Gaurav Jetley is a Managing Principal and Yuxiao Huang is an Associate at Analysis Group, Inc. This post is based on their recent paper and is part of the Delaware law series; links to other posts in the series are available here. Related research from the Program on Corporate Governance includes Using the Deal Price for Determining “Fair Value” in Appraisal Proceedings (discussed on the Forum here) and Appraisal After Dell, both by Guhan Subramanian.

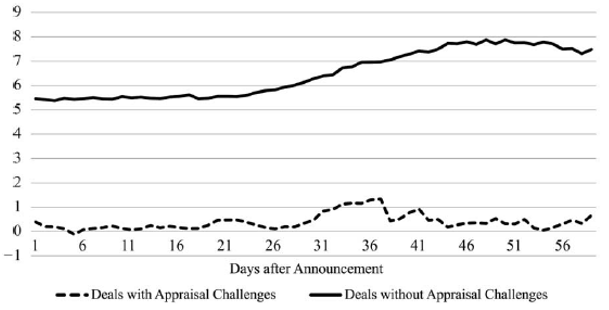

There is an ongoing debate regarding the extent to which increased appraisal litigation in the Delaware Chancery Court is beneficial from a public policy perspective. A paper published in the May 2019 issue of The Journal of Law and Economics—“Merger Negotiations in the Shadow of Judicial Appraisal,” by Audra Boone, Brian Boughman, and Antonio J. Macias (hereafter “Boone et al.”)—contributes to this discussion. The authors find, among other things, that compared to deals without appraisal challenges, deals subject to appraisal challenges have, on average, a 6% lower post-announcement arbitrage spread. (See Figure 1.) Based on this observed gap, the authors claim that appraisal challenges benefit target shareholders by narrowing arbitrage spreads. In particular, they state that

“[t]he narrower spread provides preexisting investors in such firms the option to receive approximately 6 percent more value if they decide to sell prior to closing (insuring against the risk of deal failure). Passive investors have the opportunity to share in some of the gains from merger arbitrage.”

Figure 1. Arbitrage Spread Between Deals with and without Appraisal Challenges (Figure 4. Evolution of Average Arbitrage Spreads from Boone et al.)

In our paper, we find, however, that the observed gap in mean arbitrage spread is driven largely by outliers and sampling biases. Specifically:

- Errors in available data on mergers and acquisitions can sometimes lead to calculated arbitrage spreads of over 50% or below –100%. Outliers can have a significant effect on means, and thus distort a comparison of mean arbitrage spreads of deals with and without an appraisal challenge.

- In order to compare the arbitrage spreads of deals with and without such challenges, it is critical to ensure that deals belonging to the two groups should otherwise be expected to have the same arbitrage spread. In other words, there should be no economic reason to expect the arbitrage spreads of deals with an appraisal challenge to be lower than those of deals without a challenge because of other factors. However, the composition of the deals that received appraisal challenges and of deals that did not are very different along at least three dimensions: time period, deal consideration, and target state of incorporation. These differences introduce a bias that artificially inflates the arbitrage spread of the non-appraisal group.

Motivated by these findings, we made the following adjustments:

- To minimize the impact of the large outliers, we compare median instead of mean arbitrage spread between the two groups.

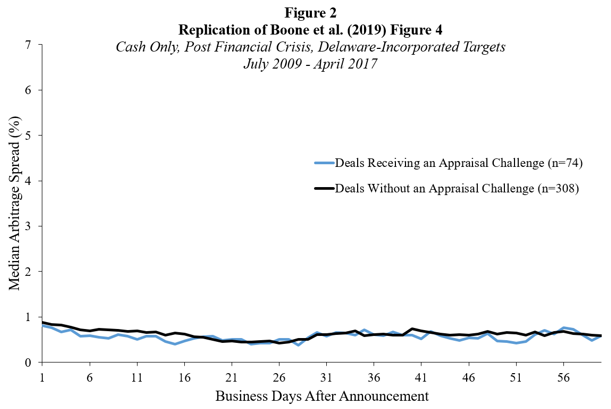

- To address the sampling biases, we restrict the sample for both groups to i) cash-only deals; ii) deals completed after the financial crisis; and iii) deals with target companies incorporated in the state of Delaware.

