Mike Chen is Portfolio Manager, George Mussalli is Chief Investment Officer and Head of Equity Research, and Yosef Zweibach is Head of Business Strategy & Investor Relations at PanAgora Asset Management, Inc. This post is based on a PanAgora memorandum by Mr. Chen, Mr. Mussalli, and Mr. Zweibach. Related research from the Program on Corporate Governance includes Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here) and Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here).

Interest in ESG investing has exploded in recent years. However, despite increased demand for this type of strategy, asset owners still have many questions regarding ESG and best practices for constructing optimal investment portfolios. These questions include: What exactly is ESG investing? Do I sacrifice alpha if I invest in ESG portfolios? How does quant ESG work and what are the advantages to a quant approach? In this post, PanAgora seeks to answer many of these commonly asked questions. Our main conclusions are as follows:

- Originally viewed by the investment industry as incompatible with alpha generation, evidence shows that ESG considerations can actually enhance both a portfolio’s economic performance and its ESG profile.

- ESG considerations capture many of the return and risk drivers not captured through traditional financial metrics, and are relevant for the valuation of today’s corporations.

- The quantitative investment approach is well-suited to take advantage of the large and growing collection of datasets. Investors would be well served to utilize quantitative methods to evaluate companies’ ESG footprints, as well as for portfolio construction and output measurement.

- All asset owners should consider ESG portfolios in their investment allocation, whether via integration into their larger portfolio or via the impact approach.

What is ESG?

Before moving forward, let us first understand, what is ESG? ESG stands for “Environmental, Social, and Governance.” An ESG strategy considers attributes of a company that are broader than traditional financial metrics such as earnings per share (EPS) and return on assets (ROA), etc.

Some of the non-traditional metrics ESG investors may consider include:

- Environmental: Carbon and green-house-gas emission; water pollution; resource usage efficiency

- Social: Employee motivation and corporate culture; customer, and community sentiments towards the corporation; gender and racial equality

- Governance: Sensible executive pay policies; effective and experienced corporate boards; proper accounting and reporting procedures.

Historically, ESG categories factored into the investment process typically consisted of those classified as governance and the issues associated with corporate governance, as these have traditionally been the easiest factors to quantify. It is not a leap of faith to see that governance can impact a company’s economic prospects. But what about issues related to environmental and social categories? Would considering these factors diminish an asset manager’s focus on generating positive returns on behalf of their clients?

Doing good versus doing well

Generally speaking, the prevailing view held by the investment community was that profit maximization and “doing good” socially and environmentally are necessarily mutually exclusive. This view is perhaps best expressed by the Friedman Doctrine, which states that a company should have no “social responsibility” to the public or society because its only concern is to increase profits for itself and for its shareholders, and that the shareholders in their private capacity are the ones with the social responsibility. [1] The corollary to the Friedman Doctrine is that when corporations try to be socially responsible, they give up potential returns in the process. Subsequently, the investment community has also taken the view that if an investor makes investment decisions based on socially responsible considerations they may give up investment returns in the process.

PanAgora believes the philosophy underlying the Friedman Doctrine was rooted in valid historical reasons that no longer hold true in the present day. When the Friedman Doctrine was first expressed in the 1970’s, the following circumstances existed:

- Corporations that dominated the capital markets were mainly those that made widgets, such as General Foods and Bethlehem Steel. [2] Most of the corporate market values of that time were composed of tangible assets. During this era, the main focus of such corporations was to minimize unit cost of production input in order to maximize profit, per traditional economic theory. This meant that spending corporate resources on social or environmental responsibility issues was not consistent with profit maximization.

- On the investment front, traditional ESG portfolios were constructed using exclusion lists. Under such an arrangement, an ESG portfolio’s investment universe is smaller than that of a non-ESG portfolio. By basic properties of mathematical optimization, the smaller the universe of companies over which one constructs a portfolio, the lower the potential performance of the resulting portfolio.

As markets and technologies have evolved, these conditions are no longer valid.

