Jonathan Doorley is partner at Brunswick Group LLP. This post is based on his Brunswick memorandum.

Having a sophisticated and current understanding of how the investment community gathers and processes information is critical for success when a corporate issuer is communicating with the market on an ongoing basis or during a complex situation such as a transaction or responding to a shareholder activist.

Brunswick has been tracking the digital consumption habits of institutional investors and sell-side analysts around the world for a decade, and the results of our latest study reveal important trends that should be considered when formulating both ongoing and event-driven investor engagement programs.

Data Collection Methodology

In the fourth quarter of 2018, Brunswick’s in-house research division (Brunswick Insights) surveyed 318 institutional investors (52%) and sell-side analysts (48%) on their use of digital and social media platforms in the investment research process. 40% of participants were located in the U.S., with the remaining located throughout Europe, the U.K., and Asia. In this report, “digital” refers to any information source, publisher or platform that lives solely online, and “social media platforms” refer to a subset of digital sources where users can consume, share and discuss information.

Highlights of Results

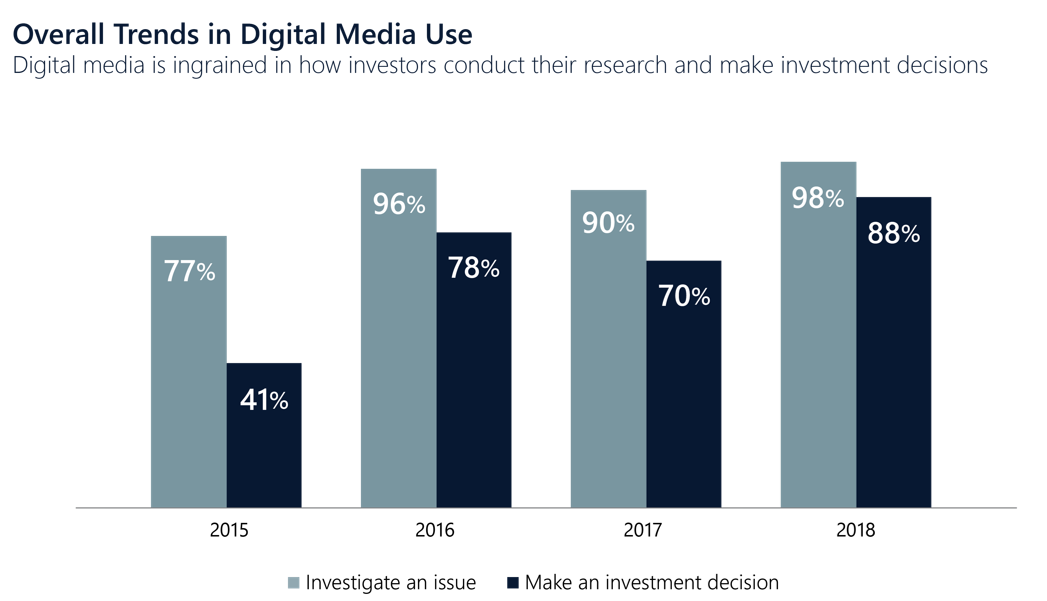

- Use of digital research methods is now ubiquitous—According to our study, 98% of the investment community uses digital sources to investigate and conduct research during their investment process. 88% of participants told us that they make decisions based on information they learned online, marking a significant 18% increase from the 2017 results and a 41% increase from 2015.

