Amy Rojik is a National Assurance Partner at the BDO Center for Corporate Governance. This post is based on her BDO memorandum.

Board members are reconsidering their oversight priorities after a tumultuous 2020 and slow economic recovery. For many, this means navigating some level of financial difficulty that will take a combination of outside capital, resourcefulness and innovation to overcome. For others, it means focusing on emerging or elevated risks and opportunities impacting corporate strategy execution.

Concurrently, shareholders, regulators and other stakeholders have expanding expectations for board action in the wake of the pandemic. Boards of directors are being prompted to address financial and social pressures, a reimagined workplace, evolving regulatory demands and increased scrutiny on environmental, social and governance (ESG) activities. The 2021 BDO Winter Board Pulse Survey reveals how public company boards are moving forward despite continued uncertainty.

While directors may have been eager to turn the page on 2020, most recognize the lingering challenges that will continue to require significant time and attention, which vary based on where companies lie on the business continuum, whether they’re thriving or just surviving. To set the stage for a more stable 2021, it’s critical that decisions be guided by engaging on the broad needs of stakeholders, along with leveraging timely and accurate insight and data.

—Amy Rojik

National Partner, BDO Center for Corporate Governance

Economic Strain Drives Growing Pains

Businesses are looking to shift their focus from resilience to growth, but many boards are finding their growth plans stunted by the pandemic’s ongoing economic impacts. Capital, if available, may be rerouted toward fueling immediate business needs rather than funding expansion plans.

Increasing Appetite for Acquisitions

Six months ago, 21% of boards expected to pursue a merger or acquisition by the end of 2020, and nearly the same percentage (20%) indicated they wanted to boost their M&A skillset.

Now, pursuing an acquisition strategy (48%) is the most-cited corporate strategy for 2021, with more than double the percentage from just six months ago. Those with underperforming business units may be shedding assets to focus on core capabilities and strengthen the balance sheet, while others may be taking the opportunity to make strategic acquisitions at a potential discount. Boards will be tasked with evaluating the due diligence performed for significant strategic transactions.

Evolving Reporting and Regulatory Demands Trigger Apprehension

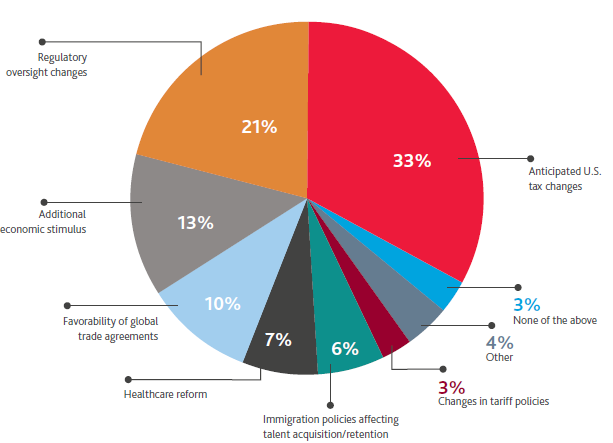

If 2020 was the year of shocks, 2021 may prove to be the year of questions. A change in the U.S. presidential administration, forthcoming widespread COVID-19 vaccine distribution and a volatile economy only scratch the surface of factors impacting board members’ next moves.

When it comes to the new administration, many directors are concerned about adapting to a new government agenda and policies aimed at changes in taxation and regulatory oversight, a focus on climate change, additional economic stimulus

and globalization concerns. The impact of many of these anticipated changes likely won’t be felt in the near term, but informed boards are already contemplating various scenarios for their organizations.

19% say regulatory demands are their greatest business risk for the next 12 months

While preparing for the impact of changes at the federal level, boards are also focused on approaching shareholder and proxy season with concrete plans and objectives. In fact, more than 1-in-5 directors (21%) cite restoring or retaining shareholder confidence as their top governance oversight challenge in the next 6 months. Boards will need to be transparent about where they see opportunities and challenges and be intentional in their disclosure of specific actions to achieve their goals. This is especially true if they find themselves in need of securing additional capital.

Proxy season and forthcoming shareholder meetings are a critical time for boards to share their projected company plans and growth opportunities. Following one of the most volatile years for business, there are several priority items to discuss. Here’s a sampling of what’s on their agendas:

- Demonstrating corporate purpose in delivering value to stakeholders

- Assessing sustainability risks

- Human capital management beyond diversity and pay equity, including SEC Regulation S-K

- Enhanced transparency into a company’s ESG activities

- Continuing effects of COVID-19 on business strategy and liquidity

- Board composition and refreshment

- Expanded disclosure of board oversight for risk management

- Changes to compensation in response to COVID-19 impacts

- Planning ahead for virtual meetings

- Regulatory focus on executive perquisites

An overwhelming 60% say resilience of liquidity, revenue streams and operations will be their shareholders’ greatest concern in the 2021 proxy season.

Boards also face new challenges around financial reporting with heightened scrutiny of results and reporting accuracy after a volatile year.

