Wes Hall is Executive Chairman and Founder, Amy Freedman is Chief Executive Officer, and Ian Robertson is Executive Vice President of Communication Strategy at Kingsdale Advisors. This post is based on a their Kingsdale memorandum. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

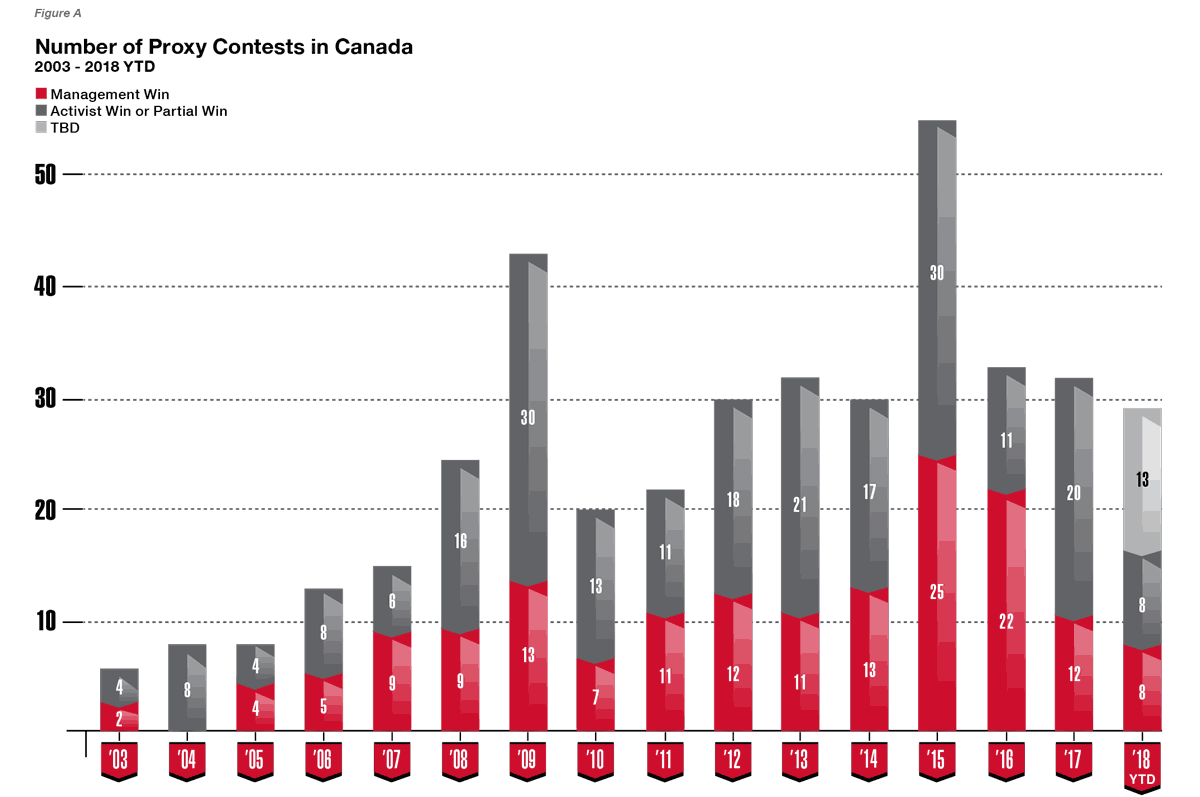

Throughout the years, we’ve seen a large increase in the number of public proxy contests in Canada, from six in 2003 to a peak of 55 in 2015. While we likely won’t reach 2015 numbers, 2018 is on pace to be another eventful year.

Year-to-date activity has exceeded last year’s figures: this time last year, there were 21 public proxy contests, increasing to 32 by year-end. Comparatively, there have already been 29 proxy fights in 2018, and new battles continue to surface daily.

Clearly, activism continues to be a popular investment style and an important tool for investors looking to extract value or halt what they see as value erosion. Consequently, Canadian companies need to remain vigilant and maintain plans for addressing activist shareholder attacks.

Of particular note this year, we have observed more proxy fights being initiated after the so-called conclusion of proxy season, reinforcing a point we have made in previous reviews: there is no longer a proxy season, so heightened vigilance is required year-round.

We continue to reiterate that while the number of fights may have decreased from the 2015 peak, that is largely a function of the behind closed- doors engagement that is taking place between activists and companies.

Public activism is not always the goal nor the result of an interaction with a concerned shareholder.

Companies and activists are finding new ways to work more constructively behind the scenes to realize what both hope to be value-enhancing solutions, while saving public reputations and corporate funds.

Based on our deep industry experience, we estimate that only one-third of proxy fights ever become public.

Activist Success Rates Falling in Canada but Rising in the U.S.

Years ago, we branded Canada as the land of milk and honey for activists, and for years, this has been the case. Not just because of the structural regulatory advantages that exist, but also because of a sustained period of victories for activists.

But now it looks like things might finally be starting to change, even accounting for the small sample size to date this year.

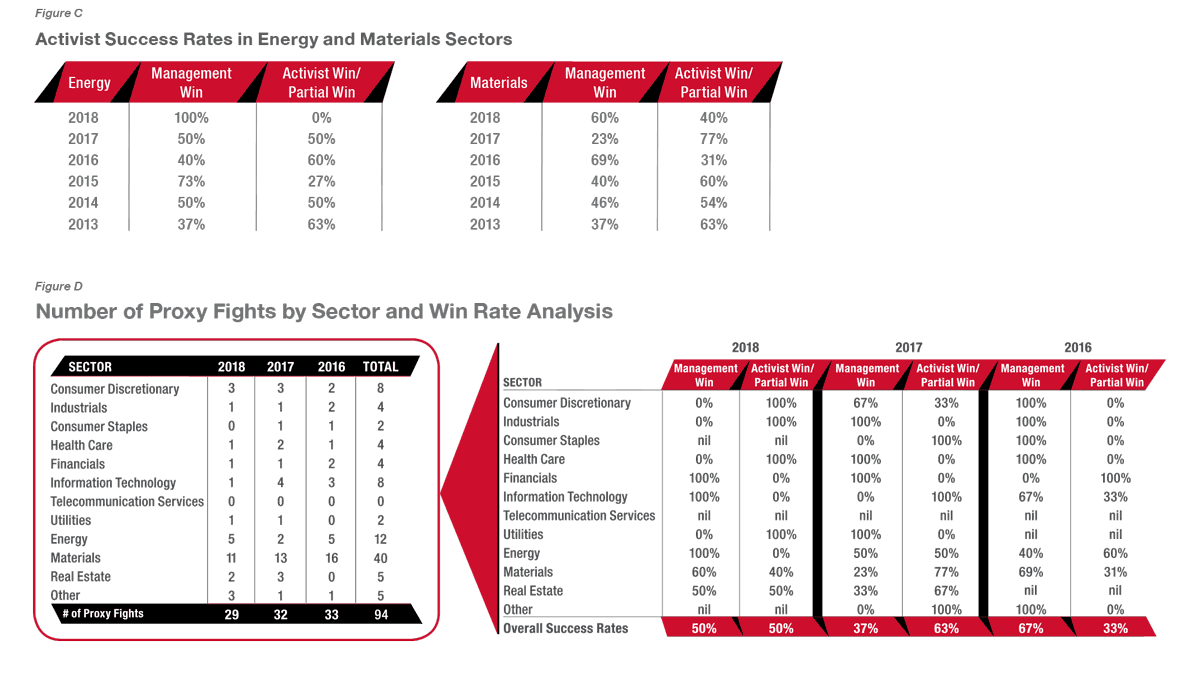

So far in 2018, activists in Canada have won 50% of the proxy contests compared to a 63% success rate for all of 2017.

Interestingly, the activist win/loss ratio differs greatly from what’s happening in the U.S. where, this year, the activist win rate stands at 72% according to Shark Repellent.

This inverse trend between Canada and the U.S. may be due, in part, to the difference in marketplace dynamics. Delaware law allows a company to not give an activist the right to call a special meeting, raising the bar of what is required when launching a proxy fight and helping to ensure that campaigns are very well thought out and planned prior to launch.

The U.S. also houses larger and more experienced activist players who have the deep pockets, know-how, and teams needed to force a victory in even the most challenging fights.

Conversely, in Canada, public companies have become increasingly well-defended as the market has been educated about how activist-friendly of a jurisdiction Canada is seen as. Even smaller companies are cognizant of the activist playbook and have taken steps to protect themselves.

What counts as a proxy contest?

We take a very comprehensive view as to what is considered a proxy fight, as only a small number of activist actions see a circular mailed and an even smaller number actually go to a meeting.

We consider a proxy fight to have been initiated when an activist shareholder (or group of shareholders), in opposition to management, makes a public filing of its activist intent (from a planted news story to a press release to a 13D), requisitions a shareholder meeting, publicly announces an intention to nominate alternate directors, solicits alternative proxies, conducts a “vote no” campaign on either the election of directors or M&A transactions, or announces the intention to launch a hostile takeover bid, regardless of whether a vote or the hostile bid actually takes place, as long as the opposition is publicly known. In other words, if a shareholder says it has publicly targeted you, we consider the fight to be on.

Our proxy contest data captures the campaigns that served as a tool to drive change for activists seeking board representation, changing board composition, catalyzing changes in strategy or in capital allocation, urging a sale or break-up of the company or other value-enhancing transactions, blocking a board-approved transaction, or making a hostile bid, among other dissenting actions.

What counts as a win?

For activists seeking board representation, an activist win is defined as the activist achieving a majority of its objectives. For example, the activist asks for three board seats and receives two. A partial win is if an activist receives any of its asks. Conversely, a management win means an activist receives nothing.

Given the smaller pool of Canadian directors (a topic we cover in greater detail on page 50, Hot or Not? Being a Director), we have seen a lot of directors with repeated experience in dealing with activists—an experience that brings not only the know-how but also the chops needed to stare down an activist.

In addition, given that Canada has fewer structural defences available to companies, boards are more willing to take proactive actions on board composition, management team changes, and business strategy. This means the incumbent may enjoy the benefit of the doubt from shareholders, making it harder for the activist to make the case for change.

Most Active Sector Analysis

Proxy Fights by Sector

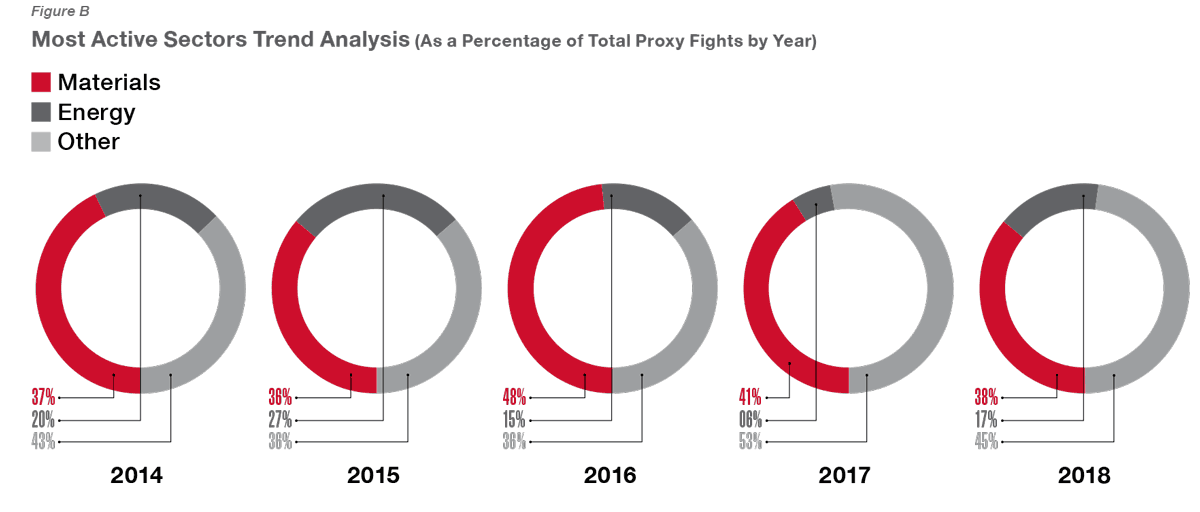

The materials sector is, once again, the most active for proxy battles in Canada, likely representative of the high number of extractive companies amongst the TSX.

One of the most publicized materials sector contests this year is the ongoing battle between U.S.-based hedge fund Paulson & Co. and Detour Gold Corporation. In the summer, Paulson & Co. initiated a public campaign against Detour Gold pushing for a sale of the company and requisitioned a meeting to replace the entire board.

The second most active sector in 2018 is the energy sector, regaining its position following a dip in 2017. Clearly, depressed oil prices in 2017 discouraged activists from deploying capital in a sector significantly levered to the commodity cycle. Now, in 2018, oil companies whose stock value fails to keep pace with rising oil prices are seen as weak performers, opening themselves up to activist attacks.

