Michael Albano is partner, Julia M. Rozenblit is a practice development lawyer, and Emily C. Barry is a law clerk at Cleary Gottlieb Steen & Hamilton LLP. This post is based on their Cleary memorandum. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

ISS recently released updates to its Frequently Asked Questions (“FAQs”) on U.S. Compensation Policies and Equity Compensation Plans. [1] The FAQs are intended to provide general guidance regarding the way in which ISS will analyze certain issues as it prepares proxy analyses and determines vote recommendations for U.S. public companies.

A summary of updates to the FAQs is provided below. In addition to the ISS and Glass Lewis proxy voting guidelines that were released in the fall of 2018, U.S. public companies should consider the applicability of the ISS FAQs in light of their individual facts and circumstances. [2]

Compensation Policies

Pay for Performance Evaluation

- Quantitative Pay-for-Performance Screens. ISS confirmed that there will be no changes to its quantitative screens for 2019 and that the Financial Performance Assessment screen will continue to use GAAP/accounting performance measures. Consistent with the updates to its 2019 voting policies, ISS indicated that it is continuing to explore the potential for future use of Economic Value Added (“EVA”) measures to add additional insight into a company’s financial performance, and EVA measures will be displayed in ISS research reports on a phased-in basis over the 2019 proxy season.

- TSR as an Incentive Program Metric. ISS indicated that it does not endorse or prefer the use of total shareholder return or any specific metric in executive incentive programs. While ISS recognizes that investors prefer emphasis on objective and transparent metrics, it believes that the board and compensation committee are generally best qualified to determine which metrics will encourage executive decision-making that promotes long-term shareholder value creation.

- Analysis of “Front-Loaded” Awards. ISS stated that it is unlikely to support equity grants that cover more than four years (i.e., the grant year plus three future years) on the basis that very large awards intended to cover future years limit the board’s ability to adjust future pay to account for unforeseen events or changes in performance or strategic focus. ISS indicated that when a company grants front-loaded awards, any commitments not to grant additional awards over the covered period should be firm. In addition, due to the potential for outsized payouts, in making its recommendations ISS will more closely scrutinize the usual pay-for-performance considerations and consider (i) completeness of disclosure, (ii) emphasis on transparent and rigorous performance criteria and (iii) stringent vesting provisions that limit windfall risk. This updated ISS position is not surprising given ISS’ historical tendency to provide negative recommendations for so-called mega-grants, like the one recently granted by Tesla to CEO Elon Musk.

ISS’ approach is also in line with Glass’s Lewis’ announced policy for the 2019 proxy season, under which Glass Lewis will consider the quantum (on an annualized basis), design and the company’s rationale for granting such awards, as well as a firm commitment not to grant additional awards for a defined period. Companies considering front-loaded awards should be particularly mindful of these new policies both when determining whether to grant such awards and in the design and structure of any such awards.

Problematic Pay Practices

- Problematic Pay Practices Likely to Result in An Adverse Recommendation. ISS deems certain pay practices problematic and thus likely to result in an adverse say-on-pay vote recommendation. Problematic pay practices added in 2019 include: [3]

- New or materially amended agreements that provide for: (i) problematic “Good Reason” termination definitions that present windfall risks, (ii) change in control (“CIC”) severance payments in connection with a problematic “Good Reason” definition and (iii) excessive termination payments (generally exceeding three times base salary and average, target or most recent annual bonus).

- Insufficient executive compensation disclosure by externally-managed issuers (“EMIs”), such that a reasonable assessment of pay programs and practices applicable to the EMI’s executives is not possible.

- Evaluation of “Good Reason” Termination Definitions. ISS believes that CIC severance payable in connection with a “Good Reason” termination should be limited to circumstances that are reasonably viewed as an adverse constructive termination. ISS will focus its review on “Good Reason” definitions that present a potential windfall risk and considers problematic definitions that are triggered by potential performance failures (e.g., a company bankruptcy or delisting). ISS also indicated that “Good Reason” definitions that are triggered by a successor’s failure to assume a specific agreement will no longer trigger the problematic pay practices policy. This focus on “Good Reason” definitions that go beyond the more typical triggers such as a diminution in duties/role or reductions in compensation suggests that companies should review any “Good Reason” definitions in agreements with their executives in order to determine whether any such definitions could result in an adverse say-on-pay vote recommendation by ISS.

