Jennifer F. Fitchen and Brent M. Steele are partners at Sidley Austin LLP. Related research from the Program on Corporate Governance includes Are M&A Contract Clauses Value Relevant to Target and Bidder Shareholders? by John C. Coates, Darius Palia, and Ge Wu (discussed on the Forum here); and The New Look of Deal Protection by Fernan Restrepo and Guhan Subramanian (discussed on the Forum here).

During these unprecedented times, all of us have had to acclimate to new ways of working, adapting creatively to the changed environment. Economic activity, including M&A dealmaking, has inevitably been depressed by the COVID-19 crisis, especially in Q2 2020—but industries and businesses have found novel solutions to the problems they face. By Q4, M&A was again beginning to surge.

In this post, we examine the creative deal structures that are being employed with much greater frequency throughout the M&A market. Based on interviews with 150 US corporates and private equity firms, this post analyzes the ways in which M&A is moving forward in spite of the pandemic.

Q2 2020 saw a marked downturn in M&A activity relative to pre-crisis transaction levels. But, since then, dealmaking has bounced back strongly. While a full-scale recovery may not be achievable in the immediate future, there are many reasons to be positive.

The increased use of creative deal structures will be an important part of that story, helping buyers and sellers to overcome some of the risk aversion holding M&A back in the currently volatile and uncertain environment—and enabling more confident parties to pursue emerging opportunities. Indeed, we are already witnessing such an increase, reflected in the rising number of joint venture transactions and the boom in the launch of special purpose acquisition vehicles (SPACs).

Against this backdrop, this post considers the experience of M&A market participants to date and investigates how they intend to deploy creative deal structures in the next 12 months and beyond. Such mechanisms look set to prove integral to the ongoing recovery of M&A volumes and values.

Part I: M&A and COVID-19

The COVID-19 pandemic has taken an unmistakable toll on sentiment in the US M&A market. Deal activity was depressed through much of 2020—though some sectors and regions proved more resilient—and the corporates and private equity firms surveyed for this research did not expect a return to pre-pandemic levels in 2021.

However, there are reasons for cautious optimism. The roll-out of COVID-19 vaccines is gathering pace around the world, enabling governments still battling the virus to look ahead to the unlocking of their economies. That should enable a return to positive rates of economic growth, with the World Bank forecasting a 4% increase in global output in 2021.

Moreover, many market participants are well-placed to intensify their activity. Private equity, in particular, has substantial funds available, with dry powder approaching an all-time high. Post-pandemic, there will be no shortage of dealmaking opportunities as businesses restructure for growth or offload distressed assets. And, as this post details, creative dealmaking strategies are coming very much to the fore.

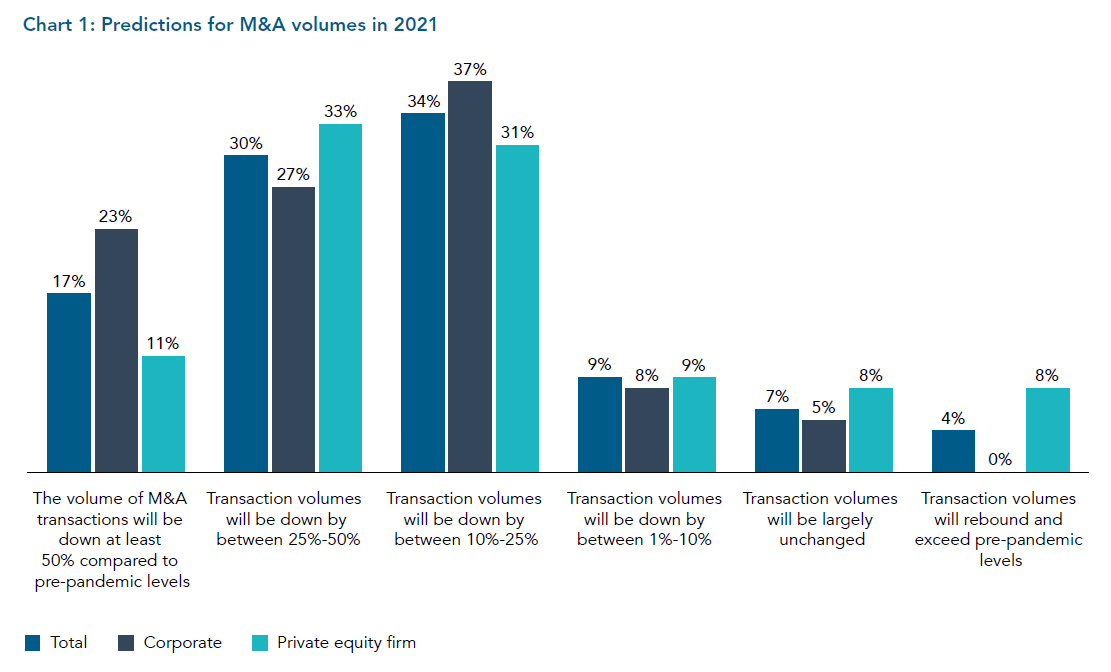

However, when surveyed in November 2020, respondents did not expect US M&A activity to bounce back fully over the next 12 months, though activity for Q4 as a whole ended up exceeding most people’s expectations. Some 90% of respondents expected deal volumes overall to be down from pre-pandemic levels, including 30% who expected them to be down by as much as 25%-50%, with 17% predicting an even greater decline (Chart 1). Just 4% expected M&A volumes to exceed pre-pandemic levels over the next year.

Corporates were particularly gloomy: almost a quarter (23%) expected M&A volumes to be at least 50% below pre-pandemic levels over the next 12 months, and none predicted an increase. By contrast, private equity respondents were likelier to anticipate a more modest departure from pre-pandemic activity.