Refute to Reason 1: Market and value-generation drivers have evolved

Fast forward 40 years, from the 1970’s to the present date, and the economic landscape has changed with both investments in intangible assets, and the share of GDP they represent, outpacing the tangible assets equivalent. For corporations, these intangible assets include brand values, patents and intellectual properties, number of active users (which is heavily influenced by corporate community relations), etc. Given the increasing importance of intangibles in corporate valuation, many of the valuation drivers that matter to the modern corporation can be examined through the ESG investment lens. Very simply put, PanAgora believes ESG considerations capture many of the return and risk drivers that are not captured through traditional financial metrics, but are relevant for the valuation of today’s corporations.

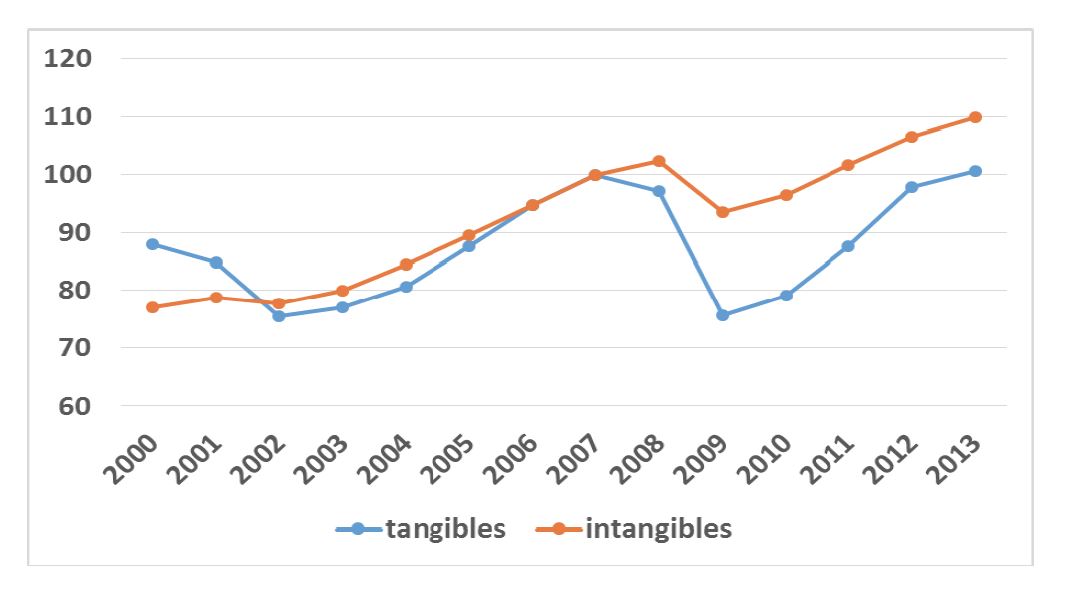

Figure 1: Investments in intangibles in the US has minimally dropped during the Great Recession, and has increased since (chained values, 2007=100)

Source: [RHJI, 2018]

