Barbara Novick is Vice Chairman at BlackRock, Inc. This post is based on a Policy Spotlight issued by Blackrock.

Index funds have democratized access to diversified investment for millions of savers who are investing for long-term goals, like retirement. The popularity of index funds has, however, drawn critics who claim that index fund managers may wield outsized influence over corporations due to the size of their shareholdings in public companies. Some commentators speculate that the largest asset managers are determining the outcome of proxy votes. Central to this hypothesis is an assumption that the shareholdings of the largest asset managers are sufficiently sizeable to determine the outcome of proxy votes. An analysis of the margins by which proxy votes are won or lost demonstrates that this is rarely the case.

Director Elections

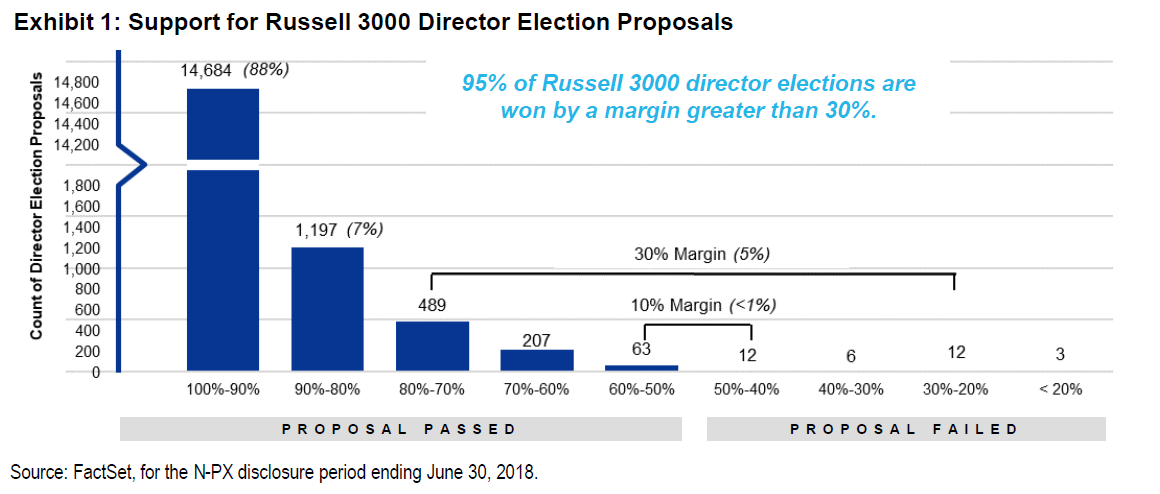

The Russell 3000 index is a broad-based index comprised of the 3,000 largest US public companies by market capitalization and thus provides a broad sample of US companies from which to analyze proxy voting activity. Assuming that a single asset manager can vote 10% of a company’s shares, Exhibit 1 shows that during the 2017-2018 proxy season, less than 1% of Russell 3000 director elections could have been decided by a 10% shareholder changing their vote. In addition, Exhibit 1 shows that in the 2017-2018 proxy season, 95% of Russell 3000 director elections were won by a margin greater than 30%. This means that even three 10% shareholders changing their votes in the same direction would not have changed the outcome.

By the Numbers

Claims that index fund managers are determining the outcome of most proxy votes is not supported by the data, which show that within the Russell 3000:

