Kosmas Papadopoulos is Senior Director at the Corporate Governance & Activism practice and Rodolfo Araujo is Senior Managing Director and Head of the Corporate Governance & Activism Practice at FTI Consulting. This post is based on their FTI memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Max M. Schanzenbach and Robert H. Sitkoff (discussed on the Forum here); and Companies Should Maximize Shareholder Welfare Not Market Value by Oliver Hart and Luigi Zingales (discussed on the Forum here).

In the world of corporate governance and proxy voting, 2020 has been a remarkable year, not only because annual general meetings took place in the midst of a global pandemic that forced the abrupt transition to a virtual proxy season, but also because this year marked the beginning of the new decade at a time when companies and investors experience a major shift in how they engage on the topic of corporate governance. The scope of corporate governance activities is no longer limited to issues directly linked to routine meeting agenda items, such as director elections, shareholder rights, executive compensation, and audit quality. The definition of governance is expanding to include the management of environmental and social risks and opportunities.

Many investors begin to recognize ESG issues as part of their fiduciary responsibility, and several have committed to using their votes to hold boards and management teams accountable for the potential mismanagement or lack of oversight of material issues. Climate change, employee health and safety, data privacy, and human rights are only a few of the many factors where investor expectations are changing, requiring companies to demonstrate robust management systems, oversight mechanisms, and measurable performance in addressing potential risks and opportunities.

In this review of trends during the 2020 proxy season, we focus on key developments in proxy disclosures and director elections, trying to see behind the numbers to identify emerging patterns that reveal the forces driving investor and company behavior in this new era of corporate governance, where a holistic ESG approach is at the center of the discussion about investor stewardship and corporate accountability. Further, we outline the implications of the new expanded definition of corporate governance for the ongoing COVID-19 global crisis and economic shareholder activism.

Our research indicates that the linkage between ESG management and corporate governance is becoming more pronounced not only in investor stewardship policies and communications, but also in company disclosures and company practices. We observe a correlation between company ESG management and corporate governance practices. These trends highlight that companies at higher risk of facing shareholder opposition due to ESG management concerns may already face shareholder concerns due to corporate governance issues, which emphasizes the need to view corporate governance and sustainability as part of the same cohesive strategy. Importantly, the COVID-19 crisis stresses a number of key ESG management areas, such as human capital, health and safety, management compensation, and cybersecurity. Boards will need to remain on high alert and demonstrate effective management of key issues, since investors will likely place significant scrutiny on company responses to the crisis in the upcoming season.

Proxy Statements Incorporate ESG Information

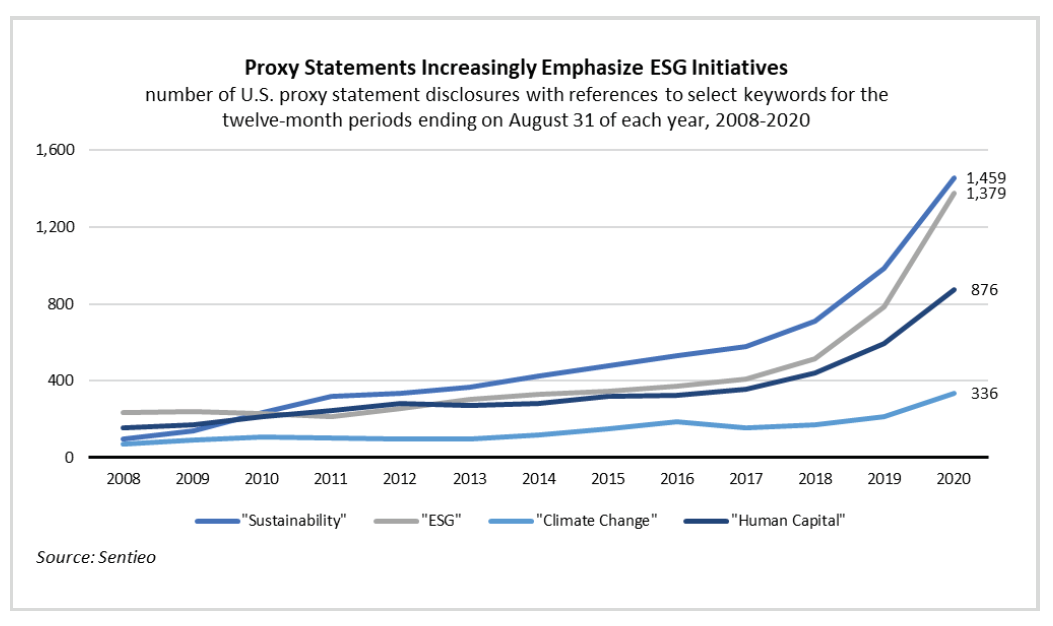

The shift to a broader definition of governance, to include key environmental and social issues, is becoming visible in proxy statement disclosures. The content of DEF 14A documents is no longer dictated by minimum disclosure requirements set by the SEC and other regulatory bodies. Instead, companies increasingly incorporate information about their management of environmental, social, and governance issues in these filings. In 2020, references to terms like “sustainability,”, “ESG,” “climate change,” and “human capital” more than doubled compared to disclosures from two years ago and more than tripled compared to disclosures from five years ago, as illustrated in the graph below.

These disclosures represent a recognition by corporations that investor expectations around corporate governance are expanding to encompass a comprehensive set of financial and non-financial factors that may have an impact on the company’s long-term sustainable performance. This trend is a continuation of a change in proxy statement disclosures that began during the previous decade, as companies enhanced their corporate governance communications with voluntary information, visual representations, and statistics related to board composition, shareholder rights, and executive compensation practices.

