Colin Mayer is Co-Chair of the Enacting Purpose Initiative (EPI) and Peter Moores Professor of Management Studies at University of Oxford Saïd Business School; Amelia Miazad is North American Chair of EPI and Founding Director and Senior Research Fellow of the Business in Society Institute at the University of California at Berkeley School of Law; and Rupert Younger is Chair of EPI and Director of the Oxford University Centre for Corporate Reputation at University of Oxford Saïd Business School. This post is based on their EPI report.

Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

Introduction

There is a growing consensus in the global business and investment community that sustainable and inclusive capitalism is vital to society, the environment, and the economy. This paradigm shift is propelling corporate purpose to the top of the agenda for directors and investors.

The first report from the Enacting Purpose Initiative, Enacting Purpose Within the Modern Corporation, A Framework for Boards of Directors, was published in August 2020. This report builds upon that foundation by setting out how directors can work with their investors to leverage corporate purpose to address societal issues and sustain long-term value creation.

This report’s recommendations were informed by extensive dialogue with over 35 board members in the Director Steering Group and over 30 global investors and asset owners and managers in the Investor Steering Group. We remain encouraged by the common ground between investors and directors regarding the value of corporate purpose. This report lays out that common ground in order to produce actionable insights for directors seeking to deepen their collaboration with investors on corporate purpose.

The Common Ground: Taking Ownership Of Corporate Purpose

Directors should take a more active role in ensuring that the company’s purpose aligns with its strategy and values. Doing so will require them to “take ownership” of their role in corporate purpose and explicitly communicate to management and investors that corporate purpose is a priority for the board. One way that boards could do this is by incorporating purpose into the charters of several board committees.

To leverage the full power of corporate purpose, directors should first embrace their unique role relative to that of CEOs. Members of the Investor Steering Group emphasized that directors should take a more active role in driving corporate purpose, and that many directors delegated that role to the CEO or executive management too often. Some directors, on the other hand, felt strongly that management, not the board, must own purpose. Given this tension, our discussions with investors and directors sought to find common ground by clarifying the role that an independent director, as opposed to the CEO or management, ought to play in advancing corporate purpose.

While some directors disagreed with the use of the word “own,” investors maintained that it connotes the sort of active board oversight that they expect from directors.

As we emphasized in our first report, responsibility for corporate purpose must be distributed throughout the organization. At the same time, it is imperative that directors take ownership of corporate purpose. That is because purpose must transcend CEO and management tenures, becoming a part of the board’s fiduciary duties to actively oversee business strategy as well as legal and business risk.

By using the word “own,” we are not suggesting that directors must always be responsible for defining the organization’s purpose. We acknowledge that the process by which each company defines, or redefines, its purpose varies greatly. At many companies, the purpose may already have been articulated by a founding CEO or rearticulated by their visionary successor. At other companies, the board and executives might cocreate the company’s purpose with input from management, employees, and even external stakeholders. Regardless of how the company articulates its purpose, the board is ultimately responsible for continually assessing whether the company’s purpose is

aligned with its strategy and values.

Many investors we spoke with also reiterated that they expect directors to do more than ensure compliance with legal mandates. We therefore put forward a triangle of responsibilities for the board intended to ensure the alignment of purpose, specific strategy choices, and embedded values (see right figure).

Purpose in Practice: Taking Ownership of Corporate Purpose

The board has to own corporate purpose because management comes and goes. While management often takes the lead because they are closest to the heartbeat of the company, ultimately the board has to own it.

—Clarence Otis

Lead Director, Verizon Board of Directors

We know the pressures on management. The board’s role is to take a much longer-term view so that the executives do not get lost in the challenges of today. The board must ensure that there is a clear understanding of why the company exists and that corporate

purpose remains the North Star.

—Deirdre Mahlan

Audit Committee Chair, Experian PLC

In my opinion, co-creation of corporate purpose between the board and management is the most powerful way to get a well-aligned purpose. One way to do this is to devote one day for the board and management to discuss their distinct roles in advancing corporate purpose…

—Zein Abdalla

Director, Cognizant

Boards should embrace the company’s purpose and ensure its continuity as management teams and leaders change. Over decades, Boards have the opportunity to help evolve purpose as circumstances change.