- Reduced Compensation Disclosure for “Smaller Reporting Companies”. The SEC’s recent change to the definition of a “smaller reporting company” (“SRC”), will result in an expansion in the number of companies that are entitled to provide scaled-back compensation disclosure requirements. In its FAQs, ISS focused on the fact that SRCs are still required to hold say-on-pay votes, and emphasized the importance of completeness of disclosure as a pay-for-performance consideration. ISS indicated that companies entitled to provide scaled-back compensation disclosure requirements should continue providing sufficient disclosure to enable investors to make informed say-on-pay votes. If the disclosure is such that shareholders cannot meaningfully assess the board’s compensation philosophy and practices, ISS is unlikely to support a say-on-pay proposal.

The policy expressed in the ISS FAQs is in line with Glass Lewis’ updated voting policies for 2019, which provide that Glass Lewis will consider the impact of materially decreased CD&A disclosure when formulating say-on pay recommendations and may consider recommending against members of a compensation committee in instances where a reduction in disclosure substantially impacts shareholders’ ability to make an informed assessment of the company’s executive pay practices. These new policies reflect a tension between SEC requirements and proxy advisory firm policies that are seemingly seeking to legislate beyond those requirements, and suggest that companies that are now—but were not previously—eligible for reduced disclosure should carefully evaluate the new guidance in determining whether to streamline their disclosure moving forward.

- Compensation Program Changes Made in Light of the Section 162(m) Amendments. In connection with 2017 tax reform, the qualified performance-based compensation exception under Section 162(m) of the Internal Revenue Code (“Section 162(m)”) was eliminated, subject to transition relief, with the result that many companies will no longer be able to deduct significant portions of executive compensation. Unsurprisingly, ISS has indicated that despite the elimination of the exception, shifts away from performance-based compensation and toward discretionary or fixed pay elements will be viewed negatively as a problematic pay practice by ISS when recommending a vote on say-on-pay. ISS also clarified its analysis of equity plan proposals in connection with the amendments to Section 162(m) in its Equity Compensation Plans FAQs, as described in greater detail below.

Non-Employee Director Pay

- “Excessive” Levels of Non-Employee Director Pay. Last year, ISS announced that it may issue adverse vote recommendations for board members responsible for approving or setting non-employee director (“NED”) pay when there is a recurring pattern, defined as two or more consecutive years, of excessive pay without a compelling rationale. This year, ISS updated its quantitative methodology to identify NED pay outliers (i.e., individual NED pay figures above the top 2-3% of all comparable directors) as a result of additional investor feedback. ISS will now compare individual NED pay totals within the same index and sector, and directors will be compared to other directors within the same two-digit GICS group and within the same index grouping. [4] The revised methodology recognizes that board-level leadership positions, limited to non-executive chairs and lead independent directors, often include a pay premium as compared to other directors. For non-executive directors who serve in these board leadership positions, the policy will identify outliers as compared to others within the same category of board leadership (still considering index and sector). The updated methodology will also consider limited instances of narrow distributions of NED pay within any particular sector-index grouping. In groups where there is not a pronounced difference in pay magnitude between the top 2-3% of directors and the median director, this may be considered as a mitigating factor. If ISS identifies a NED pay outlier based on the updated quantitative analysis described above, it will continue to conduct a qualitative analysis of the company’s disclosure to determine whether such concerns are adequately mitigated. Factors that would typically mitigate the concern around high NED pay include:

- Onboarding grants for new directors that are clearly identified to be one-time in nature;

- Special payments related to corporate transactions or special circumstances (such as special committee service or requirements related to extraordinary need); or

- Payments made in consideration of specialized scientific expertise (as may be necessary in certain industries such as biotech/pharma).

Payments in connection with separate consulting agreements will be assessed on a case-by-case basis with particular focus on the company’s rationale, and payments to reward general performance or service will generally not be viewed as a compelling rationale.

In light of the change to its methodology, ISS will not issue adverse vote recommendations under this policy until meetings occurring on or after February 1, 2020 (i.e., for companies where ISS has identified excessive NED pay without a compelling rationale in both 2019 and 2020). [5] However, this change in methodology is consistent with increased proxy advisory and shareholder scrutiny of NED pay and, as a result, companies would be advised to more proactively review their current NED pay programs to the extent they have not already done so.

