Paula Loop is Leader, Paul DeNicola is Principal, and Barbara Berlin is Managing Director at PricewaterhouseCoopers Governance Insights Center. This post is based on their PwC memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here); and Toward Fair and Sustainable Capitalism by Leo E. Strine, Jr (discussed on the Forum here).

Now that you know what the board is overseeing when it comes to management’s development and execution of an ESG strategy, how exactly does the board go about overseeing these efforts? The board will have to consider a number of different topics/issues.

Where responsibility lies: Because ESG strategy should align with business strategy and focus on material risks and business drivers, the full board will want to understand the ESG messaging and how those risks are being mitigated. If this is a new area of focus for the board and the company, directors may need to assign detailed oversight to specific committees to help the ESG strategy launch smoothly. Ultimately, ESG issues will be relevant to all committees. For example, the nominating and governance committee will be interested in the shareholder engagement element, while the compensation committee will be interested in accountability through compensation. The audit committee will be interested in the disclosure, messaging, and metrics.

As the board determines where ESG oversight will be assigned, it may want to consider the following questions:

- Do we have a specific committee with the capacity, interest, and skills to take the lead on overseeing the company’s overall ESG efforts? If not, will the full board take on this responsibility or should we create a new committee?

- Have we considered how the committees will stay aligned on ESG considerations? Have committee charters and proxy disclosures been updated to transparently disclose to shareholders and other stakeholders the board’s allocation of ESG oversight responsibility?

Board oversight and investors’ expectations:

Investors are continuing to expect more and more transparency from boards in how they oversee particular topics. ESG oversight is no exception. Boards can find a number of ways to provide shareholders with the information they seek.

- Robust disclosure in the proxy statement describing the board’s oversight efforts Updates to board committee charters to address committee oversight responsibilities related to ESG

- Additional information about directors’ skills that enhance their contribution to ESG oversight efforts

