Matteo Tonello is Managing Director of ESG Research at The Conference Board, Inc. This post is based on co-publication by The Conference Board, Semler Brossy, and ESGAUGE, authored by Mr. Tonello, Mark Emanuel, Todd Sirras, Elijah Ostro, and Paul Hodgson. Related research from the Program on Corporate Governance includes the book Pay without Performance: The Unfulfilled Promise of Executive Compensation, and Executive Compensation as an Agency Problem, both by Lucian Bebchuk and Jesse Fried.

Director Compensation Practices in the Russell 3000 and S&P 500: 2021 Edition documents trends and developments in non-employee director compensation at 2,855 companies issuing equity securities registered with the US Securities and Exchange Commission (SEC) that filed their proxy statement in the period between January 1 and December 31, 2020, and, as of January 2021, were included in the Russell 3000 Index. The project is a collaboration among The Conference Board, compensation consulting firm Semler Brossy, and ESG data analytics firm ESGAUGE.

Data from Director Compensation Practices in the Russell 3000 and S&P 500: 2021 Edition can be accessed and visualized through an interactive online dashboard at https://conferenceboard.esgauge.org/directorcompensation. The dashboard is organized into six parts.

Part I: Compensation Elements, with benchmarking information on the prevalence, value, and year-on-year increases of cash retainers, meeting fees, stock awards, stock options, and any benefits and perquisites.

Part II: Supplemental Compensation, including the cash retainer and meeting fees granted for serving on board committees and the premiums offered for board and committee leadership roles.

Part III: Equity-Based Compensation, which reviews cash and equity compensation mix, the prevalence and value of various equity award types, and the vesting schedules of awarded equity.

Part IV: Stock Ownership Guidelines and Retention Policies, for a detailed analysis of the features of ownership guidelines for board members (including their disclosure, their compliance window, the definition of ownership adopted, and whether the guidelines revolve around a multiple of the cash retainer or a specific number of shares) and the types of retention requirements applicable to equity-based compensation (including the retention ratios and the duration of the retention period).

Part V: Compensation Limits, including the prevalence of limits by type (whether total compensation limits, dollar-denominated limits or share-denominated limits) and the median and average value of these ceilings.

Part VI: Deferred Compensation and Deferred Stock Units (DSUs), including elective and mandatory deferrals, to what compensation element the deferral applies, the form of the deferred compensation payout, the use of deferred cash investment vehicles (such as money-market or savings accounts, retirement accounts, or others) and the prevalence, value, holding requirements, vesting periods, and payout forms of DSUs.

Compensation figures included in Director Compensation Practices in the Russell 3000 and S&P 500: 2021 Edition reflect the disclosures made in the director compensation tables and narratives included, under SEC rules, in proxy statements filed during the examined period.

The following calculation methodologies were applied. The calculations extend to the entire sample of companies, including those reporting no value for any of the compensation components or supplemental compensations described:

- Total Compensation figures are the sum of all compensation elements paid to each member of the board of directors (including cash retainer, total meeting fees, stock awards, and stock options but excluding the values reported under “other compensation,” which often display significant variations from company to company) plus the per-director value of the supplemental compensation paid to committee members (exclusive of any leadership premiums).

- Unlike Total Compensation, Total Board Service Compensation excludes any supplemental compensation paid for committee service.

- Total Actual Compensation is the average of the amounts actually received by each director on the board, as reported in the Director Compensation table included in the proxy statement. Since the compensation paid to individual directors varies based on committee membership, leadership role, meeting attendance, and time of appointment, the average across the board is calculated.

- Total Committee Service Compensation is the sum of all cash retainers and total meeting fees for all meetings held across all standing or special committees of the board, divided by the number of directors. It excludes board chair premiums and committee leadership premiums. The sum of Total Committee Service Compensation and Total Board Service Compensation then equals Total Compensation.

- Total Committee Leadership Premium is the sum of the premiums paid to the directors serving as chairs of standing or special committees of the board, above the value of a committee member’s compensation.

Total Compensation is reported two ways: exclusive of initial equity premiums and inclusive of initial equity premiums on an annualized basis. For the calculation inclusive of initial equity premiums, the premium was annualized over a five-year period: As a result, the figures reported represent 1/5 of any initial equity premium value.

Compensation figures are reported for the aggregate Russell 3000 and the aggregate S&P 500. Russell 3000 figures are also segmented according to business industry and company size. The industry analysis aggregates companies within 11 groups, using the applicable Global Industry Classification Standard (GICS). For the company-size breakdown, data are categorized along seven annual-revenue groups (based on data from all GICS groups except for companies in the Financials and Real Estate sectors) and seven asset-value groups (exclusively based on data reported by companies in the Financials and Real Estate sectors, which tend to use this type of benchmarking). Annual revenue and asset values are measured in US dollars as of December 31, 2020.

