Lyuba Goltser is a partner and Aabha Sharma is an associate at Weil, Gotshal & Manges LLP. This post is based on their Weil memorandum.

The board self-evaluation process has evolved from a “check-the-box” obligation into a highly effective tool to help boards of directors take a critical look at their capabilities and readiness to meet the growing expectations of investors and other corporate stakeholders. As directors think about the opportunities and challenges their companies face in 2020 and beyond, the self-assessment process should be an important part of the board’s agenda. We describe below a flexible six step framework for conducting and enhancing the benefits of this process.

Overview

Boards of directors are under pressure to achieve a multitude of goals, among them to foster a company culture that supports long-term value creation, improve the diversity of the board and the management team, focus on sustainability issues affecting the company’s long-term strategy, enhance oversight of risk, and strengthen engagement efforts with stakeholders. As boards tackle these challenges, a thoughtful self-assessment process can improve board alignment around key issues, reveal gaps in composition, provide fresh perspectives on the board’s and management’s functioning and strengthen the effectiveness of the board’s procedures and practices.

Moreover, disclosing the nature and positive outcome of the board’s evaluation process signals the board’s commitment to its governance responsibilities.

There is little guidance, however, on the board evaluation framework. The Securities and Exchange Commission does not mandate either the conduct or disclosure of board evaluations. The New York Stock Exchange (but not Nasdaq) requires listed company boards and their audit, compensation, and nominating committees to perform annual self-evaluations, but does not prescribe how such evaluations should be conducted. Proxy advisory firms ISS and Glass Lewis strongly encourage board evaluations but do not provide detailed guidance on the process.

The absence of any prescriptive methodology means that boards have the freedom to design a process to meet their objectives and tailor evaluation methodologies to their current circumstances, as discussed below.

Framework for Board Evaluations

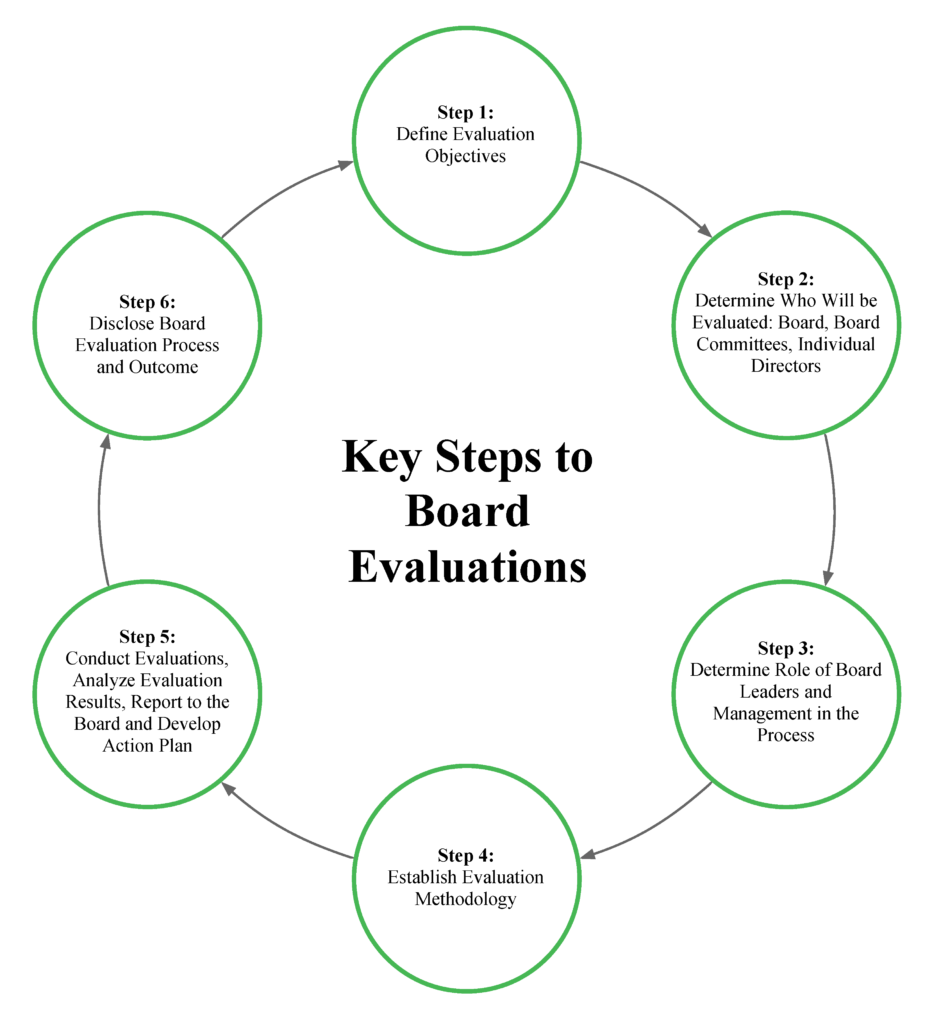

The framework diagrammed below provides a step-by-step guide for boards and their internal and external advisors for establishing a self-assessment process.

