David H. Kistenbroker, Joni S. Jacobsen, and Angela M. Liu are partners at Dechert LLP. This post is based on their Dechert memorandum.

Despite being headquartered abroad—and in some cases having a minimal connection with the United States—companies based outside the U.S. have still become targets in securities class actions filed in the U.S., even when the crux of the allegations occurs outside the country.

Although 2018 saw a slight decrease in securities class action litigation on the whole, non-U.S. issuers—those companies with headquarters located outside of the U.S.—were popular targets of such suits.

Non-U.S. issuers should therefore take heed of last year’s decisions and securities class action filings to ensure they are aware of recent trends and to take steps to reduce and mitigate risks associated with such suits.

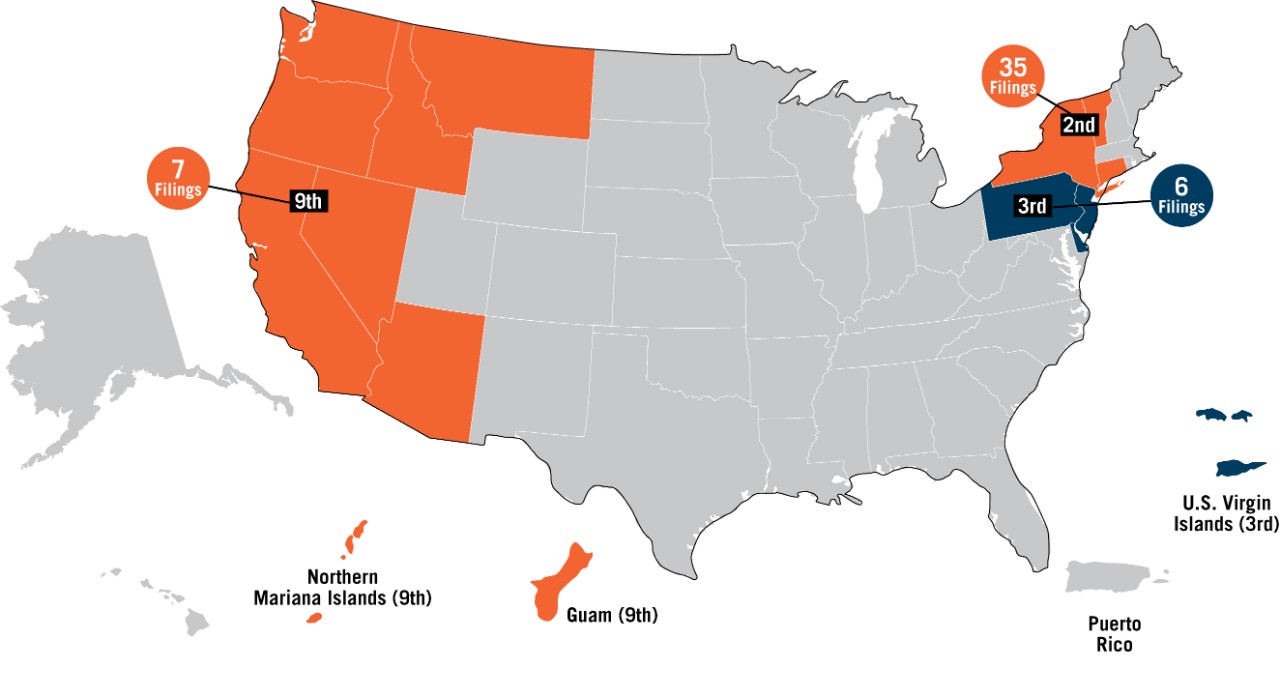

In 2018, plaintiffs filed a total of 54 class action securities lawsuits against non-U.S. issuers.

