Peter Reali is Senior Director of Responsible Investing, Anthony Garcia is Director of Responsible Investing and Candace Hewitt is Senior Analyst of Responsible Investing at Nuveen, LLC. This post is based on their Nuveen memorandum. Related research from the Program on Corporate Governance includes Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here) and Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here).

Aspirational requests become accountability requirements

In recent years, heightened attention by institutional investors on companies’ responsible business practices has led to increased calls for greater accountability on a variety of environmental, social and governance (ESG) issues.

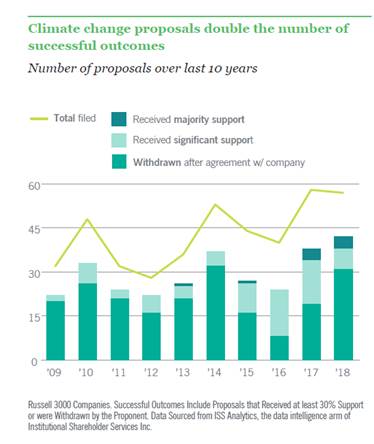

In the last two years, environmental and social issues collectively overtook traditional governance topics to become the primary drivers of more than half the shareholder proposals submitted to U.S. public companies for consideration during their annual meetings. Approximately 450 ESG shareholder proposals were voted in 2018. The overall average vote result on these proposals resumed a long-term upward trend with over 35% of proposals receiving at least 30% support, an increase from 28% in 2017.

Nine environmental and social proposals earned majority support from shareholders in 2018. This was the highest number of such proposals to meet that hurdle of success. Out of these, climate change emerged as the leading issue of interest, with four such proposals attracting over 50% of votes [1].

Inclusion and diversity among boards and workforces has remained a high-profile issue for investors engaging proactively with companies on ESG topics. Board diversity transformed from an aspirational request to an investor demand and regulatory requirement in the span of a year. 2018 also saw a number of unplanned executive departures due to conduct issues, such as sexual harassment. This provided credence to investors’ increasing support of proposals on human capital management.

Proxy statements for 2019 annual meetings will lay out the steps taken by companies to modernize their corporate governance to include environmental and social issues. Meanwhile, shareholder votes at these meetings will illustrate whether or not investors believe companies are, or should be, holding themselves accountable to both shareholders and stakeholders alike.

During the 2019 proxy season, companies will likely face calls for greater transparency on three key issues: board refreshment, climate change and board diversity. While these issues, outlined in more depth below, are not new, investors’ demand for accountability has intensified, and many companies are now addressing these issues for the first time. These topics do not encompass the full scope of ESG issues expected to arise during the 2019 proxy season. They convey a high profile theme that most companies will consider in conducting engagements and preparing their proxy statements.

Board Refreshment

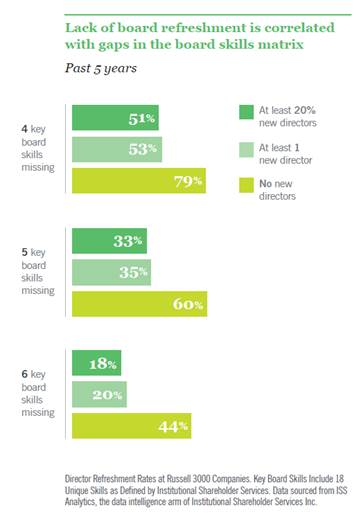

The demand for board refreshment comes from a variety of origins. In some cases, the tenure of a specific director raises concerns regarding objectivity. In other cases, the tenure of the board as a whole raises questions on if there is sufficient diversity of thought in the boardroom. Similarly, investors are focused on whether the skills of the board are sufficient to oversee the growing risks faced by a public company. When there is a clear gap, investors are likely to scrutinize the company’s board refreshment track record and policies around future director recruitment to determine if there may be an oversight risk.

While the skills needed on each board are contextually specific, public companies’ complexity requires boards to look beyond previous CEO and industry experiences in evaluating its composition. Oversight of material ESG risks such as cybersecurity, sexual harassment, and climate change requires skills or knowledge that are not always inherent in more traditional director qualification policies. Effective ongoing board refreshment strategies can also be viewed as a pathway to achieving improved gender and racial diversity on boards.

While the skills needed on each board are contextually specific, public companies’ complexity requires boards to look beyond previous CEO and industry experiences in evaluating its composition. Oversight of material ESG risks such as cybersecurity, sexual harassment, and climate change requires skills or knowledge that are not always inherent in more traditional director qualification policies. Effective ongoing board refreshment strategies can also be viewed as a pathway to achieving improved gender and racial diversity on boards.

Boards that have not added new members for several years may become complacent and can pose risks to long-term performance and effective management oversight. U.S. boards tend to have higher average tenure than other markets (such as Europe) as global governance codes contain specific provisions linking board tenure to board independence. While U.S. investors have not embraced the idea of quotas or mandatory retirement ages, they have become increasingly weary of boards with excessive average tenure. Several investors have adopted policies to vote against nominating and governance committees in these cases. In addition to relevant skills and expertise, many investors have started to engage with companies to ensure board refreshment practices take into account board composition in terms of gender, race, ethnicity, and age.

