Subodh Mishra is Executive Director at Institutional Shareholder Services, Inc. This post is based on an Institutional Shareholder Services publication by Georgina Marshall, Global Head of Research & Policy at Institutional Shareholder Services.

UNITED STATES

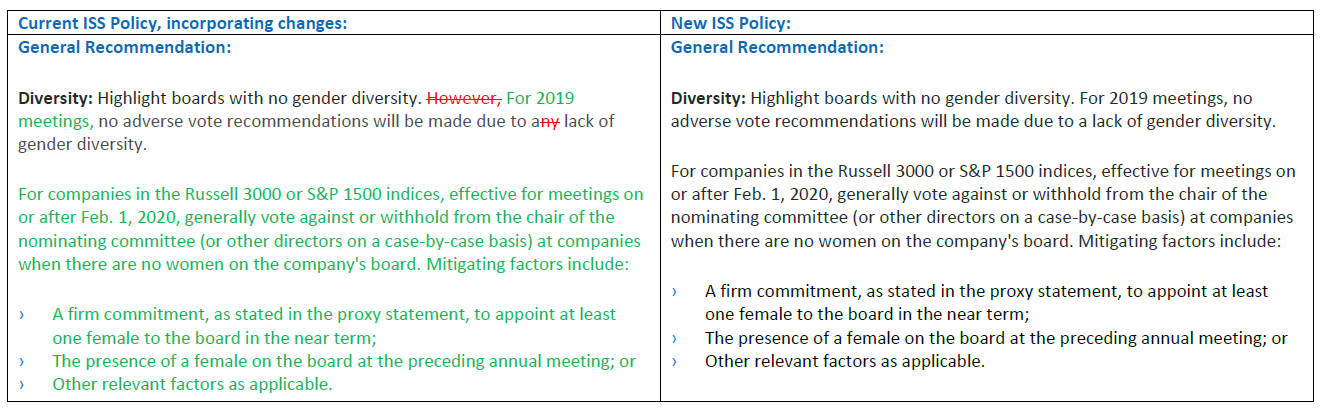

Board of Directors—Voting on Director Nominees in Uncontested Elections

Board Composition—Diversity

Rationale for Change:

1) Investors favor gender diverse boards.

During the 2017 and 2018 proxy seasons, investors increasingly targeted companies with little or no female representation on their boards, citing reasons of equality, good corporate governance, and enhanced long-term company performance. [1] Increased investor engagement on the topic appears to have prompted many boards to add one or more women directors to their ranks over the past two years. When boards fail to respond to such engagement, a number of large investors have cast votes against directors.

As noted in ISS’ 2018 U.S. Proxy Season Review and as shown in the following figure, companies that lacked a gender diverse board were correlated with lower support levels for nominating committee chairs. [2]