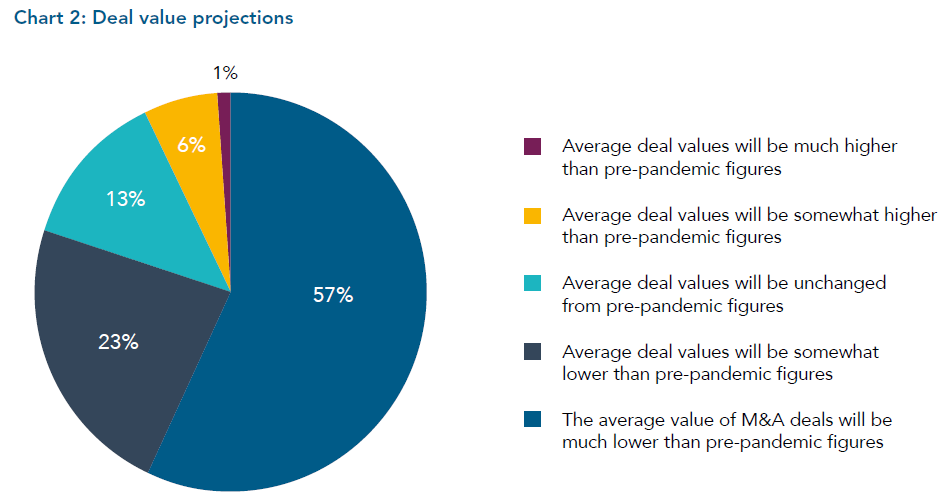

Respondents expected the shape of dealmaking activity to differ markedly over the next 12 months, as they predict the M&A market will be dominated by smaller transactions. More than half (57%) expected average deal values to be significantly lower compared to pre-pandemic figures, while a further 23% expected them to be somewhat lower (Chart 2). Elevated private equity activity, restructuring and distressed asset sales will naturally mean a shift to lower deal values.

Just 7% of respondents believed average deal values will be up on pre-pandemic levels over the next 12 months. But this optimistic minority may, if the most recent figures bear out, be proved right. According to Mergermarket data, 33 megadeals were announced in H1 2020, down from 51 during the same period the year prior. Those 33 transactions were, however, easily eclipsed in Q3, when 36 megadeals were announced, followed by 43 more in Q4. When all was said and done, H2 2020 was one of the most prolific periods for M&A in several years.

It is not only transaction sizes that have changed and are expected to continue to change over the next 12 months, but also the nature of deals, with dealmakers now more likely to consider a broader range of creative structures.

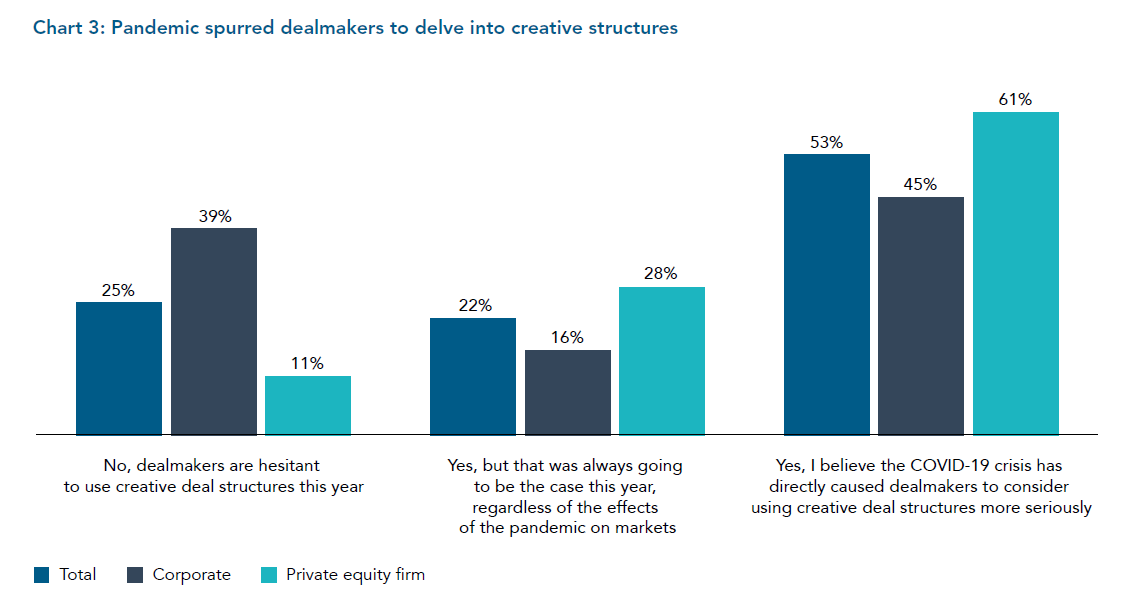

More than half (53%) of respondents overall said dealmakers will deploy more creative strategies as a direct response to the COVID-19 crisis, rising to 61% among private equity firms that participated in the research (Chart 3). A further 22% of respondents said increased use of creative deal structures was likely even leaving aside the effects of the pandemic.

The nature of these structures is varied. Many respondents anticipated increased appetite for risk-sharing in dealmaking, with joint ventures and club deals, for example, rising in popularity. A predicted increase in the number of deals involving equity clawbacks or contingent consideration also signals a more defensive view of the M&A market, with buyers seeking to build protection into transactions. For their part, private investment in public equity (PIPE) deals may offer investors an opportunity to buy at discounted prices and enable sellers to raise funds speedily.

On the other hand, expectations for the launch of more SPACs suggests ongoing demand for structures that provide opportunistic investors with a means to move quickly—as well as to enable private company owners easier access to the public markets. As has been well-documented, 2020 saw a marked increase in the use of SPACs, as investors sought to raise funds ready for rapid deployment as the volatile environment presented opportunities.

Challenges and Drivers

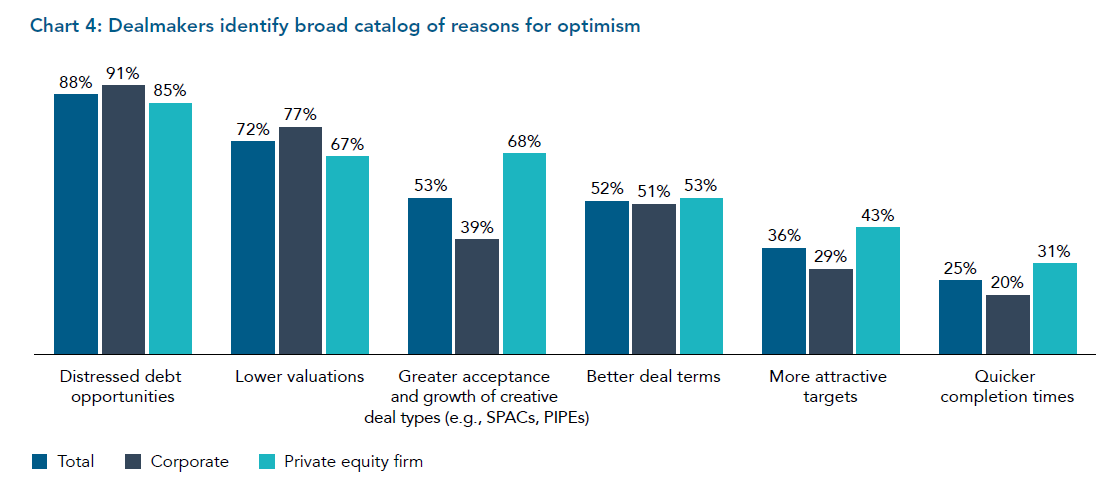

The advancement of creative deal structures is just one of several reasons for cautious optimism about dealmaking prospects, with survey respondents pointing to a number of other positive drivers (Chart 4).

