normative and positive questions on the relative value of SEC enforcement vis-a-vis class-action litigation against FPIs. For instance, my previous article on class actions against foreign firms demonstrates that, among other trends, the mean and median settlements have shrunk since mid-2010. In 2010, in Morrison v. National Australia Bank, the Supreme Court limited the extraterritorial reach of the antifraud provisions of the securities law. Today, the projected revenue of a plaintiffs’ attorney is a priori lower in contemplation of an action against an FPI, whereas the average costs of bringing a successful suit remain at least the same. Moreover, there are other factors that affect attorneys’ cost-benefit analysis and may dampen the incentives to bring class actions specifically against foreign firms. Many of these factors are related to exchange-trading, asset location, and the unique transaction costs of cross-border actions. Cross-border class actions essentially represent a special case of Landes and Posner’s “overenforcement theorem.” Namely, a systematic “fissure” in private enforcement could be created as larger and more “visible” listed FPIs would suffer from excessive plaintiff monitoring. All the while, others would routinely slip through the cracks in the civil liability machinery, and the victims of their fraud could be undercompensated on average. In such a scenario, the SEC may be able to ensure more optimal deterrence and fill the gaps left by private class actions.

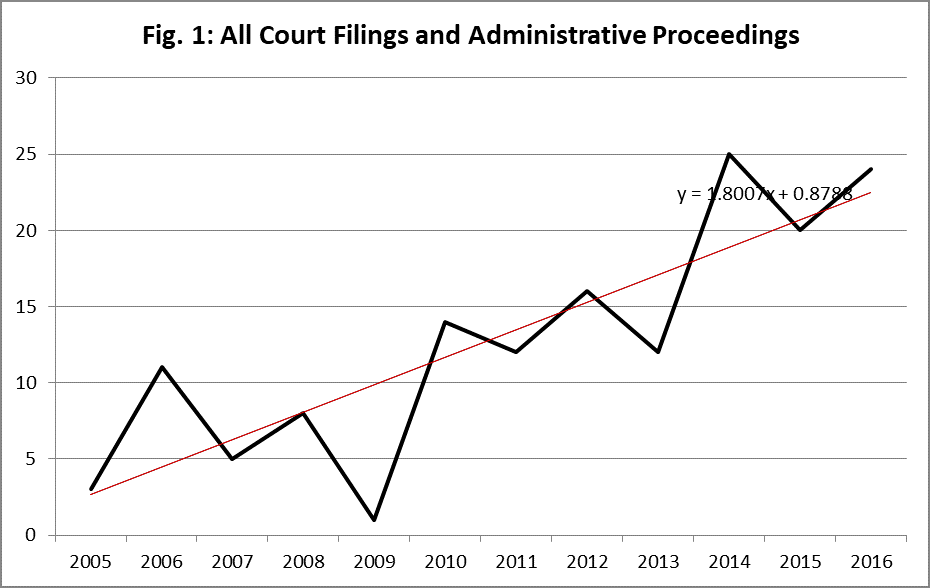

This article is the first attempt to analyze the changes in SEC enforcement between 2005 and 2016. My working hypothesis was that if there was an underenforcement problem after 2010, i.e., post-Morrison, there would be more enforcement actions against foreign companies. The results below suggest that this has not happened. Instead, the SEC’s caseload remained comparatively stable.

The dataset includes hand-collected data on the SEC actions against FPIs registered with the Commission and FPIs not registered with the SEC. To categorize the cases, I used the “initial dates” of actions, including the dates of orders instituting administrative proceedings (“OIPs”), orders instituting cease-and-desist proceedings, complaints filed in federal district courts, or orders of suspension of trading. The final sample includes 151 cases against FPIs.

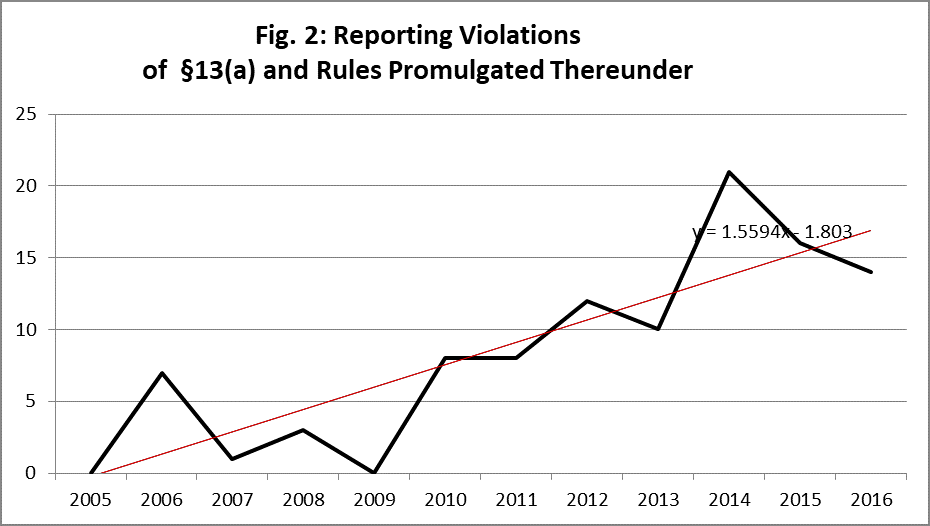

Figure 2 shows that this upward trend was driven primarily by an increase in Section 13(a) actions for reporting violations.