This was the case in the energy sector’s most high-profile activist fight of the year. In April, Cation Capital (a newly founded, one-man-show activist) launched a last-minute proxy battle in an attempt to replace four directors at Crescent Point Energy’s annual general meeting. Despite proxy advisor Institutional Shareholder Services’ (ISS) support for two activist nominees, all incumbent Crescent Point Energy directors were elected at the meeting. (You can read our case study on this fight later in this post.)

Activist success rates in the energy sector have declined significantly from 50% in 2017 to 0% in 2018 while activist success rates in the materials sector have declined from 77% to 40% (see Figure C on the next page). This can partially be attributed to increasingly well-defended issuers and shareholders realizing the inherent difficulties of enacting change in a fluctuating commodity price environment.

We have observed that activist losses in this space suffer from some common themes: inability to make a compelling case for change; inability to attribute a real decline in value to the board and management directly vs. external factors; and lacklustre board nominees. Activist campaigns that share these characteristics have a difficult time branding themselves and their plan, and often fall victim to “better the devil we know” thinking by shareholders.

Proxy Contest Highlights And Showcase

Transaction- vs. Board-Related Proxy Contest Count

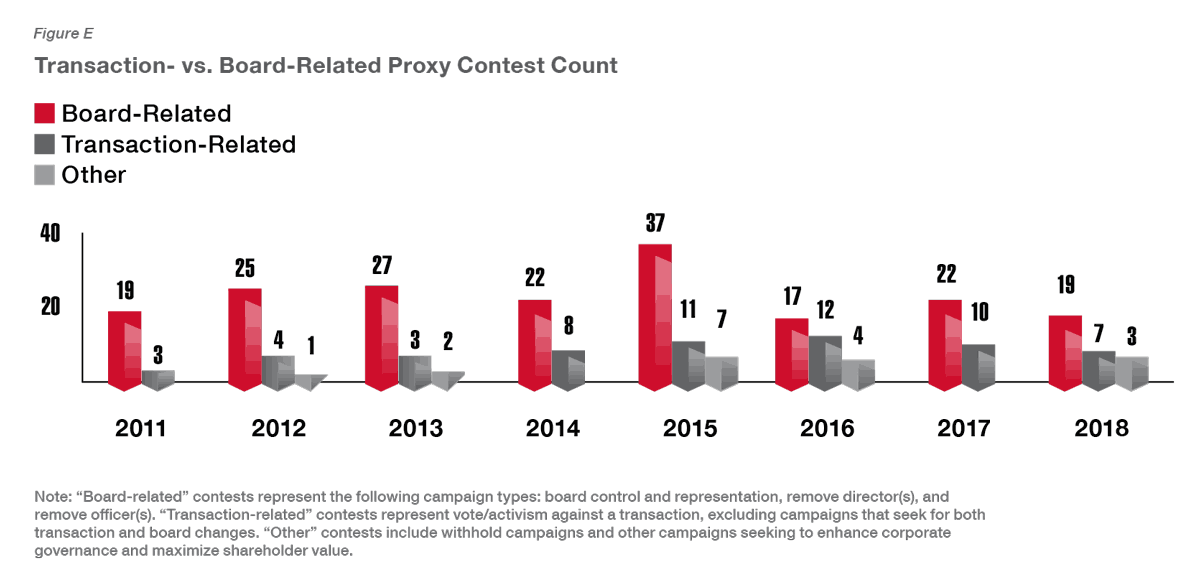

In 2018, the percentage of board-related proxy contests for declared fights decreased slightly to 66%, but is still up from the low of 52% in 2016. The consistent proclivity towards board-related fights is, in part, due to the recognition by activists and potential acquirers that the easiest path to transact may be by first replacing the board. This is especially true under the new takeover bid rules.

The extended 105-day bid period means increased uncertainty, which may limit the desire of acquirers to go hostile and, at the same time, encourage activists to try to work a deal from the other side.

What better way to eliminate that uncertainty than by “engineering” a friendly transaction. This appears to be the case with Detour Gold, where the activist, Paulson & Co., wants the company to launch a public sales process. Management did not yield to the demands and, as a result, a proxy contest was launched to replace the entire board of the company with directors who would presumably be more amicable to a sales process, possibly even with a specific suitor in mind.

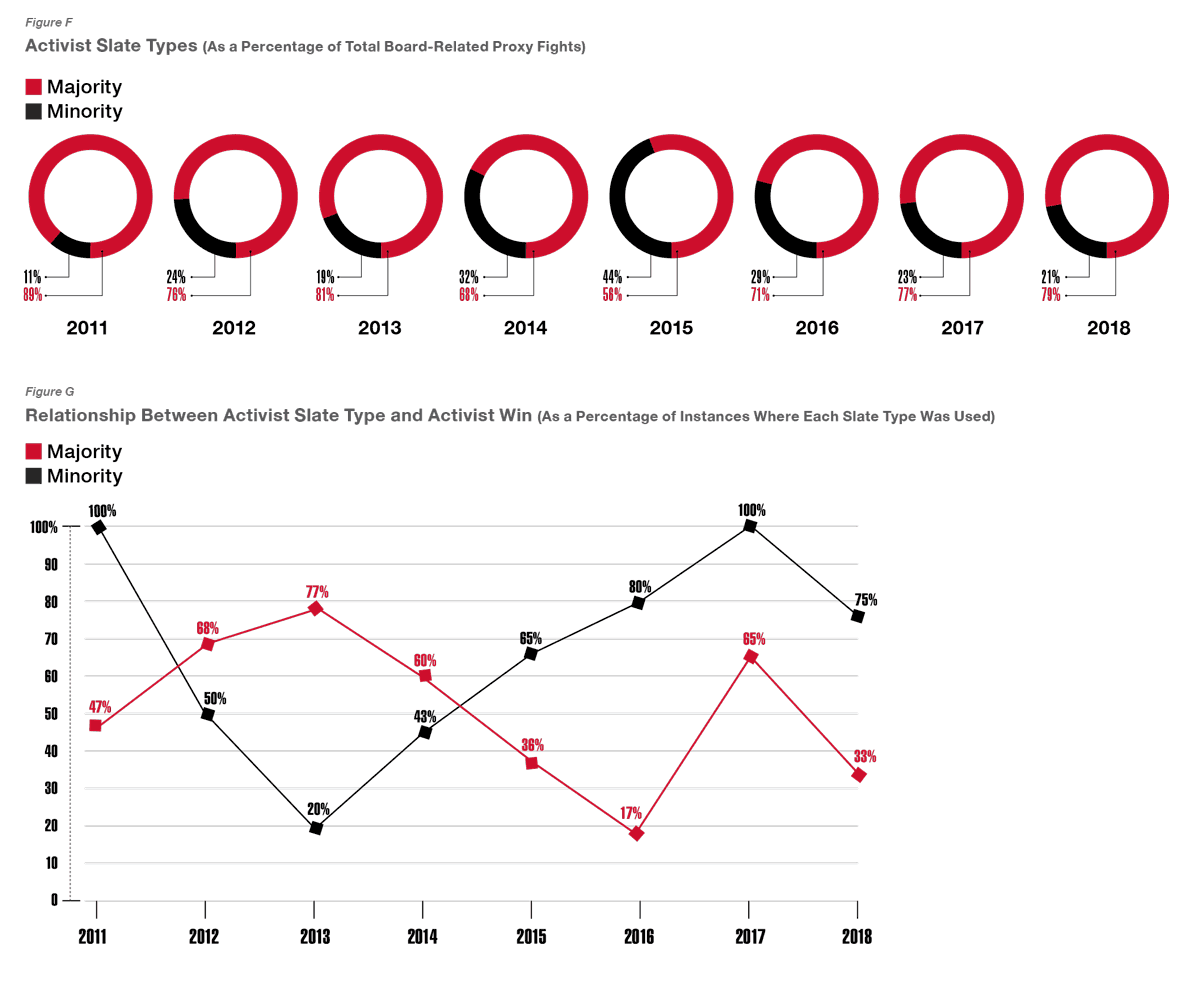

Board-Related Fights—A Deep Dive on Slate Type

Since 2011, Kingsdale has tracked the number of times an activist in a board-related fight has put forward a majority slate versus a minority slate. This year, we see a similar trend as in 2017, with minority slate usage hovering around the 21% range. Based on our analysis, the type of slate an activist uses has some correlation with its share ownership. Generally, the greater the ownership, the more likely it is that an activist will use a majority slate.

For example, in the proxy contest launched against DavidsTea Inc., co-founder and former director, Mr. Herschel Segal, solicited for the replacement of the entire board while holding approximately 46% control. Alternatively, in the case of Cation Capital against Crescent Point Energy, Cation Capital only held 0.3% of the outstanding shares, and nominated a minority slate—though pursuing four of 10 directors is a bold call. As can be seen in Figure G, slate type does not truly have correlation with win rates.

Deciding which slate type to use is pivotal to an activist’s strategy. In cases where there is a large institutional shareholder base which de facto results in significant ISS and Glass Lewis influence, activists need to consider the proxy advisory firms’ framework when building their slates.

For example, a majority slate will require a detailed activist business plan as well as a management transition plan, whereas a minority slate will require a less stringent threshold.

While it appears the principle of proportional representation, especially vis-à-vis ISS and Glass Lewis, may make it easier for minority slates to win, activists will weigh the minority slate strategy against the number of directors they believe they need on a board to create change.

Up-and-Coming Sectors and Predictions

This year, blockchain and cannabis are the two hottest sectors in Canada, captivating investors with their growth potential. Just because these industries are in their respective infancies, however, doesn’t mean that they’re immune to proxy contest activity, especially transaction-related proxy contests. With the volatility and the highs and lows in these sectors, there is bound to be criticism of the underperformers, as well as divergent shareholder views on the appropriate growth path or exit strategy. These high-growth companies generally lag on corporate governance best practices as well.

In May 2018, Hiku Brands and WeedMD agreed to a merger, only to have Canopy Growth, an industry leader, submit a superior proposal to acquire Hiku Brands.

Late last year, Aurora Cannabis launched an unsolicited bid for CanniMed Therapeutics, which eventually turned friendly in 2018 after a sweetened offer. Given the boom in the cannabis industry, we believe competing and/or hostile bids in this sector will continue.

While not as frequent, we’ve also started to see board-related fights in these industries. Earlier this year, Ms. Penny Green, a former COO and director of Glance Technologies (a company involved in both blockchain and cannabis-related technologies), launched a proxy contest to reconstitute the company’s board.

Return of the Founder or Insider

In 2018, we’ve seen a significant number of former founders or insiders launching proxy contests against companies they are, or were once, affiliated with. These events represent unique challenges for issuers, given that former insiders have access to information that an outside activist would not, including the identity of shareholders as well as operational and financial knowledge.

ISS’ Changing Views: Last-Minute Proxy Contests and Proportional Representation

Earlier this year, Cation Capital launched a proxy contest against Crescent Point Energy, a leading North American oil producer. While an activist launching an attack against an oil company isn’t unique in itself, Cation Capital and its strategy was.

Just a few weeks prior to Crescent Point Energy’s annual general meeting, Cation Capital was formed and, with a mere 0.3% share ownership, submitted a minority slate pursuant to Crescent Point Energy’s advance notice by-laws, just one day before the deadline.

As ISS’ policy does not require “a detailed plan” when dissidents seek a minority of the board seats, the key requirement is that new nominees can add value to board oversight. In this case, ISS believed that two directors from the management slate with independence issues and lack of (what it considered) relevant experience should be replaced by activist nominees with substantial public board experience. ISS supported two of four nominees, paying very little attention to the credibility of the newly formed fund and the investment duration, but rather placing significant weight on relative underperformance. Glass Lewis, on the other hand, did not support any of Cation’s nominees, appearing to have accepted management’s claims of ambush.

Issuers should take heed of the Crescent Point Energy case. Low share ownership, relatively recently accumulated position, as well as last-minute ambush tactics may very well be justifiable to proxy advisors if a strong case for change has been made.

Companies with historically weak total shareholder returns and a board that lacks skin in the game are especially vulnerable to these tactics given that shareholders may be fatigued by corporate rhetoric and have a desire for change.

In the Crescent Point Energy case, management was able to ensure that the entire incumbent slate was re-elected by using independent directors to talk to shareholders directly and effectively explain the risk of appointing nominees misaligned with their interests, the lack of additive expertise of the new nominees, and the changes that had already occurred at the board level. The lack of credibility of the activist also resonated with investors.

To Date, In 2018, We’ve Seen at Least Seven Contests Launched by Former Insiders

- DavidsTea Inc.—ACTIVIST WIN. Rainy Day Capital (controlled by co-founder and former director, Mr. Herschel Segal), against DavidsTea Inc.

