Eli Kasargod-Staub is Executive Director of Majority Action and the Climate Majority Project. This post is based on his Majority Action report. Related research from the Program on Corporate Governance includes The Agency Problems of Institutional Investors by Lucian Bebchuk, Alma Cohen, and Scott Hirst (discussed on the Forum here); Index Funds and the Future of Corporate Governance: Theory, Evidence, and Policy by Lucian Bebchuk and Scott Hirst (discussed on the forum here); and Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here).

Key Climate-Related Shareholder Resolutions Would Have Passed with BlackRock and Vanguard Support

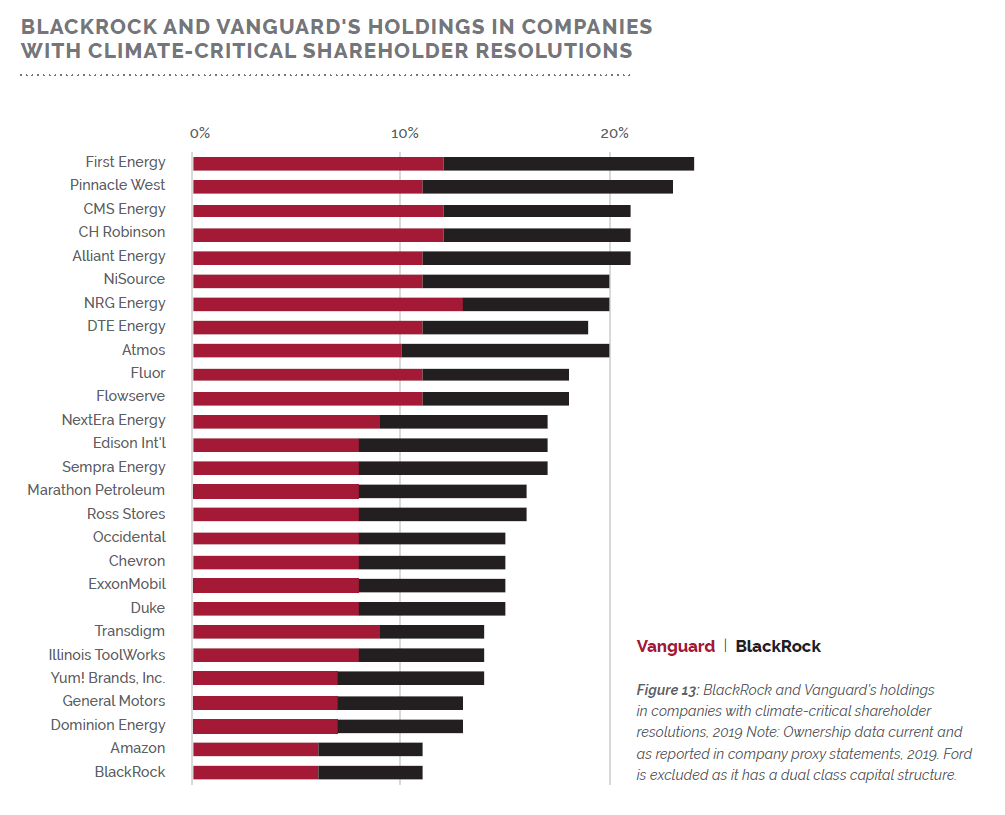

The world’s largest asset managers BlackRock and Vanguard control the largest blocks of shares in nearly every publicly traded firm in the U.S. The pattern of ownership is seen in the energy and utility industries, and across the companies at which there were critical climate votes in 2019 (see Figure 13). The two asset managers were both in the top five common stock shareholders at all 28 companies with critical climate resolutions.

BlackRock and Vanguard were the two largest shareholders at 18 of these 28 companies.