Lyndon Park is Managing Director at ICR Inc. This post is based on his ICR memorandum.

Overview

At first glance, the patterns and trends of the 2019 proxy season don’t seem to indicate shifts that are beyond marginal in terms of proxy voting impact. But in closer analysis, in conjunction with recent investor behavior and industry trends (e.g., Business Roundtable Statement on the Purpose of a Corporation signed by 181 CEOs disavowing shareholder-centrism in favor of greater commitment to stakeholders and society), the results of the 2019 proxy season evince an already-shifting pattern of voter behavior, and contain important clues as to what companies must do to prepare for the 2020 proxy season.

Throughout this post, we will note some of the specific issues to watch out for 2020 proxy season.

Say-On-Pay (SOP)

The average support for SOP among Russell 3000 companies held steady at around 90% (slightly lower than 2018), as well as the percentage of companies failing SOP (~2%).

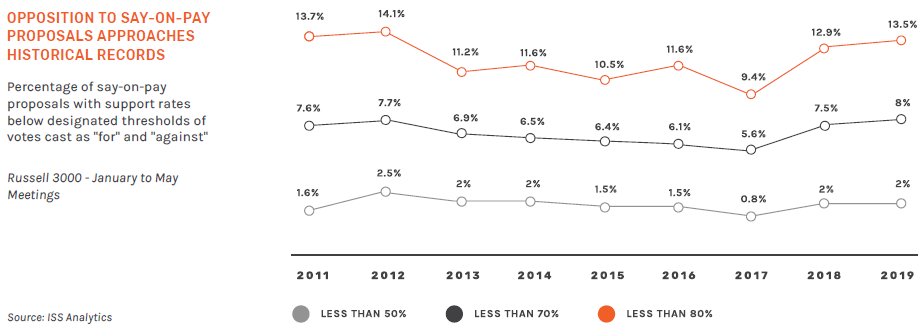

However, as evidenced by the chart from ISS Analytics below, there is a marked rise in the percentage of SOP with support rates below 80%—which is the threshold at which both investors and proxy advisory firms begin scrutinizing Compensation Committee members for their oversight of the pay program, as well as their responsiveness to investor concern:

From our perspective, having advised our clients on SOP issues this proxy season, we can note certain trends which may have contributed to this rising opposition to SOP proposals:

- Big passive investors have been less willing to support one-time retention or discretionary equity awards for executives that do not have performance contingencies. Whereas in prior years, these investors may have been open to supporting such plans if there is a pay-for-performance alignment over the long term, they have been more strident on holding companies accountable this year through their proxy vote.

- Whereas in previous years, general pay-for-performance alignment relying on relative TSR could suffice as a reason to support SOP, investors have developed more discretionary approaches that employ both quantitative and qualitative factors these firms prioritize (e.g., BNY Mellon utilizes a proprietary quantitative assessment utilizing data provided by Equilar, a compensation data firm).

- More than ever, investors view problematic pay practices as one of the primary signals that indicates a lack of proper oversight of management by the board, especially Compensation Committee members, which exhibits lack of independence on the board. These investors are more willing to vote against SOP to register their concern to company boards, which will make offseason engagement efforts and company “responsiveness” to investor concerns critically important for the 2020 proxy season.

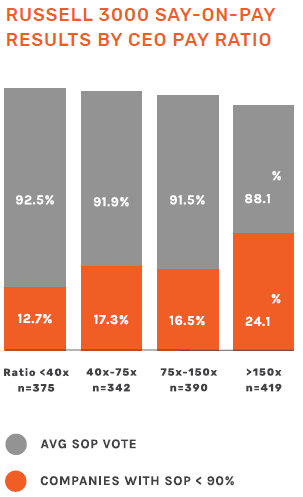

One more trend to watch for the 2020 proxy season and beyond: although investors have not been using CEO pay ratio as an input by which to assess SOP vote, the strong correlation between CEO pay ratio and SOP results could nudge some of these investors to more closely scrutinize the pay ratio information in the proxy materials.

