David Larcker is Professor of Accounting at Stanford Graduate School of Business; Brian Tayan is a researcher with the Corporate Governance Research Initiative at Stanford Graduate School of Business; and Edward Watts is Assistant Professor of Accounting at Yale School of Management. This post is based on their recent paper.

We recently published a paper on SSRN, Stock-Option Financing in Pre-IPO Companies, that examines a new industry in which specialty-finance companies provide capital to employees and executives to facilitate the exercise of stock options in pre-IPO companies.

Equity awards and stock-option grants are a central element of compensation programs in pre-IPO companies. According to the National Association of Stock Plan Professionals (NASPP), approximately three-quarters of private companies offer stock options as part of their compensation mix. In Silicon Valley, where many technology and healthcare startups are located, over 90 percent offer stock options. Stock options are not just awarded to the highest-level executives. Half of companies distribute stock options to over 80 percent of their employee base; a third distribute them to all employees.

Companies include stock options in the compensation mix for attraction, retention, and incentive purposes. Because of the leveraged nature of stock-option payouts, stock options attract highly skilled and risk-tolerant employees who are willing to sacrifice current salary for the potential of much larger future pay if the company is successful through their efforts. By paying a portion of the compensation in equity, companies in the early stage of development can reduce cash outlays. Stock options also serve as retention tools, by encouraging employees to remain with the company until granted awards are fully vested and full value realized upon completion of a liquidity event.

In recent years, start-up companies have remained private longer before completing an IPO—a trend which has complicated this arrangement. Whereas in the early 2000s, a typical company was 8 to 9 years old at IPO, today it is closer to 12. Companies are raising more rounds of capital from private sources, with the result that a larger portion of the growth in that equity is accruing to pre-IPO investors and employees rather than public investors.

For employees, high private-company valuations mean they have a lot more equity wealth than ever before. However, without a clear understanding of when the company might complete an IPO, employees also do not know when they can expect to receive liquidity for these shares. Their large and growing wealth is essentially “on paper”, making it difficult to finance basic standard-of-living improvements, such as the purchase of a home. This is the case for employees and executives at all levels of the company. Early employees of the company bear an additional burden. Because most stock-option plans grant stock with a 10-term before expiration, employees of a company that remains private longer than this term are required to exercise their shares while the company is still private or else forfeit its value.

While illiquid stock-option compensation can serve as a golden handcuff effectively locking employees to their employer until IPO, increased competition for executive and technical talent has flipped the script, pressuring companies to try to accommodate the financial needs of their employees in order to retain them. Financing options for stock options, however, are scarce. The exercise of deeply in-the-money options requires significant capital and triggers an income-tax bill that employees are generally not able to bear. Given the illiquidity of private-company options and the difficulty of accurately valuing them, traditional lenders are generally not willing to accept these instruments as collateral for a loan. While secondary markets exist for the outright purchase and sale of private-company shares, these exchanges cater to direct holders of the equity, not the holders of options. Secfi estimates that in 2020 startup employees passed up on $4.9 billion in tax savings by not exercising their options early.

In this post, we examine a new industry that has arisen in recent years to facilitate the financing of stock-option exercises for employees and executives of pre-IPO companies. These capital providers allow individuals to exercise and retain their stock-option awards, meaning the employee can continue to participate in any future appreciation of the shares while still receiving the money needed to exercise the award, pay taxes, and in some cases extract additional capital to finance personal expenditures. We consider the economic implications of this market from the perspectives of employees and employers, as well as the financial model of the capital providers that participate in this space.