—Jim Loree

CEO, Stanley Black & Decker

Being Properly Informed About Corporate Purpose

Boards should ensure that they are informed about the impact of the company’s operations on stakeholders. That starts with ensuring that there is a diversity of backgrounds represented on the board. Boards should also construct their agendas to allow for time to be spent on the alignment of purpose, strategy, and values. Finally, boards should ensure that they are getting information from a diversity of perspectives. They can do so by asking management questions about how it is embedding purpose into its key strategic decisions as well as by periodically meeting directly with middle management and external stakeholders.

Many investors felt that directors are often not sufficiently informed about how the company is operationalizing its purpose. Directors also emphasized that crisis management and short-term pressures often prevent directors from staying informed about corporate purpose. The information asymmetry between senior executives and directors is a longstanding corporate governance problem. Given that management is responsible for implementing the corporate strategy on a day-to-day basis, it will always have an informational advantage over the board. We agree that the board should not be mired in the minutiae. Rather, the board needs to ensure that the company has a robust process in place for eliciting information from internal and external stakeholders so that it can consider whether the company is using purpose as its guiding star and guardrails. Our discussions uncovered three methods for enhancing the information flow to the board: 1. increasing board diversity; 2. creating time on the board’s agenda to discuss purpose; and 3. communicating with internal and external stakeholders.

Method 1. Increase Board Diversity

There are many reasons why investors and other stakeholders have made board diversity a key priority, including ones that are fundamentally grounded in equality. One theme that emerged from our discussions with investors and directors is how diversity helps the board advance corporate purpose by improving its decision-making process. Our discussions repeatedly emphasized that a lack of board diversity often leads to ‘groupthink’ and impedes the boards’ ability to elicit and consider information from a wide range of stakeholders. A growing body of academic research supports the link between board diversity (or the board’s broader commitment to diversity) and sound risk oversight.19 Diverse board members are more inclined to elicit and consider information that reflects the concerns and expectations of a diversifying workforce as well as consumers, investors, and other stakeholders.

Board diversity is even more important at a moment when racial justice is central to the global public debate. A diverse board is more likely to elicit information regarding how the company’s operations will advance or impede racial justice.

Purpose in Practice: Increasing Board Diversity

Board diversity in all regards is critical to ensure our purpose is thoroughly considered from the perspective of all stakeholders.

—Christine Detrick

Director, RGA

Board diversity is a governance issue; the more a board reflects its community, customers, and stakeholders, the better for the company’s governance.

—Rose Marcario

Former CEO, Patagonia

Method 2. Make Time on the Board’s Agenda

Even for purpose-driven companies, many directors felt that short-term pressures had a tendency to eclipse board discussions about corporate purpose. To address this pitfall, directors identified practical steps they can take. Some companies designate a significant amount of time to discuss corporate purpose at board offsites. Others begin each board meeting with their company’s purpose. While it may seem trivial, this technique helps to ensure that purpose continues to operate both as a guiding star and as a set of guardrails against the board’s decisions.

Investors would like to see more active integration of purpose into board discussions. They noted that boards often become overwhelmed, both with the amount of information they have to process with dominating risk and regulatory compliance issues. They ask that boards devote a much larger part of the agenda to “steering” as opposed to “compliance,” particularly over a longer-term horizon.

Purpose in Practice: Making Time on the Board’s Agenda for Corporate Purpose

Some companies start every meeting with their Statement of Purpose to remind the board of why the company exists.

—Christine Detrick

Director, RGA

Boards, just like shareholders, can really guide this. If the board doesn’t want to talk about purpose, that’s how the company is going to be guided. Giving directors not only license but a mandate to make purpose part of the discussion is critical. Adding specific time on the board’s agenda and creating accountabilities for purpose are important components.

—Bill Rogers

President & COO, Truist Financial Corporation

Our board carves out time annually at an offsite to do a much deeper dive into the core of the business, which includes a focus on corporate purpose.