Climate Change

Energy firms were investors’ initial focus for climate change proposal filings, but subsequent iterations of climate risk-related proposals have targeted companies outside the energy sector. While energy will remain a high priority, sectors with significant fossil fuel use and greenhouse gas (GHG) footprints, such as those with large real estate assets and transportation fleets, will also likely receive attention in 2019. Additional proposals are being filed to request companies report on the feasibility of adopting environmentally sustainable business strategies, or the environmental and monetary costs associated with disposing of environmental waste. Altogether, these signs point to a potential incremental uptick in the number of climate-related proposals shareholders will vote this proxy season.

Current actions by some shareholder proponents have shown an increased conviction to hold companies accountable for climate change risks. To date, there have been a record 75 shareholder proposals related to climate change filed for 2019 annual meetings [2]. An additional illustration of this increased conviction is a recent lawsuit filed to force a vote on a climate change proposal after a company attempted to omit it by seeking SEC no-action relief. While shareholder proponents typically will address their arguments within the SEC’s no-action review process, this willingness to resort to litigation demonstrates not only the importance shareholders place on climate risk, but also their urgency in having it addressed.

Current actions by some shareholder proponents have shown an increased conviction to hold companies accountable for climate change risks. To date, there have been a record 75 shareholder proposals related to climate change filed for 2019 annual meetings [2]. An additional illustration of this increased conviction is a recent lawsuit filed to force a vote on a climate change proposal after a company attempted to omit it by seeking SEC no-action relief. While shareholder proponents typically will address their arguments within the SEC’s no-action review process, this willingness to resort to litigation demonstrates not only the importance shareholders place on climate risk, but also their urgency in having it addressed.

Standard-setters such as the Financial Stability Board’s Task Force on Climate Related Financial Disclosure (TCFD) and policy makers in the European Commission seek to raise the bar regarding climate mitigation disclosures by companies and asset managers. In light of recent pull-backs in environmental regulations in the U.S., we expect investor demand for climate-resilient investment solutions will continue to grow. This reflects an inclination towards driving private sector solutions to address the gaps in policies meant to limit global warming.

We anticipate that in 2019 shareholder advocates will continue to encourage ambitious target-setting, such as achieving net zero emissions, increasing revenue tied to green strategies, or tying environmental metrics more explicitly to executive compensation. Companies should be proactive in identifying business operations or market opportunities where sustainable practices can create value.

Diversity & Inclusion

Since 2015, momentum has grown for diversity-related shareholder proposals. Investors have made significant inroads expanding the conversation on a range of diversity related proposals, from requests that boards establish enhanced diversity policies, to proposals seeking disclosure of workforce diversity statistics and pay gap risk assessments.

Investors continued voting on this issue in 2018. While the number of proposals seeking a report on pay equity or pay gap analysis declined, those seeking more detailed disclosure of diversity in the workforce increased. Institutional investors have become less amenable to accepting boilerplate disclosure, and some have pressed companies for further details on workforce composition and compensation issues. This continued push by shareholder proponents has been aimed at both the board and employee levels.

Underscoring the sustained investor pressure for more gender-diverse boards, California adopted legislation requiring one female director on the board in 2019 and up to three female directors by 2021 [3]. Other states may soon adopt similar legislation [4]. With new legislative requirements and continued shareholder engagement underway, we expect to observe a continued incremental increase in the proportion of women on boards over the next few years.

With gains on the horizon at the board level, investors will likely ramp up focus on broader employee-related diversity considerations. This builds on momentum from shareholder proposals and the wider societal focus on harassment and discrimination affecting workers. Proposals seeking disclosure of workforce employment data have attracted significant increases in average support, from between 20-24% for 2013- 2016, to 28% in 2017, and to 40% in 2018. One such proposal recently received majority support [5].

Industries in the spotlight have included financial service firms and technology enterprises, but we expect to see a broader variety in 2019. Companies whose reputations have been tarnished by related controversies—whether executive misconduct, sexual harassment, pay and labor concerns—could attract additional scrutiny in the form of shareholder proposals. Those shareholder proposals will likely request enhanced disclosure of more detailed employee metrics (i.e. workforce diversity composition and pay equity), or enhanced accountability mechanisms (i.e. enhanced clawback policies that incorporate reputational risk).

In Closing

Each of the topics described above represent one avenue investors use to evaluate not only the inputs to the board’s strategy and oversight, but also the outcomes achieved from both a shareholder and stakeholder perspective. If a company is going to create long-term value for its shareholders, then it must recognize investors are looking beyond the balance sheet to understand how the environment, customer, employees, suppliers, and communities are incorporated into the company’s strategy and its business operations.

Endnotes

1Belyeu, Kathy, Enver Fitch and Angelica Valderrama. “U.S. Environmental and Social Issues -2018 Proxy Season Review” ISS. August 30, 2018 (p.4). (go back)

2Based on ISS data of shareholder resolutions at Russell 3000 companies for 2019, as of February 2019.(go back)

3See Senate Bill 826. The law requires all publicly-traded companies headquartered in the State to have at least one female director by the end of 2019. The law further requires that by year-end 2021, all firms have at least one female director if the board has four members or fewer, two female directors if the board has five members, and three female directors if the board has six members or more.(go back)

4See e.g. New Jersey Bill introduced in November 2018. Njleg.state.nj.us. (2019). A4726. [online] Accessible https://www.njleg.state.nj.us/2018/Bills/A5000/4726_I1.HTM.(go back)

5Based on ISS data of shareholder resolutions at Russell 3000 companies for meetings from 2013-2018.(go back)

Print

Print