Friso van der Oord is Director of Research and Barton Edgerton is a Research Consultant at the National Association of Corporate Directors (NACD). This post is based on their NACD memorandum.

About Our Survey

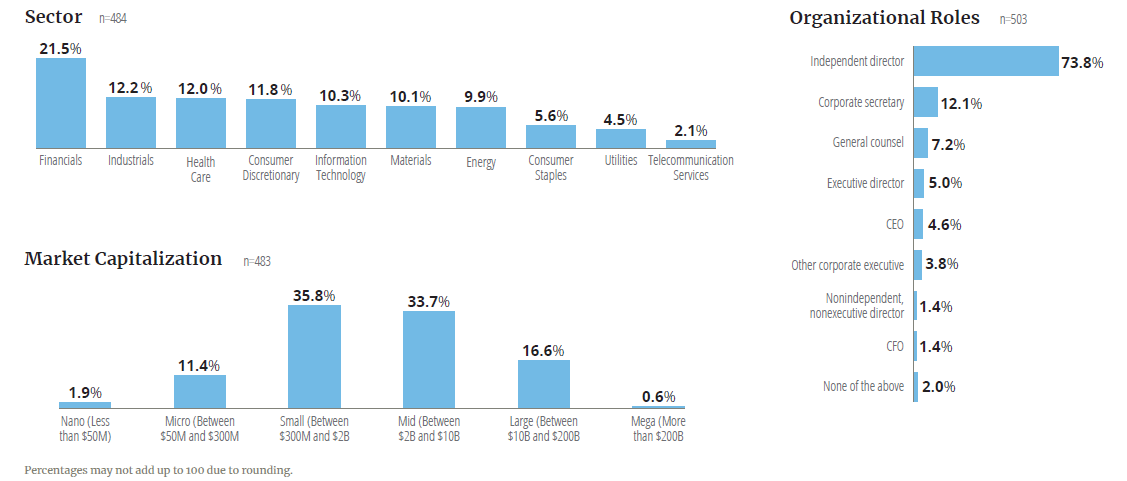

The 2018–2019 NACD Public Company Governance Survey presents findings from our annual questionnaire. This report details responses from more than 500 public-company directors. Findings from our private company governance survey are published separately. The first section of this publication presents key findings from our analysis of the data. The second section is a chart-based data appendix containing descriptive statistics and frequencies for all questions in the survey with aggregate responses to questions covering the most critical board leadership and governance topics. Results come from the more than 80 survey questions. Analysis derived from the Russell 3000 was provided by Main Data Group.

Methodology and Demographics

Data Collection

Leveraging its proprietary member database as a sample frame, NACD sent email invitations to directors and others who serve on public-company boards asking them to participate in our annual governance survey. The questionnaire was administered electronically, and respondents were instructed to respond on behalf of one of the boards on which they serve. Those serving on multiple boards were encouraged to fill out surveys reflecting their experiences on each of them.

Analysis

For questions regarding matters of individual opinion, each response is counted individually. If the unit of analysis for a given question is the board itself (for example, those regarding board structure), duplicate responses on behalf of the same board are counted once. Percentages are based on the total number of responses specific to each question. For example, if a question received only 400 out of 414 total responses, and 300 respondents answered “yes” while 100 answered “no,” the result is reported as 75 percent affirmative. In some cases, survey responses totaling less than 5 percent are not represented in graphs for the sake of clarity.

Key Findings

- Directors report that changes in the regulatory climate, the prospect of an economic slowdown, growing cybersecurity threats, business-model disruptions, and worsening geopolitical volatility will most significantly impact their organizations in 2019. These often interconnected risks have increased business uncertainty as management finds their likelihood difficult to anticipate and their impacts difficult to mitigate.

- Directors rate artificial intelligence (AI) as the biggest technology disruptor but also regard it as the biggest business enabler likely to benefit their organizations in the next 12 months.

- Strengthening oversight of strategy execution and risk management, in light of these disruptive forces, are top improvement priorities for boards in 2019.

- Although environmental, social, and governance (ESG) issues are currently a relatively low priority for many boards, most directors would like their boards to take more action and enhance ESG oversight.

- Most boards demonstrate mixed performance as strategic assets to their organizations (against the framework defined in NACD’s 2016 Blue Ribbon Commission report). Specifically, only a minority of them effectively use tenure-limiting mechanisms and invest in individual director development to ensure their boards remain fit for purpose.

- Board oversight of corporate culture is more robust than last year. Not only do directors report a solid understanding of management’s tone at the top, but they also are developing a better grasp of culture at the middle and lower levels of the organization.

- The vast majority of directors, 81 percent, believe that their boards’ understanding of cyber risks has improved over the last two years. One reason may be that 50 percent of directors indicate that cyber-risk reporting from management is of much higher quality than it was two years ago.

- Quarterly board agendas typically cover six to seven major governance issues, reflecting the growing mandate of public-company boards and underlining the difficulty for directors in balancing the breadth and depth necessary for effective oversight.

- Over the last 12 months, directors spent nearly twice as much time reviewing materials from management as they allocated to reviewing relevant information from external sources, revealing a heavy dependence on management views and analysis in fulfilling their oversight duties. However, 53 percent of directors indicate that the quality of management reporting to the board must improve, suggesting that boards need better—not more—information from management.

- A large majority of directors (88%) agree that their board’s primary role is to guide the organization’s long-term strategic direction. To reinforce this board mandate, their use of nonfinancial metrics in designing CEO pay is growing. Further, more than half of boards now communicate directly with investors, with board oversight of long-term strategy the most frequent topic of investor dialogue.

- Despite calls for increasing gender diversity on public company boards, progress has been scant. On average, only 16.5 percent [1] of board seats of companies in the Russell 3000 index are held by women. But 53 percent of boards now have a formal goal to diversify their composition. Of those boards, 70 percent report that their diversity mandate is driven by the need to enhance cognitive diversity of boards, while 49 percent indicate that increased diversity is a moral imperative.

Endnotes

1Main Data Group.(go back)

Print

Print