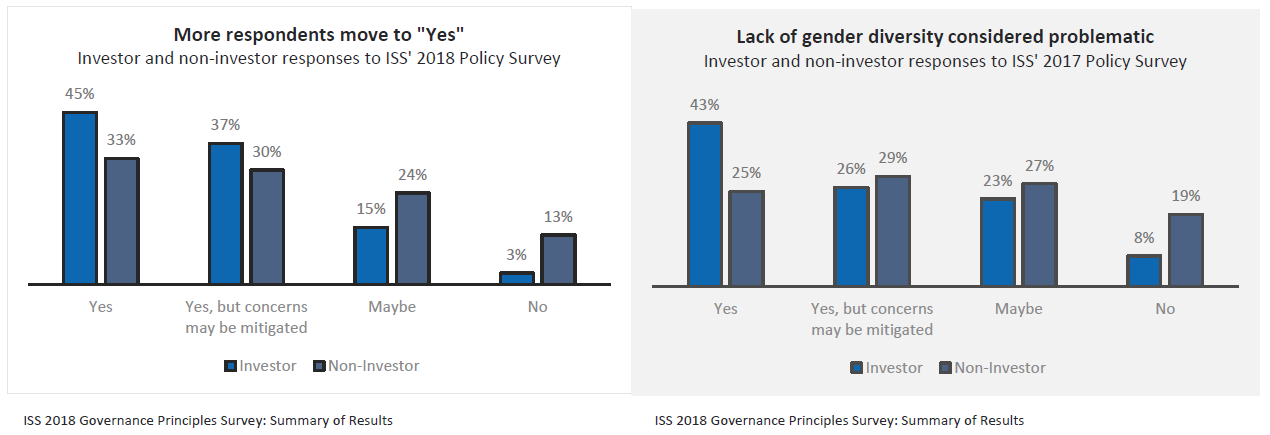

ISS’ 2018 policy survey results show a growing investor preference for boosting levels of boardroom gender diversity. According to the survey results, only three percent of investor respondents stated that they did not consider a lack of board gender diversity to be problematic, and over 80 percent of the investor respondents indicated an absence of gender diversity at the board level to be problematic. [3] Forty-five percent of investor respondents stated that the absence of at least one female director may indicate problems in the board recruitment process. Another 37 percent responded that the recruitment process may be problematic, but such concerns may be mitigated if there is a disclosed policy or approach that describes the steps taken by the board or the nominating committee to boost gender diversity on the board. Fifteen percent of investor respondents answered that lack of diversity could be problematic on a case-by-case basis.

Non-investor respondents generally echoed investors’ responses. A low number (13 percent) stated that a lack of gender diversity on the board is not problematic.

Based on these survey results, most investors and other corporate constituencies consider that the absence of gender diversity may be problematic and should (at a minimum) trigger a deeper examination of a board’s nomination practices and policies. Although both investors and non-investors continue to list engaging with the board or management as their most favored response to a board’s lack of female representation, a growing number of shareholders think that adverse recommendations could be warranted for one or more directors. Non-investors overwhelmingly prefer engagement, but also appear to growingly recognize escalation at the ballot box may be an appropriate action by shareholders in some circumstances.

2) Board gender diversity has been positively correlated to better company performance in some studies.

Many investors view the existence of board gender diversity as good corporate governance in light of a series of studies that have found that board gender diversity is positively correlated to better company performance. [4]

Looking beyond returns, recent ISS and other studies have identified additional benefits to companies and their shareholders from boosting gender diversity in the boardroom. A recent ISS report [5] found that women directors are more likely to possess skillsets that are most sought after by boards. That study found that female nominees surpassed their male peers in the prevalence of skills related to audit, strategic planning, technology, sales, risk management, legal, government, CSR, and human resources.

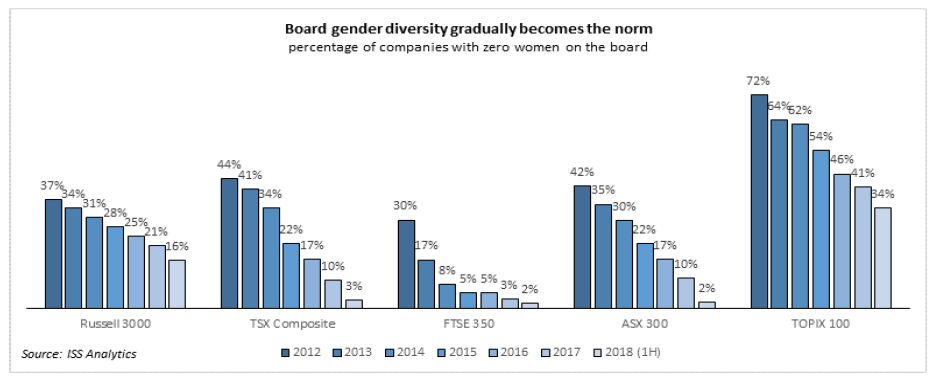

3) Gender diverse boards are the market norm.