Overall, almost three-quarters (72%) of respondents pointed to valuation opportunities. While public equity markets, led by the US, have proved resilient in the face of the COVID-19 crisis, there is a clear view that sellers are being forced to take a more conservative view on both valuations and acceptable deal terms. A narrowing of the valuation gap will clearly be

an important M&A driver if those perceptions prove correct. Indeed, more than half of respondents (52%) foresaw better deal terms for buyers, potentially reversing the trend in recent history towards frothy valuations and other increasingly seller-friendly terms.

Private equity firms, in particular, believe that the current market environment is creating new M&A opportunities: 43% of those respondents suggested that the availability of more attractive targets will drive dealmaking over the next 12 months.

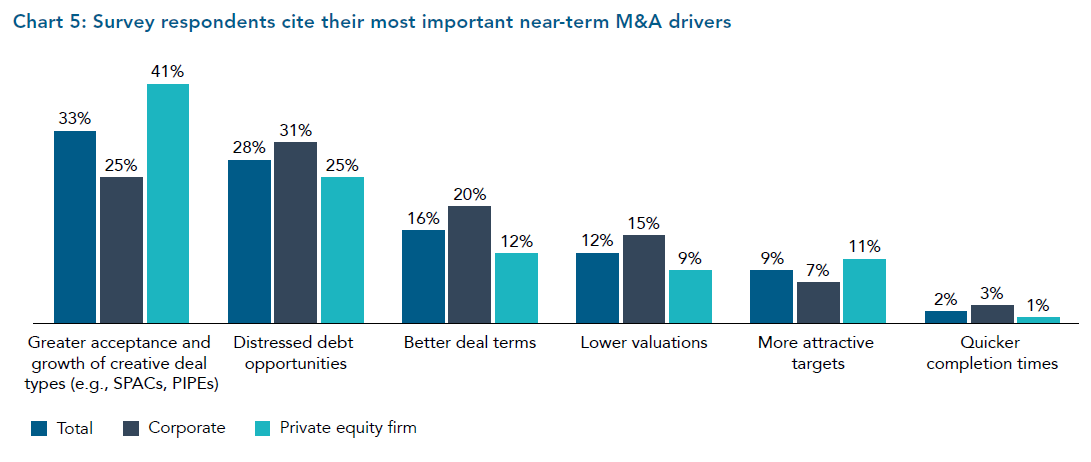

Nevertheless, asked which of these drivers will be the most important spur to dealmaking, respondents returned to creative deal structures (Chart 5). The growth of such deals is regarded as the most important driver of dealmaking by 33% of respondents overall, a higher figure than for any other factor.

Private equity firms are especially likely to take this view, with 41% pointing to the use of creative deal structures as a route to increasing M&A activity. While the figure was lower among corporate respondents, a quarter (25%) agreed with their private equity counterparts. For corporates, only distressed debt opportunities are expected to be a more important driver of dealmaking over the next 12 months.

Such views reflect the broad range of creative deal structures available. Different structures provide means with which to surmount different problems, from overcoming the reservations of risk-averse parties to bridging valuation gaps to providing rapid deployment of capital options for more opportunist dealmakers.

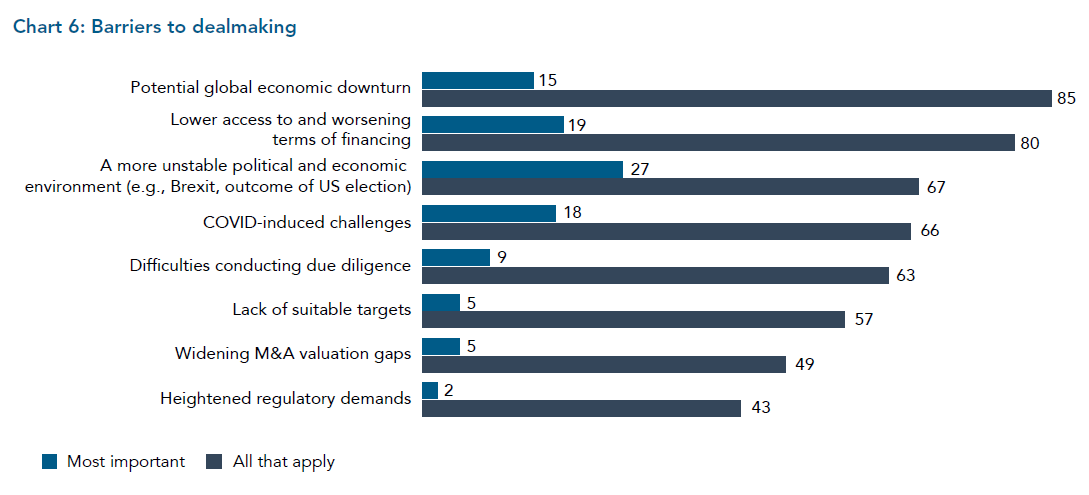

Still, despite these positive drivers, the expectation of reduced M&A activity reflects the challenges facing dealmakers. These hurdles are both significant and broad (Chart 6), posing some difficult questions at both the macro and the micro level.

Overall, 85% of respondents cited the difficult economic backdrop as among the impediments to dealmaking over the next 12 months. Moreover, and notwithstanding the low interest rate environment and increase in access to public capital, four-fifths of respondents were concerned about the difficulty and cost of accessing capital.

However, asked which challenge is the single most important barrier, 27% pointed to the uncertainties of the political and economic environment. While a final result in the US presidential election and the resolution of the Brexit impasse in Europe do provide some reassurance for participants, plenty of questions persist. In particular, the new US administration has yet to set out its approach to trade relations with China, providing potential for further global trade tensions and uncertainty over the next 12 months, even if most analysts anticipate a less hostile Sino-American relationship than has characterized the past few years.