With the abundance of new information included in proxy statements, companies and investors face several challenges, as the risk of information overload becomes imminent. Importantly, companies will need to focus their ESG-related disclosures on issues that can have a significant impact to the business. Most investors examining ESG factors are primarily concerned with the management of material risks and opportunities.

Director Election Criteria Continue to Evolve

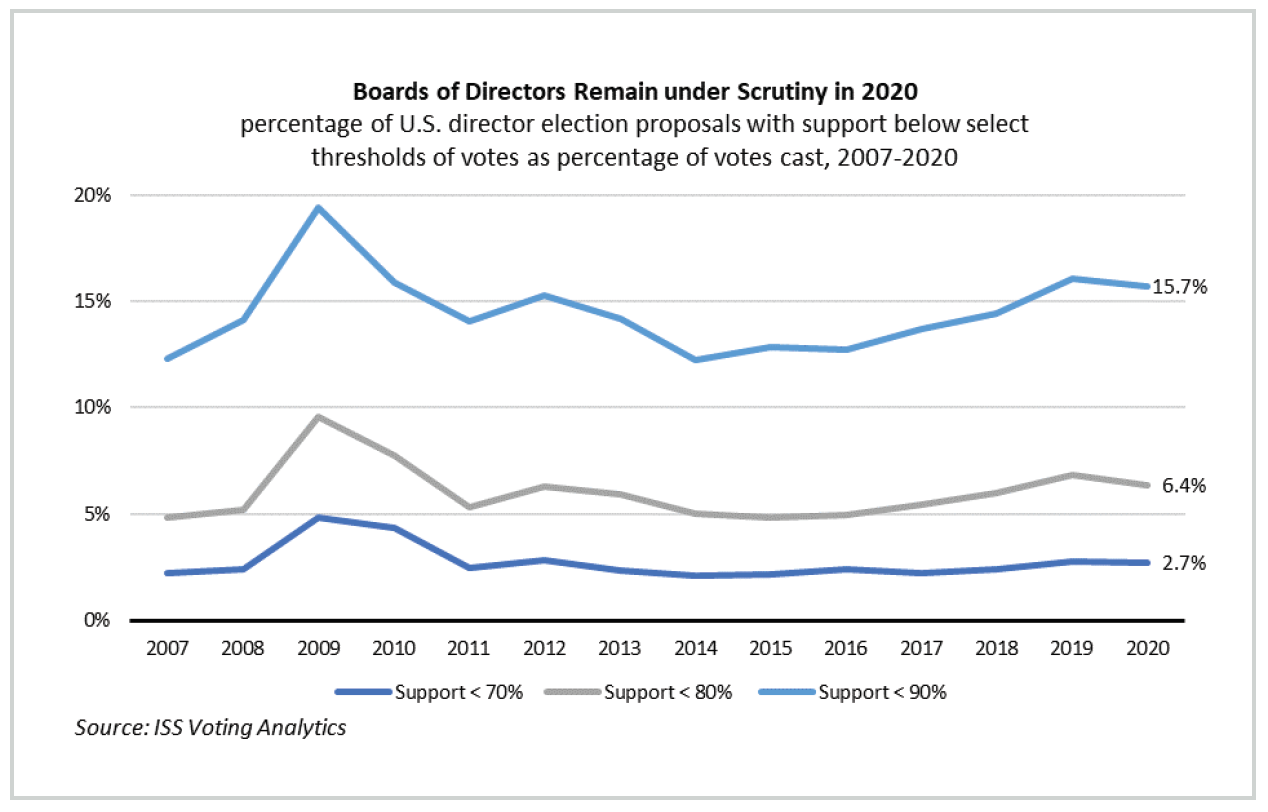

The intersection of investor stewardship and company’s management of ESG issues displays most prominently in the voting of director election proposals. In the past few years, we observe two parallel trends in this area. Investors have intensified their efforts in applying a diverse set of criteria to ensure boards remain diligent in overseeing management and guiding the company’s strategy, considering factors such as board diversity, board refreshment, board accountability, and board responsiveness to shareholders. At the same time, companies take steps to improve their processes and practices around board composition, board succession, and board evaluation. Investor stewardship efforts during the past five years have led to higher levels of significant opposition to director elections. In 2020, while the frequency of significant opposition against director election proposals dropped slightly compared to 2019, the rates of significant director election opposition represent a significant increase compared to 2014 when director opposition levels were at their lowest in recent years.

Every year, investors’ board evaluation approaches include more factors under consideration, with more sophisticated criteria for assessing those factors. Further, an increasing number of asset managers build customized methodologies as part of their proxy voting guidelines, forming a very diverse landscape of viewpoints on corporate governance and stewardship.

Finding the Link between ESG Management and Board Accountability

In the beginning of the year, and prior to the onset of the global pandemic, some of the world’s largest asset managers suggsted they would consider potential votes against directors if they found companies’ management approaches to key ESG risks to be insufficient. The Big Three, BlackRock, SSGA, and Vanguard, have all indicated they are evolving their approach to board accountability in this area through pre-season and post-season public statements.

As board accountability policies evolve to more systematically capture ESG management, we should expect new patterns emerging in investor voting behavior. Companies at greater risk of facing investor opposition due to ESG concerns are not only the limited few that may have faced significant ESG controversies in recent years, but a broader universe of firms that fail to demonstrate robust policies, oversight mechanisms, and risk management programs addressing key ESG risks and opportunities.