According to the 2017 U.S. Board Study: Board Diversity Review, in 2017 and at the time of their annual meetings, 99 percent of the firms in the S&P 500, 90 percent of the S&P 400, and 77 percent of the S&P 600, and 87 percent of the companies in the S&P 1500 had at least one woman on the board. As of Sept. 25, 2018, and according to DataDesk data, only three companies in the S&P 500 had no female directors. Boards with female representation far outnumber all-male boards in the Russell 3000 Index too where, according to Data Desk data, 84 percent of the companies have at least one female on the board. Female representation at the board level has thus become the norm at companies traditionally associated with having better governance practices in the U.S., as well as in other markets, as shown in the figure below.

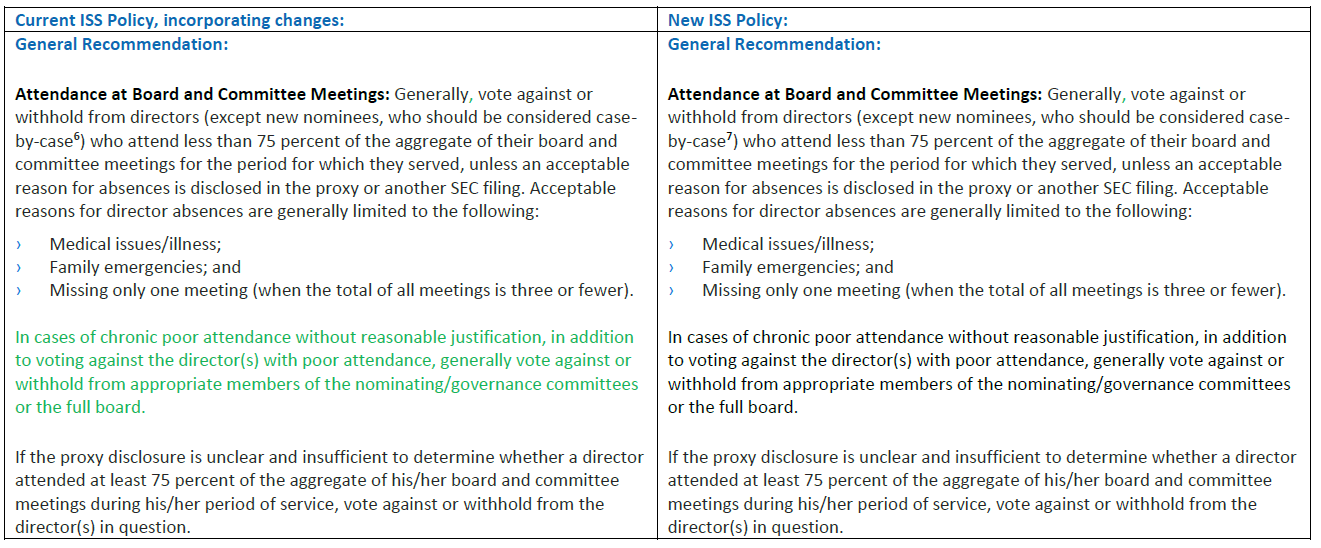

Board Composition—Attendance

Rationale for Change:

ISS is codifying the case-by-case approach taken when faced with situations of possible chronic poor attendance by directors. ISS defines “chronic poor attendance” as three or more consecutive years of poor attendance without reasonable explanation. The policy approach may also be applied in cases where there is a long-term pattern of absenteeism, such as poor attendance the previous year and three out of the four prior years.

Currently, the policy is generally applied as follows:

- After three years of poor attendance by a director, recommend withhold from the chair of the nominating or governance committee;

- After four years, recommend withhold from the full nominating or governance committee; and

- After five years, recommend withhold from all nominees.

When the director with chronic poor attendance is on the ballot, the recommendations at the chair or committee level will be directed towards the nominating committee for the continued nomination of the director, in spite of the poor attendance. When the director is not on the ballot, as in the case of a classified board, the recommendations will be directed towards the governance committee for maintaining a governance structure where the director is not directly accountable to shareholders on an annual basis.

