Todd Sirras is Managing Director and Austin Vanbastelaer is a Consultant at Semler Brossy Consulting Group, LLC. This post is based on their Semler Brossy memorandum. Related research from the Program on Corporate Governance includes Executive Compensation as an Agency Problem by Lucian Bebchuk and Jesse Fried.

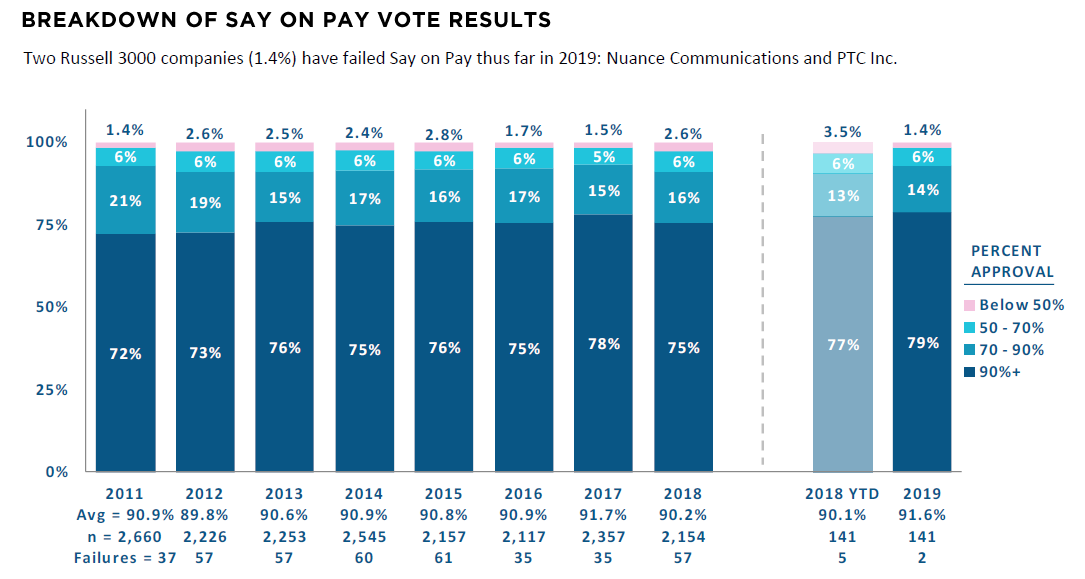

Average Say on Pay support in 2018 declined to the lowest level observed since 2012, driven by an increase in the number of companies receiving vote support below 70%. Shareholder engagement increased on environmental proposals; other environmental, social, and governance (ESG) topics; Board diversity; and the use of GAAP versus non-GAAP performance metrics in compensation program design. Shareholders will continue pushing companies to adopt and disclose formal policies on these topics in 2019 and may vote critically in Say on Pay and Director elections if they feel companies are not sufficiently responsive. A politicized external environment and the growing attention to wealth inequality will also influence companies and introduce further messaging challenges during the second year of the CEO Pay Ratio disclosures.

Prediction 1: Russell 3000 average Say on Pay vote support will continue to decline.

Shareholders will vote more critically when casting Say on Pay votes in 2019, and average vote support will decline for a second consecutive year. Shareholders will continue to push company leadership on a broader range of governance issues this year, and we expect that Say on Pay voting will be used as an indirect mechanism for shareholder activism.

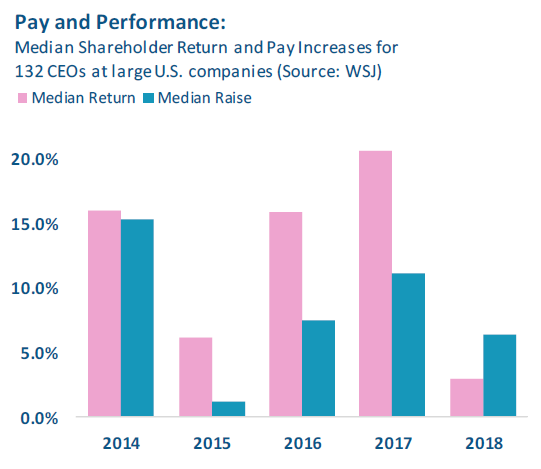

2019 Say on Pay support will also likely reflect a higher degree of pay and performance misalignment for Russell 3000 companies in 2018 than was observed in 2017. Target CEO pay rose last year after 2017’s strong stock market performance, but performance stalled in 2018—total shareholder return (TSR) for the Russell 3000 was flat despite large windfalls from corporate tax benefits. Shareholders will vote more critically in 2019 if they determine that pay is not aligned with the value delivered by a company’s stock, particularly after several years of sustained high returns.

