David Gordon is a managing director, and Dina Bernstein and Andrew R. Lash are consultants at Frederic W. Cook & Co., Inc. This post is based on a FW Cook memorandum.

On December 18, 2018, the Securities and Exchange Commission (SEC) approved final rules requiring the disclosure of hedging policies in annual proxy statements. The rules, which became effective for proxy statements filed in fiscal years beginning on or after July 1, 2019, implement a Dodd-Frank mandate.

We reviewed the first 40 proxies that included the newly required disclosure (covering the period from August 23, 2019 to October 4, 2019) and observed the following about the companies we examined:

- 100% have hedging policies in place;

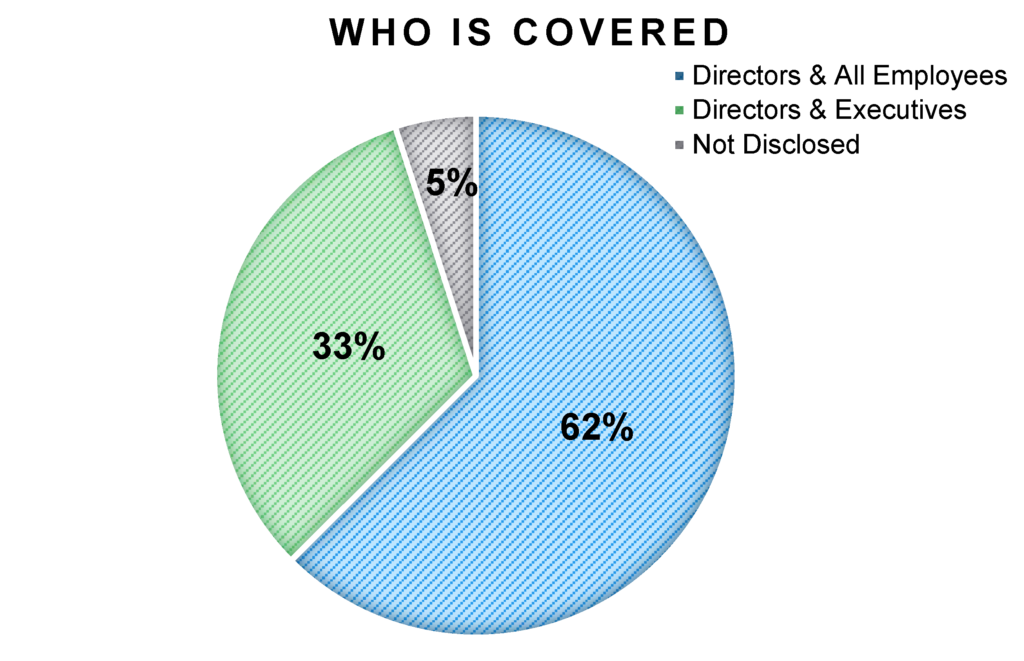

- 62% have hedging policies that cover directors and all employees;