Practical problems endure as well. Almost two-thirds of respondents (63%) worried about difficulties conducting due diligence. As travel bans and lockdowns persist, face-to-face meetings remain difficult, hampering such work, though the M&A market has increasingly turned to virtual solutions.

Part II: Creative Deal Structures in the Spotlight

Creative deal structures offer a broad range of solutions for dealmakers facing practical problems as they consider M&A activity. Against a still-volatile market backdrop, survey respondents said the use of such structures is set to increase over the next 12 months, including:

- Joint ventures/minority investments—deals involving two or more parties pooling their resources (including the target company in deals where the acquirer is taking a non-controlling, minority stake).

- SPACs—companies with no commercial operations that are formed in order to raise capital through an initial public offering (IPO) for the purpose of acquiring other businesses as opportunities arise.

- PIPE deals—the purchase of a public company’s stock by a private investor, rather than on a public exchange.

- Club deals—acquisitions involving multiple private equity purchasers.

- Equity clawbacks—provisions in deals that provide the seller with a means to benefit in the event that the buyer subsequently sells the business.

- Convertible debt investments—the use of debt securities that offer equity conversion rights.

- Contingent consideration/earn-outs—deals offering additional payments to the seller in the event that the business sold hits set performance targets or meets other criteria.

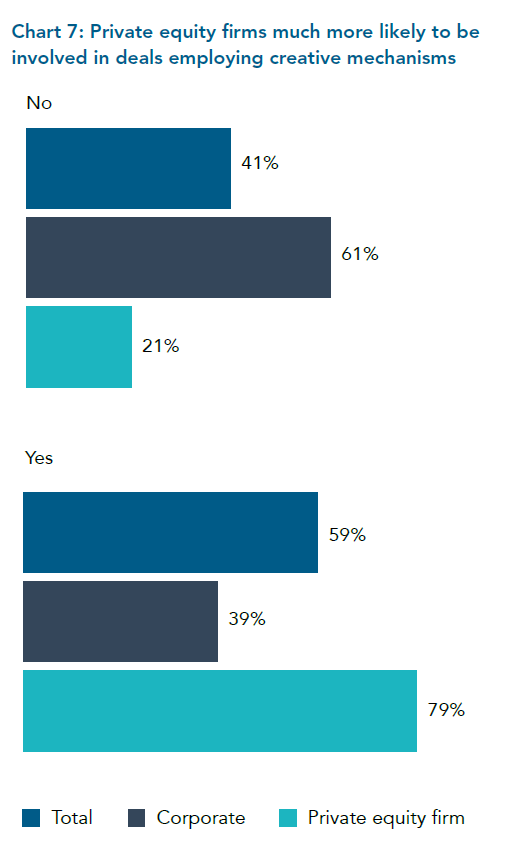

Many of these structures are already being deployed on a widespread basis. In this research, 59% of respondents overall said they have been involved in the past 24 months in at least one M&A transaction that has employed some sort of creative deal structure (Chart 7). Among private equity respondents, that figure rises to 79%, whereas corporates (39%) are much less likely to have been involved in deals of this nature.

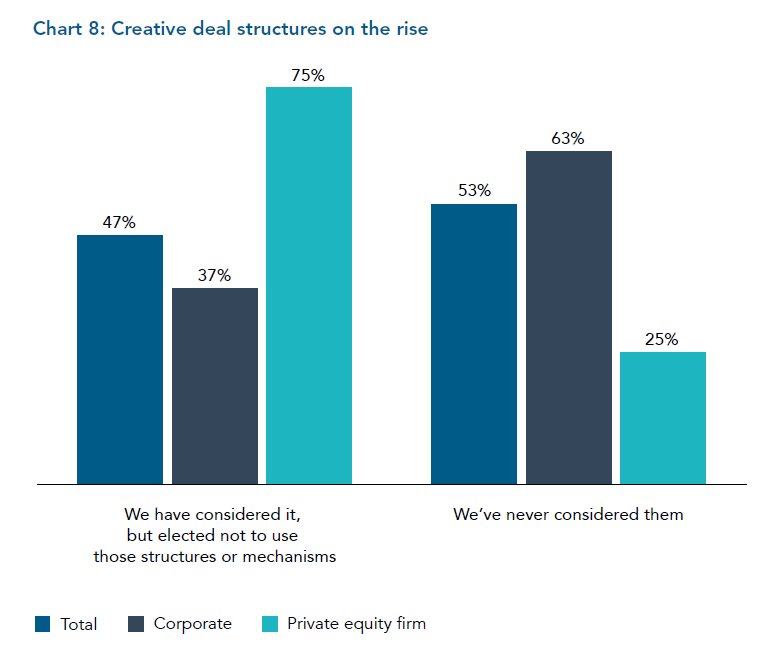

Moreover, those respondents who have not used creative deal structures have often actively considered doing so. Almost half of those who have not gone down this route over the past 24 months (47%) said they at least looked at creative mechanisms before proceeding.

Again, private equity respondents (75%) were more likely to have considered a creative deal structure than corporates (37%) before opting to pursue a more conventional route (Chart 8). Indeed, of the private equity respondents in this research, some 95% have either used a creative deal structure over the past 24 months or considered doing so.

One explanation for the divergence between private equity firms and corporates may simply be that the former have more experience of creative deal structures.“We invest in multiple sectors and creative deal structures give us more flexibility,” said the managing director of one private equity firm. “It’s a means to optimize value for our investors.” At a different firm, a partner said: “About a third of our deals use creative deal structures because of the potential for efficiency and value creation—these deals accelerate growth and provide more stability.”

Still, while corporates may have done fewer such deals in the past, the COVID-19 crisis has prompted some to look much more seriously at different ways to structure transactions. “The impacts of COVID-19 meant we wanted to lower risks and mitigate key market challenges,” said the vice president of corporate strategy & investments at one company. “We have found creative deal structures have really helped during the negotiation process.” The director of M&A at another corporate added: “We’ve increased our use of creative deal structures during the crisis because we’ve seen improvements in deal completion times as a result.”

Private equity respondents also pointed to the pandemic as a driver of increased use of alternative deal types. “Given the risks associated with COVID-19, we decided to implement creative deal strategies more often,” said a managing director. “This has helped us mitigate threats and conduct negotiations with clear intent.”

