Marc Treviño is partner and June M. Hu and Joshua L. Levin are associates at Sullivan & Cromwell LLP. This post is based on a Sullivan & Cromwell memorandum by Mr. Treviño, Ms. Hu, Mr. Levin, Melissa Sawyer, and Elizabeth D. Lombard. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); and Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here).

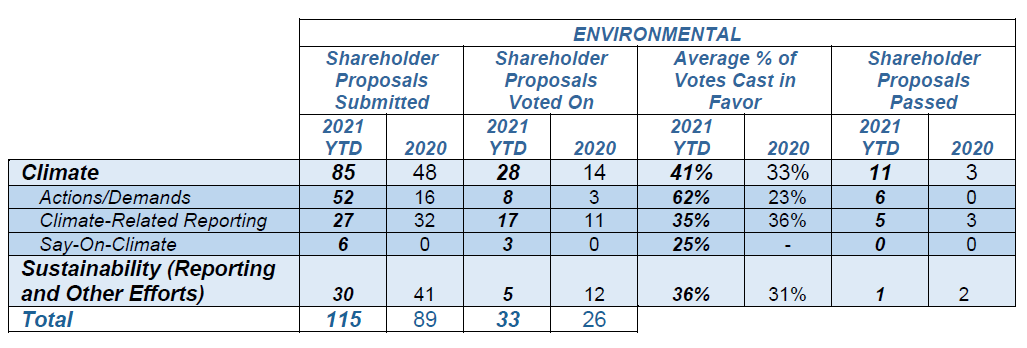

Shareholder proposals submitted on environmental matters and, in particular, climate-related proposals have increased for the second consecutive year, exceeding even the number of proposals submitted in 2018 following former President Trump’s withdrawal from the Paris Agreement in 2017 (115 in 2021 compared to 110 in 2018). The substantial majority (85) of these proposals were climate-related.

1. Increased Withdrawal Rate

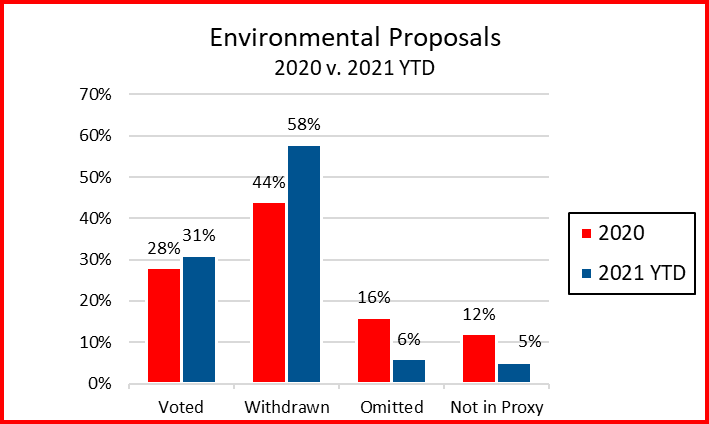

Environmental proposals were withdrawn at a meaningfully higher rate this year compared to last year. Given the increased focus of institutional investors (including BlackRock, Vanguard and State Street) on climate-related issues, many companies may have preferred engaging with a proponent rather than taking the proposal to a vote. Of the 115 environmental proposals submitted, over half (70 total) were withdrawn (compared to 39 in 2020).

The major proponents rarely settled with companies unless the company committed to take actions towards the specified environmental goals or at least adopted their disclosure-based demand. For example, of the 41 environmental proposals submitted by As You Sow, [1] As You Sow reported reaching an agreement with the company and subsequently withdrawing 21 proposals, [2] including five with major financial institutions on adopting a goal of reaching net-zero financed emissions by 2050. [3] Ten other proposals were either withdrawn without a reported settlement, excluded through the no-action process or did not appear in the company’s proxy. The eight As You Sow proposals that went to a vote generally received between 36% and 57% support, [4] with two exceptions of high shareholder support [5] and one low shareholder support. [6] The New York State Comptroller also reported withdrawing proposals at five companies following their commitment to set greenhouse gas emissions (GHG) targets and, in two cases, additional green energy use or production goals. [7] The commitments were in response to the State Comptroller’s proposals on these companies to report on plans to reduce their total carbon footprint. More could follow as the State Comptroller announced in December 2020 the plan for the New York State Common Retirement Fund to transition its portfolio to net-zero GHG emissions by 2040.