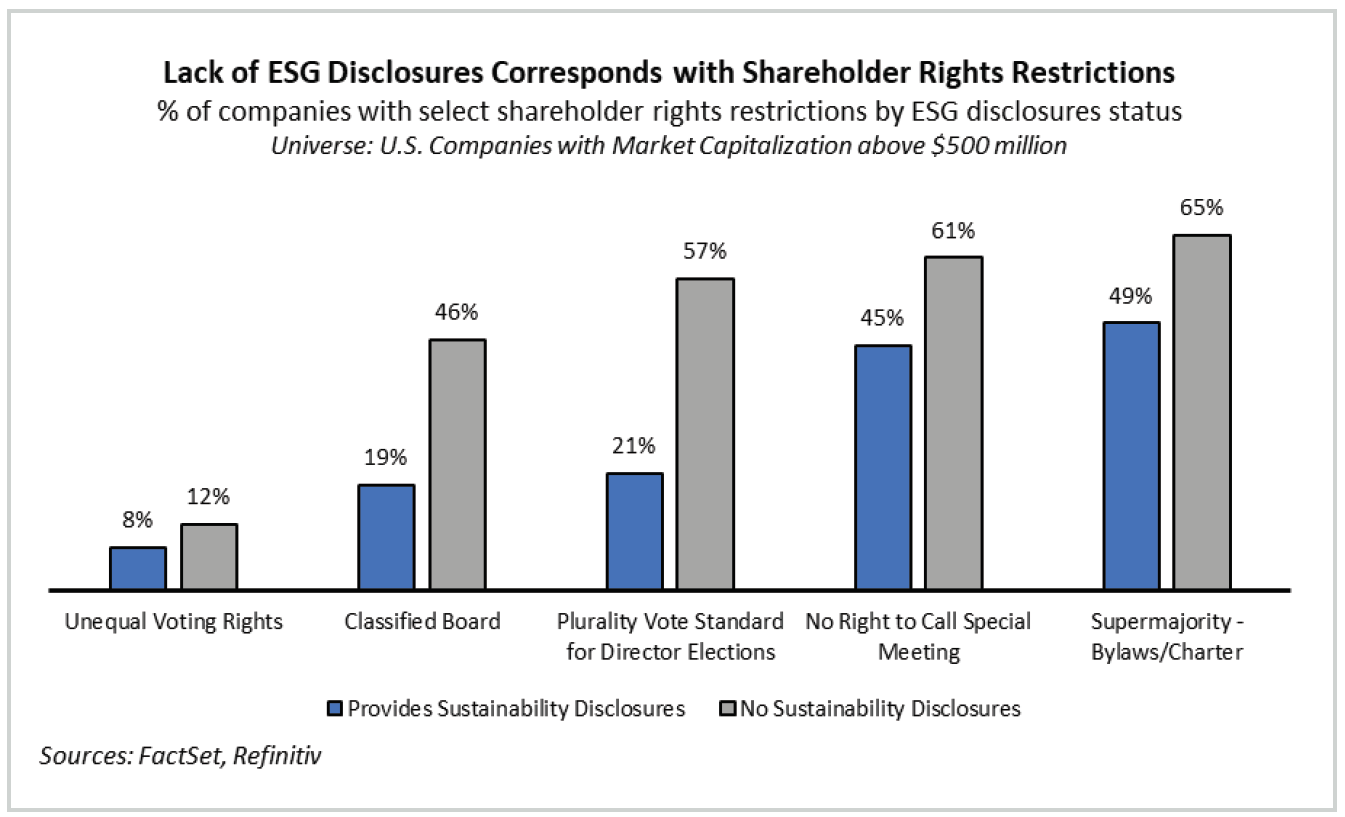

We examined companies with better ESG management disclosures and oversight mechanisms and compared their governance practices (shareholder rights and board composition) to companies with worse ESG management disclosures and oversight mechanisms. As ESG management indicators, we reviewed sustainability reporting, the establishment of an ESG committee at the Board or senior management level, and the extent to which companies disclose their assessment of commercial risks and opportunities in relation to climate change risks. While these factors cannot fully represent the strength of a company’s ESG management program, they are useful indicators of the level of priority the company places in its sustainability efforts.

