Stacy Coleman is Managing Director at Promontory Financial Group and Mara Childress is Director of Public Policy at Bloomberg LP. This post is based on their Task Force on Climate-related Financial Disclosures (TCFD) report. Related research from the Program on Corporate Governance includes Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here) and Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here).

Executive Summary

In June 2017, The Task Force on Climate-related Financial Disclosures (Task Force or TCFD) released its final recommendations (2017 report), which provide a framework for companies and other organizations to develop more effective climate-related financial disclosures through their existing reporting processes. [1] In its 2017 report, the Task Force emphasized the importance of transparency in pricing risk—including risk related to climate change—to support informed, efficient capital-allocation decisions. [2] The large-scale and complex nature of climate change makes it uniquely challenging, especially in the context of economic decision making.

Furthermore, many companies incorrectly view the implications of climate change to be relevant only in the long term and, therefore, not necessarily relevant to decisions made today. Those views, however, have begun to change. [3]

A Call to Action

Based on a recent report issued by the Intergovernmental Panel on Climate Change, a global group of climate scientists convened by the United Nations, urgent and unprecedented changes are needed to meet the goals of the Paris Agreement. [4] [5] The report warns limiting the global average temperature to a maximum of 1.5°C “require[s] rapid and far-reaching transitions in energy, land, urban and infrastructure [systems] (including transport and buildings), and industrial systems.” In fact, according to a recent United Nations Environment Programme report on emissions, global greenhouse gas emissions have to peak by 2020 and decline rapidly thereafter to limit the increase in the global average temperature to no more than 1.5°C above pre-industrial levels. [6] However, based on current policies and commitments, “global emissions are not even estimated to peak by 2030—let alone by 2020.” As a result, governments and private-sector entities are considering a range of options for reducing global emissions, which could result in disruptive changes across economic sectors and regions in the near term. Limiting the global average temperature requires “rapid and far-reaching transitions in land, energy, industry, buildings, transport, and cities.” [7]

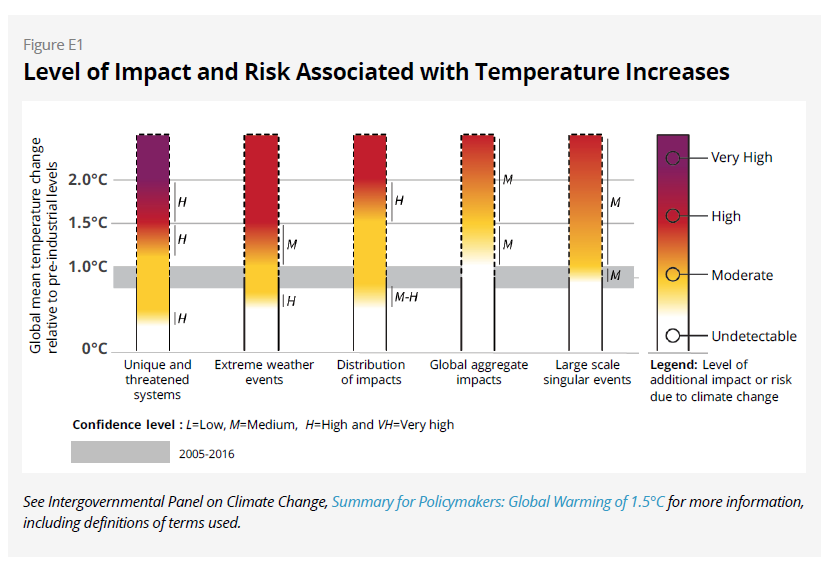

Figure E1 below illustrates the level of impact and risk on people, economies, and ecosystems associated with global average temperature increases. Importantly, four of the five categories of risk have increased since 2014 “based on multiple lines of evidence.” [8] Now more than ever it is critical for companies to consider the impact of climate change and associated mitigation and adaptation efforts on their strategies and operations and disclose related material information. Companies that invest in activities that may not be viable in the longer term may be less resilient to risks related to climate change; and their investors may experience lower financial returns.

Compounding the effect on longer-term returns is the risk that present valuations do not adequately factor in climate-related risks because of insufficient information. As such, investors need better information on how companies—across a wide range of sectors—have prepared or are preparing for a lower-carbon economy; and those companies that meet this need may have a competitive advantage over others.