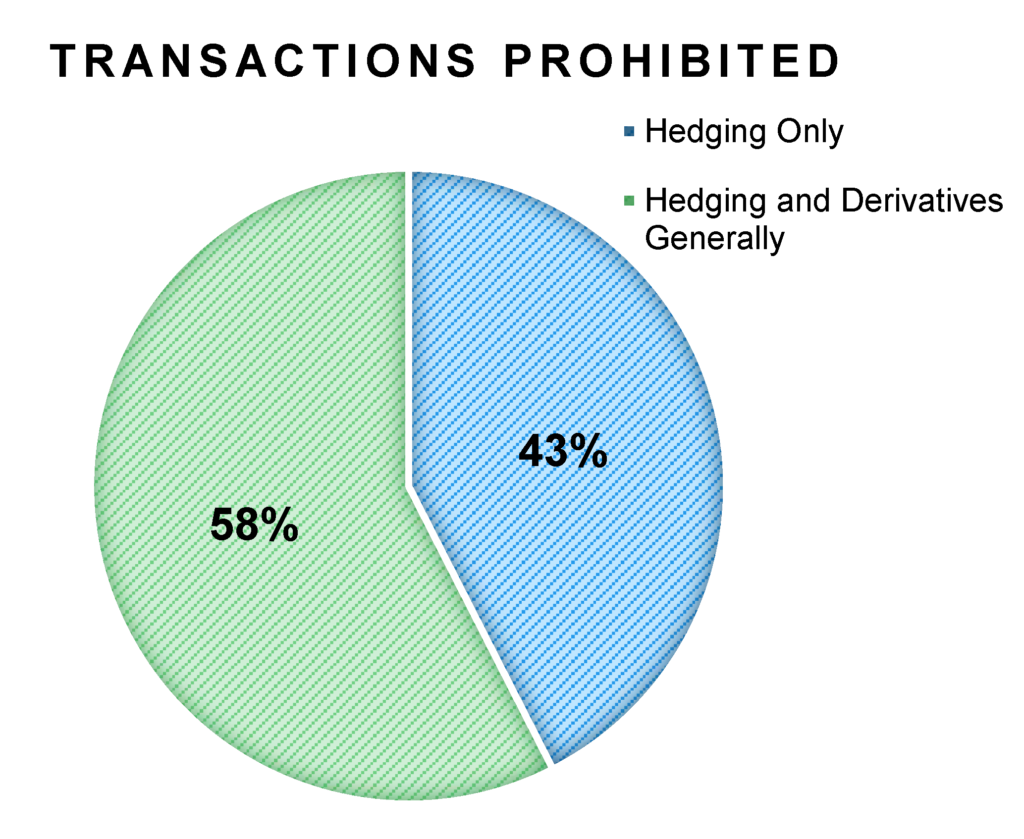

- 58% disclose policies that prohibit both transactions in company stock with a hedging function and derivative transactions generally; and