The following are the key findings.

Director pay reported in 2020 filings continued the upward trends reported in recent years, as figures reflect decisions made before the pandemic. For a few industries and some companies, increases were substantial, reflecting an every three-to-four-year cycle of adjustments to bring director pay to market instead of the annual increases often awarded to executives. Moves toward a simpler approach to director compensation policy continued as well.

According to proxy statements filed in the January 1-December 31, 2020 period, the median Total Compensation awarded to a board member in the latest fiscal year (most often, 2019) was $189,980 in the Russell 3000 and $280,000 in the S&P 500. In both indexes, these figures represent an increase from the previous fiscal year: the rate of growth was higher (4.6 percent) for companies in the Russell 3000 compared to the S&P 500 (1.8 percent).

These changes appear to be driven primarily by the rise in the value of equity awards. According to 2020 disclosure documents, the median value of equity awards made to board members increased by 7.6 percent since the prior year (from $110,000 to $118,355) in the Russell 3000 and by 2.4 percent (from 165,000 to 168,933) in the S&P 500. On the contrary, the dollar amounts of cash retainer and total meeting fees granted to directors in the index were flat since the prior reporting year, with meeting fees used in director compensation policies by only 17.4 percent of Russell 3000 companies and 12.5 percent of S&P 500 companies. See p. 15 for how Total Compensation is calculated for the purpose of this study.

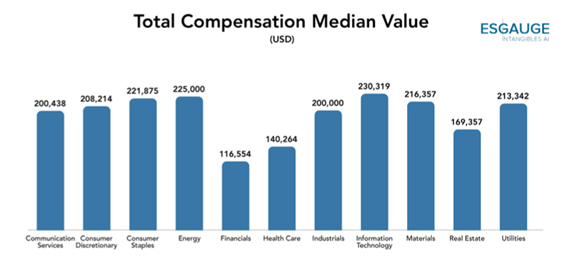

The Russell 3000 analysis by business sector shows that the highest year-on-year increases in the median value of Total Compensation occurred in the Materials and Financials groups (8.2 percent and 7.1 percent, respectively), while the lowest were reported by companies in the consumer product sectors (0.7 percent in Consumer Discretionary and 0.9 percent in Consumer Staples). At least in part, this disparity can be attributed to the fact that, while director pay may be reviewed annually, it is rarely also adjusted annually. In fact, it is more likely to be increased only once every three, four, or even five years. We can expect to see this practice continuing because compensation committees typically do not want to increase director pay by incremental amounts, generally waiting until a substantial market correction is necessary before recommending changes. It is also worth noting that, while the Financials sector reported one of the highest annual rates of increase, the median financial company granted the lowest Total Compensation to its directors ($116,554, according to 2020 disclosure documents, or almost half of the $221,875 paid by the median company in the Consumer Staples sector).

For comparison purposes, median increases in non-employee director compensation lagged behind CEOs and named executive officers (NEOs). For CEOs in the Russell 3000, the increase in median total compensation (i.e., the sum of the disclosed target value of compensation elements, such as base salary, annual bonus, stock awards, and stock options) was 7.8 percent. For CEOs in the S&P 500, the increase in total pay was 4.8 percent. For NEOs in the Russell 3000, the increase in median total compensation was 9 percent, and 3.7 for NEOs in the S&P 500. [1]

Since the onset of the pandemic, a significant proportion of boards temporarily reduced or eliminated their pay, and few felt that an increase in retainers going forward was appropriate. As a result, despite the exponential growth in board members’ workload, the current disclosure season is likely to reveal an end (or a pause?) to the trend of rising director compensation recorded in recent years.

While the median Total Compensation of directors reported in 2020 filings increased, the data on Total Actual Compensation from this year’s proxy statements will most likely paint a different picture. Not only were many director retainers reduced during the pandemic, but owing to economic challenges of various kinds, it is likely that anticipated or planned increases will have been postponed. In fact, increases contemplated during the fall of 2019 and instituted in the early months of 2020 may have been adjusted back down again at some companies.

Our Database of COVID-Related Compensation Changes

Although cuts to director retainers due to the pandemic may be partially restored as the economic recovery continues, in 2020 compensation reductions were widespread.

