Jason Frankl is Senior Managing Director and Brian G. Kushner is Senior Managing Director and Leader of Private Capital Advisory Services at FTI Consulting. This post is based on their FTI Consulting memorandum. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

Market Update

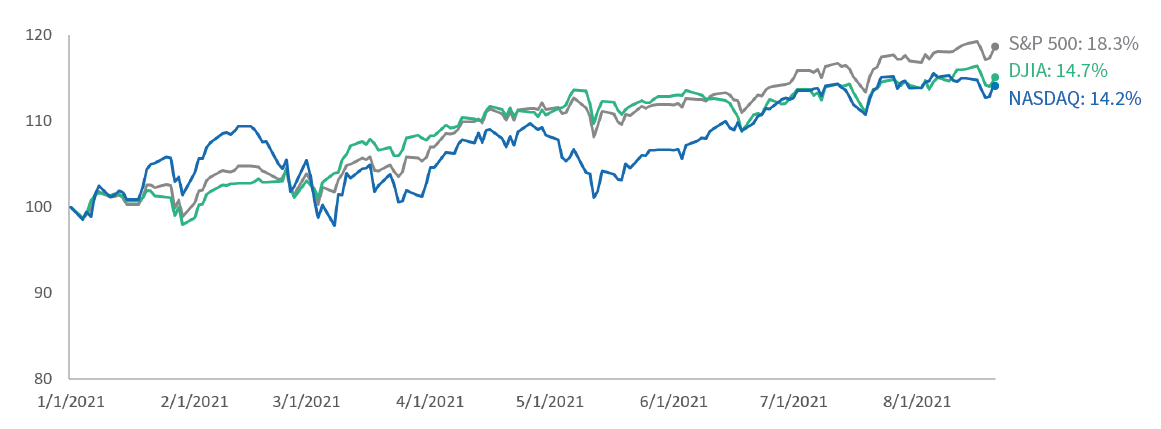

The more things change, the more they stay the same. Although COVID-19 remained a global concern, U.S. equity markets continued to push higher in Q2 2021. For the year, the S&P 500 Index is up 18.3%, while the Dow Jones Industrial Average has returned 14.7% and the Nasdaq Composite Index has returned 14.2%. [1]

Year-to-Date Performance (2021) [2]

While value stocks outperformed growth stocks in the Q1 2021, that style rotation appears to have been short-lived, and the longer-term trend of growth stock outperformance has continued so far in 2021. Year-to-Date, the S&P 500 Growth Index has returned 20.6% compared to the S&P 500 Value Index, which has returned 17.9%. [3]

For the second quarter of 2021, equity markets were in part driven by another strong corporate earnings season. While above-average growth rates are in part due to an easier comparison to weaker earnings from Q2 2020, quarterly profits are also expected to surpass their 2019 levels. [4] The strength of both the equity market and corporate earnings came despite headwinds including the Delta variant, rising inflation concerns and Beijing’s recent regulatory crackdown on the technology industry. [5]

