Damien Fruchart is Associate Director, Michael Jenks is Vice President, and Verena Simmel is an Associate at ISS ESG. This post is based on their ISS memorandum. Related research from the Program on Corporate Governance includes Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here) and Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here).

During the first weekend of August, the United States (U.S.) again experienced two deadly mass shootings, the first one taking place in a Walmart store in El Paso, Texas, the second in the Oregon Historic District in Dayton, Ohio. The shootings, which occurred within less than 24 hours of each other, left 32 people dead and dozens more injured. In the wake of these events the issue of gun violence and gun control has once more become a focal point of public debate in the U.S., which, according to the Gun Violence Archive, already experienced more than 270 mass shootings, defined as a shooting incident where four or more people (not including the perpetrator) are shot or killed, since the beginning of 2019. As of today, three weeks after the shooting in Dayton on August 4, 2019, a further 25 mass shootings have taken place across the U.S.

Despite recurring outcry and raging debate following previous prominent mass shootings—including those at Sandy Hook Elementary School in Newton, Connecticut, in December 2012, at a nightclub in Orlando, Florida, in June 2016, and at Marjorie Stoneman Douglas High School in Parkland, Florida, in March 2018—legislative responses have been hampered by lawmakers’ divisions about how, or if, to address the issue. After the recent events in El Paso and Dayton the public debate focused anew on the issue of background checks.

U.S. President Donald Trump reacted to the weekend shootings, indicating that he could rally Republicans behind two bills previously passed by the House of Representatives, which have yet to be presented to the Senate for a vote. One of the bills would close an existing legal loophole that allows private, unlicensed gun sellers to sell or gift guns without conducting a background check on the buyers, by requiring private parties to seek a federal license to conduct a firearms transaction. The second bill would extend the time the government has for completing a background check on transactions at licensed dealers. Such measures have been discussed in the past following other mass shootings, but these have not led to any legislative action. In spite of past legislative deadlock, several groups active in the debate on gun violence, including the Brady Campaign to Prevent Gun Violence and the Giffords advocacy group, initially seized on the mood and expressed confidence on possible legislative change. Indeed, U.S. public sentiment appears to give backing to these groups, as Gallup figures from 2018 show that 61 percent of U.S. citizens support stricter laws on firearms. However, on August 20, President Trump reportedly retreated from his earlier support for legislative action, stating “We have very, very strong background checks right now”. With this, legislative action on gun control appears unlikely at the federal level in the foreseeable future.

A rare instance of recent legislative action on gun control at the federal level came in December 2018, when, following the use of a modified firearm in a mass shooting in Las Vegas, Nevada, in October 2017, the U.S. Department of Justice amended regulation to clarify that “bump stocks” fall within the definition of “machineguns,” and are thus subject to strict regulations under U.S. federal law. Bump stocks, also known as “slide-fire systems,” are firearms accessories that are used to modify otherwise semi-automatic firearms to achieve the rate of fire of automatic firearms. Several states, including Florida, Vermont, and Delaware, had by that point already banned them.

Corporate Responses To Public Pressure

In addition to attempting to address the stalled legislative situation, the recent discourse on gun violence has also increased awareness of the wider firearms value chain. While firearms manufacturers are naturally considered key actors, public attention is increasingly turning to distributors of firearms as well. In recent weeks, criticism by gun control advocates has focused on Walmart Inc. after two deadly shootings took place at stores in El Paso and in Southaven, Mississippi. The retail chain, which is one of the largest sellers of firearms and ammunition in the U.S., has adapted its policies on firearms products several times in recent years. In 2015, Walmart ceased the sale of assault weapons, and, in 2018, it raised the minimum age to buy a gun from 18 to 21 after the shooting at Marjorie Stoneman Douglas High School. Following the most recent shootings, Walmart is now confronted with calls to end the sale of all firearms products. The company has not signaled any further changes to its business, stating that there has “not been any directive to any stores around the country to change any policy”.

Other large firearms distributors have reacted to public pressure in the wake of mass shootings. For instance, following the shooting at Marjorie Stoneman Douglas High School, Dick’s Sporting Goods Inc., a Fortune 500 U.S. sporting goods retailer, stated that it would cease the sale of “assault-style firearms,” as well as raise the minimum age for the purchase of firearms to 21 years. In a March 2019 earnings call Dick’s CEO further announced that the company would stop selling guns in 125 store locations as a pilot project, with the option of removing firearms and hunting products from more stores in the future. Also in March 2019, The Kroger Co. declared that its Fred Meyer stores would exit the firearms business altogether.

Similar reactions by distributors of firearms have also been observed outside the U.S. After the March 2019 shooting at a mosque in Christchurch, New Zealand, Wellington-based Trade Me Group Ltd., which runs an online auction platform that sells of firearms and ammunition among other products, announced that it halted the sale of semi-automatic weapons and related accessories (such as high-capacity magazines). The company stated that it had “listened to public sentiment following [the] terrorist attack in Christchurch and decided to remove all semi-automatic firearms sales and parts associated with those weapons.”