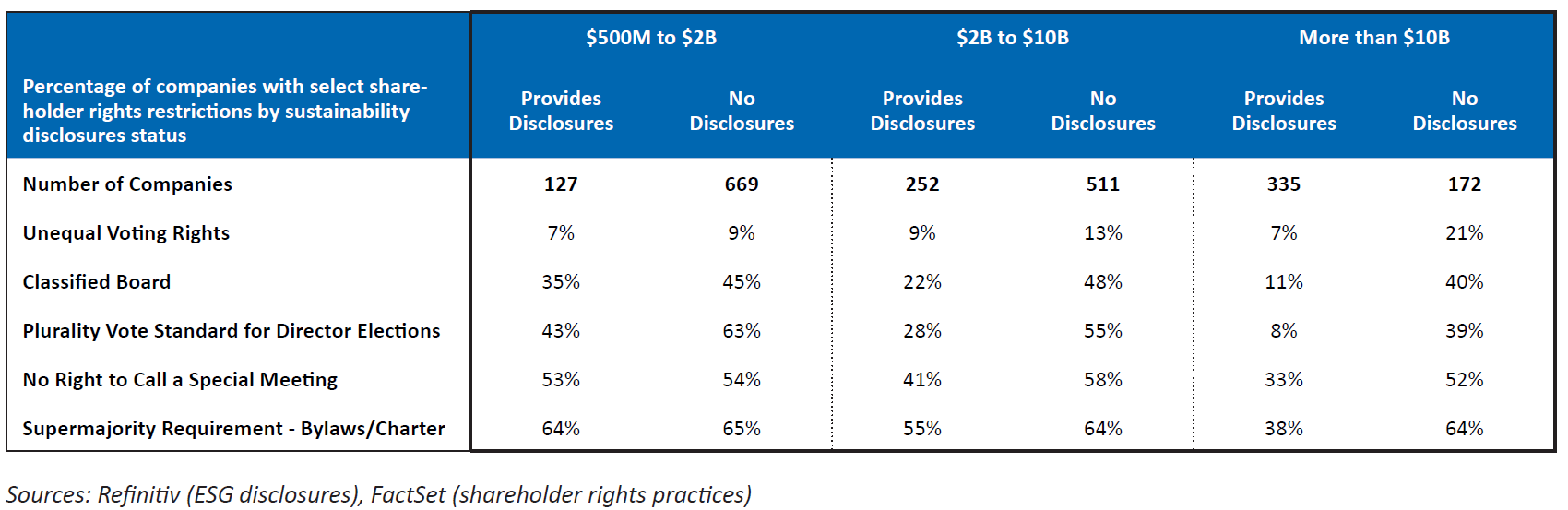

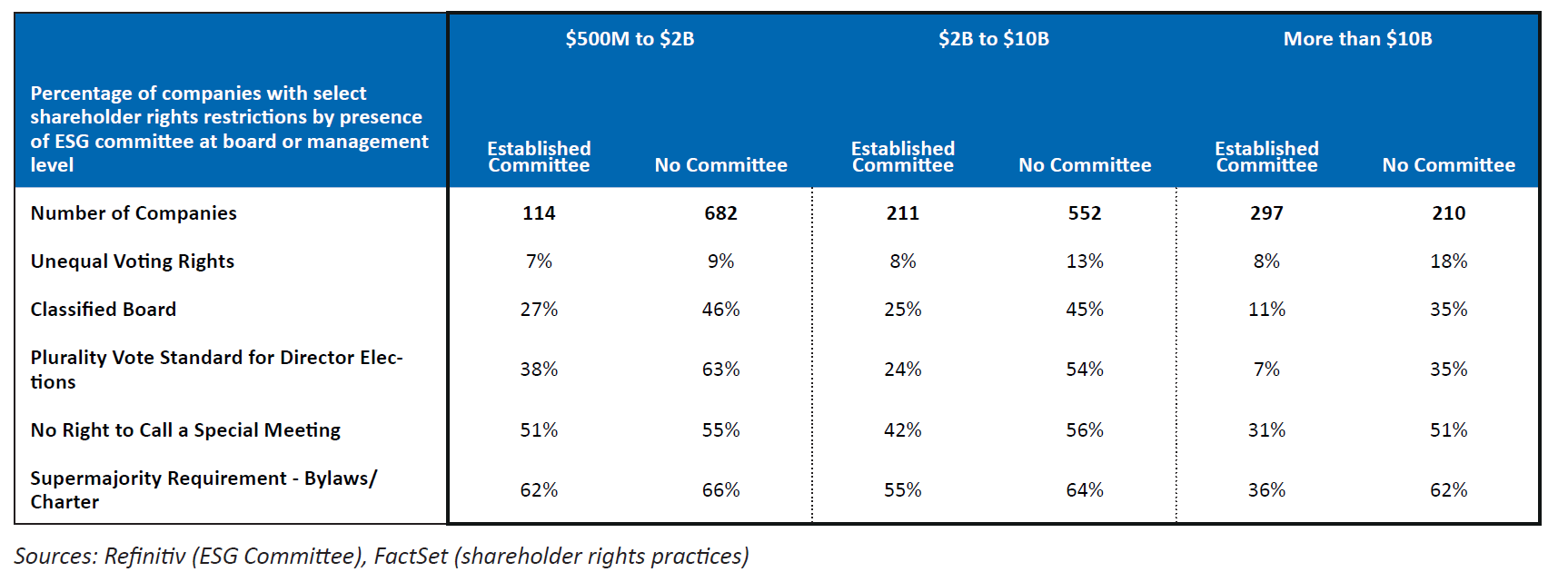

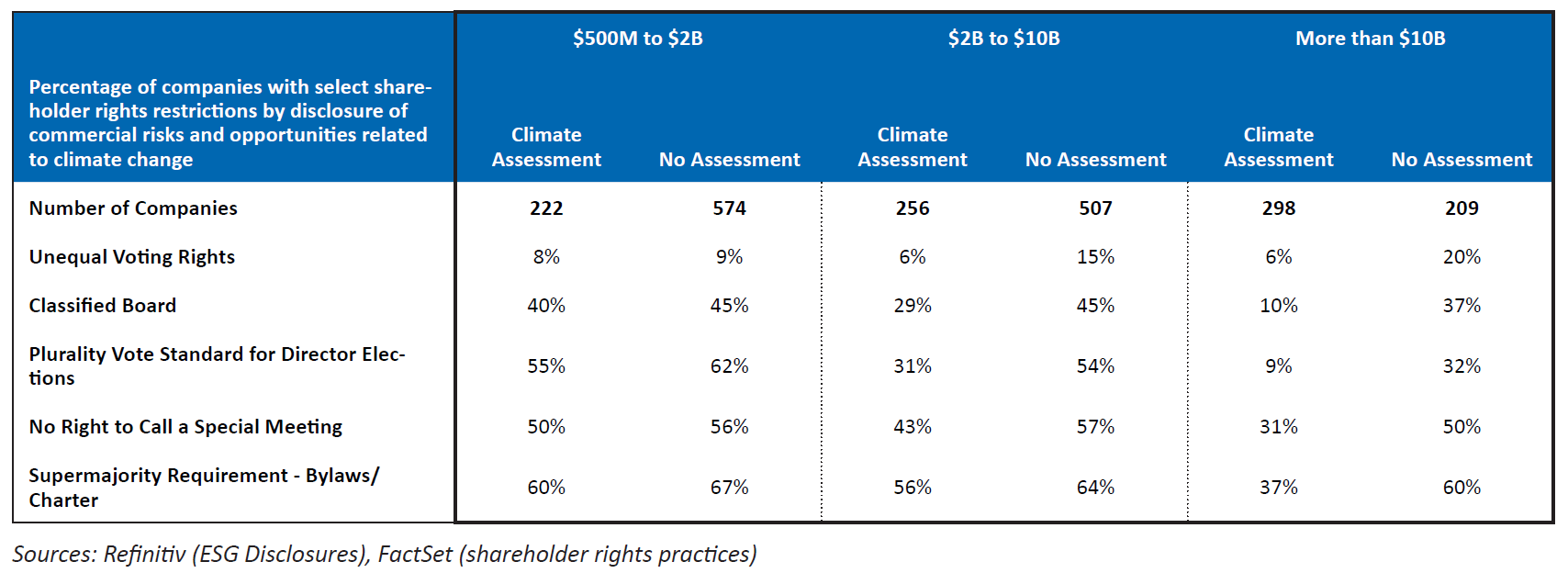

In our research, we find that companies with more shareholder-friendly governance practices—having fewer shareholder rights restrictions in their corporate governance programs, with boards that are independent and diverse—are more likely to have better reporting and oversight practices of ESG issues. According to our analysis of FactSet and Refinitiv data, companies that provide sustainability disclosures appear less likely to impose shareholder rights restrictions, such as unequal voting rights, classified boards, plurality vote standard for uncontested director elections, restrictions on the right to call a special meeting, and supermajority vote requirements, as the graph below illustrates. These trends remain consistent when comparing companies of similar size in terms of market capitalization (see appendix). The likelihood of shareholder rights restrictions appears higher also among firms that have not established an ESG committee at the board or management level and among firms that do not disclose any assessment of commercial risks and opportunities related to climate change, controlling for size (see appendix).