With these adjustments, the gap in arbitrage spread between deals that received appraisal challenges and those that did not completely closes. (See Figure 2.) We conclude that the observed gap in Figure 1 is a result of outliers and sampling biases. Therefore, there is no evidence that appraisal challenges benefit target shareholders through narrowing arbitrage spreads.

We summarize our findings on outliers and sampling biases in more detail below.

Outliers

Boone et al. use the mergers and acquisitions data from the Securities Data Company (“SDC”). A review of the SDC data shows that there are recording errors in the database that result in implausible arbitrage spreads. For example, on March 3, 2017, First Bancorp acquired Carolina Bank Holdings Inc. SDC recorded the transaction price per share as $39.03. The deal synopsis, however, stated that for each share of the target stock, the shareholders were offered $20 in cash or 1.002 shares of the acquirer stock. Apparently, SDC combined the values of these two options and, as a result, reported an offer price that is approximately twice as large as it actually was. Had SDC recorded the price correctly, the day-one arbitrage spread would have been 9.35%. Instead, the calculated value based on SDC data was 52.46%.

Such large outliers have a greater effect on means than on medians. In order to ensure that observed difference in arbitrage spreads are not influenced by outliers, we suggest comparing medians rather than means.

Sampling Biases

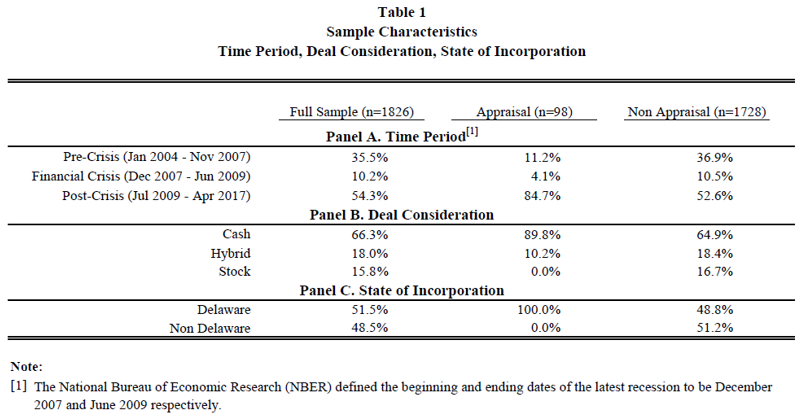

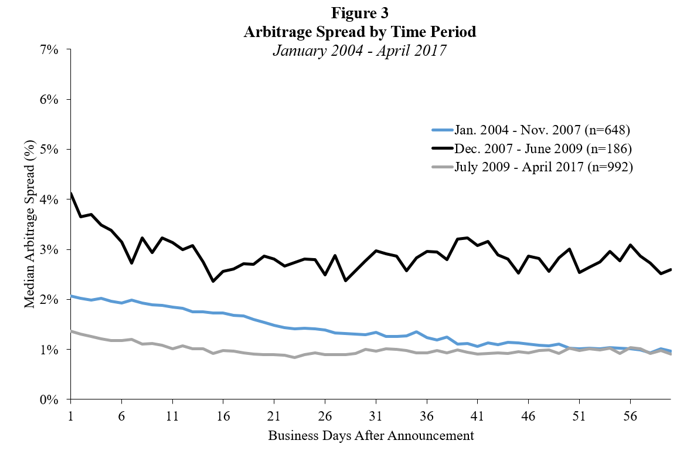

Comparing deals with and without appraisal challenges, we document sampling biases along three dimensions: time period, deal consideration, and target state of incorporation. Table 1 shows that the set of deals without appraisal challenges contains a disproportionately large share of deals that 1) took place before or during the financial crisis, as opposed to after the financial crisis; 2) offered stock or hybrid considerations, as opposed to cash consideration only; and 3) involved target companies incorporated outside of Delaware. We find that these deal characteristics are correlated with arbitrage spreads, and that they are the underlying drivers of the observed gap in arbitrage spread documented by Boone et al.