Figure 3 summarizes more serious violations of the antifraud provisions and the books and records provisions.

Separately, typical securities fraud cases brought under Section 10(b) and Rule 10b-5 and under Section 17 remained rare. There does not seem to be a clear pattern in this enforcement area.

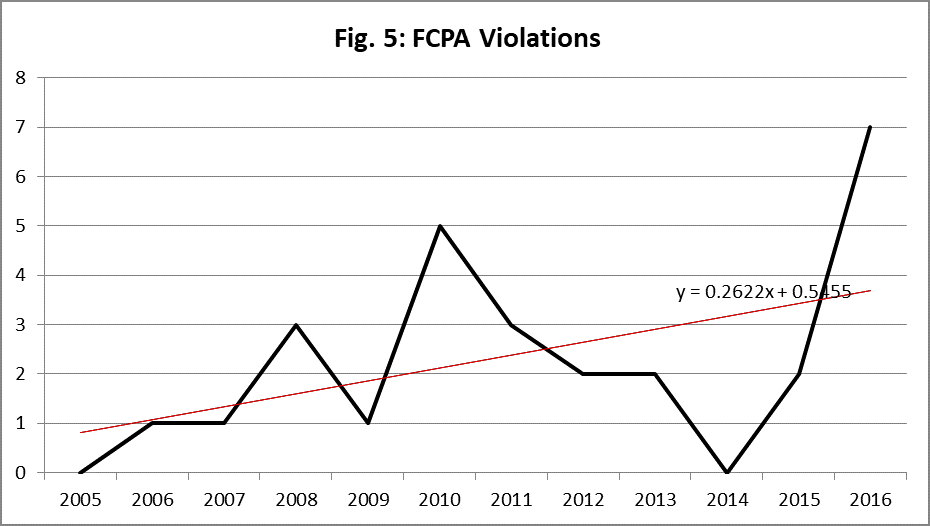

The long-term trends in FCPA enforcement are also unclear.

I also reviewed the last reports filed by FPIs whose registrations were revoked. The data include the dates of the reports filed on Form 20-F, Form 40-F, Form 10-K, and Form 10-Q; registration statements; or amendments thereto. In line with the previous research, the OIPs and ultimate revocations were issued against FPIs that were delinquent in filings for two-three years on average. Plausible explanations of this tardiness are that the Commission does not interdict trading between willing buyers and sellers absent a threat of substantial public harm, that it relies on market gatekeepers such as broker-dealers, that it needs to economize on enforcement resources, and/or that it is unwilling to spend resources on routine “housekeeping.”

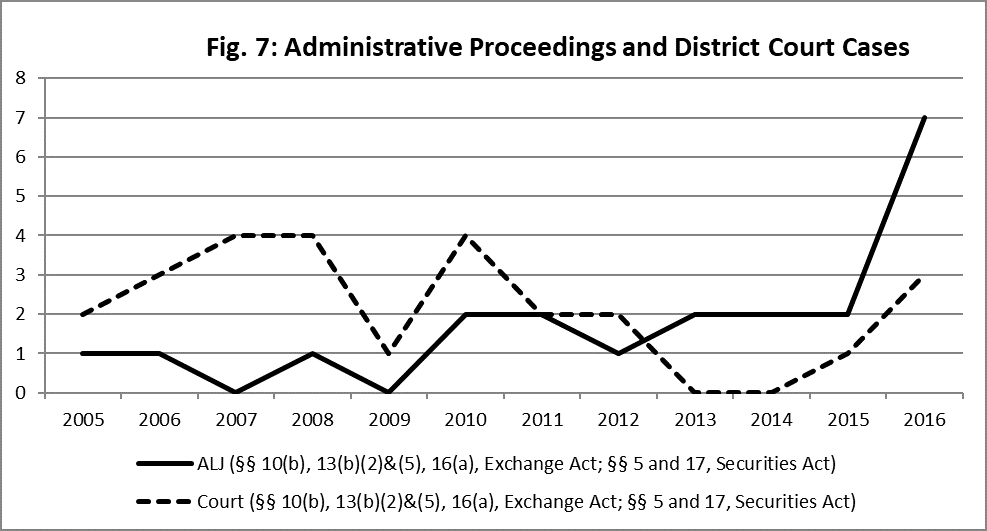

As expected, the data show a substantial increase in in-house administrative proceedings vis-à-vis civil court actions. Figure 7 excludes standalone Section 13(a) violations.