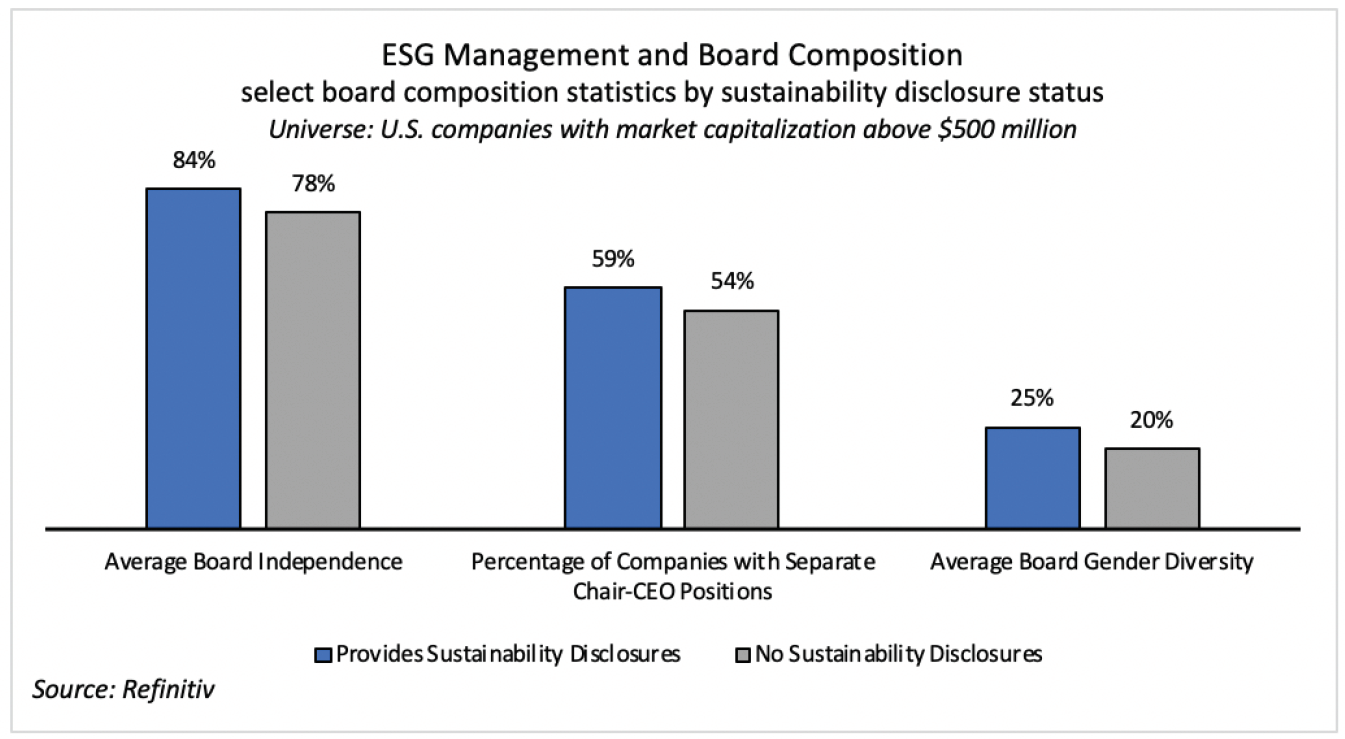

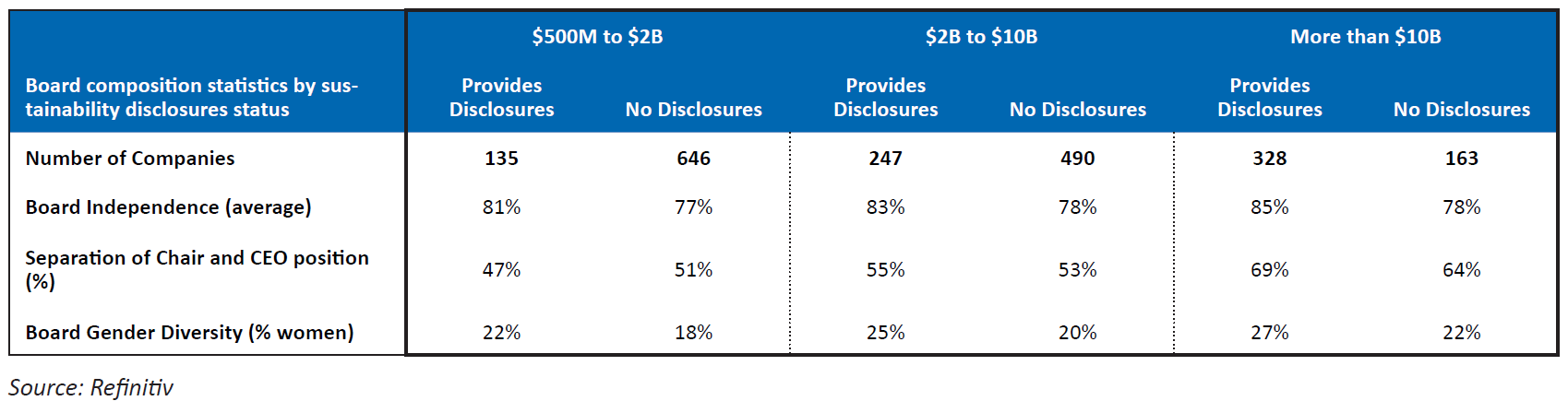

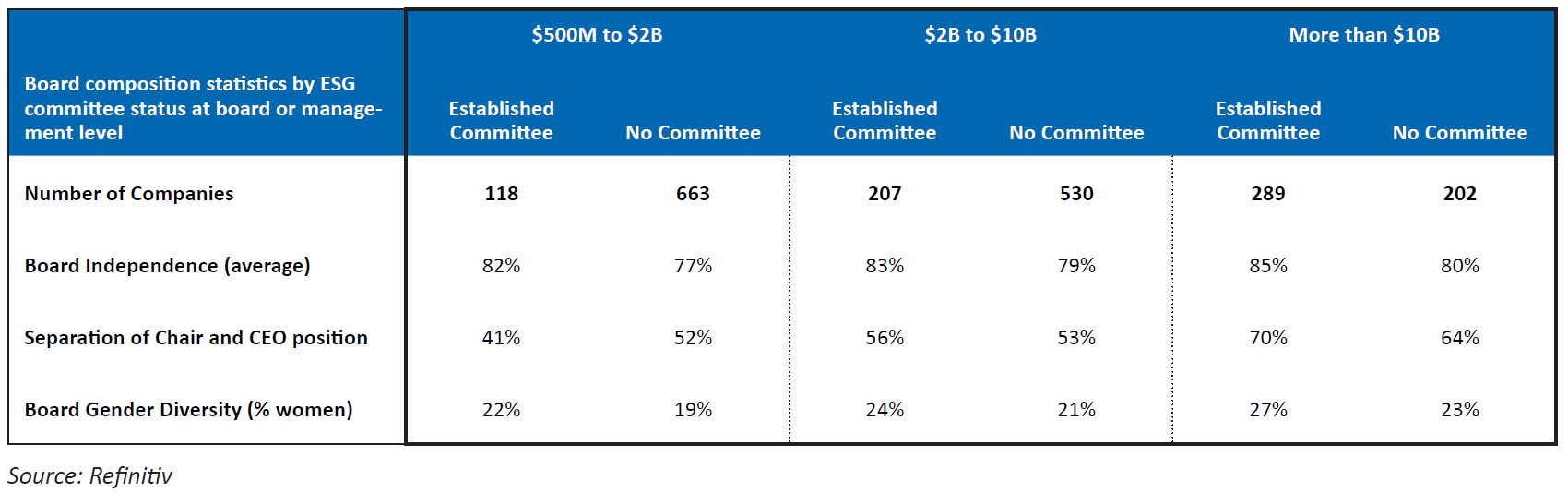

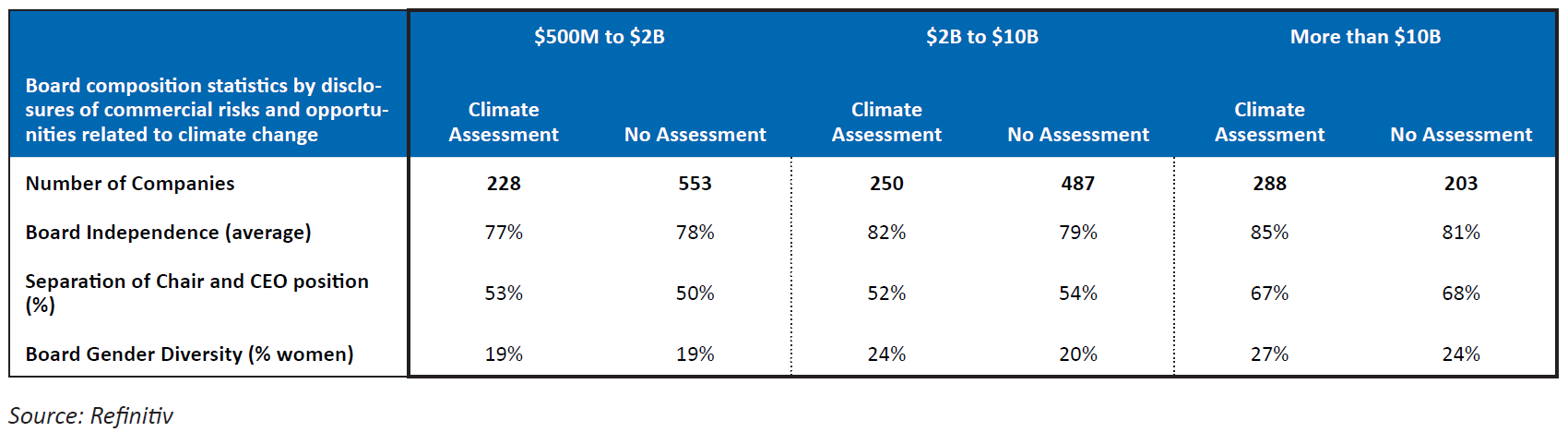

We observe the same correlation between ESG management practices and board composition, specifically regarding board independence, the separation of the Chair and CEO positions, and board gender diversity. As the graph below illustrates, companies that provide sustainability disclosures are more likely to demonstrate greater board independence, a separation of the positions of Chair and CEO, and greater gender diversity at their boards. While the differences in board independence and board gender diversity appear to be only a few percentage points, these represent substantial deviations compared to market standards. These trends generally hold true when controlling for company size, and the same patterns emerge when reviewing companies that have established ESG oversight bodies and companies that disclose their assessments of commercial risks and opportunities in relation to climate change impacts (see appendix).