- Viridium Pacific Group—ACTIVIST WIN. E&R Holdings Ltd. and concerned shareholders, including former consultant to the company, Mr. Sean MacNeil, against Viridium Pacific Group

- Alexandria Minerals—MANAGEMENT WIN. Mr. Eric Owens, former CEO of the company, against Alexandria Minerals

- Colorado Resources—ACTIVIST PARTIAL WIN. Mr. Adam Travis, former CEO of the company, against Colorado Resources

- Glance Technologies—MANAGEMENT WIN. Ms. Penny Green, former executive and director of the company, against Glance Technologies

- Karnalyte Resources—MANAGEMENT WIN. Mr. Robin Phinney, former CEO of the company, against Karnalyte Resources

- Getty Copper—TBD. Mr. John Lepinski, former CEO of the company, against Getty Copper

Compensation Issues as a Springboard to Activism

Management and board compensation levels remain a key governance weakness that activists continually target during their campaigns. How much board and management pay themselves has—fairly or not—become a symbol for whether or not management is aligned with shareholders.

This was a key tactic used by Cation Capital in its proxy battle against Crescent Point Energy: Cation Capital criticized Crescent Point Energy’s compensation schemes, reminding shareholders of the company’s 2016 failed say-on-pay vote.

Notably, as a result of the contested solicitation against say-on-pay in 2018, with an against recommendation on Cation Capital’s proxy card, Crescent Point Energy failed its say-on-pay vote for a second time with only 38.52% support.

We’ve also seen companies run into issues with ISS’ Relative Degree of Alignment test, which measures total shareholder return performance rank relative to CEO pay rank.

A low Relative Degree of Alignment score is indicative of an underperforming company with high pay, and a company with sustained low scores over multiple years can become vulnerable to an activist.

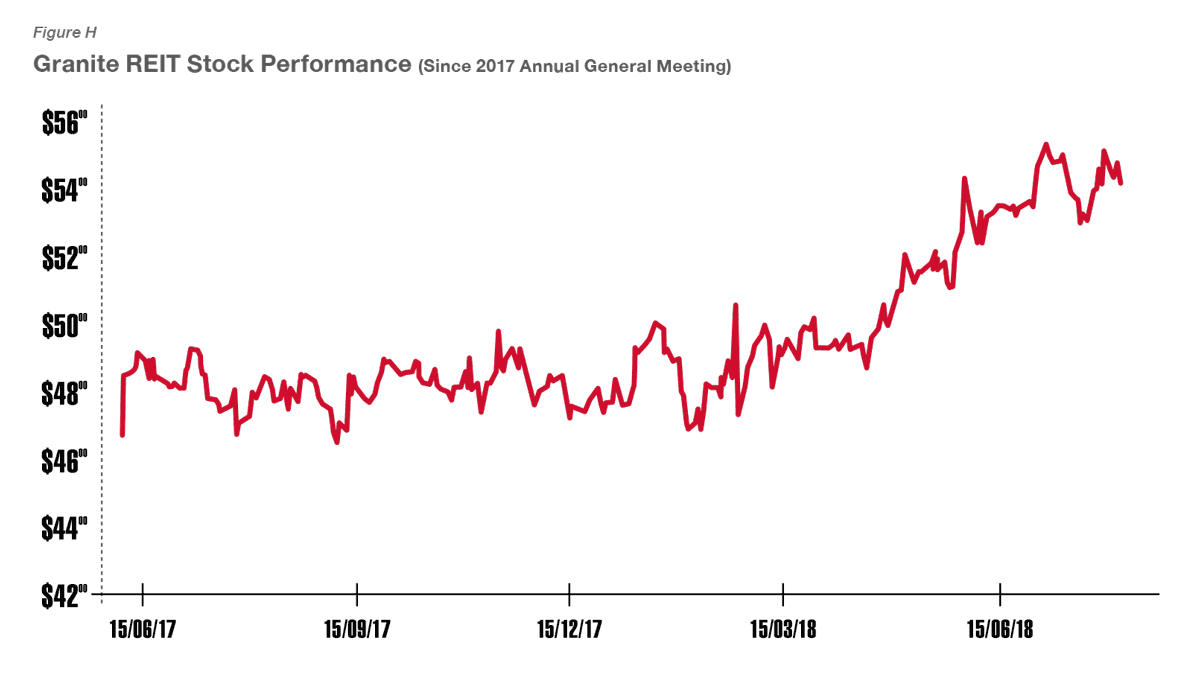

Granite REIT—One Year Later

Once the media coverage dies down, it is rare, but useful, to have the opportunity to go back and look at how high-profile proxy contest victories have fared for investors.

One of the most prominent proxy battles in 2017 was at Granite REIT, where activists FrontFour Capital and Sandpiper Group successfully made the case for change.

So far in 2018, it looks like the change the activists sought is bearing fruit.

Principal activist arguments during the proxy contest included: high director compensation; the inefficient capital structure (low debt of which leverage could be used to unlock value); and high focus on Magna-tenanted properties.

Immediately after the appointment of three activist nominees at the unitholder meeting on June 14, 2017, a board meeting was held to reduce trustee compensation by another 20% effective January 1, 2018.

While leverage (net debt to fair value of investment properties) remains well below the 40% target (as of April 2018), Granite REIT had made significant progress in reducing Magna concentration to 51% as a percentage of gross leasable area (down from 61% as of Q4 of 2017).

The trustees have also recruited a new CEO, Mr. Kevan Gorrie, the former CEO of Pure Industrial REIT (PIRET), who had successfully closed the sale of PIRET to Blackstone and Ivanhoé Cambridge.

While the current trading price of $53-54 per unit is still below the activist target of $60 per unit indicated during the proxy contest, the REIT has made significant headway in terms of performance. Through to July 15, 2018, the REIT generated total unitholder returns of 17%, outperforming the S&P/TSX Capped REIT Index, which generated returns of 13%.

Overall, it appears that FrontFour Capital and Sandpiper Group are delivering on their plan to unlock unitholder value at Granite REIT.

Concentration on Compensation

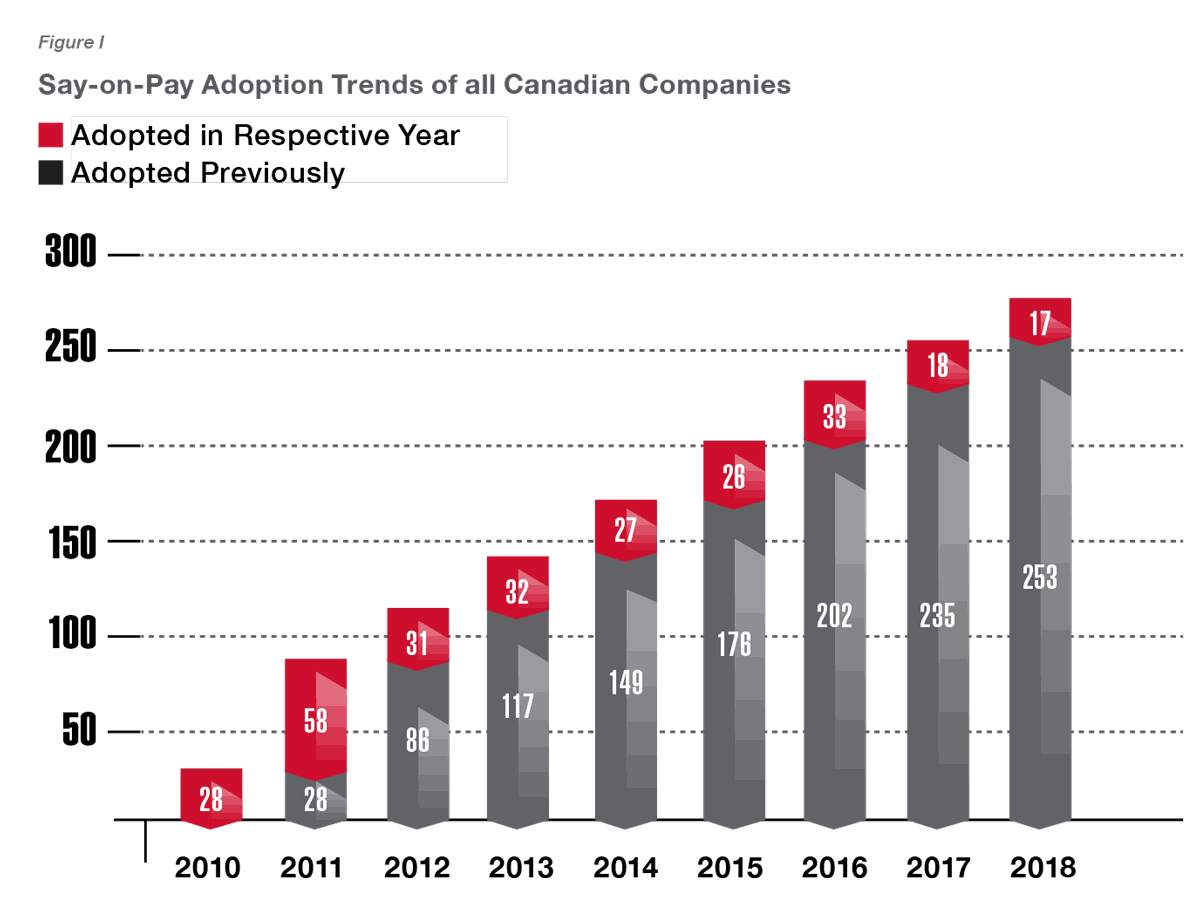

Without significant impetus in the marketplace or at an issuer specifically, say-on-pay adoption continues to fall in Canada. Adoption is approaching an asymptote with 151 adopters amongst the S&P/TSX Composite Index.

We continue to advise companies, however, to adopt say-on-pay policies both as a best practice and as an added protection for compensation committee members who might otherwise be withheld on by proxy advisors and displeased shareholders. We have also noted an increase in pension fund investors sending letters urging the boards of companies they are invested in—that do not already have say-on-pay votes—to adopt such a policy, and outlining their intention to vote against certain board committees they hold responsible. These letters are entirely policy positions and ignore the actual pay practices in place.

New Adopters in 2018

There were 17 first-time say-on-pay adopters in 2018, with 16 having disclosed their say-on-pay voting results as of the time of writing. Average support for this group was slightly above 90%, with Crew Energy earning the distinction of the new adopters with the lowest level of support at 58.73%.