The trend is accelerating. Among those respondents with experience using creative structures, more than a third (34%) of all deals in which they were involved over the past 24 months incorporated some form of creative solution, a higher share than in the recent past. Overall, 63% of respondents making use of creative deal structures said more of their most recent deals have incorporated such mechanisms than has historically been the case. Among private equity firms, the figure was 68%.

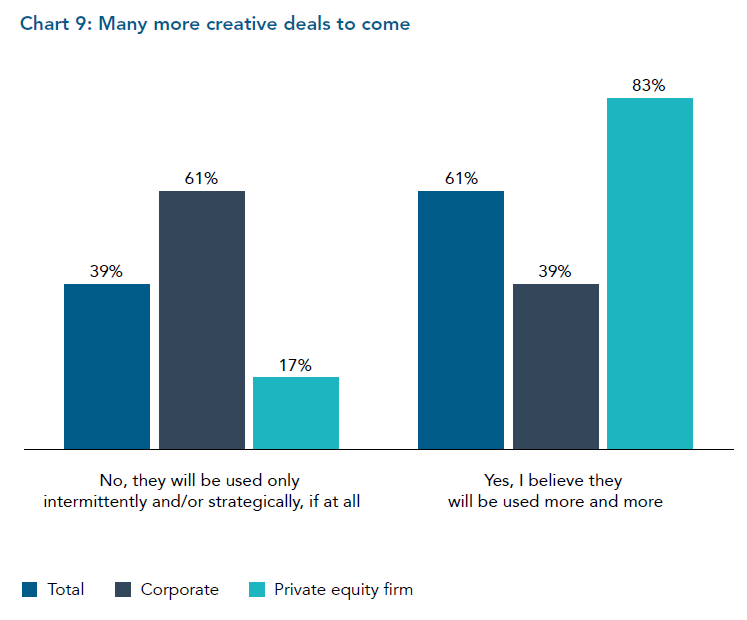

Looking forward, well over half the respondents to this research (61%) remarked that creative deal structures will be an increasingly common part of dealmaking (Chart 9). Private equity respondents are particularly likely to take this view, with 83% anticipating greater adoption of creative mechanisms.

Corporates are much more reluctant in comparison: 61% said they will use creative deal structures only intermittently. At one corporate, the executive director of corporate development worried that such structures can make it more difficult to realize the strategic objectives of the business’s dealmaking. “We have considered using creative deal structures to manage deal flows more smoothly, but we don’t think they are ideal for our objectives,” the executive explained. “The goal could be ambiguous, and this will affect the end results.”

Nevertheless, it is clear that both private equity and corporate dealmakers—albeit to a lesser extent in the latter’s case—have been making growing use of creative structures, and that these mechanisms are likely to be a key feature of their M&A activity going forward.

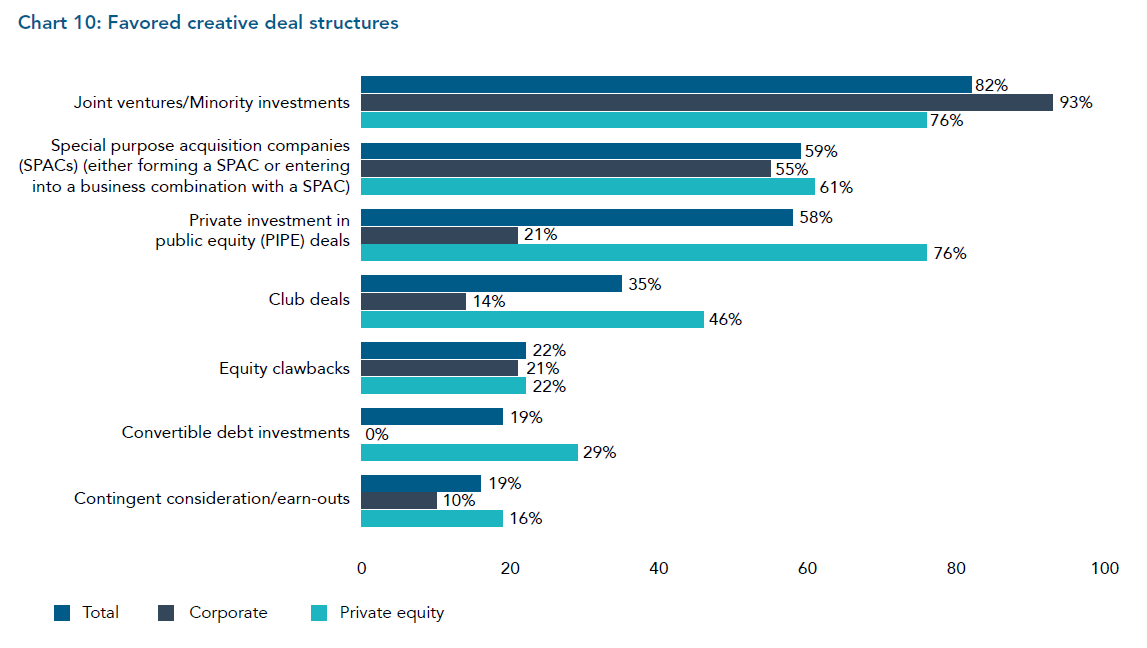

Naturally, some structures are more popular than others. In this research, respondents cited joint ventures/minority investments as the creative deal structure they have used most often, with 82% having employed such a mechanism over the past 24 months (Chart 10). This was the most common deal type among both corporates (93%) and private equity firms (76%).

Businesses may enter into joint ventures for various reasons. Many such deals, particularly in cross-border transactions and in certain sectors, mitigate regulatory or competition challenges. Joint ventures are also increasingly used to acquire new technologies or intellectual property. Equally, the current environment provides additional drivers for joint venture/minority interest arrangements. Notably, such deals may be more straightforward to fund, reducing the risk of capital committed to a transaction or overcoming problems with securing external finance. As the managing director of a private equity firm observed, “Traditional financing options have dropped down, and this has led to a short-term trend towards joint ventures.”

While respondents expected more joint ventures to materialize over the next 12 months, they pointed out that these arrangements are not without their difficulties. Agreeing upon strategic priorities and managing the venture may be challenging. Cultural differences between the parties involved may lead to problems. Parties may also encounter difficulty agreeing upon terms related to exit rights and the eventual unwinding of the venture.