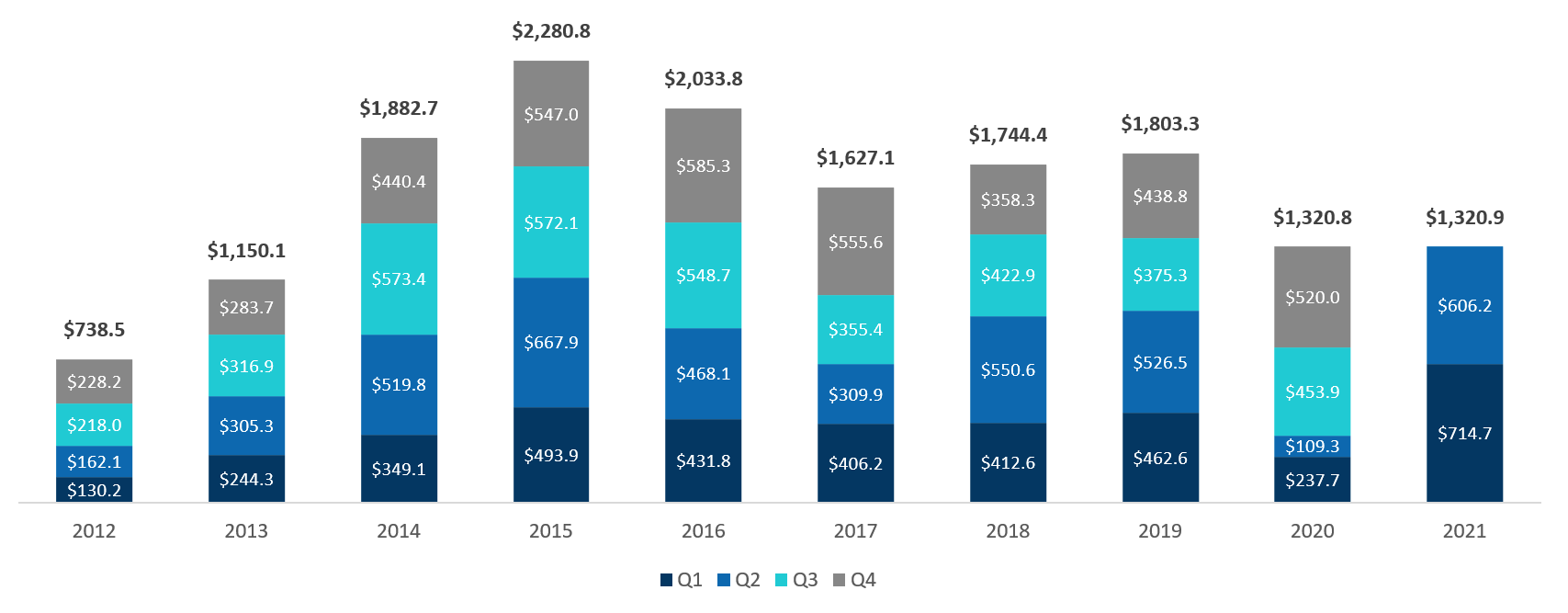

It was also another strong quarter (and half) for corporate M&A and private equity LBOs, both globally and domestically. Globally, H1 2021 set a record high for M&A deals greater than $2 billion, with 143 such deals recorded in Q2 2021 and 161 such deals recorded in Q1 2021. For U.S. companies specifically, over $1.3 trillion was spent on M&A during the first six months of the year—the highest amount in the past 10 years. [6] A portion of U.S. M&A activity was driven by a first-half

boom in SPAC transactions; through June 2021, 176 SPAC transactions worth more than $386 billion had been completed. [7] Bill Ackman’s attempted SPAC transaction (Pershing Square Tontine Holdings’ acquisition of a minority stake in Universal Music Group) was one of the more prominent and high profile deals of the year before the deal was challenged in a lawsuit by a group including former U.S. Securities and Exchange Commissioner Robert Jackson. The lawsuit challenges the fundamental structure of a SPAC and its current regulatory status as an operating company; if successful, the lawsuit may reform the entire SPAC industry. [8]

U.S. Quarterly M&A Volume by Value ($ in bn) [9]

It was also a strong quarter (and half) for private equity globally, with H1 2021 representing the strongest half-year on record with a total buyout value of $489.9 billion across 1,107 deals. For the U.S. specifically, leveraged buyouts represented over 10% of all U.S. acquisitions, by deal count, worth approximately $162.1 billion. [10]

Activism Update

While global and domestic M&A activity is often a bellwether for shareholder activism, the activist investment strategy did not receive a commensurate uptick in activity in Q2 2021 or H1 2021. The second quarter of 2021 represented the fewest number of U.S. activist targets (133) since Q2 2015; Q2 2021 activist targets were down 18% compared to Q2 2020, when there were 167 U.S. activist targets. [11] Moreover, the first half of 2021 represented the fewest number of U.S. activist targets (302) since H1 2015; H1 2021 activist targets were down 13% compared to H1 2020, when there were 341 U.S. activist targets. [12] While broader activist activity remained muted through H1 2021, Elliott Management returned prominently to the market in Q2 2021, launching five campaigns globally—and two of which were in the U.S. [13]