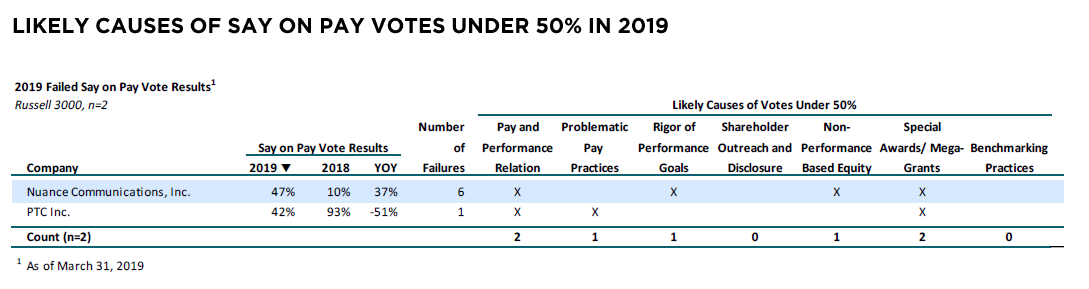

Prediction 2: Russell 3000 Say on Pay failure rate will reach 3% for the first time.

The Say on Pay failure rate has fluctuated year-to-year but has not ended any years below 1.4% or above 2.8% since voting began in 2011. We expect the failure rate to jump above 3% this year for the first time.

Proxy advisors and shareholders will continue to scrutinize compensation program mechanics and incentive goal rigor to ensure pay is meaningfully aligned with performance. This scrutiny will be exacerbated by the flat TSR performance observed in 2018, which will place incremental stress on quantitative evaluations of pay and performance alignment for more companies.

Historical vote results show that three of the four years with the lowest average vote results (i.e., 2012, 2015, and 2018) also had the three highest failure rates. We predict this pattern will continue in 2019, with another year of low average Say on Pay support combined with a record-high failure rate.

Prediction 3: Russell 3000 average Director election vote results will fall below 95%.

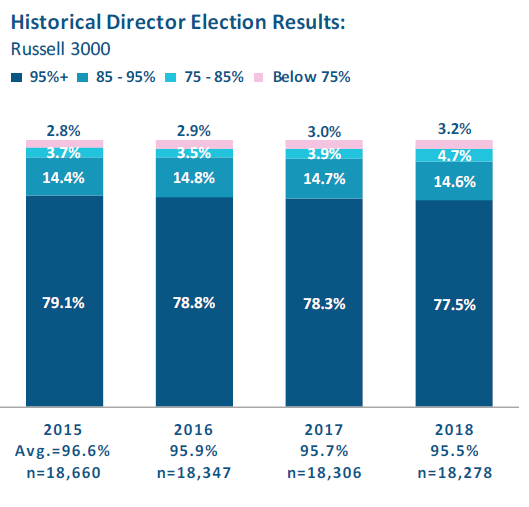

Average Director election vote support declined in each of the last three years, from 96.6% in 2016 to 95.5% in 2018. We expect that shareholders will continue to vote more critically in Director elections in 2019.

The role of Directors has expanded in recent years due to external demands for increased oversight by Boards regarding ESG topics and compensation programs. Shareholders are encouraging Boards to expand the defined responsibilities of Compensation Committees and/or develop separate Environmental and Social Responsibility Committees. Proxy advisors and large investors have released voting policies and guidelines, while states, such as California, have released laws that urge Boards to work towards increasing gender diversity. Such developments have increased the expected accountability of Directors and have created additional opportunities for shareholder activism. We predict that average vote support for Director elections will fall below 95% in 2019 due to this heightened focus on Board governance.

Prediction 4: 20% of Russell 3000 companies will report an alternate CEO Pay Ratio in 2019.

Shareholders became more vocal in requesting that companies disclose more information about their CEO Pay Ratio calculations at the end of 2018. A coalition of 48 institutional investors recently sent a letter to every company in the S&P 500 index. The letter requested enhanced disclosure of a company’s workforce demographics, compensation philosophy, and approach to human capital management in order to provide shareholders with further context around their Pay Ratio. We expect that many large companies will respond to these requests in 2019 by disclosing more detail about their median employee, and that more companies will disclose an alternate Pay Ratio.

Companies will also be challenged to explain year-over-year changes in their CEO Pay Ratio and median employee pay from the 2018 to 2019 disclosure. A one-time CEO pay action or a shift in a company’s workforce demographics can lead to a material change in a company’s Pay Ratio. Some companies with more significant changes will volunteer to calculate and disclose an alternate Pay Ratio using a different and likely more favorable methodology in an effort to provide additional context that they believe to be more reflective of their particular circumstances.

