Edward A. Hauder is Lead Consultant and Senior Advisor at Exequity, LLP. This post is based on an Exequity memorandum by Mr. Hauder. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

If you are considering taking a request to shareholders for the approval of shares for an equity compensation plan and a significant number of your shareholders are influenced by the Institutional Shareholder Services (ISS) vote recommendations, you should understand how ISS evaluates equity plan proposals. This post provides an overview of ISS’ EPSC model which ISS uses to evaluate equity compensation plan proposals.

Overview of the EPSC Model

The EPSC looks at three categories (or “pillars,” as ISS refers to them) when evaluating an equity compensation plan proposal:

- Plan Features

- Grant Practices

- Plan Cost

A company’s ability to influence the outcomes under these three categories varies. The above bullets list the categories in order of a company’s ability to influence them when submitting an equity compensation plan proposal to shareholders—from most able to least able for a company to influence.

“That Terminator is out there! It can’t be bargained with. It can’t be reasoned with. It doesn’t feel pity, or remorse, or fear. It absolutely will not stop…ever…”

– Kyle Reese, The Terminator (1984)

The EPSC model is a lot like the Terminator—it doesn’t care what your company does, if it runs afoul of the EPSC model by not getting enough points to achieve or exceed the threshold score, ISS will recommend against the equity compensation plan proposal, and there is very little you can do about it.

The three categories of the EPSC model look at different aspects of equity compensation at a company and will ultimately influence whether ISS issues a positive vote recommendation for an equity plan proposal. Generally under the EPSC model, if an equity plan scores points equal to or greater than the applicable points threshold, [1] ISS will issue a positive vote recommendation for the proposal.