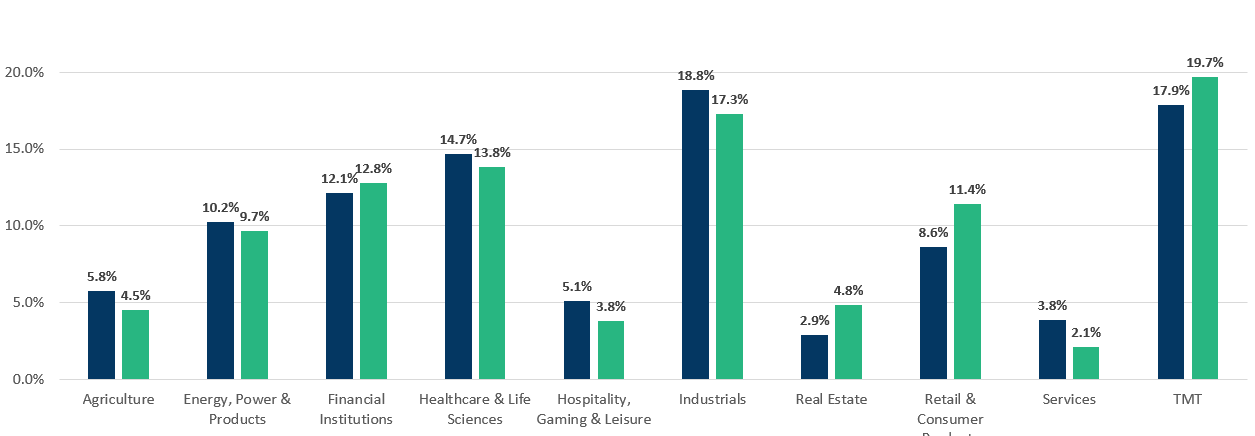

Through the first half of 2021, the Technology, Media and Telecom (“TMT”) sector was the sector most frequently targeted by activist investors, with TMT companies accounting for nearly one out of every five activist campaigns. The Industrials sector was the second most frequently targeted, followed by the Healthcare & Life Sciences sector. These three sectors were also the most frequently targeted in the first half of 2020, representing a continuity of focus (or comfort level) by the activist investing community. On the other hand, the Services and Real Estate sectors have been the least targeted by activist investors during the first half of both 2020 and 2021. [14]

Activist Targets by Sector (% of All U.S. Activist Targets)

As a result of the diminished activism campaign activity through H1 2021, activist investors have gained the fewest number of board seats through the first six months of the year over the past four years. Board seats gained by activists in the U.S. are down 15% when compared to H1 2020 and down over 53% when compared to H1 2018, the recent highwater mark. [15]

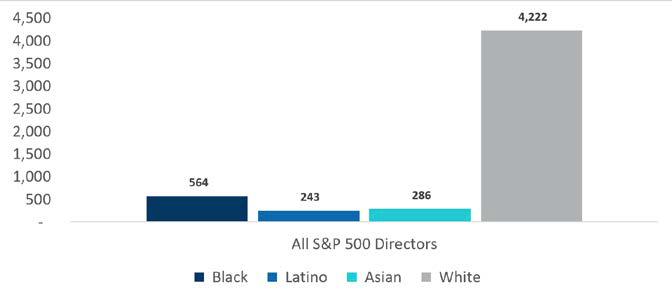

Despite fewer board seats being won by activists, the broader corporate governance and public company director landscape continued to shift in H1 2021. Through mid-June, S&P 500 companies tripled the share of newly appointed directors who are Black and more than doubled the share who are Latino. Despite positive trends in ethnic diversity on corporate boards,gender diversity appears to have regressed slightly, with women accounting for just 43% of new board members in 2021, down from 47% in 2020. [16] However, even with the seemingly meaningful shift, U.S. corporate boards remain in the early innings of improving gender and ethnic diversity, a trend which we expect will continue to gain momentum in the new decade.