2. Increased Shareholder Support

The submitted environmental proposals that did go to a vote received greater shareholder support (an average of 41% of votes cast compared to 32% in 2020). Excluding the six anti-ESP environmental proposals that reached a vote, which continued to receive low votes, [8] average shareholder support for environmental proposals was even higher this year (around 53% overall and 55% for climate-related proposals compared to 32% and 36%, respectively, in 2020).

A record 12 environmental proposals passed this year (up from five in 2020). Eleven of the 12 passing proposals were climate-related, [9] and each received between 57% and 98% shareholder support. Of these, five requested transparent disclosure of climate-related lobbying efforts, [10] two requested increased reporting on contributions to or measures addressing climate change, [11] and four (three of which were oil and gas companies) requested adopting GHG emissions targets. [12] Ten additional environmental-related shareholder proposals received between 30% and 50% shareholder support.

3. ISS Support

Overall, ISS supported 64% of environmental proposals this year (on par with 65% support in 2020). In addition to recommending against the anti-ESP proposals discussed above, ISS recommended against six other environmental proposals this year, contributing to substantially different results: excluding the six anti-ESP proposals, proposals without ISS support received only 15% of votes cast compared with an average 55% support when ISS recommended in favor of the proposal. Compared to the 2020 proxy season, shareholder support for environmental proposals has increased both with and without ISS support, from 42% with ISS support and 12% without (again excluding anti-ESP proposals) in 2020.

4. Standardized Reporting

Standardized reporting on environmental metrics continues to be endorsed by ISS and investors such as BlackRock, Vanguard and State Street. [13] Over the last year, it has also been featured on the U.S. federal and state legislative agenda: [14]

- President Biden. On May 20, 2021, President Biden released an executive order requiring (i) the Secretary of the Treasury, as the Chair of the Financial Stability Oversight Council (FSOC), to issue a report that addressed the “necessity of any actions to enhance climate-related disclosures by regulated entities to mitigate climate-related financial risk to the financial system or assets and a recommended implementation plan for taking those actions” and (ii) the Federal Acquisition Regulatory Council, in consultation with the Chair of the Council on Environmental Quality and the heads of other agencies as appropriate to consider amending the Federal Acquisition Regulation (FAR) to “require major Federal suppliers to publicly disclose greenhouse gas emissions and climate-related financial risk and to set science-based reduction targets.” [15]

- SEC. On March 4, 2021, the SEC announced an enforcement task force focused on climate and ESG issues in the Division of Enforcement intended to identify gaps or misstatements in ESG disclosure of both issuers and investment advisers and funds. [16] Ten days later, then-Acting Chair Allison Herren Lee announced the opening of public comment on potential climate-related disclosure regulations. [17] While no proposed rulemakings have yet been made public, Chair Gary Gensler made clear in testimony before the House Financial Services Committee in May that addressing ESG disclosures was a “top priority” for the SEC. According to the SEC’s rulemaking agenda released on June 11, new proposed rules regarding climate-related disclosures (as well as related to human capital management and corporate board diversity) should be expected by October of this year. [18]

- Congressional Efforts. Bills have been introduced in both houses of Congress that would require certain ESG disclosure. The Climate Risk Disclosure Act of 2021 (introduced by Senator Elizabeth Warren and Representative Sean Casten) would require (1) public companies to disclose risks based on different climate-change scenarios, explain strategies and corporate governance processes in place to manage those risks, and analyze the social cost associated with their greenhouse gas emissions and (2) SEC rulemakings to implement the climate disclosure requirements. [19] The ESG Disclosure Simplification Act of 2021 (introduced by Representatives Juan Vargas and Jesus “Chuy” Garcia) would require disclosure of a description of the company’s views on the link between ESG metrics and long-term business performance annually in their proxy statements and would establish the Sustainable Finance Advisory Committee that would recommend policies to the SEC to facilitate the flow of capital towards environmentally sustainable investments. Both bills have passed in the house, but have not yet been considered by the Senate. [20]

- State Efforts. The Climate Corporate Accountability Act, a bill introduced in the California state senate, would require reporting by companies with annual revenues in excess of $1 million that do business in California of scope 1, 2 and 3 GHG emissions beginning in 2024 and require compilation of a summary report.