It would serve the companies well to keep abreast of the just-emerging best practices in pay ratio disclosure, and refrain from the practice of excessively “Non-GAAP”-izing this data which could trigger negative investor reaction, hence leading to votes against board members.

Director Elections

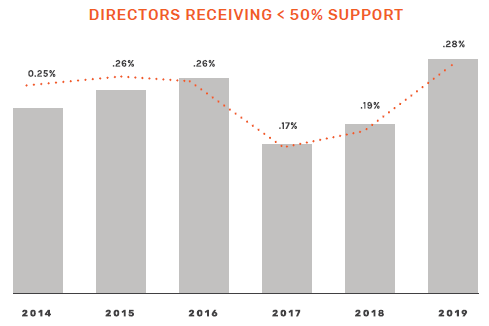

Through Russell 3000 shareholder meetings held in the first half of 2019, 45 directors failed to receive majority support from shareholders in uncontested elections (vs. 36 such directors in the entire year of 2018). According to the data provided by Council of Institutional Investors (CII), an influential governance coalition whose members include almost all the significant asset owners and asset managers, 89% of the directors who received less than majority support in 2018 still remain on the boards. CII is calling these directors zombie directors, and is now tracking the list of these directors on their website, which is viewable by all their members.

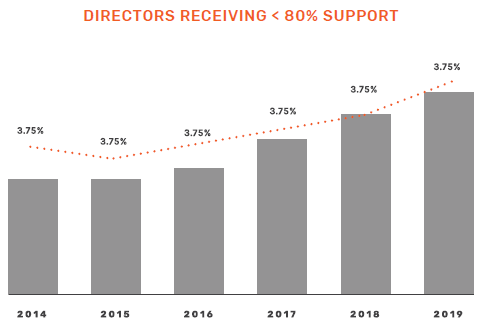

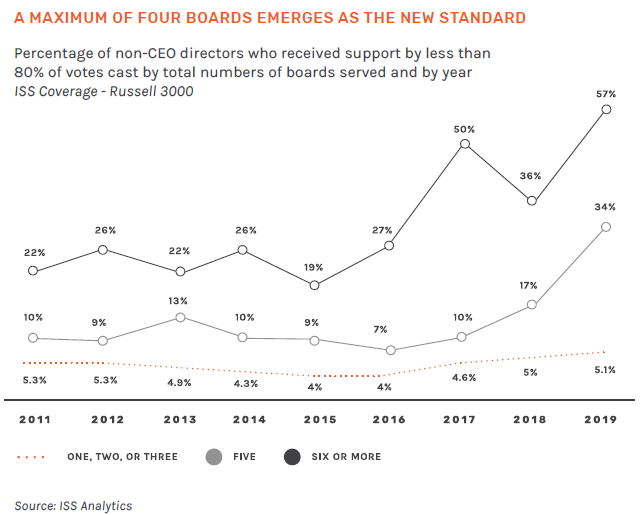

In addition to the directors who have failed to receive majority shareholder support, the percentage of directors receiving withhold votes from investors has sharply risen in 2019. Per ISS data:

There is a strong correlation between the rising level of SOP opposition in recent years and the increased levels of director election opposition: around 16% of the Russell 3000 directors receiving negative recommendation from ISS was for compensation-related reasons, primarily due to their non-responsiveness to poor SOP in 2018.

Further contributing to poor director election results is the more stringent director over-boarding policies by large asset managers which went into effect in 2019. BlackRock, for example, allows maximum of 2 boards that a sitting CEO can serve on, and 4 boards for non-CEO directors (Vanguard: 2 maximum for CEOs, 5 for non-CEO directors).