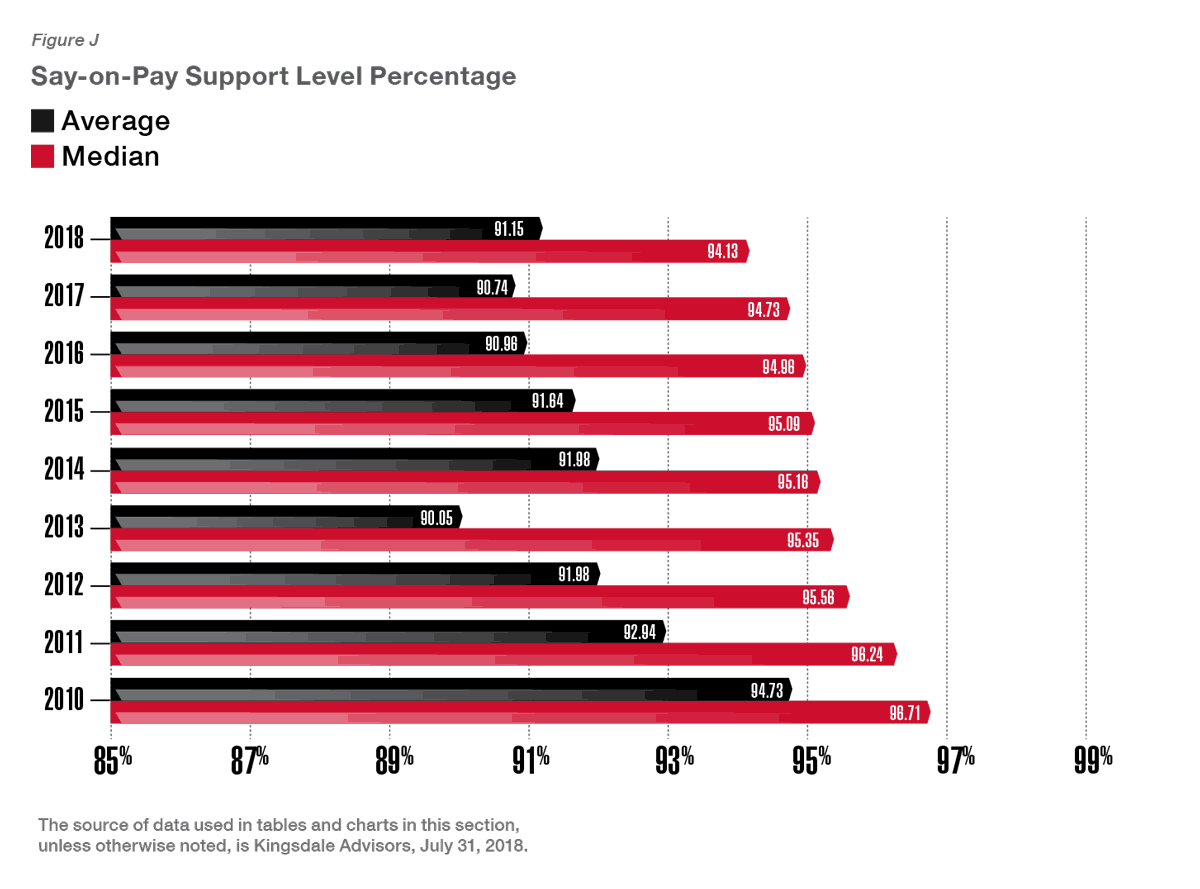

Shareholder Support Levels

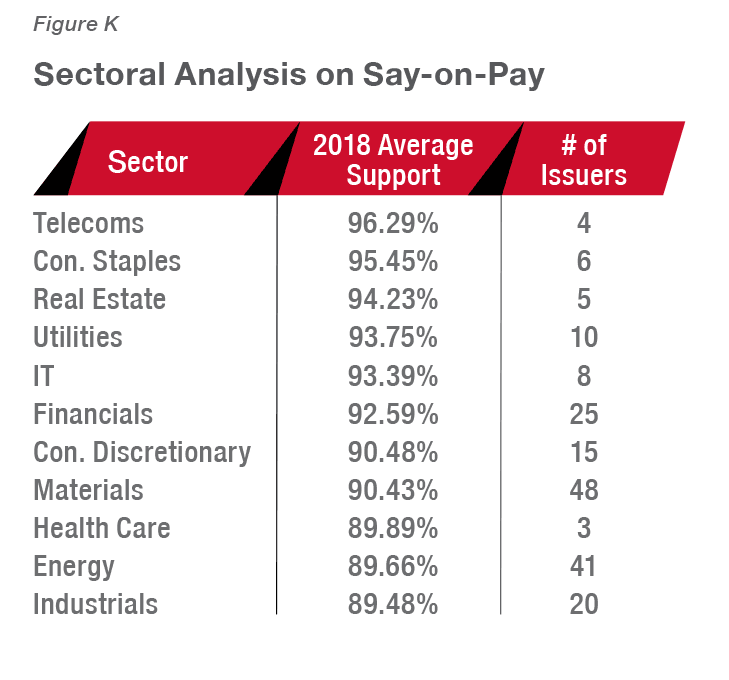

Average shareholder support levels for say-on-pay throughout all industries have remained steady since 2016, hovering in the 90% to 91% range.

This year, the industrials sector had the lowest average say-on-pay support level (89.48%), with Maxar Technologies earning just 47.26% support after receiving against recommendations from both major proxy advisors.

Traditionally, the materials sector has had the lowest support levels.

As with previous years, issuers in the energy and materials sectors remain the most active adopters in 2018, a total of 41 energy sector companies and 48 materials sector companies had say-on-pay votes.

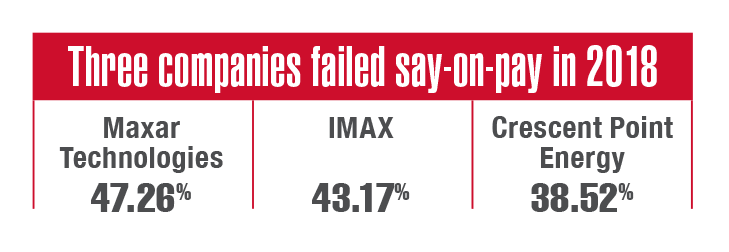

Companies that Failed Say-on-Pay

In 2018, three Canadian-listed companies failed say-on-pay compared to four in 2017. This year’s failed votes were at Maxar Technologies, IMAX, and Crescent Point Energy.

This is the first year that Maxar Technologies failed say-on-pay, with just 47.26% shareholder support; last year, the company received 71.16% support, with ISS recommending for and Glass Lewis against.

IMAX failed their say-on-pay vote for the second consecutive year, with 43.17% support after a for recommendation from ISS but an against recommendation from Glass Lewis. Last year, IMAX received just 29.98% support.

As noted previously, Crescent Point Energy represents a special case of say-on-pay failure at a contested meeting. Activist Cation Capital had actively criticized Crescent Point Energy’s say-on-pay during its campaign to replace four directors. ISS ultimately recommended against Crescent Point Energy’s say-on-pay while Glass Lewis supported it, leading to 38.52% support. Comparatively, Crescent Point Energy received 86.36% support last year with both ISS and Glass Lewis supporting, but failed in 2016 with just 31% support.

As noted earlier, while Crescent Point Energy failed its say-on-pay vote, the company did win its proxy fight against Cation Capital. While on the surface it may appear anomalous, we believe there are two key reasons for this. Firstly, shareholders have a higher bar for replacing directors than for voting against say-on-pay. Secondly, given the say-on-pay history at Crescent Point Energy, this may be a case of shareholder fatigue, with shareholders expressing their displeasure of the board’s performance via the nonbinding say-on-pay vote versus risking appointing questionable activist nominees to the board.

Companies that Failed in 2017—Where Are They Now?

TransAlta received 89.01% support for say-on-pay at its 2018 annual general meeting, having been supported by both ISS and Glass Lewis, a reversal from the previous year when both proxy advisors recommended that shareholders vote against. Based on TransAlta’s 2018 information circular, “as a result of last year’s voting result, the Board and HRC undertook a rigorous review of the compensation arrangements and undertook extensive shareholder engagement.” TransAlta also disclosed that it had engaged with the proxy advisory firms in October 2017. Collectively, TransAlta engaged shareholders representing 46% of the shares outstanding and met with 11 shareholders representing 35% of the shares outstanding. TransAlta also made several structural changes to their compensation programs, including increasing their Performance Share Unit (PSU) percentage by 5% (thereby decreasing reliance on stock options) and forgoing discretionary increases in payouts.

Eldorado Gold received 90.74% support at its 2018 annual general meeting for say-on-pay, having been supported by both ISS and Glass Lewis. (In 2017, ISS recommended against say-on-pay while Glass Lewis recommended support.)

Based on Eldorado’s 2018 information circular, “In 2017, in addition to executing our regular annual and charter appointed duties, the Compensation Committee along with management communicated with our Shareholders on executive compensation matters.” In April 2017, Eldorado Gold “reached out to the Company’s key Shareholders by phone and email to provide information on our compensation practices and solicit feedback ahead of Eldorado’s annual general meeting.”

Again, in November 2017, “Management met with and solicited feedback from the Company’s key Shareholders (i.e. those representing 40% of our Shareholder base at the time), on business strategy and executive compensation.” The key change in Eldorado Gold’s pay structure was a new CEO with lower target short- and long-term incentive pay. Additionally, weightings of PSUs were increased and the company announced that, going forward, annual bonuses will only be linked to measurable corporate performance.

IMAX received 43.17% support at its 2018 annual general meeting for say-on-pay, having received support from ISS but not Glass Lewis, whereas last year both ISS and Glass Lewis recommended against the say-on-pay. Based on IMAX’s 2018 information circular, “We have made continuing efforts over the past several years to better understand and address shareholders’ concerns regarding our compensation program. On an annual basis, we engage with shareholders representing more than half of our outstanding shares and gather feedback on, among other things, our executive compensation program.”

Primero Mining was acquired by First Majestic Silver in May 2018 and, as such, no say-on-pay vote was held.

Based on these examples, it is evident that proxy advisor support, shareholder engagement, understanding, and goodwill represent key tools for companies facing say-on-pay issues.

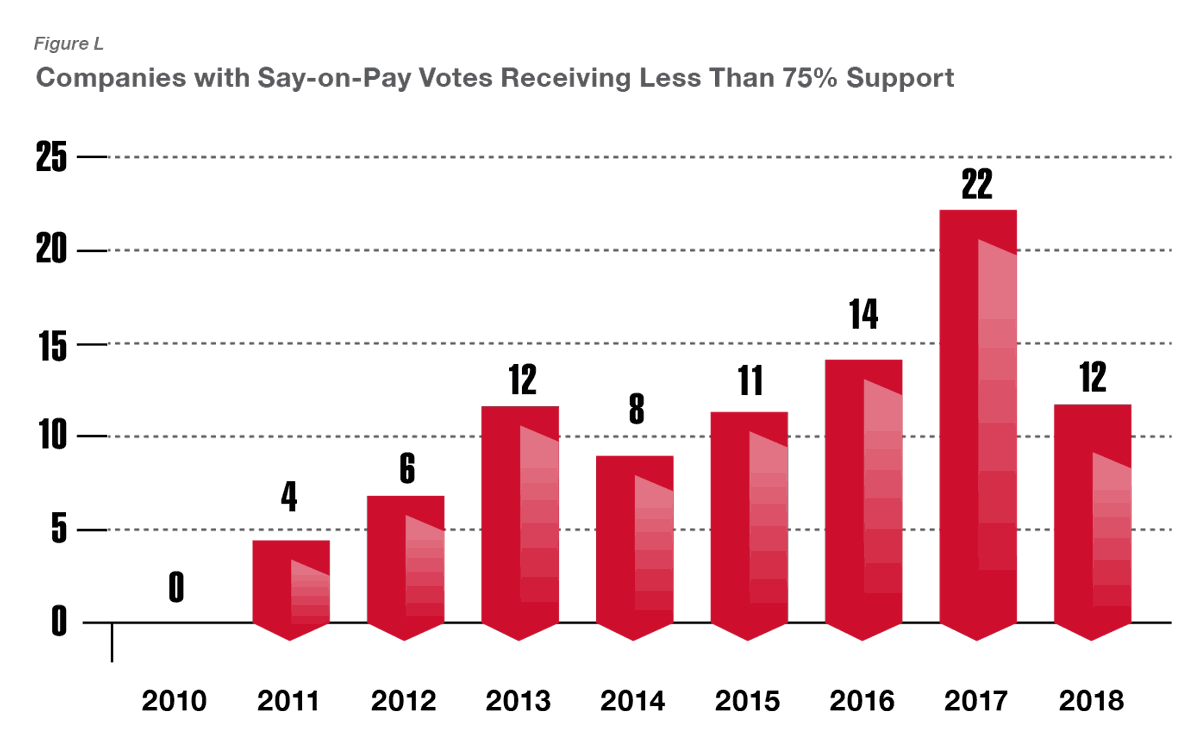

Companies with Less Than 75% Support

Say-on-pay adopters are faring better than in previous years. This year, the number of companies that received less than 75% support for their say-on-pay resolutions dropped to 12 from 22 in 2017.

We attribute much of this decline to the ramping up of shareholder engagement efforts by companies and a general increase in awareness among compensation committees of the impact of ISS’ and Glass Lewis’ recommendations and the process involved in making them.

Notably, based on our tracking, ISS only recommended against say-on-pay at eight companies this year compared to 18 companies this time last year, a record high. As for Glass Lewis, it recommended against say-on-pay for at least 18 companies compared to 12 in 2017, representing a high watermark.

Of the 12 companies receiving less than 75% support, one-third received both ISS and Glass Lewis support. It appears that, while ISS remains the far more influential proxy advisor, shareholders are more willing to go against proxy advisor recommendations when it comes to compensation issues.

Innovative Design: Tesla Revolution and Performance-Based Mega-Grants

It seems that Tesla is not only an innovator when it comes to cars but also an innovator when it comes to compensation. Earlier this year, Tesla introduced a never-before-seen one-time mega-stock option grant to its founder and CEO, Mr. Elon Musk, and put the grant up for binding shareholder approval at a special meeting held just for the purpose of approving the grant.

The present value of Musk’s 10-year stock option grant, vesting in 12 tranches based on aspirational performance metrics, totals a whopping US$2.6 billion, with the future value that could be realized reaching US$55.8 billion. Beyond the massive face value of the grant, there were several unique features to this innovative compensation scheme:

- The package demonstrates the pay-for-performance doctrine in its purest form with an all-or-nothing design. The vesting conditions of each tranche are comprised of one market capitalization milestone (at increments of US$50 billion up to US$650 billion after first reaching US$100 billion from the current US$55 billion) and one operating milestone (out of eight topline milestones and eight bottom-line milestones: revenue from US$20 billion to US$175 billion; adjusted EBITDA from US$1.5 billion to US$14 billion).