- 95% of director elections are won by margins greater than 30%

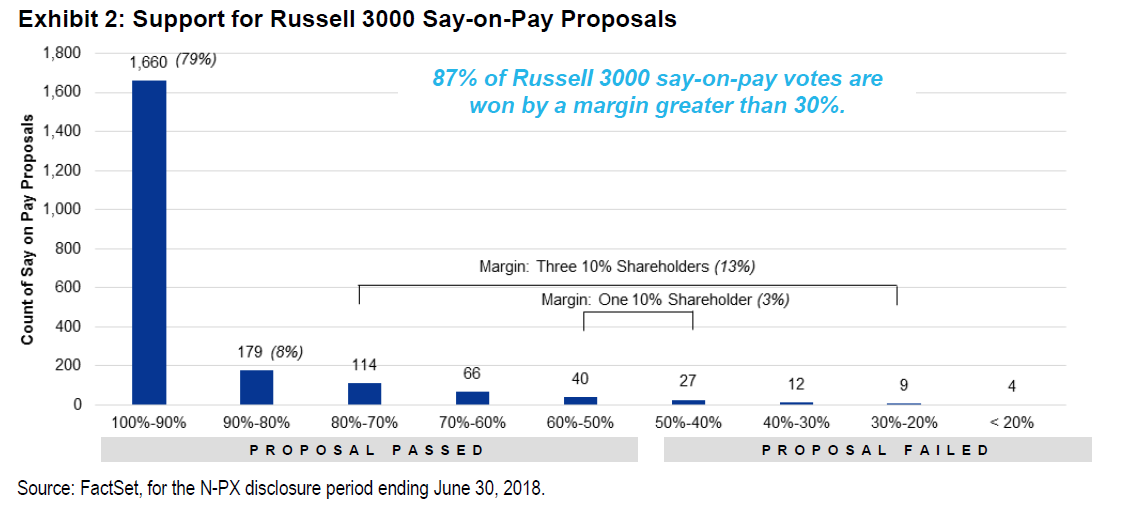

- 87% of say-on-pay votes are won by margins greater than 30%; and

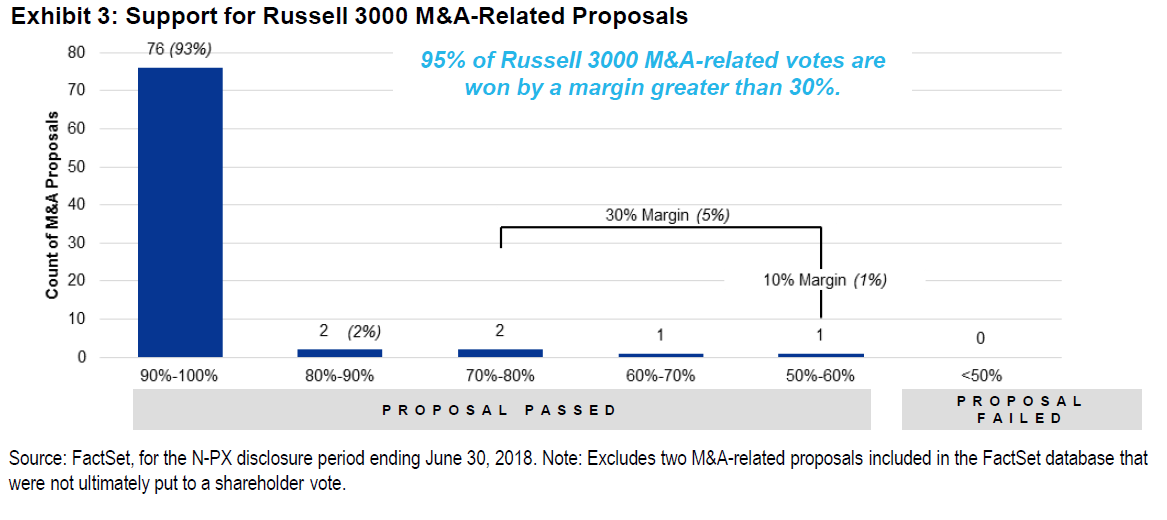

- 95% of M&A-related votes are won by margins greater than 30%.

In other words, the outcome of the vast majority of votes would not change even if three 10% shareholders changed their vote in the same direction.

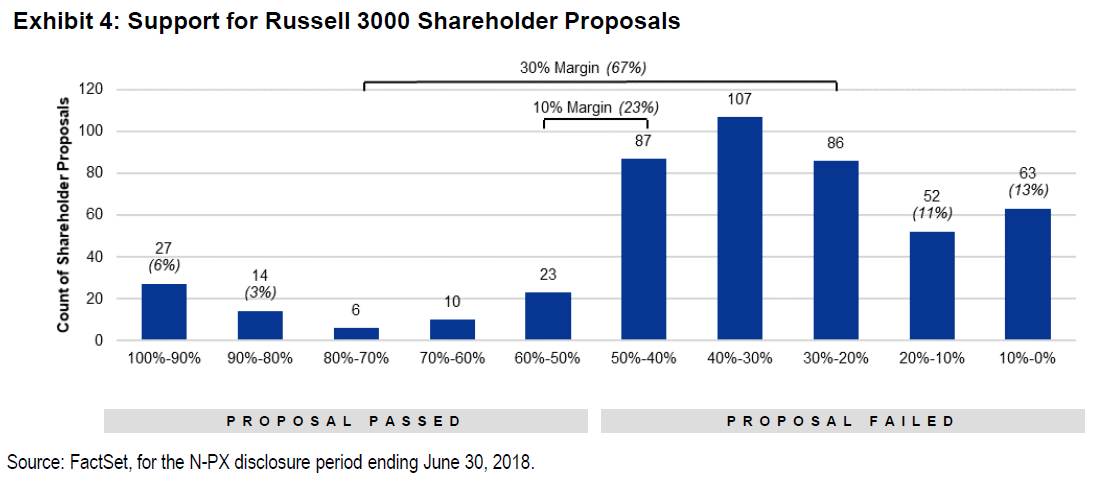

Shareholder proposals are more controversial (about two-thirds are decided within a 30% margin), but the significant variation in asset manager voting records negates the idea of a multi-firm voting bloc.

Say-on-pay and M&A-Related Votes

Another area of focus has been the level of influence shareholders have on executive compensation and mergers and acquisitions (M&A). However, looking at the margins by which ‘say-on-pay’ and M&A-related votes are approved presents a similar picture to director elections – that it is rarely possible for even the largest shareholders to change the outcome.