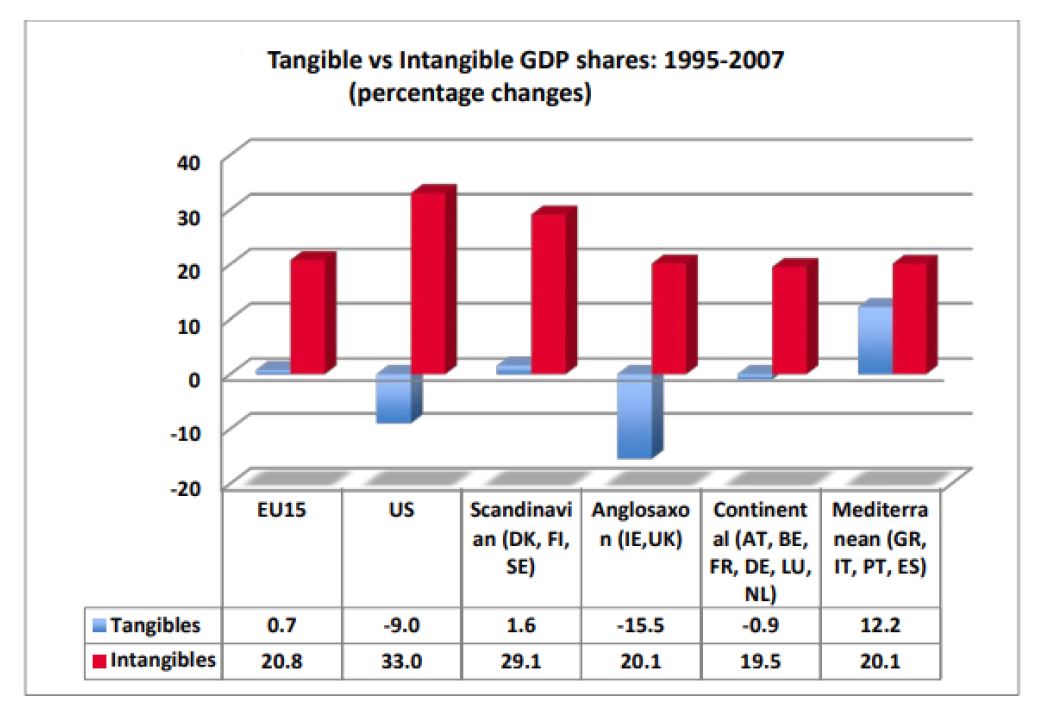

Figure 2: Intangible are becoming a bigger part of GDP

Source: INTAN Invest, http://www.intan-invest.net

Refute to Reason 2: ESG Investing 2.0

The traditional, exclusion-list based approach to ESG investing is no longer the only method employed in ESG investing. Over the past several years, two alternative approaches have emerged and are becoming increasingly popular: [3]

- Integration: Under the Integration approach, ESG issues are only considered from the alpha- generating perspective of the investment portfolio. If a particular ESG consideration generates alpha, it is taken into account in the investment process. For example, PanAgora has found gender equality to be a social metric that is also alpha additive to our models.

- Impact: Under the Impact approach, portfolios are constructed with an aim to achieve both positive alpha and alignment with investor values on ESG issues. That is, instead of the single dimension objective of positive return, impact portfolios have a two-dimensional objective. Referencing the gender equality metric again, an Impact portfolio with this ESG metric would consider how the portfolio performs on alpha return, and gender ratios of the companies owned by the portfolio.

Neither of the two methods described above are exclusion-list based, and both PanAgora and academia have found no evidence that portfolios constructed under either method perform worse than their non-ESG counterparts. In fact, PanAgora has found that taking ESG considerations into account can be alpha enhancing, [4] provided the ESG issues under consideration are material, [5] having a non-negligible impact on a firm’s operations.

Both the Integration and Impact approaches to ESG investing require much more data than is needed by an exclusion-based approach. [6] PanAgora believes the exponential growth and variety of data available in recent years [7] is yet another reason why the investment community has come to the realization that ESG considerations are alpha additive.

Where to get ESG data?

Having established that ESG considerations can be alpha enhancing rather than detracting, the logical next question an investor may ask is where to obtain ESG data and metrics in order to incorporate them into the investment process.

Generally speaking, there are three major sources for ESG data an investor may investigate:

- Commercial ESG data and metrics providers

- Alternative data sources

- Non-governmental (NGO), non-profit and academic organizations

Commercial ESG data and metrics providers:

Perhaps the easiest way to obtain ESG data is to purchase it commercially. There are various commercial vendors that sell ready-to-use ESG scores. Many asset managers offer ESG products by taking the simple approach of using these commercially available scores to filter or tilt their portfolios. One issue with this practice is that the correlation of ESG scores amongst commercial providers is typically low due to inconsistencies between data sources, aggregation methods and relevant ESG topics. [8] Another issue is that ESG portfolios constructed in this manner typically do not deliver alpha, as the materiality considerations are missing from the portfolio construction process.