- It is a long-term package that lasts 10 years but has no quarterly or annual targets. The milestone can be reached at any time within the 10 years. Multiple tranches can vest at once. In a world where short-termism has gained popularity, this feature really stands out.

- Rather than traditional figures like total shareholder return and real profitability, the scheme focuses on growing market capitalization and topline revenue.

Tesla engaged with 15 of its largest institutional shareholders over six months while designing this package. Ultimately, both ISS and Glass Lewis recommended that shareholders vote against the pay package. Despite this, approximately 80% of shareholders supported the resolution. Clearly, as the Tesla case proves, shareholders can and will cast their votes according to their own analysis and opinion, ignoring ISS and Glass Lewis recommendations.

Canada has yet to see such a mega-grant to its top executives followed by a special meeting to approve a compensation item on a binding basis. One comparable case is BlackBerry CEO Mr. John Chen’s contract extension this year, whereby his pay package included time-based and performance-based equity grants and an incentive cash award with total pay opportunity equal to US$253 million.

While BlackBerry did not put the pay package to a special binding vote, Chen’s pay package was voted on as part of BlackBerry’s 2018 say-on-pay vote. Interestingly, ISS supported the compensation arrangement, citing stellar FY18 performance and the fact that the new contract extension includes the introduction of PSUs. Glass Lewis, on the other hand, recommended that shareholders vote against, citing concerns related to the quantum and structure of the award.

In particular, Glass Lewis questioned the reliance on share price hurdles as a performance metric for the PSUs where share prices can also benefit (or suffer) from transitory factors that aren’t necessarily under management’s control. Nevertheless, shareholders supported BlackBerry’s 2018 say-on-pay with 90.6% support.

For Canadian companies, the Tesla compensation program could be an example to follow for issuers wanting to get around ISS and Glass Lewis against recommendations. A specific compensation item, once approved by shareholders, would likely not be criticized by ISS or Glass Lewis in the future, given that shareholders have already clearly given their blessing. But a move like this also comes with increased risk to the compensation committee; careful planning and engagement are required to sell these plans to shareholders.

And, while on the topic of Tesla, we would be remiss if we did not offer a caution about the use of Twitter. As Musk has learned after his tweet about taking Tesla private, along with his numerous other tweets over the years, tweeting can have a big impact on corporate reputation and a company’s share price. Will Musk tweet his way away from hitting his milestone targets?

Key Governance Developments

Board Diversity

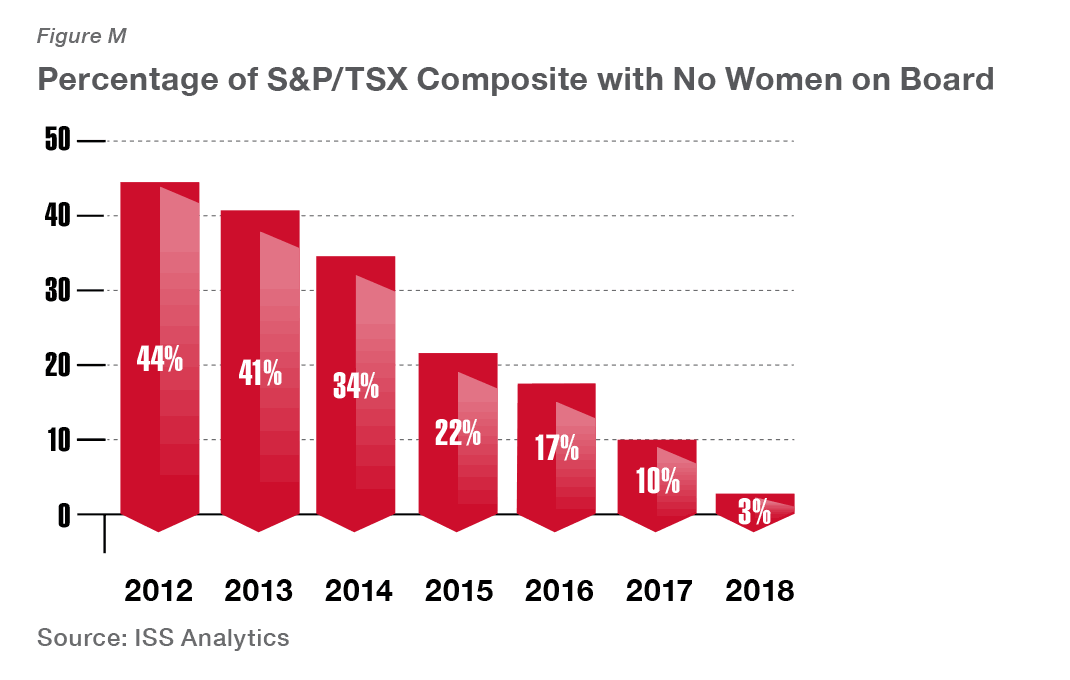

In some ways, 2018 is set to be the year of gender diversity on Canadian boards.

As of the beginning of 2018, ISS will recommend that shareholders of S&P/TSX Composite Index companies withhold votes from the chair of the nominating committee if the company has not disclosed a formal and robust written gender diversity policy, and if there are no female directors on the board. All TSX 60 constituents came to their 2018 annual general meetings with at least one woman on board and only 3% of the S&P/TSX Composite Index companies have no women on board. According to a study conducted by the Canadian Securities Administrators published on October 5, 2017, 39% of TSX-listed companies still have no women on their boards. ISS will extend this policy to the broader TSX mainboard in 2019.

Major institutional shareholders and pension funds have already incorporated gender diversity as part of their proxy voting guidelines. Below are select policies from major Canadian funds:

BCI: BCI will vote against the chair of the nomination/governance committee if a board lacks adequate female representation unless there is a legitimate rationale or plan to address this gap going forward.”

BBC GAM: We will generally support proposals that call for enhanced disclosure or reporting requirements regarding board diversity policies and procedures.

We will generally support proposals to adopt non-binding guidelines for female or other minority representation on the board.

We will review proposals to adopt binding quotas or targets for female or other minority representation on the board on a case by case basis. If a company’s board has no women directors and does not disclose its policy on diversity, or discloses a diversity policy that is inadequate, we may vote against directors who sit on the nominating and corporate governance committees of the board. An adequate policy should include: (i) A commitment to increase board gender diversity; (ii) Measurable goals or targets to increase board gender diversity within a reasonable period of time. Consideration will be given to a board’s approach to gender diversity in executive officer positions and any related goals, targets, programs or processes for advancing women in executive roles. We expect issuers to disclose progress on reaching board gender diversity targets and the strategies or plans employed to achieve them.”

AIMCo: Generally, vote for shareholder proposals that request companies to comply with applicable local market regulations for board diversity, such as disclosure of the processes to nominate women to their board. AIMCo may, subject to discretion and extenuating circumstances, vote against or withhold our vote from the chair of the nominating committee in developed country markets where the issuer exhibits low levels of board gender diversity, such as where there have been no women on the board for the last 2 or more years, with no stated targets to achieve gender diversity.”

And institutional investors aren’t alone. Activist Mr. Bill Ackman of Pershing Square said in April he was wanting to run a proxy contest with an all-female, diverse, ethnic slate, noting he was sure it would win hands-down.

Diversity Beyond Gender

While gender diversity remains a hot topic in the governance world, other forms of diversity are also coming into play. ISS’ less influential social advisory arm recently updated its guidelines to include a policy related to broader diversity. Beginning in 2018, ISS’ Social Advisory Services has recommended that shareholders withhold votes from nominating committee members if the board lacks at least one woman and one minority, and the board is not at least 30% diverse (on a racial and gender basis).

This move certifies the importance of diversity beyond gender and we expect shareholders to follow suit in years to come. Companies are advised to bolster their disclosure in cases of racial diversity to further make it easier for shareholders to get the information they need to make the correct voting decision. For example, a simple addition to the director biography regarding racial and other forms of diversity, where applicable, could go a long way. We have learned that directors’ photos aren’t always enough to identify racial diversity as photos can be easily misinterpreted.

Directors Triggering Majority Voting Policies

The application of majority voting policies remains a rare occurrence in Canada.

Last year, only one director received less than 50% support, thereby triggering the majority voting policy, while this year, majority voting policies were triggered for three directors at two companies.

In the first case, at Partners REIT’s 2018 annual general meeting, Messrs. Simon Nyilassy and Moray Tawse received 44.2% and 45.4% support, respectively, despite both nominees receiving ISS and Glass Lewis support. Mr. Nyilassy had been a trustee since 2015 while Mr. Tawse was a first-time nominee, holding 20.7% of the REIT’s outstanding units. Mr. Tawse was also a significant shareholder in First National Financial, which had provided various mortgages, mortgage brokerage arrangements, and a line of credit to Partners REIT. In these cases, we believe that unitholder discontent motivated opposition to these two trustee nominees and manifested itself through a behind-the-scenes withhold campaign.

Both nominees offered their resignation shortly after the meeting. Generally, an issuer’s governance or nominating committee would deliberate the resignation within 90 days prior to making its decision once majority voting policies are triggered.

In this case, however, Partners REIT confirmed that both resignations were accepted concurrently with the filing of the report of voting results.

In the second case, Mr. Ruilin Zhang, director of Journey Energy, received 39.7% support at the company’s 2018 annual general meeting. While Glass Lewis recommended that shareholders withhold votes from him, ISS recommended that shareholders support his election. Despite ISS’ support, Mr. Zhang received less than 50% support.

One day after the May 23, 2018 annual general meeting, the company announced in a press release that Mr. Zhang had resigned pursuant to the majority voting policy of the company and that its Governance and Compensation Committee would consider the resignation and make a recommendation as to whether or not they should accept it within 90 days. On June 18, 2018, Journey Energy announced that the company had accepted Mr. Zhang’s resignation.

Virtual Annual General Meetings

The adoption of virtual meetings continues to rise in the U.S. while, in Canada, we’ve seen a failure to launch.

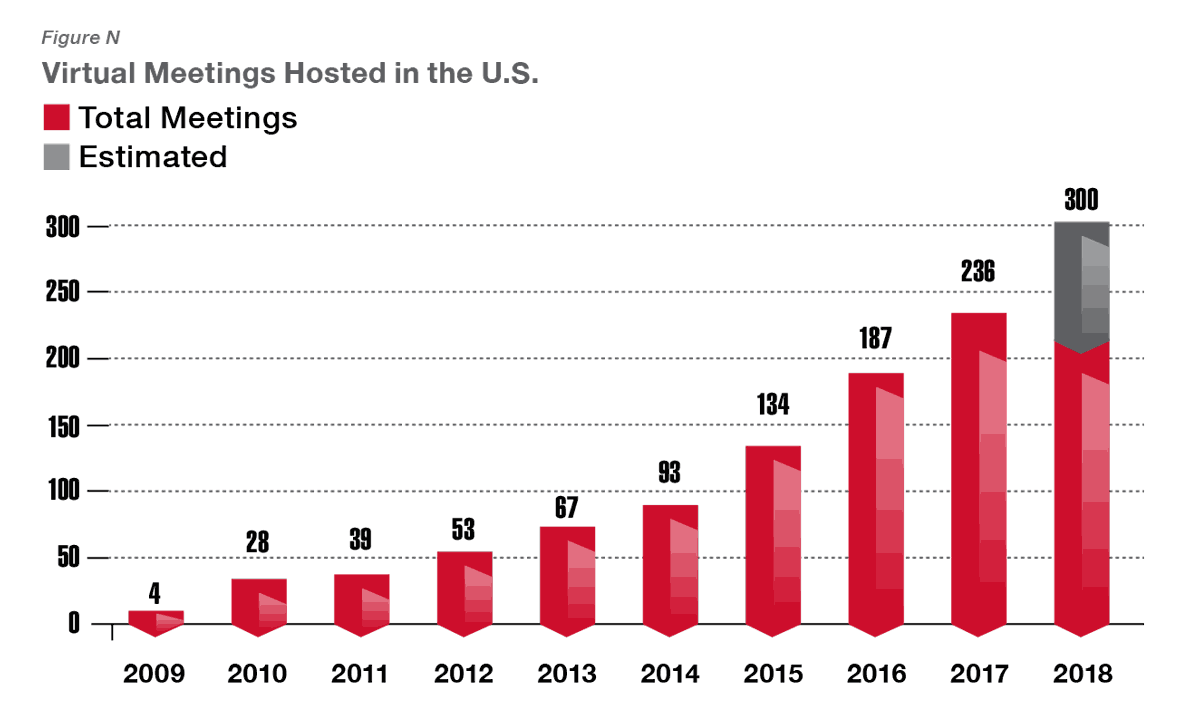

In the U.S., according to Broadridge Financial, which recently facilitated its 1,000th virtual meeting, the first six months of 2018 saw public companies host 212 virtual meetings in comparison to 180 in 2017 over the same period. Broadridge estimates that by year-end, we’ll have seen 300 virtual meetings, representing a 27% increase year over year.