Another interesting observation is that, excluding the 12 outliers with settlements above $30,000,000, the average judgments and settlements in the pre- and post-Morrison subsamples were comparable. By contrast, my previous article found a considerable decrease in settlements and judgments against FPIs in private class action litigation. The average settlements in enforcement actions before the end of June 2010 were about $9 million, and the average settlements after June 2010 were about $9.8 million.

In search of a possible “complementarity” of public and private enforcement, I identified the types of securities in the SEC’s crosshairs and classified the FPIs based on the markets for their securities as “OTC” and “exchange-listed.” At first glance, the data seem to suggest that private class actions and public enforcement are complements. For instance, as my previous research indicates, in more than ninety percent of private class action complaints filed between 2005 and 2015, plaintiffs overwhelmingly focused on exchange-traded securities. In contrast, between 2005 and 2016, the SEC targeted more companies trading ADRs and shares of stock on the OTC market.

The nature of the penalties, however, belies this superficial conclusion. Most actions against OTC issuers resulted in the revocation of the registration of their securities. By contrast, most actions against exchange-traded issuers involved more serious charges and produced heavy monetary penalties. Overall, more research is needed to establish whether public enforcement and private litigation are complements.

To summarize, the results suggest that the overarching enforcement policies are stable. It is possible that, as consistent with prior research, the SEC ordinarily prefers a comparatively low-key strategy in enforcement against FPIs. This low-key approach represents the dominant strategy for the Commission and is supported by normative, institutional, public choice, and international aspects of enforcement. One argument is that as a national regulator, the Commission would not capture the full benefits from enforcement: Its actions, associated with better deterrence or more competitive and transparent markets, would generate a global positive externality and be a pure “unrequited subsidy” to public agencies and markets in other jurisdictions.

Yet, as the SEC needs to fine-tune its policy to take into account post-2010 post-Morrison changes, I propose several solutions adjusting the dominant strategy, keeping potential international fraudsters in check, and simultaneously avoiding deterring honest firms by ratcheting up the costs of cross-listing. The primary objective of the proposals is eliciting cooperation and improvements in issuers’ corporate governance, transparency, and/or internal controls.

Specifically, the Division of Economic and Risk Analysis (“DERA”) may run data analysis and alert either the Enforcement Division or the Division of Corporation Finance that an FPI or several foreign companies with certain characteristics exhibit reporting discrepancies and anomalies. After that, the Divisions, or one of them, may informally communicate to the potential subjects that they need to address the concerns raised by DERA.

A foreign firm would have the right to either respond to the informal request from the Commission or modify its reporting and corporate policies without responding to the letter. In the latter case, the firm would have an option to file either a current report by furnishing Form 6-K; its next annual report; or a report with a foreign regulator and/or exchange. Another alternative could be to publish a notice in English about relevant corporate governance or reporting improvements on the firm’s webpage. The management’s incentives to comply would be strengthened by the nonpublic nature of the SEC’s actions. The firm would publicize its corporate initiatives as if they were “sua sponte” actions. Even though the role of the SEC would remain nonpublic, the resultant governance improvements should accrue to the benefit of the investors.

To promote compliance, the informal SEC letters could explicitly stipulate two courses of action. First, the Commission could threaten retaliation. Unless a firm explained its reporting choices or changed its policies as described above, the Division of Corporation Finance would send a comment letter, which would later on become public. In more serious cases, the Enforcement Division would either commence an investigation or refer the matter to the firm’s primary regulator abroad. Under this mechanism, the Commission would be blowing the whistle either by prompting the firms to run internal investigations and ensure proper reporting and internal controls or by referring the anomaly to foreign enforcers and removing that item from the SEC enforcement agenda and balance sheet.

Second, the SEC might also spell out that it reserved the option not to retaliate, without providing an explanation to the target. In other words, it could openly exercise discretionary nonenforcement. As the firm would not know upfront which action the SEC might choose, its management would be incentivized to cooperate and undertake compliance measures or, in the alternative, to prepare for an enforcement action. Companies choosing to heed the warnings will be self-identifying as “oranges,” whereas firms ignoring the SEC will default to the “lemons” category. There will be a clear separating equilibrium, which will help the SEC identify and, if necessary, proceed against certain issuers. Informing foreign issuers early about possible investigations and negative publicity should help the SEC improve overall deterrence and identify international companies that value their cross-listings programs and, simultaneously, allow those companies take corrective measures preempting enforcement and negative publicity.

The complete article is available for download here.

Print

Print