—Joe Rigby

Director, Dominion Energy

On one board that I serve on, we have leveraged our annual board survey to be more thoughtful about corporate purpose. We ask someone from the senior management team, such as the General Counsel or head of HR, to develop ten or more questions for the board to reflect upon. We then set up a board meeting during which we discuss and debate those questions.

—Dr. David Schenkein

Board Chair, Agios Pharmaceuticals

Method 3. Communicate with Stakeholders and Middle Management

As we noted above, boards must ensure that management has a robust process in place for gathering information from internal and external stakeholders as well as considering how that information is aligned with corporate purpose. In order to do so, directors should not rely exclusively on the CEO or executive management for their information. Rather, directors should pressure test the company’s information-gathering processes by periodically meeting directly with key stakeholders and middle management.

Some directors we spoke with specifically asked for presentations from middle management at board meetings, for example. Others stressed the benefits of visiting key locations for business operations, such as factories or stores. The specific methods will vary by company and industry, but the important thing is that directors are not exclusively relying on the CEO or executive management for their information. Even when the source of the information is the CEO or executive management, the board can clearly articulate that it wants management to provide information relating to corporate purpose. Seeing as management’s priorities are often dictated by what the board deems important, boards should not underestimate the value of inquiring about corporate purpose.

Purpose in Practice: Communicate with Stakeholders and Middle Management

Asking some of the unthinkable questions that are critically important is the responsibility of the board.

—Robert Malcolm

Board Director, The Hershey Company

[Boards] have to enact a consequence when the purpose isn’t being followed… the role of boards with purpose is to prod and gather information to adequately exercise their oversight function.

—Joe Rigby

Director, Dominion Energy

Connecting Corporate Purpose to Board Decision-Making

Boards are doing good work reporting on how purpose-led strategies deliver valuable societal outcomes through sustainability and ESG reports. Investors, however, would like to see more evidence of how purpose-led activities deliver shareholder value alongside societal value, and how this is rewarded. For example, more board discussion on how decision-making is driven by corporate purpose, including instances of where decisions have or have not been made as a result of such linkages and how managerial incentives are tied to these decisions. They also would like to see more standardization in how purposeful business translates into greater market capitalization, ideally with common methodologies being adopted across peer group organizations when it comes to capital allocation policies and returns targets.

In order to cultivate the power of purpose, boards must embed corporate purpose into key decisions. This can be accomplished by incorporating purpose into their strategies for executive compensation and capital allocation.

Method 1. Link Executive Compensation to Corporate Purpose Metrics

Incentives matter. They drive individual behavior at all levels of every organization. Investors stressed that boards of directors have the responsibility to set and maintain the right incentive structures for executives.

As we have pointed out in the Enacting Purpose Initiative’s other reports, “[t]raditional methods of corporate performance measurement fail to account for the emerging phenomenon of purpose-based belief systems and managerial practices.” [1] These traditional methods instead measure assets and costs that the company has “ownership” of, such as physical production plants. Rather than viewing investments in social or environmental projects as assets (recognizing that these enhance a company’s brand and hence create value), traditional accounting deems them expenditures. The same is true for investments in the workforce.

Our first report detailed that, for the majority of management, financial metrics are most relevant to compensation and promotion. To effectively enact corporate purpose, however, the relevant metrics should reflect the organization’s success in delivering on its purpose. Thus, these financial metrics should be combined with others that account for the organization’s success in delivering benefits to stakeholders beyond its shareholders. Boards must treat these purpose-aligned metrics with the same importance as sales or returns metrics. Boards should also identify and publish the key metrics they use to inform their decisions. The specific metrics will depend upon industry. Internally, explicit purpose metrics should be at the forefront of executive appraisal and performance reviews. Recruitment should also ensure that new talent commits to corporate vision and purpose before any offer is formally made.

Both directors and investors see an urgent need to actively link incentives to wider, purpose-led goals.

As long as managerial incentives are tied to financial rather than purpose-aligned outcomes, it will be hard to see real progress in embedding purpose within business strategies.