Stock-Option Awards in Pre-IPO Companies

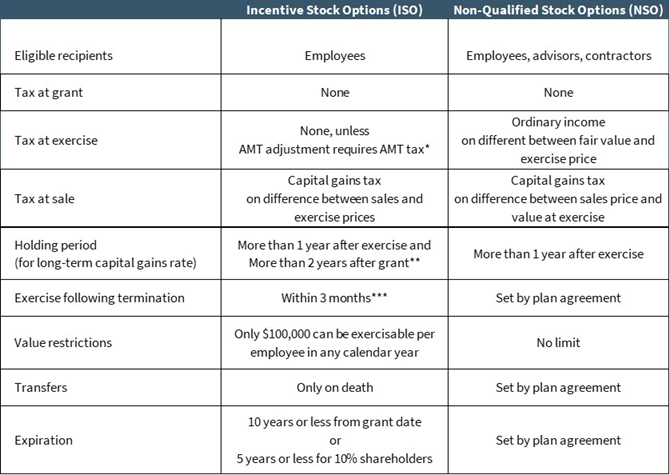

The economics and tax treatment of stock options is a complicated subject that many employees in private companies apparently do not fully understand. Two types of stock options exist: incentive stock-options (ISOs) and non-qualified stock options (NSOs). Of the two, incentive stock options have somewhat more favorable tax treatment. ISOs are not taxable to the employee at the time of grant and not taxable at the time of exercise unless their value triggers an alternative minimum tax (AMT) payment. When the shares are ultimately sold, the difference between the proceeds and the exercise price is treated as a capital gain or loss. ISOs are most valuable when granted at the early stages in the lifecycle of a private company when valuations are lowest. According to the NASPP, 60 percent of private companies (81 percent of private companies in Silicon Valley) grant ISOs.

NSOs are not taxable to the employee at the time of grant. At exercise, the difference between the exercise price and fair value of the NSO is treated as wage income, and both ordinary income tax rates and payroll taxes are due on the net proceeds. The value of the shares retained at exercise becomes the new cost basis. Any future appreciation (or depreciation) relative to this price is treated as a capital gain (or loss) at sale. (The above is a simplified summary of the tax treatment of stock options. For more details see Exhibit 1).

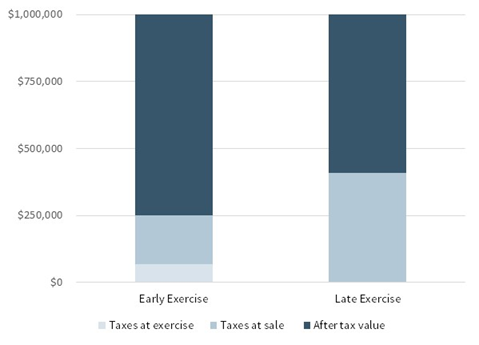

Because of the tax treatment of stock option exercises, it often makes economic sense for the employee of a private company to exercise options early in the company’s growth cycle. This is true because, under the current tax code, the marginal AMT and ordinary income rates are higher than marginal capital gains rates. An employee holding ISOs will benefit by paying AMT taxes on a smaller dollar amount, thereafter being subject to the lower capital gains on any subsequent appreciation in value. Similarly, an employee holding NSOs will pay ordinary income taxes on the net proceeds, before starting the clock on the lower capital-gains rate. Early exercise makes sense particularly prior to a funding round or IPO when valuations are expected to increase. In this situation, the employee will owe taxes based on the share price established by the previous round and enjoy an almost immediate step up in value (see Exhibit 2).

Because private-company shares are illiquid, however, employees wishing to exercise their options generally do not have access to the capital necessary to do so. The exercise event requires employees to pay the exercise price for their shares, as well as the associated taxes. While public-company employees can sell a portion of their shares in the public markets to finance these costs or execute a cashless exercise, private-company employees holding illiquid stock lack this alternative. For this reason, most private-company employees wait for a liquidity event (either IPO or sale of the company) to exercise their options, but at this point the tax advantages of early exercise have disappeared. Furthermore, employees wanting to depart from the company might feel unable to do so. The terms governing most stock-option plans generally require an employee leaving the company to exercise vested stock options within 90 days of departure, or else forfeit their value. Without the capital to fund this exercise, employees with significant in-the-money value find themselves locked into the company until a liquidity event occurs (which gives rise to the so called “golden handcuffs”). Golden handcuffs limit the ability of the employee to voluntarily change jobs because any new employer would need to make the employee whole on these forfeited equity claims. Furthermore, employees involuntarily terminated from their job suffer the same potential loss of equity rights; some employees might adopt a defensive posture at work to avoid being fired, harming performance.