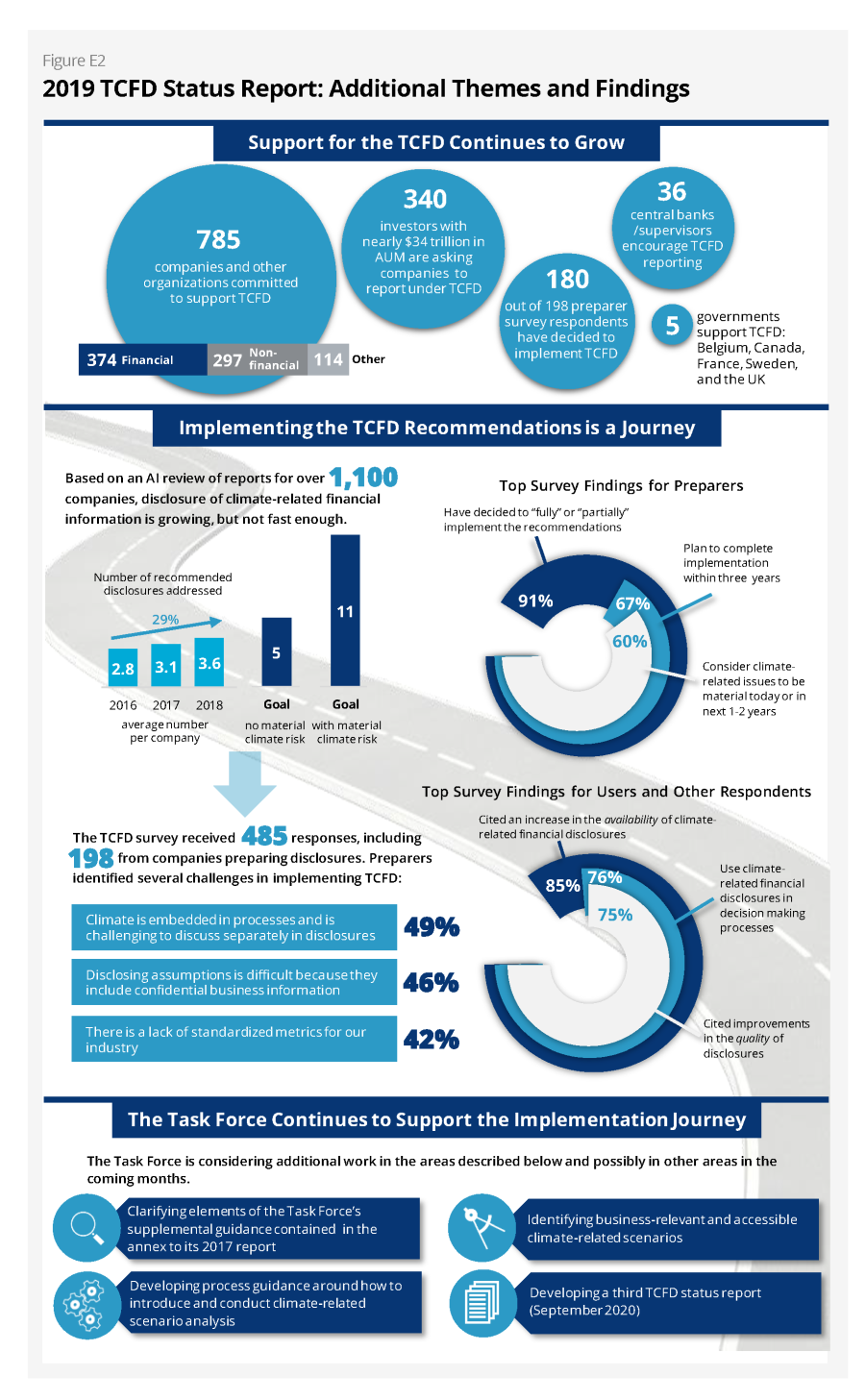

In addition, there is a growing demand for decision-useful, climate-related financial information by investors. There are likely many factors driving investor demand, ranging from European regulations requiring certain investors to disclose climate-related information to weather-driven events resulting in significant financial impacts and leading investors to seek better information on their exposure to climate-related risks. [9] As evidence of this demand, more than 340 investors with nearly $34 trillion in assets under management have committed to engage the world’s largest corporate greenhouse gas emitters to strengthen their climate-related disclosures by implementing the TCFD recommendations as part of Climate Action 100+. [10]