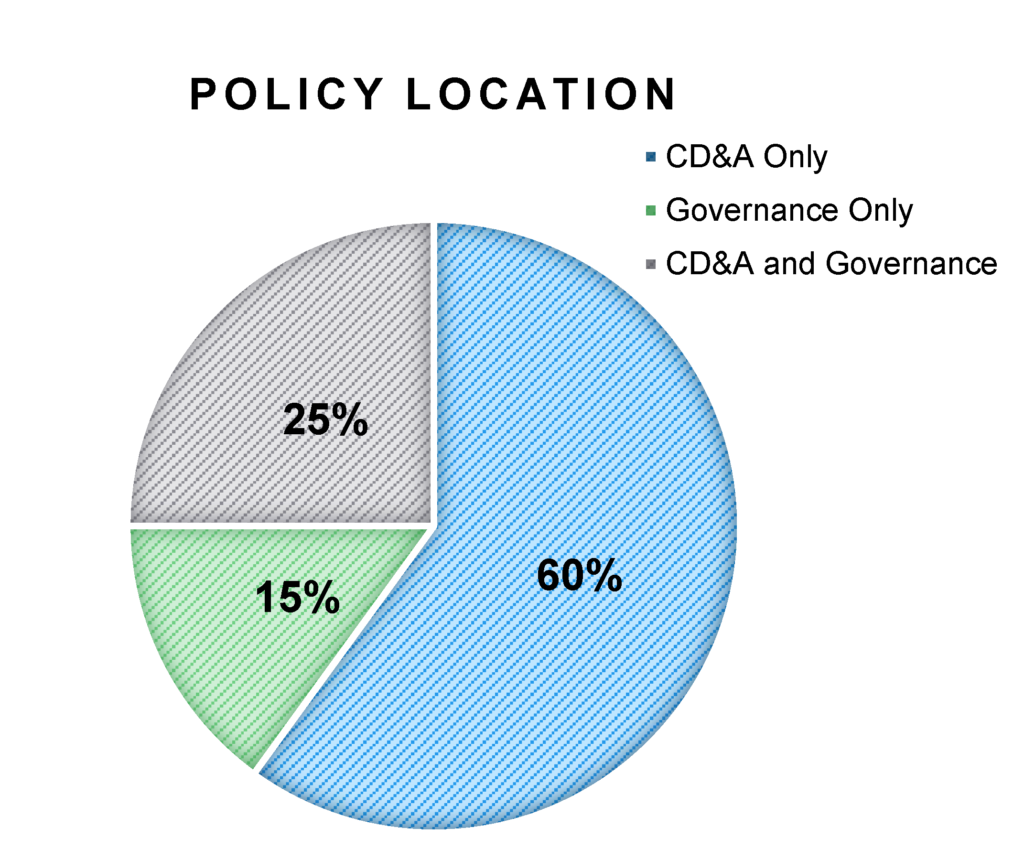

- 60% include their hedging disclosure only in the Compensation Discussion & Analysis (CD&A) section of the proxy

Background

SEC Rules

Rules implemented by the SEC in 2006 suggest the CD&A section of the proxy statement should discuss hedging policies. Specifically, Item 402(b) of Regulation S-K states that the CD&A should explain all material elements of the registrant’s compensation and that material information could include “the registrant’s equity… ownership requirements…and any registrant policies regarding hedging the economic risk of such ownership.” While this language does not require describing the policy or that the policy forbid hedging, many issuers have concluded that the safest response is to disclose their policy and forbid hedging among executive officers. The CD&A, of course, only requires disclosure with respect to a company’s “named executive officers” (NEOs), so the original SEC rules do not require any disclosure, one way or the other, with respect to a company’s hedging policies for non-NEO employees or non-employee directors.

On December 18, 2018, the SEC approved final rules requiring the disclosure of hedging policies in annual proxy statements. The rules, which became effective for proxies filed in fiscal years beginning on or after July 1, 2019, implement a mandate from the Dodd-Frank Wall Street Reform and Consumer Protection Act. Like the NEO compensation disclosure rules, the rules do not require that companies have a hedging policy or practice in place; rather, the rules relate only to disclosure.

The rules add a new Item 407(i) to Regulation S-K and require a description of “any practices or policies that the registrant has adopted regarding the ability of employees (including officers) or directors of the registrant, or any of their designees, to purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of registrant equity securities—(i) Granted to the employee or director by the registrant as part of the compensation of the employee or director; or (ii) Held, directly or indirectly, by the employee or director.”

Proxy Advisory Firm Positions

For purposes of assessing corporate governance standards, Institutional Shareholder Services (ISS) and Glass Lewis, the leading proxy advisory firms, have adopted prescriptive positions based on their views of “best practices.” ISS provides that:

“Stock-based compensation or open market purchases of company stock should serve to align executives’ or directors’ interests with shareholders. Therefore, hedging of company stock through covered call, collar or other derivative transactions sever [sic] the ultimate alignment with shareholders’ interests. Any amount of hedging will be considered a problematic practice warranting a negative vote recommendation against appropriate board members.” [1]

Glass Lewis provides that:

“Glass Lewis believes that the hedging of shares by executives in the shares of the companies where they are employed severs the alignment of interests of the executive with shareholders. We believe companies should adopt strict policies to prohibit executives from hedging the economic risk associated with their share ownership in the company.” [2]

Both firms have historically focused on executives and not all employees, so it is not clear how far they intend their positions to extend now that final rules on disclosure of hedging policies are in effect.

The Scope of Company Hedging Policies

In reflection of the SEC rules adopted in 2006 and the views of large institutional investors and the major proxy advisory firms, most companies have for many years been describing their hedging policies as applicable to NEOs, which policies generally prohibit hedging. The new disclosure requirement applies to all employees, however, and offers a unique window into the scope of company practices that has not historically been publicly available.

While the new rules do not require companies to maintain specific policies that prohibit hedging, our research indicates that all 40 companies examined maintain specific prohibitions and, further, that about 62% of these companies have hedging policies that cover directors and all employees. [3]

Table notes: Reference to “executives” is generally inclusive of named executive officers, executive officers and other senior executives as designated by the applicable company. In our research, two companies also included consultants, and two companies did not state who is subject to their hedging policies.