Private-Company Stock-Option Financing

In recent years, specialty players have entered the market to provide financing to employees to facilitate the exercise of private-company stock options. Examples include ESO Fund, Liquid Stock, Quid, and Secfi. These providers are not traditional lenders but are backed by investors who want access to the equity of pre-IPO companies while at the same time receiving the capital protection of a collateralized financing. While these firms operate in different niches and offer differentiated solutions, their products share certain characteristics.

The main product is non-recourse financing. The provider advances the capital necessary for the employee to fund the exercise cost of the stock options and pay associated taxes. (These providers also lend against restricted shares.) In some cases, the employee will obtain additional liquidity to finance personal living expenses, such as the down payment on a house. The borrower’s shares serve as collateral for the agreement. Following exercise, the employee retains ownership of the shares in the company and therefore will enjoy any future appreciation in share price. When the company eventually experiences a liquidity event, the employee will sell a portion of their shares to repay the capital provider. If no liquidity event occurs or the value of the options are zero, the employee owes nothing to the financing firm because of the non-recourse nature of the transaction.

The structure of financing can take two forms: a loan or a private securities agreement. In either case, the financing is nonrecourse, meaning the capital provider can only take back the securities as repayment for the amount owed; it does not have recourse to seize other personal assets or pursue personal bankruptcy to force repayment.

Because the collateral for the agreement is the private-company stock, due diligence focuses on the quality of the company and probability and timing of a liquidity event; it does not focus on the credit quality of the individual holding the options. As such, once a decision has been made to advance capital to one employee at the company, generally all employees holding options in the company become potential customers. This includes everyone from the CEO and senior executive team all the way down to salaried workers.

Deal sizes can range from twenty-five thousand to tens of millions. The expectation is that the agreement will be outstanding for 2 to 5 years. However, there is no stated maturity date; repayment is due upon a liquidity event. There is also no prepayment penalty if the employee is able to close out the agreement using alternative capital sources. The fee structure includes three components:

- Origination fee. The origination or underwriting fee reportedly range from 3 to 6 percent, which is typically added to the repayment amount rather than charged to the borrower out-of-pocket up front. Not all providers charge an origination fee.

- Interest charge. An interest charge is incurred while the capital is outstanding. Reported interest rates range from 7 to 10 percent.

- Incentive fee. An incentive fee is also embedded into the repayment, structured as a percent of the value of the collateral at IPO (or sale of the company). The incentive fee allows the capital provider to participate in the upside appreciation of shares. Incentive fees vary widely based on the risk of the company, their stage of development and funding, and the quality of financial information they provide to the financing firm. Incentive fees can range from 1 percent to 50 percent, depending on these factors, but among established pre-IPO companies they generally fall between 5 and 10 percent.

Even though the contract is with the employee, the terms are essentially established based on the profile of the company, but some variation can occur depending on how much liquidity or capital the individual needs.

The firms participating in this market are not targeting venture-capital type returns from their investment. Instead, they are looking for above-average lending returns, with internal rates of returns of around 20 percent. Capital providers see this market as an opportunity to participate in the capital appreciation of pre-IPO companies as they transition to public company status. Still, they predominantly evaluate opportunities from a credit perspective. For this reason, the majority of deals are for late-stage companies, with established track records, multiple rounds of private financing, and a clear path to the public markets. Time-to-exit is a significant factor in risk assessment, directly impacting the interest rate charge and incentive fee. The primary risks to the provider are the potential for a decrease in valuation (a so-called “down round”) that marks down the collateral value to below the capital advanced, a bankruptcy that wipes out the value of the collateral, or the potential that the company remains private longer and cannot access public markets, making it difficult for the employee to sell the shares and repay what is owed.