Share of All S&P 500 Directors by Race, Ethnicity and Gender (2021) [17]

Share of All S&P 500 Directors by Gender (2021)

Share of All S&P 500 Directors by Race and Ethnicity (2021)

The increased momentum toward diversifying U.S. corporate boards is a result of both investor sentiment and new regulations. In August, Nasdaq’s board-diversity proposal surprisingly gained approval from the Securities and Exchange Commission (“SEC”); Nasdaq will now require its companies to meet certain minimum targets for the gender and ethnic diversity of their boards or provide disclosure for why they do not. [18]

The other regulatory change that likely will continue to be a focal point for both activist investors and companies are proposed amendments and changes to SEC’s oversight of proxy statement rules. Proposed amendments include “requiring the use of universal proxy cards in all non-exempt director election contests, revising the consent required of a bona fide director nominee and eliminating the short slate rule. [19] Sidley Austin described the rule changes as “Proxy Access on Steroids,” while Elliott Management said that the amendments would “enhance the proxy system.” [20] [21]

Q2 2021’s Most Vulnerable Industries

The table below shows the Total Vulnerability Scores for the 36 industries:

| Rank | ▲ Rank QoQ | FTI Industry | Q2 2021

Vulnerability Score |

Q1 2021

Vulnerability Score |

|---|---|---|---|---|

| 1 | ▲ 1 | Aviation & Airlines | 60.3 | 58.5 |

| 2 | ▲ 5 | Media & Publishing | 59.7 | 55.4 |

| 3 | ▼ 2 | Utilities | 58.4 | 59.5 |

| 4 | – | Power | 57.9 | 57.0 |

| 5 | – | Biotechnology | 56.1 | 56.0 |

| 6 | ▲ 11 | Regional Banks | 55.4 | 53.2 |

| 7 | ▲ 11 | Automotive | 55.3 | 51.9 |

| 8 | ▼ 5 | Savings Banks | 54.9 | 57.8 |

| 9 | ▲ 5 | Energy | 54.7 | 53.7 |

| 10 | ▲ 3 | Aerospace and Defense | 54.3 | 53.9 |

| 11 | ▼ 2 | Telecommunications | 54.2 | 54.6 |

| 12 | ▼ 4 | Hospitality & Gaming | 54.2 | 54.7 |

| 13 | ▼ 1 | Insurance | 53.2 | 54.1 |

| 14 | ▲ 2 | Restaurants | 53.2 | 53.3 |

| 15 | ▼ 5 | REITs | 53.0 | 54.5 |

| 16 | ▼ 5 | Pharmaceuticals | 52.9 | 54.3 |

| 17 | ▲ 5 | Healthcare Services | 52.4 | 50.9 |

| 18 | ▲ 3 | Agriculture & Chemical Products | 52.3 | 51.3 |

| 19 | ▲ 7 | Consumer Finance | 52.1 | 48.9 |

| 20 | ▼ 14 | Real Estate | 52.0 | 55.4 |

| 21 | ▼ 2 | Consumer Non-Durables | 51.9 | 51.5 |

| 22 | ▲ 1 | Transportation | 51.0 | 49.6 |

| 23 | ▼ 8 | Financial Conglomerates | 50.8 | 53.6 |

| 24 | ▲ 6 | Chemicals | 50.6 | 47.6 |

| 25 | ▼ 5 | Business Services | 50.5 | 51.5 |

| 26 | ▲ 1 | Industrial Distributors | 49.8 | 48.5 |

| 27 | ▼ 2 | Construction | 49.5 | 49.1 |

| 28 | ▼ 4 | Professional Services | 49.4 | 49.3 |

| 29 | ▲ 3 | Banks | 47.7 | 46.6 |

| 30 | ▲ 3 | Consumer Durables | 47.4 | 46.3 |

| 31 | ▼ 2 | Industrial Equipment | 47.3 | 47.7 |

| 32 | ▼ 4 | Technology-Software | 46.0 | 47.8 |

| 33 | ▲ 1 | Investment Managers | 45.4 | 46.0 |

| 34 | ▼ 3 | Life Sciences | 44.6 | 46.8 |

| 35 | ▲ 1 | Mining | 44.1 | 41.7 |

| 36 | ▼ 1 | Technology-Hardware | 42.9 | 43.2 |

For the first time since the Q3 2020 report, the Utilities sector is not the most vulnerable sector to shareholder activism, as defined by FTI’s Activism Vulnerability Screener. Both the Aviation & Airlines sector and the Media & Publishing sector have overtaken the Utilities sector in terms of total vulnerability to shareholder activism. The Aviation & Airlines sector faces continued COVID-19 challenges, as business travel remains depressed when compared to pre-pandemic levels; the near-term future for both business and personal travel remains murky due to the surging Delta variant.