No one self-evaluation method is right for every board—or right for every year—and should be driven by the company’s current circumstances. Whatever process is selected, it should lead to a critical look at the board’s effectiveness and culminate in specific actionable items for board improvement based on evaluation results.

Step 1: Define Evaluation Objectives

First, the board should understand and agree on the specific objective or objectives of the process. Sometimes an objective may arise from a difficult issue the board has just addressed where, in the aftermath, the board wishes to reassess how the issue was identified and handled. Sometimes, the objectives may be more general. A well-run board evaluation can provide a meaningful opportunity to address critical topics, such as:

- Consider board composition, including skills and diversity

- Evaluate efficiencies and effectiveness of board leadership

- Consider director independence, especially where directors represent the interests of significant shareholders or founding families

- Improve meeting and information processes

- Assess quality of boardroom discussions and relationships

- Discuss succession strategies

- Consider the board’s relationship with management

- Refresh the board to achieve diversity, including of age, tenure, gender

- Consider committee responsibilities and effectiveness

- Rotate committee composition and leadership

- Address issues from recent transformative transactions (i.e. mergers, acquisitions of significant units, spin-offs)

- Discuss specific issues or concerns facing the company and/or industry

- Enhance governance guidelines

- Reinvigorate the board as a whole

Step 2: Determine Who Will be Evaluated: Board, Board Committees, Individual Directors

An important step in determining the scope is deciding who will be evaluated. Typically, some combination of the board, board leadership, board committees and/or committee chairs are evaluated. As noted above, at a minimum, the NYSE listing rules require annual evaluations of the board, as well as audit, compensation and nominating committees.

A growing number of boards are conducting individual director evaluations through either, or both, director self-evaluations (directors evaluate their own performance) or peer evaluations (directors evaluate each of the other directors). Currently, approximately 40% of Fortune 100 companies conduct individual director self-evaluations, up from 25% in 2018, and 25% conduct peer evaluations, up from 10% in 2018. [1] Because individual assessments require directors to ask and answer difficult questions about themselves and their colleagues, we recognize that the process can be met with hesitation. Common concerns include that candid feedback, even if constructive, may single out individual director shortcomings, put directors on the defensive and undermine a collegial board culture. In our experience, however, when done thoughtfully, periodic individual director evaluations can offer constructive feedback to improve performance, which can be welcomed by the director who receives it. A third party facilitator can be useful to encourage open and confidential conversations when conducting individual director interviews.

Step 3: Determine Role of Board Leaders and Management in the Process

Leadership is critical in designing and implementing the evaluation process. The responsibility to determine the appropriate evaluation process and consider the overall objectives is typically delegated to the nominating and governance committee. The New York Stock Exchange rules provide that one of the purposes of the nominating and governance committee should be to oversee the evaluation of the board.

Depending on the evaluation methodology selected, the board, working with the nominating and governance committee, should also determine the role of the independent chair/lead director in the evaluation process. The process is often led by the independent board chair/lead director and/or the chair of the nominating and governance committee. The selected directors should drive the process – including setting the agenda and involving the right people.

In addition to the CEO, as a member of the board, sometimes a limited number of key management individuals such as the General Counsel or Corporate Secretary may be asked to participate. While members of management may have important roles in the process, the board should be leading the process.