Investors also tend to discredit an organization’s stated purpose that purportedly values stakeholders if its compensation strategy solely rewards financial goals and is tethered to short-term measures like quarterly earnings. For this reason, corporate boards of purpose-driven companies are increasingly aligning executive and board compensation with environmental metrics, such as carbon reduction goals, and social targets, such as diversity or workplace safety. [2]

Purpose In Practice: Linking Executive Compensation to Corporate Purpose Metrics

United Health Group’s short-term incentive plan aligns executive behavior with the interests of stakeholders by rewarding behavior that improves customer feedback measured by improved net promoter scores and employee engagement survey data. In its proxy statement, the company emphasizes that the teamwork metric “fosters company growth and performance, optimizes the use of enterprise-wide capabilities, drives efficiencies, and integrates products and services for the benefit of its customers and other stakeholders.” [3]

Diversity Targets

Set to be implemented through a five-year plan, Nike announced that it will be tying its executive compensation to diversity targets.

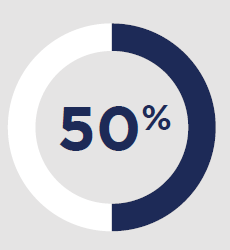

By 2025, the company aims to achieve 50% representation of women in its global corporate workforce…

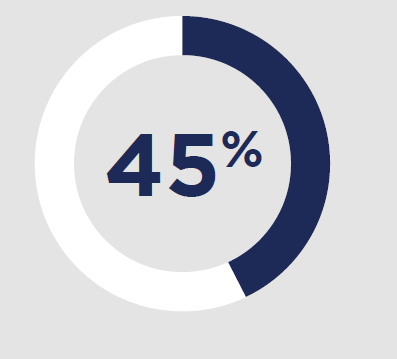

and 45% representation of women in leadership positions—VP level and above.

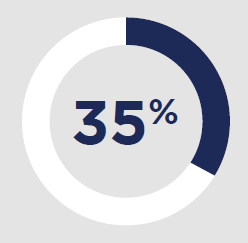

It’s also targeting 35% representation of racial and ethnic minorities in its U.S. workforce by then. [4]

Nike’s transparency in reporting its metric percentages is notable. Other corporations set to begin linking executive compensation to DEI goals include Starbucks, Wells Fargo, and Uber. [5]

One of the most important elements of the SCORE framework that boards must take accountability for is the reward mechanism…make sure the investors understand why that reward mechanism is in place because it is about sustainable long-term value creation for them.

—Zein Abdalla

Director, Cognizant

When I write the introduction letter for the Compensation Report, I always start with purpose and strategy and their link to incentives and compensation. That’s what stakeholders are after, a clear articulation of how the board is translating purpose and strategy into a compensation framework.

—Bruce Brown

Board Member, Nokia and Glatfelter

We have made purpose-driven metrics a component of the score card for our CEO as well as the top executives. The score card includes: Human capital, retention, growth, how we are interacting with our partners, including other measures.

—Vicki Escarra

Director, Docusign, Inc

A big part of this is to change the definition of success within the company. If the only celebration is the financial achievements, that is a red flag.

—John Bryant

Retired Chairman and CEO, Kellogg Company

Method 2. Align Capital Allocation with Corporate Purpose

The International Corporate Governance Network (“ICGN”) recently defined capital allocation as:

“[t]he process of distributing an organization’s financial resources with a purpose of enhancing the firm’s long-term financial stability and value creation—while providing fair returns to providers of risk capital and showing proper regard to the needs of employees, customers, suppliers, and other stakeholders.”

When an organization’s capital allocation is inconsistent with its corporate purpose, it is a red flag for investors that the board does not take purpose seriously. The COVID-19 pandemic has exposed the fragility of many companies and sectors, concentrating investors’ focus on capital allocation decisions like share buybacks, dividends, leverage, and executive compensation. Investors are also paying attention to how companies address their responsibilities to protect workers’ health and safety during the pandemic, particularly in regard to paid sick leave, health and pension benefits, and training.

