Jay Clayton is Chairman of the U.S. Securities and Exchange Commission. This post is based on Chairman Clayton’s recent public statement. The views expressed in this post are those of Mr. Clayton and do not necessarily reflect those of the Securities and Exchange Commission or its staff.

Good morning. This is an open meeting of the U.S. Securities and Exchange Commission, under the Government in the Sunshine Act. This morning, we have two items on the agenda.

Before we begin with today’s agenda, I want to note the passing of Justice Ruth Bader Ginsburg and the joint statement of the Commission recognizing her as a giant of the law who authored many opinions that meaningfully impacted the lives of all Americans, including our nation’s investors. Of particular relevance to our work at the Commission was United States v. O’Hagan, which upheld the misappropriation theory of insider trading and has served as a critical element of our securities law framework.

At today’s meeting, we are considering amendments to the rules governing the Commission’s whistleblower program. Over the past ten years, the whistleblower program has been a critical component of the Commission’s efforts to detect wrongdoing and protect investors and the marketplace, particularly where fraud is well-hidden or difficult to detect. Enforcement actions from whistleblower tips have resulted in more than $2.5 billion in ordered financial remedies, including more than $1.4 billion in disgorgement of ill-gotten gains and interest, of which almost $750 million has been, or is scheduled to be, returned to harmed investors.

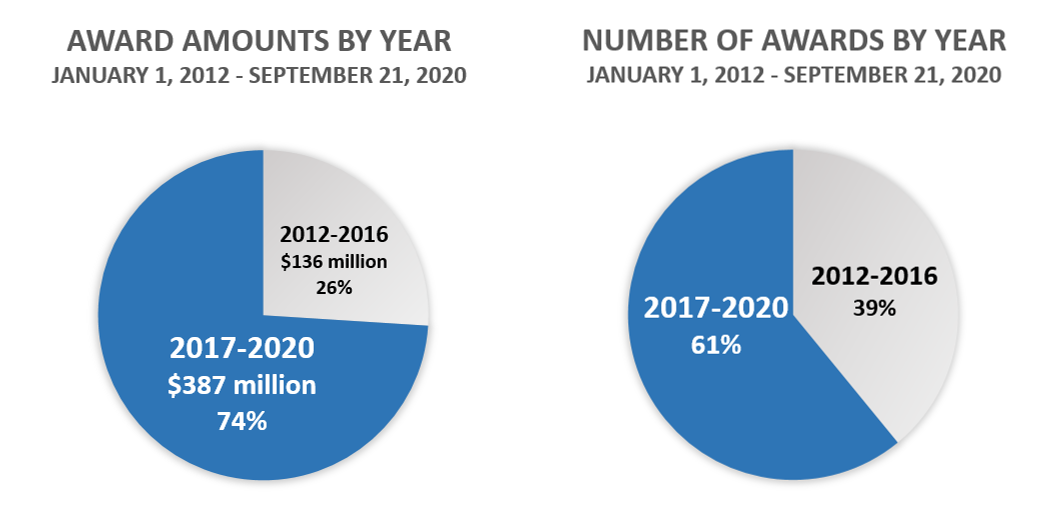

During my time at the Commission, with the support and assistance of Stephanie Avakian, Jane Norberg, staff from the Office of the Whistleblower and the Office of the General Counsel, and my various fellow Commissioners, we have added transparency and efficiency to the program and enhanced the impact of the program, including by increasing the number of whistleblowers awarded each year. Numbers never tell the whole story, but here they are a clear and loud voice for our commitment to Congress’s direction to implement a robust and effective whistleblower program.

Transparency, efficiency and effectiveness are the goals that have been a priority for me during my time as Chairman. Since I joined the Commission in May 2017, we have awarded approximately $368 million to eligible whistleblowers, including the five largest awards in the program’s history—two awards at approximately $50 million each, and one each at $39 million, $37 million, and $33 million. We have also focused on processing claims faster—in fiscal year 2020, even with the impact of COVID-19, we have already processed more claims than we have in any prior year, which means we have been able to issue more awards.