According to the Dodd-Frank Act, say-on-pay is a mandatory, non-binding advisory vote (held at least every 3 years). Say-on-pay votes ask shareholders to opine on the compensation of named executives that is disclosed in the proxy statement, rather than on the company’s compensation program going forward. Say-on-pay votes are backward looking; they do not dictate current compensation. For more information on executive compensation including regional differences, see the Policy Spotlight, Executive Compensation: The Role of Public Company Shareholders. As shown in Exhibit 2, during the 2017-2018 proxy season, 79% of say-on-pay proposals were approved with greater than 90% support by all shareholders and 87% were won by margins greater than 30%. Only 3% of say-on-pay proposals were won or lost by a margin of 10% or less.

M&A-related votes, which can entail approving the ability to raise capital to fund a transaction rather than the transaction itself, receive similarly high levels of support. Exhibit 3 shows that 93% of M&A-related votes during the 2017-2018 proxy season received 90% or more support and only one transaction (1%) was passed within a margin of 10% or less. Likewise, less than 5% of transactions passed within a 30% margin. We note that M&A reflects special situations; the company’s management and board often spend considerable time presenting the strategic rationale for the transaction directly to shareholders and may, to the extent possible, incorporate feedback in advance of holding a vote. This, in part, explains the high levels of support for M&A-related votes, though the level of support also reflects the fact that most shareholders defer to the board’s process and management’s business judgement on these types of matters.

Shareholder Proposals

Shareholder proposals comprise about 2% of all Russell 3000 ballot items. As shareholder proposals encompass a wide range of topics, they tend to be more controversial than other ballot items, and the voting outcomes often reflect much smaller margins. As shown in Exhibit 4, nearly one-quarter of shareholder proposals in the 2017-2018 proxy season were won or lost by a margin of 10% or less, and approximately two-thirds were within a 30% margin. As a result, these proposals have become an area of intense focus.

Some commentators have pointed to the influence of proxy advisors, as it has been estimated that due to the mechanical voting of some institutional investors, recommendations by proxy advisors can determine between 15% and 25% of a vote. [1] The largest asset managers do not ‘follow’ proxy advisor recommendations. BlackRock uses data from proxy advisors as one of several inputs into our decision, evaluating each proposal on its own merits, in conjunction with our region-specific guidelines. (See ViewPoint: Investment Stewardship Ecosystem for more information on BlackRock’s approach to proxy advisors.)

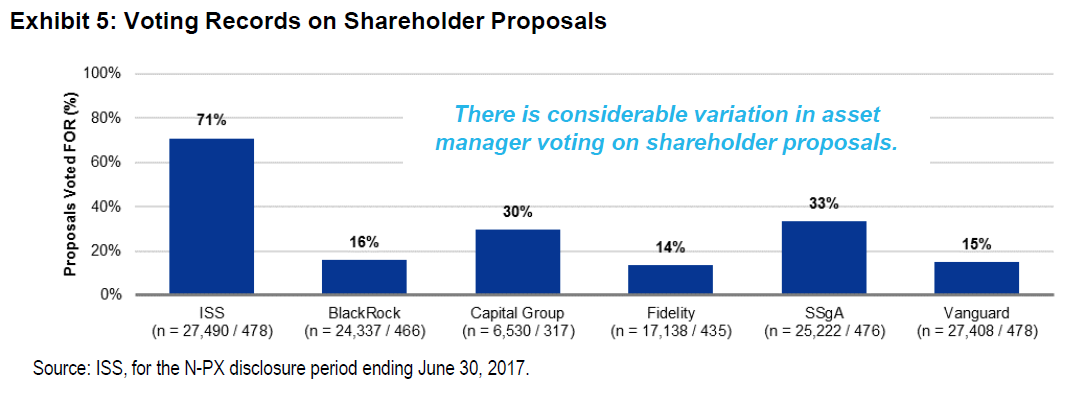

While shareholder proposals are more controversial and the outcomes reflect closer votes, the idea of a ‘multi-firm voting bloc’ that has been suggested by some does not exist. Exhibit 5 demonstrates considerable variation in voting for shareholder proposals by the largest asset managers. In essence, large asset managers are informed investors who have views that are often different from one another and from proxy advisor recommendations.

Bottom line:

The view that asset managers are ‘determining’ the outcome of proxy votes is not supported by the data. The vast majority of ballot items are won or lost by margins greater than 30%, meaning that even the three largest asset managers combined could not change the vote outcome. While the small subset of votes on shareholder proposals tend to be closer, the considerable variation in voting records among asset managers negates the concept of a multi-firm voting bloc as the ‘swing vote”.

Endnotes

1Nadya Malenko and Yao Shen, Boston College, The Role of Proxy Advisory Firms: Evidence from a Regression-Discontinuity Design (Aug. 2016), available at https://www2.bc.edu/nadya-malenko/Malenko,Shen%20(RFS%202016).pdf.(go back)

Print

Print