Barbara Novick is Vice Chairman and Co-Founder and Michelle Edkins is Global Head of Investment Stewardship at BlackRock. This post is based on their BlackRock memorandum.

As a fiduciary investor, BlackRock undertakes all investment stewardship engagements and proxy voting with the goal of protecting and enhancing the long-term value of our clients’ assets. In our experience, sustainable financial performance and value creation are enhanced by sound governance practices, including risk management, oversight, and board accountability.

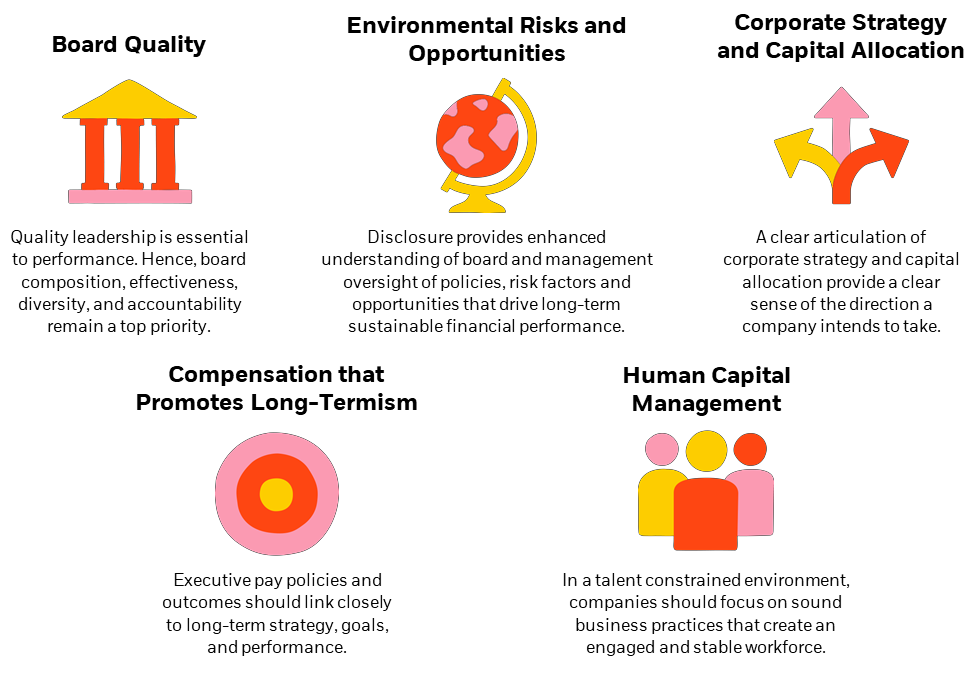

2020 Engagement Priorities

We are committed to providing transparency into how we conduct investment stewardship activities in support of long-term sustainable performance for our clients. As part of our commitment to clients, we are enhancing our disclosures in 2020. Key steps towards increased transparency include 1) moving from annual to quarterly voting disclosure, 2) prompt disclosure around key votes including an explanation of our voting decisions, and 3) enhanced disclosure of our company engagements.

Each year, we prioritize our work around engagement themes that we believe will encourage sound governance practices and deliver sustainable long-term financial performance for our clients. Our Engagement Priorities for 2020 represent a continuation and evolution of themes identified over the past several years. We hope that highlighting our priorities will help company boards and management prepare for engagement with the Investment Stewardship team and provide clients with insight into how we are conducting engagement and voting activities on their behalf. Some governance issues, like board quality and performance, have long been core components of the Investment Stewardship team’s work. Other Engagement Priorities evolve over time and are informed by regulatory and market developments. In 2020, we are putting an increased focus on sustainability-related issues and relevant disclosures, given the growing impact of these issues on long-term value creation. We are also mapping our engagement priorities to specific United Nations Sustainable Development Goals, such as Gender Equality and Clean and Affordable Energy, and providing a high level, globally relevant Key Performance Indicator (KPI) for each Priority so companies are aware of our expectations.

Our Engagement Philosophy

BlackRock’s Investment Stewardship (BIS) team engages with portfolio companies to encourage corporate governance and business practices aligned with sustainable long-term financial performance. The team is comprised of more than 45 professionals across the world (with team members in New York, San Francisco, London, Tokyo, Singapore, Hong Kong, and Sydney), taking a local approach with companies while benefiting from global insights. BIS is positioned within the firm as an investment function. As such, we work closely with BlackRock’s active portfolio management teams. Core tenets of good governance—board oversight, minority shareholder rights, and management quality—are desirable qualities for all investors and can be a differentiating factor for equity and debt investors’ decision-making.