Who Should be Covered by a Company Hedging Policy?

The historical background and our research results still leave open the key question of just how far a hedging policy should extend.

There are a number of related considerations involved in determining the scope of a hedging policy, some of which point in the direction of a narrow policy (extending to a select group of employees, such as those subject to stock ownership guidelines) and others toward a broad policy (extending to most or all employees). Related to this, and as discussed separately under “Other Insights from Initial Hedging Disclosures – Transactions Prohibited,” some policies cover only transactions in company stock with a hedging function, while other policies also cover derivative transactions generally. If a policy only covers classic hedging transactions, this might, for example, point in the direction of more narrow coverage than if a policy extends to a broader range of transactions. [4] As illustrated further below, however, we did not observe a correlation between the scope of hedging policies and the types of transactions covered.

Potential Corporate Impact/Equity Ownership

In deciding how broadly to apply a hedging policy, companies may focus on which particular groups of employees have the ability to significantly affect overall company performance, as well as the financial ability of such employees to hold employer stock. Related to this, a company may consider which employees are subject to stock ownership guidelines, as such employees are required to hold a meaningful amount of company stock.

If an employee’s potential impact on company performance is not significant and/or the employee is not required or does not have the financial ability to hold a meaningful amount of company stock, a company may consider whether it is appropriate to subject him or her to a company’s hedging policy. One may argue that subjecting such employees to a hedging policy is counterproductive. Some employees who might have otherwise purchased company stock or held shares received through equity incentive awards will choose not to do so if they cannot hedge the risk of loss.

Enforceability

In determining the appropriate scope for a hedging policy, a company could consider its ability to enforce the policy. If the covered employees are already subject to stock ownership guidelines, the company presumably has a mechanism in place for monitoring transactions. Enforcing a hedging policy for the same population likely does not represent a significant expansion beyond the scope of administration of the stock ownership guidelines. Enforcing a company-wide hedging policy could, however, prove more challenging. There is a significant expansion in administrative complexity (including broad-based employee education about the prohibited transactions). Further, there will inevitably be some violations of the hedging policy, which raises the issue of adopting an appropriate monitoring procedure and a response in the event of a violation.

One possibility is that the company adopt an all-employee policy but operate on the “honor” system rather than having a system in place to monitor compliance below the level of employees subject to stock ownership guidelines. Under this approach, a violation, if identified, could carry consequences including possible employment termination. We would not expect such a company to disclose in its proxy statement that it is not monitoring the policy at these lower levels since disclosing the lack of monitoring defeats the purpose of having the policy. In this case, the company should determine whether such an approach contains any legal risks.

Size and Compensation of Employee Population

In determining the scope of a hedging policy, a company could also consider the nature of the employee population. A broader policy may be a better fit for a smaller, more highly compensated population. Other considerations could include whether equity grants are made widely throughout the employee base, and whether there is an employee stock purchase plan in place.

Employee Perception

Firmwide policies may be better received by executives since it is easier to communicate a broad prohibition than one that applies to only a subset of the population.

Company Values

Some companies may conclude that certain transactions in derivative securities are so counter to company values that they should be prohibited at all levels. The classic example of this might be an employee’s purchase of put options at the company’s current price. These options are only valuable if the company’s current stock price drops. One can sympathize with a company’s desire to prohibit this kind of transaction in all circumstances. We realize that purchasing a put would not necessarily be a hedging transaction but, as already noted, many policies cover more than classic hedging transactions.

Other Insights from Initial Hedging Disclosures

In addition to the scope of hedging policies, we observed the following in our review of the new hedging disclosures.

Transactions Prohibited

There cannot be a hedging transaction unless the employee owns some stock, so as a technical matter a policy that allowed employees to purchase put options, so long as they do not hold company stock, would not be a policy that permits hedging (though we note that Section 16(c) of the Securities Exchange Act of 1934, which forbids short selling by insiders, is violated if an uncovered put option is purchased by insiders). Further, even with respect to employees that own employer stock, some derivative transactions have no hedging function (for example, purchases of call options).