Government and NGO, non-profit, and academic organizations:

Other sources of ESG data include sustainability-minded organizations around the world. Many of these enterprises have a large store of ESG data that can be used to make responsible investment decisions. In addition to knowing where to look for ESG data, managers may also face the challenge of working with data sets that are often unstructured by multiple formats, have gaps in coverage, or need mapping between the underlying dataset and the publicly-traded corporate entity. Common examples include text files, such as hostile workplace incident reports, audio and video files, and emission and pollution data. Therefore, investors need to organize, clean and process the data before it can be used. Furthermore, this data is often not constructed into top-level, easy-to-use metrics that an investor can directly implement into an investment process. Ingenuity and research is needed to reveal the “ESG-ness” of the data and its associated corporate entity.

Alternative data sources:

The third and largest type of ESG data source is that which we have termed alternative data. This diverse category of ESG data ranges from information collected from individuals on social media, such as product reviews and blog content, to imagery obtained via drones and satellites used to evaluate conditions such as pollution emission quantity and intensity. As with data provided by sustainability organizations, data from many alternative sources typically cannot be implemented directly into an investment model, but rather needs to be extensively processed and researched before it can be useful.

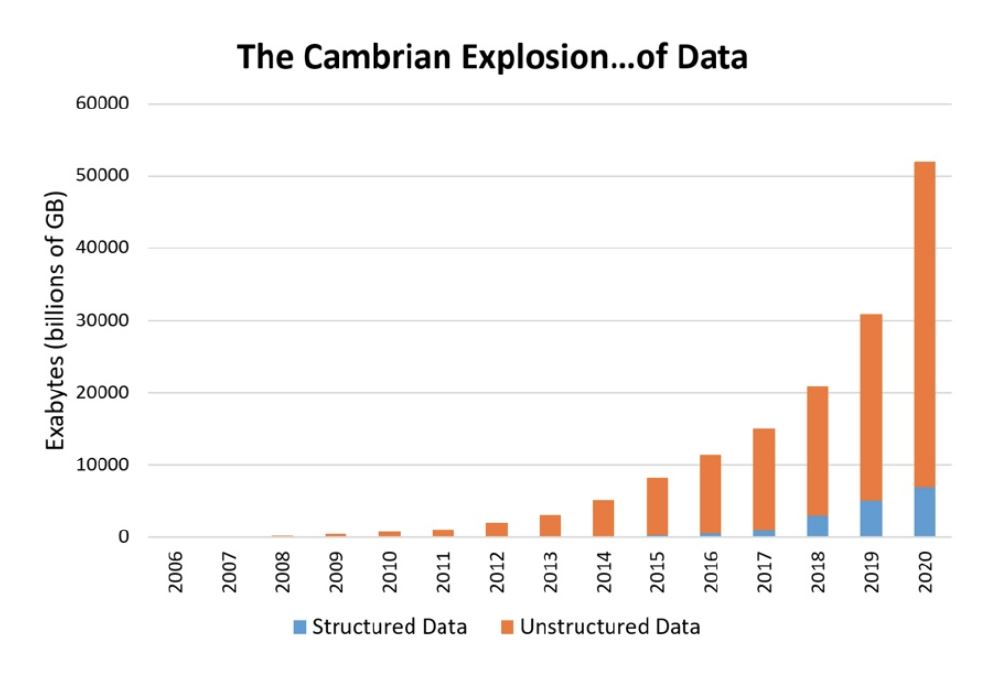

Figure 3: There has been an exponential growth of data of all kinds, including ESG

Source: https://www.eetimes.com/author.asp?section_id=36&doc_id=1330462

How do I measure my ESG portfolio?

For a traditional investment portfolio, quantifying alpha return is straight forward and well-established. What about evaluating results for an ESG investment portfolio? After constructing an ESG portfolio, how do investors and asset owners measure the output of the resulting portfolio? Previously we discussed two types of ESG approaches: Integration and Impact. Measuring alpha for an ESG portfolio should depend on the type of approach chosen.

For Integration strategies, the sole objective is alpha return; hence, they should be measured similarly to all other investment portfolios, i.e., via the standard set of portfolio return attribution tools and reports.