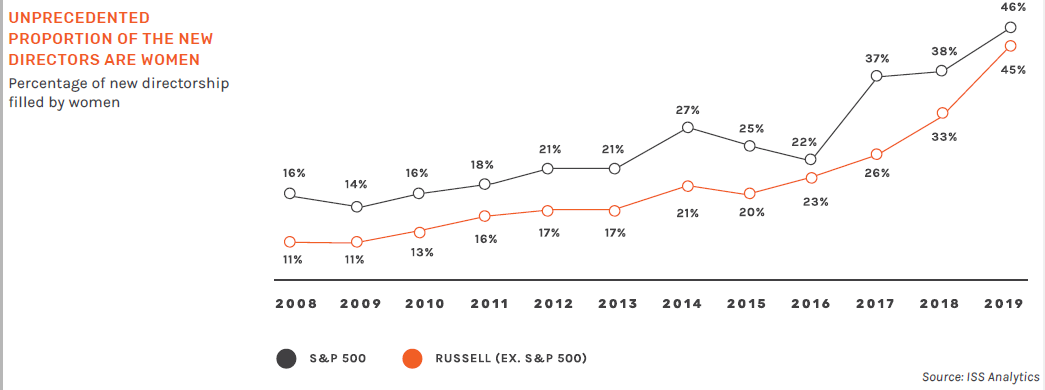

Also impacting director election results are gender diversity policies adopted by some investors. In 2019, 45% of new Russell 3000 board seats were filled by women (compared to only 12% in 2008), and now 19% of all Russell 3000 seats are held by women directors:

Especially given this rising trend of refreshing boards with women directors, institutional investors have been more willing to adopt a more strident policy concerning gender diversity, voting against Nominating and Governance Committee members of boards who do not have sufficient minimum number of women directors. BlackRock, for example, has sent out letters this year warning companies whose boards have less than 2 women directors. From 2020 proxy season, it is expected that BlackRock will take more of a bright line approach and start voting against board members whose boards have less than 2 women.

A critical issue to watch for director elections in 2020 will be on the ISS policy against directors who set and approve excessive director compensation. If you recall, ISS revised its policies in 2018 to start flagging companies with high director pay levels relative to those at peer company boards, and stated that if there is excessive director pay for 2 or more consecutive years without mitigating factors stated in disclosure, it will start recommending withhold votes for the relevant directors responsible for determining director pay. ISS began noting issues with director pay levels at companies in 2019, which means they will issue negative recommendations starting 2020.

Shareholder Proposals & ESG

Continuing the trend in 2018, shareholder proposals related to corporate governance comprised most of the proposals that actually reached a vote (64.4% in 2019) and represented the majority of proposals that passed at companies.

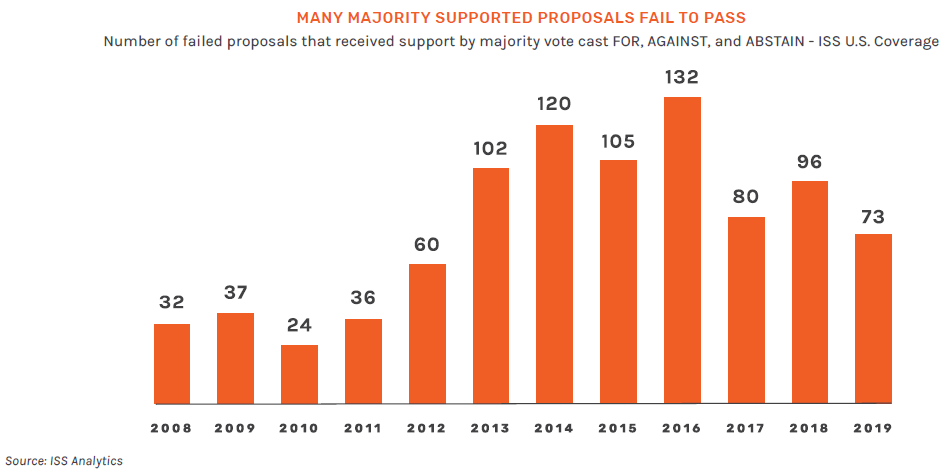

Among these governance proposals, Adoption of a Majority Voting Standard continued to receive a high level of support, as the proponents of shareholder proposals and investors both realize that the increase in the number of proposals that passed (21% in 2019 vs. 13% in 2019) is correlated with the increase in the number of Elimination of Supermajority Thresholds proposals that passed. In continuation of this trend, 16 of supermajority elimination proposals passed in 2019 vs. 9 in 2018.