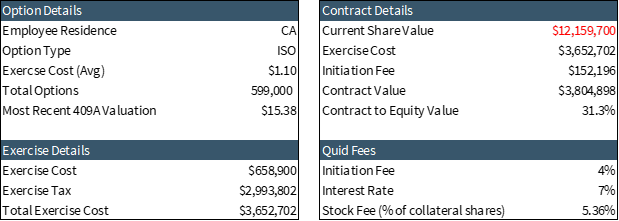

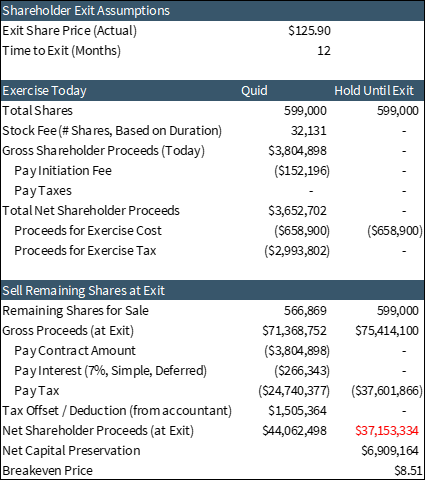

For the employee’s perspective, working with a capital provider to finance the exercise of stock options offers several advantages. Importantly, the employee saves on taxes through early exercise. If desired, the employee can extract additional capital backed by the paper wealth in the company to support a higher quality of living (such as the purchase of a home). At the same time, they retain ownership of the shares after exercise and continue to participate in any upside appreciation. Because the agreement is non-recourse, the employee is risking the value of shares only and does not put other personal assets at risk. Lack of a maturity date eliminates the risk of forced repayment while the company is still private. The cost of receiving these benefits are interest and fees charged by the capital provider (see Exhibit 3 for a detailed example).

Evolution of the Market for Stock-Option Financing

The market for private-company stock-option financing has grown rapidly in recent years. However, industry-wide statistics are unavailable. By some estimates, the average financing size is just over $1 million, with an average term of 13 months. Approximately 36 percent of contracts are for option exercise only, 55 percent for option exercise plus additional liquidity, and 9 percent for liquidity only.

The earliest providers entered the market in 2012. Some of the players in the industry include the following:

- Secfi. Founded in 2017, Secfi finances stock-option exercises through prepaid variable forward contracts. It specializes in financing employees at mid- to late-stage companies. Secfi also sponsors programs with companies to offer financing to eligible employees. Secfi is backed by a $700 million fund from Serengeti Asset Management.

- Quid. Quid is a California-registered lender and its financing solutions are structured as both loans and forward contracts. Quid is backed by $420 million of funding, with capital provided by Oaktree Capital, David Kempner, and a prominent Ivy-League endowment. Quid has advanced over $220 million in capital through both individual and company-sponsored programs.

- ESO Fund. Founded in 2012, ESO Fund is one of the earliest entrants in the space. ESO Fund has advanced more than $1 billion in capital since its founding. The fund finances stock-option exercises in both early- and late-stage companies.

- EquityBee. Unlike the providers above, EquityBee functions as a marketplace, allowing employees to list shares and allowing investors to bid on financing.

These providers as a whole have been very successful penetrating the market of pre-IPO companies. Secfi itself has worked with founders and employees at 80 percent of U.S. unicorns since 2019.

Company View of Stock-Option Financing

Companies have a mixed reaction to external firms offering stock-option exercise financing to employees. On the one hand, some are wary of third-party vendors trying to “cash in” on employee equity. Many have experience with pre-IPO secondary markets through which outside investors purchase employee shares at a great discount to subsequent prices established by capital raises or IPO. They appear to view financiers as taking advantage of the employee’s need for liquidity to extract a share of equity intended as compensation. Others are wary of third-party firms altering the incentive structure established through the stock-option program, one that is structured to defer payout until a liquidity event when employees and investors alike gain access to public markets. Changing this arrangement can distort employee incentives.