The Regional Banks and Automotive sectors were the largest movers up the vulnerability rankings, each moving up eleven spots. The Real Estate sector, on the other hand, was the largest downward mover in the vulnerability rankings, moving lower by fourteen spots. The S&P Real Estate Select Sector Index is the top performing sector index year-to-date after a challenging 2020 in which it was the second worst performing sector index. The Real Estate sector was particularly stalled by COVID-19 and the ensuing stay-at-home orders but has rebounded as vaccination rates increase and both corporations and citizens return to normalcy.

FTI Observations and Insights

SEC Regulatory Update: Form 13-F

In an effort to increase the transparency behind investor movements, in late July, the U.S. House Financial Services Committee voted to advance a bill that would provide more frequent insights into investor positions, while providing disclosures for short-seller movements. The Short Sale Transparency and Market Fairness Act would require investors with at least $100 million of equity investment discretion to file their holdings via SEC Form 13F within 10 days of the end of the previous month (versus the current SEC rules that stipulate that these investors have 45 days from the end of a calendar quarter). [22] These more frequent filings would include both equity positions and direct or indirect derivative positions, such as security-based swaps. Furthermore, within 180 days after the enactment of the bill, the SEC will issue rules implementing disclosure on short sales, which is an amendment related to the Dodd-Frank Act, and not later than one year after the enactment of the bill the SEC will submit a study on the confidential treatment of Form 13F reports. [23]

This new bill is a dramatic turnaround from the prior administration’s agenda, which in July of 2020 had proposed increasing the Form 13F threshold for equity investment discretion to $3.5 billion. [24] Passage of this new bill would create a major blockade to the techniques used by the shareholder activist community. Activist investors typically use different types of derivatives investments, such as over-the-counter options and swaps, in order to “fly under the radar” while having economic exposure to their investment. In practice, while the investor may hold the benefit of the price appreciation, the counterparty to the derivative position will file the ownership information with the SEC. Should passage of this bill come to fruition, the public will know which of these activist investors has exposure to certain equities in a timelier fashion.

It would be naïve to think that passage of this bill will cut back on shareholder activism. While the tactics of these investors would become public in a more frequent manner, the speed at which these investments are accumulated by the activist may be accelerated. Accurate and timely knowledge of the hedge fund movements inside the shareholder base will be of utmost importance in order for the public entity to keep its “first mover advantage.”

– David Farkas, Managing Director, Activism and M&A Solutions

2021 Proxy Season Update and Review

ESG campaigns received significant publicity this proxy season, in part due to a successful proxy campaign incorporating an ESG theme against supermajor oil company, ExxonMobil. Environmental proposals themselves have received stronger support from investors in 2021. Average shareholder support for shareholder-sponsored environmental proposals at U.S. companies was 45% through June 18, 2021, a noteworthy increase from 33% in FY2020. Twelve shareholder environmental proposals passed by that date this year, far more than by that date in any of the previous three years. BlackRock (75.0%) and Vanguard (66.7%) each have supported a much higher percentage of environmental proposals this year than in prior years. Their vocal support of such measures may spur other money managers to more frequently support environmental proposals in future years.

This year’s successful shareholder environmental proposals often targeted America’s largest companies. Shareholders of Chevron approved a resolution asking it to substantially reduce the greenhouse gas emissions of its energy products in the medium to long-term. United Airlines’ shareholders agreed that the company should issue a report describing if, and how, its lobbying activities (including through trade groups) align with the Paris Climate Agreement. DuPont de Nemours’ shareholders voted that the company should issue an annual report about the amount of plastic in various forms released by the company. [25]

Support for shareholder-sponsored social proposals also grew, although at a slower rate than support for environmental proposals. Such proposals at U.S. companies have received average shareholder support of 31% so far in 2021, a modest increase over the previous three years, when average support ranged between 24% and 29%. Five shareholder-initiated social proposals passed by June 18, 2021, in line with 2020’s results. As with environmental proposals, BlackRock and Vanguard also gave much more support to social proposals, from less than 25% in 2020 to 75% in 2021 for each firm. [26] Given the prominence of such issues since Spring 2020 and increased support from two typically large shareholders, it seems surprising that social proposals have not attracted more support so far in 2021.