Today’s recommendations will further strengthen our whistleblower program. They will enhance the Commission’s ability to make awards that will provide incentives for whistleblowers to come forward. This, of course, and most importantly, benefits investors generally. The recommendations also provide additional transparency into our award determination process—including by codifying current practices—and add additional process efficiencies that will help us get more money into the hands of whistleblowers faster.

Today’s recommendations will further strengthen our whistleblower program. They will enhance the Commission’s ability to make awards that will provide incentives for whistleblowers to come forward. This, of course, and most importantly, benefits investors generally. The recommendations also provide additional transparency into our award determination process—including by codifying current practices—and add additional process efficiencies that will help us get more money into the hands of whistleblowers faster.

Improvements Based on Our Experience Administering the Program

We have learned a lot in the ten years of administering our whistleblower program. The amendments we are considering today began through a reflection on the history of the program and an evaluation of our progress to date, all through the lens of the responsibilities that Congress placed on us. We assessed our efforts and evaluated whether amendments were necessary or appropriate to further implement our directive from Congress. For example, we considered whether whistleblowers would benefit from additional guidance about what they should expect when submitting a tip and about issues that have arisen in the determination of eligibility and of award amounts. And we evaluated whether there were improvements to be made that could increase the speed and efficiency of preliminary determinations and awards.

Getting More Money to Whistleblowers, Faster

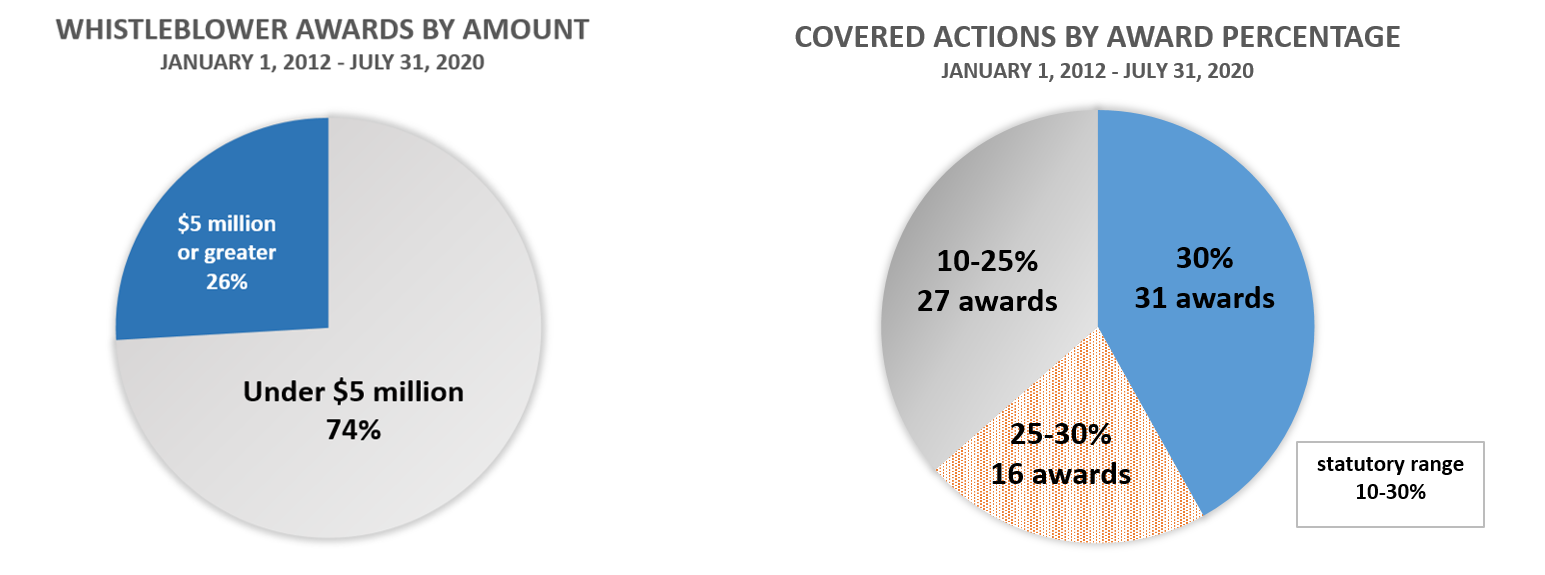

Our review resulted in the amendments we are adopting today. Let me provide one example, which is an amendment that is designed to speed up the award process and get more money to whistleblowers faster. As we looked back on the history of the program, we saw that the Commission historically has awarded the majority of whistleblowers amounts in the top quarter of the statutory award range. As of July 31, 2020, of the 74 enforcement actions where whistleblowers were awarded, 31 were at the statutory maximum, with another 16 in the top quarter of the statutory range.