Circuit Courts Where the Majority of Lawsuits Were Filed

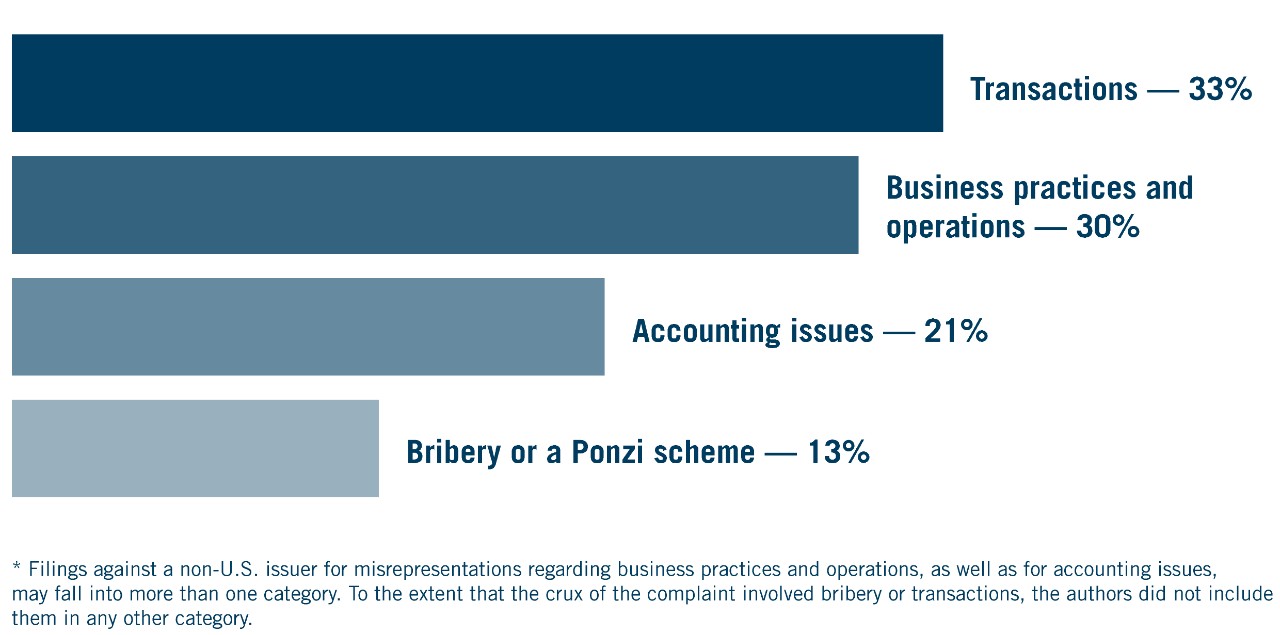

The Lawsuits Alleged Misrepresentations Involving

Many of the complaints filed in 2018 allege misrepresentations regarding transactions including mergers and acquisitions, takeovers, proposed sales and IPOs. In addition, there were groups of cases alleging misrepresentations regarding business practices and operations, accounting, and bribery.

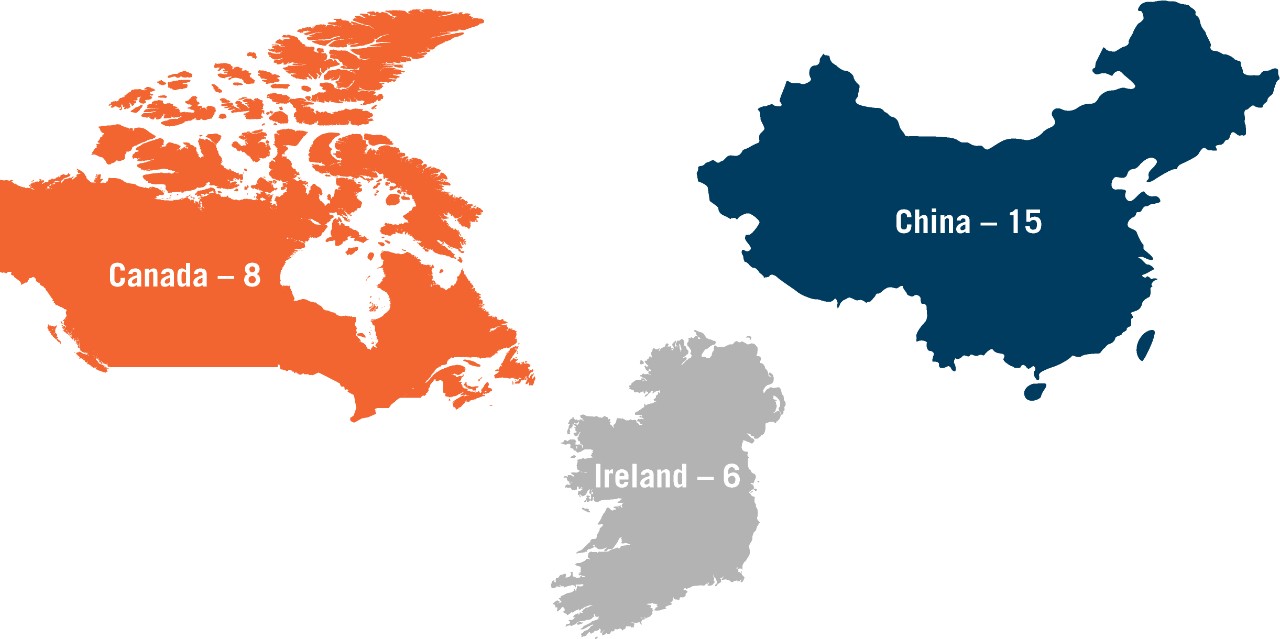

Number of Suits Filed Against Companies Headquartered In

The suits covered a diverse range of industries. Non-U.S. companies in the software and programming industry had the most suits filed against them (four); all of these companies were headquartered in China.

In addition, in 2018 and early 2019, courts continued the trend of issuing a number of dispositive securities fraud decisions.

The complete publication, including footnotes, is available here.

Print

Print