– Kurt Moeller, Managing Director, and Robert Kueppers, Senior Advisor; Activism and M&A Solutions

What This Means

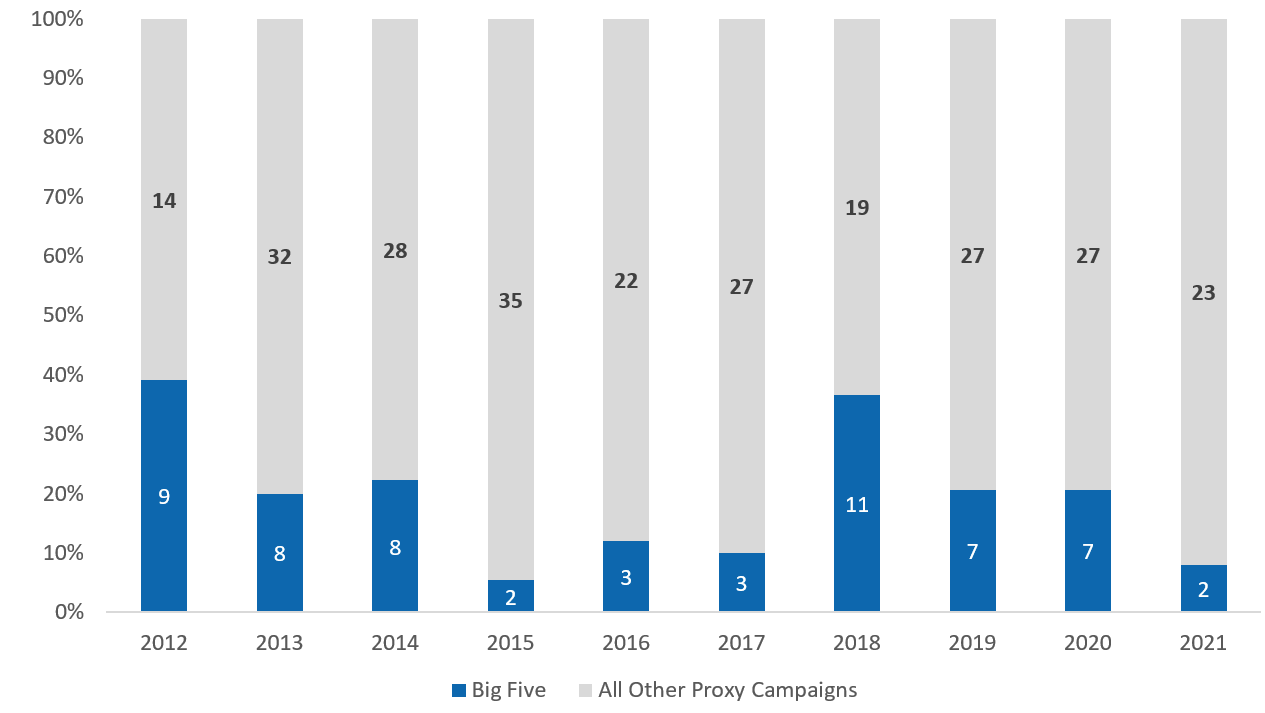

Through the early part of the last decade, brand-name shareholder activists grew to be highly influential in both the investing and financial media communities. As their investment strategies rose to prominence, activist investors gained reputational credibility, media notoriety, a following from “permanent” investors and, most importantly, capital commitments. The most prominent activist funds were not only influential investors, but also savvy media strategists. As proxy campaigns captured the focus of investing media, many activist investment funds gained recognition, but five funds became particularly prominent: Elliott Management, Icahn Associates, Pershing Square Capital Management, Starboard Value and Third Point Partners. These funds not only launched a number of proxy campaigns but were notably successful in doing so.

At their peak in 2012, these five funds represented 39% of all proxy campaigns. [27] Thus far in 2021, these five funds have launched only two campaigns. In recent years Starboard Value (a combined 16 campaigns between 2018 and 2020) has remained quite active in this area, but several other prominent funds have taken a less public and/or hostile approach. At least for now.