In contrast, year two of virtual meetings in Canada has not yielded a significant growth in adoption. So far in 2018, only five companies have hosted virtual meetings, with four of those hosting a hybrid virtual/physical location meeting, an approach that affords issuers the opportunity to test the waters.

The platform of choice for Canadian companies is Lumi Global, which was used for all five virtual meetings in Canada.

Meanwhile, Broadridge, which made its virtual meeting services available in Canada for the first time this year, has yet to gain any traction. It should be noted that the Lumi platform has been used as an add-on to existing material distribution and voting channels, focusing on just the shareholders’ meeting. This may explain its appeal for hybrid meeting adopters.

The Broadridge model, on the other hand, is an end-to-end solution of material distribution, voting channels, and annual general meeting platform. Given the more fundamental offering, Broadridge will likely appeal to issuers looking to make strategic changes rather than bolt-on capabilities.

Proxy Access One Year Later

Since the 2017 proxy season that saw the emergence of proxy access in Canada and the prediction of follow-on cases, not a lot has happened.

Following the shareholder proposals submitted at the 2017 annual general meetings of the Toronto-Dominion Bank and Royal Bank of Canada by Mr. Lowell

Weir, all the tier one Canadian banks, along with two major insurers, have voluntarily adopted proxy access in policy form, which doesn’t require shareholder approval.

This year, Mr. Weir went on to submit follow-up shareholder proposals at TD and

RBC’s 2018 annual general meetings calling for the following:

- “The Proxy Access Policy implemented by the conflicted Bank Directors be cancelled immediately.”

- “The Proxy Access By-law be implemented immediately by Bank Directors.”

- “The Chairman of the Bank Board of Directors immediately resign.”

- “A complete change in the governance committee directors be implemented over the next twelve months.”

- “Any Director or Officer refusing to act in accordance with this Resolution shall immediately submit their resignation from the Bank.”

Ultimately, and unsurprisingly given the radical nature of the proposal, the TD 2018 shareholder proposal received only 1.4% support, with both ISS and Glass Lewis recommending against it, while the proposal at RBC was withdrawn.

It is interesting to note that Kingsdale privately tracked one case where an activist submitted a proxy access shareholder proposal to a company pursuant to a campaign to nominate directors. However, ultimately, the shareholder proposal was pulled when the activist campaign was settled without a public fight.

Following our last report, the Canadian Coalition for Good Governance (CCGG) released their proxy access policy in November 2017. The CCGG version of proxy access follows the terms below:

- A shareholder or group of shareholders must hold an aggregate economic and voting interest of at least 3% of the outstanding shares

- The 3% minimum threshold must have been held for at least 3 years

- The number of directors to be nominated by shareholders using the proxy access mechanism cannot exceed the greater of 2 or 20% of the board

- Nominating shareholders must represent that they are not seeking control and that their economic ownership interest is at least equal to 3% of the issuer’s outstanding voting shares

- Disclosure about shareholder nominees should be set out fairly in the company’s proxy circular, including being located in the same section of the proxy circular with the same prominence and on essentially the same terms as disclosure about the company’s nominees, along with the use of a fair “universal proxy” form

- Shareholders nominating directors should be able to use the company’s proxy circular to solicit support (i.e. they should not be required to deliver a dissident circular)

- Shareholders must continue to hold the prescribed percentage of shares up to the time of the meeting at which the shareholder‐nominees are proposed for election

- Proxy access be adopted in the form of a by‐law rather than a board policy

Despite the developments with the CCGG model policy, no companies beyond the tier one Canadian banks and two large insurers have voluntarily adopted proxy access.

Shareholder Proposal Spotlight

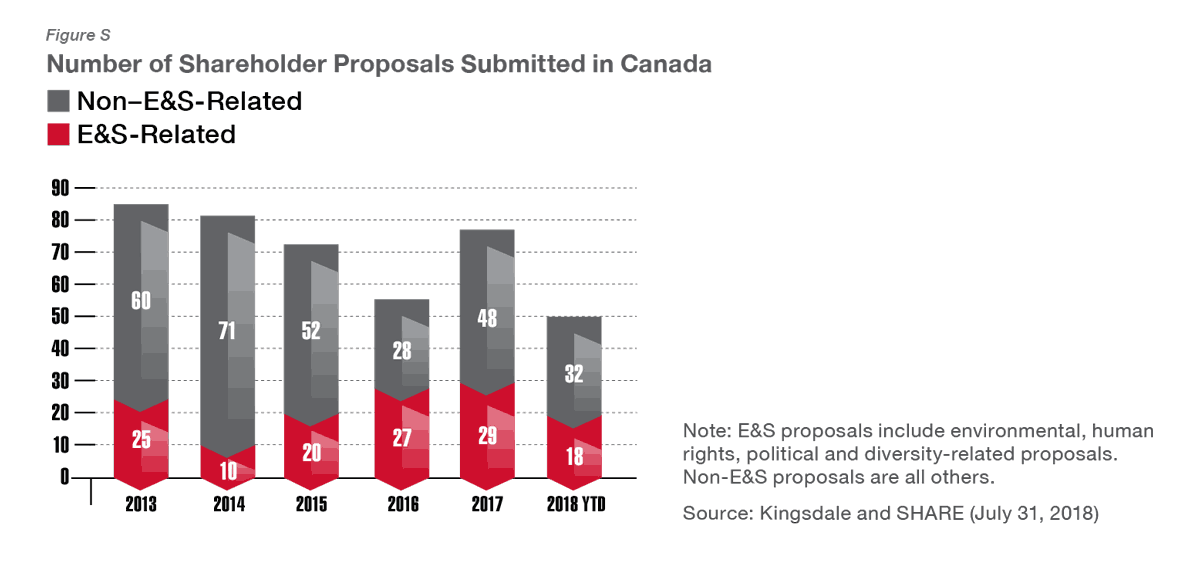

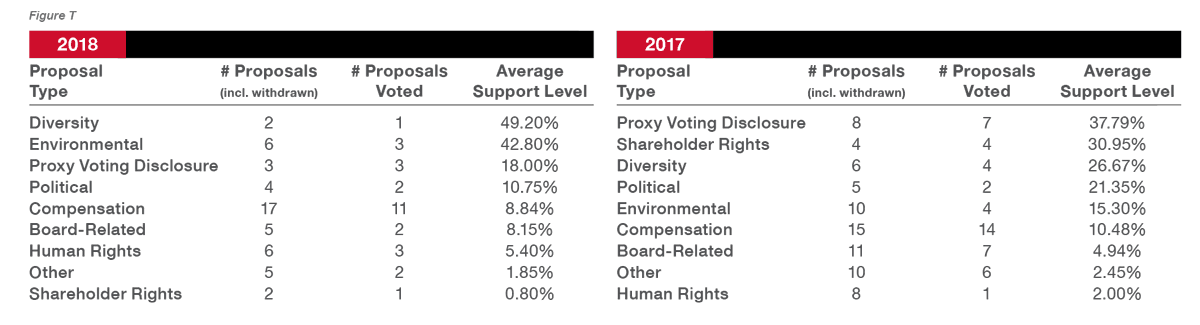

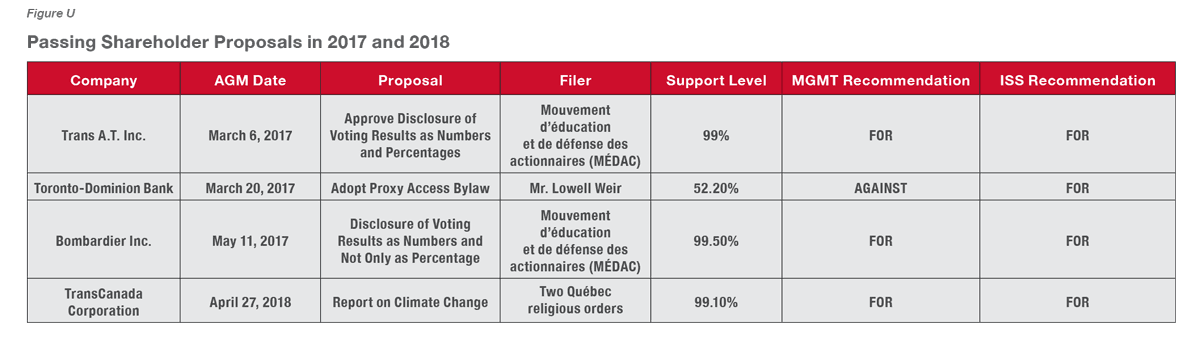

Based on statistics tracked by Kingsdale and the Shareholder Association for Research & Education (SHARE), 50 shareholder proposals have been submitted at 27 different Canadian companies so far in 2018. Of the 50 proposals, 22 were withdrawn before going to a vote, one is still pending, and 26 failed, averaging support of only 14.09%. One shareholder proposal did pass—the TransCanada proposal requesting a report on climate change—after being endorsed by management and receiving 99.10% support.

Comparatively, in 2017, 77 shareholder proposals were submitted at 33 different Canadian companies. Of the 77 proposals, 28 were withdrawn before going to the vote. Of the 49 shareholder proposals that did advance to a shareholder vote, 46 failed. Overall, shareholder proposals averaged support of 16.26%.

The shareholder proposals that passed were at Trans A.T. and Bombardier (calling for the disclosure of voting results in numbers and percentages) and at TD Bank (calling for the adoption of a proxy access by-law). We note that both proposals at Trans A.T. and Bombardier were endorsed by management, leading to greater than 99% support for the proposals, while management of TD Bank opposed the proposal, leading to 52.2% support.

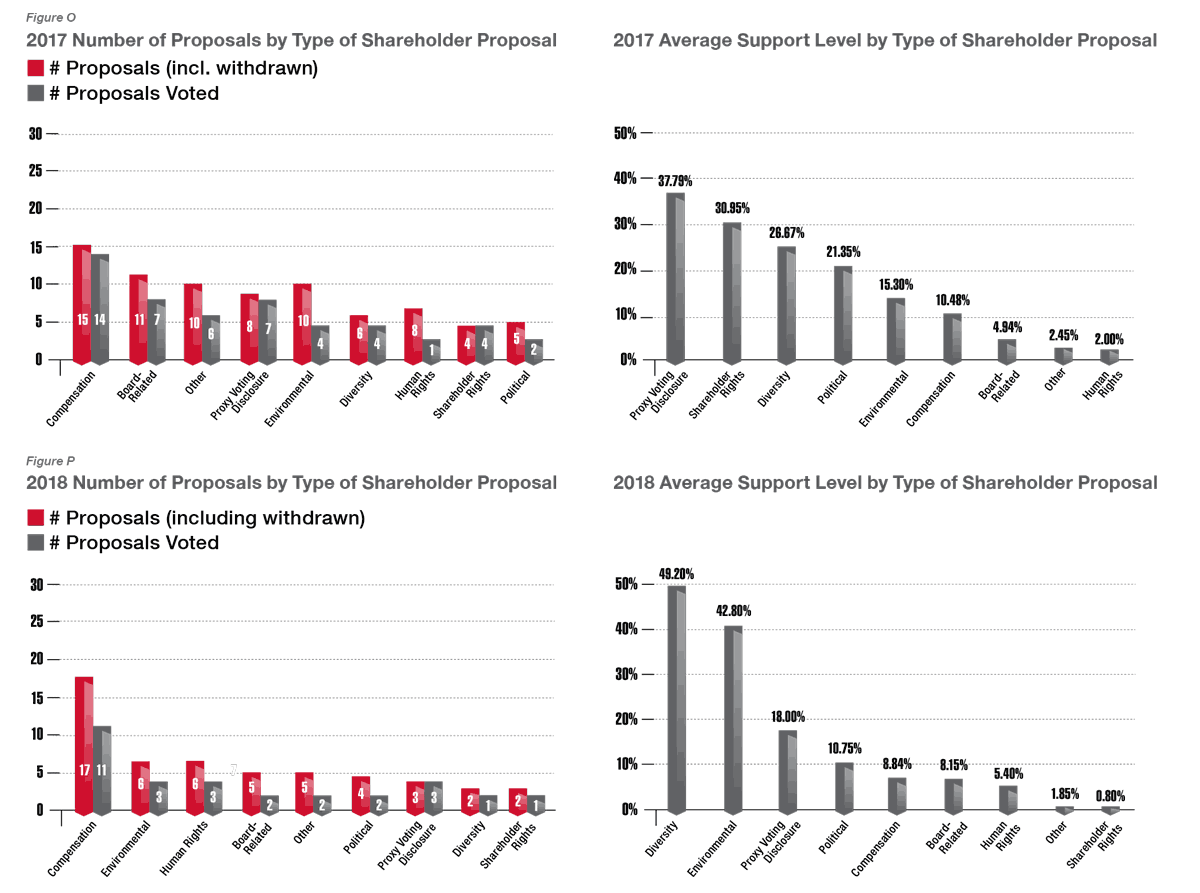

In 2018, compensation-related proposals remained the most popular type of shareholder proposal, with 17 submitted in 2018 and 11 of those voted on vs. 15 submitted in 2017 and 14 voted on. The Mouvement d’éducation et de défense des actionnaires (MÉDAC) was the most prolific filer, with 29 proposals at 14 different companies. MÉDAC’s proposals cover a wide range of different topics, inclusive of board-related issues, compensation, proxy voting disclosure, and environment-related proposals.