In the case of joint ventures between private equity firms specifically, given that 46% of those survey respondents have taken part in a club deal over the past 24 months, some of those challenges may be easier to overcome.

Assuming each firm is willing to commit to shared timescales, operating processes and objectives, club members may be less likely to run into problems, though potential conflicts of interest will still need to be managed carefully. Such deals may be especially attractive in the current environment, enabling private equity firms to commit smaller stakes to a wider range of projects, reducing risk and improving diversification.

From the seller’s perspective, a club deal may provide a route to sale that would otherwise be difficult to secure. The potential downside, of course, is a reduced pool of bidders as potential competitors team up and incremental execution risk related to the club members’ negotiations.

Another area where creative deal structures have often been employed over the past 24 months is private investment in public equity. These PIPE deals offer several advantages that are particularly relevant in the current environment. Notably, they provide publicly listed businesses a means to raise funds more quickly than traditional transactions would allow, with lower costs and potentially less regulatory complication compared to public offerings. For investors, there is an opportunity to secure a stake in the target company at a discount to the share price.

Still, as with other creative deal types, there are potential downsides to PIPE deals that both issuers and investors must consider. For issuers, any deal must be managed judiciously to avoid upsetting shareholders, who may be required to give the go-ahead for a PIPE deal and will have concerns about the value of their investments being diluted. For investors, not every interested party will necessarily have the accreditation needed to take part or be willing to be limited by the initial resale restrictions on securities acquired in PIPE deals.

Even so, given that PIPE deals may be an attractive way for businesses to approach joint ventures, more such arrangements are likely to arise over the next 12 months. We may also see PIPE transactions involving a sale of convertible preferred stock or convertible debt, providing investors with downside protection.

Some survey respondents were already quite familiar with employing convertible securities in their M&A strategies, with 19% having used such tools in a transaction over the past 12 months. Similar shares had sought to mitigate risk with deal structures that incorporated equity clawback provisions (22%) or contingent consideration (16%). All of these arrangements effectively put some of the risk of the deal back on to

the selling party, reducing the pressure on the buyer and smoothing the deal process amid market uncertainty.

No One-Size-Fits-All Solutions

Crucially, our research suggests that creative deal structures may be used more regularly in some industries than others, as well as be more prevalent in particular parts of the world.

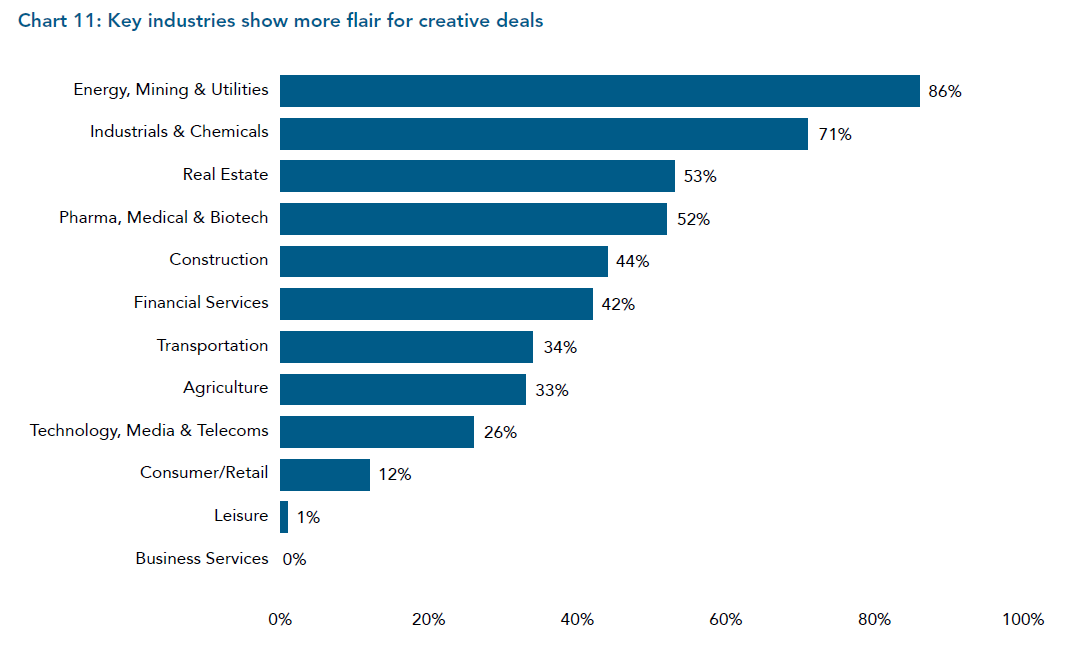

At an industry level, 51% of respondents suggested they are more likely to use creative deal structures in certain industries. Among these respondents, 86% picked out energy, mining & utilities (EMU) as an example, while 71% cited industrials & chemicals (Chart 11). Real estate (53%), pharma, medical & biotech (52%), construction (44%) and financial services (42%) also stood out.

On EMU and industrials & chemicals deals, the managing director of a private equity firm pointed out: “These industries are capital-intensive, so they need creative deal mechanisms to support operations in a timely manner.” Transactions in both sectors may also face regulatory hurdles, for which a creative approach is required. The same is true of transactions in the financial services sector.

The managing director of another private equity firm highlighted that some sectors had seen a more marked increase in creative deal types than others amid uncertainty and volatility during the COVID-19 crisis. “The pandemic has changed how deals in certain sectors are perceived and the value that dealmakers ascribe to them,” the executive said. “In some cases, that has increased the need for both sides to consider more creative deal structures.”

From a regional perspective, more than a third of respondents (37%) believed creative deal structures are used more commonly in some parts of the world than in others—they were most likely to cite North America and Asia Pacific.

In North America, the managing director of a private equity firm said creative deal structures have become increasingly important in bridging the gap between sellers’ expectations and buyers’ willingness to pay. “We have seen this practice grow to cover valuation gaps,” the executive remarked. “Sellers are often very enthusiastic about the value of their companies, and where this does not sit well with buyers, a creative deal structure can provide a mutually agreeable solution.”

Looking at Asia Pacific, the managing partner of another firm pointed to nervousness about dealmaking in riskier emerging markets. “These call for more sustainable deal terms,” the partner said. “Creative deal structures provide valuable opportunities to manage risk, particularly during market crises.”