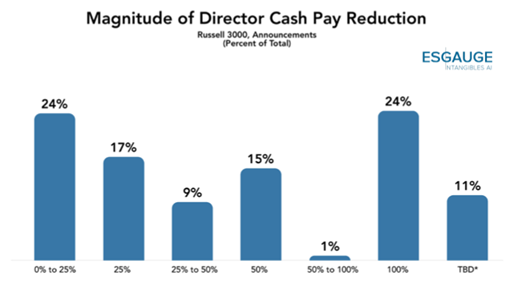

According to a database created by ESGAUGE in collaboration with The Conference Board and Semler Brossy, through March 31, 2021, 695 companies in the Russell 3000 index announced adjustments to pay levels; of those, 416 included both executives and directors, while the remainder applied only to executives. In the sample of director pay cuts, 25 percent of the companies opted for the total forfeiture of cash retainers, while another 25 percent of companies applied cuts of between zero and 25 percent. Some 15 percent of the sample cut retainers by half and 17 percent cut them by a quarter of their value. In most instances, pay was reduced in the same proportion as for executives, but in 82 cases director pay went down by more than for the CEO.

For the current list of Russell 3000 and S&P 500 companies that made this announcement, access the public database.

* TBD indicates that the company disclosed the reduction but not its magnitude.

Several other factors are putting downward pressure on the Total Actual Compensation of directors.

The trend away from per-meeting fees (toward fixed-fee retainers) will mean there is no compensatory upside to the marked increase in meetings in response to the pandemic. Since the onset of the COVID-19 crisis, directors had to meet much more frequently, as reported in recent months and confirmed by data on board practices maintained by ESGAUGE and The Conference Board. [2] If, in the past, such a rise in the number of meetings would have led to an increased level of compensation for directors, under the new circumstances this increased workload is unlikely to have similar effects.

Among those that do still pay meeting fees, around 70 percent of companies award them for live meetings only. Only about 30 percent pay them for both live board meetings and telephonic or videoconference meetings. Almost all board meetings were remote during 2020, which may also keep a lid on pay for some directors. Therefore, a change to this policy might be forthcoming, with companies potentially paying the same for remote meetings as in-person. [3]

That all said, the volatility of the stock market may also have had a dampening effect, at least initially, on the “take-home” value of director compensation. The standard way of calculating equity awards (i.e., a fixed value of shares, either stock or stock options) might have resulted in directors receiving more shares at lower prices if those shares were granted during the initial depths of the pandemic.

Therefore, the policy of granting stock based on a fixed value could be subject to some change or, at least, adaptation. Undoubtedly, many companies had to make adjustments to the way they calculated share awards. These have included delaying grant dates until share prices have normalized, using six-month trailing average stock prices or premium pricing stock. New plans may make allowances for these kinds of adjustments to be an integral part of a flexible policy adapted to meet any situation.

Recruiting a new breed of diverse directors with different experience and skills may require significant changes to director pay structures, including adjusting compensation levels upwards to make posts more attractive to in-demand talent. For directors who are not former CEOs, having pay in the form of equity that is likely locked up until retirement may not be much of an incentive to join a board, leading companies to seek new, creative solutions such as signing equity grants or different equity/cash ratios.

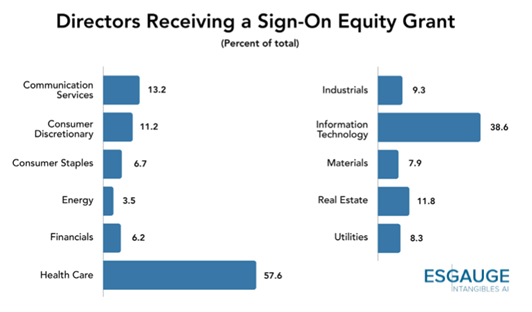

While there is a strong impulse to constrain pay levels given the current circumstances, many companies must keep their director compensation policies attractive to a diverse slate of candidates with relevant operating expertise in the evolving business landscape. The new demand for diversity in the boardroom may also further accentuate the director recruitment challenges encountered by smaller companies and certain industries. For some years, our data has been showing that almost twice the proportion of Russell 3000 companies (21.8 percent, according to 2020 disclosure) offer a sign-on equity grant to newly elected directors, compared to the S&P 500 (12.3 percent). This finding is even more pronounced in the Health Care sector, where as much as 57.6 percent of companies offer a sign-on bonus.

