Amit Batish is Manager of Content and Courtney Yu is Director of Research at Equilar, Inc.

With the 2020 proxy season now concluded, thousands of U.S. public companies have filed their proxy statements highlighting key trends with regards to their governance practices. Among the many trends captured from this year’s proxy season are those related to Say on Pay and the CEO Pay Ratio. In this post, Equilar analyzes Say on Pay voting results and the effects of the CEO Pay Ratio on Say on Pay among Equilar 500 companies—the 500 largest U.S. public companies by revenue.

A decade following its inception, Say on Pay continues to play a pivotal role in providing shareholders a platform to voice discontent over executive compensation pay practices. In particular, shareholders seek for executive pay plans to align with company performance and shareholder return, and when that alignment is not present, executive pay is likely to come under some level of scrutiny.

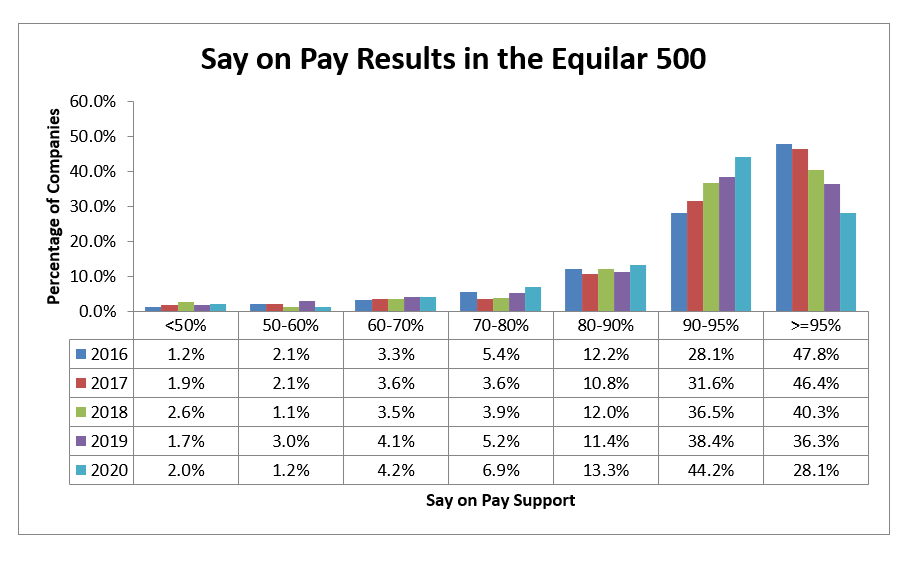

While executive compensation packages have been largely accepted by investors, approval percentages have steadily declined in recent years. During the first five years following the implementation of Say on Pay, a large proportion of companies passed their Say on Pay votes with over 95% support. However, so far in 2020, just 28.1% of Equilar 500 companies passed with more than 95% support—this represents a near 20 percentage point decrease from 2016 when 47.8% of companies passed with such level of support (Figure 1). Three-fourths of companies still passed their Say on Pay votes with over 90% support.

Figure 1: Say on Pay Results (Equilar 500)

The number of companies that fail Say on Pay remains minimal; however, higher thresholds set by proxy advisors have created another challenge for companies to stay out of the spotlight. For example, according to Glass Lewis’ proxy voting guidelines, 80% support is the threshold that a company must achieve before the firm will scrutinize executive pay further in the following year. 10.8% of Equilar 500 companies passed Say on Pay with less than 80% support in 2016, and that figure has increased to 12.3% in 2020. Therefore, it is critical that companies construct pay plans that will not only appease shareholders and pass, but also meet the 80% support threshold.

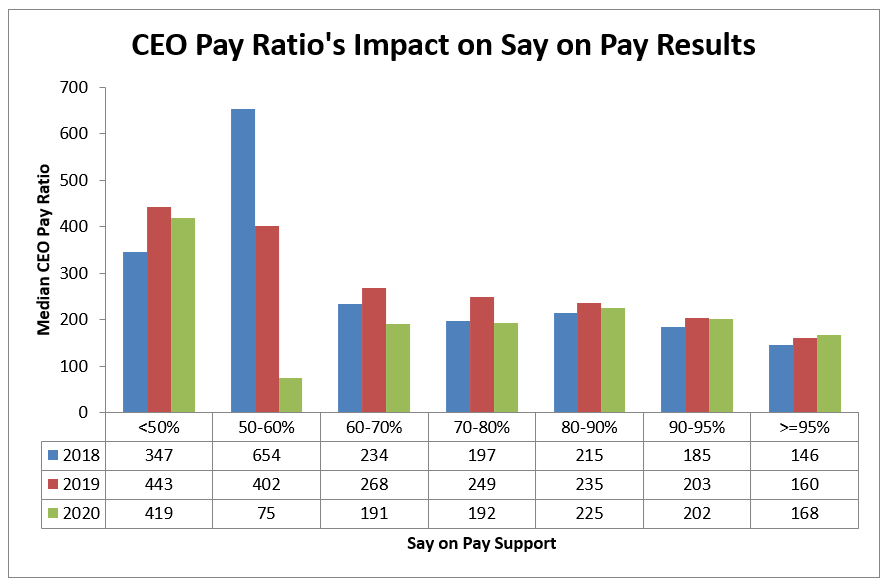

Several factors play a role in driving these Say on Pay trends, but the steady increase in CEO pay certainly continues to capture the spotlight. To highlight the growing trend, the CEO Pay Ratio was established as mandated SEC disclosure starting in 2018. The measurement requires companies to compare the compensation of the CEO to the compensation of the median employee of the same company. With an increased social concern around income inequality, the CEO Pay Ratio gives investors another view of how much the CEO is compensated.

When examining data from the first three years of CEO Pay Ratio disclosures, there is a general trend that companies with low levels of Say on Pay support have higher median ratios than those companies with higher levels of Say on Pay support (Figure 2). However, there’s enough variance in the data to say it’s inconclusive as to whether lower CEO Pay Ratios help improve a company’s Say on Pay voting support.

Figure 2: The Effects of the CEO Pay Ratio on Say on Pay (Equilar 500)

The CEO Pay Ratio has yet to garner the impact that many key stakeholders initially thought it would have prior to its implementation. A key reason for this is due to shareholders not having a clear approach in leveraging this data in their analyses. The CEO Pay Ratio presents difficulties as a benchmarking figure. It is difficult to incorporate this measurement when setting CEO compensation because the ratio varies on a number of different factors, including company size or the inclusion of international workers.

Most institutional investors still scrutinize pay for performance, rigor of performance metrics and problematic pay practices when assessing how to vote on Say on Pay. Proxy advisors continue to note the data in their reports, but they currently don’t factor in the pay ratio in their Say on Pay vote recommendation. However, as unlikely as it is that investors will vote against a company’s Say on Pay because of its CEO Pay Ratio, there is a steady increase in interest to see more robust disclosure of the ratio and how companies tell their stories. Thus, the coming years should paint a clearer picture as to what the role of the ratio may be in executive compensation moving forward.

Overall, Say on Pay continues to have a lasting impact on the executive compensation landscape as shareholders seek sound pay practices from the companies in which they invest. While the trends uncovered in this study reflect pay trends over the last five years, the current pandemic is likely to shift the landscape in the coming year and it will be interesting to see how this impacts the many facets of executive pay, including the CEO Pay Ratio.

Print

Print