For Impact portfolios, the objective is both alpha return and improvements along specific ESG dimensions that align with asset owners’ values. In addition to a standard set of portfolio return attribution metrics, this type of portfolio should also be measured along the ESG dimension for which the portfolio is built to improve. Since every asset owner’s sustainability value differs, [9] there is no one-size-fits-all metric by which to measure impact. However, there are some popular frameworks that a number of impact investors use to measure the ESG aspect of their portfolio, and to ensure that they’re “doing good”. Some popular frameworks include measuring the carbon footprint of a portfolio’s holdings or their alignment with UN Sustainable Development Goals (UN SDG). [10] More specific metrics, such as executive-level diversity or employee happiness can also be developed and measured upon agreement between the asset owners and investment managers. Similar to data intake, quantitative asset managers may again have a relative advantage in regard to this measurement as they are better able to dissect and analyze their portfolios on a more granular level.

Figure 4: UN Sustainable Development Goals

How does ESG investment fit into my investment portfolio allocation?

The question of how ESG investments fit into an asset owner’s portfolio allocation should be determined based on each asset owner’s goals. Previously we’ve argued that ESG and alpha are not necessarily mutually exclusive and that certain material ESG considerations are also alpha enhancing. If the asset owner’s sole investment objective is alpha generation, then ESG integration should be considered for such portfolios. In ESG integration portfolios, ESG considerations are part of the investment process if and only if they enhance return. From PanAgora’s own experience, we have found that integrating ESG considerations into the investment process enhances alpha return, and we consider ESG factors for all of our investment portfolios, regardless if they are explicitly ESG focused or not .

On the other hand, if the asset owner’s objective is both alpha and a positive outcome along certain ESG metrics, then they should consider ESG impact portfolios. For ESG impact portfolios, a trade-off may be necessary amongst the two objectives of positive ESG impact and alpha delivery, depending on whether the specific ESG issues are material to the holdings in the investment portfolio. [11]

The bottom line is, since ESG considerations can deliver alpha regardless of the asset owner’s value system, PanAgora believes all asset owners can benefit by incorporating ESG considerations into the investment portfolios.

Why is Quant ESG attractive?

In an earlier section of this paper, we discussed various sources of ESG data. While there are large quantities and varieties of ESG data sources in the public domain, investors need to know where to look, and how to verify that information. Given that much of the data requires additional processing and statistical techniques in order to create data sets that are implementable, quantitative investing is well suited for ESG investing.

For example, Figure 3 shows that the largest portion of recent data growth is in the area of unstructured data. In order to make sense of this type of data, advanced statistical techniques such as neural-networks and support vector machines prove themselves to be very valuable. PanAgora has used these techniques in extracting knowledge and has had success in generating alpha from the data deluge.