Notwithstanding the foregoing, about 58% of the companies we examined have trading policies that prohibit transactions that do not necessarily have a hedging function. The prohibition is sometimes part of a so-called hedging prohibition and sometimes a separate trading prohibition covered by the company’s insider trading policy. The justification for this type of prohibition appears to be that such non-hedging derivative transactions may nonetheless result in the appearance of insider trading, reflect undesired speculative trading, increase the risk of a securities law violation, and/or possibly alter employees’ alignment with the company’s best interests (for example, by encouraging short-term thinking).

Table note: The numbers in the chart are rounded from 57.5% and 42.5%.

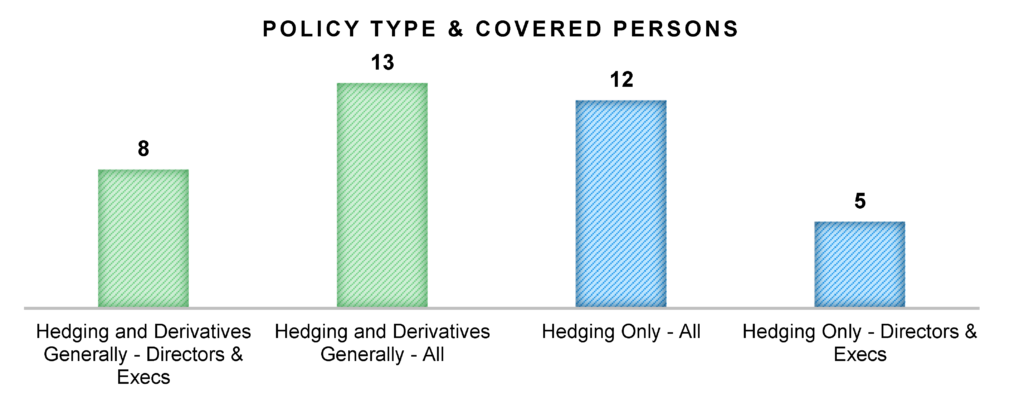

Interestingly, we did not observe a significant correlation between the scope of hedging policies and the types transactions prohibited:

Table note: Two companies did not provide information regarding who is covered under their policy.

Placement

The recent hedging disclosure regulations provide that the new disclosure may be placed anywhere in a company’s proxy statement. As noted above, the CD&A typically includes disclosure about hedging policies for NEOs. To avoid duplicative disclosure, the hedging disclosure rules allow a company to: place the disclosure outside of the CD&A and include separate disclosure in the CD&A; place the disclosure outside of the CD&A and include a cross-reference in the CD&A; or include the disclosure within the CD&A. The last option, while most efficient, would result in disclosure for non-NEOs within the CD&A, which some companies may wish to avoid. Our research shows that about 60% of companies include their hedging disclosure only within the CD&A.

Table note: Reference to “governance” includes all sections of the proxy statement other than the CD&A.

Disclosure Approach: Summary or Full Policy

Per the hedging disclosure regulations, a company can provide either full disclosure of a hedging policy or practice or, alternatively, a summary. A summary needs to describe the categories of people subject to the policy or practice and the categories of transactions that are permitted or specifically prohibited. A company without a hedging policy or practice needs to either say it has no such policy or practice or provide that it permits hedging. In our research, all companies included a summary of their hedging policy rather than disclosing their full policy; two companies did include a link to their full hedging policy.

Endnotes

1U.S. Proxy Voting Research Procedures & Policies (Excluding Compensation Related) Frequently Asked Questions, Q&A 65.(go back)

22019 U.S. Proxy Paper Guidelines.(go back)

3Although not included in our reported research results, we observed that a company that filed its proxy after October 4, 2019, disclosed that it does not have hedging prohibitions in place.(go back)

4For example, if the policy only covered transactions that hedged the risk of stock ownership, a company might conclude that there is less reason to extend the policy to employees not subject to stock ownership guidelines.(go back)

Print

Print