We also saw that the vast majority of whistleblower awards—roughly 75 percent—involved enforcement actions where we ordered $16.67 million or less in monetary sanctions. Given the award range set by Congress, that meant that our awards in those 75 percent of cases were statutorily limited to $5 million or less.

Let’s take those two data points together: (1) in roughly 75% of cases, we were limited to awarding $5 million or less by statute, and (2) in most of our cases, it turned out that after analyzing the award factors, we awarded amounts in the top quarter of the range. How, then, could we take this information and use it to help us get money to these whistleblowers faster?

Let’s take those two data points together: (1) in roughly 75% of cases, we were limited to awarding $5 million or less by statute, and (2) in most of our cases, it turned out that after analyzing the award factors, we awarded amounts in the top quarter of the range. How, then, could we take this information and use it to help us get money to these whistleblowers faster?

The amendments today provide that, for awards where the statutory maximum is in the aggregate $5 million or less and no negative award factors are present, there will be a presumption that the award be set at the statutory maximum, subject to certain exclusions that will not apply in the majority of circumstances. Again, in these cases, our review will presume that the whistleblower will get the maximum award allowed under the statute. In addition to providing greater transparency and certainty, this presumption will reduce the time the Commission would otherwise spend determining the precise award amounts. Said simply, based on our experience, we can add more certainty around time and amount in the substantial majority of cases, enhancing the effectiveness of the program for the Commission and increasing incentives for whistleblowers, all with no meaningful countervailing cost.

But what about cases where the maximum possible statutory award is greater than $5 million? The evaluation will remain unchanged. For awards where the statutory maximum is greater than $5 million, the Commission will continue to determine the award amount using the same framework that we have used from the inception of the program. Our rules recognize that Congress gave the Commission the discretion to set the amount of awards according to prescribed factors, subject to a statutory minimum of 10 percent of monetary sanctions collected and a maximum of 30 percent. The Commission will continue to implement its responsibility to consider the applicable factors, and consistent with past and current practice, we expect that the majority of awards for which the statutory maximum aggregate award amount is $5 million or more and no negative factors are present will continue to be in the top third of the statutory award range.

Additional Enhancements to Transparency, Clarity and Efficiency

I also want to highlight a few additional areas that reflect the transparency, clarity and efficiency that we are implementing today. Many market participants are familiar with the factors that we use when determining award amounts—for example, we look at the significance of information provided by the whistleblower, as well as the degree of assistance the whistleblower provided in the relevant action. But, as was evident during the rulemaking process, there was public confusion about the Commission’s discretion in applying those factors. The amendments we are adopting today recognize the responsibility that Congress gave us to determine the amount of awards, subject to the statutory minimum and maximum. Our rules also recognize that whistleblowers are motivated by—and compensated by—dollar amounts, not percentages. All you need to do is look at our award descriptions and you will see the majority of them described by their dollar amounts (e.g., a $50 million award, or a $39 million award). To provide greater transparency to whistleblowers, our rule amendments make clear that Congress provided the Commission with the discretion to set awards, and apply the award factors, in dollar terms or percentage terms. Also, to be clear, in determining the award amounts, we apply the factors and only the factors, to determine the amount. There is no separate (post application of the award factors) assessment of whether award amounts are too small or too large or any type of a cap apart from the statutory maximum established by Congress.