There is also growing interest in climate-related financial disclosures by financial regulators. In April, the Network for Greening the Financial System (NGFS)—comprised of 36 central banks and supervisors and six observers, representing five continents—issued six recommendations aimed at facilitating the role of the financial sector in achieving the objectives of the Paris Agreement. One of the recommendations is to achieve robust and internationally consistent climate and environment-related disclosure; and the NGFS “encourages all companies issuing public debt or equity as well as financial sector institutions to disclose in line with the TCFD recommendations.” [11]

Climate-Related Financial Disclosure Practices

As part of its efforts to promote adoption of the recommendations, the Task Force prepared this status report to provide an overview of current disclosure practices as they relate to the Task Force’s recommendations, highlight key challenges associated with implementing the recommendations, and outline some of the efforts the Task Force will consider undertaking in coming months to help address some of the implementation challenges.

To better understand current climate-related financial disclosure practices and how they have evolved, the Task Force reviewed—using artificial intelligence technology—reports for over 1,000 large companies in multiple sectors and regions over a three-year period. In addition, the Task Force conducted a survey on companies’ efforts to implement the TCFD recommendations as well as users’ views on the usefulness of climate-related financial disclosures for decision-making.

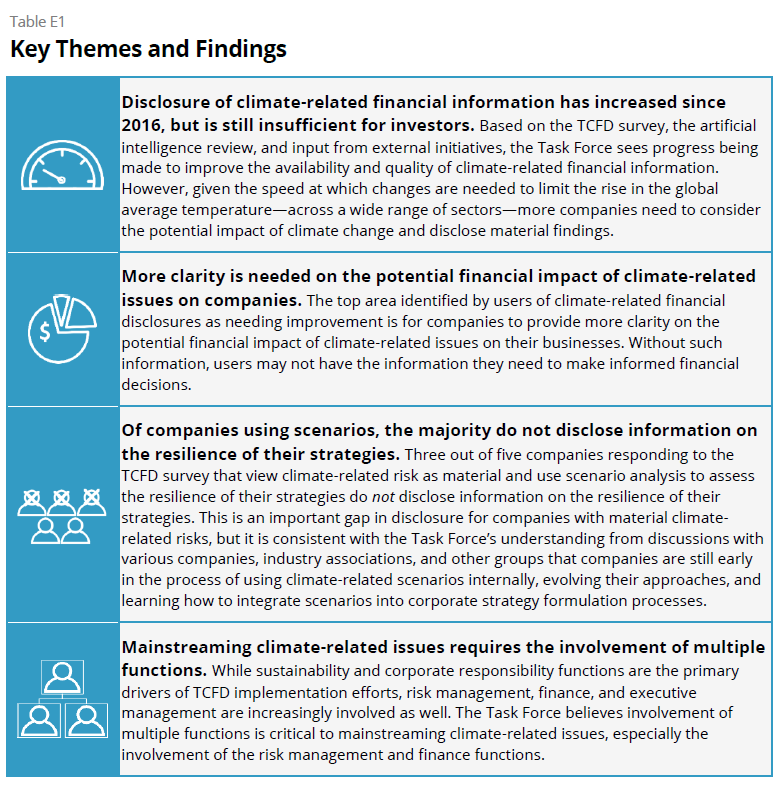

While the Task Force found some of the results of its disclosure review and survey encouraging, it is concerned that not enough companies are disclosing decision-useful climate-related financial information. This could be problematic for financial markets if market participants do not have sufficient information about the potential financial impact of climate-related issues on companies. Table E1 summarizes the key themes and findings from the Task Force’s disclosure review and survey results.

In addition, Figure E2 below provides a summary of additional themes and findings from this report, and Section A.2. Purpose of Report in the complete publication provides an overview of the report’s major sections.