Equity Compensation Plans

Section 162(m)

- Plan Proposals Seeking Section 162(m) Shareholder Approval. Although 2017 tax reform eliminated the qualified performance-based compensation exception under Section 162(m), certain awards may continue to qualify for transition relief. As a result, equity plan proposals seeking shareholder approval for Section 162(m) qualification will likely continue to appear on ballots (albeit less frequently than in the past). ISS confirmed that its evaluation of Section 162(m)-related proposals remains consistent with prior years. Further, proposals that only seek shareholder approval in order to ensure the tax deductibility of performance-based awards under the Section 162(m) grandfather and that do not seek additional shares for grants or approval of any plan amendments will generally receive a favorable vote recommendation regardless of Equity Plan Scorecard (“EPSC”) factors (“positive override”), provided that the compensation committee or other administering committee is 100% independent under ISS standards.

- Plan Amendments Reflecting Section 162(m) Changes. ISS will view plan amendments that remove general references to Section 162(m) qualification, including references to approved metrics for use in performance plan-based awards, as administrative/neutral. However, if a plan contains provisions reflecting good governance practices, even if no longer technically required under Section 162(m), the removal of such provisions may be viewed as a negative change in a plan amendment evaluation. In particular, the FAQs highlight the removal of individual award limits, which are no longer required as a result of the changes to Section 162(m), as a negative change. Companies that are considering plan amendments to reflect Section 162(m) changes should therefore be mindful of any revisions that might result in the elimination of what would otherwise be viewed as a best practice and thus result in potential negative ISS vote recommendations.

EPSC

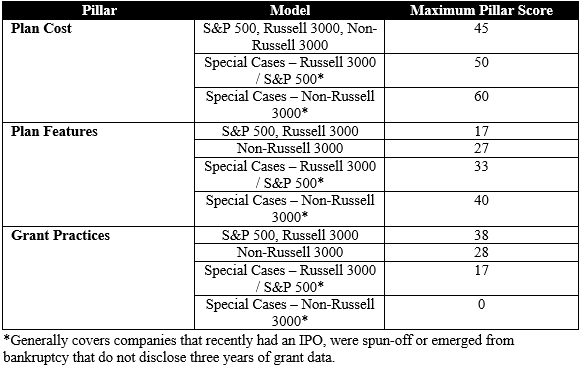

- Overview. ISS’ EPSC considers a range of positive and negative factors, grouped under three “pillars” (Plan Cost, Plan Features and Grant Practices) in order to evaluate equity incentive plan proposals. ISS does not equally weight EPSC factors. Instead, each factor is assigned a maximum number of potential points, which may vary by model. For all models, the total maximum points that may be accrued is 100. The passing score (absent overriding/egregious factors) is 53 for all models except the S&P 500 model, which has a passing score of 55. Although ISS continues to issue negative vote recommendations for plan proposals that feature certain egregious characteristics, a company’s total EPSC score will generally determine ISS’ vote recommendation. There are currently five EPSC models, based on the type and status of the company being evaluated. The maximum scores by EPSC model and pillar are shown below.

- Changes for 2019. For 2019, ISS (i) adjusted the weighting of its EPSC pillars and certain factor scores, (ii) updated certain factors under the Plan Features and Grant Practices pillars of the model and (iii) added a new negative overriding factor, each as described in greater detail below. These updates will apply to ISS’ EPSC evaluations effective for meetings on or after February 1, 2019.

- Adjustments to Pillar Weight and Factor Scores. This year, ISS decreased the weighting of the Plan Features pillar and increased the weighting of the Grant Practices pillar for S&P 500, Russell 3000 and Non-Russell 3000 companies. The weight of the Plan Features pillar was decreased to 17 (from 19) for S&P 500 and Russell 3000 companies, and to 27 (from 30) for Non-Russell 3000 companies. The weight of the Grant Practices pillar was increased to 38 (from 36) for S&P 500 and Russell 3000 companies and to 28 (from 25) for Non-Russell 3000 companies. In addition, certain factor scores have been adjusted, per ISS’ proprietary scoring model. Among these adjustments, weighting on the plan duration factor under the Grant Practices pillar has increased to encourage plan resubmission to shareholders more often than listing exchanges require. This increase in weighting suggests that ISS is attempting to counter the possibility of less frequent shareholder approval of equity plans in the wake of Section 162(m) tax reform.