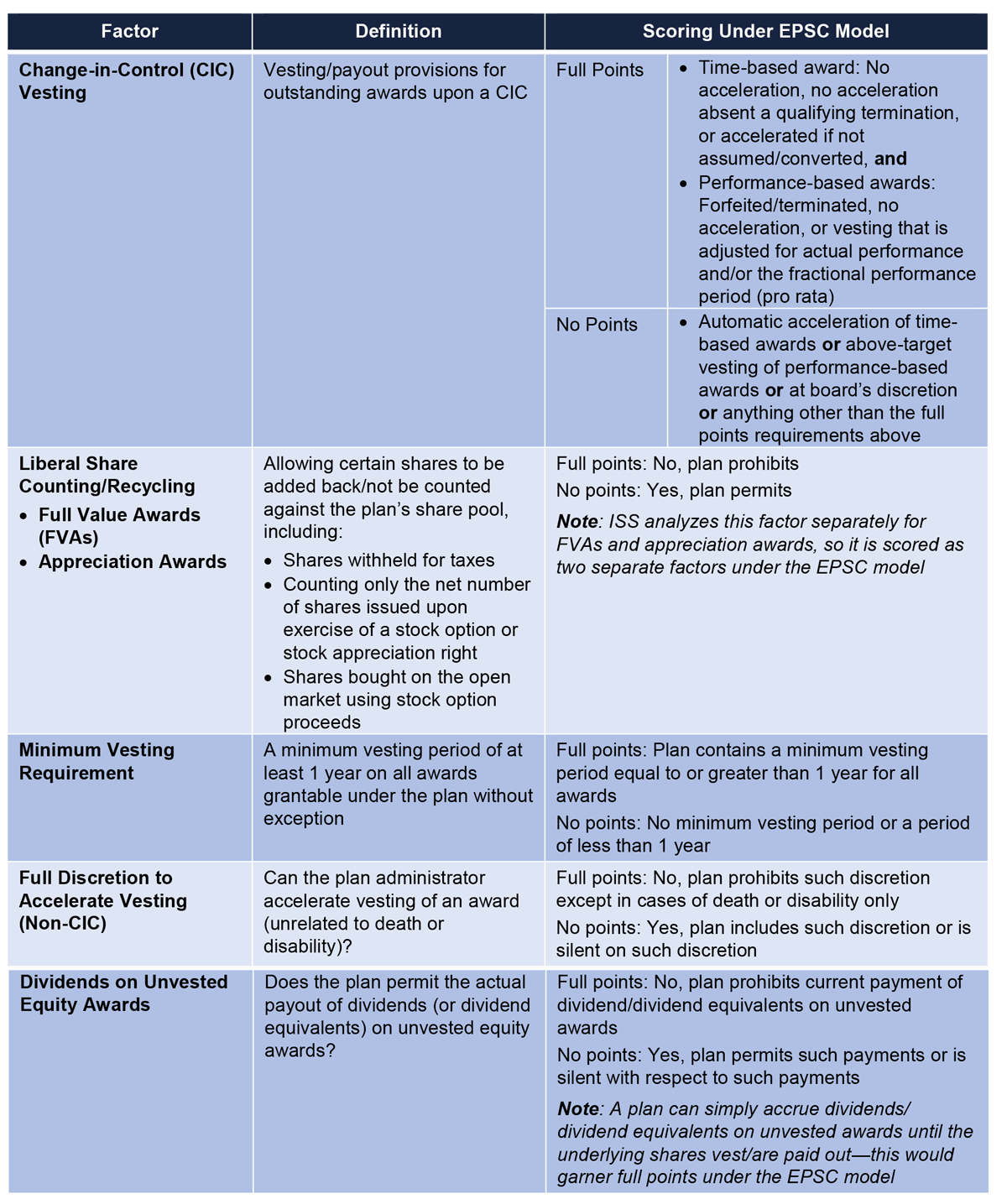

Plan Features

This category looks at the plan features included in the proposed plan document. As such, it is the category most easily influenced by a company, as the company can decide whether to include or revise the provisions in its proposed plan.

The plan features that influence the score under this category of the EPSC model are:

Exequity comment: In our experience, most companies are willing to comply fully with the minimum vesting requirement and dividends on unvested equity awards factors. Whether companies are willing to comply with the liberal share counting/recycling factor generally depends on the modeling under the EPSC model that they have conducted and whether they need to place a limit on the share pool in order to ensure a positive vote recommendation from ISS. On the CIC vesting factor, most companies during the 2018 proxy season went with no points as few were willing to hard code into the plan document the requirements necessary to gain full points under the factor. Most companies were unwilling to limit their discretionary ability to vest awards to only cases of death or disability, and so gained no points under that factor.

Grant Practices

The Grant Practices category looks at two things:

- 3-year average Burn Rate and Plan Duration

- Features on Equity Granted to the CEO and other named executive officers (NEOs)

Burn Rate and Plan Duration

ISS compares the burn rate it calculates for the subject company to an industry-specific benchmark in one of three groups: S&P 500, Russell 3000 (excluding S&P 500), and Non-Russell 3000. ISS annually publishes a table of the burn rate benchmarks for the industry groups in all three groups of companies. If a company’s burn rate is 50% or less of the applicable industry benchmark, then it will receive full points under the burn rate factor in the EPSC model. If the burn rate is greater than 50% of the benchmark, it will only receive partial credit, and if too far over the benchmark, no points at all.

In calculating the burn rate for a company, ISS applies a multiplier to FVAs (awards other than stock options or stock appreciation rights that are settled in shares). The multiplier is based on a company’s 3-year annualized volatility. The volatility is inversely related to the multiplier used. Thus, the multiplier can range from 1 FVA counting as 1.5 option shares for volatility of 54.6% or greater, up to 1 FVA counting as four option shares, for a volatility of less than 7.9%. See the Appendix for a table setting forth the FVA multipliers based on 3-year average annualized volatility.

Plan duration is calculated by ISS based on the proposed share reserve (new shares plus existing shares available) using the company’s 3-year average burn rate and making assumptions about expected growth in the company’s common shares outstanding. Full points are awarded under this EPSC model factor if the duration is equal to or less than 5 years. Half points are awarded if the duration is greater than 5 years, but equal to or less than 6 years. If the duration is greater than 6 years, ISS awards no points under this factor.