Purpose In Practice: Aligning Capital Allocation with Corporate Purpose

When boards talk to us about purpose, what we always look for as investors is some sort of quantitative data to help us evaluate those statements. And I feel that’s often left out of the discussion.

—Rob Wilson

Investment Officer and Research Analyst, MFS Investment Management

In our case, the board discussed how our purpose ‘to save our home planet’ aligned with the capital allocations decisions we were making. If we were investing in new building infrastructure, for example, it had to have the lowest possible environmental impact, which in some cases meant our costs were higher.

—Rose Marcario

Former CEO, Patagonia

3M provides a good example of a capital allocation policy that is aligned with corporate purpose. The Policy:

- commits to sustained reinvestment in organic growth, most notably by allocating 5% and 6% of sales to CAPEX and R&D respectively;

- reports 100+ years of paid dividends without interruption, expected to grow in line with earnings over time; and

- maintains a minimum threshold for repurchases, based on relative value and influenced by other demands on capital.

Governing Purpose

There is strong common ground on the need to distinguish between purpose and ESG measures and between purpose and stakeholder engagement. Clarity on these elements will create positive alignment and unlock benefits for investors and companies.

Method 1. Distinguish Purpose from ESG

While purpose articulates why an organization exists, ESG represents that organization’s environmental, social, and governance measures against which it is assessed by external parties.

First, ESG activities deserve sustained focus and interrogation to the extent that they explicitly address critical societal themes, like environmental degradation and employee treatment. Second, questions relating to ESG commitments have become the dominant focus of investor engagement, making them top of mind for boards and senior executive teams.

Boards and senior management need to align purpose with ESG criteria because they are the basis on which the firm is externally evaluated. Thus, purpose serves as a board’s strategic guiding star, while its ESG requirements are one of the ways in which its performance will be assessed.

While it is true that purpose-driven companies must account for the impacts of their business on stakeholders, that process is conceptually distinct from corporate purpose.

Method 2. Distinguish Purpose from Stakeholder Governance and Dialogue

As noted above, purpose-driven companies must account for the impacts of their business on stakeholders. To ensure their long-term sustainability and maintain their social license to operate, companies cannot limit considerations to shareholder benefit. Even shareholders agree that companies must build trust with their employees, customers, suppliers, local communities, NGOs, and regulators that their survival depends on. By doing so, they enhance shareholder value.

To that end, companies must be responsive to the needs of internal and external stakeholders. Stakeholder governance, also referred to as stakeholder dialogue, is the process by which companies incorporate stakeholder input into their strategy and decision-making. Although stakeholder governance is foundational to delivering on corporate purpose, it is conceptually distinct in that corporate purpose seeks to articulate the reasons why a corporation exists in the first place.

Purpose in Practice: Distinguishing Purpose from Stakeholder Governance and Dialogue

Patagonia clearly sets forth why it exists by stating that “We are in business to save our home planet.”

To deliver on that purpose, Patagonia has established a robust stakeholder governance process in which it actively solicits stakeholder feedback through an ongoing dialogue with employees, NGOs, local communities, suppliers, and policymakers.

[To engage employees,] the process we used at Patagonia was a detailed survey performed each year by a third party to ensure consistency and arms length from senior management…The survey ranked management on how they were performing in all areas related to the company’s stated values, not related to financial metrics. This annual scoring was used as a tool by the board to set direction for the management team to address the concerns of the organization when it came to company values and how they were being executed by the leadership team.…

The board at Patagonia was comprised of members who understood the environmental movement and were well versed in the nuances of these topics… With respect to carbon, we used the Scope 1-3 framework to guide actions on our footprint and other tools such as the UN Sustainability Goals and the Planetary Boundaries. The executives also held a Footprint Council meeting monthly that addressed supply chain issues, which included social and environmental goals across the company; this team provided updates and brought key decisions to the board.…

The best thing an individual consumer can do to curb their personal environmental footprint is to keep the products they own in use longer. When we sold a product to a customer, because of our purpose, our relationship did not end at the completion of the sale. While the cost of repairing products could be considered prohibitive in a strict financial analysis and some of our product teams felt the secondary market would compete with new products, we were guided by our values to find a responsible solution to repairing and reselling our product. What first began as a repair department became a resale business, as well, to offset the cost of repair and turn a profit.