The team engages companies from the perspective of a long-term investor and irrespective of whether a holding is in an active or indexed investment strategy. As the majority of our clients invest through index-based strategies in which we cannot sell shares, engagement is a critical mechanism for providing feedback or signaling concerns about governance and sustainability factors affecting long-term performance.

We initiate many of our engagements because companies have not provided sufficient information in their disclosures to fully inform our assessment of the quality of their governance. We ask companies to review their reporting in light of their investors’ informational needs. In our view, companies that embrace corporate governance and sustainability reporting as a strategic objective—as opposed to a compliance function—are more likely to generate sustained financial returns over time.

BIS emphasizes direct dialogue with companies on governance issues that have a material impact on financial performance. We seek to engage in a constructive manner and ask probing questions, but we do not tell companies what to do. Where we believe a company’s governance or business practices fall short, we explain our concerns and expectations. As a long-term investor, we are willing to be patient with companies when our engagement affirms they are working to address our concerns. However, when we do not see progress despite ongoing engagement, or companies are insufficiently responsive to our efforts to protect the long-term financial interests of our clients, we may signal our concern by voting against management. We believe that when a company is not effectively addressing a material issue, its directors should be held accountable.

In practice, we assess whether to initiate an engagement or accept an invitation to engage with individual companies based on a range of material factors including our prior history of engagement with the company, our thematic priorities, level of concern on specific governance issues, observation of market events, and assessment that engagement will contribute to outcomes that protect and enhance the financial value of our clients’ investments. We strongly encourage companies to provide a detailed agenda when sending us a request for engagement.

Board Quality

Board composition, effectiveness, and accountability remain a top priority. In our experience, most governance issues, including how relevant material environmental and social factors are managed, require effective board leadership and oversight. We encourage engagement protocols that foster constructive and meaningful dialogue, including conversations with independent directors to articulate strategic risk oversight. As we believe that high quality boards provide a competitive advantage, we will seek to better understand how boards assess their effectiveness and director performance, along with the skills and expertise needed to take a company through its future (rather than prior) multi-year strategy. In that context, we want to see disclosure regarding the board’s position on director responsibilities and commitments, turnover, succession planning, and diversity. With regard to director responsibilities and commitments, we seek to understand the board’s role in crisis management in the face of, for instance, cyber events, sudden departures of senior executives, negative media coverage, or a proxy contest given the likelihood that such events are often material and can significantly detract from a board’s ability to carry out its other responsibilities.

In relation to board qualifications and effectiveness, we will continue to engage with companies to better understand their progress on improving diversity in the boardroom. In our view, diverse boards make better decisions. BlackRock recognizes that diversity has multiple dimensions, including personal factors such as gender, ethnicity, and age, as well as professional characteristics, such as a director’s industry, area of expertise, and geographic location. Where we consider a board to be insufficiently diverse, we may vote against directors on the nominating and/or governance committee for an apparent lack of commitment to board effectiveness. Further, we will encourage governance structures that enhance accountability (e.g. proxy access in the United States), limit entrenchment (e.g. regular election of directors and board evaluations) and align voting rights and economic interests (e.g. one share, one vote).

Board quality KPI—BIS seeks to understand how, and how effectively, a board oversees and counsels management. A core component of BIS’ evaluation is direct engagement with a board member. In each key regional market, for those companies with which we seek to engage, we expect to have access to a non-executive, and preferably independent, director(s) who has been identified as being accessible to shareholders where appropriate. BIS will hold the most senior non-executive director, e.g. chairman or lead independent director, accountable for ensuring such a role is identified.

Environmental Risks and Opportunities

Management of climate and environment-related factors is an increasingly defining factor in companies’ long-term prospects. We also believe that robust disclosure is essential for investors to effectively gauge companies’ preparedness for environmental risks and opportunities. We are asking that by the end of 2020, companies issue reports aligned with the recommendations of the Sustainability Accounting Standards Board (SASB) and the Taskforce on Climate-related Financial Disclosures (TCFD), which are discussed in greater detail below. We will hold directors accountable if a company does not make adequate progress on such disclosures.