This may, of course, be true in developed markets too. Europe has been badly affected by the COVID-19 situation, pointed out the director of mergers & acquisitions and corporate development at one corporate. “Market conditions have become highly unpredictable and it is not easy to manage the risks and mitigate them, given the prolonged nature of this uncertainty; this is the main reason why dealmakers are using creative deal structures.”

The Unstoppable Rise of SPACs

The surge in SPAC activity has been one of the prominent M&A stories of the past 12 months. In part, that has reflected the high profile of SPAC founders, who have ranged from the hedge fund manager Bill Ackman to the former basketball star Shaquille O’Neal. But the headlines also recognize the very significant increase in the volumes of cash raised for these “blank check” companies.

SPACs raised a record $83bn last year, six times as much as in 2019, according to data from Chicago-based SPAC Research.

That money came from 248 listings, compared to only 59 in the preceding 12 months. The scale of the phenomenon meant that SPACs accounted for almost $76bn of the record $159bn raised through IPOs in the US during 2020.

The boom reflects the recent unusual market conditions, with the US Federal Reserve signaling that interest rates will stay at ultra-low levels until at least 2025, given the need to support the economy post-pandemic. That has left investors anxious about where they will find new sources of return—and happy to support SPAC founders with a compelling value proposition and a strong track record. Those founders argue that having money in the bank enables them to move quickly in volatile market conditions as opportunities emerge.

From an M&A perspective, SPACs are attractive because they provide sellers—particularly of privately-held companies—with a quicker and more straightforward route to an exit than traditional means, such as an IPO. Not least, regulatory and reporting disclosures are less burdensome.

Nevertheless, there are potential downsides to the SPAC structure. Critics say the historic performance of such vehicles has been mixed and worry about their transparency, complexity and fee structures.

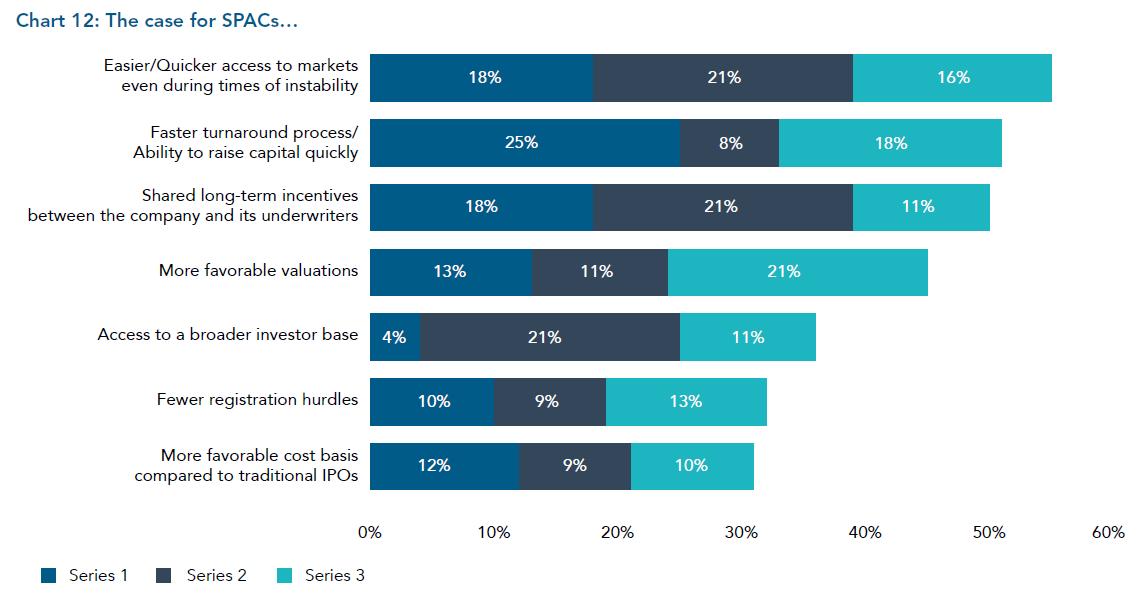

Survey respondents were aware of the positives and the negatives. The main advantages of SPACs include quicker access to markets during periods of instability, cited as among the top-three benefits by 55% of respondents, the ability to raise capital quickly (51%) and the fact that the SPAC and its underwriters share long-term incentives (50%) (Chart 12).

Of these benefits, speed is the standout attribute for SPAC proponents. A quarter of respondents emphasized the faster turnaround process of a SPAC as the principal advantage of using such a structure.

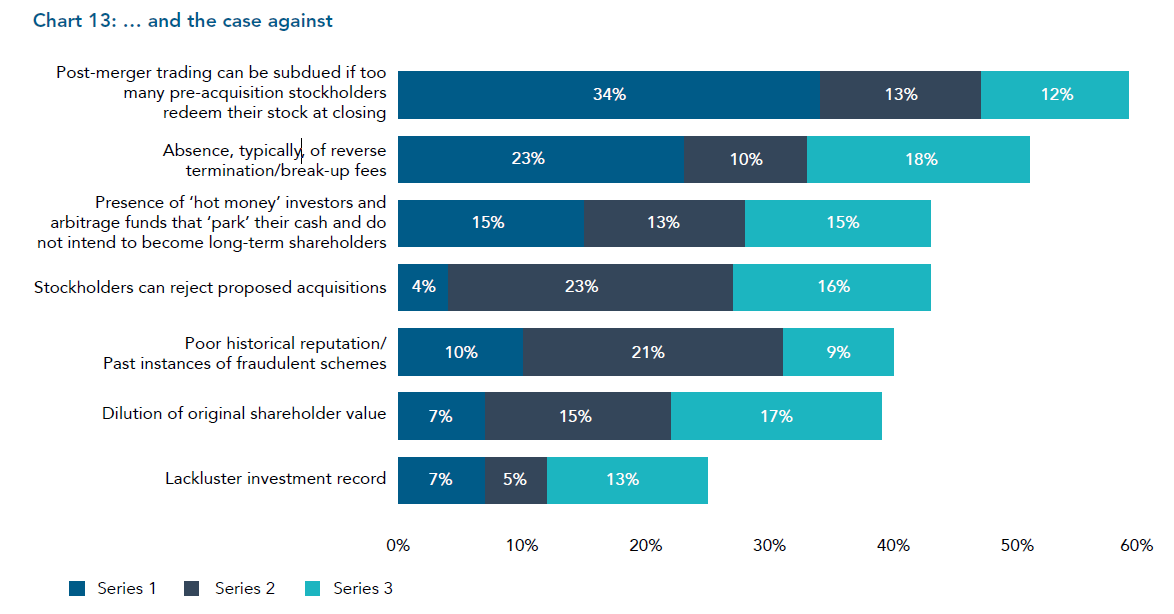

On the other hand, respondents also had legitimate concerns about these vehicles (Chart 13). They argued that with SPAC shareholders often seeking to sell down their stakes once the vehicle completes its transaction, trading can be subdued in the period following deal completion. This was cited as among the top-three downsides to SPACs by 59% of respondents; that includes 34% of respondents who saw this as the greatest disadvantage of such a structure.