The increased focus on the wider firearms value chain and on distributors of civilian firearms by advocacy groups can be explained when considering that, for most large retailers, the sales of firearms and ammunition do not account for a significant portion of total sales. As a result, distributors are more likely to respond to advocacy, customer, or investor pressure regarding their involvement in this segment. Producers of firearms have a different perspective, since their involvement in civilian firearms and related products typically accounts for a considerable share of sales. While several retailers announced that they would withdraw from the firearms market or impose other restrictions on the sales of firearms to civilians, there have been only few corresponding measures announced by large firearms producers.

One notable example is Vista Outdoor Inc., which sold its Savage Arms and Stevens firearms brands in July 2019. The initial May 2018 divestiture announcement came just two month after U.S. outdoor retailer REI had put on hold orders of products that Vista usually sells through REI, citing Vista’s involvement in firearms and specifically the company’s lack of a clear plan of action following the Marjorie Stoneman Douglas High School shooting. While Vista subsequently sold its contested firearms business, which included the production of assault weapons, the company remains involved in the production of ammunition for the civilian market through brands such as Speer and Federal Premium Ammunition. Moreover, Vista is a diversified outdoor company that holds a variety of sports brands, including producers of bicycles, helmets and outdoor gear and thus the firearms business did not account for the majority of the company’s revenue—in contrast to specialized firearms producers such as for example Remington Outdoor Co. Inc or Colt Defense LCC.

Corporate Involvement in Civilian Firearms and Ammunition

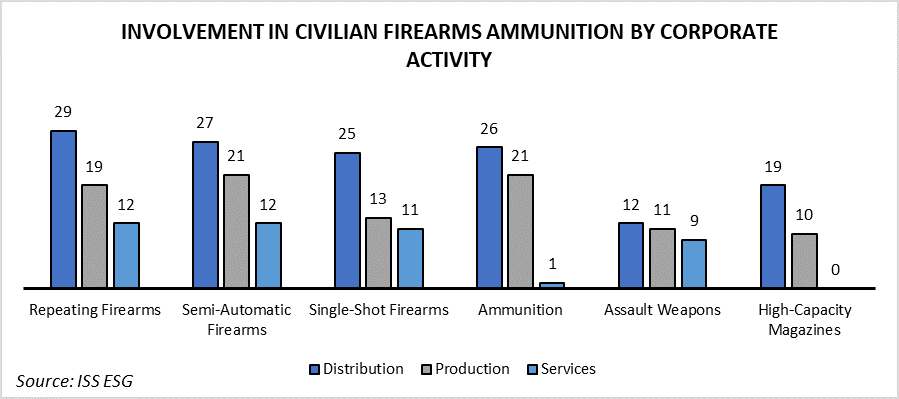

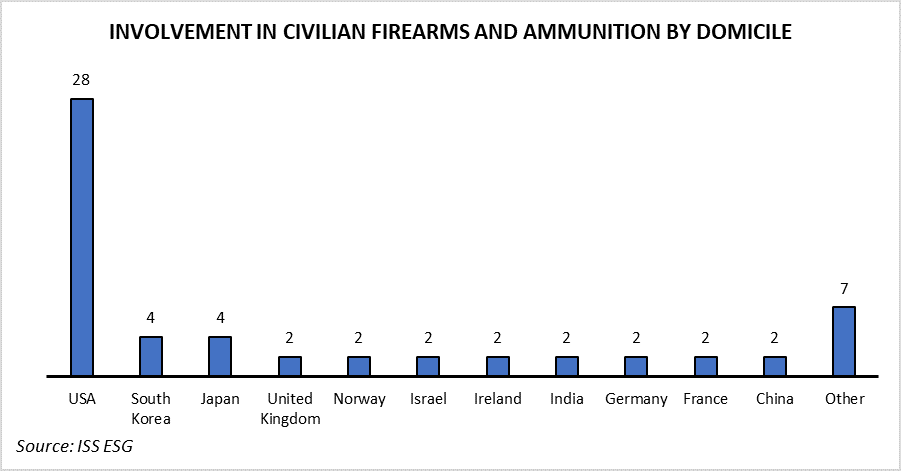

ISS ESG monitors companies globally for involvement in civilian firearms and ammunition. An analysis of ISS ESG data identifies 59 companies across major indices in developed and emerging markets involved in the manufacture or sale of civilian firearms or ammunition. An additional 22 companies undertake business activities that risk association with these markets. These companies are spread across 18 markets, with half of companies domiciled in the United States, followed by South Korea and Japan. These firms, which service the civilian market, are involved in the manufacture, sale and/or servicing of firearms, including assault weapons, semi-automatic firearms, single-shot and repeating firearms, as well ammunition used in these weapons and high-capacity magazines. Many of the companies include producers and retailers with household names such as Remington Outdoor Co. Inc. and Big 5 Sporting Goods Corp., while others include less well-known manufacturers, including Brazil’s Taurus Armas SA and Poongsan Corp. of South Korea.