Step 4: Establish Evaluation Methodology

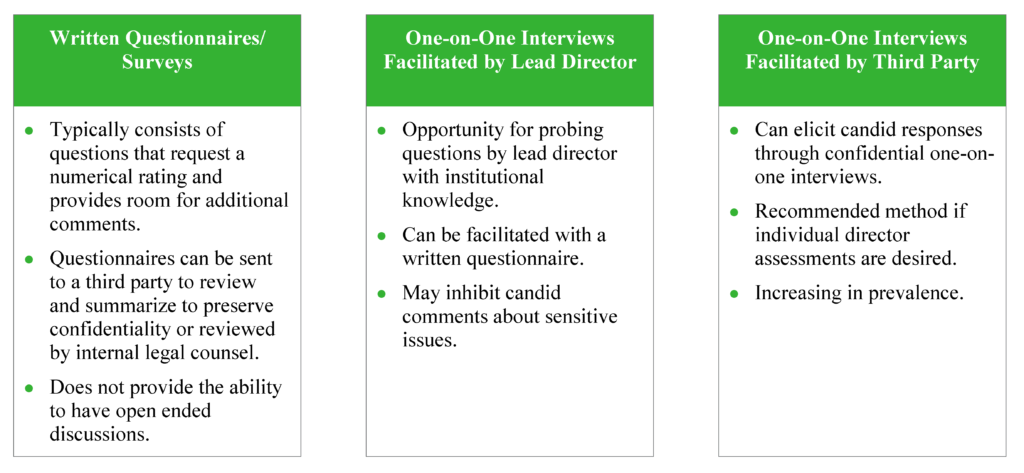

Perhaps the most debated element of the self-assessment framework is the methodology itself. Below we suggest methodologies which can be conducted on a stand-alone basis or in combination. The decision with respect to the format is often determined by the board’s prior experiences with the self-evaluation process and the comfort level of the directors. We recommend varying the board evaluation format periodically to encourage new perspectives and illuminate actionable areas for improvement.

The most common evaluation format is the written questionnaire, with more than 40% of Fortune 100 companies using questionnaires to elicit information about board effectiveness. To avoid a checklist approach, written questionnaires should be updated each year to reflect current issues and ask whether the prior year’s recommendations have been achieved.

Director interviews are becoming increasingly common, often conducted by the independent chair/lead director, or a third party. Approximately 30% of Fortune 100 companies used both questionnaires and individual director interviews during the evaluation process. Interviews allow for follow-up questions, as well as for directors to elaborate in further detail than may be practical in questionnaire format.

External facilitators, retained by more than 25% of Fortune 100 companies, can bring a fresh and objective perspective to board evaluations and perform a range of evaluation services, including designing and leading the evaluation process, conducting one-on-one director interviews, and developing an action plan based on evaluation results. Experienced third party evaluators also have the benefit of working first-hand with other companies addressing similar issues and are experienced at eliciting candid responses. Directors may also be more likely to provide open, honest and uncensored responses with outside facilitators during confidential one-on-one interviews than with their colleagues, leading to a more meaningful and introspective evaluation process. Even with the use of a third party facilitator, however, the selected directors leading the self-evaluation should drive the process, providing direction to the facilitator regarding the scope and methodologies, as well as any follow-up action items based on evaluation results.

Concerns about the discovery of board evaluation materials are commonly raised by directors, with some boards opting for paperless facilitated board and committee discussions. Using outside counsel or having outside counsel engage and oversee the work of the third-party facilitator will help to preserve the privilege. No matter the methodology selected, it is advisable to take precautions to preserve the privilege, to the extent possible, including indicating clearly on evaluation materials that the content is “Privileged and Confidential” and taking care in the distribution and dissemination of such materials.

Step 5: Conduct Evaluations, Analyze Evaluation Results, Report to the Board and Develop Action Plan

Taking the time to analyze and understand the results of the evaluation is critical. This includes not only focusing on numerical scores, if any, but also taking into consideration the company’s current circumstances, including any recent events at the company that may have played a role in director responses, the “tone” of responses, previous evaluation results and how the results align with the company’s strategic goals.

Once synthesized, evaluation results should be reported to the board. Results are often first discussed with the nominating and governance committee, the committee chair and/or the independent chair/lead director before presentation to the full board, which generally takes place in executive session. Moreover, it is often very helpful to preview evaluation results with board leadership and/or certain individual directors before sensitive feedback is delivered.

Based on the results of the evaluation, the board should consider whether there are gaps between where the board strives to be and where the board currently stands, including the reasons for such gaps. Moreover, the board, as a whole, should commit to an action plan, with concrete steps, based on evaluation results. The board should establish a timeline for each action item and periodically evaluate progress, using next year’s evaluation to measure progress. The key is ensuring follow-through for each action item.