In our Global Corporate Governance & Engagement Principles, we explain that sound practices in relation to the environmental factors inherent to the business model can be a signal of operational excellence and management quality. Environmental factors relevant to the long-term financial performance of companies are typically industry-specific, although in today’s dynamic business landscape, some, such as regulation and technological change, can have a broader impact.

Our engagements encompass a broad set of material environmental factors, including energy consumption, operational efficiency, water and waste management, emissions, and natural resource management as well as climate-related risks and opportunities. An example of this is reflected in our commentary on how we engage on sustainable agribusiness.

We recognize that the proliferation of reporting standards creates challenges for companies and for investors, which is why we have encouraged reporting in line with the TCFD and SASB. The TCFD’s 11 recommendations provide an overarching framework for disclosure on the business implications of climate change, and potentially other environmental and social, “E&S” factors. We find SASB’s industry-specific guidance, as identified in its materiality map, beneficial in helping companies identify and discuss their governance, risks assessments, and performance against KPIs.

Climate change poses risks and opportunities that may impact the long-term financial sustainability of companies across all sectors. We seek three specific outcomes in our climate risk engagements with companies:

- better disclosures that will contribute to improved market-level data;

- substantive action by companies in addressing climate risk; and

- more informed voting decisions aligned with long-term value creation. We explain our approach to engagement on climate risk in more detail here.

In another commentary, we explain how we engage to encourage companies to adopt the TCFD and SASB frameworks to disclose their approach to climate-related risks and the transition to a lower carbon economy. These reporting frameworks cover the physical, financial and transition risks associated with climate change and provide guidance to companies for disclosing material, decision-useful information that is comparable within each industry. While these frameworks are currently voluntary, they are gaining momentum; we encourage companies to be proactive in understanding and adopting them.

In the absence of robust disclosures, investors often, and reasonably, conclude that companies are not adequately managing risk. We view the SASB and TCFD frameworks as complementary in achieving the goal of disclosing more financially material information for investors, particularly as it relates to industry-specific metrics and target setting.

The impact of climate risk on investment portfolios is increasingly apparent and we are accelerating our engagement with companies on this critical issue. In January 2020, BlackRock joined Climate Action 100+, an investor-led corporate engagement initiative, as a natural progression of the work we have done to date in promoting enhanced governance practices, target setting and disclosures with the companies in which we invest on behalf of clients. Given the groundwork BIS has already laid engaging on climate risk disclosure, and the growing investment risks surrounding sustainability, we will be increasingly disposed to vote against management when companies have not made sufficient progress.

Environmental risks and opportunities KPI—BIS expects companies with which we have already engaged on TCFD-aligned reporting to disclose sufficient detail across the four pillars of the TCFD framework and provide a timeframe within which the company will report fully in line with the eleven recommendations. BIS will hold members of the relevant committee, or the most senior non-executive director, accountable for inadequate disclosures and the business practices underlying them.

Corporate Strategy and Capital Allocation

For several years we have asked companies to articulate their strategic frameworks for long-term value creation and to affirm that their boards have reviewed those plans. Investors expect the board to be fully engaged with management on the development and implementation of the strategy, particularly when the company needs to enhance its competitiveness or pivot in light of unanticipated developments. This demonstrates to investors that boards are engaged and prepared, when necessary, to transition and adapt in a fast-moving business environment.

Corporate strategy disclosures should clearly explain a company’s purpose, i.e. what it does every day to create value for its stakeholders. In our view, companies that better articulate their purpose and connect it with their long-term strategy are more likely to have engaged employees, loyal customers, and other supportive stakeholders. [1] This gives a company a competitive advantage and a stronger foundation for generating superior financial returns.

Companies should succinctly explain the long-term strategic goals that the board and management are working towards, the applicable measures of value creation, milestones that will demonstrate progress, and steps taken in response to challenges.

This explanation should be refreshed periodically and adapted to reflect the changing business environment and how it might affect how a company prioritizes its capital allocation, including capital investments, research and development, technological adaptation, employee development, and capital return to shareholders, i.e. dividend, buy-back, or other return opportunity.