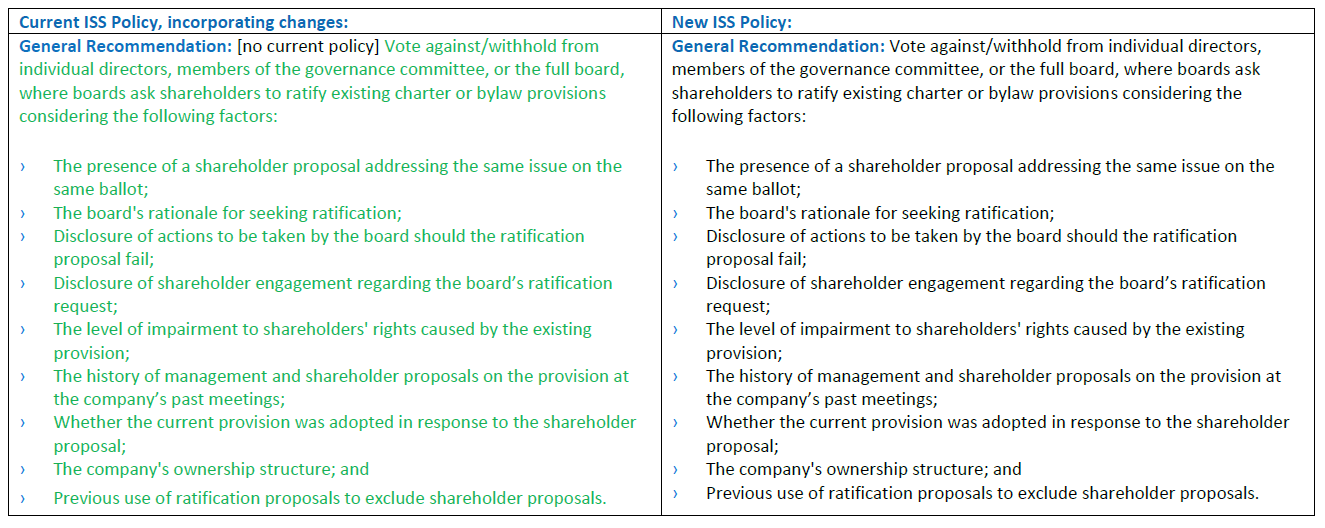

Board Accountability—Management Proposals to Ratify Existing Charter or Bylaw Provisions

Rationale for Change:

The use of board sponsored proposals to ratify existing charter or bylaw provisions increased significantly during the 2018 proxy season in response to guidance from the SEC staff that granted some companies’ requests to grant no-action relief if companies sought to exclude shareholder proposals from their ballots by including a “conflicting” management-sponsored proposal to ratify one or more of their existing governance provision citing 14a-8(i)(9). Seven companies in 2018, for example, obtained no-action relief to exclude shareholder proposals to adopt or amend the right of shareholders to call a special meeting by seeking ratification of their current provision. Notably, none of these ratification proposals made material changes to the provisions that enhanced shareholders’ rights to call special meetings.

These “ratification” proposals appear to have been offered by boards to block shareholder proposals that requested more shareholder-friendly governance provisions from appearing on ballots. Notably, shareholders on numerous occasions on a wide range of issues have demonstrated their ability to thoughtfully vote when both management and shareholder proposals on the same issue appear on the ballot.

Please see the related policy updates regarding Board Responsiveness—Ratification Proposals and Shareholder Rights—Management Proposals to Ratify Existing Charter or Bylaw Provisions (below).