In contrast to the governance proposals, though more environmental & social (E&S) proposals were submitted than governance proposals year-over-year (454 vs. 367), these proposals did not reach a vote but instead were withdrawn at record levels. This does not indicate that E&S factors are de-prioritized by the shareholders, but instead signal an important fact that as investors continue to prioritize ESG issues, both companies and investors are proactively engaging on the key ESG issues in the offseason, consequently leading to a high number of withdrawn proposals.

As ICR Governance Solutions had forecast prior to the 2019 proxy season, the investor focus on the “S” factor has been ascendant in 2019 in the E&S spectrum, eclipsing the environmental issues that had been the focal point in 2017. In 2019, around 56% of human capital management proposals actually went to a vote (vs. 22% in 2018). If you consider this year’s letter from Larry Fink, CEO of BlackRock, exhorting public companies to link social purpose and profit to serve all their stakeholders, as well as other large investors’ policy and engagement focus on similar aims, this trend should not be surprising.

On August 19, 2019, Larry Fink’s vision received a huge validation and endorsement with the Business Roundtable Statement on the Purpose of a Corporation signed by 181 CEOs, disavowing the Milton Friedman-esque shareholder-centrism and value maximization in favor of greater commitment by the companies to their stakeholders and society. This said, companies need to mindfully engage with their shareholders to let them know that their stakeholder-inclusive governance approach (to the extent adopted) is not exclusive but complementary to being accountable to their shareholders.

We believe this momentum will carry forward into 2020 and beyond, and encourage all companies to level-set their expectations on this and other ESG issues this offseason with their important shareholders who have become more vocal in this arena through their engagement and voting. Many of these important investors are now incorporating ESG screens not just for stewardship and engagement/voting activities, but for their investment decision-making.

As many of these investors have developed proprietary methodologies to rate their portfolio companies’ ESG scores (e.g., State Street’s R-Factor platform), it would be wise for companies to be as thoroughly prepared as possible on these investors’ “house approach”, as well as on commonly adopted ESG frameworks such as those established by SASB, TCFD, et al., prior to engaging with their shareholders on sustainability issues.

Intensifying Scrutiny on Recent IPO Companies

In 2019, the most prevalent reason for negative ISS recommendation against Russell 3000 directors related to adverse corporate governance provisions and shareholder rights. These provisions include classified boards, non-independent board leadership, plurality vote standards, and supermajority voting requirements to amend bylaws.

Both proxy advisors and investors have especially focused on the supermajority voting provisions in recent years, as even when companies on their own volition submit a management proposal to improve certain of these IPO-related governance structures, they fail to pass due to the supermajority requirement.

ISS by policy will recommend voting against relevant directors, board committees or entire boards, if prior to or in connection with the IPO a company adopted bylaw or charter provisions that impair shareholder rights or implement multi-class structures (currently, around 7% of Russell 3000 companies maintain a dual-class structure).

Although ISS is rather dogmatic in their voting policies against these such IPO-related governance provisions, institutional investors have so far shown a more pragmatic approach to these issues by preferring to engage rather than apply punitive votes against directors proactively. This said, the current investor sentiment on these starter kit IPO governance provisions is rapidly turning more negative, as more IPO companies continue to adopt such shareholder-unfriendly governance structures.