Say on Pay Observations

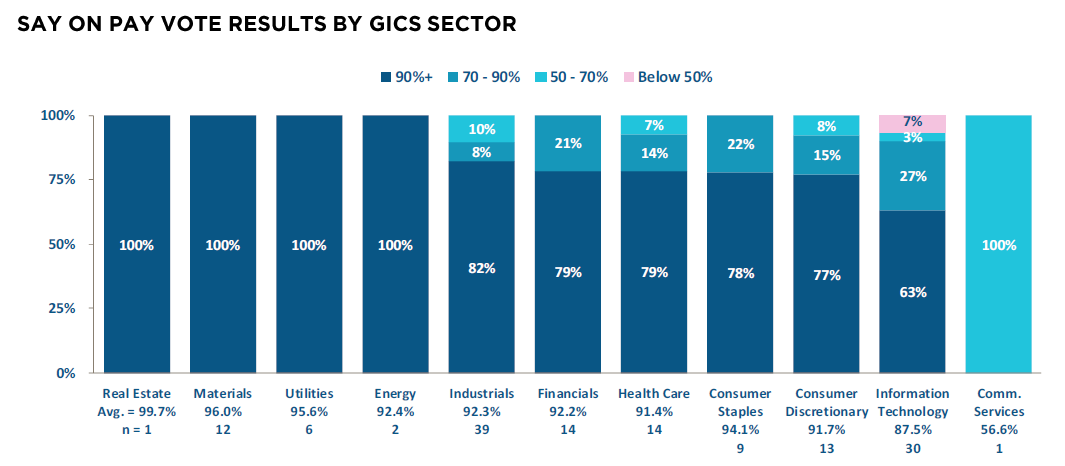

- The current failure rate (1.4%) is 210 basis points lower than the failure rate at this time last year (3.5%)

- The 91.6% average vote result thus far in 2019 is 150 basis points higher than the average vote result at this time last year

- Say on Pay voting for the majority of December 31st fiscal year-end companies will occur in late April and early May

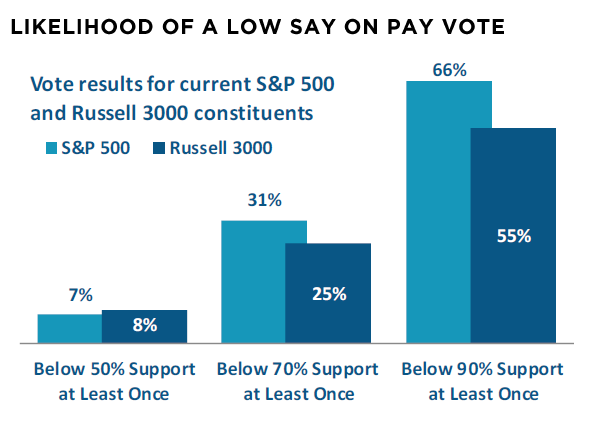

- Nearly one-third of the S&P 500 has received vote support below 70% at least once since 2011

- 8% of the Russell 3000 and 7% of the S&P 500 constituents have failed Say on Pay at least once over the same period

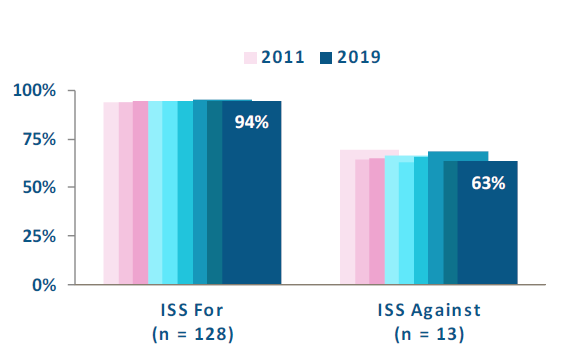

ISS Impact on Say on Pay Vote Results

- The average vote result for companies that received an ISS “Against” recommendation is 31% lower than for companies that received an ISS “For” recommendation

- This is at the high end of the historical average range of 25-30% observed since 2011

- At this time last year, we observed a 39% difference, which declined to 31% by year-end

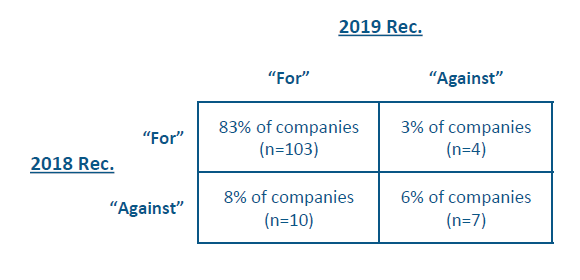

ISS Year Over Year Breakdown

- 14 companies (11.3%) received one “For” and one “Against” recommendation from ISS during the last two years

- 7 companies (6%) received ISS “Against” recommendations in each of the last two years

- Only 3% of companies received consecutive “Against” recommendations in the two prior years (2017 and 2018)

Print

Print