Directors start to come around on ESG

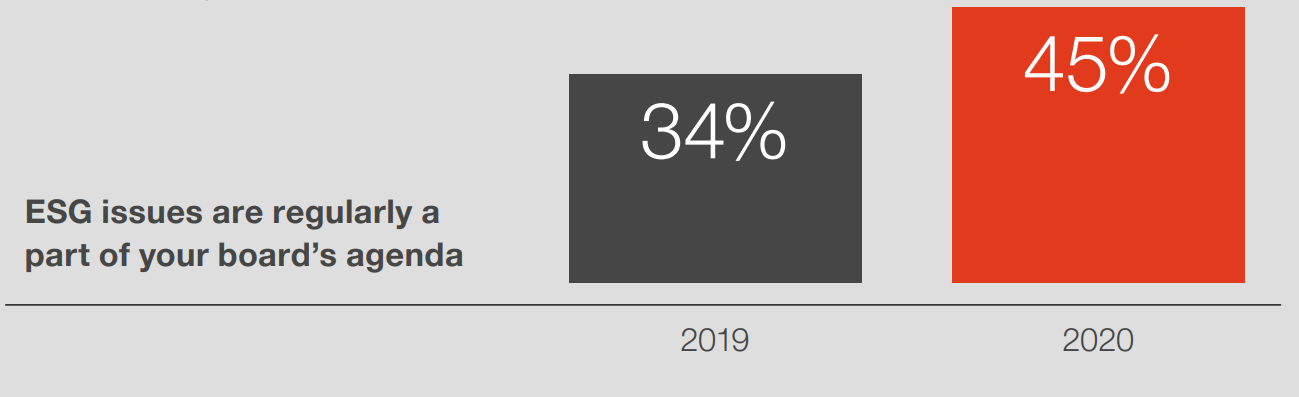

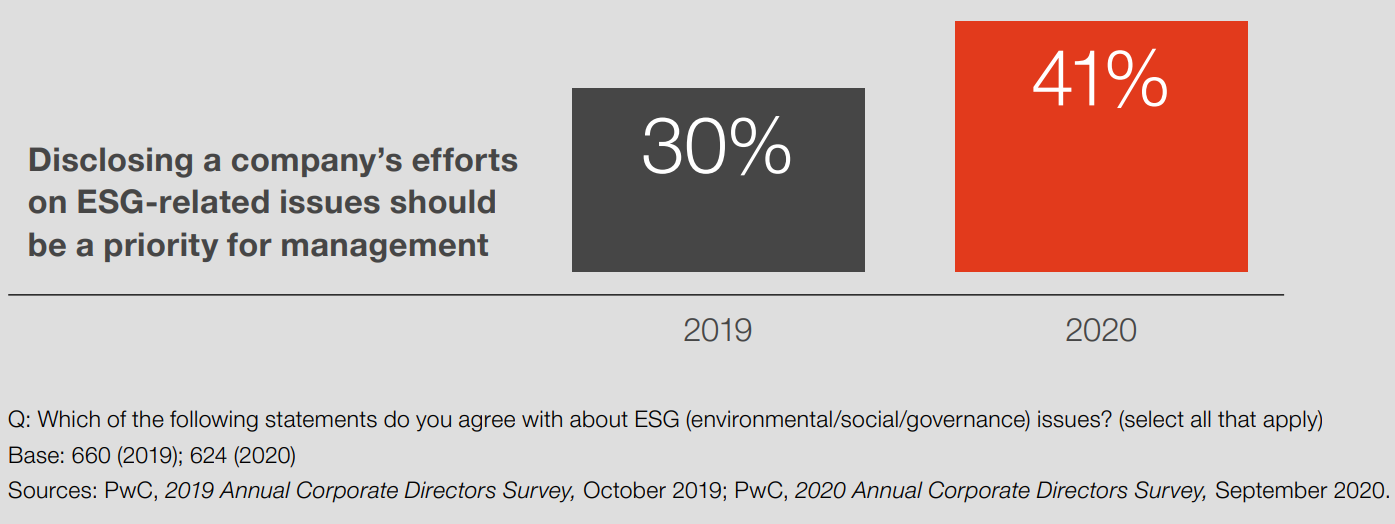

In 2020, just under half of directors (45%) say that ESG issues are regularly a part of the board’s agenda, up from just 34% in 2019.

Directors are also much more likely to say that disclosing a company’s efforts on ESG-related issues should be a priority for management.

Integrating ESG into board oversight responsibilities

Full board

Oversee:

- Strategy: Are ESG risks and opportunities integrated into the company’s long-term strategy? How is the company measuring and monitoring its progress against milestones and goals set as part of the strategy?

- Messaging: Do ESG messaging and activities align with the company’s purpose and stakeholder interests?

- Risk assessment: Have material ESG risks been identified and incorporated into the ERM? Has the board allocated the oversight of these risks to the full board or individual committees?

- Reporting: What is the best communication platform to use for the company’s ESG disclosures?

Audit committee

Oversee:

- Disclosures: Are the ESG disclosures (both qualitative and quantitative) investor grade? Which ESG frameworks and/or standards is the company using?

- Processes and controls: Are there processes and controls in place to ensure ESG disclosures are accurate, comparable, and consistent?

- Assurance: Should independent assurance be obtained to ensure ESG disclosures are reliable?

Compensation committee

Oversee:

- Accountability: Are the ESG goals and milestones effectively integrated into executive

compensation plans? - Talent and culture: How is management organized to execute the ESG strategy? Are the right people and processes in place? Does the company have a culture which embraces ESG efforts?

Nominating and governance committee

Oversee:

- Engagement: Is the company’s ESG story being effectively communicated to investors and other stakeholders?

- Board composition: Does the board have the necessary expertise and skills to oversee ESG risks and opportunities?

- Education: Does the board understand why ESG is important to investors and other stakeholders? Is the board appropriately educated on ESG?

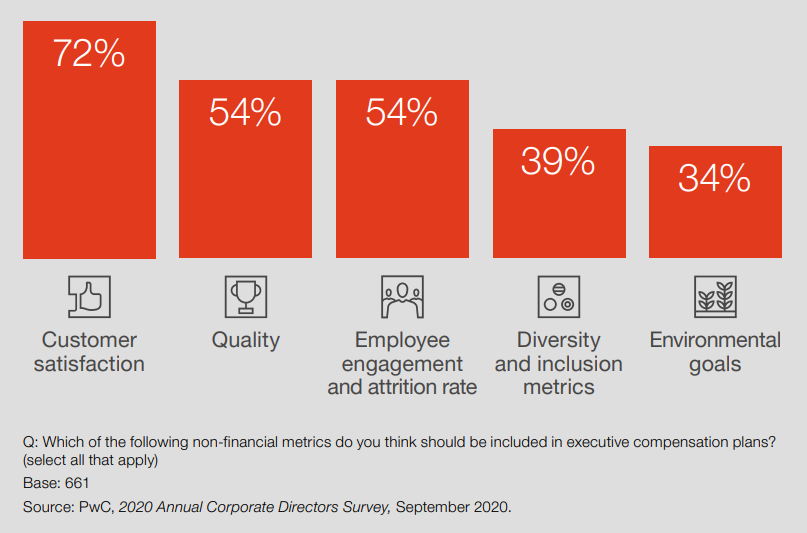

ESG metrics tied to executive compensation

In our 2020 Annual Corporate Directors Survey, we asked directors which non-financial metrics they think should be linked to executive compensation

Considering ESG goals and milestones as elements of executive compensation

Many investors are focused on the connection between ESG goals and executive compensation. By tying incentive plan metrics explicitly to the company’s ESG strategy, a company is not only encouraging the achievement of those ESG goals, it is also signalling the importance of those issues. A growing number of shareholder proposals are asking companies to link the two. And a number of large companies have already taken steps to do so.