—Rose Marcario

Former CEO, Patagonia

Method 3. Recognize the Need for Different Governance at Different Stages of the Corporate Purpose Journey

There are stages to a corporation’s ‘journey’ when it comes to purpose. Some organizations have been working on articulating and aligning purpose-led business models for many years, others are at a much earlier stage in this process, and some might even be just starting out. Investors and boards agree that these differences should be recognized, and that they might require different approaches to governance and a different set of expectations around what can be achieved within different timeframes. Working collaboratively, investors and boards can share emerging best practices, providing explicit guidance for early stage, mid stage, and late stage purpose companies. In crafting these guidelines, questions to consider relate to stakeholder prioritization, evolving metrics, and internal ownership and governance options, such as purpose oversight committees.

Method 4. Adopt the SCORE Framework

A consistent theme of our discussions with directors and investors was their shared appreciation for the intrinsic value of corporate purpose. Both directors and investors repeatedly noted that purpose-driven companies are more resilient and better able to deliver long-term value to stakeholders, including shareholders. While the “how” is not yet clearly defined, the “why” is not disputed.

Harnessing the power of purpose starts with the board. Our first report set forth a governance framework, the SCORE framework, which included five elements for how directors can embed corporate purpose into board governance:

- SIMPLIFY Articulations of corporate purpose must be sufficiently simple, precise, and persuasive for all stakeholders—including the entire workforce and wider supply chain—to understand.

- CONNECT Corporate purpose initiatives must drive strategy and capital allocation decisions at the board level in order to affect substantive change.

- OWN Boards should establish appropriate structures, control systems, and processes for enacting corporate purpose initiatives.

- REWARD Boards should define performance metrics that evaluate how the organization delivers on its purpose and align incentives and awards by promoting purposeful behavior.

- EXEMPLIFY It is incumbent upon boards and executives to bring corporate purpose to life through vivid communication and narrative strategies to foster a sense of shared identity.

The SCORE framework has been well received by investors and boards as well as by regulators and other stakeholders. Therefore, we reiterate that advocating again for its adoption by boards as a simple governance framework. As this becomes more widely adopted, investors will be able to assess organizations across peer group sectors and more widely.

Communicating With Investors

There is common ground that directors should increase both the volume and quality of communication with investors on corporate purpose. Various recommendations emerge from the EPI discussions, including the option of publishing a ‘Statement of Purpose’ signed off by the board that reflects both purpose intent and how it is governed and a more proactive approach to investor communication and interaction.

Our interviews identified a rich stream of insights into how directors can more effectively communicate with investors on corporate purpose. For one thing, investors want to hear directly from directors on how the board is incorporating corporate purpose into its decision-making processes. Directors are also keen to engage more directly with investors through discussions more explicitly related to corporate purpose.

In North America, most large, publicly listed companies specify in their corporate governance guidelines that one of the duties of the independent chair, or lead independent director, is to communicate with major investors. However, the robustness and proactivity of how this duty is executed varies greatly. In order to meet investors’ desire for more robust engagement with directors about business purpose, investors had several recommendations, which we detail below.

Method 1. Publish a Statement of Purpose

Our interviews with directors and investors revealed that many directors conflate disclosure on specific ESG or sustainability goals—such as carbon reduction or diversity— with disclosure of how the board actively oversees and validates corporate purpose. The two must remain conceptually distinct. Sustainability or ESG disclosure undoubtedly provides investors with material information, and the board should ensure that the organization’s ESG disclosure is accurate and robust. But what investors seek from directors for corporate purpose disclosure is assurance that:

- the board understands the organization’s purpose;

- the board has ensured that management has sufficient systems in place to advance that purpose;

- management and the board continually receive and consider stakeholder input when making decisions; and

- boards evaluate their firm performance against its purpose.