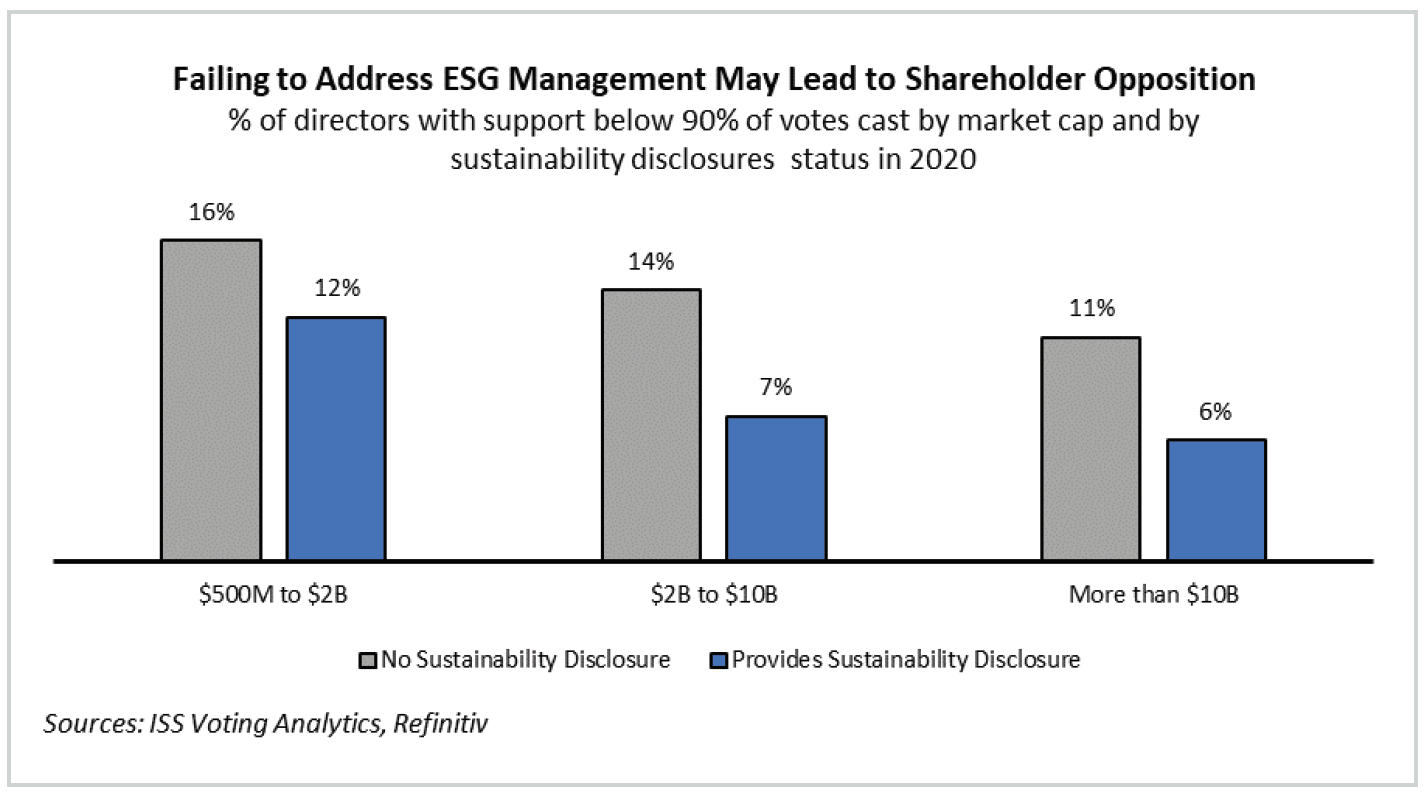

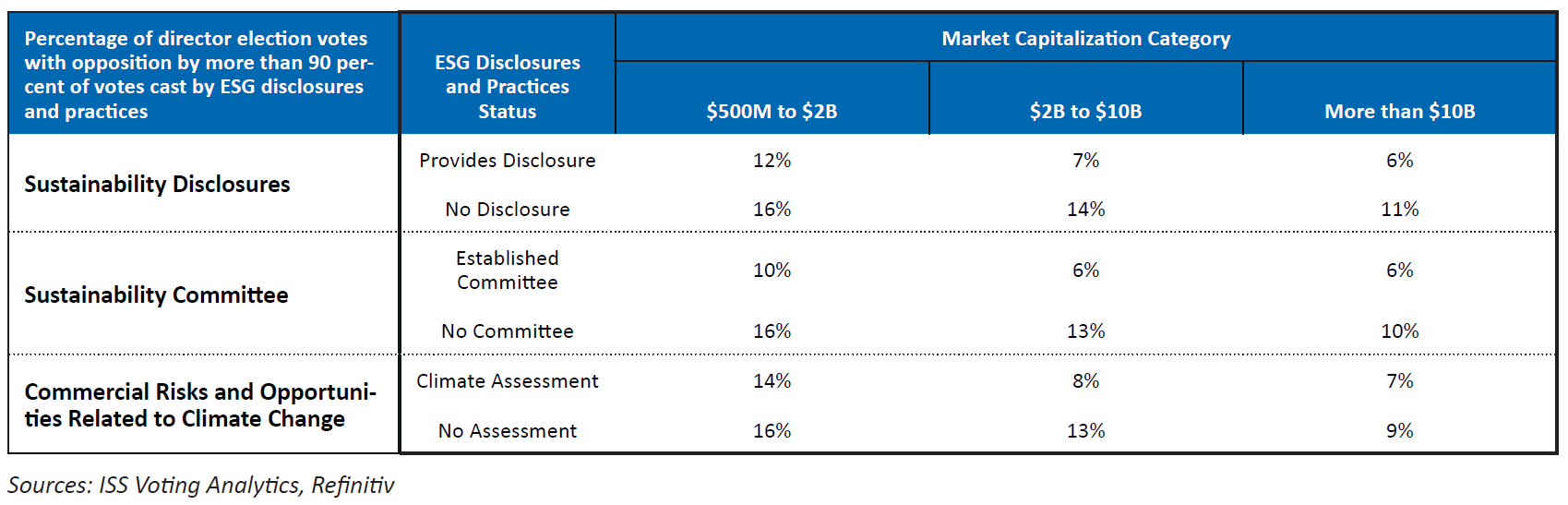

This analysis reveals that companies that already face higher risk of investor opposition due to corporate governance concerns compound the risk of investor scrutiny by being laggards in the management of environmental and social issues. In fact, we observe a higher frequency of significant shareholder opposition among firms that have fewer sustainability disclosures or lack of ESG oversight mechanisms, as shown in the graph below. This observation does not necessarily establish a causal relationship. However, it underlines the strong connection between corporate governance and the management of ESG issues. Essentially, these two areas of stewardship cannot be viewed as separate from each other, and, as investor expectations continue to evolve, we anticipate the connection between governance and sustainability to become more pronounced in proxy voting.

Considerations for Boards in Light of COVID-19

The Covid-19 crisis should put boards on high alert in relation to shareholder engagement. In 2009, in the aftermath of the Financial Crisis, shareholders voted against director elections in record numbers, with almost one in five and one in ten of director nominees facing opposition by at least 10 percent and 20 percent of votes cast, respectively. While the ongoing crisis is very different compared to the 2008 Financial Crisis, boards will need to demonstrate oversight and responsiveness to key issues and exposures to risks heighted by the pandemic.

In 2009, shareholders tended to express concerns around compensation by voting against members of the board, as “say on pay” was not established as a routine voting item until 2011, as a key provision of the Dodd-Frank Act of 2010. Moreover, the 2008 Financial Crisis was seen as the result of problematic incentives and corporate governance failures at companies (primarily in the financial sector), which prompted a direct response by investors seeking governance reform and greater board accountability across all sectors, not only in the U.S. but around the globe.