Linking purpose, risks, and messaging: The company should ensure that its purpose is reflected through its messaging and activities, while looking at it with a risk lens. And as part of its oversight role, the board should engage with management to understand how the company’s purpose, messaging, and risks all tie together. For example, in considering the company’s purpose and the metrics management uses to measure performance, the board should keep sight of the risk landscape. You may want to ask the following questions of management:

Purpose and stakeholders

- Has the company clearly articulated a purpose that considers key stakeholder needs and aligns with business strategy?

- Has the company considered how its purpose compares to that articulated by its competitors?

Risks and ERM

- Do the company’s existing risk processes include identification of any ESG risks? Should any of the risk identification processes be expanded to allow for a broader scope of risks to be captured?

- Does the ERM process include assessment and mitigation plans for all ESG-related risks that

have been identified? - How does management prioritize ESG risks and opportunities? Are these ESG risks and opportunities included in capital allocation decisions?

Messaging

- How is the company communicating its purpose and its goals in furtherance of long-term sustainable success? Is the company using both quantitative information, such as metrics, and

qualitative information to measure its progress? - How does the company monitor what competitors are doing, what the rating agencies are

reporting, and other benchmarking data? - Is the company transparently tracking their performance against milestone goals, as well as long-term goals, so stakeholders and others can monitor progress?

- Has the company evaluated various ESG standards and frameworks to determine whether it is

addressing the most significant risks and issues facing its industry?

ESG and enterprise risk management

Fifty-five percent of directors say ESG issues are a part of the board’s enterprise risk management discussions.

Q: Which of the following statements do you agree with about ESG (environmental/social/governance) issues? (select all that apply)

Base: 624

Source: PwC, 2020 Annual Corporate Directors Survey, September 2020.

Reliability of ESG information: Once the company has settled on the qualitative and quantitative messaging it will disclose, the board will want to verify the information is consistently prepared and reliable. After all, investors will be using it to analyze the company and make investment decisions.

The board needs to understand management’s policies and procedures supporting the assessment of internal controls over these disclosures. Determining that the right controls are in place to ensure consistency and accuracy of reporting will be key as well as whether the company should consider obtaining some type of assurance over the ESG information disclosed. You may want to ask:

- Does the company have robust policies and procedures to support the development of their disclosures? Do their disclosures adhere to the requirements of particular frameworks or standards? Are the disclosures investor-grade?

- Has management found any gaps in the internal controls that support the completeness and accuracy of the disclosures? If so, how does management plan on mitigating those gaps? Is the disclosure committee one of the controls used by the company to ensure its disclosures are appropriate?

- Would stakeholders be confident with the accuracy of the disclosure without independent assurance? Could independent assurance serve as a differentiating factor among peers?

Disclosures: With the messaging determined and an assessment of the reliability of the information complete, the board should understand where the company will be disclosing its messaging. Boards may want to consider the following questions:

- Are disclosures made in the right place and does that address various stakeholder preferences? For example, a customer or an employee will most likely refer to the company’s website for ESG information, while an investor would more likely refer to either corporate responsibility reporting, annual reports, or proxy statements.

- Are disclosures consistent across various platforms and appropriate for the different audiences of each? For example, are material risks disclosed in a corporate responsibility report aligned with those identified in the company’s Form 10-K filing?

- Is the messaging being incorporated in operational discussions, such as quarterly analyst calls?

- Has the company considered its exposure when including ESG information in SEC filings?

Conclusion

Rapid strides have been made in unlocking the business value of ESG in recent years. The ESG issues a company faces vary widely by industry and company maturity, and there’s no one-size-fits-all solution. But the one thing that’s a sure bet is that directors have a big role to play in guiding management to allocate the appropriate resources and attention. Forward-looking companies value being a frontrunner on ESG issues because they see the connection to the company’s long-term success.

The complete publication is available here.

Print

Print

One Comment

I am keen to learn more about ESG oversight I head the Sustainability and Ethics Committee of the board.