In this regard, the information that investors seek resembles a “Section 172 statement” in the U.K., which now requires boards to issue a statement describing how the board oversees the impact of its decisions on stakeholders. In the U.K., unlike in the U.S., Section 172 of the corporate code explicitly requires directors to consider:

- “The likely consequences of any decision in the long term,

- The interests of the organization’s employees,

- The need to foster the organization’s business relationships with suppliers, customers and others,

- The impact of the organization’s operations on the community and the environment,

- The desirability of the organization maintaining a reputation for high standards of business conduct, and

- The need to act fairly as between members of the organization.”

Despite Section 172’s enactment in 2006, U.K. companies are required, as of 2019, to disclose how the board of directors monitors the organization’s impact on stakeholders. While no corresponding legal mandate to issue such a statement exists in the U.S., the Section 172 requirements emulate the type of information that the investors we interviewed are seeking.

Drawing inspiration from and building upon the Section 172 statement—which does not explicitly refer to corporate purpose—one effective strategy for boards to better address investor expectations is publishing a concise Statement of Purpose. Each organization’s Statement of Purpose would be unique and provide details, in a narrative, about the organization’s purpose and how the board is ensuring that it is enacted.

The Statement of Purpose could address the following topics:

- The organization’s purpose;

- How the board measures the company’s resource allocation and performance against its purpose;

- How the board aligns its management oversight, including incentive structures, to advance the organization’s purpose;

- How the organization’s purpose acts as a guiding star and a guardrail to help the board make key strategic decisions;

- The organization’s key stakeholders, including its investors;

- The organization’s strategy for seeking regular input from key stakeholders;

- How the board receives information from stakeholders, either directly or through management or external advisors or intermediaries;

- The issues and factors that are most important to the organization’s stakeholders;

- How the board uses information from stakeholders to advance its purpose; and

- How the board has taken the impact on key stakeholders into account when making key decisions or weighing trade-offs.

While there is unanimous support for clarity of articulation, we recognize that there is also some disagreement over whether any Statement of Purpose should be issued as a separate statement or form part of the regular annual operating review. The important point that both directors and investors did agree on was the need for any such statement to be backed up by clear governance and actions/accountability.

Method 2. Create Engagement Opportunities for Board Members and Investors

Investors find meetings with directors extremely valuable to ascertain. In a more direct and nuanced way, investors value the board’s view of the company’s purpose, how clear it is, whether this view is aligned with how management implements it, and how the board is overseeing and measuring corporate purpose. While the board members we interviewed regularly met with investors, they are in the minority. Many investors expressed frustration that some companies still refuse to provide investors with the ability to meet with board members. At the risk of stating the obvious, investors who cannot meet with directors to discuss corporate purpose will infer that those directors are not engaged in or actively overseeing purpose.

We appreciate that companies need to manage the demands of investors for the opportunity to engage, and many now organize investor days to specifically address these issues. There is also a need to ensure that such discussions do not stray into material nonpublic information. Within these boundaries, however, there is room for expanding the dialogue beyond quarterly earning calls that typically focus only on the needs of analysts who inform trading decisions, rather than those of long-term shareholders.

As noted above, the topics outlined in the Statement of Purpose provide directors with a useful framework for engaging with investors on long-term and sustainable value creation. One particularly effective way for directors to demonstrate to investors that they are meaningfully engaged in corporate purpose is to describe how their engagement has helped the board navigate trade-offs with stakeholders over time as well as how it has made the organization more resilient during times of crisis.

The complete publication, including footnotes, is available here.

Endnotes

1Source: EPI, Measuring Purpose – An Integrated Framework, http://enactingpurpose.org/assets/measuring-purpose—an-integrated-framework.pdf(go back)

2https://hbr.org/2020/02/a-new-framework-for-executive-compensation(go back)

3United Health Group’s Proxy Statement: https://www.sec.gov/Archives/edgar/data/731766/000104746919002425/a2238439zdef14a.htm(go back)

4See: https://www.hrdive.com/news/compensation-dei-goals-diversity-execs-accountable-mercer/586238(go back)

5See: https://www.hrdive.com/news/wells-fargo-diversity-executive-pay-incentives-performance-management/580110(go back)

Print

Print