Kevin Sneader is the global managing partner of McKinsey & Company; Sarah Keohane Williamson is the CEO of FCLTGlobal; and Tim Koller is a partner with McKinsey & Company. This post is based on a recent McKinsey article by Mr. Sneader, Ms. Williamson, Mr. Koller, Victoria Potter, and Ariel Babcock.

Ample evidence shows that when executives consistently make decisions and investments with long-term objectives in mind, their companies generate more shareholder value, create more jobs, and contribute more to economic growth than do peer companies that focus on the short term. Addressing the interests of employees, customers, and other stakeholders also brings about better long-term performance. The future, it seems, should belong to leaders who have a long-term orientation and accept the importance of treating various stakeholders fairly.

Nevertheless, our research shows that behavior geared toward short-term benefits has risen in recent years. In a recent survey conducted by FCLTGlobal and McKinsey, executives say they continue to feel pressure from shareholders and directors to meet their near-term earnings targets at the expense of strategies designed for the long term. Managers say they believe their CEOs would redirect capital and other resources, such as talent, away from strategic initiatives just to meet short-term financial goals.

Executives may continue to focus on short-term results because adopting a long-term orientation can be challenging. While previous studies have established that long-term companies perform better than others in the long run, they haven’t identified the management behaviors that enable that success. A new report, Corporate long-term behaviors: How CEOs and boards drive sustained value creation, represents our attempt to fill that gap. In it, we show that long-term companies adhere to certain management behaviors, and we recommend actions that CEOs and boards can take to institute those behaviors at their companies.

Five behaviors that create value over the long run

To determine how companies maintain a long-term orientation, we reviewed and synthesized our own research and that of others in academia and the business world. We also surveyed executives and analyzed data on management and corporate performance. As a result, we have identified five general long-term behaviors that executives can adapt and apply according to their company’s situation:

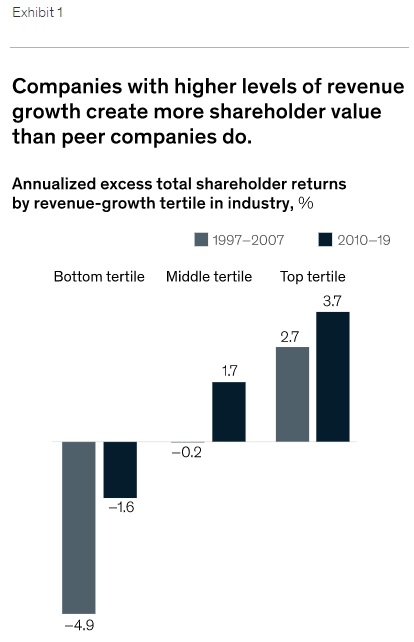

- Investing sufficient capital and talent in large, risky initiatives to achieve a winning position. Many established businesses have developed an aversion to risky bets. Instead of playing to win, they play not to lose—and so they struggle to stay in front of competitors. Long-term companies identify strategic moves that will keep them ahead in the long run and commit ample resources to strategic initiatives, such as product innovation, marketing and sales, and talent development. Sustained investments in strategic priorities matter for long-term performance because they lead to higher rates of revenue growth—and revenue growth is one of the most important drivers of long-term shareholder returns (Exhibit 1).

- Constructing a portfolio of strategic initiatives that delivers returns exceeding the cost of capital. Growth alone won’t deliver value. Indeed, many companies that prioritize growth end up destroying shareholder value because they do not deliver strong returns on invested capital. According to a fundamental principle of corporate finance, companies create long-term shareholder value only when their returns on invested capital (ROIC) exceed their cost of capital. Not every investment that a company makes has to earn more than its cost of capital. But if the entire portfolio of strategic initiatives earns more than its aggregate cost of capital, then a company can expect to create value over the long term (Exhibit 2).

- Dynamically allocating capital and talent—via divestitures, if need be—to businesses and initiatives that create the most value. Running a long-term company doesn’t equate to maintaining the same business mix for extended time spans. Managing for the long term requires executives to monitor their companies’ standing in the market and enter or exit businesses as their competitive landscapes shift. Dynamic resource reallocation confers a significant performance advantage (Exhibit 3). The practice involves making acquisitions and divestitures; sometimes, it even calls for shrinking a company. Additionally, companies must reallocate talent as frequently as they reallocate capital.