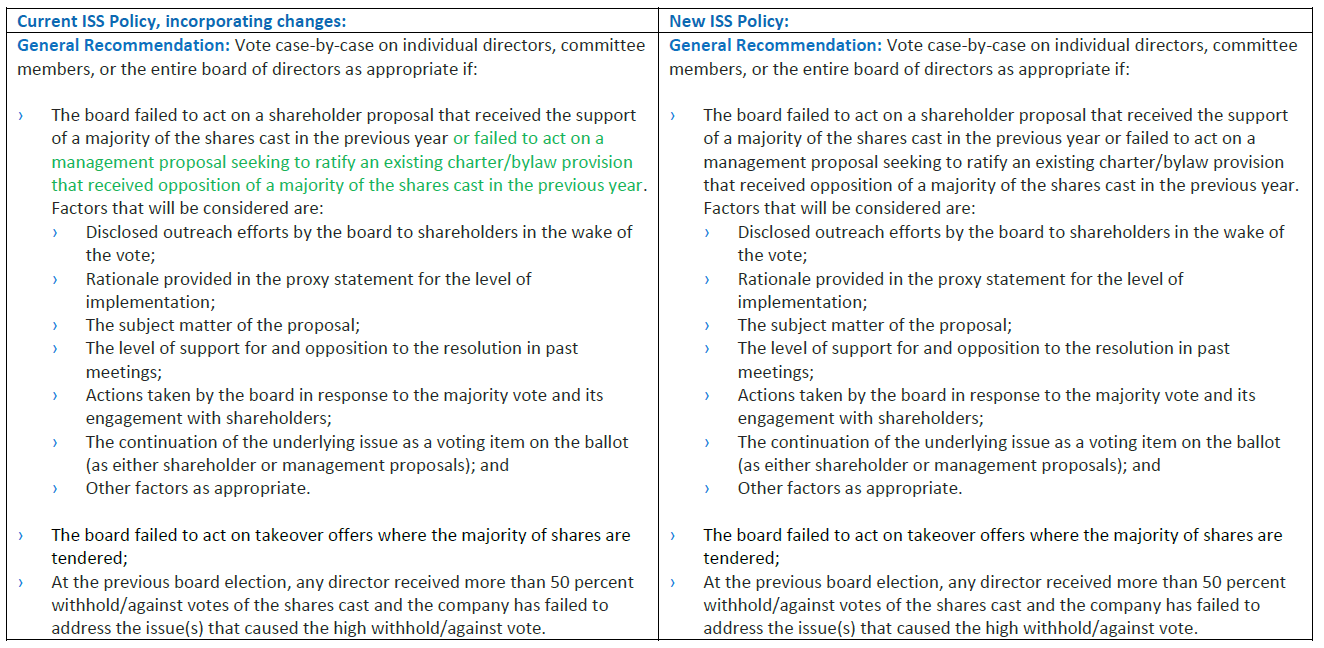

Board Accountability—Director Performance Evaluation

Rationale for Change:

The Director Performance Evaluation policy is intended to identify companies that have a long-term underperformance and a significant number of board entrenchment features. Moving the five-year underperformance test to the initial screen, as opposed to as part of a secondary step in the evaluation, will reduce the number of companies that undergo scrutiny under this policy.

Board Responsiveness—Ratification proposals

Rationale for Change:

This policy update is being made in conjunction with the new policy (see above) that codifies ISS’ approach for analyzing management-submitted ratification proposals of existing charter/bylaw provisions. The existing responsiveness policy is updated to reflect that the failure of a management proposal to ratify existing charter/bylaw provisions to receive majority support will trigger a board responsiveness analysis at the following annual meeting.

Shareholder Rights & Defenses

Management Proposals to Ratify Existing Charter or Bylaw Provisions

Rationale for Change:

See Board Accountability—Management Proposals to Ratify Existing Charter or Bylaw Provisions (above).

Capital/Restructuring

Reverse Stock Splits

Rationale for Change:

The policy on reverse stock splits is being updated to codify the approach currently taken for companies that are not listed on major stock markets/exchanges and are not proportionately reducing their authorized shares. Delisting notices are not applicable to companies that do not trade on a major market/exchange. The policy is being broadened to include consideration of other critical factors for all companies, exchange listed and non-exchange listed, where substantial risks exist—in particular, whether they will continue as going concerns.