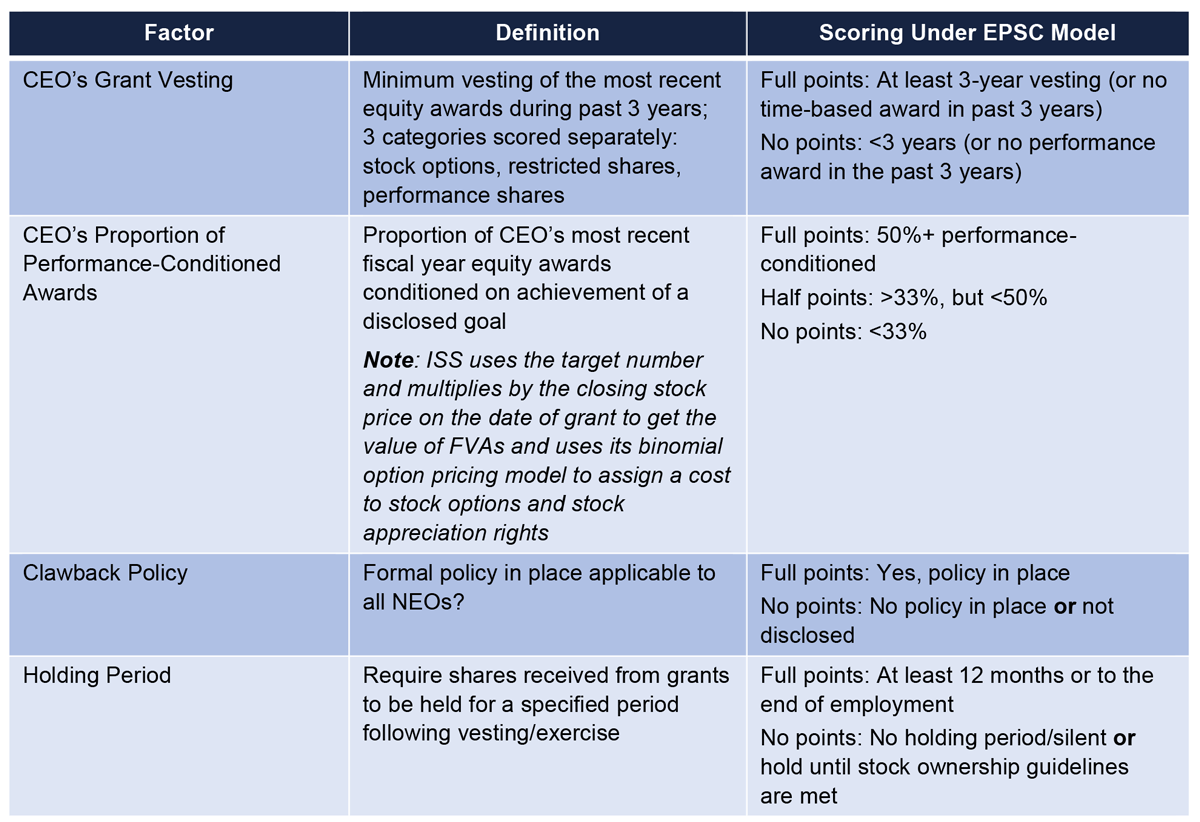

CEO’s and Other NEOs’ Equity Grants

This portion of the Grant Practices category is looking at several different factors—two focused on the most recent grants to the CEO and two focused on the grants to all the NEOs.

Plan Cost

This portion of the EPSC model is the one most directly related to the original ISS equity plan cost policy, which only looked at Shareholder Value Transfer (SVT) compared to a proprietary, company-specific SVT cap to determine ISS vote recommendations. Today, ISS measures two types of SVT—one as it has traditionally been measured, and another that excludes outstanding equity awards. SVT traditionally was a measure of the cost associated with equity awards available for grant, new shares being requested, and outstanding equity awards (all being assigned a dollar value by ISS), expressed as a percent of a company’s market value (the 200-day average stock price multiplied by the common shares outstanding as of the proxy record date).

ISS typically awards full points under this factor if the SVT cost comes in at or below approximately 65% of the SVT cap. This is true for both forms of SVT that ISS measures and each has a separate SVT cap. Generally, coming in at the SVT cap will result in partial points, but if the SVT cost is too far above the SVT cap, no points will be awarded under this factor of the EPSC model.

Overrides

There are certain actions or provisions that, regardless of whether the plan proposal would otherwise pass the EPSC model (i.e., score points equal to or greater than the threshold), may cause ISS to recommend against the plan proposal. The non-comprehensive list of such actions/features, which override the EPSC model result, includes:

- The plan provides for excise tax gross-ups.

- The plan provides for reload options.

- The plan includes a liberal CIC definition that could result in vesting of awards by any trigger other than a full double trigger.

- The plan permits repricing or cashing out underwater stock options or stock appreciation rights without shareholder approval.

- A pay-for-performance disconnect or problematic pay practice has been identified at the company and the equity plan has been identified as a vehicle for said disconnect or problematic pay practices.

When Should You Run the EPSC Model?