- Generating value not only for shareholders but also for employees, customers, and other stakeholders. Long-term companies focus on improving outcomes for all their stakeholders, not just those who own shares in the business. They have good reasons to do so. Motivated employees get more done than disgruntled ones. Well-treated suppliers work together more collaboratively. Satisfied regulators are more likely to award operating licenses. While executives must consider trade-offs among the interests of their constituents every day, over the long term, the interests of shareholders and stakeholders converge.

- Staying the long-term course by resisting the temptation to take actions that boost short-term profits. When temporary changes in fortune—dips in revenue, for example— occur, maneuvers that boost short-term results take on a powerful appeal. Long-term companies resist three temptations: starving long-term growth investments to make up for short-term challenges, such as earnings deviations; cutting costs to an extent that could weaken their competitive positions; and making ultimately uneconomic choices just to reduce the natural volatility in revenue and earnings.

Board and CEO actions that orient companies toward the long term

Getting a company to manage for long-term performance requires considerable effort. CEOs and directors must take up new behaviors, abandon old ones, and empower managers to make decisions with long-term outcomes in mind. Here, we outline some practical steps that boards and CEOs can take to promote long-term behaviors.

A board of directors ordinarily has a well-established role: thinking about the future of a company, approving its strategy, reviewing its performance, and evaluating management. However, few boards spend adequate time on assessing the strategies and investment plans of the businesses they direct. Boards can help orient management toward the long term in three ways:

- Ensuring that strategic investments are fully funded each year and have the appropriate talent assigned to them. To formalize this practice, boards can ask management to report on the funding and progress of strategic initiatives and review that report for signs of effective strategic implementation.

- Evaluating a CEO on the quality and execution of the company’s strategy, the company’s culture, and the strength of the management team, not just on near-term financial performance. Responses to the survey by FCLTGlobal and McKinsey indicate that companies that evaluate executives’ performance mainly in terms of the company’s financial results—rather than on how they achieved those results—were 13 percent less likely to have revenue growth above peers.

- Structuring executive compensation over longer time horizons—including the time after executives leave their companies. Adjusting some elements of executive pay structures, such as the time horizon over which CEOs are compensated, appears to encourage long-term behaviors on the part of CEOs.

CEOs, supported by their top teams, are ultimately responsible for creating long-term orientations in their companies. An important part of that responsibility is serving as role models for the rest of their management teams when making big decisions. CEOs can also promote a long-term orientation among managers and employees by applying their influence and authority in four ways:

- Personally ensuring that strategic initiatives are funded and staffed properly and protected from short-term earnings pressure. Our survey found that companies whose CEOs ensure resources are allocated to critical growth areas are more likely than other companies to exhibit greater organic revenue growth than their peers.

- Adapting their management systems to encourage bold risk taking and to counter biased decision making. For example, implementing a company-wide approach to resource allocation can help managers see that their portfolios can accommodate bets on relatively risky endeavors.

- Proactively identifying and engaging long-term-oriented investors—and having the courage to ignore short-term shareholders and other members of the investment community. It helps CEOs to spend more time talking with long-term investors. Many feel they learn a lot from—and even enjoy—these conversations, which also help reassure executives that a long-term outlook best serves the company and its shareholders.

- Demonstrating the link between financial and nontraditional metrics to prevent short-term trade-offs. To enrich their dialogue with long-term shareholders and other stakeholders, executives can select, track, and report nontraditional indicators, such as employee satisfaction, that are most material to their companies’ long-term performance.

Executives undeniably face real pressure to focus on and deliver satisfactory short-term results. However, they should weigh short-term demands against two other noteworthy considerations. The first is the strong empirical evidence showing that companies that seek strong long-term results outperform companies that optimize short-term results. The second is the long-term interests of both investors and other stakeholders.

Business leaders who choose to prioritize long-term value creation must take on the responsibility of reorienting their companies accordingly. By understanding which management behaviors distinguish successful long-term companies and expressly fostering those behaviors, CEOs and boards can help their companies produce value for stakeholders over the long run.

The complete publication, including footnotes, is available here.

Print

Print