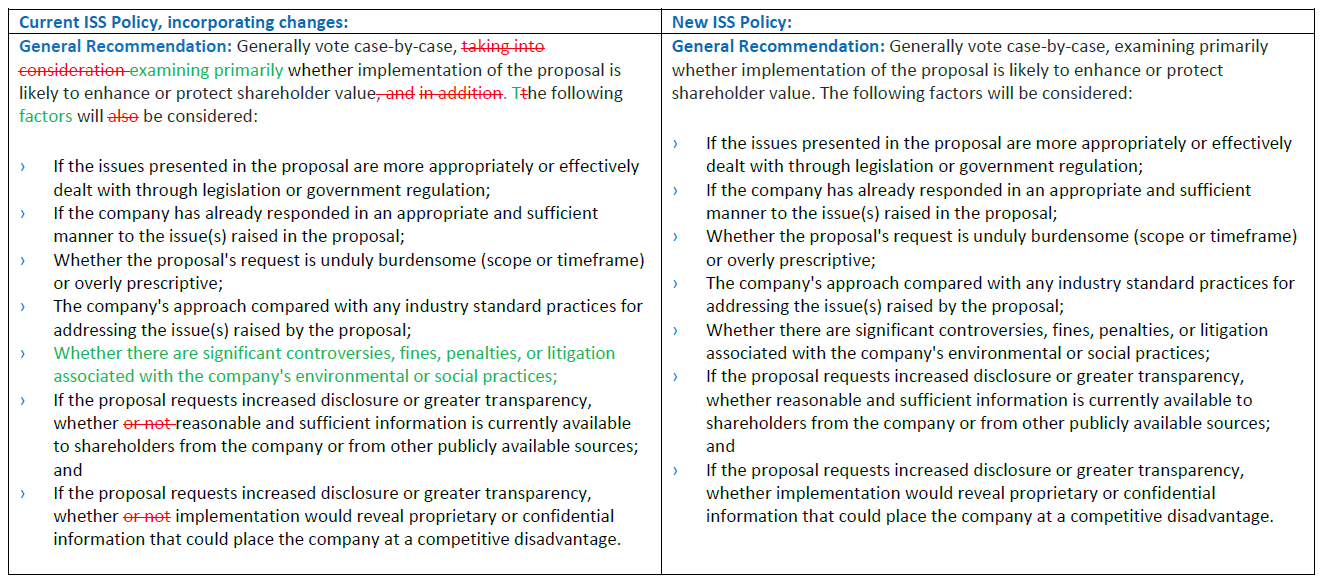

U.S. AND CANADA

Social and Environmental Issues

Global Approach

Rationale for Change:

The update is being made to codify the factors that are already taken into consideration in ISS’ case-by-case analyses of environmental and social (E&S) shareholder proposals. The update makes it more explicit that significant controversies, fines, penalties, or litigation are considered when evaluating E&S shareholder proposals.

The complete publication, including footnotes, is available here.

Endnotes

1See Kosmas Papadopoulos, Robert Kalb, Angelica Valderrama and Thomas Balog, U.S. Board Study: Board Diversity Review, p. 11-12, Apr. 11, 2018.(go back)

2United States: Uncontested Director Elections & Governance Proposals: 2018 Proxy Season Review.(go back)

3ISS, 2018 Governance Principles Survey: Summary of Results, p. 7, 12-14, Sept. 18, 2018.(go back)

4Conyon, Martin J. and He, Lerong, Firm Performance and Boardroom Gender Diversity: A Quantile Regression Approach, March 16, 2017; Deloitte, Global Center for Corporate Governance, Women in the boardroom: A global perspective, P. 3-4, Fifth Ed. (2017); PwC, Governance Insights Center, PwC’s 2017 Annual Corporate Directors Survey, p. 11-12; Vivian Hunt, Dennis Layton and Sara Prince, McKinsey & Co., Diversity Matters, Feb. 2, 2015; Marcus Noland, Tyler Moran and Barbara Kotschwar, Peterson Institute for International Economics, Is Gender Diversity Profitable?, February 2016.(go back)

5Anthony Garcia, ISS Custom Research, Director Skills: Diversity of Thought and Experience in the Boardroom, Governance Insights, Sept. 14, 2018.(go back)

6New nominees who served for only part of the fiscal year are generally exempted from the attendance policy.(go back)

Print

Print