In the face of economic concerns, companies are reluctant to permanently increase compensation levels for newly recruited directors; therefore, they may favorably view the use of sign-on equity grants or the offer of a choice among compensation packages with different equity/cash mixes. Some directors, especially those who may not be coming to the board with a long career as a corporate executive, may benefit from these one-time grants and a somewhat higher portion of cash compensation. To avoid any negative attention from proxy advisors or shareholders’ concerns, boards should disclose such awards and explain their rationale, especially that they are non-recurring payments (if that is indeed the case).

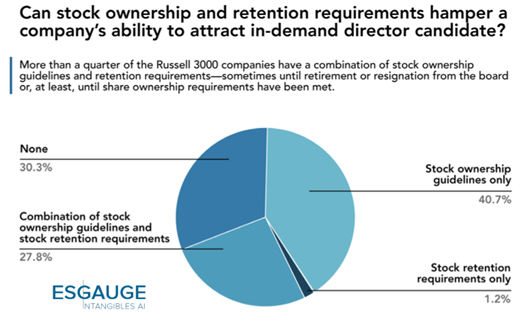

Few companies, either in the Russell 3000 or the S&P 500, have either mandatory or a combination of mandatory or elective deferred compensation policies, so this practice is unlikely to be a significant barrier to recruitment. However, more than a quarter and just less than half of the Russell 3000 and the S&P 500, respectively, have a combination of stock ownership guidelines and retention requirements—sometimes until retirement or resignation from the board or, at least, until share ownership requirements have been met.

Mandatory deferral policies, hold-until-retirement or post-retirement provisions, and other stock retention provisions that defer transfer or vesting of stock until after a director leaves the board could impair the companies’ ability to recruit in-demand candidates. It will then be helpful to monitor how these policies evolve in the coming years.

The pecking order of standing board committees when it comes to committee compensation (audit at the top, followed by compensation then nominating/governance) may be in for a reshuffle as director responsibilities and workloads change and expand to human capital management, environmental, social, governance skills and disclosures, diversity and inclusion—few of which come under the purview of the audit committee.

Typically, supplemental committee member compensation is highest for the audit committee, followed by the compensation committee, with nominating/governance committee in third place. Our most recent Russell 3000 data, in particular, show that audit committee members earn, at the median, an annual supplemental retainer of $10,000, compared to $7,500 for compensation committee members and $5,000 for nominating/ governance committee members. The leadership roles at these committees are also rewarded differently, with audit committee chairs paid an annual premium of $15,000, compared to the $10,000 granted, at the median, to their counterparts at the compensation and nominating/governance committees.

In recent years, the workload and breadth of directors’ responsibility have been rising, as evidenced by an increasing number of meetings. [4] Additional responsibilities encompass areas such as the oversight of environmental, social, and governance (ESG) practices, the promotion of policies advancing diversity, equity, and inclusion (DE&I) in the workforce, and the mitigation of risks related to climate change. At the same time, scrutiny of director pay levels is intensifying, alongside increased scrutiny of executive pay, for which directors are responsible. This expansion is beginning to affect the standing of committees.

The general principle in committee pay is to compensate for the additional workload required to perform the specific tasks assigned to a committee. As a result, over time and once the current crisis has passed, these developments may bleed through to director pay levels in the form of increased supplemental retainers for committee service. In particular, if the compensation committee is given responsibility for the oversight of DE&I while the task of hiring directors with ESG experience is assigned to the nominating/governance committee, it is likely that compensation premiums for the service on (and the leadership of) those committees will increase and catch up to audit retainers.

Similarly, pay for leadership roles within the board may begin to outpace the overall growth rate of standard director compensation. Data on leadership premiums published in 2020 proxy statements already show a rise in the median retainer for the chair of the nominating/governance committees at the largest US public companies by annual revenue—to $20,000, from $15,000 of the prior disclosure year. It might be an early indication of the potential developments in supplemental compensation for board committee leaders.

Another point to consider is that, while some companies try to calibrate compensation based on committee workload, others do not pay extra for committee chairs or committee service. It happens because they understand that the duties and workloads will change over time or because they don’t want to impair committee members and chairs’ rotation or create divisions within the board. With this in mind, the convergence described above could be a further opportunity to take a fresh look at whether supplemental compensation for committee membership and leadership should be used at all.

While instances of excessive director pay sporadically come to the fore, the spotlight on board compensation from shareholders and proxy advisory firms affects all companies. As a result, pay ceilings in equity plan documents are more common, and advisory votes on board pay (or on those directors who decide board pay) could become a more frequent proxy matter.