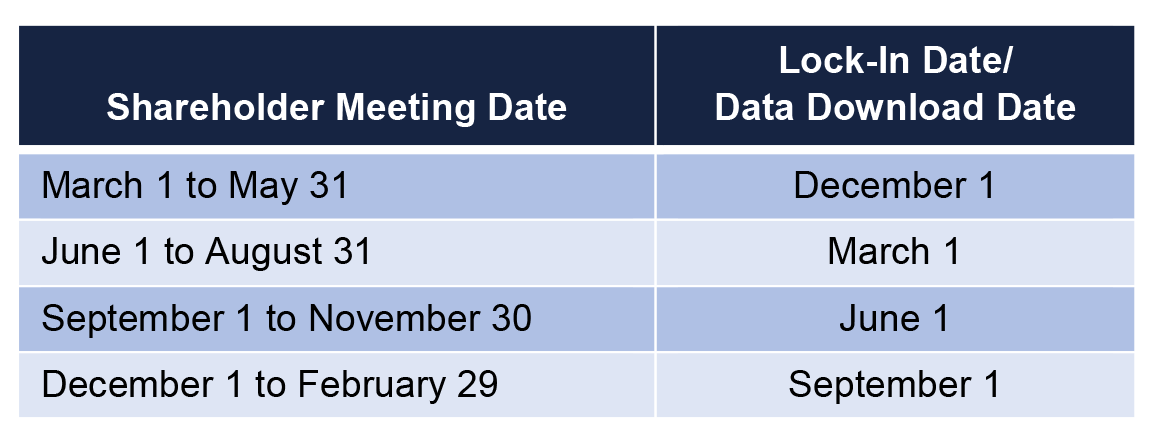

While ISS will sell you access to the EPSC model any time before your next annual meeting and it will remain open until your next final proxy is filed, you should give some thought as to when you will run the EPSC model. While you could run it right after your annual shareholders meeting, the chance that it will accurately reflect the EPSC factors and benchmarks that ISS Research will apply at your next annual meeting is exceedingly remote. The benchmarks in the EPSC model generally get refreshed on a quarterly basis. The refresh date/lock-in date (ISS refers to this date as the data download date) that applies to a particular company depends on when its shareholder meeting will be held:

In our experience, while the EPSC model can be run prior to reaching the lock-in date, doing so increases the risk of internal challenges and misunderstanding. Often the EPSC model benchmarks shift between the September 1 and December 1 lock-in dates enough that any prior modeling is rendered moot. In such case, the modeling done post-lock-in date will show a different number of shares (typically lower) that could pass the EPSC model (if any). Given that the earlier modeling invariably establishes certain expectations, this may present communication and understanding challenges to ensuring everyone understands why the outcome changed. Simply putting off running the EPSC model until after the lock-in date avoids needing to battle expectations set by a pre-lock-in date ISS model run. However, we have found that oftentimes at their Fall meeting, compensation committees want some idea about what the company might receive in the way of shares under the EPSC model. This can be especially true when no December meeting is scheduled. In these cases, we find being very clear about expectations and model outputs prior to the lock-in date helps avoid problems with communication and understanding challenges.

Other Considerations

In addition to the EPSC model, ultimately, you will also want to evaluate how your proposed plan stacks up against the three criteria for a good equity plan:

- Compliance: Does it satisfy all the applicable legal and regulatory requirements?

- Market/Best Practices: Does it comply with market/best practices?

- Flexibility: Does it provide suitable flexibility within the context of the two above criteria?

Another thing you might want to consider doing prior to running ISS modeling is checking your equity usage and dilution to evaluate how your company is using equity compared to its peers.

- Consider conducting a dilution analysis for your company and your company’s peer companies.

- Consider conducting a run rate and burn rate analysis for your company and your company’s peers.

Conclusion

While the EPSC model has a number of factors, a company’s ability to influence the model generally is somewhat limited. Consequently, companies should understand how their “fixed” provisions and practices will impact their request for shares under the EPSC model. Failing to pass the EPSC model and receive a positive ISS vote recommendation does not necessarily mean the proposal will fail to secure shareholder approval (Exequity’s research shows fewer than 1% of equity plan proposals for Russell 300 companies failed; see the Appendix of the complete publication for voting statistics). Rather, failing to pass the EPSC model will mean a much more active shareholder engagement for the plan proposal and being able to clearly articulate the rationale for the plan as proposed, in order to secure shareholder support.

The complete publication, including Appendix, is available here.

Endnotes

1See the Appendix of the complete publication for the thresholds and category weightings under the 5 EPSC models.(go back)

Print

Print