Overall, the Task Force found signs of progress in implementing the recommendations among companies traditionally engaged on climate-related issues. These companies demonstrate that disclosing climate-related information consistent with the TCFD recommendations is possible and is a journey of continuing improvement. Given the urgent and unprecedented changes needed to meet the goals of the Paris Agreement, the Task Force is concerned that not enough companies are disclosing information about their climate-related risks and opportunities.

The Task Force strongly encourages more companies to use its recommendations as a framework for reporting on climate-related risks and opportunities, especially companies with material climate-related risks. Companies in early stages of evaluating the impact of climate change on their businesses and strategies and those that have determined climate-related issues are not material are encouraged to disclose information on their governance and risk management practices. [12] To accelerate the disclosure of consistent, comparable, reliable, and clear climate-related financial information, the Task Force encourages investors and other users of such information to engage with companies on the specific types of information that are most useful for decision making.

The Task Force has often highlighted that implementation of its recommendations would be a journey, and it applauds those who have started down the path. The Task Force urges those companies to continually improve the quality and usefulness of their climate-related financial disclosures. For those companies that are “piloting” reporting internally, it is time to begin disclosing; and for those who have not started, now is the time.

Next Steps

The Task Force believes its climate-related financial disclosures review and survey results highlight the need for continued efforts to support implementation of the recommendations, especially in terms of companies using scenario analysis to assess the resilience of their strategies under a range of plausible future climate states. As such, over the next several months, the Task Force will continue to promote and monitor adoption of its recommendations and will prepare another status report for the Financial Stability Board in September 2020. In addition, the Task Force is considering additional work in the following areas:

- Clarifying elements of the Task Force’s supplemental guidance contained in the annex to its 2017 report (Implementing the Recommendations of the TCFD),

- Developing process guidance around how to introduce and conduct climate-related scenario analysis, and

- Identifying business-relevant and accessible climate-related

The Task Force believes the success of its recommendations depends on continued, widespread adoption by companies in the financial and non-financial sectors. Through widespread adoption, climate-related risks and opportunities will become a natural part of companies’ risk management and strategic planning processes. As this occurs, companies’ and investors’ understanding of the financial implications associated with climate change will grow, information will become more useful for decision making, and risks and opportunities will be more accurately priced, allowing for the more efficient allocation of capital and contributing to a more orderly transition to a low-carbon economy.

The complete publication, including footnotes, is available here.

Endnotes

1In this post, the Task Force uses the term “companies” to refer to entities with public debt or equity as well as asset managers and asset owners, including public- and private-sector pension plans, endowments, and foundations.(go back)

2In December 2015, the Financial Stability Board established the Task Force on Climate-related Financial Disclosures to develop voluntary, consistent climate-related financial disclosures that would be useful in understanding material risks related to climate change.(go back)

3For example, rising global average temperatures are increasing the frequency and severity of extreme weather events, with combined insured losses related to natural catastrophes of $219 billion in 2017 and 2018, the highest ever for a two-year period (Swiss Re Institute, Natural catastrophes and man-made disasters in 2018: “secondary” perils on the frontline, April 10, 2019.).(go back)

4Intergovernmental Panel on Climate Change, Summary for Policymakers: Global Warming of 1.5°C., October 2018.(go back)

5United Nations Framework Convention on Climate Change, ”The Paris Agreement,” December 2015. Under the Paris Agreement, nearly 200 governments have agreed to strengthen the response to the threat of climate change by “holding the increase in the global average temperature to well below 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5°C above pre-industrial levels.”(go back)

6 United Nations Environment Programme, The Emissions Gap Report 2018, November 2018.(go back)

7Intergovernmental Panel on Climate Change, “Press Release: Summary for Policymakers: Global Warming of 1.5°C,” October 8, 2018.(go back)

8Ibid and Intergovernmental Panel on Climate Change, Fifth Assessment Report, Cambridge University Press, 2014.(go back)

9For example, see France’s

10See Climate Action 100+.(go back)

11NGFS, A call for action: Climate change as a source of financial risk, April 17, 2019.(go back)

12The Task Force understands many investors want insight into the governance and risk management context in which companies’ financial and operating results are achieved. The Task Force believes disclosures that follow its Governance and Risk Management recommendations directly address this need for context.(go back)

Print

Print