A. Time Period

Table 1 shows that a disproportionally large number of deals in the non-appraisal group are from the period before and during the financial crisis. For example, 36.9% of the non-appraisal deals took place in the pre-financial crisis period, while only 11.2% of the appraisal deals took place in the same period. Similarly 10.2% of the non-appraisal deals took place during the financial crisis, compared to 4.1% of the deals that were subject to appraisal. This distributional difference across time periods artificially inflates the arbitrage spreads of the non-appraisal group. It is well established that arbitrage spread has generally decreased over time (See Jetley and Ji, 2010, and the 2013 update available at https://www.analysisgroup.com/merger-arbitrage-spread—still-shrinking); thus, all else being equal, arbitrage spreads of deals announced in, say, 2005 would be expected to be higher than those of deals announced in 2010. Similarly, we know that deal risk increased during the financial crisis, in part because funding for deals became more uncertain during this period. It follows that the arbitrage spreads of deals announced during the financial crisis should be higher than that of deals announced before or after the crisis.

These patterns are substantiated by Figure 3, which presents the median arbitrage spread for deals before, during, and after the financial crisis as defined by the National Bureau of Economic Research. In addition, arbitrage spreads were much higher during the financial crisis because the risk of deal failure was, presumably, much larger. As discussed above, the arbitrage spread is the highest for deals announced during the financial crisis, followed by deals that were announced before the crisis. Deals announced after the financial crisis had the lowest spread.

Therefore, in order to ensure that a comparison of arbitrage spreads of deals with and without appraisal challenges is not influenced by the economic environment during which the deal was announced, we restrict the samples to the post-financial crisis period.

B. Deal Consideration

Table 1 also shows that 35.1% of the deals in the non-appraisal group are stock or hybrid deals, while the appraisal group has only 10.2% of hybrid deals and 0% of stock-only deals. The disproportionally large share of deals with stock considerations in the non-appraisal group introduces upward bias in the observed arbitrage spread in Figure 1. This is because, all else being equal, the arbitrage spread is expected to be lower for cash deals than deals that involve stock (Jetley and Ji, 2010). There are at least two reasons why deals that involve stock have higher arbitrage spreads. First, it is more expensive for arbitrageurs to realize the arbitrage spread in deals that involve stock consideration, since they have to both buy the target’s stock and short the acquirer’s stock, which makes the arbitrage of deals with stock consideration costlier than the same for cash-only deals. The higher transaction cost results in a higher arbitrage spread. Second, deals with stock considerations often involve strategic buyers. For those deals, legal concerns, such as antitrust issues, lead to a higher risk of deal failure, and thus a higher arbitrage spread.

Figure 4 compares the median arbitrage spread across deals with different considerations, and shows that hybrid and stock deals exhibit significantly higher arbitrage spreads than cash-only deals. As expected, the arbitrage spread for cash-only deals is the lowest. Thus, to ensure that a comparison of arbitrage spreads of deals with and without appraisal challenges is not influenced by differences in deal consideration, we further restrict the samples to cash-only deals.

C. State of Incorporation

Finally, Table 1 shows that 100% of the deals in the appraisal group involve target companies incorporated in the state of Delaware. In contrast, 51.2% of the target companies in the non-appraisal group were incorporated in other states.

Comparing the median arbitrage spread between deals with Delaware targets and deals with non-Delaware targets, we observe that deals with Delaware targets exhibit slightly higher arbitrage spreads in the first 30 trading days after deal announcements. While the difference is small, it may introduce biases to the comparison because only the non-appraisal group includes deals involving non-Delaware targets. We restrict the samples to deals with Delaware targets only to ensure that the comparison is unbiased.

As illustrated by Figure 2, after addressing the sampling biases with the three adjustments above and comparing medians rather than means, the gap in arbitrage spread between deals that received appraisal challenges and deals that did not is eliminated. Thus, there is no economic evidence that passive investors share some of the gains form increased appraisal activity.

The complete paper is available here.

Print

Print