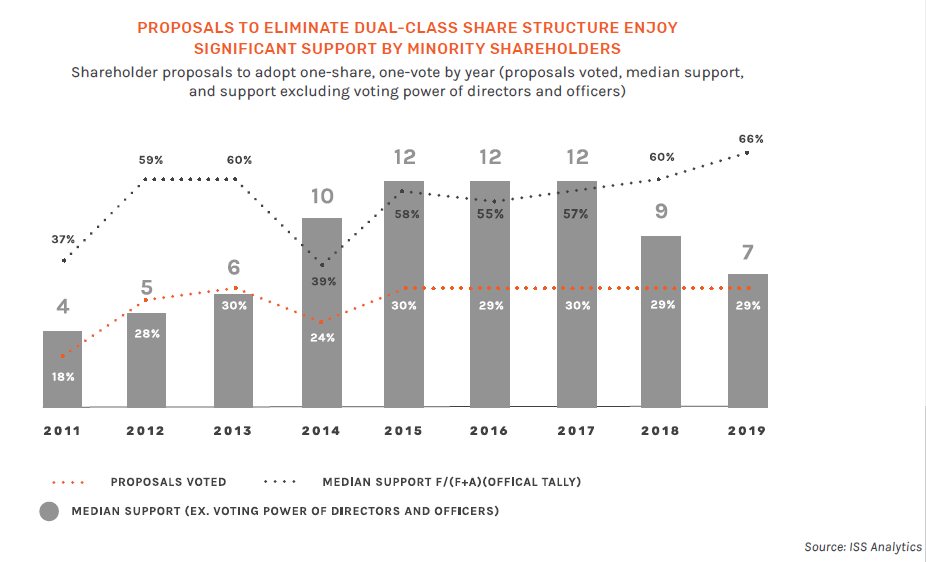

In addition, shareholder proposals to adopt one-share, one-vote continue to enjoy a healthy support from the investors, as most investors view one-share, one-vote mechanism as one of the foundational pillars of shareholder rights, to be able to hold boards and management teams accountable through the proxy vote, as well as have a voice in important corporate events and transactions:

In August 2019, CII launched a new tool aimed at holding board members accountable for enabling dual-class stock at IPOs. CII is tracking, and disclosing, the names of these “dual-class enabling” directors as well as all the boards they sit on.

Given that large institutional investors like BlackRock, Vanguard, State Street and Dimensional are members of CII, companies will need to reach out to their investors this offseason to gauge whether this list could indeed be used by them to single out these directors.

But more importantly, all recent IPO companies must engage with their shareholders this offseason, when there is no proxy vote on these matters, to communicate their views on maintaining such governance provisions, and also learn from the investors their expectations on these IPO-contiguous governance regime to proactively address potential proxy issues in 2020 and beyond.

“Some investors may choose to vote against directors at single-class companies who participated in pre-IPO board decisions to adopt dual-class equity structures without sunsets elsewhere.”

—Ken Bertsch, Director of CII

2020 Proxy Season: Sneak Preview

There is no better way for companies to prepare for the 2020 proxy season other than by crafting a compelling engagement strategy and reaching out to their shareholders to solicit feedback and communicate their positions on corporate governance, sustainability, and board-related concerns; in so doing, they must tie these factors to their corporate strategy and how their boards and management are protecting and enhancing the long-term interests of their shareholders.

There are several industry trends to keep in mind as you consider your company’s offseason engagement program.

ISS released its Annual Policy Survey, which is used by ISS to make decisions on potential policy changes for the next proxy season and beyond. Their clients—institutional investors as well as other market participants—respond to the survey.

On the regulatory front, the SEC on August 20, 2019 voted 3-2 in favor of proposing new rules on proxy advisory firms to address complaints that the issuers have had, such as correcting mistakes in the proxy advisory reports, as well as conflicts of interest in these proxy advisory firms’ business models.

But perhaps more significantly, in addition to requiring ISS and Glass Lewis to take more steps to disclose how they make their proxy voting recommendations, the SEC voted to issue guidance to asset managers that will likely prescribe steps they should consider if they become aware of errors or weakness in ISS or Glass Lewis reports.

In addition to the cost burden that will likely be borne by ISS and Glass Lewis on hiring more personnel to interact with issuers and address product quality (the cost which likely will be passed down to their investor clients), there could likely be an increased pressure on investors to engage in a more thorough due diligence upon finding errors in proxy advisors’ reports, especially when companies reach out, thereby putting an even greater emphasis on the importance of engagements.

Print

Print