The Fonds de solidarité des travailleurs du Québec (FTQ) was the second most frequent filer, with four proposals filed at four unique companies focusing on political lobbying, human rights, diversity, and environment-related issues.

Tied for third place are the B.C. Government and Service Employees’ Union General Fund, individual shareholder Mr. Lowell Weir, and OceanRock Meritas Jantzi Social Index Fund, each having filed three proposals. The B.C. Government and Service Employees’ Union General Fund focused on human rights, board-related, and environmental issues; Mr. Lowell Weir focused on shareholder rights related to the proxy access proposal filed in the previous year; and OceanRock Meritas Jantzi Social Index Fund focused on political lobbying.

ESG Spotlight

In previous years, we’ve forecasted the rise of environmental, social, and governance (ESG) concerns and subsequent proposals from shareholders. This year, we can declare ESG has arrived with a record number of majority-supported proposals in the U.S. and a little help from activist funds. Canadian companies that have followed international trends and proposals at larger companies have been well-served in their preparedness.

Over the last few years, ESG’s growing prominence in the investment sector has been nothing short of remarkable. ESG investing is now estimated at over US$20 trillion AUM, with ESG being integrated into portfolios at a growth rate of 17% a year. [1]

Credit agencies have also taken note, with Standard & Poor’s and Moody’s publicly acknowledging climate change is a major risk not currently factored into their ratings.

Moody’s has gone a step further, warning U.S. coastal cities they need to show evidence of preparing for climate change impacts or face a downgrade on their bonds. Now environmental issues have teeth. A downgrade to a city like Los Angeles would have a major effect on the cost of borrowing and impact their ability to fund city projects. Similarly, small island states could have their sovereign debt downgraded, limiting their development and making them more reliant on aid.

Evolving Shareholder Attitudes

Increasingly, investors around the world are taking the view that an issuer’s environmental and social activities will impact its financial returns and long-term sustainability.

At the root of this new investment philosophy is an increased awareness of topics such as climate change, wealth gaps, and gender inequality, along with a belief that these are important when making investment decisions—either because integration of these factors can be used as part of a risk mitigation screening process when evaluating companies or because investors are increasingly adopting the belief that what you invest in is equally important to the returns you see. In Canada, this is being fuelled by dramatic demographic shifts.

First, millennials, who account for a larger proportion of issuers’ shareholder base every year, are 65% more likely than their parents to examine a company’s environmental and social record when making investment decisions, according to a recent study by the Responsible Investment Association (RIA).

Second, studies have shown that women are more sympathetic to ESG issues than their male counterparts. Consequently, as the share of private wealth controlled by women doubles to more than $2.7 trillion by 2024, Canadian companies can expect increased pressure to pursue environmental and social initiatives as well as equal representation in the boardroom.

Investors in some industries have tuned in more than others as well. Take Canada’s mining sector for example. It is an attractive asset class globally but is highly susceptible to climate change. Much of Canada’s northern mining relies on winter supply via ice roads and summer access over permafrost roads. Shorter, mild winters or loss of permafrost would lead to supply shortages, massive capital outlays, or inability to access mine sites at all. Shareholders want to see some indication of how these risks will be managed.

Institutional investors have realized that management teams that show they are able to grapple with the multiple non-aligned issues and stakeholders on ESG show adaptive management skills correlated with handling complex business and strategy issues—the kind of skills that underpin adaptation for long-term performance.

U.S. Trends

This mainstream investor interest in environmental and social issues has certainly manifested itself in the 2018 proxy season, especially south of the border, where it has received record support.

According to ISS Voting Analytics, there were 87 proposals related to environmental and social issues in 2017. Year to date in 2018 there have been 63. At this point, it is uncertain whether the number of proposals by the end of the year will surpass last year’s level.

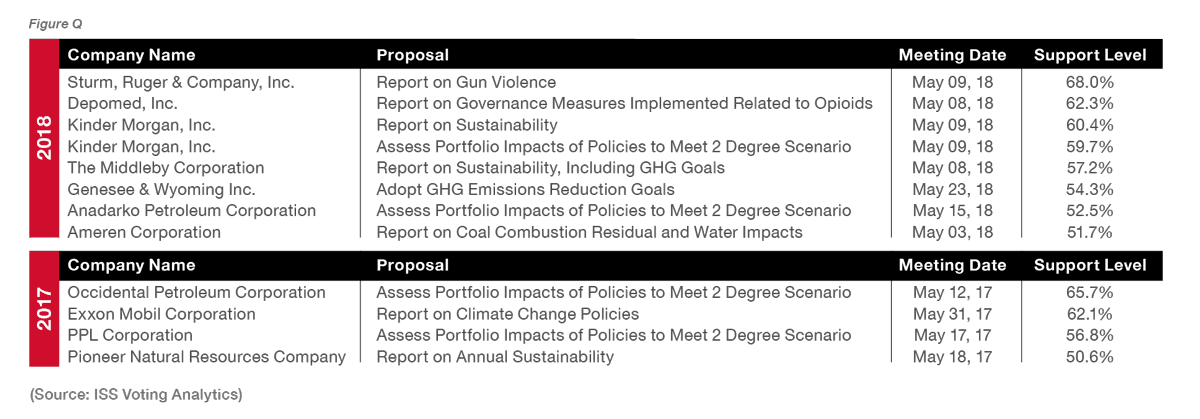

However, while in 2017 only four environmental and social shareholder proposals passed, year to date in 2018 a record number of eight environmental and social proposals have passed.

Two of the more high-profile majority votes were at Kinder Morgan and Anadarko Petroleum. Shareholders at both companies passed resolutions requiring the issuers to report on how they’re preparing for a 2°C limit on global warming pursuant to the 2015 Paris Accord. All but two of the majority votes were environmental resolutions, with the others related to gun safety and opioid abuse.

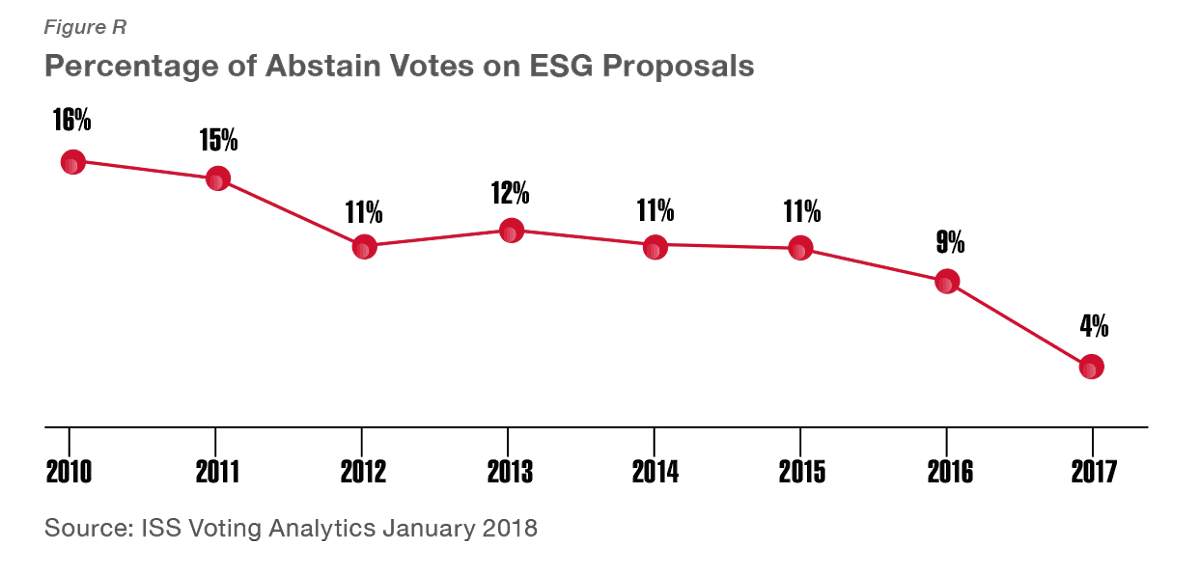

Along with the increase in majority-supported proposals, we’re seeing a concurrent drop in the rate of abstain votes on ESG proposals. This illustrates that investors are increasingly taking a position on ESG proposals rather than viewing them as nonessential segments of the voting program.

Institutional Investors Becoming More Vocal About ESG

Part of what is driving the decrease in abstain votes is that large institutional investors are becoming more involved in supporting and promoting ESG-related issues and subsequent shareholder proposals.

- In January, BlackRock Chairman and CEO, Mr. Larry Fink, issued an open letter to CEOs of companies in its portfolio urging them to develop long-term strategies in the context of non-financial metrics. BlackRock backed up the letter with a plan to double the size of its investment stewardship team and launched a suite of open-ended ESG Emerging Market Debt funds.

- In February, Hermes Equity Ownership Services announced that it will seek to support long-term sustainable growth through a comprehensive ESG engagement policy.

- In June, Fidelity Investments announced a new sustainability bond index fund.

According to a 2018 State Street survey report, the impetus for institutional investors to support ESG comes from the recognition that these issues are material to long-term financial outcomes. Specifically, the report notes that “developments such as the United Nation’s Principles for Responsible Investment are helping investors see ESG factors in terms of both opportunity and risk.”

ESG in the Crosshairs

We also see many governments failing to prepare for the future, on issues ranging from retirement and infrastructure to automation and worker retraining. As a result, society increasingly is turning to the private sector and asking that companies respond to broader societal challenges. Indeed, the public expectations of your company have never been greater. Society is demanding that companies, both public and private, serve a social purpose.

To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.

Companies must benefit all of their stakeholders, including shareholders, employees, customers, and the communities in which they operate.

—Mr. Larry Fink, BlackRock Chairman and CEO

We are an asset manager with a difference. We believe that, while our primary purpose is to help savers and beneficiaries by providing world-class active investment management and stewardship services, our role goes further. We believe we have a duty to deliver holistic returns—outcomes for our clients that go far beyond the financial—and consider the impact our decisions have on society, the environment and the wider world. Our goal is to help people invest better, retire better and create a better society for all.”

—Hermes Equity Ownership

We’re providing more opportunities for investors to advance specific causes and align their personal principles with their investment objectives.”

—Colby Penzone, Senior Vice President for Fidelity’s Investment Product Group

Activists Jump on the ESG Bandwagon

This year, we saw activists start embracing ESG. JANA Partners, in conjunction with the California State Teacher’s Retirement System (CalSTRS), pressured Apple to restrict children’s access to iPhones and develop a study on the effects of the device on teenagers, declaring “Addressing this issue now will enhance long-term value for all shareholders.” They’ve also hired an ESG portfolio manager and announced plans to launch the JANA Impact Capital Fund that will invest in companies that “are good bets but could do better for the world.”

Similarly, Blue Harbour Group said that social and environmental considerations will carry more weight with regard to how it will decide where to invest its US$3 billion in assets, and Mr. Bill Ackman of Pershing Square mused about running a proxy contest with an all-female board.

So why have activists, who are often characterized as short-term actors focused exclusively on the bottom line, become so enamoured of ESG?

The simple answer is that, like many retail and institutional investors, activists have recognized the link between ESG and long-term sustainable growth as well as overall positive impact on a company’s brand. The more complicated and perhaps cynical answer is that activists are publicly supportive of ESG initiatives as a means to court major institutional investors who have championed ESG investing.

Whatever the reason, the key takeaway for issuers is that activists have now joined in and are supporting and promoting ESG proposals, presenting a new dynamic moving forward.

What’s Happening in Canada

Despite a smaller market and a slightly reduced net volume of ESG proposals (29 in 2017 vs. 18 so far in 2018), Canada has also shown a strong receptivity to ESG concerns and proposals. The RIA reported that, as of 2018, responsible investing represents 38% of the Canadian investment industry. Additionally, according to a survey conducted by RBC Global Asset Management, two-thirds of institutional investors currently consider ESG factors when undertaking investment or voting. Not surprisingly, given Canada’s high volume of corporations operating in the energy and resource sectors, there is a proportionately higher degree of exposure to environmental proposals.