Step 6: Disclose Board Evaluation Process and Outcome

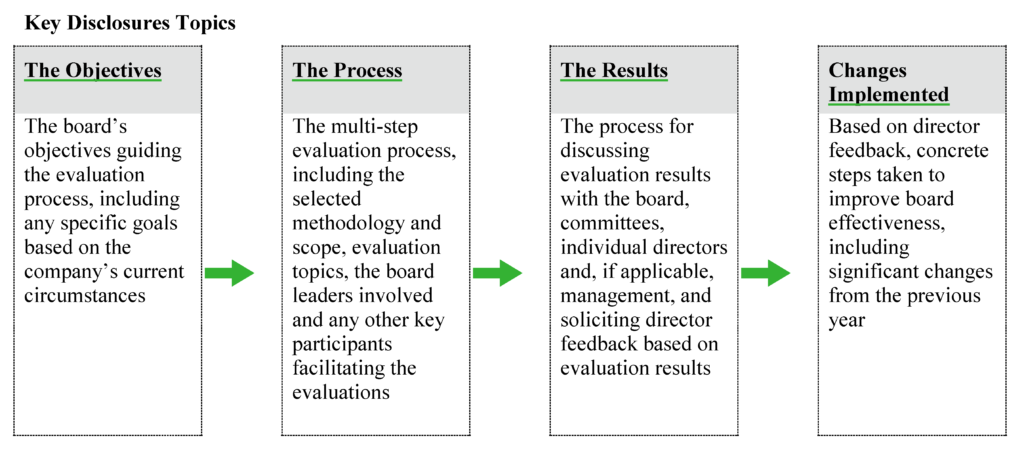

While it is common practice to address, at a high-level, the board evaluation process in company corporate governance guidelines and the proxy statement, there is a wide variety in the breadth of these disclosures.

In light of investor demands for transparency regarding board effectiveness and oversight – including steps by directors to continuously assess and improve board performance – public companies in dramatic and increasing numbers are allocating significant space in the proxy statement to a discussion of the board’s self-assessment process.

An overwhelming majority, 93% of Fortune 100 companies, provided at least some disclosure about their board evaluation process in their 2019 proxy statements. Approximately 50% of these companies identified general topics covered in their evaluations and 25% disclosed actions taken by the board in response to the evaluation results, such as:

- Enhanced director orientation and education programs

- Changes to board structure

- Changes in composition and director tenure or retirement age limits

- Expanded director search and recruitment practices

- Improvements to the format and timing of board materials

- Changes to the board’s agenda with more time allocated to key strategic issues

- Changes to company and board governance documents

- Improved evaluation process

Some companies are also using graphics to make information about the evaluation process accessible to the reader at a glance. The nominating and governance committee, partnering with management, should review the company’s current board evaluation-related disclosures to determine, first, whether they accurately reflect the board’s current philosophy and practice and, second, whether the disclosure provides investors with meaningful information about the quality of the board’s self-assessment.

Timing of Board Evaluations

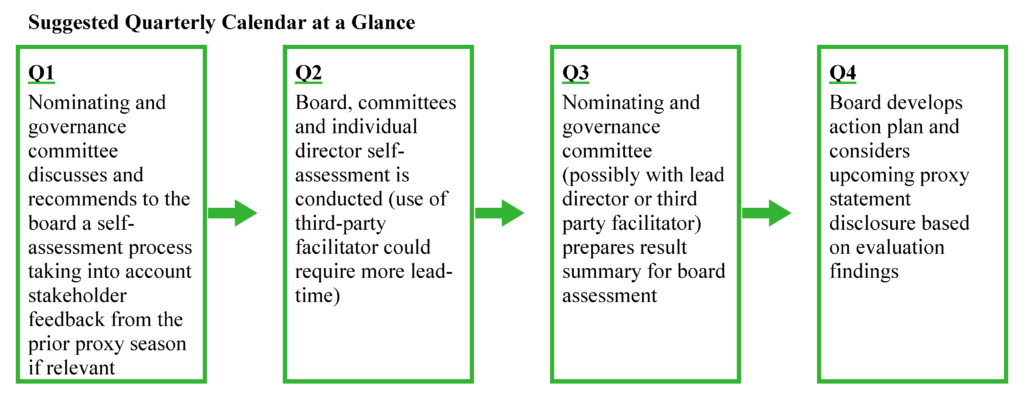

There is no “one size fits all” approach to board evaluations – including the timing of when evaluations are conducted. It is important however that directors at least annually assess board and board committee performance in some form.

One best practice is to conduct board evaluations following critical inflection points in the company’s life cycle, which can include the company undergoing significant transformations, such as:

- Preparing to go public

- Mergers or other significant corporate transactions

- Restructuring

- CEO transition

- Change in board leadership or composition, reputational concerns, litigation or other crisis events

- A significant period of time without refreshment

To provide the board and management sufficient time to establish and engage in a robust evaluation process and reach milestones based on the board’s action plan, the evaluation process should generally be on the board calendar at about the same time every year. The second or third quarter board meeting is typically a good time to solicit feedback and make decisions about the form and methodology of the board’s self-assessment process for the upcoming year. No matter the timetable selected, the following year’s proxy statement will be an opportunity for the board to communicate with investors about its self-assessment process.

Endnotes

1Source for Fortune 100 company board evaluation data throughout this paper is from EY Center for Board Matters: How Companies are Evolving Board Evaluations and Disclosures.(go back)

Print

Print