- CIC Vesting Factor. The CIC vesting factor under the Plan Features pillar was updated to provide points based on the quality of disclosure of CIC vesting provisions, rather than based on the actual vesting treatment of awards. Full points will be earned if the plan specifically discloses CIC vesting treatment for both time- and performance-based awards. If the plan is silent on CIC vesting for either type of award, or if the plan provides for merely discretionary vesting for either type of award, no points will be earned. [6] This update is a bit unexpected given that companies with single trigger CIC vesting for equity awards can now receive full points for this factor so long as such treatment is clearly disclosed. However, in light of double trigger CIC vesting becoming viewed as a “best practice” and ISS’ other policies regarding problematic pay practices, we do not expect to see the market reverse course with a significant uptick in single trigger CIC vesting provisions.

- Vesting of CEO Awards. In prior years, ISS specified that vesting periods that incentivize long-term retention under the CEO’s most recent equity grants during the three prior years were beneficial and could have a positive impact on the Grant Practices pillar score. For 2019, ISS has broadened the scope of this factor to also capture multi-year performance measurement periods that incentivize long-term retention as potentially positively impacting such pillar score.

- Excessive Dilution as Negative Overriding Factor. ISS added excessive dilution to its list of egregious plan features that may result in an adverse equity plan recommendation on a stand-alone basis, regardless of other EPSC factors. Excessive dilution may result in an adverse recommendation for the equity plan proposal if the program is potentially highly dilutive to shareholders’ holdings. This factor will be triggered when the company’s equity compensation program is estimated to dilute shareholders’ holdings by more than 20% (for the S&P 500 model) or 25% (for the Russell 3000 model). This overriding factor examines share capital dilution (as opposed to voting power dilution) calculated as: (A + B + C) ÷ CSO, where: A = # new shares requested; B = # shares that remain available for issuance; C = # unexercised/unvested outstanding awards; and CSO = common shares outstanding. This overriding factor does not apply to the Non-Russell 3000 or Special Cases models.

Endnotes

1The FAQs are available at https://www.issgovernance.com/file/policy/latest/americas/US-Compensation-Policies-FAQ.pdf and https://www.issgovernance.com/file/policy/latest/americas/US-Equity-Compensation-Plans-FAQ.pdf, respectively.(go back)

2Please see our prior blog posts, ISS Updates its 2019 Proxy Voting Guidelines, available at https://www.clearymawatch.com/2018/11/iss-updates-2019-proxy-voting-guidelines/, and Recent Updates to Proxy Advisory Firm Guidelines, available at https://www.clearymawatch.com/2018/11/recent-updates-proxy-advisory-firm-guidelines/, for additional detail.(go back)

3ISS will continue to consider the following pay practices as problematic: (i) repricing or replacing of underwater stock options or stock appreciation rights without prior shareholder approval (including cash buyouts and voluntary surrender of underwater options); (ii) extraordinary perquisites or tax gross-ups; (iii) new or materially amended agreements that provide for excessive CIC payments, single or modified single trigger CIC severance payments (i.e., “walk-away” rights or payments without an involuntary job loss or substantial diminution of duties), CIC excise tax gross-up entitlements (including modified gross-ups), multi-year guaranteed awards, and liberal CIC definitions combined with single-trigger CIC benefits and (iii) any other egregious provision or practice that presents a significant risk to investors.(go back)

4Index groupings for purposes of this policy are as follows: S&P 500, combined S&P 400 and S&P 600, remainder of the Russell 3000 Index, and the Russell 3000-Extended.(go back)

5Given the February 1, 2020 date and the fact that proxy disclosure relates to the prior year, we assume this generally means circumstances where ISS has identified in 2019 and 2020 excessive NED pay without a compelling rationale for the 2018 and 2019 fiscal years, respectively.(go back)

6ISS will not consider disclosure regarding performance-based awards if the plan does not provide for them as a potential award type.(go back)

Print

Print