While the COVID-19 crisis is not seen as a direct result of corporate behavior, companies’ response to ESG issues related to the crisis may trigger investor action. As the full impacts of the ongoing crisis remain uncertain, the 2020 proxy season should not serve as an indicator of investors’ reaction to company responses. Shareholder engagement in relation to relevant issues exposed by the ongoing crisis will likely increase in 2021, depending on how economic and social conditions evolve. The global health crisis puts employee health and safety under the microscope, while the economic and social repercussions of the pandemic—including the social unrest about racial inequality—highlight additional human capital factors, such as diversity and inclusion and employee benefits. Further, the accelerated digitalization as a result of companies’ adjustment to social distancing emphasizes the need to protect against cybersecurity and data privacy risks. These are only but a few factors that companies and investors will likely be mindful of in the coming months.

Implications to Economic Activism

The willingness of large institutional investors to hold boards accountable for environmental and social issues should be a wakeup call for many companies. During the past decade, activist hedge funds have used executive compensation, shareholder rights, and board composition concerns to create a link between a company’s perceived underperformance and the board’s lack of ability or willingness to tackle the situation. In the same manner, activists are likely to add arguments about the management of environmental and social issues to their arsenal of criticism, drawing a direct connection to a company’s operations or its reputation. Issues will vary by company, as not all environmental and social issues are material to every business; however, expect underperformance in human capital management and the lack of a climate change strategy as prime potential drivers of dissent that may be explored, given how large asset managers have prioritized such issues when engaging with their portfolio companies. No matter what the specific topic of discussion at a given situation, companies should be mindful that material ESG issues will be under close scrutiny, with potential gaps in ESG management making them more vulnerable to activist campaigns.

Appendix: Statistical Tables

ESG Practices and Shareholder Rights

ESG Practices and Board Composition

ESG Practices and Director Election Opposition

Print

Print

One Comment

FTI Consulting has no credibility on these issues. https://www.nytimes.com/2020/11/11/climate/fti-consulting.html