“Big 5” Activists as a % of Total Proxy Campaigns

Despite the “Big Five’s” shift away from waging proxy campaigns this year, the absolute number of annual campaigns has averaged 31 over the past five years. This suggests both that smaller activist funds are launching campaigns at an increasing pace and that there are new entrants to the shareholder activism strategy, including both first-time hedge funds and non-activist, institutional managers. The activism strategy is entering a new stage of its evolution from corporate raiders of the 1980s to the media-focused, proxy campaigns of the 2010s to its current state, where operational and strategic activism has fused with corporate governance and ESG. Funds like Engine No. 1 have recently proven that to be successful in a proxy campaign, a fund no longer needs a proven pedigree of prior campaigns, nor a major asset base.

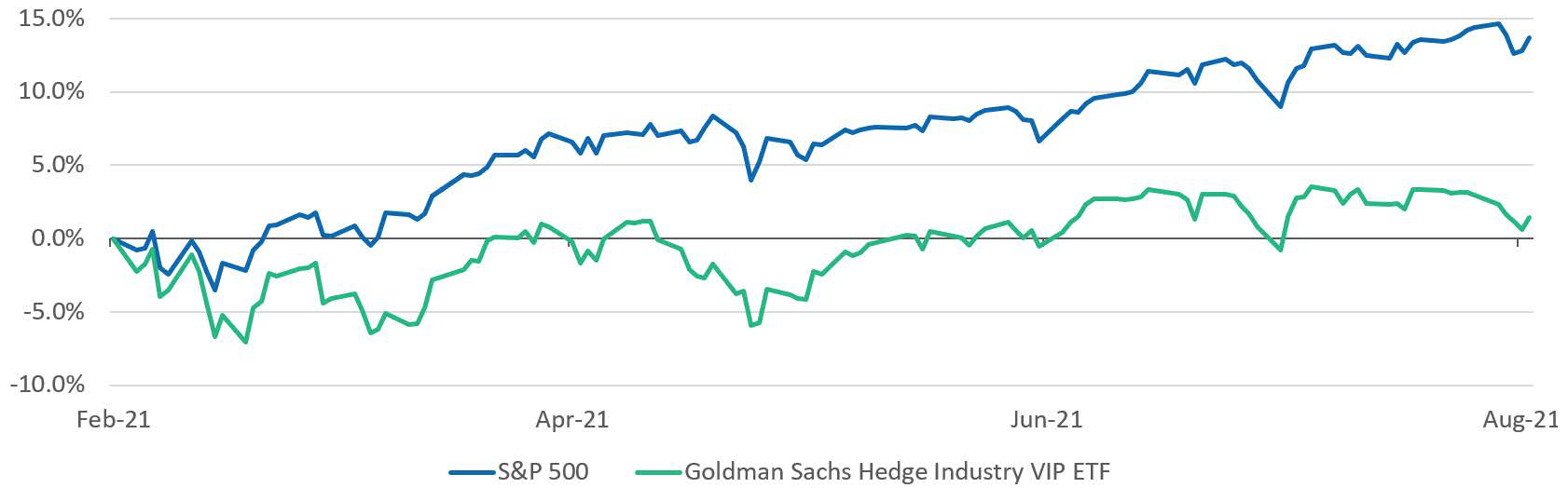

While the broader universe of equity-focused hedge funds has performed quite well, relatively, in the first half of 2021, this group of funds underperformed the benchmark market (the S&P 500 Index) through the same period. One reason for the underperformance of the asset class was the underperformance of its favorite stocks. Over the past six months, the Goldman Sachs Hedge Industry VIP ETF, which takes into account the most heavily owned shares by U.S. hedge funds, has significantly underperformed the S&P 500 Index, returning just 1.4% over the six month time period, compared to returns of 13.7% for the Index. [28]

Hedge Fund’s Favorite Stocks Have Recently Underperformed (Trailing 6 Months)

Given the wide-ranging underperformance of the U.S. hedge fund managers’ highest-conviction stocks, we suspect a number of fund managers have begun contemplating how they would improve one, or more, of their holdings’ operational performance, how they would improve its capital allocation strategy or how they would improve its corporate governance. Taking it a step further, we suspect some of these managers have likely voiced their concerns and suggestions to management and, pending management’s receptivity, have contemplated voicing their concerns publicly. In a fee-sensitive world, where fund managers are often only as good as their most recent returns, we suspect many managers are feeling the pressure to take an active role in improving the performance of their key holdings. In the second half of 2021 and beyond, we think that the environment is favorably positioned for both occasional and first-time activists to represent a driving force in shareholder activism and the number of proxy campaigns.