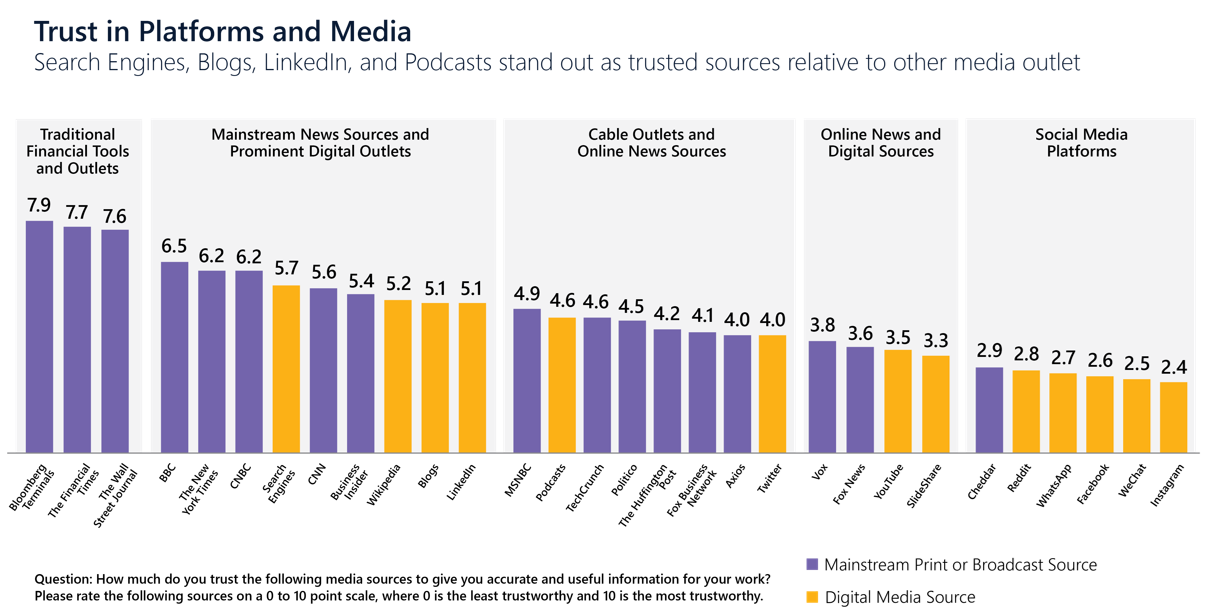

- Trust in digital platforms is accelerating—The investment community is placing increasing levels of trust in information that they’re sourcing online. Though not quite at the same level as the most top-tier financial media, trust levels for digital platforms now compare favorably to other traditional content publishers. For example, information from search engines is trusted on a similar footing with The New York Times, CNBC and CNN. And the top social networking platform, LinkedIn, is more trusted than MSNBC, TechCrunch and Politico. It’s no surprise then that 81% of participants rely upon information retrieved from Google during the research process and 63% of participants use LinkedIn for the same purpose.

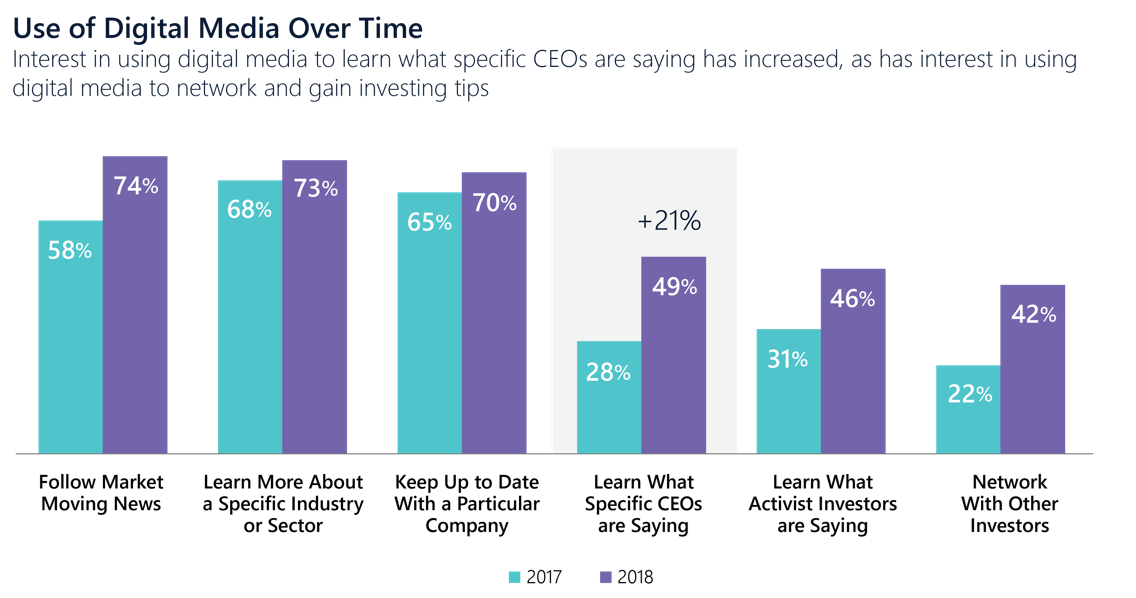

- CEOs are expected to be digitally engaged—The expectation for CEOs to engage with audiences via digital channels is intensifying. Half of participants told us that they now use digital channels to learn what CEOs are saying, a dramatic 21% increase over last year’s results. That increase is especially significant among sell-side analysts, 59% of whom now say that they use digital to stay connected with CEOs.

Key Recommendations for Corporate Issuers

- Utilize all available channels at your disposal—Over the last decade, engaging with the investment community has evolved from a quarterly or annual exercise managed by the investor relations department to an ongoing strategic imperative that demands participation from senior management and independent directors. While nothing will replace the core tenants of a robust investor engagement program—roadshows, conference participation, AGMs, etc.—digital channels provide an opportunity for corporate issuers to communicate directly with investors and analysts on an ongoing basis as well as around times of significant change like an M&A transaction.

- CEOs need to get in on the action—Executives who lack a strong, personal digital profile and content strategy are creating business risk. As a practical matter, building an effective individual digital profile is not just an essential component in a successful investor relations strategy, it is now a necessity for maintaining shareholder value and competing with peers that are more active in digital and social media. Concerns about Reg-FD issues and other SEC disclosure obligations are easily mitigated through careful planning alongside legal counsel.

- Don’t leave anything to chance—With recent studies suggesting that corporate reputation is now directly responsible for up to half of market capitalization, a robust and thoughtful engagement strategy with the investment community—around results, off-cycle, or event-driven—is critical for both maintaining and enhancing shareholder value.

Print

Print