Perhaps related to the uncertain outcome of these legislative efforts, most environmental proposals focused more generally on companies’ commitment to adopting sustainability disclosure and policies rather than demanding a specific reporting framework. Only one 2021 shareholder proposal requested standardized disclosure based on SASB framework and none requested standardized disclosure based on the TCFD framework. [21] The one SASB-linked proposal (at Pilgrim’s Pride, focusing on water pollution) received only 11% shareholder support. This represents a departure from 2020, when SASB-linked proposals received between 61% and 79% shareholder support (other than a water pollution-related proposal at Sanderson Farms that received 11% of votes cast). Pilgrim’s Pride has not committed to producing SASB-aligned disclosures, which Sanderson Farms did last year despite the low vote on its proposal.

Companies should continue to track developments in this space and be prepared for the possibility of disclosure regimes reflecting the rigorous regulation now being considered in the European Union. As with all disclosure, however, companies must remain cognizant of the risks presented by ESG disclosure that could give rise to a claim of material misstatement and result in liability under federal securities law. While plaintiffs were dealt a recent defeat in Ocegueda v. Zuckerberg (one of the several derivative suits filed last year alleging violations of federal securities laws and breaches of directors’ fiduciary duties due to failure to live up to disclosed diversity and inclusion commitments), a recently filed case against Coca Cola (alleging the company’s disclosures with respect to plastic pollution constitute material misstatements) confirms that ESG disclosures are not immune to scrutiny from the plaintiffs’ bar. [22] The SEC is considering the extent to which forward-looking statements and commitments regarding climate change and sustainability should be, or can be, protected under the Private Securities Litigation Reform Act of 1995 (PSLRA). [23]

5. Say-on-Climate

This year, there were six proposals that requested companies to adopt an annual shareholder vote on climate transition plans. Three of these so-called “Say-on-Climate” proposals went to a vote at Union Pacific, Booking Holdings and Monster Beverage Corporation, where they received 32%, 37% and 7% support, respectively. [24] Among the companies that have already adopted the Say-on-Climate scheme, Moody’s and S&P Global received overwhelming support for their climate transition plans (99% and over 99%, respectively).

Although the size of this subcategory remained low in 2021, institutional investors’ attitudes on Say-on-Climate may dictate whether annual advisory shareholder votes on climate-related issues become the norm. Vanguard, for instance, currently evaluates these proposals by observing whether climate change is a material risk for the company and considers a number of factors, including (i) the reasonableness of the request, (ii) whether the proposal addresses a gap in disclosure and (iii) the proposal’s alignment with industry standards. [25] While not in the context of a shareholder proposal, investors (including institutional investors such as California Public Employees Retirement System (CalPERS)) sent a strong signal about the relative importance of climate-related matters this year when they supported new activist Engine No. 1 in successfully unseating three Exxon directors in a short-slate proxy contest. This campaign will be addressed in greater detail in our annual review of shareholder activism.

Endnotes

1While the majority of these proposals were climate-related, As You Sow also submitted 10 proposals related to plastic pollution and withdrew six such proposals following negotiated agreements with Eastman Chemical, PepsiCo, McDonald’s, Mondelez, Target and WalMart and one without reporting a settlement at Kraft Heinz. The three plastics-related proposals that went to a vote received 36%, 45% and 81% support at Amazon, Kroger and DuPont, respectively.(go back)

2Current Resolutions, As You Sow, available at https://www.asyousow.org/resolutions-tracker. Supplemented by ISS data and independent research.(go back)