Investor Action

Divestment

As discussed in a 2018 ISS ESG publication, recent years have seen a series of investor reactions and divestments in the aftermath of mass shootings. In response to past incidents and the resulting public pressure, several investors have reduced or eliminated their holdings in companies that produce or sell civilian firearms. The California Teachers Pension Fund System (CalSTRS) liquidated $3 million of investments in firearms manufacturers, including Smith & Wesson (now part of American Outdoor Brands Corp.) and Sturm, Ruger & Co. Inc. following the Sandy Hook Elementary School shooting in 2012. In 2015 CalSTRS also disposed of its $375 million investment in Remington (then known as Freedom Group), which it held through an index fund managed by Cerberus Capital Managers.

Similarly, in March 2018, New Jersey’s public employee pension system sold off its $1.9 million stake in Vista Outdoor due to the company’s involvement in the production of semi-automatic firearms and assault weapons for civilian use. In response to the latest shootings in El Paso and Dayton, the New Jersey pension system is currently reviewing the option of cutting all ties to companies involved in the manufacture of guns and ammunition, with the state’s governor Phil Murphey recently endorsing the approach, and stating to the media that he is “all in for divestment.” Likewise, in the wake of the Christchurch attacks earlier this year, the New Zealand state-owned Superannuation Fund announced that it would be looking into divesting from its currently held shares in civilian firearms manufacturers and retailers, namely American Outdoor Brands, Sturm Ruger, and Vista Outdoor.

Engagement and Voting

Beyond divestment, investors are increasingly also turning towards direct engagement with companies in the firearms industry. Most notably, in November 2018 a coalition of 13 U.S. investors announced the launch of Principles for a Responsible Civilian Firearms Industry. The group includes several pension funds, such as CalSTRS and the Connecticut Retirement Plans and Trust Funds, as well as asset owners and asset managers, including State Street Global Advisors and Rockefeller Asset Management. The five principles supported by the group address the safety of firearms products and safety in the retail process. According to a joint press release, the principles should serve as “a framework for institutional investors seeking to improve engagement with public and private companies globally that manufacture, distribute, sell or regulate products within the civilian firearms industry in order to address gun safety issues and reduce investment risk.” The investor coalition calls on companies in the industry to collaborate, communicate, and engage with the Principle’s signatories and demonstrate compliance with each of the principles, stating that in case of a failure to do so “we will consider using all tools available to us as investors to mitigate these risks.”

Institutional investors have also begun engaging with the industry individually. For example, following the March 2018 high school shooting in Florida, U.S. investment firm BlackRock announced that it was reaching out to civilian firearms manufacturers and retailers about their business policies and practices. BlackRock elaborated that its engagement with firearms companies is “fundamentally looking to understand whether the company has the appropriate policies and controls in place and is sufficiently managing the risks associated with these issues.” The investment firm also indicated that, based on its engagement conversations and its long-term view of a respective firearms company, it may vote against specific directors or in support of shareholder proposals related to gun control and gun safety.

With regards to filing shareholder proposals on the issue, precedent was already set last year by faith-based investors who demanded increased transparency on the business conduct of firearms companies. In 2018, shareholders voted in favor of a resolutions which required firearms manufacturers Sturm Ruger and American Outdoor Brands to prepare reports about the risks of their businesses. The shareholder proposal at Sturm Ruger, requesting disclosure on the company’s activities related to gun safety measures and the mitigation associated with gun products, received 68.8 percent of votes cast, one of the highest levels of support for any social shareholder proposal on record. While both American Outdoor Brands and Sturm Ruger published reports as requested by shareholders, the companies also used the publications to stress that they would not change their practices—among others rejecting the call for the production of “smart guns” with advanced safety and security features, describing them as not “safe, reliable, or commercially feasible,” and stating that their reputation among purchasers of firearms and the enhancement of shareholder value are more critical than their reputation “among industry detractors and special interest groups with a political agenda.”

Considerations for Investors

In light of recurring mass shootings and the increased public scrutiny towards corporate and financial actors over their involvement in the production or sale of civilian firearms and ammunition, as well as investment in these companies, institutional investors are facing growing demand to identify, monitor, and take a more active stance towards their investments in companies involved in civilian firearms and ammunition. Investors looking to implement divestment or engagement and voting policies with regards to civilian firearms will benefit from using a clearly defined set of definitions and scope. To minimize the risk of exposure, investment policies should acknowledge different types of involvement in firearms value chains and a comprehensive coverage of various types of firearms and ammunition. Moreover, the availability of granular data regarding corporate involvement in civilian firearms and ammunition allows investors to tailor their approach for a maximum impact. For example, investors may engage with companies that may be more likely to respond to pressure, such as retailers or producers with a low revenue share generated from firearms, while divestment may be used as an option in cases where engagement is less likely to yield a positive outcome.

Print

Print