On the other hand, companies are aware that employees are strapped for capital and unable to access their vast paper wealth to finance personal standards of living. Founders and senior executives alike are generally aware of the tax benefits of early exercise, and those with previous experience in a start-up company have had to pay the significant tax bills due on options left unexercised until IPO. Others like the education process that comes from explaining to employees not only how stock-option taxation works but also about the increase in value that has already occurred during their tenure and illustrating the additional potential increases that can occur if the company maintains its growth trajectory. In addition, cultural attitudes have changed. Whereas historically companies saw stock-option awards as golden handcuffs tying the employee to the company until IPO, companies now care about their reputation in the labor market as an employer eager to improve the personal outcomes of their employees. Stock-option financing meets this need from an education and financial standpoint.

By one estimate, approximately 70 percent of pre-IPO companies are favorable toward their employees using these solutions.

Future Evolution of the Market

Finally, it is not clear how changes to markets or changes to tax law might impact the industry going forward. The last decade has witnessed a steady increase in public and private company valuations. This trend has boosted the collateral value of shares that underpin the financial model of stock-option financing. It is not clear how a slow down or reversal of this process would impact employees or the capital providers that participate in this market. Also, tax savings are a significant selling point of early exercise. Any changes to tax law that would bring capital gains rates more closely in line with ordinary income tax rates might lessen the attractiveness of early exercise. At the same time, so long as employees have significant equity wealth trapped in illiquid form and unavailable for personal use, capital providers are likely to find a willing market of customers looking to gain early access to that wealth.

Why This Matters

- Capital providers that finance stock-option exercises in pre-IPO companies have developed a product that meets the tax and personal financial needs of employees. Whereas employees previously were unable to access the value of their wealth, they now have a solution that provides capital earlier in the growth phase of the company, lowers their personal tax bill, and does this through nonrecourse financing that does not put other personal assets at risk. Why don’t more companies educate their employees about the potential benefits of this solution? For which employees is this solution appropriate, and for which does it not make sense?

- Stock-option financing in pre-IPO companies has grown significantly in recent years. How big might this market grow? Is market growth driven by large increases in private company valuations, or would it continue to grow in the absence of these forces?

- The companies and funds serving this market are specialty finance providers rather than large, established players. Many are backed by private pools of capital. Given the collateralized nature of the offering and the conservative loan-to-value ratios at which lending occurs, why haven’t more traditional lenders (such as commercial and investment banks or brokers) entered the market? Do regulatory barriers keep traditional lenders out, or is the size of the market too small to merit their interest? Would more competition from capital providers drive down lending rates and the returns that these vendors enjoy?

- Stock options have traditionally been the main incentive tool used by private companies to attract, retain, and motivate employees to aggressively grow value in pre-IPO companies. What impact would widespread early exercise of stock options have on incentive programs? Does it make sense for companies to continue to offer stock options if employees are simply going to exercise them and convert them to equity, or would it be economical to grant straight equity instead?

The complete paper is available for download here.

Exhibit 1: Tax and Restrictions of Stock Option Grants

* The difference between fair-market value and the exercise price of the ISO is treated as an adjustment for AMT purposes. If this adjustment exceeds federal thresholds, an AMT payment is owed.

** If the shares are sold less than a year after exercise, the sale is treated as a disqualifying disposition and the difference between fair-market value and exercise value is treated as ordinary income.

*** Because ISOs must be held by employees, exercise following termination is required.

Source: Mary Lewis, “ISOs v. NSOs: What’s the Difference?” CooleyGO (accessed July 13, 2021), available at: https://www.cooleygo.com/isos-v-nsos-whats-the-difference/. See also Anne Bushman, “Deciding Between Incentive and Nonqualified Stock Options: Which Stock Plan is Right for Your Company?” RSM US LLP (August 2016).

Exhibit 2: Tax Savings from Early Exercise

Notes: 100,000 options for a hypothetical company with $1 strike price, $3 early exercise price, and $10 IPO price. Assumes personal gross income of $150,000, married filed jointly, California resident, 2021 tax year. Does not include financing costs to fund stock option exercise.

Calculated using Secfi tax calculator, available at https://www.secfi.com/preview/equity/preview-company/tax-calculator/

Exhibit 3: Example of Stock-Option Financing

Contract Information

Comparison of Outcomes

Source: Quid

Print

Print