FTI’s Activism Vulnerability Screener Methodology

- The Activism Vulnerability Screener is a proprietary model that measures the vulnerability of public companies in the U.S. and Canada to shareholder activism by collecting criteria relevant to activist investors and benchmarking to sector peers.

- The criteria are sorted into four categories, scored on a scale of 0-25, (1) Governance, (2) Total Shareholder Return, (3) Balance Sheet and (4) Operating Performance, which are aggregated to a final Composite Vulnerability Score, scored on a scale of 0-100.

- By classifying the relevant attributes and performance metrics into broader categories, experts at FTI can quickly uncover where vulnerabilities are found, allowing for a more targeted response. FTI’s Activism and M&A Solutions team determined these criteria through research of historical activist campaigns in order to locate themes and characteristics frequently targeted by activist investors.

- The following is a selection of themes that are included for each category:

- The Activism and M&A Solutions team closely follows the latest trends and developments in the world of shareholder activism. Due to the constantly evolving activism landscape, FTI’s Activism and M&A Solutions team consistently reviews the criteria and their respective weightings to ensure the utmost accuracy and efficacy of Activism Screener.

Endnotes

1FactSet, Market Data as of August 20, 2021; FTI Analysis(go back)

2FactSet, Market Data as of August 20, 2021; FTI Analysis(go back)

3FactSet, Market Data as of August 20, 2021; FTI Analysis(go back)

4https://www.wsj.com/articles/record-pace-for-corporate-earnings-keeps-stocks-buoyant-11628415002?mod=searchresults_pos6&page=1(go back)

5https://www.ft.com/content/7e6f9a08-37be-4ab3-ae15-953533ab33b5(go back)

6FactSet, Market Data as of August 20, 2021; FTI Analysis(go back)

7https://www.nytimes.com/2021/08/17/business/dealbook/bill-ackman-spac.html(go back)

8https://www.nytimes.com/2021/08/17/business/dealbook/bill-ackman-spac.html(go back)

9https://www.ft.com/content/7e6f9a08-37be-4ab3-ae15-953533ab33b5(go back)

10Cravath Quarterly Review: M&A, Activism and Corporate Governance (Q2 2021)(go back)

11https://www.activistinsight.com/research/Insightia_H12021.pdf(go back)

12https://www.activistinsight.com/research/Insightia_H12021.pdf(go back)

13https://www.lazard.com/media/451731/lazards-h1-2021-review-of-shareholder-activism-vff.pdf(go back)

14https://www.activistinsight.com/research/Insightia_H12021.pdf(go back)

15https://www.activistinsight.com/research/Insightia_H12021.pdf(go back)

16https://www.wsj.com/articles/this-years-influx-of-directors-starts-shift-in-boardroom-diversity-11623835801(go back)

17https://www.wsj.com/articles/this-years-influx-of-directors-starts-shift-in-boardroom-diversity-11623835801(go back)

18https://www.wsj.com/articles/nasdaqs-board-diversity-proposal-faces-sec-decision-11628242202(go back)

19Activist Insight; Planned universal proxy changes draw mixed reaction(go back)

20https://www.sidley.com/-/media/update-pdfs/2021/06/20210608shareholderactivismupdate.pdf?la=en(go back)

21https://www.sec.gov/comments/s7-24-16/s72416-8883055-240420.pdf(go back)

22https://financialservices.house.gov/uploadedfiles/bills-1174618ih.pdf(go back)

23https://www.govinfo.gov/content/pkg/PLAW-111publ203/pdf/PLAW-111publ203.pdf(go back)

24https://www.sec.gov/news/press-release/2020-152(go back)

25Insightia—Proxy Insight; Data as of August 20, 2021(go back)

26https://www.activistinsight.com/wp-content/uploads/dlm_uploads/2021/06/Insightia_ESG21.pdf(go back)

27FactSet, Market Data as of August 20, 2021; FTI Analysis(go back)

28FactSet; FTI Analysis; https://www.nytimes.com/2021/08/24/business/dealbook/pfizer-fda-covid-vaccine-mandates.html(go back)

Print

Print