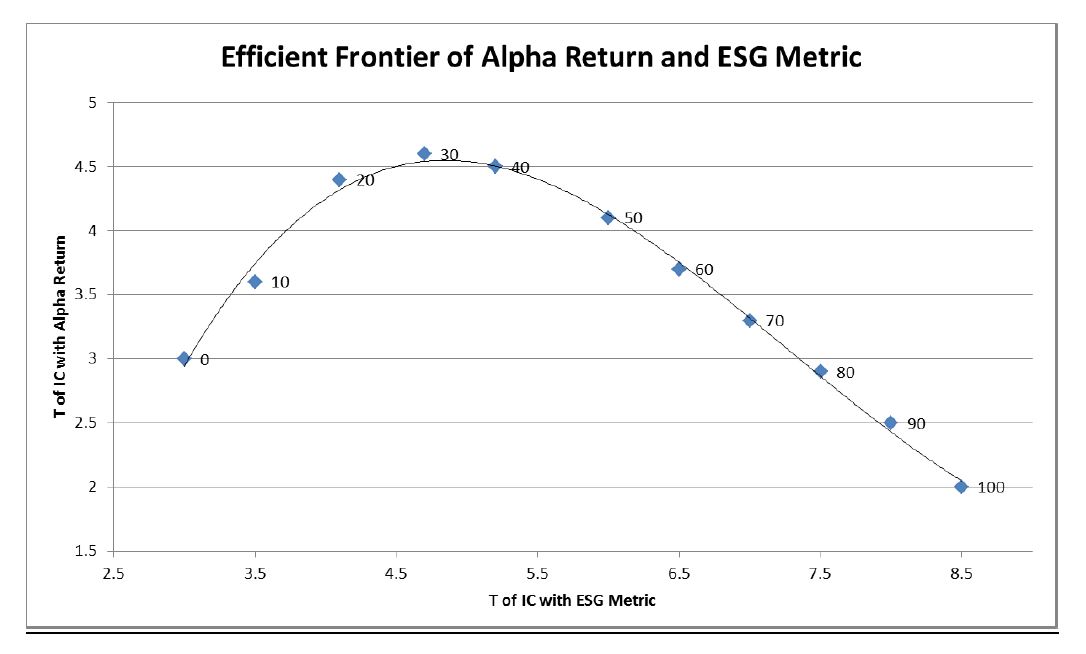

As noted earlier, PanAgora believes that quantitative investors also have an advantage in the areas of portfolio construction and measurements. Following directly the methods proposed in [CM, 2018], PanAgora can inform asset owners of the exact trade-off between alpha return and sustainability goals. In other words, PanAgora can map out an “efficient frontier” for impact investors to decide how best to both express their values and achieve portfolio alpha. Since, by definition, all Impact portfolios are customized portfolios, we believe this is a crucial advantage that quantitative ESG strategies have over fundamental approaches.

Figure 5: Quant ESG portfolios can allow asset owners to position their portfolio on the efficient frontier between alpha and ESG.

Source: PanAgora, for Illustration purposes only.

Conclusion

The investment community’s view on ESG investment has come a long way since the 1970’s. Originally viewed as incompatible with alpha generation, academic and investing communities have now started to view ESG investing and alpha performance as not mutually exclusive, provided the ESG issues considered are material to the portfolio’s holdings. That is, one can “do good while doing well.” There are many ESG data sources in the public space, provided one knows where to look and how to ingest and process the data to make it useful for their investment process. Given the large and diverse varieties of data, and the fact that all impact portfolios are by definition customized portfolios, a quantitative investment approach is well-suited for ESG investing.

Endnotes

1https://en.wikipedia.org/wiki/Friedman_doctrine(go back)

2Both of these companies were in the Dow index in the 70s. Neither of the two companies exist today.(go back)

3For more details on Integration and Impact approaches to Quant ESG investing, see Chen M. and Mussalli G. “Integrated Alpha: The Future of ESG Investing”, Panagora White Paper, 2018. https://www.panagora.com/insights/integrated-alpha-the-future-of-esg-investing/.(go back)

4For example, see Kotsantonis, Pinney, and Serafeim, “ESG Integration in Investment Management: Myths and Reality”, Journal of Applied Corporate Finance, Vol. 28, No. 2, pp 10-16, Spring 2016.; and Chen M. and Mussalli G. “Integrated Alpha: The Future of ESG Investing”, Panagora White Paper, 2018. https://www.panagora.com/insights/integrated-alpha-the-future-of-esg-investing/.(go back)

5See Khan, Serafeim, and Yoon, “Corporate Sustainability: First Evidence on Materiality”, The Accounting Review 91, 1697-1724, 2016 for more on link between materiality and economic performance.(go back)

6Exclusion-based approach only requires list of companies to be excluded. While Integration/Impact approach requires data that can provide insight on a variety of ESG-related considerations.(go back)

7For example, see https://www.forbes.com/sites/bernardmarr/2015/09/30/big-data-20-mind-boggling-facts-everyone-must-read/#205c9a0a17b1.(go back)

8For more details, see the Aggregate Confusion Project at MIT: http://web.mit.edu/rigobon/www/aggregate-confusion-project.html.(go back)

9For example, a Nordic SWF may care about carbon emission, while a Midwestern pension fund make emphasize workplace equality.(go back)

10https://www.un.org/sustainabledevelopment/sustainable-development-goals/(go back)

11For more discussions on ESG integration vs ESG impact portfolios, and a mathematical framework that span both approaches, see Chen M. and Mussalli G. “Integrated Alpha: The Future of ESG Investing”, Panagora White Paper, 2018. https://www.panagora.com/insights/integrated-alpha-the-future-of-esg-investing/.(go back)

Print

Print