3These included Bank of America, Citigroup, Goldman Sachs, Wells Fargo and J.P. Morgan Chase. These institutions announced commitments to achieving net-zero greenhouse gas emissions from its financing activities by 2050, meeting As You Sow’s proposal to issue a report “outlining if and how it intends to reduce the GHG emissions associated with its financing activities” to reach net-zero emissions. These institutions’ commitments vary on measuring and disclosing the financed emissions through the Partnership for Carbon Accounting Financials (PCAF) and disclosing interim targets.(go back)

4Including two proposals to report on impacts of plastic packaging at Amazon (36% support) and Kroger (45%), four proposals relating to the 2050 Net Zero GHG emission target and Say-on-Climate at Chevron (48% support), Exxon Mobil (49%), Booking Holdings (57%) and Caterpillar (48%), and one at Sempra Energy to report on climate-related corporate lobbying (38% support).(go back)

5These included a proposal on General Electric to disclose its plan to meet Net Zero GHG emissions by 2050, which was supported by the board and received a 98% shareholder support, and a proposal at DuPont de Nemours to report the environmental impact of its plastic released into the environment, which received 81% shareholder support despite the board’s recommendation against it.(go back)

6A proposal on Monster Beverage Corporation to add a Say-on-Climate vote received 7% support.(go back)

7DiNapoli: State Pension Fund Calls on Companies to Address Climate Risk, Transition to Cleaner Operations, Office of the New York State Comptroller, available at https://www.osc.state.ny.us/press/releases/2021/03/dinapoli-state-pension-fund-calls-companies-address-climate-risk-transition-cleaner-operations.(go back)

8All six anti-ESP proposals were submitted by Steven Milloy, one of the leaders of Burn More Coal, who requested that Alliant Energy, CMS Energy, DTE Energy, Exxon Mobil, PNM Resources and Xcel Energy report on the costs and benefits of taking voluntary environmental actions. These proposals received between 1.6% and 5.2% of votes cast (with the greatest support at Exxon where ISS recommended not voting on the proposal).(go back)

9The other passing proposal was the plastic-related proposals at DuPont discussed above.(go back)

10These included proposals at Phillips 66 (63% support), Exxon Mobil (64% support), Norfolk Southern (76% support), Delta Air Lines (63%) and United Airlines (65% support). These proposals generally requested companies to evaluate and report how their lobbying activities affected the prospect of achieving certain climate-related or GHG emission targets.(go back)

11These included proposals at Bloomin’ Brands (76% support) and Bookings Holdings (57% support).(go back)

12These included proposals at ConocoPhillips (59% support), Phillips 66 (80% support), Chevron (61% support) and General Electric (98% support). The General Electric board supported the proposal, rather than settling with As You Sow Foundation, using the proxy statement and shareholder vote as an opportunity to highlight General Electric’s commitment to, and efforts regarding, climate.(go back)

132021 Climate Proxy Voting Guidelines, ISS, available at https://www.issgovernance.com/file/policy/active/specialty/Climate-US-Voting-Guidelines.pdf (recommending voting for shareholder proposals asking companies to report in accordance with the Global Reporting Initiative (GRI)); Our 2021 Stewardship Expectations, BlackRock, available at https://www.blackrock.com/corporate/literature/publication/our-2021-stewardship-expectations.pdf (asking companies to “demonstrate they were adequately managing climate and other sustainability-related risks by reporting in line with the Task Force on Climate-related Financial Disclosures (TCFD) framework and metrics provided in the Sustainability Accounting Standards Board (SASB) standards.”); 2021 Proxy Voting Summary, Vanguard, available at https://about.vanguard.com/investment-stewardship/portfolio-company-resources/2021_proxy_voting_summary.pdf (likely supporting proposals that “address a shortcoming in the company’s current disclosure relative to market norms or widely accepted frameworks” like SASB and TCFD); Asset Stewardship Report 2020, State Street Global Advisors, available at https://www.ssga.com/library-content/pdfs/asset-stewardship/asset-stewardship-report-2020.pdf (evaluating companies based on ESG scores generated by leveraging the SASB transparent materiality framework.).(go back)