They also pointed out that the terms SPACs offer can be one-sided, with an absence, very often, of reverse termination fees – 51% of respondents pointed to this downside. Moreover, some 43% were concerned about the short-termist approach of many SPAC shareholders; they worried that investors in such structures are less likely to become long-term backers of the businesses the vehicles acquire.

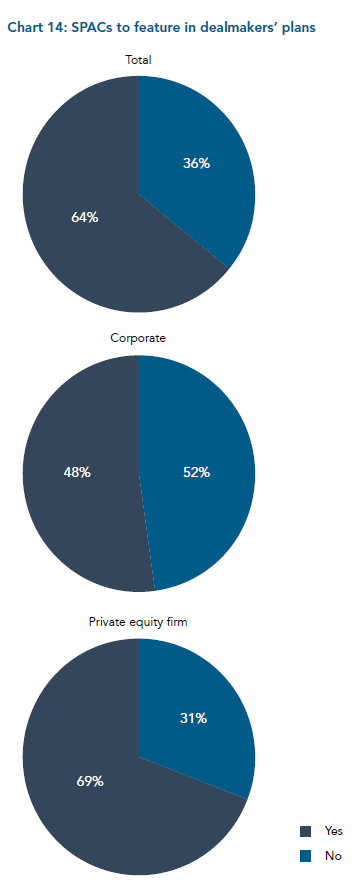

Nevertheless, SPACs seem set to remain prominent over the next 12 months—not least as those vehicles that have raised money look to make acquisitions. Of the 59% of survey respondents who expected to conduct transactions employing creative deal structures over the next 12 months, 64% thought this will include a deal involving a SPAC (Chart 14).

At 69%, the proportion of private equity firms who expected to be involved in SPAC-related transactions is significantly higher than among corporates (48%). Private equity firms are, of course, more likely to be SPAC investors than corporates—though some corporates may find they become targets of vehicles with cash piles to invest.

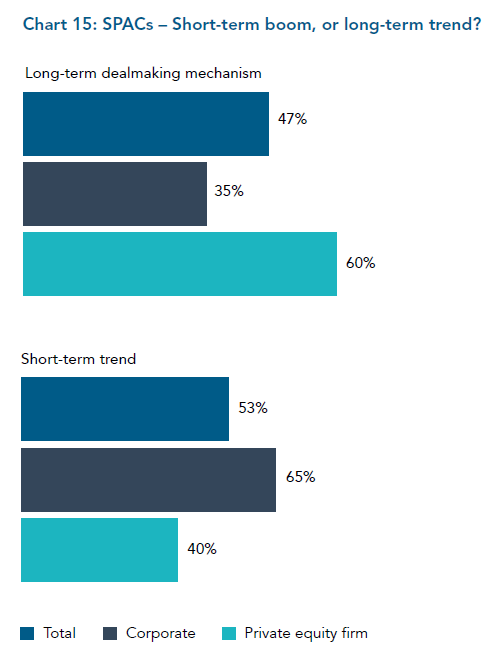

However, the profile of SPACs may soon recede (Chart 15). More than half of respondents (53%) believed the SPAC phenomenon is unlikely to be sustained as a popular dealmaking mechanism in the long term. Corporates were more likely to take this view, with 65% dismissing SPACs as a short-term trend; by contrast, just 40% of private equity firms agreed, reflecting their deeper engagement with these structures, though views differ among respondents.

“Although it may seem like the trend is catching on once again after the previous financial crisis, the motivation will remain short-term,” said the managing partner of one private equity firm. “The main intention is to deal with the current position in the economic cycle and we will then move on to more regular deal mechanisms.”

On the other hand, the senior managing director at another firm argued: “Transactions involving SPACs will increase and this will become a long-term feature because these vehicles have the ability to solely concentrate on the acquisition; they can collect enough information and research various possibilities to arrive at more informed decisions.”

The concern of some respondents that last year’s boom is a case of too much “hot money” (see Chart 13) resonates with commentators who worry that the SPAC market has some of the characteristics of a bubble. But where SPACs are successful, both for their investors and the businesses in which they invest, the case for using such vehicles beyond the extant unusual market conditions will strengthen.

Conclusion

This post suggests that while there is appetite among corporate entities and private equity firms alike for a sustained return to M&A activity over the next 12 months, a significant degree of nervousness remains. Such anxiety is likely to persist until the world’s major economies emerge decisively from the COVID-19 crisis—and until it is clear that a stable recovery has begun.

Nevertheless, deal activity will continue to rebound. Creative deal structures will come to the fore, playing a vital role in ensuring that market participants are able to overcome some of the reservations they have about M&A. They will provide a route around practical problems such as financing difficulties and enable more optimistic investors to proceed.

These structures afford different types of opportunity. For the more risk-averse, joint ventures, club deals, contingent equity arrangements and similar mechanisms offer means with which to pool resources and share risk, including with sellers. Other mechanisms enable market participants to get on the front foot. The rise of SPACs, notably, has been one of the most striking features of the M&A market over the past 12 months. The continuation of this trend, including how SPACs invest the capital they have raised, will be a critical story to watch in 2021 and beyond.

It should be noted, of course, that creative deal structures are not new. Many of the strategies employed by dealmakers over the past 12 months are tried, tested and largely trusted. This is to be welcomed—in challenging conditions, dealmakers need solutions they know they can fall back on in order to participate in the market.

There is consequently reason to be confident that creative deal structures will remain prominent for the foreseeable future. The bottom line is that such mechanisms will be vital if the ongoing recovery of M&A activity is to continue.

Print

Print

One Comment

Exceptionally comprehensive & through data. Thank you for your excellence & attention to details.