We are also codifying and further extending the approach we have taken regarding compliance with TCR filing requirements. These amendments are designed to provide clear guidance to whistleblowers. They are also intended to reduce the chance of an individual being disqualified from receiving an award simply because of a lack of knowledge of our filing requirements. In particular, currently our rules do not provide any established mechanism to permit individuals who fail to comply with the TCR requirement to qualify for an award when they provide information to the Commission prior to filing a TCR, although we have allowed for a brief grace period for compliance. The amendments provide a waiver from compliance where the Commission determines that the administrative record demonstrates that the individual would otherwise qualify for an award and the individual shows compliance with the requirements (1) within 30 days of communicating with the staff, or (2) alternatively within 30 days of first obtaining actual or constructive notice about those requirements. To provide maximum clarity to whistleblowers, the waiver is automatic where the criteria specified in the rule are satisfied. And the Commission retains its separate discretionary exemptive authorities to grant relief where appropriate. This approach balances the agency’s administration of the program with ensuring we are not imposing unnecessary burdens on whistleblowers.

We are adopting several other amendments that are intended to clarify and enhance certain policies, practices, and procedures in implementing the program and to increase the efficiency of the claims review process. I won’t go into all of them, but I encourage you to read my more detailed remarks, our fact sheet and the final rule, which will be posted on our website.

For example, I have spoken many times on the importance of the proper allocation of resources, and the whistleblower program is an example of this priority. We are fortunate that the SEC’s whistleblower program has been such a success that our volume of tips increases each year, and we are focused on ensuring that whistleblowers continue to receive prompt award determinations. From the inception of the program, the Office of the Whistleblower has processed hundreds of claims, over one-third of which have been in the past three years. The efforts undertaken by the Office of the Whistleblower to streamline and substantially accelerate the evaluation of claims for whistleblower awards have already yielded positive results in Fiscal Year 2020, with—as I mentioned –more claims reviewed so far this fiscal year than any previous year. The dedication of the staff to this improvement is commendable.

In our experience administering the whistleblower award program, unfortunately we found that a small number of applicants repeatedly filed award applications that were clearly frivolous. Processing those frivolous applications took up significant staff resources that otherwise could have been spent working to get money to meritorious whistleblowers. Today’s amendments would free up staff resources by providing a mechanism to—with sufficient process—bar those individuals who repeatedly file frivolous applications from submitting future award claims.

Similarly, today’s amendments also will improve efficiency by allowing for a summary disposition process for certain types of straightforward denials, such as failing to meet application deadlines or failing to specify the tip on which an award claim is based. Again, these amendments are intended to allow the Commission to allocate resources where they will most effectively advance the objectives of the whistleblower program—to ensuring the efficient processing of awards to meritorious whistleblowers.

Finally, before I turn to our colleagues for their presentation, I want to note our appreciation to whistleblowers who, sometimes at great risk to their livelihood, report suspected securities laws violations to the SEC. Our whistleblower program has been a success because of their efforts. Working together, we have stopped frauds and prevented losses for countless investors. Today’s amendments build upon the strong foundation to date and make the program even stronger. I look forward to your continued assistance in rooting out fraud and protecting investors and the marketplace.

I would like to acknowledge a number of individuals who have contributed to this rulemaking and to the success of the whistleblower program.

From the Division of Enforcement and the Office of the Whistleblower: Stephanie Avakian, Jane Norberg, Emily Pasquinelli, Jonathan Carr, Kerry Knowles, Lisa Wardlaw, and Nikkia Wharton.

From the Office of General Counsel: Bob Stebbins, William (Brooks) Shirey, Michael Conley, Laura Jarsulic, Thomas Karr, Matthew Ferguson, Stephen Yoder, Bryant Morris, Connor Raso, and Cree Kelly. I would also like to thank Brian Ochs, who recently retired from the Office of the General Counsel after providing a decade of assistance to the whistleblower program.

From the Division of Economic and Risk Analysis: S.P. Kothari, Chyhe Becker, Hari Phatak, Y.C. Loon, Michael Schihl, Andrew Glickman and Morgan Williams.

And now, I will turn it over to Stephanie Avakian, Director of the Division of Enforcement, Jane Norberg, the Director of the Office of the Whistleblower, and S.P. Kothari, our Chief Economist and Director of the Division of Economic and Risk Analysis. The Office of the General Counsel is also available to answer any questions.

Print

Print