A Closer Look at 2018 in Canada

Based on Kingsdale’s analysis, in 2018, environmental and diversity-related shareholder proposals received the highest average support levels, with one environment-related shareholder proposal seeking a report on climate change filed at TransCanada passing with 99.10%—which is not surprising given that management endorsed the proposal. This endorsement skews the average support level overall, but if it is excluded as an outlier, the average support level for the three environment-related proposals that went to a vote would be just 14.65%.

While in the U.S., companies can seek no-action relief from the Securities and Exchange Commission, Canadian companies are not afforded the same mechanisms to strike down shareholder proposals and not include them in the information circular. As such, companies may often find themselves being engaged by shareholders or pension funds on ESG and other issues prior to the filing of shareholder proposals.

In our experience, if environmental and social shareholder proposals are received, issuers can engage the filer to understand their exact desires. At times, if additional disclosure is requested and the information is available internally, it may be relatively easy to appease the filer by providing such information. For example, while a total of 18 environmental and social-related proposals were submitted to companies in 2018, half of them were withdrawn. While the exact reasoning as to why proposals were withdrawn is not always disclosed publicly, based on our experience, we see that in most cases companies had engaged the filer to understand the exact concerns and to address them.

Kingsdale’s Take

ESG is now part of the investing mainstream. While this can pose several challenges for issuers as they seek to understand how their ESG profile will be understood and benchmarked by investors, there are several proactive measures boards can take to remain ahead of the ESG curve.

Develop your own ESG policies. A proactive approach can help reduce the probability of issuers receiving shareholder proposals that may be popular but do not align with their strategy. In developing ESG policies, issuers should be aware of what proposals are being received by peers and with what levels of support, and conduct an internal ESG SWOT analysis.

Enhance disclosure. Retail and institutional shareholders alike are seeking greater transparency and disclosure regarding issuer preparedness on environmental and social issues. We advise clients to develop a corporate responsibility report, updated bi-annually and available for shareholders.

Understand the ESG policies of your shareholders. We recommend that issuers be informed about the ESG voting policies of their shareholders and ensure that their concerns are addressed in the corporate responsibility report or as part of ongoing outreach. We also recommend that companies include proactive discussion on this topic during regular shareholder meetings to ensure they are not left in the dark about an investor’s view.

Ensure your board has environmental and social risk expertise. Issuers need to ensure that their board composition has the expertise required to address environmental and social issues, in addition to allocating the responsibility for managing this risk to a specific committee. Companies could also consider the use of an advisory board or having expert advisors present to join relevant committees.

If these steps fail and shareholder proposals are brought forward, companies can negotiate with the shareholder to find a mutually agreeable path forward that often includes commitments from the company. Unlike an activist attack, we do not recommend a company openly engage in a campaign against a shareholder proposal in the ESG space, as many will see such proposals as wholesome as mother’s milk.

Pot Shots: What Cannimed’s Poison Pill Defence Against Aurora Means

It’s a pivotal time in the Canadian cannabis industry as companies seek to position themselves as players in the new recreational market. A flurry of recent deals has led to the major companies increasing their market position, ramping up production capacity, and strengthening their balance sheets.

November 2017 marked the first hostile bid in the cannabis industry and only the eighth under Canada’s new hostile bid regime. It was, however, the first test of a tactical rights plan—or poison pill—under the new rules.

Kingsdale designed a national advertising campaign to galvanize CanniMed shareholders and force Aurora to increase its bid. A similar tactic was used by Canadian Oil Sands in its hostile bid defence against Suncor.

The Bid Comes In

On November 13, 2017, Aurora Cannabis submitted a proposal to CanniMed Therapeutics Inc.’s board of directors to purchase all of the issued and outstanding common shares of CanniMed for consideration, consisting of common shares of Aurora valued at $24.00 per CanniMed share, subject to variation as Aurora’s share price changed.

CanniMed rejected the offer and, on November 17, announced a friendly acquisition agreement with Newstrike Resources whereby Newstrike shareholders would receive 33 CanniMed shares per 1,000 Newstrike shares. The Newstrike offer also included a $9.5 million cancellation fee clause.

Aurora called the Newstrike deal “oppressive to CanniMed shareholders and to Aurora’s offer” and on November 27 launched its formal takeover bid with support from three of CanniMed’s largest shareholders, at the time representing 38% of CanniMed shares.

In response, CanniMed adopted a shareholder rights plan—notably a day before Aurora could start making purchases under the 5% exemption. The poison pill tactic was something many, including regulators, considered unnecessary under the new takeover rules except to prevent creeping bids and private agreements. However, the 38% locked-up plus the ability to make additional purchases was clearly going to make finding a superior proposal difficult.

Having been part of CanniMed’s advisory team, the strategy was not to implement a rights plan the regulators would uphold, which was acknowledged to be a challenge, but to buy time to protect the Newstrike deal.

Adopting a rights plan would not only stop Aurora from relying on the 5% exemption to buy more shares in the open market, which would create a blocking position for any other transaction and from entering into additional lock-up agreements with shareholders, but would also provide CanniMed with more time to get additional news and deals into the market, and advance its transaction with the little-known Newstrike. If the Newstrike deal was supported, Aurora had said it would abandon its bid.

Additionally, as the case proceeded to the regulators, if Aurora was deemed to be the beneficial owner of the locked-up shares, it would have had to comply with the rules for an insider bid, thereby delaying their process. To back up this argument, CanniMed argued two of its directors affiliated with the locked-up shareholders passed along confidential information to Aurora and those shares should be excluded from the 50% minimum tender condition and any minority approval of a subsequent transaction.

Challenge to the Courts

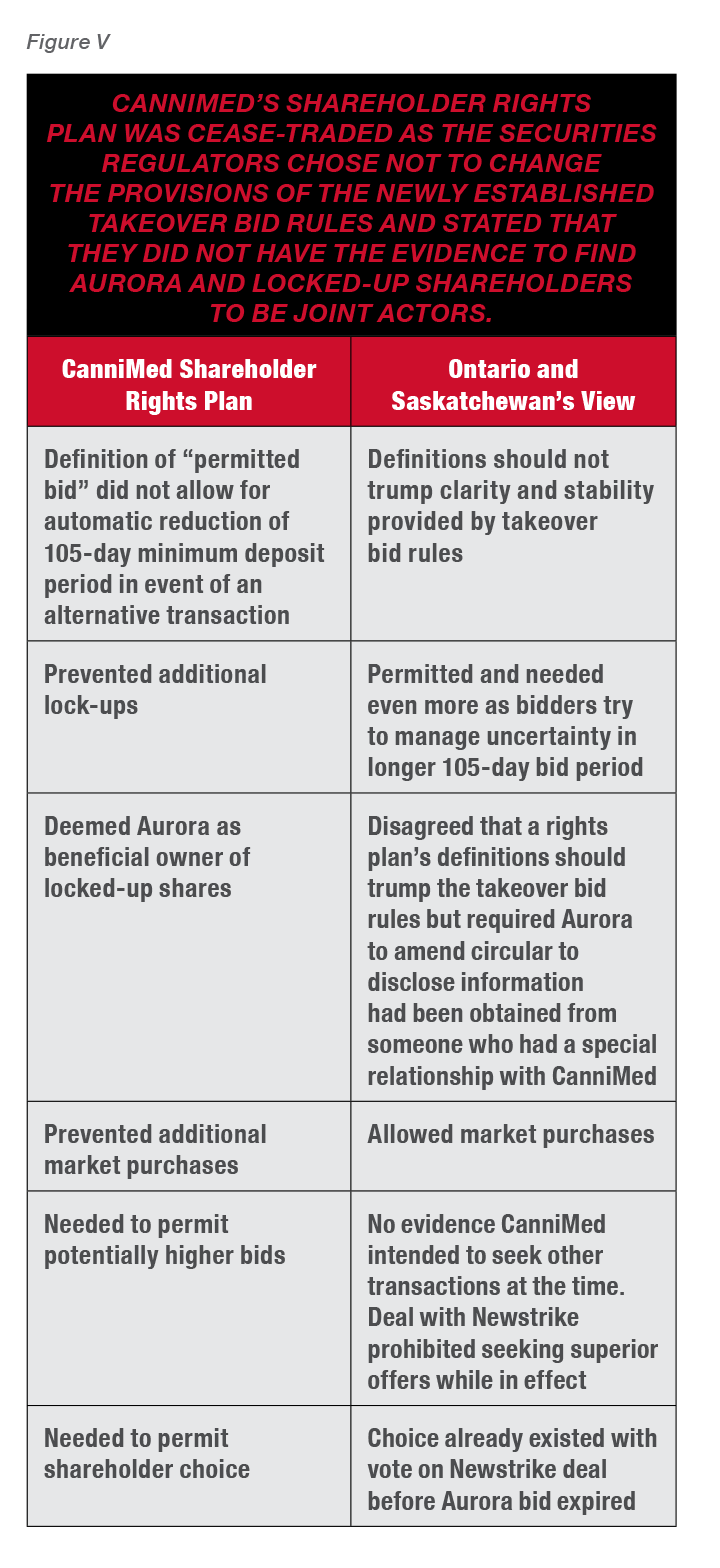

Aurora appealed to the Financial and Consumer Affairs Authority of Saskatchewan and Ontario Securities Commission to cease-trade the rights plan, saying it was meant to halt its bid, was made up of unusual restrictions that were inconsistent with the newly established takeover bid rules, and restricted Cannimed shareholders from tendering. Aurora also asked that the 105-day minimum big period be reduced on the basis of the Newstrike deal constituting an alternative transaction, thus rendering the need for 105 days to find another offer obsolete.

What the Regulators Said

The regulators placed importance on the predictability the new takeover bid regime was meant to achieve with clear, stable rules governing the market and providing increased certainty to market participants.

The regulators cease-traded the rights plan on the basis of it being an impermissible defensive tactic and “primarily a tactical motivation”. They also did not accept that the rights plan would help facilitate higher bids, as CanniMed was restricted from seeking suitors under its deal with Newstrike and shareholder choice was not being limited because they had the opportunity to vote on the Newstrike deal before the Aurora offer expired.

Among other things, the regulators also pointed out lock-up agreements are legal and take on increased importance for a prospective bidder under the new takeover rules because the 105-day bid period adds increased uncertainty. If a tactical rights plan served to block a lock-up and buying in the market, the new takeover regime would become far less predictable and may discourage accretive transactions.

With regards to Aurora’s arguments, the regulators disagreed that the Newstrike deal was an alternative transaction as it did not involve the acquisition of CanniMed shares, included customary fiduciary outs, and the only reason the transactions were mutually exclusive was the condition Aurora included stating it would only proceed if the Newstrike deal was voted down. The result was that regulators disagreed with the bid period being shortened in this instance.

What This Means

Use of tactical poison pills. There still may be a role if it could be demonstrated the pill was needed to ensure shareholder choice, and provided the pill does not seek to duplicate or layer onto the requirements of the takeover bid regime with additional, and likely confusing, discrepancies about how the requirements should be fulfilled.

Lock-up agreements. Hard, unconditional lock-up agreements are fair game and may even have an increased role under the new rules that introduce increased uncertainty with a longer 105-day bid period.

Joint actor status. Just because an insider may have shared material non-public information in an attempt to help thwart a potential deal and structure another with an outside party, this does not necessarily mean they were acting jointly if they are on different sides of the transaction being challenged and, as shareholders, they were simply seeking the best available outcome.

The Deal Goes Friendly

On January 24, 2018, Aurora and CanniMed announced an end to the takeover battle with a friendly $1.1 billion deal, at the time the largest transaction in the history of the fledgling Canadian cannabis industry. The agreement tendered CanniMed shares at a much higher price of $43.00 each, a 185.53% premium over the November 13, 2017 closing price. Notably, the transaction excluded Newstrike thereby triggering the $9.5 million break fee payout.

Kingsdale’s Take

Balance between the target and the bidder is paramount in the eyes of the regulators. In light of this, employing a tactical pill will face an even tougher uphill climb than many thought under the new rules. If a pill is adopted, a premium must be placed on demonstrating it is necessary to allow shareholders to make decisions in their own interests.

In instances where a board is seeking to extract more value from a potential alternative bidder, the absence of a tactical pill may make it harder for a white knight to be ensured support if the original bidder is able to continue to purchase shares in the market and, coupled with locked-up shares, create a blocking position.

One consideration is how the regulators would view a tactical pill that was approved by shareholders. Shareholder-approved rights plans meant to prevent creeping takeovers are likely not impacted by this decision. Finally, as the regulators noted, lock-ups will take on increasing importance moving forward.

Endnotes

1“The Remarkable Rise Of ESG”, George Kell. Forbes.com, July 11, 2018(go back)

Print

Print