Five Highly Anticipated Areas of Pandemic-Driven Impact on the 2021 Financial Reporting Process

Spotlight on ESG Reporting

Stakeholder focus on aligning ESG activities with long-term sustainability reporting is growing, as are external calls to report related metrics in a more standardized way. Larry Fink’s recently released annual letter to CEOs highlights “issues that are pivotal to creating durable value—capital management, long-term strategy, purpose and climate change” and outlines actions for companies to take to both address risk and create investment opportunities. Corporate execution of a cohesive ESG strategy with high transparency is ideal, but how to effectively implement these plans continues to plague boards and their management teams.

ESG reporting requirements was one of the most frequently cited changes boards anticipate for the 2021 audit and annual reporting process. Of note, a quarter (25%) of board members cited enhancing sustainability reporting as one of their top three ESG priorities in the next 12-18 months, while 29% said the same for the long-term (18-36 months). Directors are aware of shareholders’ and others’ attention to ESG priorities and are concerned about adequately promoting and reporting their initiatives as part of their overall corporate strategies.

Directors should note that incorporating ESG practices into their strategic business and workplace plans goes beyond box-checking, and may serve to boost the bottom line and reduce risk. It’s important for boards to pursue ongoing education about the evolving ESG reporting landscape and how shareholders are using ESG metrics in their investment and transaction decisions.

What’s Next for Work?

Employees are not only often the largest intangible asset of a company but they also represent one of the most important business stakeholder groups. Their changing preferences should be heard and valued to preserve morale and maintain performance levels.

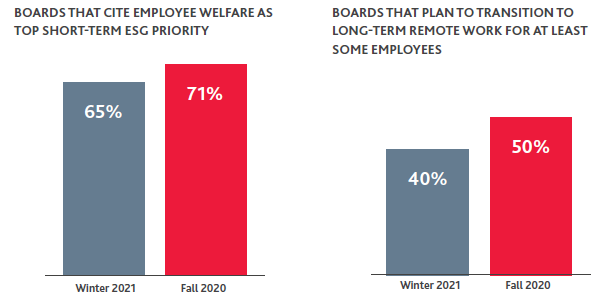

At the start of the pandemic, the immediate need was to keep employees safe from COVID-19. While employee safety and welfare remain a top priority, effectively implemented COVID-19 safety procedures allow boards to look ahead to recruitment and retention, including potential long-term remote work.

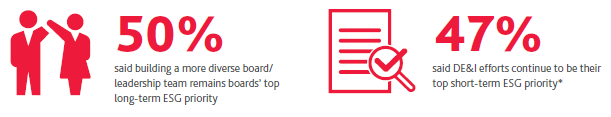

Diversity Remains Long-term Priority, but Liquidity Still Takes Center Stage

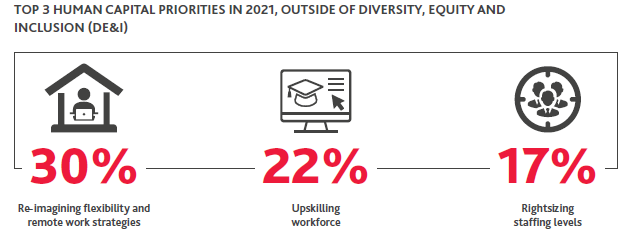

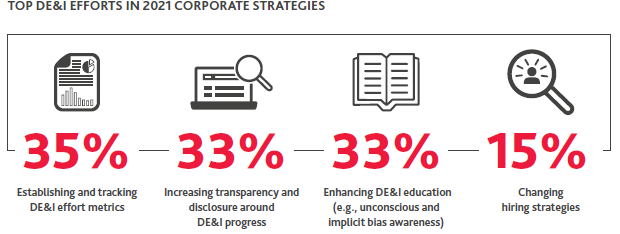

Diversity, equity and inclusion (DE&I) efforts remain one of the most frequently discussed governance topics, further fueled by recent spotlights on injustices in the U.S. In 2020, NASDAQ, the SEC and California lawmakers came forward with new mandates for human capital management—both at the board level and throughout the organization—and boards are recognizing the criticality of diversity for both stakeholder satisfaction and meeting performance goals. However, while boards understand it’s a priority, execution beyond baseline efforts may be lagging as they address immediate pandemic-driven issues.

Board diversity is not just a top-down initiative; it also must be addressed from the bottom up. Growth opportunities at all levels for all employees are essential to ensure adequate representation of a company’s strongest perspectives and capabilities.

Incorporating hiring and human capital advancement practices into business processes and protocols are not just human resource responsibilities; the onus is also on the board and management teams to ensure maximum efficacy. Directors and management teams need to be well prepared, particularly heading into shareholder meeting season, to address concerns over human capital management policies.

Navigating Through 2021

The coming months will be critical in establishing whether 2021 will be a year of further volatility or a shift to stability. Continuing education will remain a critical aspect for thoughtful corporate governance as boards navigate the road to recovery. To receive timely thought leadership and access to live and on-demand programming designed with your needs in mind, visit BDO’s Center for Corporate Governance and Financial Reporting.

Print

Print