14Despite the increased focus on legislation and regulation to implement standardized ESG disclosures, the United States is a relative laggard compared to the European ESG reporting regime. The European Union Non-Financial Reporting Directive (EU Directive 2014/95/EU) currently requires companies to report based on a so-called “double materiality” standard requiring disclosure of both how sustainability issues affect a company’s business and how the company’s business affects people and the environment (as opposed to the “single materiality” or “financial materiality” standard that is the hallmark of the principles-based U.S. ESG disclosure regime). The Corporate Sustainability Reporting Directive, a proposed amendment to the current NFRD, would expand current ESG disclosure requirements (related to environmental, social, human capital, human rights, anti-corruption and board diversity matters) to “large” companies that meet two of three metrics (over 250 employees, over €40 million revenue and over €20 million assets) and would apply to U.S. companies operating in Europe. See our memorandum of April 30, 2020, available at Sustainable Finance Update. For more information regarding KPIs, see our publication, dated March 19 2021, entitled “EU Mandatory Reporting on Sustainability KPIs under EU Taxonomy–Update.”(go back)

15Executive Order 14030, 86 Fed. Reg. 27,968 (May 25, 2021), available at https://www.govinfo.gov/content/pkg/FR-2021-05-25/pdf/2021-11168.pdf.(go back)

16SEC Announces Enforcement Task Force Focused on Climate and ESG Issues, SEC (March 4, 2021), available at https://www.sec.gov/news/press-release/2021-42.(go back)

17Allison Herren Lee, Public Input Welcomed on Climate Change Disclosures, SEC (March 15, 2021), available at https://www.sec.gov/news/public-statement/lee-climate-change-disclosures.(go back)

18Daniel F.C. Crowley & Karishma Shah Page, SEC to Move Quickly on Proposed ESG Disclosures, NAT. L. R. (May 13, 2021), available at https://www.natlawreview.com/article/sec-to-move-quickly-proposed-esg-disclosures. In April, Representative Patrick McHenry, Republican leader of the House Financial Services Committee, released a letter to then recently appointed SEC Chair Gensler cautioning against “mission creep” following former Acting Chair Lee’s climate-related initiatives and requesting (i) any ESG-related disclosure requirements be rooted in the SEC’s historical materiality-based approach and (ii) that no “rulemaking through new enforcement or examination standards” take place before new rules were established through the notice-and-comment rulemaking process. The letter to Chairman Gensler is available via https://republicans-financialservices.house.gov/uploadedfiles/2021-04-19_gensler_priorities_letter.pdf.(go back)

19H.R. 2570, 117th Congress (2021), available at https://www.congress.gov/117/bills/hr2570/BILLS-117hr2570rh.pdf.(go back)

20H.R. 1187, 117th Congress (2021), available at https://www.congress.gov/117/bills/hr1187/BILLS-117hr1187rh.pdf.(go back)

21For further discussion of certain leading standardized disclosure frameworks and related institutional investor policy, see our memorandum of June 8, 2021, available at The Rise of Standardized ESG Disclosure Frameworks in the United States; see also https://corpgov.law.harvard.edu/2021/05/17/which-corporate-esg-news-does-the-market-react-to/.(go back)

22See the Earth Island Institute v. The Coca-Cola Company, Case No. 2021CA001846B, complaint filed with the D.C. Superior Court on June 4, 2021 available at https://www.earthisland.org/images/uploads/suits/Earth.Island_.v_._Coca-Cola_.Complaint_.(stamped)_.pdf.(go back)

23See Public Input Welcomed on Climate Change Discussions, SEC (March 15, 2021), available at https://www.sec.gov/news/public-statement/lee-climate-change-disclosures (and comments received).(go back)

24The two other proposals were at Moody’s, which became the first S&P 500 company to adopt Say-on-Climate, and at Union Pacific, whose proposal was excluded through the SEC no-action process.(go back)

25How We Evaluate Say on Climate Proposals, Vanguard Investment Stewardship Insights, available at https://about.vanguard.com/investment-stewardship/perspectives-and-commentary/INSSAYC_052021.pdf.(go back)

Print

Print