Corporate strategy and capital allocation KPI—As part of long-term strategy and capital allocation, companies should articulate publicly how sector relevant sustainability risks and opportunities, for instance those identified in the SASB framework, are integrated into business strategy. BIS will engage with companies to review our reporting expectations and encourage them to make the connection between long-term planning and business-relevant sustainability risks and opportunities. BIS will hold the most senior non-executive director accountable if, within an agreed timeframe, the company has not provided adequate disclosures and made progress on the business practices underlying them.

Compensation that Promotes Long-Termism

We are interested in how boards establish and explain their compensation program in the context of a company’s long-term strategy. In our engagements, we seek to understand how a specific pay program appropriately incentivizes executives to deliver on strategic and operational objectives, consistent with sustainable financial performance. In general, we expect a meaningful portion of executive pay to be tied to the long-term returns of the company, as opposed to short-term increases in the stock price. The metrics used to trigger payments under incentive plans should be explained and justified in the context of a company’s business model and sector. To this end, we expect companies to clearly articulate the company’s balance and prioritization between “input” metrics that are within management’s control relative to “output” metrics such as earnings per share or total shareholder return.

Where pay seems misaligned with performance, we expect the company to provide detailed justification in its public disclosures. We may seek to engage with independent directors if our concerns are not addressed. We may ask the board to explain the extent to which it considers internal pay equity and the broader macroeconomic context when setting pay. We believe that companies should use appropriately benchmarked peer groups to maintain an awareness of peer pay levels and practices so that pay is market competitive, while mitigating potential ratcheting of pay that is disconnected from actual performance.

We may vote against the election of compensation committee members in instances, including but not limited to, where a company has not demonstrated the connection between strategy, long-term shareholder value creation, and incentive plan design.

Compensation to promote long-termism KPI—Executive pay should be adequately aligned with performance and shareholder investment return. BIS expects pay outcomes to be correlated with a business relevant long-term performance metric, e.g. 3-5 year total shareholder returns or returns on invested capital. BIS will also evaluate company-wide structures, as we believe compensation, including base, bonus, and pension contributions, is an important element of a company’s ability to retain and attract talent at all levels and provides insight into a company’s human capital management in practice. BIS will hold compensation committee members accountable for pay outcomes.

Human Capital Management

Most companies BlackRock invests in on behalf of clients have, to varying degrees, articulated in their public disclosures that they are operating in a talent constrained environment. It is therefore important to investors that companies explain how they establish themselves as the employer of choice for the workers on whom they depend. A company’s approach to human capital management (HCM) will vary across sectors, but it is a factor in business continuity and success. Employee development, corporate culture, compensation, inclusion and diversity, as well as a commitment to sound practices in relation to equal employment opportunity, health and safety, labor relations, and supply chain labor standards—amongst other things—are all critical components of a robust HCM strategy. In light of evolving market trends, like shortages of skilled labor, uneven wage growth, and technology, that are transforming the labor market, many companies and investors consider robust HCM as a competitive advantage.

In our HCM engagement commentary we explain that we seek disclosure around a company’s approach to ensuring the adoption of sound business practices likely to create an engaged and stable workforce. We expect such disclosure to provide us with an understanding of how boards oversee and work with management to improve performance in these areas. Complete qualitative and quantitative disclosures helps investors understand how companies are considering HCM as a business risk and valuing their employees as a long-term asset to the company. Useful industry-specific metrics can provide companies and investors insight into the return on investment related to talent and enable companies to understand if they are outliers relative to peers from the perspective of long-term performance. SASB provides industry-specific HCM metrics that may prove helpful to companies considering enhancing their disclosures. Comprehensive disclosure provides investors with a sense of the company’s culture, long-term operational risk management practices and, more broadly, the quality of the board’s oversight. In our engagement with companies on HCM, we discuss their current and prospective disclosures, as well as their strategy and policies to attract, retain, and develop the people on whom their business performance depends.

Human capital management KPI – Given most companies identify their employees as their greatest asset, we expect boards to oversee human capital management strategies. Absent disclosure about the board’s role in overseeing the company’s human capital practices, including an explanation of the type of information reviewed and how frequently, BIS will hold members of the relevant committee, or the most senior non-executive director, accountable.

Endnotes

1“Culture of Purpose – Building business confidence; driving growth – 2014 core beliefs & culture survey” available at https://www2.deloitte.com/content/dam/Deloitte/us/Documents/about-deloitte/us-leadership-2014-core-beliefs-culture-survey-040414.pdf.(go back)

Print

Print