Even though shareholder litigation fears over excessive director pay [5] may have subsided in the past couple of years, the number of companies applying a ceiling to director compensation continues to grow. According to our review of proxy statements, in the last three disclosure years, the percentage of companies reporting some type of director pay ceiling has grown, from 48.7 to 61.5 in Russell 3000 and from 53 to 66.9 in the S&P 500. Specially, the share of companies setting limits on total director compensation (whether made of cash only or cash and equity) has risen to 26.9 percent in the Russell 3000 and 28.9 percent in the S&P 500 (from the 16.1 percent and 18.9 percent reported, respectively, in 2017 filings). Moreover, about 30 percent of S&P 500 companies have dollar-denominated equity limits, and 16.3 percent of Russell 3000 companies disclose share-denominated equity limits.

The introduction of compensation limits for directors mitigates the risks of litigation. It may also head off objections from proxy advisors. In particular, ISS considers the adoption of pay limits when assessing non-executive director compensation policies for which management seeks shareholder ratification. [6] It also recommends a vote against directors responsible for setting board compensation at a company that shows excessive director pay for two successive years—unless it discloses “a compelling rationale or other mitigating factors” for being an outlier. [7] (Glass Lewis, the other large proxy advisory service in the US, also warns about the dangers of excessive director pay as it can compromise the objectivity and independence of non-executive directors. However, its guidelines are not specific on what should be viewed as “excessive” and do not equally emphasize the importance of benchmarking by company size and industry. [8])

The Definition of Outlier and the Importance of Benchmarking in Setting Director Pay

The ISS voting policy defines outliers as those companies reporting director pay figures above the top 2 percent of all comparable directors within the same index and two-digit GICS business sector group.

In practice, within those groupings, the distribution of director pay data can be much more compressed than the one often observed for executive compensation, underscoring the importance of stress-testing director compensation in different benchmarking scenarios. For example, according to our data, in the Russell 3000 Consumer Discretionary sector, the difference in total director compensation between the median and the 90th percentile can amount to only $68,008, or 32.6 percent of the median (a fraction of what is typically seen in executive compensation data). Therefore, companies should be mindful of the effects on total compensation of program features such as meeting fees and guidelines applicable to fixed-share grants. In a year of frequent meetings or rapid share price appreciation, these features could easily move the company’s directors to the higher end of the peer comparative range.

The ISS policy recognizes that board-level leadership positions, such as non-executive chairs and lead independent directors, are often paid more than other directors and thus compares such positions to similar roles. Reasons that might mitigate a company’s position as an outlier include the payment of legacy retirement benefits or incentives earned as an executive but paid after becoming an outside director.

Over time, and for the reasons just explained, a ceiling for director equity pay may become a standard part of all or most director equity plans. To place a ceiling on cash payments, management could submit a proposal on the specific issue of director compensation limits for a vote at the next annual meeting. This practice would provide similar legal protections as equity pay ceilings in equity plans. Alternatively, a change in the board or committee charter that applied an overall ceiling to total director compensation amounts although it would not grant legal protection unless also ratified by shareholders.

Endnotes

1Paul Hodgson and Matteo Tonello, CEO and Executive Compensation Practices in the Russell 3000 and S&P 500: 2020 Edition, The Conference Board/ESGAUGE/Semler Brossy, November 2020.(go back)

2Rusty O’Kelley et al., Corporate Governance Challenges in the COVID-19 Crisis: Findings from a Survey of US Public Companies, The Conference Board/ESGAUGE, June 2021.(go back)

3Matteo Tonello, 2021 Proxy Season Preview and Shareholder Voting Trends (2017-2020), The Conference Board/ ESGAUGE, January 2021.(go back)

4For a review of recent data on the frequency of board committee meetings and the expanding committee responsibilities, see Matteo Tonello, Corporate Board Practices in the Russell 3000 and S&P 500: 2020 Edition, The Conference Board/ESGAUGE, October 2020.(go back)

5For a discussion, see the last edition of this study: Mark Emanuel, Todd Sirras, and Matteo Tonello, Director Compensation Practices in the Russell 3000 and S&P 500: 2020 Edition, The Conference Board/ESGAUGE/ Semler Brossy, April 2020.(go back)

6United States Proxy Voting Guidelines: Benchmark Policy Recommendations, Institutional Shareholder Services (ISS), November 19, 2020, p. 50. Where companies do offer up their director compensation policy to a shareholder vote, ISS will assess factors such as the relative magnitude of director compensation as compared to companies of a similar profile, equity award vesting schedules, the cash-equity mix, and meaningful limits on director compensation.(go back)

7Id., p. 16.(go back)

82021 Proxy Paper Guidelines: United States, Glass Lewis, p. 47.(go back)

Print

Print